Chinese Studies

Vol.06 No.02(2017), Article ID:76133,16 pages

10.4236/chnstd.2017.62007

An Empirical Analysis of the Impact of RMB Exchange Rate Fluctuation on Textile and Clothing Export of Guangdong

Yuping Su

Jinan University, Guangzhou, China

Copyright © 2017 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: March 14, 2017; Accepted: May 12, 2017; Published: May 15, 2017

ABSTRACT

The main purpose of this paper is to analyze if RMB appreciation is the reason for the decline of Guangdong textile and garment exports and how to make textile and garment industry of Guangdong province break through the bottleneck of development, so as to achieve a qualitative leap in the context of the RMB exchange rate fluctuations and rising production costs. Five parts are included, the first part is introduction, which elaborates the research signifi- cance and literature review; the second part is about data and research methods; the third part is an empirical analysis of the impact of RMB exchange rate fluctuation on textile and clothing export of Guangdong; the fourth part is the conclusion analysis, while the last part are policy suggestion, which includes three aspects, government industry and enterprise themselves. In theory, the appreciation of the exchange rate will reduce the export price advantage to reduce exports. However, in this paper, the VAR and VEC models were constructed by using the monthly data of Guangdong textile and clothing export (LNEX), RMB real exchange rate (LNER) and purchasing price index (LNPPI) in 2007-2014, finding that Although LNEX has a co-integration relationship with LNER in the long run, LNER is not the Granger Cause of LNEX, while LNPPI passes the test of causality; Impulse response curves show that LNER has a negative impact on LNEX in the short term, while there is no shock effect for a long time; Variance decomposition analysis shows that contribution of LNER to LNEX was 0, both in the long term and short term, while the long-term contribution of LNPPI to LNEX is about 8%.

Keywords:

RMB Exchange Rate, Textile and Clothing, Export, VAR

1. Introduction

Guangdong is a big province of China’s exports of textile and garment products, according to statistics (Hu Dongsheng & Yu Xiujiang, 2009) , in 2007, export value of its Textile and garment products reaches for $41 billion 990 million, leading in all provinces of China, and accounting for 25% of the proportion of national textile and garment exports (Wu Xiling, 2011) ; However, it cannot conceal the fact of its slow development. After the global financial crisis of 2008, although the export of textile and clothing in Guangdong in 2009 was bottomed out, the performance is not ideal in the next few years, the growth rate were 1%, 5.3% and 7.7% from 2012 to 2014, far less than the growth rate of GDP in China. Since the reform of RMB exchange rate system in 2005, RMB has shown a strong appreciation trend, according to statistics, the real exchange rate of RMB has appreciated by 34.47% from January 2007 to December 2014, at the same time, the costs of the labor and raw material of textile enterprises are also increasing. The appreciation of the RMB real exchange rate and the increase of the cost will be the reason for the slow growth of the textile and garment exports in Guangdong province? In the face of slowing export growth, how to improve the competitiveness of Guangdong textile enterprises in the current fierce market? How should the government make the textile industry healthy and rapid development, make Guangdong pro- vince shift from export-heavy province to export-strong provinces? The above questions are what will be answered in this paper. Textile industry is one of the pillar industries in our country, which plays an important role in solving employment, increasing foreign exchange income and improving the economic strength of our country. However, it is a relatively high degree of dependence on foreign markets, so it has important and practical significance to study how to promote the development of textile industry in Guangdong Province under the background of the appreciation of RMB real exchange rate and the slowdown of textile and clothing export growth in Guangdong province.

