American Journal of Industrial and Business Management

Vol.4 No.5(2014), Article

ID:46017,6

pages

DOI:10.4236/ajibm.2014.45029

Study on Efficiency Optimization of R&D Resources Allocation in Shanghai

Huangxin Li, Bin Hu

School of Management, Shanghai University of Engineering Science, Shanghai, China

Email: 314355263@qq.com

Copyright © 2014 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 17 March 2014; revised 14 April 2014; accepted 30 April 2014

ABSTRACT

Based on the R&D activities of Shanghai’s high-tech industries during 2010 to 2012, this paper uses super efficiency DEA model to analyze and evaluate the R&D efficiency of Shanghai’s hightech industries. The results show that the R&D efficiency of Shanghai’s high-tech industries has dissimilitude. The R&D efficiency values of some high-tech industries are relatively low. There are many redundancies of R&D personnel input. The input and output structure needs to be optimized. Based on this, the paper summarizes the problems in the R&D activities of Shanghai’s high-tech industries and puts forward some countermeasures.

Keywords:R&D, Super Efficiency DEA, High-Tech Industries

1. Introduction

High-tech industries are dominated by the development and production of high technology product. They have the characteristics that knowledge and resource are intensive; the proportion of technical employee is large. The intensity of R&D input is relatively high in high-tech industries. For the past few years, the R&D input of high-tech industries in our country is on the increase; it effectively promoted the development of high-tech industries. The statistical data shows that from 2004 to 2010, in high-tech industries, the annual growth rate of R&D personnel input is 22.56%, the annual growth rate of R&D appropriation expenditure is 22.15%, and the annual growth rate of sales revenue of new products is 18.38%. It shows that the R&D resource allocation efficiency of high-tech industries in our country needs to be optimized. R&D efficiency is the key factor that affects the scientific research innovation ability and the economy developing level of high-tech industries. In Shanghai’s high-tech industries in 2012, the R&D personnel input of designed size enterprises is 27,400 people, R&D appropriation expenditure of designed size enterprises is 8.865 billion yuan. Therefore, it is very necessary to scientifically measure and evaluate the comprehensive efficiency of R&D resources [1] -[5] .

This paper uses super efficiency DEA model to compare and analyze the R&D resource allocation efficiency of Shanghai’s high-tech industries. It researches the R&D comprehensive efficiency level of Shanghai’s high-tech industries, explores the main reason of R&D personnel redundant and puts forward some countermeasures.

2. The Construction of DEA Model

Data Envelopment Analysis (hereinafter referred to as the DEA method) was first proposed by a famous American operational research expert A. Charnes, W.W. Coop and others in 1978. DEA method is based on the concept of relative efficiency, and is especially suitable to make relative effectiveness evaluations on decisionmaking units of multi-index input and multi-index output. The main reasons are as follows: 1) DEA model uses optimization as tool, uses the weight coefficient of multi-index input and multi-index output as decision variables, makes the evaluations based on optimization, has internal objectivity, has avoided the need to determine the index weight when the parameter method is used. 2) In DEA models, it does not need to consider the mutual contact and mutual restriction factors of the input and output. The models have avoided considering the problems such as correlation and multicollinearity between each variable in various kinds of statistical and econometric models. 3) It is unnecessary to standardize every dimension of input and output variables. 4) DEA model can provide output efficiency of each group of input and is more conducive for management to consult and make decisions [6] -[10] .

The  model is the first DEA model put forward. In

model is the first DEA model put forward. In  model, DEA validity of decision-making units is comprehensive effective, that is to say, this is in terms of both feasibility of scale and feasibility of technology. Such a situation may arise in practice: Even if a decision-making unit is technical efficiency (i.e., the decision-making unit is located in the efficient production frontier), it is not necessarily the DEA effective. The reason is that the decision-making unit is not scale efficiency. Thus, some people put forward a DEA model that is used to evaluate the technology relative effectiveness between departments—

model, DEA validity of decision-making units is comprehensive effective, that is to say, this is in terms of both feasibility of scale and feasibility of technology. Such a situation may arise in practice: Even if a decision-making unit is technical efficiency (i.e., the decision-making unit is located in the efficient production frontier), it is not necessarily the DEA effective. The reason is that the decision-making unit is not scale efficiency. Thus, some people put forward a DEA model that is used to evaluate the technology relative effectiveness between departments— model. However, the two models above did not compare the R&D efficiency of the decision making units that is DEA effective.

model. However, the two models above did not compare the R&D efficiency of the decision making units that is DEA effective.

