Journal of Financial Risk Management

Vol.06 No.03(2017), Article ID:78354,16 pages

10.4236/jfrm.2017.63017

Modeling and Quantifying of the Global Wrong Way Risk

Badreddine Slime

Financial Risk Quant from ENSAE (Ecole Nationale de la Statistique et de l’Administration Economique), Paris, France

Copyright © 2017 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: June 18, 2017; Accepted: August 8, 2017; Published: August 11, 2017

ABSTRACT

The counterparty risk issue has become increasingly important in the world of finance. This risk is defined as the loss due to the counterparty default. The regulator uses the Credit Value Adjustment (CVA) to measure this risk. However, there is the independency assumption between the default and the exposure behind the CVA computation and it is not verified on the financial market. This paper presents two mathematical models for the assessment and the quantification of the counterparty risk without this assumption. This kind of risk is known as Wrong Way Risk (WWR). This study focuses on three approaches: empirical, copula and mixed model. The first one is based on the hazard rate modelling to express the correlation between the probability of default and the exposure. The second one is about calculating the WWR effect using copulas. The last one is a combination of both. There is another assumption that makes easier the CVA computation: The constant of the loss given default (LGD). As we know this assumption is not verified because the LGD could be deterministic or stochastic. Otherwise, it could lead to a correlation effect between the LGD, the exposure and the default, and we then obtain a Global Wrong Way Risk (GWWR). Indeed, we propose a model allowing the CVA quantification without these assumptions.

Keywords:

Counterparty Risk, Credit Value Adjustment, Wrong Way Risk, Copulas

1. Introduction

The credit value adjustment (CVA) computation is based on the independency assumption between the exposure and the default. However,this assumption is not verified on the market, and we although have correlation between the probability of default (PD) and the exposure at default (EAD). Therefore, we get two types of this effect: The Wrong Way Risk (WWR) when the correlation is positive and the Right Way Risk (RWR) when the correlation in this case is negative. There is another effect appears when the LGD becomes random and also depends on the default. Indeed, this could generate a correlation between the three variables that make the CVA assessment. In this case, we could call this effect as the Global Wrong Way Risk (GWWR). First, we will focus on the WWR effect and we make the difference between two kinds:

・ The systemic WWR: this kind arises at the moment where the dependency between the exposure and the default is due to a macroeconomic factor. In this case, this factor increases the EAD and the PD. If we take a put on the CAC40 index with some bank like Société Général (SG) as the issuer, then the CAC40 spot impacts both of the exposure and the counterparty rating. In fact, this index is a systemic factor in the French market and the SG is a part of the CAC40 composition.

・ The specific WWR: on the other hand, this kind comes from a specific factor. For example, we get this effect when we have a put on the stock of the issuer as underlying.

There are several models allowing the CVA computation with the WWR component. We present some of these approaches:

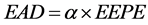

・ The Basel model1 ( Basel Committee on Banking Supervision, 2010 ): this approach is the most straightforward one to add the correlation effect and it is used by the Basel committee to add the WWR effect in the counterparty credit risk (CCR) charge. It is based on the multiplier coefficient , to explain this effect. The exposure at default is given by the formula bellow:

, to explain this effect. The exposure at default is given by the formula bellow:

With  represents the expected effective positive exposure.

represents the expected effective positive exposure.

We have by default , whatever, banks could have values above 1.2. Other institutions use values bigger than the default one. The coefficient value is appreciated, on one hand, by the name concentration and that also means the portfolio granularity by counterparties. On the other hand, we have the correlation effects between assets of the same counterparty. The Basel II accords do not give details to manage the WWR. However, Basel III brings more precision to manage this kind of risk, focusing on three aspects:

, whatever, banks could have values above 1.2. Other institutions use values bigger than the default one. The coefficient value is appreciated, on one hand, by the name concentration and that also means the portfolio granularity by counterparties. On the other hand, we have the correlation effects between assets of the same counterparty. The Basel II accords do not give details to manage the WWR. However, Basel III brings more precision to manage this kind of risk, focusing on three aspects:

Ø Implementation of a detailed process to manage the WWR.

Ø Advising banks to put more provision to cover the counterparty risk.