There are mainly three conclusions about the research on exchange rate and export. First, the appreciation of the exchange rate is not conducive to trade exports (Tenreyro, 2007; Xian Chengyi & Fan Dongjun, 2008) ; Second, the appreciation of the exchange rate is conducive to trade exports (Cerra & Saxena, 2005; Su Yuhai & Huang Xin, 2006; Wang Wei, 2013) ; Third, the impact of exchange rate appreciation on exports is not significant (Choudhry, 2005; Shen Guobing, 2005) . The reasons for the emergence of a variety of conclusions are mainly due to the difference in the national conditions, the characteristics of the industry and the research methods used by the author (Wang Hairong, 2010) . The research characteristics of the relationship between exports and exchange rate mainly has the following several aspects: First, there is a lot of research on the total amount of trade among countries, but little research on the export of a specific industry; Second, ignoring the regional characteristic when researching the relationship between export and exchange rate (Bi Yujiang, 2008) , so recommendations for the development of the industry are lack of pertinence and scientific; Third, the study of the relationship between the textile industry and the exchange rate in Guangdong province are mostly qualitative analysis, lack of empirical analysis.

2. Data and Research Methods

2.1. Data Sources and Processing

In this paper, the time interval of investigation is from January 2007 to December 2014, and then select the monthly data indicators. In addition to the impact of changes in the RMB exchange rate, the export of textile and clothing in Guangdong will also be affected by the cost of production, this paper uses the raw material purchasing price index PPI to measure. Therefore, in this paper, a total of three indicators were selected in the empirical analysis, in order to eliminate the possible heteroscedasticity, this paper carried out the logarithm pro- cessing. Data selection is as follows:

Textile and garment exports of Guangdong are made up of two parts, namely, clothing and accessories, textile yarn fabrics and products. The export unit is $10,000. The export volume of textile and apparel in Guangdong is expressed by EX, and the logarithm of it is recorded as LNEX in the model.

Exchange rate of RMB is the real exchange rate of the RMB to the dollar, which eliminates the impact of the price level of the two countries and expressed by ER, the logarithm of it is recorded as LNER. The data comes from the official website of the bank for International Settlements (BIS).

The export of textile and clothing is affected not only by the change of RMB exchange rate, but also by the cost of domestic textile production. In this paper, the textile raw materials purchasing price index (PPI) is used to measure the production cost. Similarly, it is recorded as LNPPI after taking logarithm.

2.2. Research Method

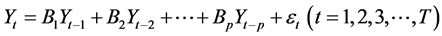

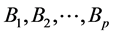

This paper makes an empirical study on the data by constructing the VAR model, which was first introduced into economics by C. A. Sims in 1980 (Cao Wei, 2011) . The advantage of this method is that it can be used to predict the dynamic impact of interconnected time series system and a series of stochastic disturbances on the variable system. With P order lag the consequent general expression of VAR model is as follows:

(1)

(1)

in the formula (1), Yt is the K dimension variable, T is the sample size,  , is the K dimension with the parameter matrix, P is the lag order,

, is the K dimension with the parameter matrix, P is the lag order,  is white noise error.

is white noise error.

3. Empirical Analysis

3.1. Test of Data Stationarity

Since the VAR model is easy to appear pseudo regression for the non-stationary time series, the first step is to analyze the stability of the data (Huang Jingbo & Ceng Zhaozhi, 2011) . In this paper, the ADF method is used, and the results are shown in the following Table 1.

As shown in Table 1, logarithmic export, real exchange rate and purchase

Table 1. Sequence stationarity test: (ADF test).

Note: (C, T, N) is the ADF test form, C, T and N respectively represent three test forms of ADF which has the intercept and trend and lag order, (C, 0, 0) means ADF test form with intercept, (C, T, 0) means ADF test form with intercept and trend, Prefix D represents the first difference form of data.

price index do not pass through the stationary test in the significant level of 5% and 1%, they are nonstationary time series. Then they take the form of first order difference to them, variables of first order difference pass through the stationary test at a confidence level of 1% and 5%, so DLNEX, DLNER, DLNPPI are first-order single whole, which meets the conditions of VAR modeling.

