Journal of Financial Risk Management

Vol.04 No.04(2015), Article ID:61555,16 pages

10.4236/jfrm.2015.44019

The Impact of Asset Price Bubbles on Credit Risk Measures

Michael Jacobs Jr.

Accenture Management Consulting, New York, NY, USA

Copyright © 2015 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

Received 15 September 2015; accepted 27 November 2015; published 30 November 2015

ABSTRACT

This study presents an analysis of the impact of asset price bubbles on standard credit risk measures, including Expected Loss (“EL”) and Credit Value-at-Risk (“CVaR”). We present a styled model of asset price bubbles in continuous time, and perform a simulation experiment of a 2 dimensional Stochastic Differential Equation (“SDE”) system for asset value determining Probability of Default (“PD”) through a Constant Elasticity of Variance (“CEV”) process, as well as a correlated a Loss- Given-Default (“LGD”) through a mean reverting Cox-Ingersoll-Ross (“CIR”) process having a long- run mean dependent upon the asset value. Comparing bubble to non-bubble economies, it is shown that asset price bubbles may cause an obligor’s traditional credit risk measures, such as EL and CVaR to decline, due to a reduction in both the standard deviation and right skewness of the credit loss distribution. We propose a new risk measure in the credit risk literature to account for losses associated with a bubble bursting, the Expected Holding Period Credit Loss (“EHPCL”), a phenomenon that must be taken into consideration for the proper determination of economic capital for both credit risk management and measurement purposes.

Keywords:

Financial Crisis, Credit Risk, Model Risk, Asset Price Bubbles, Expected Loss, Credit Val-Ue-At-Risk, Stochastic Differential Equations, Probability of Default, Loss Given Default, Constant Elasticity of Variance, Cox-Ingersoll-Ross

1. Introduction

The financial crisis of the last decade has been the impetus behind a movement to better understand the relative merits of various risk measures, classic examples being Value-at-Risk (“VaR”) and related quantities (Jorion, 2006; Inanoglu & Jacobs, 2009) . The importance of an augmented comprehension of these measures is accentuated in the realm of credit risk, as the price bubble in the housing market and the ensuing credit crunch is undoubtedly a catalyst for the financial crisis. We have subsequently learned from this that the credit models of that era fail in not incorporating the phenomenon of price bubbles, which in turn add to the severity of the downturn for investors and risk managers who mis-measured their potential adverse exposure to credit risk. This manifestation of model risk (The US Board of the Governors Federal Reserve System, 2011) is due to some extent to a lack of basic understanding, wherein a modeling framework lacks a key element of an economic reality and there for fails. This failure of the modeling paradigm in credit risk spans gaps in the measurement, characterization and economics of asset price bubbles.

In view of analyzing the impact of asset price bubbles on credit risk measures and credit capital determination with respect to a firm subject to default risk, we construct various hypothetical economies having and also not having asset price bubbles. In a stylized structural credit model framework (Merton, 1974) , we simulate a firm’s value process in each of these economies, computing the firm’s standard risk measures. We present a model of asset price bubbles in continuous time, and perform a simulation experiment of a 2 dimensional Stochastic Differential Equation (“SDE”) system for asset value determining Probability of Default (“PD”)1 through a Constant Elasticity of Variance (“CEV”)2 process, as well as a correlated a Loss-Given-Default (“LGD”)3 through a mean reverting Cox-Ingersoll-Ross (“CIR”) process having a long-run mean dependent upon the asset value. Comparing bubble to non-bubble economies, it is shown that asset price bubbles may cause an obligor’s traditional credit risk measures such as Expected Loss (“EL”) and Credit Value-at-Risk (“CVaR”) to decline, due to a reduced standard deviation and an increased right skewness of the credit loss distribution. We propose a new risk measure in the credit risk literature to account for losses associated with a bubble bursting, the Expected Holding Period Credit Loss (“EHPCL”), a phenomenon that must be taken into consideration for the proper determination of economic capital for both credit risk management and measurement purposes.