Ø Explication of the approach to manage transactions containing the specific WWR.

The implementation of this model remains easy and could be automatically integrated to the existent model, but it has two drawbacks:

Ø It does not give the contribution part of the WWR.

Ø It consumes more capital requirement to cover the counterparty risk, because the standard approach is designed for the worst case.

・ The empirical approach: this approach uses the hazard rate according to the exposure. Indeed, the relation between these two quantities allows getting the diffusion of the PD, and then it could explain the correlation with the exposure. The WWR modeling progresses into three steps:

Ø The choice of the function that gives the relation between the hazard rate and the exposure. The diffusion calculation is performed for each time step:

With  represents the exposure. Hull and White2 ( Hull & White 2012 ) suggests an exponential function to implement this method.

represents the exposure. Hull and White2 ( Hull & White 2012 ) suggests an exponential function to implement this method.

Ø The PD computation is done using the below formula:

Ø The computation of the CVA WWR using the Monte Carlo simulation. This step is deduced directly from the exposure diffusion.

This approach allows a straight integration within the existent CVA model. In fact, it replaces the computed PDs under the independency assumption with the new one using the dependency between the default and the exposure.

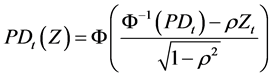

・ The copula model: This approach is based on copulas to explain the relation between the default variable and the exposure. Rosen and Saunders3 ( Rosen & Saunders 2012 ) use the Vasicek model to make this dependency. They introduced the Gaussian copula to compute the expected exposure without the independency assumption. Their model is implemented in three steps:

Ø The default is written as a latent variable and it is divided in two components. The first part represents the specific risk, and the second part is the systemic risk:

where  and

and  are two independent random variables and they follow a Gaussian distribution. The counterparty is deemed in default when

are two independent random variables and they follow a Gaussian distribution. The counterparty is deemed in default when  is lower than

is lower than . The conditional probability of default regarding to the systemic variable is expressed as:

. The conditional probability of default regarding to the systemic variable is expressed as:

With  represents the unconditional probability of default.

represents the unconditional probability of default.

Ø Future exposures are mapped to a market variable  that also follows a Gaussian distribution. The relation between this variable and the exposure is:

that also follows a Gaussian distribution. The relation between this variable and the exposure is:

With  represents the distribution function of exposure and it is uniform.

represents the distribution function of exposure and it is uniform.

Ø This model supposes that the two variables  and

and

The next section will be devoted to the WWR mathematical modeling using a mixed model. Indeed, we will use the empirical model to build the diffusion of PDs, and then we will explain the relation between the default and the exposure under copulas model.

2. Mathematical Modeling of the WWR

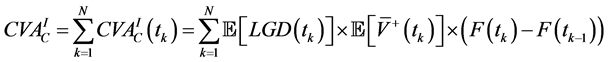

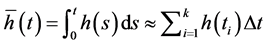

The Credit Value Adjustment (CVA) is defined by the difference between the portfolio value without the counterparty default and with this component. The CVA could be written as:

where

Using this, we find the following formula:

With

We also can write:

where

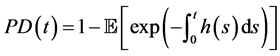

First, we begin by modeling the probability of default using the empirical model. For this, we introduce the hazard rate concept that measures the counterparty default occurrence. Giving the assumption that the default frequency follows the Poisson density, we get the formula below:

The relation between the

With

This function should also verify the following relation under the assumption that the hazard rates curve is flat:

With

We deem the following function of the hazard rate:

where

We can find the stochastic derivative equation (SDE) of the hazard rate by applying the Itô’s lemma on the

With

We conclude that the hazard rate follows a log-normal distribution with parameters below:

In our case, we more interest about the distribution of the time integration of the

With,

It also supposes that

If

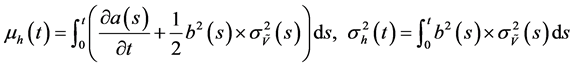

The calibration is made in each time of the Monte Carlo simulation. Indeed, we minimize the distance between the PD model and the PD market basing on spreads. So, we need to do this process

where

The Appropriate parameters are those who minimize the following quantity:

where

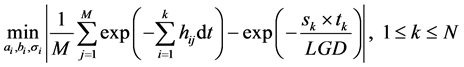

Finally, when the parameters are computed, then the hazard rates are built sequentially at each time step. The next step allows to define the relation between the exposure and the probability of default distribution. Therefore, we use the copulas to get this relation, and we take the following definitions:

・ The value of the discount exposure

・ The default time of the counterparty

・ The joint distribution of

where

The expected positive exposure (EPE) is equal to:

With

We also have:

We then replace the value of the conditional density in the formula to get the following result:

By applying the strong law of large number, we obtain the following approximation of the EPE:

It remains one issue to complete those calculations; we are talking about the estimation of the correlation between the exposure and the probability of default. In fact, it is the requirement parameter to compute

・ The first one uses the Spearman6 ( Daniel, 1990 ) correlation who is defined as:

where

diffusion for this. Finally, we can estimate the correlation by

・ The second one is based on the minimization of the difference between the simulated survival probabilities at time

We then can estimate the correlation by

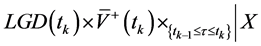

We have now all components to complete the CVA computation with the WWR effect. It remains to calculate all

・ The Loss Given Default

・ The discretization of time space is done on 100 steps.

・ The dividends are equals to 0.

・ The credit spread of the counterparty is constant and equal to 0.8%.

・ The CAC40 put strike value is 4350.

・ The Credit Support Annex (CSA) contains a Margin Call with 10 days as Margin Dates and the calculation will be done with and without collateral.

The value of the correlation between exposures and defaults using Spearman is equal to

We conclude that the EPE increases with the WWR effect and the CVA will also have the same behavior. The Figure 2 displays this effect:

The WWR increases the CVA quantity with 30%, and that proves its importance and impact on the counterparty risk measurement. The Table 1 summarizes these results.

Figure 1. Expected positive exposure with and without WWR effect.

Figure 2. CVA and WWR effect with and without collateral.

Table 1. CVA WWR calculation results.

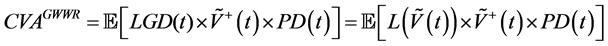

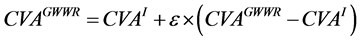

3. The Global Wrong Way Risk (GWWR)

As we saw in the last section, the compute of the CVA supposes that the LGD is constant. Furthermore, this assumption leads to the independency of this variable to the default. Nevertheless, the LGD depends to the default and automatically to the exposure, because the WWR proves that there is a dependency between the exposure and the default. We choose the word “Global” because we study the dependency between the three components that allow the calculation of the CVA. In order to model the Global Wrong Way Risk, we suggest two approaches:

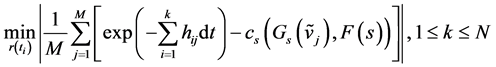

・ The first approach is based on the building of a relation between the LGD and the exposure, and also, the definition of the relation between the exposure and the default. We use the same notation in the last section and we link the LGD with the exposure through the below function:

With

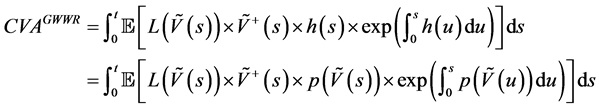

We then replace in the CVA formula:

There is two ways to compute this expectation, on one hand; we can make it with empirical approach. We define the relation below:

With

We so get the following result:

By applying the strong law of large number, we have at each step of time

Using the trapezoid method for calculation the integral, we get:

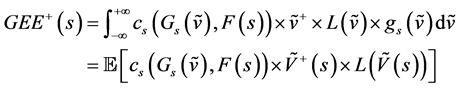

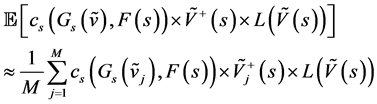

On the second hand, we can use the copula approach. Given the definitions in the last section, we have:

Knowing that,

We get the following result:

By applying the strong law of large number, we obtain the following approximation of the GEPE:

We compute this quantity at each time step, and then we use the trapezoid method to compute the GWWR CVA.