3.2. The Choice of Lag Order and the Establishment of VAR Model

Before estimating the VAR model, the maximum lag length must be determined. The choice of lag length must be reasonable, the large lag order can better reflect the dynamic characteristics of the model. However, the larger the lag order, the more parameters to be estimated, the higher the degree of freedom. In this paper, the method of selecting the lag order is AIC (Akaike Information Criterion) and SC (Schwarz Criterion). The following table (Table 2) lists the AIC and SC values when the lag order is 0 - 8, and the results are as follows:

According to the AIC and SC information criterion, the optimal lag order is 2.

(2)

(2)

3.3. Stability Test of the Model (AR Root Test)

The VAR model is based on its overall stability, so it is necessary to test the whole stability of the model. In this paper, we use the characteristic root test of unit circle, the model can pass the stability test only when the characteristic roots are in the unit circle. As shown in the Figure 1, the 6 characteristic roots of the model are within the unit circle.

3.4. Cointegration Test

Variables may deviate from the mean value due to seasonal effects or random interference in the short term, if the deviation is temporary, then it will return to equilibrium mover time; if the deviation is persistent, it can not be said that these variables have a balanced relationship. The cointegration test can be re-

Table 2. Selection of optimal lag order.

Note: *denotes the selection of the optimal lag order, Lag means lag order, AIC means akaike information criterion while SC means schwarz criterion.

Figure 1. Model stationarity test (unit root test).

garded as a statistical representation of the nature of the equilibrium relationship. In order to check whether there is a cointegration among the three variables, Johansen-Juselius cointegration test will be used.

As Table 3 shows, trace statistic of 30.79 is greater than the critical value 29.7 in 5% confidence level, so there is not a refusal to accept any cointegration hypotheses, indicating that there exist at least one cointegration relationship among the export (LNEX), exchange rate (LNER) and the purchase value index (LNPPI). The cointegration relationship among the variables obtained by standardized processing is:

(3)

(3)

3.5. Stationarity Test of Co-Integration Equation Residuals

The setting of the co integration equation is reasonable only when the residual

Table 3. Test of the cointegration relation (Johannsen test).

*denotes rejection of the hypothesis at the 0.05 level; **MacKinnon-Haug-Michelis (1999) p-values.

sequence is stationary. In this paper, the ADF test method is used to test the rationality of the cointegration equation, the results are as follows (Table 4).

The results show that the residual series passed the stationarity test under the three significant levels, which means that the co integration equation is reasonable.

From formula (3) can be seen that there is a reverse relationship among the textile and apparel goods, the real exchange rate of RMB and the purchase index, what is more, Exports are more sensitive to changes in real exchange rates, when the real exchange rate of RMB rose one percent, exports dropped by an average of 1.08 percentage; and when the textile industry purchase index rose one percentage point, the export of textile and clothing will decline by 0.83 percentage points on average.

3.6. Grainger Causality Test

It can be seen that the export of textile and apparel products in Guangdong province is significantly related to the real exchange rate and the purchasing index in the long run, but this is not necessarily a causal relationship, which means that it is not necessarily meaningful. Grainger causality test is a method to judge the causal relationship between variables. Therefore, this paper uses Grainger causality test to determine whether the change of real exchange rate is the reason for the change of Guangdong textile and clothing export. The following table (Table 5) gives a variety of statistical values of Grainger causality.

As can be seen from Table 5, under the original hypothesis that the real exchange rate (DLNER) is not the Grainger cause of Guangdong textile and garment exports (DLNEX), statistics F = 0.2, P = 0.81, so accept the original hypothesis, means that the past value of RMB real exchange rate cannot explain the current value of export of textile and clothing products in Guangdong Province; Also, the purchase price index (DLNPPI) of textile industry in Guangdong province is Grainger reason of the export of textile and garment products (DLNEX) in 10% confidence level, which means that the real exchange rate of RMB is the Grainger reason of the purchase price index of textile industry (DLNPPI) in confidence level of 5%.

