Modern Economy

Vol.4 No.2(2013), Article ID:28180,6 pages DOI:10.4236/me.2013.42011

Testing the Link between Inflation and Economic Growth: Evidence from Asia

1School of Management, Wuhan University of Technology, Wuhan, China

2School of Science, Wuhan University of Technology, Wuhan, China

Email: bandulapmb@yahoo.com, kapila.tr@gmail.com

Received December 4, 2012; revised January 5, 2013; accepted February 6, 2013

Keywords: Inflation; Economic Growth; Cointegration; Causality

ABSTRACT

The link between inflation and economic growth is one of the most important controversies in the economic literature. This paper investigates the short-run and the long-run relationship between the economic growth and the inflation of three Asian courtiers over the period 1980-2010. The methodology used in the study is cointegration and causality test. Johansen’s cointegration test and bound test approach were performed on the variables which have been tested for the stationary property using Augmented Dickey-Fuller and Phillips and Perron tests in order to examine the cointegration between the economic growth and the inflation. Vector error correction and Granger Causality test were further performed to discover the short run dynamics of the relationship between the variables and identify the direction of causality. The results reveal that there is a long run negative and significant relationship between the economic growth and inflation in Sri Lanka. Whereas no statistically significant relationships were found between the variables in China and in India, a negative and significant short run relationship was found for China. The causality results reveal that there is a unidirectional causality that runs from the economic growth to the inflation in China. The paper discusses the important policy implications of the results.

1. Introduction

The relationship between inflation and economic growth is one of the most important economic controversies among the economists, policymakers and monetary authorities in the last few decades. In particular, the core of argument is that whether inflation is necessarily for economic growth or it is harmful to economic growth. Although the relationship between inflation and economic growth has been widely examined and investigated over the years the relationship is being debated in economic literature. The empirical and theoretical evidences provide basically three types of relationship between the inflation and the economic growth, positive, negative and none. Early of the twentieth century, where the Keynesian policies predominated, inflation was not regarded as a problem and considered it has a positive effect on the economic growth. Phillips Curve has taken more attention in the same period and hypothesizes that high inflation positively affects the economic growth by creating of a low unemployment rate. Subsequently, a series of studies found no conclusive empirical evidence for either a positive or a negative association between inflation and economic growth [1,2]. The studies which based arguments on the real business cycle theories and based on cross countries have later demonstrated that there is a negative correlation between inflation and growth in the long run due to the influence of the former on reducing investment and productivity growth. Nevertheless, a recent study of Reference [3] analyzes the inflation-growth dynamics in four South Asian countries finds a significant positive relation between two variables in the long run. These divergent results confirm that there is a debate yet on the relationship between inflation and economic growth in the literature. This controversial condition encourages for further studies in examining the dynamics of the relationship between inflation and economic growth.

On the other hand, it is the general consensus that the developing countries are more susceptible to supply shocks causing high variability in inflation and disturb the consumption, investment and production behavior. Moreover, more government interventions in financial and goods markets and macro economics behavior cause economic instability and market failure. Therefore, prices do not give correct signals about the policies and the course of actions of the economy agents in the most of developing countries. In this context, the examination of inflation-growth relationship with respect to developing countries is imperative. Thus, this paper seeks to examine the relationship between the inflation and the economic growth in three developing countries in Asia; China, India and Sri Lanka.

The rest of this paper is organized as follows. The next section reviews the literature with relevant empirical studies. Section three describes the methodology used in the study. Next two sections are devoted to present and discuss the results of the present study in order to conclude the paper.

2. Literature Review

The existence and nature of the link between inflation and economic growth have extensively been investigated in the economic literature. Some economic theories explain that inflation is conducive to economic growth and there is a positive relationship between inflation and economic growth [1]. Keynesian Model explains that there is a short run tradeoff between output and the change of inflation, but no permanent trade-off between output and inflation. The concept of Phillips Curve also hypotheses that high inflation is positively affected economic growth by contributing creation of a low unemployment rate. The Tobin Effect suggests the inflation causes individuals to substitute out of money into interest earning assets, which leads to greater capital increasing and promotes economic growth. In effect, inflation exhibits a positive relationship to economic growth [4].