The results of our experiment demonstrate that the existence of an asset price bubble, which occurs for certain parameter settings in the CEV model, results in the firm asset value distribution having both a lower standard deviation and a greater right skewness. This augmented right skewness in conjunction with a reduced variance of a firm’s return due to bubble expansion results in a reduction of the right skewness in the distribution of the default rate and a lower PD, which in combination with a lower mean of the LGD process, results in a credit loss distribution having lower mean right skewness and standard deviation. This in turn implies results in the firm’s CVaR measures declining, an understatement in the credit risk of the firm. Based on these measures alone, their declining values imply that in the presence of asset price bubbles, less credit capital is required. However, as shown by the additional risk measure proposed in the present paper, the EHPCL, this conclusion is incorrect. This credit loss measure increases in bubble economies and is due to bubble bursting, which causes significant firm value losses on the bubble-bursting paths.

As asset price bubbles are inevitably bound to burst, causing significant credit loss to creditors, more credit capital should be held for these bubble-bursting scenarios. Unfortunately, the se-verity of these bubble-bursting scenarios is not adequately captured by the standard credit risk measures, whose computation is based on the standard moments and quantiles of a firm’s credit loss distribution over time horizons such as a year, over which bubble bursting is unlikely. These bubble-bursting scenarios are captured, however, in some correctly constructed credit risk measures such as the EHPCL.

An outline for this paper is as follows. Section 2 presents a review of the literature. Section 3 presents our credit model incorporating the effect of asset price bubbles. Section 4 describes the results of our simulation experiment, while Section 5 summarizes the implications of our analysis for credit risk management.

2. Review of the Literature

Modern credit risk modeling (e.g. Merton, 1974 ) increasingly relies on advanced mathematical, statistical and numerical techniques to measure and manage risk in credit portfolios. This gives rise to Model Risk (Federal Reserve Board of Governors, SR 11-7), defined as the potential that a model used to assess financial risks does not accurately capture those risks, and the possibility of understating inherent dangers stemming from very rare yet plausible occurrences perhaps not in reference data-sets or historical patterns of data4, a key example of this being the inability of the credit risk modeling paradigm to accommodate the phenomenon of asset price bubbles.

The relative merits of various risk measures, classic examples being Value-at-Risk (“VaR”) and related quantities, have been discussed extensively by prior research (Jorion, 1997, 2006) . Risk management as a discipline in its own right, distinct from either general finance or financial institutions, is a relatively recent phenomenon. A general result of mathematical statistics due to Sklar (1956) , allowing the combination of arbitrary marginal risk distributions into a joint distribution while preserving a non-normal correlation structure, readily found an application in finance. Among the early academics to introduce this methodology is Embrechts et al. (1999, 2002, 2003) . This was applied to credit risk management and credit derivatives by Li (2000) . The notion of copulas as a generalization of dependence according to linear correlations is used as a motivation for applying the technique to understanding tail events in Frey & McNeil (2001) . This treatment of tail dependence contrasts to Poon et al. (2004) , who instead use a data intensive multivariate extension of extreme value theory, which requires observations of joint tail events.

Since the 2007 crisis, the mathematical finance literature has made significant advances in the modeling and testing of asset price bubbles (Jarrow & Protter, 2010; Hong et al., 2006) . Inanoglu & Jacobs (2009) contribute to the modeling effort by providing tools and insights to practitioners and regulators, utilizing data from major banking institutions’ loss experience, exploring the impact of business mix and inter-risk correlations on total risk, and comparing alternative established frameworks for risk aggregation on the same data-sets across banks. Protter (2011) , Protter et al. (2010) and Jarrow et al. (2014) apply these new insights to determine the impact, if any, that asset price bubbles have on the common risk measures used in practice for the determination of equity capital, which we extend to the realm of credit risk.