3.7. VEC Error Correction Mechanism

Though there is a long-term co integration relationship among LNEX, LNER and LNPPI, the long-term stable relationship can be maintained under the short- term dynamic continuous adjustment, error correction mechanism exists in all

Table 4. Stationarity test of the residuals of co integration equation.

*denotes rejection of the hypothesis at the 0.05 level.

Table 5. Grainger causality test.

co-integration relations. The VEC model is a dynamic one to study the short- term dynamic relationship of cointegration variables, it is dynamic function of export change in this paper. The model established in this paper is as follows:

(4)

(4)

In the formula (4), the error correction term of

3.8. Impulse Response Analysis

In practice, the VAR model is a non theoretical model, it does not need any priori constraints on the variables, we tend not to analyze a variable how to effect on the other variables in the analysis of the vector auto regression model, but to analyze the dynamic effects of an error term (pulse value) on the system, the analysis method is the impulse response function (impulse response, function, IBF). IBF describes how the dependent variable in the VAR coefficient responds to the impact of the error term in the equation. The following graphs report the trajectory of Guangdong textile and apparel exports (DLNEX) in response to the impact of the RMB real exchange rate (DLNER) and the purchase price index (DLNPPI), the abscissa is the number of lag period (unit: month), this paper select it for 10; The ordinate is the degree of response to the export of textile and clothing exports in Guangdong province.

As can be seen from Figure 2, textile and apparel exports of Guangdong (DLNEX) reach the lowest point in the third period after a slight decline in first two periods when giving RMB real exchange rate (DLNER) a positive impact in the current period. From the beginning of the fourth period, the export of textile and clothing products in Guangdong is not affected by the impact of exchange rate. This shows that the current appreciation of the RMB real exchange rate will have a negative impact on the export of textile and apparel products in the first three periods of Guangdong Province, this effect reached the maximum in the third period, and disappeared in the fourth period. As can be seen from Figure 3, Guangdong textile and apparel exports (DLNEX) fluctuate in the first three

Figure 2. Response of DLNEX to DLNER.

Figure 3. Response of DLNEX to DLNPPI.

periods, reaching the negative impact of the maximum in the second period and the highest point in the positive impact of the third period after giving a positive impact on the purchase price index, the positive impact begin to rapidly decline in the fourth period, and then gradually disappear. It shows that the increasing cost of production does not necessarily lead to decline in textile and garment export all the time, as it may encourage enterprises to improve management, improve labor productivity to offset the impact of rising costs.

3.9. Variance Decomposition

The variance decomposition aims to further evaluate the importance of different impact structure by analyzing the impact of each structure on the contribution of endogenous variables, so it gives information on the relative importance of random disturbance affect each variable in the VAR model (Ba Shusong, Wu Bo, & Zhu Yuanqian, 2007) . Respectively, Figures 3-5 analyze the contribution of RMB real exchange rate (DLNER), the purchase price index (DLNPPI) and the change of preexport to the export of textile and clothing (DLNEX). The abscissa represents the number of lag periods (unit: monthly) and the ordinate represents the contribution (unit: %).

As we can see from Figure 4, the impact of the RMB real exchange rate (DLNER) on the export of textile and garment exports in Guangdong is close to 0,which means that the real exchange rate of RMB does not explain the change of export, the real exchange rate of RMB can not affect the export of textile and clothing products in Guangdong province. According to Figure 5 and Figure 6, we can see that the error ratio of Guangdong textile and garment exports to Guangdong textile and garment exports is about 100% in the beginning, which means that export growth depends entirely on its own; In the second period, the proportion of the contribution of the initial exports began to decline, while the proportion of the purchase index began to rise to 4%; In the third period, the change of purchase price index explains the export of 8%, while, change of early export value explains the export 92%. Therefore, it can be seen from the analysis

Figure 4. Percent DLNEX variance due to DLNER.

Figure 5. Percent DLNEX variance due to DLNPPI.