However, the validity of the positive relationship was questioned in the 1970s. During the period, numerous studies have been devoted to finding of effect of inflation on economic growth since the economies around the world have experienced hyper-inflation and massive unemployment. Those studies showed that sustained high rates of the inflation can have an adverse consequence on real economic growth even in the long run and repeatedly confirm that inflation has a considerable negative effect on economic growth, at least at sufficiently high level of inflation [5-7]. Reference [8], among others, helped to shift the conventional empirical wisdom about the effects of inflation on economic growth from a positive one to a negative one.

2.1. Relationship between Inflation and Economic Growth: Empirical Studies

Examination of the inflation-growth relationship has been a major issue in economic research. Earlier works on that fail to establish any meaningful relationship between inflation and economic growth [9,10]. Later on, a number of studies have attempted to identify the dynamic of relationship between inflation and economic growth. Reference [9] shows that inflation has no impact on economic growth except the situation where the inflation rate is over 40% that has negative impact on economic growth. Similarly, Reference [10] found no evidence to establish any meaningful relationship between inflation and economic growth by studying 70 countries for a period of 1960-1989. However, some studies found that inflation has a negative and significant impact on real economic growth [5,6,9]. The studies based on cross country data show the evidence that long term growth is adversely affected by inflation [6,11,12]. Reference [13] reports that countries which experienced high inflation rates have also witnessed lower long term growth. The studies based on multi country panel data show that the rate of inflation has an adverse impact on investment that creates macroeconomics stability and growth [14]. Reference [6] examines the role of macroeconomics factors in growth and finds that growth is negatively associated with inflation and positively associated with good fiscal performance and undistorted foreign exchange markets. Fischer further suggests that, since there are no good arguments for very high rate of inflation, a government that is producing high inflation is a government that has lost control. The inflation rate thus serves as an indicator of macroeconomics stability and the overall ability of the government to manage the economy. Reference [5] validates the positive relationship between inflation and economic growth using a large sample in relation to more than 100 countries for 1960-1999. His finding shows that even though for adverse influence of inflation on growth appeared small, the long term effects on standard of living are really sizeable.

Reference [13] finds a significant negative relationship between inflation and growth by studying 12 Latin American countries. He shows that both inflation and its variance have negative effects on growth, since they are highly correlated in cross country evidence. Reference [15] shows the evidence that the cross sectional correlation between inflation and growth depends on severe inflation observations with high frequency data. Reference [9,16] found support for the view that the negative relationship emerge only when rates of inflation exceed some threshold. Reference [15,17] also questioned whether a uniformly negative relationship exists between inflation and real activities independently of the previous rate of inflation. Paul et al. (1997) examined a multi country empirical investigation of the patterns between inflation and growth in a sample of 70 industrial economies and developing countries. They conclude that the relationship between inflation and growth is non-uniform across countries and a vast majority of countries show either uniform or bilateral causality over the selected period.

A series of recent studies provide the evidences to support the argument that inflation has a negative effect on inflation. In fact, Reference [18] studied inflation and growth relationship in Turkey over 20 years and found a negative short term relationship between the variables. Similarly, Refernce [19] found a strong long term inverse relationship between CPI and GDP in Kuwait from the data covering 20 years. Reference 20 found a long term negative relationship between inflation and economic growth in Bangladesh. Conversely, Reference [20] established divergent results, a long term positive relationship between inflation and economic growth, by studying the long term and short term dynamics of the relationship for four south Asian countries; Bangladesh, India, Pakistan and Sri Lanka.

On the other hand, cross country evidences show that countries which experienced higher growth are those with lower inflation rates and higher inflation has an adverse impact on long run economic growth. A study carried out by World Bank states that the high performing East Asian countries had a sustainable high economic growth in the last three decades since a stable macroeconomics environment that fostered high rates of investment and economic growth [21]. Some of studies argue that negative relationship between inflation and economic growth may be varied between opened and closed economies whereas the relationship is expected to be stronger in opened economies which rely on foreign direct and domestic investment.