3. A Credit Model for Asset Price Bubbles

We model the evolution of asset prices, incorporating the phenomenon of price bubbles, using the approach of

Jarrow et al. (2007, 2015)

. The setting is a continuous trading economy, without loss of generality having a and finite horizon , with randomness described by the filtered probability space

, with randomness described by the filtered probability space , where we define:

, where we define:

the state space , the

, the

-algebra

-algebra , the information partition

, the information partition , and the physical probability

, and the physical probability

measure

(or actuarial, as contrasted to a risk-neutral probability measure, commonly denoted by the symbol

(or actuarial, as contrasted to a risk-neutral probability measure, commonly denoted by the symbol ). We assume, again without loss of generality and for the purpose on focusing on the application to cre-

). We assume, again without loss of generality and for the purpose on focusing on the application to cre-

dit loss, a single asset value process

that is adapted to the filtration

that is adapted to the filtration . Note that this could also

. Note that this could also

represent a share of stock owned by a representative equity investor, which is a claim on the single productive entity or firm in this economy. In the general setting,

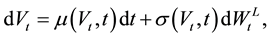

follows an Ito diffusion process

(Øksendal, 2003)

having the following SDE representation:

follows an Ito diffusion process

(Øksendal, 2003)

having the following SDE representation:

(3.1)

(3.1)

where μ(Vt, t) is the instantaneous drift process,

is the instantaneous diffusion process,

is the instantaneous diffusion process,

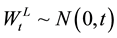

is a standard Weiner process (or a Brownian motion process) on the filtered probability space , and

, and

Without loss of generality we assume that the asset

We model an economy potentially having an price bubbles through the assumption that the risky asset’s prices follows a Constant Elasticity of Variance (CEV) process, as in Jarrow et al. (2014) , which is the following restricted version of the Ito diffusion process in (3.1):

where

where

satisfy certain technical condition.5 The mechanism in (3.4) involving the risk-neutral probability measure affords us a means of computing present values where we shift the mass of the probability distribution (magnitude of the cash-flows) such that we can recover the same prices as under actuarial measure with the original cash- flows-but note that

It follows that we may define the asset’s price bubble

Since as a conditional expectation, the fundamental value normalized by the value of the money market account is a martingale under

the asset’s normalized price

and a strict-local martingale under

In order to model the distribution of credit loss in the structural modeling paradigm (Merton, 1974) , we define the unconditional loss process as an Ito process, similarly to the asset value process (3.1):

where ν(Vt, t) is the instantaneous drift process,

is a standard Weiner process (or a Brownian motion process) on the filtered probability space

Therefore, for

We define expected credit loss

We may estimate this quantity as

Similarly, we may obtain estimators of the population standard deviation

by their sample analogues

These statistics are estimates of the credit loss distribution’s moments under the physical probability measure

where:

where

conditional CVaR measure, the Expected Tail Credit Value-at-Risk (“ETCVaR”), as the expected loss conditional on credit loss being greater than or equal to loss at confidence level

In order to model the influence of an entire boom to bust cycle of asset values upon credit risk measures, we introduce a measure of credit loss over a sequence of smaller sub-intervals, which we call the Expected Holding Period Credit Loss (“EHPCL”). Let

Then we define the

Finally, we make note that we may look at all of these measures on a relative basis, scale by the

4. A Simulation Experiment

We demonstrate the impact of asset price bubbles on an obligor’s credit risk measures, as defined in the previous section (i.e. EL, CVaR, ETCVaR and EHPCL), through a stochastic simulation experiment. Simulation is needed to determine the probability distribution of asset value, loss given default rate and ultimately the credit loss rate over a given time interval. In our experiment we fix the time period for the standard credit risk measures to be 250 trading days or one year, which is conventional for economic and regulatory credit risk capital calculations, with subintervals of one business week or five trading days for the EHPCL measure. We use simulation because an analytic solution for the firm value’s probability distribution using the CEV process is unavailable (Emanuel & MacBeth, 1982; Schroder, 1989) .8

We perform the simulation experiment through constructing a collection of different economies, some with bubbles and some without, by varying the CEV parameter

The results of our sssanalysis are tabulated in Table 1 and Table 2, and in Figures 1-10. In Table 1 we present