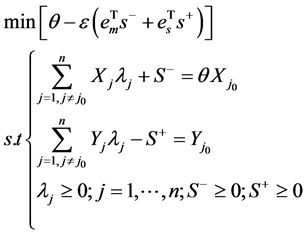

2.1. Super Efficiency DEA Model

As a matter of fact, there is a defect in the basic DEA model. In the basic model, there is no difference between the decision making units that is DEA effective. While in fact, there are diversities between the decision making units. Therefore, Andersen and Petersen built improved super efficiency DEA model.

(1)

(1)

In this model, it is the non-Archimedean infinitesimal, is a number greater than zero and less than any positive number (in actual use, constant );

); ,

, ;

; ,

,  are input and output slack variables;

are input and output slack variables; ,

,  are input vector indicators and output vector indicators of

are input vector indicators and output vector indicators of ;

;  is the combination ratio of

is the combination ratio of  in the decision making units that is DEA effective;

in the decision making units that is DEA effective;  is the effective value (degree of effective utilization of input relative to output) of the evaluated decision making units.

is the effective value (degree of effective utilization of input relative to output) of the evaluated decision making units.

When evaluating the effectiveness of , the model deleted the DMU in the constraint condition, the DEA optimal value can be greater than 1, we can get the DMU that is DEA effective in the original model. The DEA optimal value of the DMU that is not DEA effective in the original model, and then we can get the comprehensive efficiency ranking of the decision making units.

, the model deleted the DMU in the constraint condition, the DEA optimal value can be greater than 1, we can get the DMU that is DEA effective in the original model. The DEA optimal value of the DMU that is not DEA effective in the original model, and then we can get the comprehensive efficiency ranking of the decision making units.

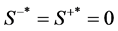

2.2. The Economic Meaning of the Models

Let’s suppose that the optimization of project problem (1) is ,

,  ,

,  ,

, . If

. If , DMU is weakform efficiency; If

, DMU is weakform efficiency; If , and

, and , DMU stands the efficient frontier and is DEA effective; That is to say, the input and output of DMU have reached the optimal configuration state. Unless increase one or more investment or reduce certain kinds of output, otherwise it is unable to increase any existing production or reduce any existing inventory. If

, DMU stands the efficient frontier and is DEA effective; That is to say, the input and output of DMU have reached the optimal configuration state. Unless increase one or more investment or reduce certain kinds of output, otherwise it is unable to increase any existing production or reduce any existing inventory. If , DMU is DEA invalidity.

, DMU is DEA invalidity.

3. The Selection of Indexes

We should evaluate the effectiveness of R&D activity comprehensively; the input and output index system should strive to comprehensive and systematic. In addition, considering the feasibility of data collection and the index select requirements of DEA method, the index system is unfavorable to have a complicate level and too much indexes. We should use as little as indexes to reflect as much information as possible. The waiting selected indexes are determined by the qualitative method, using the professional knowledge that the evaluators have, according to the purpose and requirements of the evaluation, and according to the characteristics of the evaluated objects. Then we screen the evaluation indexes by principal component analysis and correlation analysis method from the waiting selected indexes, and calculate the evaluation index system.

When evaluating the R&D efficiency, we usually select R&D personnel and R&D appropriation expenditure to evaluate the R&D resource input. In this paper, according to the characteristics of high-tech industries, we selected R&D personnel input intensity and R&D funds input intensity as the input indexes. And we selected sales revenue intensity of new products as output index (as shown in Table 1).

4. Empirical Analysis

4.1. Comprehensive Efficiency Evaluation of R&D Input and the Result

Shanghai high-tech industries include Photographic Equipments (PE), Pharmaceuticals (PS), Aircraft and Spacecraft (AS), Electronic and Telecommunications Equipments (ETE), Computers and Office Equipments (COE), Medical Equipments and Meters (MEM).

According to super efficiency DEA model, we organized the data derived from Shanghai Statistical Yearbook (from year 2011 to 2013) and Shanghai Statistical Yearbook on Science and Technology (from year 2011 to 2013), used WINQSB to compute R&D comprehensive efficiency and the rank of Shanghai high-tech industries from 2010 to 2012(as shown in Table 2) [11] -[15] .