3. Methodology

The study uses the annual time series data of real GDP growth rate and inflation rate of the three countries from 1980 to 2010. Since the study focuses the Asian region, three developing countries namely China, India and Sri Lanka were selected. China and India being the two big developing nations in the region have shown remarkable development in the recent years. Although Sri Lankan economy is too small compared to these two countries it has shown invariable growth in the past years and is considered as an emerging economy in the region. The data were obtained from the online publication base of the World Bank Indicators. The unit roots test is initially performed to find the stationary properties of the each time series. Augmented Dickey-Fuller Test (ADF) and Philips and Perron (PP) unit root tests are used for that purpose [22,23]. In the testing, if any variable does not show stationary at level then stationary property will be test on its first difference. If variables are stationary at their first difference long run association of the variable can be tested by using multivariate cointegration technique. This paper employs a testing procedure for cointegration projected by [24] which is known as bounds test approach to cointegration and Johansen’s cointegration test. The most important advantage of this procedure is that this method does not depend on whether variables are stationary at I(0) or I(1). To test the long run relationship F-test is used. If estimated F statistics comes above the upper level at integrated order one, which suggest a relationship between the variables. If F statistics comes at bottom level which signs for no long run relationship between the variables. If there is a case in which computed value of Statistics lies within the top and bottom, no conclusion can be made from the result. Vector error correction and Granger causality test are further employed and performed to investigate the short run dynamics of the relationship between inflation and economic growth.

4. Results and Discussion

Table 1 shows the average inflation rate and real GDP growth rate for the period of 1980-2010. China, among others, has experienced an immense average economic growth while keeping average inflation below 10% in the period. The lowest average GDP growth was recorded in Sri Lanka which experienced the highest average inflation rate in the period. However, India was succeeded to keep modest economic growth rate while keeping average inflation below 10% over the period.

4.1. Stationary Test

ADF t-tests and PP tests were performed on each of the time series to examine the stationary properties. The results reproduced in Table 2. Although ADF test results shows that growth rate of China is stationary at its level I(0), PP test results does not support that and indicates that the growth rate of China is stationary at its first difference I(1). However, both test results show that inflation rate of China is stationary at its first difference I(1). With respect to India, both test results indicate that the growth rate is stationary at its level I(0) while inflation rate is integrated at its first difference I(1). However, both variables for Sri Lanka are stationary on their level at 1% of significance. The above results show that there is no evidence to generate spurious estimation results be4.2. Cointegration

The above unit root tests reveal that all the time series are

Table 1. Average inflation and GDP growth.

Table 2. Results of ADF and PP.

**significant at 1%; *significant at 5%.

tween inflation and economic growth of these three countries. stationary at level or the first difference at 1% level of significance. Since the level of integration is in different stages, the cointegration cannot be performed directly. However, Engle and Granger approach to cointegration state that time series which are not stationary at levels but stationary in the first difference can be modeled with their level states [25]. On the other hand, in the situation where more than one cointegration vectors exit limits the usage of this approach. Johansen cointegration approach based on VAR model can be used to test the number of cointegration vectors among the variables. However, to use of these methods, all series should not be stationary at the levels and should become stationary when same differences are taken. Bound test approach developed by Pesaran et al. solve these problems and can be used to examine cointegration relationship between the series regardless whether they are I(0) or (1). Thus, results confirm that there is no long run relationship between economic growth and inflation in China. Although the series for India have stationary property at different level, Johansen’s test results show that there is no cointegration equation for the variables. Therefore, as similar to China, a long run relationship between economic growth and inflation cannot be found in India. However, trace statistics and Maximum Eigen value show that there are two cointegration equations for Sri Lanka.

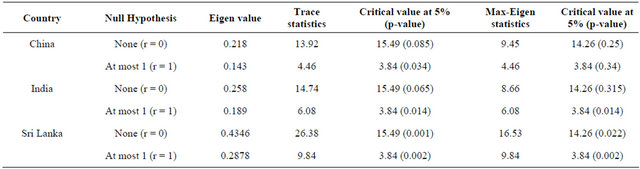

Since economic growth and inflation rate of China have stationary property at their first difference and same difference taken, Johensen’s cointegration test is performed to identify the long run relationship between the variables. The results are shown in Table 3. The Trace statistics and Maximum Eigen statistics show that there is no cointegration between economic growth and inflation of China at 5% level of significance.