Table 1. Alternative absolute credit risk loss measures and distributional statistics-stochastic simulation of CEV asset value process (

Table 2. Alternative relativee credit risk loss measures and distributional statistics-stochastic simulation of CEV asset value process (

the absolute credit loss measures as defined in Section 3, whereas in Table 2 we present these measures on a relative basis, scale by the expected credit loss. We also show the estimate of PD and the distributional statistics of

Figure 1. Alternative absolute credit risk loss measures-stochastic simulation of CEV asset value process (

Figure 2. Alternative relative credit risk loss measures-stochastic simulation of CEV asset value process (

Figure 3. Stochastic simulation of CEV asset value process (

Figure 4. Stochastic simulation of CEV asset value process (

the asset value, LGD and credit loss processes. Figure 1 and Figure 2 plot some key credit loss measures against the values of the CEV parameter, both in absolute and relative terms with respect to EL, respectively. Figures 2-10 plot the distributions of asset value, LGD and credit loss processes, as well as the simulation paths

Figure 5. Stochastic simulation of CEV asset value process (

Figure 6. Stochastic simulation of CEV asset value process (

of the asset value and LGD processes.

We can see from the results that all of the standard risk measures decrease as we increase the CEV parameter into the region where we have an asset price bubble, whereas the EHPCL increases montonically and at an

Figure 7. Stochastic simulation of CEV asset value process (

Figure 8. Stochastic simulation of CEV asset value process (

increasing rate as this parameter grows. We observe that this is driven by a change in the asset value process as

Figure 9. Stochastic simulation of CEV asset value process (

Figure 10. Stochastic simulation of CEV asset value process (

increase

In the bottom panel of Table 1 we show the various credit loss metrics as a functions of the CEV parameter, and observe that all of the standard measures are declining in

In the bottom panel of Table 2 we show the various relative credit loss metrics (scaled by ECL) as a functions of the CEV parameter, and observe that all of the standard relative risk measures are declining in

5. Conclusion and Future Directions

In this study, we have analyzed the impact of asset price bubbles on credit risk measures for a representative firm subject to default risk. We have constructed various hypothetical economies, both having and also not having asset price bubbles in a structural credit model framework. We have simulated a firm’s value process in each of these economies, computing the firm’s standard risk measures, in continuous time, performing a simulation experiment of a 2-dimensional system of SDEs for asset value determining PD and a correlated a LGD process. Comparing bubble to non-bubble economies, it has been shown that asset price bubbles may cause an obligor’s traditional credit risk measures (such as EL or CVaR) to decline, due to a reduced standard deviation and a reduced right skewness of the credit loss distribution (driven by an augmented right skewness of the asset value distribution). We have developed the new EHPCL credit risk measure to account for losses associated with a bubble bursting, which behaves intuitively as we transition from non-bubble to bubble economies.

The results of our experiment have demonstrated that the existence of an asset price bubble, which occurs for certain parameter settings in the CEV model, results in the firm asset value distribution to have both a lower standard deviation and a greater right skewness. We have demonstrated that this augmented right skewness, in conjunction with a reduced variance of a firm’s return due to bubble expansion, results in a reduction of the right skewness in the distribution of the default rate and a lower PD, which in combination with a lower mean of the LGD process, results in a credit loss distribution having both lower mean right skewness and lower standard deviation. This in turn implies a decline in the firm’s CVaR measures and an understatement in the credit risk of the firm. Based on these measures alone, their declining values imply that in the presence of asset price bubbles, less credit capital is required. However, we have shown that according to the new EHPCL, this conclusion is incorrect, as this EHPCL credit loss measure increases in bubble economies and is due to bubble bursting, which causes significant firm value losses, and therefore credit losses, on the bubble-bursting paths.