According to the results in Table 2, for three consecutive years, ETE is DEA effective, this shows that R&D input and output efficiency of ETE is very high. According to the comprehensive technical efficiency and ranking, the comprehensive technical efficiency of PE and AS is low. The R&D efficiency of PS is flat in 2010. In 2011, the R&D efficiency of PS declined. In 2012, the R&D efficiency of PS significantly increased. The R&D comprehensive technical efficiency of COE is DEA effective in 2010, but it is not DEA effective in 2011 and 2012, the efficiency value significantly decreased, it deviated the efficient production frontier to a great extent. The R&D efficiency of MEM is not DEA effective in three years. From the above evaluation results, we can know that the R&D resource allocation efficiency of Shanghai high-tech industries is not high; the R&D resource input has not been fully utilized.

4.2. Analysis of R&D Input Redundancies

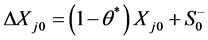

On the existing level of output, R&D resources input is over the amount but did not get the corresponding output; it makes the comprehensive efficiency show up as not DEA effective. Then, based on super efficiency DEA model, we will estimate the returns to scale of the high-tech industries. Increasing return to scale means that more than one output will accordingly produce when an input added; decreasing return to scale means that less than one output will accordingly produce when an input added; constant return to scale means that input-output of the high-tech industries achieve the optimal returns to scale.  is the comprehensive technical efficiency,

is the comprehensive technical efficiency,  is the input redundancies of

is the input redundancies of .We can calculate the value of input redundancies by formula

.We can calculate the value of input redundancies by formula  (as shown in Table 3).

(as shown in Table 3).

From 2010 to 2012, the returns to scale of PE showed as progressive increase. There were many redundancies

Table 1. Indexes of evaluating R&D efficiency.

Table 2. DEA optimal value of Shanghai high-tech industries.

Table 3. Returns to scale and input redundancies of the high-tech industries.

| Year | 2010 | 2011 | 2012 | |

| Photographic Equipments | Returns to scale | Increase | Increase | Increase |

|

| 0.0276 | 0.0306 | 0.0194 | |

|

| 0.6629 | 0.6642 | 0.7385 | |

| Pharmaceuticals | Returns to scale | Increase | Increase | Decrease |

|

| 0.0060 | 0.0153 | 0.0069 | |

|

| 0.1713 | 0.1906 | 0.0113 | |

| Aircraft and Spacecraft | Returns to scale | Increase | Increase | Increase |

|

| 0.0568 | 0.1792 | 0.2330 | |

|

| 0.3772 | 0.3544 | 0.4906 | |

| Electronic and Telecommunications Equipments | Returns to scale | Invariant | Invariant | Invariant |

|

| 0 | 0 | 0 | |

|

| 0 | 0 | 0 | |

| Computers and Office Equipments | Returns to scale | Invariant | Increase | Increase |

|

| 0 | 0.0005 | 0.0001 | |

|

| 0 | 0.1911 | 0.2135 | |

| Medical Equipments and Meters | Returns to scale | Increase | Increase | Increase |

|

| 0.0003 | 0.0103 | 0.0114 | |

|

| 0.0097 | 0.2227 | 0.2962 | |

of R&D personnel input. In 2012, the redundancy of R&D personnel input reached up to 73.85%. The main reason was R&D personnel input intensity of the industry was high and it reached up to 100% in 2012, but the relevant sales revenue intensity of new products did not improve. This shows that R&D resources have much waste. We should manage R&D resources more scientifically and improve the utilization efficiency of R&D resources.

The returns to scale of PS showed as progressive increase in 2010 and 2011, and the returns to scale showed as progressive decrease in 2012. The redundancy of R&D personnel input has decreased significantly. This shows that the R&D resources of the industry have get more and more effective utilization.

From 2010 to 2012, the returns to scale of AS showed as progressive increase. There were many redundancies of R&D personnel input. And the redundancy of R&D funds and personnel both have the trend of increase. The most important reason was R&D funds input intensity in 2012 which has increased by nearly 3 times than it in 2010, R&D personnel input intensity has also increased than 2010, but the amplification of sales revenue intensity of new products was small. Therefore, we should pay attention to effective use for R&D personnel and R&D appropriation expenditure, effectively allocate R&D resources.

The returns to scale of ETE showed as invariant in 3 years. This shows that Shanghai has the advantage in this industry.

The returns to scale of COE showed as invariant in 2010, but the returns to scale showed as progressive increase in 2011 and 2012. The main reason was R&D personnel input intensity of the industry in 2012 has decreased by 27% than that in 2010, however, the sales revenue intensity of new products has decreased 8 times. Therefore, the industry should pay attention to the optimize allocation of R&D resources and avoid the sharp fall of output when decreasing R&D personnel input.

