Modern Economy

Vol.4 No.4(2013), Article ID:30309,5 pages DOI:10.4236/me.2013.44027

Innovative Infrastructure, Financial Development and Innovative Activity in Developing Economies: Cross Country Empirical Investigation

1Institute for Forecasting and Macroeconomic Research, Uzbekistan

2Donghua University, Shanghai, China

Email: *rsalaho1@binghamton.edu

Copyright © 2013 Raufhon Salahodjaev et al. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Received January 15, 2013; revised February 14, 2013; accepted March 10, 2013

Keywords: Innovation; High-Tech Export; Clusterization; Infrastructure; Cross Country; Developing; Banking Sector

ABSTRACT

Over the last decades, technological advances have been the most important determinant of growth rate for many countries. Recent studies have been focused on explaining growth rates of countries through endogenous technological change. However there is limited number of papers aimed to explain innovative activity in developing countries. The purpose of the paper is to test the impact of banking sector and innovative infrastructure (patent protection and industrial clusterization) on innovative activity of developing economies. This paper provides empirical evidence on effects of banking system development and innovation infrastructure on innovative activity based on the sample of 51 developing economies. For example, an improvement in innovative cluster development and increase domestic credit to private sector of Russia from existing level (catching up countries) to the level of Brazil (foregoing ahead), is associated with 4.8 percent increase in high tech exports, ceteris paribus. Most of the variables in our paper are public policy variables (quality of banking system, sophistication of innovative infrastructure). Our empirical discoveries ought to be of high interest to policy makers in developing economies intended to achieve sustained economic growth through technical and technological advance.

1. Introduction

Over the last decades, technological advances have been the most important determinant of growth rate for many countries (Mitchell [1]). Additionally, a number of cross country studies identified innovation as a key factor of productivity growth (Grossman and Helpman [2]; Coe and Helpman [3]). Moreover, increase in productivity promotes international competitiveness of economy (Gustavson [4]). Recent studies have been focused on explaining growth rates of countries through endogenous technological change. Modern theories of economic growth aimed to explain the growth patterns of world economies; technological innovation is created in the research and development (R&D) sectors using human capital and the existing knowledge stock. According to these studies R&D, human capital and current stock of knowledge are the foundations of technological innovation (Frantzen [5]).

According to Porter [6], “To compete effectively in international markets, a nation’s businesses must continuously innovate and upgrade their competitive advantages. Innovation and upgrading come from sustained investment in physical as well as intangible assets”. Sophistication of financial markets is vital for innovative growth (Schumpeter [7]). As suggested by existing literature, decline in economic growth is observed when government imposes restrictions on banking system (introducing interest rate ceiling, increasing reserve requirements) (Shaw [8]).

The purpose of the paper based on the foregoing discussion is to posit following hypothesis.

Hypothesis 1. The higher the quality of banking sector is the more productive innovative activity of developed economies.

Results of Benhabib and Spiegel [9] show that Total Factor Productivity (TFP) growth and investment are positively related to financial development. TFP growth, which is a key factor of economic growth, is significantly affected by financial development (Beck et al. [10]).

Hypothesis 2. The more sophisticated innovative infrastructure (clusterization) and institutional development (patent protection) the more productive innovative activity. Several studies highlighted importance of cluster development and institutional factors for dynamics of innovation (Niosi [11]; Mowery and Nelson [12]). Literature on national innovation system emphasized the important role of government policy (intellectual property protection) (Merges and Nelson [13]).

2. Description of Data

In our paper for a measure of cross-country innovative activity we use proxy-high-tech export as a share of manufacturing exports. As a proxy for institutional factor of innovation we use Patent Rights Protection index (PRP) constructed by Ginarte and Park [14] and extended by Park [15]. This index takes into account several classes of patent laws: extent coverage, membership in international patent agreements, provisions for loss of protection, enforcement mechanisms and duration of protection.

There are various indicators to measure the quality of banking system. One of the most convenient is the ratio of banking credit to private sector to GDP, a measure for the level of a country’s overall banking system development. We account for other economic variables that affect innovative activities in our paper: R&D expenditure (% of GDP).