In the detailed analysis of the results, we have shown that the various credit loss metrics are all declining functions of the CEV parameter: The ECL is decreasing monotonically in

There are various avenues down which we may proceed in the interest of pursuing additional research. One such direction will be an extension to a structural model that can admit differential seniority for LGD, an option-theoretic approach along the lines of Jacobs (2011, 2012) . Another potential sequel to this study will be the analysis of a real portfolio of equities and empirical calibration, along the lines of Jarrow et al. (2015), although in the context of credit as opposed to market risk. Finally, we may investigate more general stochastic diffusion models for asset value, such as the incorporation of jump processes.

Cite this paper

MichaelJacobs Jr., (2015) The Impact of Asset Price Bubbles on Credit Risk Measures. Journal of Financial Risk Management,04,251-266. doi: 10.4236/jfrm.2015.44019

References

- 1. Alexander, C. (2001). Market Models: A Guide to Financial Data Analysis. New York, NY: Wiley.

- 2. Araten, M., Jacobs Jr., M., & Varshney, P. (2004). Measuring LGD on Commercial Loans: An 18-Year Internal Study. The Journal of the Risk Management Association, 2, 28-35.

- 3. The Basel Committee on Banking Supervision (2005). An Explanatory Note on the Basel II IRB Risk Weight Functions. Basel: Bank for International Settlements.

- 4. The Basel Committee on Banking Supervision (2006). International Convergence of Capital Measurement and Capital Standards: A Revised Framework. Basel: Bank for International Settlements.

- 5. The Basel Committee on Banking Supervision (2009a). Principles for Sound Stress Testing Practices and Supervision— Consultative Paper.

- 6. The Basel Committee on Banking Supervision (2009b). Strengthening the Resilience of the Banking Sector. Bank for International Settlements Consultative Document.

- 7. The Basel Committee on Banking Supervision (2010). Basel III: A Global Regulatory Framework for More Resilient Banks and Banking Systems. Bank for International Settlements.

- 8. Back, K. (2010). Asset Pricing and Portfolio Choice Theory. London: Oxford University Press.

- 9. Chan, K. C., Karolyi, G. A., Longstaff, F. A., & Saunders, A. B. (1992). An Empirical Comparison of Various Models of the Short Term Interest Rate. Journal of Finance, 47, 1209-1227.

http://dx.doi.org/10.1111/j.1540-6261.1992.tb04011.x - 10. Cornford, A. (2005). Basel II: The Revised Framework of June 2004(Technical Report). New York: United Nations Conference on Trade and Development.

- 11. Delbaen, F., & Schachermayer, W. (1995). Arbitrage Possibilities in Bessel Processes and Their Relations to Local Martingales. Probability Theory and Related Fields, 102, 357-366.

http://dx.doi.org/10.1007/BF01192466 - 12. Delbaen, F., & Schachermayer, W. (1998). The Fundamental Theorem of Asset Pricing for Un-Bounded Stochastic Processes. Mathematische Annalen, 312, 215-250.

http://dx.doi.org/10.1007/s002080050220 - 13. Development Core Team (2015). R: A Language and Environment for Statistical Computing. Vienna: R Foundation for Statistical Computing.

- 14. Emanuel, D. C., & MacBeth, J. D. (1982). Further Results on the Constant Elasticity of Variance Call Option Pricing Model. Journal of Financial and Quantitative Analysis, 17, 533-554.

http://dx.doi.org/10.2307/2330906 - 15. Embrechts, P., McNeil, A. J., & Straumann, D. (1999). Correlation: Pitfalls and Alternatives. Risk, 12, 69-71.

- 16. Embrechts, P., McNeil, A. J., & Straumann, D. (2002). Correlation and Dependence in Risk Management: Properties and Pitfalls. In M. A. H. Dempster (Ed.), Risk Management: Value at Risk and Beyond (pp. 176-223). Cambridge: Cambridge University Press.

http://dx.doi.org/10.1017/CBO9780511615337.008 - 17. Embrechts, P., Lindskog, F., & McNeil, A. J. (2003). Modeling Dependence with Copulas and Applications to Risk Management. In: S. Rachev (Ed.), Handbook of Heavy Tailed Distributions in Finance (pp. 329-384). Rotterdam: Elsevier.

http://dx.doi.org/10.1016/B978-044450896-6.50010-8 - 18. Engelmann, B., & Rauhmeier, R. (2006). The Basel II Risk Parameters. New York: Springer.

http://dx.doi.org/10.1007/3-540-33087-9 - 19. Frey, R., & McNeil, A. J. (2001). Modeling Dependent Defaults. Working Paper, ETH Zurich.