From 2010 to 2012, the returns to scale of MEM showed as progressive increase. The redundancy of R&D personnel input increased. The reason was R&D funds input intensity of this industry in 2012 has increased by 56% than it in 2010, R&D personnel input intensity of the industry in 2012 has increased by 23% than it in 2010, but the relevant sales revenue intensity of new products has decreased by 69%. Therefore, this industry needs to effectively use R&D resources and improve the utilization efficiency of R&D resources, rather than blindly increasing investment, in this way can R&D resources play a driving role in improving the industry.

5. Conclusions and Suggestions

With comparison and analysis of the R&D efficiency of Shanghai’s high-tech industries from 2010 to 2012, we can get the following conclusion:

The R&D efficiency of Shanghai’s high-tech industries have the different levels of variability, and most of them were in the invalid state. Only one of six high-tech industries is DEA effective in 3 years. From the point of high-tech industries, the R&D efficiency of Shanghai’s industries is low.

The returns to scale of Shanghai’s high-tech industries mostly showed as progressive increase and deviated the efficient production frontier, R&D funds input intensity and R&D personnel input intensity had redundancy. This shows that the R&D efficiency of Shanghai’s high-tech industries has a large room to improve; the utilization efficiency of R&D resources needs to improve. We should avoid blindly inputting resources and ignoring the effective use for resources.

With analysis the redundancy of input, we can know that the most of R&D redundancy is R&D personnel, especially PE. The main reason is that the enthusiasm and initiative of R&D personnel was not adequately mobilized, the positive effects of R&D personnel on research and development were not fully played.

R&D resources input intensity of high-tech industries has increased; it necessarily requires more sales revenue intensity of new products. Only through inputting the appropriate R&D funds and personnel, optimizing the input-output framework can we make full use of R&D resources and get the most efficient output. ETE is the competitive industry in Shanghai’s high-tech industries, and the input-output framework of ETE is reasonable. Other industries can communicate and mirror the experience of ETE, build the reasonable input-output framework.

Funding

This paper is supported by the key project on scientific research innovation of Shanghai Municipal Education Commission (Project number: 13ZS129) and the postgraduate special project on scientific research innovation of Shanghai University of Engineering Sciences (Project number: A-0903-13-01060).

References

- Hansen, K.F., Weiss, M.A. and Kwak, S. (1999) Allocation R&D Resources: A Quantitive Aid to Management Insight. Research Technology Management. Research-Technology Management, 42, 44-50.

- Cooper, W.W. (2000) Data Envelopment Analysis. Kluwer Academic Publishers, Norwell.

- Shen, Z.H. (1996) DEA Theory, Method and Application. Science Press, Beijing.

- Wei, Q.L. (2004) Data Envelopment Analysis. Science Press, Beijing.

- Hu B. (2009) An Empirical Study on R&D Efficiency of Various Chinese Cities Based on Improved DEA. Industrial Technology & Economy, 8.

- Hu, B . and Li. H.X. (2013) Longitudinal Comparative Analysis of Shanghai’s Industrial Enterprises’ R&D Resource Allocation Efficiency. Proceedings of International Conference on Complex Science Management and Education Science, Kunming, 23-24 November 2013.

- Hu, X.M. and Li X.M. (2012) An Empirical Study on R&D Efficiency of Large and Medium-sized Enterprise of Chinese High-tech Industry Based on DEA Model. Philosophy and Social Sciences, 3.

- Dong, J. and Zhang, T.W. (2012) Study on Efficiency Optimization of R&D Resources Allocation in Yangtze River Delta. Science & Technology Progress and Policy, 11.

- Fan, L.J., Chen, Y.E. and Li, N. (2010) The Impact of R&D on Technical Efficiency of High-tech Industries in China. R&D Management, 6.

- Feng J.Y. and Shi, L.P. (2012) Study on R&D Efficiency and Model of Regional High-tech Industry in China. Science & Technology Progress and Policy, 11.

- Zhong H. (2011) An Empirical Analysis on Chinese R&D Input-output Efficiency. Journal of Chongqing University (Social Science Edition).

- Mu, Z.R. (2012) Evaluation on R&D Input Performance of Beijing Based on Super-Efficiency DEA Model. Science & Technology Progress and Policy, 5.

- Li, H.L. (2013) Evaluation on R&D Efficiency of Large and Medium Enterprises Based on DEA. Science and Technology Management Research, 4.

- NBS (From Year 1996 to 2012) Shanghai Statistical Yearbook. China Statistics Press, Beijing.

- STCSM, NBS (From Year 1996 to 2012) Shanghai Statistical Yearbook on Science and Technology. Shanghai Popular Science Press, Shanghai.