The implementation of this approach needs to choose the link function between the LGD and the exposure. We then suggest the following function:

where

The calibration of the LGD model could be done by defining the maximum and the minimum of the LGD. If we note respectively

In our case, we take

The Figure 3 displays the evolution of the GEPE regarding to the PD with and without collateral using the Gaussian copula:

We deduce that the GEPE increases with the GWWR effect and the CVA will also have the same behavior. The GWWR grows the CVA quantity with 100%, and that proves its importance and impact on the counterparty risk measurement. The Table 2 summarizes these results:

The Figure 4 shows this effect:

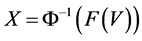

・ The second approach is built around the approximation of the difference between the classical CVA, and the other one without any assumptions using a close formula. We suppose that the default is driven via a systemic factor

Figure 3. Expected positive exposure with and without WWR effect.

Table 2. CVA GWWR calculation results.

Figure 4. CVA and GWWR effect with and without collateral.

We can write the CVA under to the independency assumption as:

With

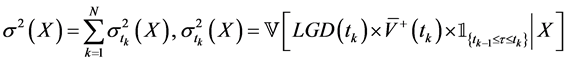

We note the Global Wrong Way Risk CVA by

For

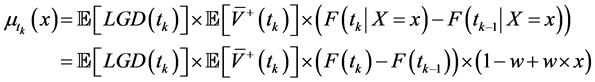

We define the following quantities:

Under the assumption of independency of

For a

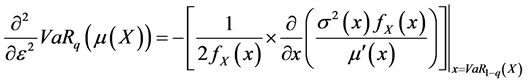

By applying the Taylor expansion on

By computing the first and the second derivative terms, we find the following results8 ( Gourieroux, Laurent, & Scaillet, 2000 ):

where

We then find the result bellow9 ( Slime, 2016 ):

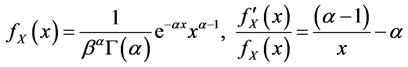

We need to define a model for computing this quantity, and we then chose the CreditRisk+10 ( Credit Suisse Financial Products, 1997 ) model. This model supposes that

Which

We also need to develop the derivative terms to complete the calculation, so we have:

and

The CVA assumption is the independency between the LGD, the exposure and the default, and this allows us to compute the following term:

The second assumption of the CreditRisk+ model is that

We get the result bellow:

With

And

We conclude that:

Subtitling in the GWWA formula, we obtain:

If we note the classical CVA by:

Then we have:

Finally, we get the following formula:

With

And

Under the assumption of

Furthermore, the Global Wrong Way Risk CVA may be approximate using the formula bellow in the case of a symmetric distribution:

For non-symmetric distribution, we have:

As we know that the systemic factor

We then should compute the maximum of the logarithmic function:

It remains to develop the first and the second derivative. The calculation leads to the following results:

We use the Stirling approximation to resolve this equation:

We compute the estimator, we then get

The Figure 5 and the Table 3 summarize the comparison between all approaches. The approximation of the GWWR using the adjustment has a tow strong advantage. The first one, it gives us a closed formula to compute the GWWR part. The second one, his implementation is straightforward and it

Figure 5. CVA and GWWA effect without collateral.

Table 3. CVA GWWA calculation results.

Figure 6. The evolution of GWWA regarding to the correlation.

could be directly integrated on the existent framework.

We also conclude in the Figure 6 that the conditional default probability decreases within

4. Conclusion

This paper was dedicated to the models allowing, on one hand, the quantifying of the Wrong Way Risk. On the other hand, we also developed two methods to integrate the Loss Given Default correlation effect. First, we began by introducing the existent approaches that give us the measurement of the WWR effect when we observe the positive correlation between the exposure and the default. We proposed a new model that combines the empirical and the copulas model. We made implementation on the European CAC40 put, and we conclude that the CVA increases potentially with the WWR effect.

Then, we generalized the concept to deem the correlation effects between the three variables. So we added the LGD correlation effect, and we proposed two models in this way. The first one is based on the definition of the function that links the LGD with the default and we also used the copula to compute the conditional expectation exposure. The second one defines a close formula to compute the difference between the classical CVA and the other one without the independency assumption.