- 20. Frye, J., & Jacobs Jr., M. (2012). Credit Loss and Systematic LGD. The Journal of Credit Risk, 8, 109-140.

- 21. Hong, H., Scheinkman, J., & Xiong, W. (2006). Asset Float and Speculative Bubbles. Journal of Finance, 61, 1073-1117.

http://dx.doi.org/10.1111/j.1540-6261.2006.00867.x - 22. Inanoglu, H., & Jacobs Jr., M. (2009). Models for Risk Aggregation and Sensitivity Analysis: An Application to Bank Economic Capital. The Journal of Risk and Financial Management, 2, 118-189.

http://dx.doi.org/10.3390/jrfm2010118 - 23. Jacobs Jr., M. (2001). A Comparison of Fixed Income Valuation Models: Pricing and Econometric Analysis of Interest Rate Derivatives. PhD Thesis, New York: The Graduate School and University Center of the City University of New York.

- 24. Jacobs Jr., M. (2011). A Two-Factor Structural Model of Ultimate Loss-Given-Default: Capital Structure and Calibration to Corporate Recovery Data. The Journal of Financial Transformation, 31, 31-43.

- 25. Jacobs Jr., M. (2012). An Option Theoretic Model for Ultimate Loss-Given-Default with Systematic Recovery Risk and Stochastic Returns on Defaulted Debt. Proceeding of the 2010 3rd Annual Joint Bank for International Settlements— World Bank—European Central Bank Public Investors Conference, BIS Paper No. 58 (October), 257-285.

- 26. Jacobs Jr., M. (2013). Stress Testing Credit Risk Portfolios. The Journal of Financial Transformation, 37, 53-75.

- 27. Jacobs Jr., M., & Karagozoglu, A. K. (2011). Modeling Ultimate Loss Given Default on Corporate Debt. The Journal of Fixed Income, 21, 6-20.

http://dx.doi.org/10.3905/jfi.2011.21.1.006 - 28. Jacobs Jr., M., & Kiefer, N. M. (2010). The Bayesian Approach to Default Risk: A Guide. In K. Boecker (Ed.), Rethinking Risk Measurement and Reporting (pp. 1-30). London: Risk Books.

- 29. Jacobs Jr., M., Karagozoglu, A. K., & Sensenbrenner, F. J. (2015). Stress Testing and Model Validation: Application of the Bayesian Approach to a Credit Risk Portfolio. The Journal of Risk Model Validation, 9, 41-70.

- 30. Jarrow, R. A., & Protter, P. (2010). The Martingale Theory of Bubbles: Implications for the Valuation of Derivatives and Detecting Bubbles. In A. Berd, (Ed.), The Financial Crisis: Debating the Origins, Outcomes, and Lessons of the Greatest Economic Event of Our Lifetime (pp. 429-448). New York: Risk Publications.

- 31. Jarrow, R. A., Protter, P., & Shimbo, K. (2007). Asset Price Bubbles in Complete Markets. In M. C. Fu, R. A. Jarrow, J. Y. J. Yen, & R. J. Elliott (Eds.), Advances in Mathematical Finance (pp. 97-121). New York: Springer.

http://dx.doi.org/10.1007/978-0-8176-4545-8_7 - 32. Jarrow, R. A., Protter, P., & Shimbo, K. (2010). Asset Price Bubbles in Incomplete Markets. Mathematical Finance, 20, 145-185.

http://dx.doi.org/10.1111/j.1467-9965.2010.00394.x - 33. Jarrow, R. A., Kchia, Y., & Protter, P. (2011). How to Detect an Asset Bubble. SIAM Journal on Financial Mathematics, 2, 839-865.

http://dx.doi.org/10.1137/10079673X - 34. Jarrow, R. A., & Silva, F. B. G. (2014). Risk Measures and the Impact of Asset Price Bubbles. The Journal of Risk, 17, 145-185.