Figure 6. Percent DLNEX variance due to DLNEX.

that export changes of Guangdong textile and garment are mainly driven by their own.

4. Conclusion and Analysis

In this paper, the VAR and VEC models are established by using the monthly data of Guangdong textile and garment export, the real exchange rate and the purchasing price index of 2007-2014, the empirical analysis draws the following conclusions: First, although there is a equilibrium mechanism between textile and garment exports Guangdong Province and the real exchange rate of RMB, the real exchange rate of RMB appreciation will not affect the overall export of textile and clothing industry in Guangdong Province, while increased business costs will lead to reduced exports; Second, although the increase in raw material costs will hinder the export of textile and garment enterprises in the short term, it will not affect the overall export level of textile enterprises in Guangdong province in the long run; Third, the error correction term will adjust the export of textile and garment products to the equilibrium state by the unit of 0.463 when the equilibrium relationship is destroyed in the short term, so as to maintain a long-term equilibrium relationship among LNEX, LNER, LNPPI.

The appreciation of the RMB real exchange rate did not affect the overall level of Guangdong’s textile and garment exports, possible reasons are as follows: First of all, the textile export enterprises in Guangdong has occupied their own overseas market with their own advantages, what is more, the international market highly rely on these textile and apparel products, as a result, the price disadvantage caused by the appreciation of the exchange rate will not have a substantial impact on its market share; Secondly, the relative decline in price advantage will encourage enterprises to improve management, use advanced technology to improve production efficiency, so as to offset the impact of its products in the international market price decline; Thirdly, the application of the terms of agreement and derivative financial instruments can reduce the exchange rate risk in the trade, so as to maintain the competitive advantage of export products.

5. Policy Suggestion

It is not easy for a big city of textile export to change into a strong one, the growth of the industry needs the support of various forces, the development of Guangdong textile industry can achieve a qualitative leap only when keeping pace with the times. In this section, I will put forward some suggestions on the development of textile and garment industry in Guangdong from three aspects.

1) Government:

Government departments should increase support for textile enterprise on innovation and finance, so as to provide legal protection for enterprise patents and create a good environment for the development of innovative textile enterprises. Specific practices can be divided into three aspects:

・ First, refinancing support. Government should provide better financial services for the transformation and upgrading of textile and garment enterprises;

・ Second, tax incentives. Tax regulation is important to the development of the industry, those who are the first to do a good job of environmental protection and good at innovating should be given preferential tax, so as to stimulate their spirit of innovation.

・ Third, the establishment of Industry Development Fund. The role of the special fund is to support the development of the industry by the use of free financing, business incentives, equity investments, purchase services, etc. At the same time, Government can also take the market approach and introduce competitive distribution methods for venture capital institutions, public service agencies and security agencies, making them have the opportunity to invest in small and medium-sized textile enterprises, so as to make full use of fiscal funds.

2) Industry:

Give full play to the role of industry associations and establish early warning mechanism of trade barriers. In recent years, China’s textile and garment enterprises has confronted so many trade dispute around the world, a big reason is because they do not understand the new regulations and new standards for the export country of textile imports, industry associations can solve the problem of information asymmetry in this area. Specific practices can be divided into the following two aspects:

・ First, set up relevant departments to collect new standards and new regulations on foreign textile and clothing industry, and study on the development trend of trade policy of importing countries. For a variety of technical standards already exist, the association should set up perfect information center and database, then timely feedback to the relevant departments and enterprises through effective means, so as to provide early warning mechanism for textile and garment enterprises in Guangdong Province.

・ Second, the textile and garment industry association should try to predict the trend of international standards of textile and garment industry according to the development trend of the national industry, it is wise to convene the domestic representative enterprises to study the formulation of new standards when there is a change in the international standard rate so as to make domestic standards and international standards convergence and achieve pre emptive. Only giving full play to the vanguard role of industry associations, can we establish risk prevention mechanism for export enterprises in Guangdong province, so as to avoid the adverse effects of changes in the new international standard, and effectively quell trade disputes in the world market.