We implemented both of these models on the European CAC40 put, and we concluded that the GWWR is more important than the WWR in term of the CVA level. Furthermore, the GWWA allows a direct integration and computation of the GWWR and we can also apply this model to the WWR. However, both of models represent some weakness. The first one needs to define and calibrate the LGD model, and the integration of the existent model is not straightforward and will cost more time calculation. The second one remains an approximation of the GWWR and requests a calibration of the systemic factor. We tried to give a close formula to allow a direct integration on the existent CVA system, because the implementation arises one of most issues in the banking platform. By the way, we suggest getting more researching on the approaches that allow a straight integration.

Cite this paper

Slime, B. (2017). Modeling and Quantifying of the Global Wrong Way Risk. Journal of Financial Risk Management, 6, 231-246. https://doi.org10.4236/jfrm.2017.63017

References

- 1. Basel Committee on Banking Supervision (2010). Basel III: A Global Regulatory Framework for More Resilient Banks and Banking Systems.

http://www.bis.org/publ/bcbs189_dec2010.pdf, December. [Paper reference 1] - 2. Bocker, K., & Brunnbauer, M. (2014). Path Consistent Wrong Way Risk. Risk Magazine, 27, 49-53. [Paper reference 1]

- 3. Credit Suisse Financial Products (1997). Credit Risk+: A Credit Risk Management Framework. London: Credit Suisse Financial Products. [Paper reference 1]

- 4. Daniel, W. W. (1990). Spearman Rank Correlation Coefficient. Applied Nonparametric Statistics (2nd ed., pp. 358-365). Boston, MA: PWS-Kent. [Paper reference 1]

- 5. Fenton, L. (1960). The Sum of Lognormal Probability Distribution in Scatter Transmission System, IEEE Trans. Communication Systems, 8, 56-57. [Paper reference 1]

- 6. Gourieroux, C., Laurent, J. P., & Scaillet O. (2000). Sensitivity Analysis of Values at Risk. Journal of Empirical Finance, 7, 225-245. [Paper reference 1]

- 7. Heston, S. L., (1993). A Closed-Form Solution for Options with Stochastic Volatility with Applications to Bond and Currency Options. Review of Financial Studies, 6, 327-343. [Paper reference 1]

- 8. Hull, J., & White, A. (2012). CVA and Wrong Way Risk. Financial Analysis Journal, 68, 58-69.

https://doi.org/10.2469/faj.v68.n5.6 [Paper reference 1] - 9. Rosen, D., & Saunders D. (2012). CVA the Wrong Way. Journal of Risk Management in Financial Institutions, 5, 252-272. [Paper reference 1]

- 10. Slime, B. (2016). Credit Name Concentration Risk: Granularity Adjustment Approximation. Journal of Financial Risk Management, 5, 246-263.

https://doi.org/10.4236/jfrm.2016.54023 [Paper reference 1]

NOTES

1Basel Committee on Banking Supervision (2010), “Basel III: A Global Regulatory Framework for More Resilient Banks and Banking Systems”.

2J. Hull and A. White (2012), CVA and Wrong Way Risk, Financial Analysis Journal, 68, pp. 58-69.

3D. Rosen, and D. Saunders (2012), CVA Wrong Way Risk, Journal of Risk Management in Financial Institutions, 5(3) pp. 252-272.

4K. Bocker and M. Brunnbauer (2014), Path consistent Wrong Way Risk, Risk Magazine.

5Fenton L. (1960) the sum of lognormal probability distribution in scatter transmission system, IEEE trans. Communication Systems, Vol 8, pp. 56-57.

6Daniel, Wayne W. (1990). “Spearman rank correlation coefficient”. Applied Nonparametric Statistics (2nd ed.). Boston: PWS-Kent. pp. 358?365.

7Heston, S.L., (1993), A closed-form solution for options with stochastic volatility with applications to bond and currency options, Review of Financial Studies, Vol.6, No 2, pp. 327-343.

8C. Gourieroux, J.P. Laurent, O. Scaillet (2000), Sensitivity analysis of Values at Risk, Journal of Empirical Finance.

9Slime, B. (2016). Credit Name Concentration Risk: Granularity Adjustment Approximation. Journal of Financial Risk Management, 5, 246-263.

10Credit Suisse Financial Products (1997). Credit Risk+: A Credit Risk Management Framework. London, 1997.