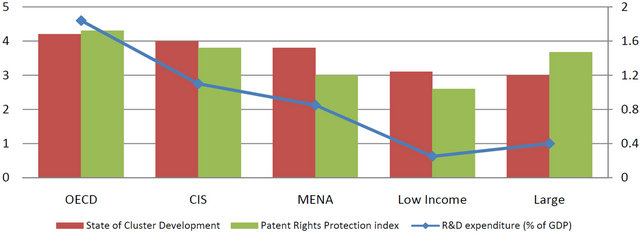

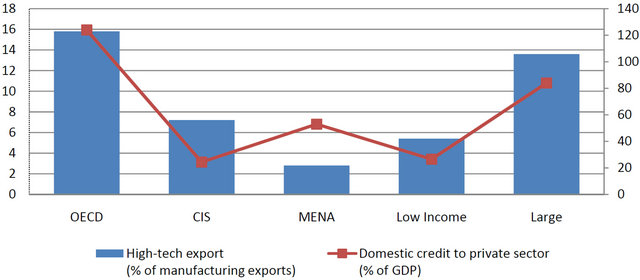

To see how high-tech export levels and the patent protection, R&D expenditure, quality of banking system with various market sizes and types behave we grouped the countries in the following groups: OECD, large countries, low income, Middle East and North Africa (MENA), and Commonwealth of Independent States (CIS).

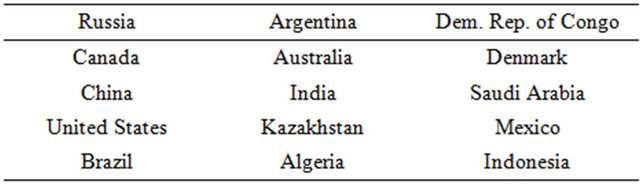

Large countries in our sample are classified by the total area (the sum of all land and inland water bodies) (Table 1). Low income countries are classified according to World Bank criterion with Gross National Income (GNI) per capita below 1025 $ in 2011.

OECD and large countries with more developed innovative infrastructure and institutions (Figure 1) have higher level of innovative activity compared to CIS, MENA and low income countries (Figure 2). Consequently this supports our choice of variables.

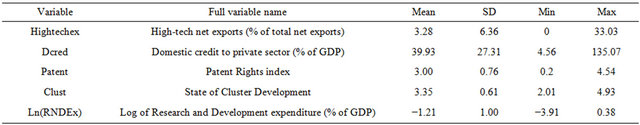

Table 2 presents selected sample statistics on key variables used in our analyses.

3. Empirical Results

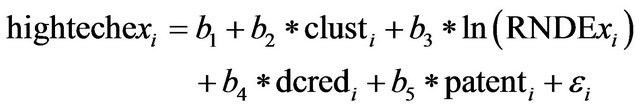

Based on the discussion of the previous sections we will estimate Equation (1) on the cross section data model for IMF developing countries1:

(1)

(1)

where i denotes country (i), hightechex is high-tech net exports (% of total net exports), dcred is domestic credit to private sector, clust is obtained from World Economic Forum’s Executive Opinion Survey (2010-2011) measuring state of cluster development in a country. Ln (RNDExi) is log of R&D expenditure and patent is Patent Rights Protection index.

Table 1. Large countries in the sample.

Source: Authors estimates.

Source: World Bank, 2012; Park, 2008; WEF, 2012. Note: Patent Rights Protection index for CIS is only given for Russia and Ukraine due to lack of data.

Figure 1. State of Cluster Development (left scale), Patent Rights Protection index (left scale) and R&D expenditure (right scale).

Source: World Bank, 2012.

Figure 2. High-tech exports (% of manufacturing exports) (left scale) and domestic credit to private sector (right scale).

Table 2. Selected sample statistics.

Source: World Bank, 2011; Park, 2008; World Economic Forum, 2010-2011.

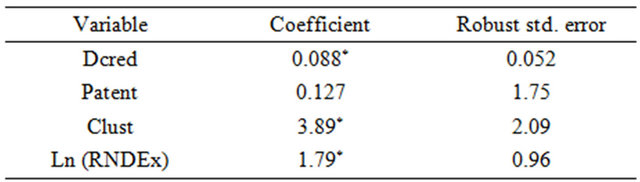

Our key finding shows that improvement in clusters of economy has substantial effect on innovation (Table 3). Our results are in line with the findings of Tan [16]. Moreover that provides empirical evidence for an argument clusters are one of the most important determinant in shaping the competitive nature of economy and technology transfer (Tallman et al. [17]). Furthermore, a positive relationship between high tech exports and quality of banking system (domestic credit to private sector) is consistent with the findings financial development increases innovative activity and economic growth (Neusser and Kugler [18]).

Table 3 presents the estimates of Equation (1).