3) The enterprise itself:

First, it is wise for enterprises to actively change the development model (Wang Xianjun, 2013) . Textile and garment industry is a labor intensive one, export products of Guangdong province and even the national textile can take advantage of the price advantage and have a rapid expansion in the world market, largely thanks to China’s cheap labor. However, with the development of textile and clothing industry in Southeast Asia, the original price advantage of export will gradually disappear, competitiveness will be relatively reduced, coupled with the increase in consumer demand for products, the products which are both cheap and serious homogeneous will be abandoned by the market. Therefore, the textile enterprises should give up the extensive mode of development, and strive to improve management, actively introduce the production technology, transform backward production equipment, improve labor productivity. Specific approach can start from three aspects:

・ Give full play to the advantages of backwardness. Compared with the developed countries, the development of light industry in China is relatively late. we are relatively backward whether in the textile industry production technology or management philosophy. This is our weakness, while it is also an advantage. Enterprises can have more communication and cooperation with the advanced enterprises to find its own deficiencies, then learn from the mature production management experience of developed country and actively introduce their advanced technology and equipment, abandon the backward production marketing idea and keep up with the pace of market changes.

・ Identify their own positioning, then seeking market segments (Ju Pengfei, 2013) . The road of extensive expansion only is difficult to continue for small and medium-sized textile and garment enterprises. The correct approach should be to tap their own advantages, so as to make the existing business perfect and build their own core competitiveness of the market. Therefore, they should accurately analyze the industry involved in their field, then divide big market into different small market, it is a good choice for small and medium-sized textile and garment enterprises to strive to become a regional leader (Song Haiying, 2005) .

・ Choose the appropriate development strategy according to its own development stage (Chao Ji, 2014) . In the process of the growth of enterprises, different stages of development should take different development strategies, only choose the right development strategy, enterprises can take less detours, grow faster. In the early stage of the development of enterprises, the use of centralized strategy is a wise choice: they can concentrate their limited capital and technology in the dominant areas and give full play to the advantages of small and medium sized enterprises to operate flexibly and quickly through continuous learning and innovation. For new product development, start-up enterprises can not blindly fight with industry leader, but should choose appropriate timing of entry, so as to avoid risks and seize the market more smoothly. Of course, enterprises can also perform a market niche strategy in the early stages of development, it is wise for them to dig market demand, and develop differentiated products, so as to make full use of business advantage to avoid competition.

Second, actively explore the domestic market (Research Group of China Textile İndustry, 2004) . On the one hand, the development of Guangdong textile and clothing industry relies heavily on exports, which is affected by the foreign economic environment, the export environmental become more unstable cou- pled with the increasing trade disputes; On the other hand, the domestic price of cotton, chemical fiber and labor began to rise from the beginning of 2008, increased production costs make domestic textile enterprises difficult to continue to export high quality and cheap goods, blindly develop the original international market is clearly not a wise move when the demand of foreign market is gradually saturated. China is a large country with a population of 1 billion 300 million, the world’s leading economic development speed, the rapid development of the economy has accumulated a lot of wealth in the mid-west, residents’ consumption capacity there is increasing. At present, many domestic manufacturing enterprises in eastern coastal areas have began to spread to the central and western regions, as human resource is rich and relatively low price there, land rent is much lower than the eastern coastal areas. Taking into account the domestic and international market is a good choice for export processing enterprises. Although the domestic textile and apparel market is the total supply of excess, the contradiction between supply and demand is prominent, effective demand cannot be met as the domestic market is flooded with too many homogeneous products. Therefore, textile and garment enterprises of Guangdong should actively explore the effective demand of the domestic market and produce differentiated and innovative products, so as to provide effective supply and open up the domestic market.