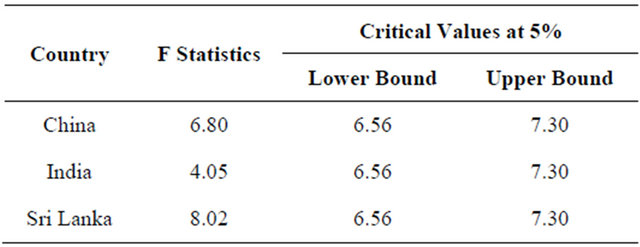

In order to validate the above results of Johansen’s cointegration, Bound Test is performed for the three countries. The results are given in Table 4. Bound test approach compares the F statistics calculated on Error Correction Model with bottom and top critical values of Pesaran et al. table to test the existence of cointegration relationship. If the F statistics is lower than the critical bottom value, no integration exit between the series. If the F statistics is higher than the critical top value, a cointegration relationship is exit between the series. However, no decision can be made in case of the F statistics are between the top and bottom critical values.

Since F statistics for China lies in between the lower and upper bound values, no exact decision can be made on the cointegration between economic growth and inflation of China. However, F statistics for India clearly reveal that there is no cointegration between economic growth and inflation of India since F value lies below the lower bound. However statistics for Sri Lanka is well over the upper bound F values, the long run relationship between inflation and economic growth is confirmed. These results further confirm the findings which have been generated from Johansen’s cointegration test.

Error correction method is further employed to check the short run dynamism of relationship between economic growth and inflation. Table 5 shows the results. According to the results, a short term negative and significant relationship can be identified between the economic growth and the inflation of China at 5% level of significance. The coefficient for EC (−1) is also negative and significant at 5% level. However, the results show no evidences for the existence of significant short run relationship between economic growth and inflation either in India or Sri Lanka.

Results of vector error correction revealed there is a short run negative relationship between the economic growth and the inflation in China. So that, there is an important issue whether inflation causes to economic growth or economic growth causes to inflation or whether there is bidirectional causality between the two variables to answer. Therefore, Granger Causality test is

Table 3. Results of johansen’s cointegration test.

Table 4. Results of bounds test.

Table 5. Results of error correction.

*Significant at 5%.

performed to investigate the causality between economic growth and inflation. The results are reproduced in Table 6.

The results show that there is a unidirectional causality between economic growth and inflation of China which runs from economic growth to inflation. This result does not support the finding of some of previous studies which found causality runs from inflation to economic growth. However, no any statistically significant causality can be found between economic growth and inflation in India and Sri Lanka.

In brief, the long run negative relationship between economic growth and inflation is found only for Sri Lanka in the selected period. No any long run relation

Table 6. Results of causality

ship was found between economic growth and inflation for China and India. However, a short run unidirectional relationship was revealed between the variables only for China. These results confirm that the country’s specific factors and macro economic conditions have significant influence over the link between the economic growth and inflation.

5. Conclusion

This study investigates the long run and short run dynamics of the relationship between economic growth and inflation in three Asian countries for the period of 1980 - 2010 in the framework of Johansen’s cointegration test; Bounds test approach, Error Correction method and Granger Causality. The results show that there is a long run negative and significant relationship between economic growth and inflation in Sri Lanka. No any significant long run relationship was found for China and India in between economic growth and inflation of long run. However, a short run negative relationship was found for China between the economic growth and inflation. A unidirectional causality running from economic growth to inflation was detected in China. In conclusion, countries which are characterized with stable high economic growth and stability macroeconomic condition do not suffer from inflation impact on their economic growth. Otherwise inflation has a long term negative impact on economic growth. Therefore, the attention of policy making bodies are necessity to aim at macroeconomic policies which provide cost efficiency and route for a steady and sustainable growth.

REFERENCES

- G. S. Dorrance, “Inflation and Growth,” Staff Paper, International Monetary Fund, Vol. 13, 1966, pp. 82-102.

- S. Johansen, “Statistical Analysis of Cointegration Vectors,” Journal of Economic Dynamics and Control, Vol. 12, No. 2-3, 1988, pp. 231-254. doi:10.1016/0165-1889(88)90041-3

- G. Mallik and A. Chowdhury, “Inflation and Economic Growth: Evidence from Four South Asian Countries,” Asia-Pacific Development Journal, Vol. 8, No. 1, 2001, pp. 123-135.

- A. C. Stockman, “Anticipate Inflation and the Capital Stock in Cash in Advanced Economy,” Journal of Monetary Economy, Vol. 8, No. 3, 1981, pp. 387-393. doi:10.1016/0304-3932(81)90018-0

- R. J. Barro, “Inflation and Economic Growth,” NBER Working Paper No. 5326, 1995.