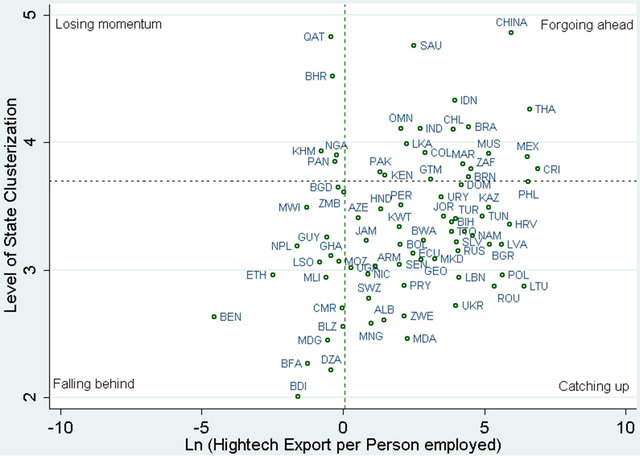

In addition, we used performance approach to classify developing countries based on their cluster level development and increase in innovative activity (high-tech export per person employed) (Figure 3). Ranging developing countries based on their cluster performance and on real production of innovation goods and services (high-tech exports) than on various innovation indices (Global Innovation Index, Innovation Efficiency Index etc.) is more powerful tool as it allows identifying benchmark countries that achieved high level of innovative activity established on efficient use of their clusters. According to this approach we identified a number of benchmark (forgoing) developing countries that achieved

Table 3. Cross section regression estimates.

Adjusted R-squared = 0.4, Number of observations = 51.

high levels of high-tech exports per capita in the last decade with clusterization level well above the global averages. These countries include China, Brazil, Thailand and Chile. Additionally we separated out a large group of “catching up” countries with increasing hightech exports per capita but less sophisticated level of clusterization.

4. Benchmarking CIS Economies

Overall clusterization of the CIS countries is well below the global averages. Kazakhstan has highest level of clusterization, according to WEF, compared to other CIS economies. Presently there are 23 key of innovative clusters. A number of fundamental laws have been enacted in country to promote further establishment of clusters in the country. The law “On special economic zones in the Republic of Kazakhstan” (2011) providing a number of

Note: Dashed horizontal line represents global mean value for the global level of state cluster development.

Figure 3. Innovative activity and cluster performance (2001-2010).

rules for the preferential and preferential treatment in taxation, customs regulations and attraction foreign labor power industrial intake. The law “On state support of industrial innovation” has been enacted, which aims to increase the competitiveness of the national economy by stimulating the development of priority sectors. The new law “On Science” (2011) establishes the National Research Council from among the leading Russian and foreign scientists. The council is responsible for decisionmaking to form and amount of research funding, the implementation of the competitive selection of research projects. This will greatly enhance the role of the research in economy; provide transparency and objectivity in the matter.

Next best CIS performer based on the scores of survey is Russian Federation with 25 innovative industrial clusters (Izotova [19]). Despite the establishment of Skolkovo Innovative cluster further formation and development of clusters in Russia as well as in other Post-Soviet countries at present time is facing limitations that include: the poor quality of business management, the lack of orientation of many companies in the international market, a low level of development of regional cooperation structures and the quality of governance (Rodionova et al. [20]). Another plausible explanation of underdevelopment of clusters in the CIS region is low long term investment confidence whereas the real benefits of clustering accrue only after 5 - 10 years. Foreign direct investment flows in the CIS countries are mostly “resource seeking”, while inflows of investments in other more advanced transition economies are “efficiency seeking” (Lankes and Venables [21]).

Our econometric results show that an improvement in innovative cluster development and increase domestic credit to private sector of Russia from existing level (catching up countries) to the level of Brazil (foregoing ahead), is associated with 4.8 percent increase in high tech exports, ceteris paribus. In case of Kazakhstan, with high comparative level of economic clusterization, the primary driver of innovative activity is the gradual expansion in domestic credit to private sector to the level of 80% of GDP, equivalent to Brazil. Increase in R&D expenditure from 0.25%, average for last decade, to 1% as a share of GDP is complimentary factor. As country makes that shift its exports of high-tech products will increase by 4.2%.

5. Conclusions

This paper provides empirical evidence on effects of banking system development and innovation infrastructure on innovative activity based on the sample of 51 developing economies for 2010. According to our research and practices of the most competitive countries, the largest breakthrough in competitiveness is achieved in countries that have high-tech clusters. Thus, countries like Switzerland, Denmark, Germany and Sweden, competitiveness leaders, are conducting a proactive cluster policy.

The empirical results of our findings suggest that increase in banking sector to private sector and improvement in state cluster development have significant effect on innovative activity. Our results are in line with the previous evidence in the existing literature. Increase in R&D expenditure sheds light on innovative activities in developing countries, as suggested by Savvides and Zachariadis [22].

Most of the variables in our paper are public policy variables (quality of banking system, sophistication of innovative infrastructure), our empirical discoveries ought to be of high interest to policy makers in developing economies intended to achieve sustained economic growth through technological advance.