Third, develop brand products and establish brand advantage. Lenovo is a pioneer in China’s enterprise brand marketing. Excellent quality and after-sale service make it a good reputation in the minds of consumers. After decades of development, Lenovo brand has won a global reputation, consumers often prefer to choose the Lenovo computer for two PCs with the same configuration and appearance, even the price of Lenovo is higher, this is the brand premium. Strong processing ability but small brand influence is the obvious phenomenon of Guangdong textile and garment industry. Companies can only earn a small amount of processing fees due to the low end of the value chain, the added value of the brand can only flow into the hands of others. The survival of the fittest is the inevitable law of the market economy, only to establish their own brand of enterprises can they increase consumer stickiness and enjoy brand premium, so as to maintain their competitive advantage and avoid being eliminated. textile and garment enterprises of Guangdong Province should strengthen their brand building efforts, increase investment in research, establish a well-known brand starting from the quality of products and services, so as to increase the competitiveness of products and added value.

Fourth, flexibly usefinancial derivatives and the terms of the contract to avoid exchange rate risk. Two-way exchange rate fluctuations is more frequent in the current exchange rate system. In the short term, the fluctuation of the exchange rate will increase the uncertainty of the export of the enterprise, therefore, the use of financial instruments will directly affect the export efficiency of enterprises. There are two ways to avoid exchange rate risk: One is adding exchange rate terms in foreign trade contracts and passing exchange rate risk to the customer; The second is the use of financial derivatives, Financial derivatives can establish exchange rate risk control system for the enterprise, when the forecast of exchange rate fluctuations have adverse effects on the export enterprises, derivatives can serve to reduce the loss of function, so that the export trade is more stable. At present the main financial instruments have long-term settlement, currency futures hedging, hedging currency options and currency swap etc. Take the currency option for an example. When predicting that RMB appreciation would lead to adverse export, the export enterprises can buy call option of RMB, the return of call option can make up part of the loss when the appreciation of RMB brings loss to export, so as to reduce the volatility of export enterprises.

Cite this paper

Su, Y. P. (2017). An Empirical Analysis of the Impact of RMB Exchange Rate Fluctuation on Textile and Clothing Export of Guangdong. Chinese Studies, 6, 55-70. https://doi.org/10.4236/chnstd.2017.62007

References

- 1. Ba Shusong, Wu Bo, & Zhu Yuanqian 巴曙松, 吴博, 朱元倩 (2007). The Analysis of the Effective Exchange Rate of RMB and Estimates the Impact on International Trade of Foreign Exchange Reserves after the Reform of Exchange Rate System 汇率制度改革后人民币有效汇率测算及对国际贸易外汇储备的影响分析. Studies of International Finance, No. 4, 56-62. [Paper reference 1]

- 2. Bi Yujiang 毕玉江 (2008). Exchange Rate Uncertainty and Import and Export Trade— Based on the Theory and Empirical Analysis of Micro 汇率的不确定性与进出口贸易——基于微观分析的理论与实证. Journal of Industrial Technological Economics, 27, 112-116. [Paper reference 1]

- 3. Cao Wei 曹伟 (2011). The Exchange Rate of RMB and the Management of China’s Trade Balance: An Empirical Study Based on the Perspective of Exchange Rate Transmission 人民币汇率变动与中国的贸易收支管理-基于汇率传递视角的实证研究. Journal of Business Economics, 1, 66-73. [Paper reference 1]

- 4. Cerra, V., & Saxena, S. C (2005). Did Output Recover from the Asian Crisis? IMF Staff Papers, 52, 6. [Paper reference 1]

- 5. Chao Ji巢吉 (2014). Research on Marketing Strategy of DD Textile Development in Domestic Market DD纺织开拓国内市场的营销策略研究. MSc Thesis, Lanzhou: Lanzhou University of Technology. [Paper reference 1]