- S. Fisher, “The Role of Macro Economics Factors in Growth,” Journal of Monetary Economics, Vol. 32, No. 2, 1993, pp. 485-512. doi:10.1016/0304-3932(93)90027-D

- S. Gerlarch and F. Smets, “Contagious Speculative Attacks,” BIS Working Paper No. 22, 1994. http//:ssrn.com/abstract=868432

- R. C. Kormandi and P. E. Meguire, “Macroeconomic Determinants of Growth: Cross Country Evidence,” Journal of Monetary Economics, Vol. 16, No. 2, 1985, pp. 141- 163. doi:10.1016/0304-3932(85)90027-3

- M. Bruno and W. Easrerly, “Inflation Crisis and Long Run Growth,” Journal of Monetary Economics, Vol. 41, No. 1, 1998, pp. 3-26. doi:10.1016/S0304-3932(97)00063-9

- S. Paul, C. Kearney and K. Chowdhury, “Inflation and Economic Growth: A Multi-Country Empirical Analysis,” Applied Economics, Vol. 29, No. 10, 1997, pp. 1387- 1401. doi:10.1080/00036849700000029

- R. C. Kormendi and P. G. Mequire, “Macroeconomic Determinants of Growth: Cross Country Evidence,” Journal of Monetary Economics, Vol. 16, No. 2, 1985, pp. 141-163. doi:10.1016/0304-3932(85)90027-3

- T. Gylfason and T. T. Herbertsson, “Does Inflation Matter for Growth,” Japan and World Economy, Vol. 13, No. 4, 2001, pp. 405-428. doi:10.1016/S0922-1425(01)00073-1

- J. De Gregorio, “Inflation, Taxation and Long Run Growth,” Journal of Monetary Economics, Vol. 31, No. 3, 1993, pp. 271-298. doi:10.1016/0304-3932(93)90049-L

- L. Serven and A. Slimano, “Private Investment and Macroeconomic Adjustments: A Survey,” World Bank Research Observer, Oxford University Press, Oxford, Vol. 7, No. 1, 1992, pp. 95-114.

- R. Levin and S. Zervos, “Stock Market, Banks and Economic Growth,” The American Economic Review, Vol. 88, No. 3, 1998, pp. 537-558.

- J. Bullard and J. Keatry, “The Long Run Relationship between Inflation and Output in Post War Economies,” Journal of Monetary Economy, Vol. 36, No. 3, 1995, pp. 477-496. doi:10.1016/0304-3932(95)01227-3

- T. E. Clark, “Cross Country Evidence on Long Run Growth and Inflation,” Federal Research Bank of Kansas City, Research Working Paper No. 93-05, 1993.

- E. Erbaykal and H. A. Okuyan, “Does Inflation Dress Economic Growth: Evidence from Turkey?” International Research Journal of Finance Economics, Vol. 17, 2008, pp. 40-48.

- A. Saaed, “Inflation and Economic Growth in Kuwait,” Applied Econometrics and International Development, Vol. 7, No. 1, 2007.

- S. Ahmed and G. Mortaza, “Inflation and Economic Growth in Bangladesh,” Working Paper 0604, Policy Analysis Unit, 2005.

- World Bank, “The East Asian Miracle: Economic Growth and Public Policy,” A World Bank Policy Research, Oxford University Press, Oxford, Vol. 1, No. 2, 1993, pp. 8- 23.

- D. A. Dickey and W. A. Fuller, “Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root,” Econometrica, Vol. 49, No. 4, 1981, pp. 1057-1072. doi:10.2307/1912517

- P. C. B. Phillips and P. Perron, “Testing for A Unit Root in Time Series Regression,” Biometrika, Vol. 75, No. 2, 1988, pp. 336-346. doi:10.1093/biomet/75.2.335

- M. H. Pesaran, Y. Shin and R. J. Smith, “Bounds Testing Approach to the Analysis of Level Relationships,” Journal of Applied Economics, Vol. 16, No. 3, 2001, pp. 289- 326. doi:10.1002/jae.616

- F. R. Engle and W. J. C. Granger, “Cointegration and Error Correction: Representation, Estimation and Testing,” Econometrica, Vol. 55, No. 2, 1981, pp. 251-276.