According to World Bank (2000) as developing countries aim to improve their innovative capacity it will require additional actions to achieve and maintain the essential level beyond which benefits begin to accrue. Hence results of our findings are straightforward. Institutional development and increase in quality of banking system does matter in increasing innovative activity.

REFERENCES

- G. R. Mitchel, “Global Technology Policies for Economic Growth,” Technological Forecasting and Social Change, Vol. 60, No. 3, 1999, pp. 205-214. doi:10.1016/S0040-1625(98)00044-4

- G. M. Grossman and E. Helpman, “Innovation and Growth in the Global Economy,” MIT Press, Cambridge, 1991.

- D. T. Coe and E. Helpman, “International R&D Spillovers,” European Economic Review, Vol. 39, No. 5, 1995, pp. 859-887. doi:10.1016/0014-2921(94)00100-E

- P. Gustavson, P. Hanson and L. Lundberg, “Technology, Resource Endowments and International Competitiveness,” European Economic Review, Vol. 43, No. 8, 1999, pp. 1501-1530. doi:10.1016/S0014-2921(98)00027-0

- D. Frantzen, “R&D, Human Capital and International Technology Spillovers: A Cross Country Analysis,” Scandinavian Journal of Economics, Vol. 102, No. 1, 2000, pp. 57-75. doi:10.1111/1467-9442.00184

- M. E. Porter, “The Competitive Advantage of Nations,” Free Press, New York, 1990.

- J. A. Schumpeter, “Theorie der Wirtschaftlichen Entwicklung,” Duncker & Humblot, Leipzig, 1911.

- E. S. Shaw, “Financial Deepening in Economic Growth,” Oxford University Press, New York, 1973.

- J. Benhabib and M. M. Spiegel, “The Role of Financial Development in Growth and Investment,” Journal of Economic Growth, Vol. 5, No. 4, 2000, pp. 341-360. doi:10.1023/A:1026599402490

- T. Beck, R. Levine and N. Loyaza, “Finance and the Sources of Growth,” Journal of Financial Economics, Vol. 58, No. 1-2, 2000, pp. 261-300. doi:10.1016/S0304-405X(00)00072-6

- J. Niosi, “Technology and National Competitiveness: Oligopoly, Technological Innovation, and International Competition,” Mc-Gill-Queen’s University Press, Montreal, 1991.

- D. Mowery and R. R. Nelson, “Sources of Industrial Leadership: Studies of Seven Industries,” Cambridge University Press, Cambridge, 1999. doi:10.1017/CBO9781139175128

- R. P. Merges and R. Nelson, “On the Complex Economics of Patent Scope,” Columbia Law Review, Vol. 90, No. 4, 1990, pp. 839-916. doi:10.2307/1122920

- J. C. Ginarte and W. G. Park, “Determinants of Patent Rights: A Cross National Study,” Research Policy, Vol. 26, No. 3, 1997, pp. 283-301. doi:10.1016/S0048-7333(97)00022-X

- W. G. Park, “International Patent Protection: 1960-2005,” Research Policy, Vol. 37, No. 4, 2008, pp. 761-766.

- J. Tan, “Growth of Industry Clusters and Innovation: Lessons from Beijing Zhongguancun Science Park,” Journal of Business Venturing, Vol. 21, No. 6, 2006, pp. 827- 850. doi:10.1016/j.jbusvent.2005.06.006

- S. Tallman, M. Jenkins, N. Henry and S. Pinch, “Knowledge, Clusters, and Competitive Advantage,” Academy of Management Review, Vol. 29, No. 2, 2004, pp. 258-271. doi:10.2307/20159032

- K. Neusser and M. Kugler, “Manufacturing Growth and Financial Development: Evidence from OECD Countries,” The Review of Economics and Statistics, Vol. 80, No. 4, 1998, pp. 638-646. doi:10.1162/003465398557726

- G. Izotova, “Keynote Speech at the IVth International Kazan Innovation Forum Nanotech 2012,” 2012.

- L. Rodionova and R. Khayrulin, “Cluster as Form of Integration Investment Resources,” Journal of Oil and Gas Business, 2006.

- H.-P. Lankes and A. J. Venables, “Foreign Direct Investment in Economic Transition: The Changing Pattern of Investments,” Economics of Transition, Vol. 4, No. 2, 1996, pp. 331-347. doi:10.1111/j.1468-0351.1996.tb00176.x

- A. Savvides and M. Zachariadis, “International Technology Diffusion and TFP Growth,” Oklahoma State University, Oklahoma, 2003.

NOTES

*Corresponding author.

1IMF developed countries classification system takes into account “1) per capita income level; 2) export diversification; 3) level of integration into the global financial system”.