- 6. Choudhry, T. (2005). Exchange Rate Volatility and the United States Exports: Evidence from Canada and Japan. Journal of the Japanese and International Economies, 19, 51-71. [Paper reference 1]

- 7. Hu Dongsheng, & Yu Xiujiang 胡冬生, 余秀江 (2009). The Strategic Thinking of Guangdong Textile and Garment Industry to Deal with the Crisis广东纺织服装产业应对危机的战略思考. International Economics and Trade Research, No. 9, 43-47. [Paper reference 1]

- 8. Huang Jingbo, & Ceng Zhaozhi 黄静波, 曾昭志 (2011). An Analysis of the Impact of RMB Exchange Rate Fluctuations and FDI Inflows on Exports 人民币汇率波动、FDI流入对出口影响之分析. Journal of Sun Yat-Sen University (Social Science Edition), 51, 192-199. [Paper reference 1]

- 9. Ju Pengfei 踞鹏飞 (2013). Analysis and Countermeasures of Small and Medium Sized Garment Textile Export of Guangdong 广东省中小服装纺织业出口现状分析与对策. Chinese Times, No. 11. [Paper reference 1]

- 10. Research Group of China Textile Industry 中国纺织工业课题组 (2004). Study on the Competitiveness of Guangdong Textile Industry 广东纺织工业竞争力研究. hina Textile & Apparel, No. 3, 76-78. [Paper reference 1]

- 11. Shen Guobing 沈国兵 (2005). Sino US Trade Balance and RMB Exchange Rate 美中贸易收支与人民币汇率关系. Contemporary Finance & Economics, No. 1, 43-47. [Paper reference 1]

- 12. Song Haiying 宋海英 (2005). Empirical Analysis of the Impact of RMB Exchange Rate Changes on China’s Agricultural Products Export 人民币汇率变动对我国农产品出口贸易影响的实证分析. Journal of Nanjing Agricultural University (Social Sciences Edition), 5, 12-17. [Paper reference 1]

- 13. Su Yuhai, & Huang Xin 宿玉海, 黄鑫 (2006). Relationship between RMB Nominal Exchange Rate and Chinese of Euro Countries Export 人民币名义汇率与中国对欧元区国家出口的关系[J]. Finance & Economics, No. 4, 16. [Paper reference 1]

- 14. Tenreyro, S (2007). On the Trade Impact of Nominal Exchange Rate Volatility. Journal of Development Economics, 82, 485-508. [Paper reference 1]

- 15. Wang Hairong 王海荣 (2010). Analysis of the Effect of RMB Appreciation on the Export of the Textile Industry of Shandong Province 人民币升值对山东省纺织业出口的影响分析. MSc Thesis, Jinan: Shandong University. [Paper reference 1]

- 16. Wang Wei 王玮 (2013). Study on the Impact of RMB Exchange Rate Fluctuation on Export: A Case Study of Jiangsu High Tech Industry and Textile Industry 人民币汇率变动对出口的影响探究——以江苏省高新技术产业、纺织产业为例. Foreign Economic Relations & Trade, No. 1, 20-22. [Paper reference 1]

- 17. Wang Xianjun 王贤俊 (2013). The Impact of RMB Appreciation on China’s Economy 人民币升值对我国经济的影响. Review of Economic Research, No. 60, 17. [Paper reference 1]

- 18. Wu Xiling 吴喜龄 (2011). The Current Situation and Countermeasures of Textile and Garment Industry in Guangdong Province 广东省纺织服装业出口现状及对策分析. Modern Business Trade Industry, 23, 13-14. [Paper reference 1]

- 19. Xian Chengyi, & Fan Dongjun 贤成毅, 范东君 (2008). Empirical Analysis of RMB Appreciation and Sino US Trade Imbalance 人民币升值与中美贸易失衡的实证分析: 1980-2005. Guangxi: Journal of Guangxi University (Philosophy and Social Science), 30, 22-25. [Paper reference 1]