- 35. Jeanblanc, M., Yor, M., & Chesney, M. (2009). Mathematical Methods for Financial Markets. In P. Jorion (Ed.), Value at Risk: The New Benchmark for Controlling Market Risk (Vol. 2, pp. 69-93). New York: McGraw-Hill.

http://dx.doi.org/10.1007/978-1-84628-737-4 - 36. Jorion, P. (1999). Value at Risk: The New Benchmark for Controlling Market Risk (Volume 2). New York: McGraw-Hill.

- 37. Jorion, P. (2006). Value at Risk: The Benchmark for Managing Financial Risk (3rd ed.). New York: McGraw Hill.

- 38. Li, D. X. (2000). On Default Correlation: A Copula Function Approach. Journal of Fixed Income, 9, 43-54.

http://dx.doi.org/10.3905/jfi.2000.319253 - 39. Merton, R. (1974). On the Pricing of Corporate Debt: The Risk Structure of Interest Rates. Journal of Finance, 29, 449-470.

- 40. Øksendal, B. K. (2003). Stochastic Differential Equations: An Introduction with Applications (6th ed.). Berlin: Springer.

http://dx.doi.org/10.1007/978-3-642-14394-6 - 41. Poon, S. H., Rockinger, M., & Tawn, J. (2004). Extreme Value Dependence in Financial Markets: Diagnostics, Models and Financial Implications. Review of Financial Studies, 17, 581-610.

http://dx.doi.org/10.1093/rfs/hhg058 - 42. Protter, P., & Shimko, K. (2010). Risk Measures and the Impact of Asset Price Bubbles. Journal of Risk, 17, 35-55.

- 43. Schroder, M. (1989). Computing the Constant Elasticity of Variance Option Pricing Formula. Journal of Finance, 44, 211-219.

http://dx.doi.org/10.1111/j.1540-6261.1989.tb02414.x - 44. Sklar, A. (1956). Fonctions de Répartition à NDimensions et Leurs Marges. Publications de l’Institut de Statistique de L’Université de Paris, 8, 229-231.

- 45. The US Board of Governors of the Federal Reserve System (2011). Supervisory Guidance on Model Risk Management (FR 2011-12). Washington DC: The US Board of Governors of the Federal Reserve System.

NOTES

1For a Bayesian stochastic model for PD in the Basel Asymptotic Single Risk Factor (“ASRF”) class of models, underlying the Basel II Advanced IRB model for credit loss, see Jacobs & Kiefer (2010) .

2For applications of the CEV model in finance see Chan et al. (1992) and Jacobs (2001) , in the context of term structure and interest rate derivatives.

3See Jacobs (2011, 2012) for a 2-factor structural credit model with stochastic LGD; Araten & Jacobs (2004) or Jacobs & Karagozoglu (2011) for empirical models of LGD; and Frye & Jacobs (2012) for a structural credit risk model in ASRF class of models, featuring co-monotonic LGD and PD that provides a parsimonious function for downturn LGD.

4In the wake of the financial crisis (Demirguc-Kunt et al., 2010; Acharya et al., 2009), international supervisors have recognized the importance of Stress Testing (ST), especially in the realm of credit risk, as can be seen in the revised Basel framework (BCBS 2005, 2006, 2009a, 2009b, 2010) and the Federal Reserve’s Comprehensive Capital Analysis and Review (“CCAR”) program (Jacobs 2013, Jacobs et al. 2015) .

5The conditions are that

6This condition is sometimes termed “no free-lunch with vanishing risk” or NFLVR (Jeanblanc et al., 2009) .

7This is partly due to the Basel II Accords (Engelmann & Rauhmeier, 2006; Cornford, 2005) .

8We use the R package Sim. DiffProc to simulate the 2-imensional system of SDEs for asset value and for LGD (Development Core Team, 2015) .