Journal of Applied Mathematics and Physics

Vol.02 No.08(2014), Article ID:47408,7 pages

10.4236/jamp.2014.28081

Applied Mathematical Theory for Monetary-Fiscal Interaction in a Supranational Monetary Union

Bodo Herzog

ESB Business School, Reutlingen University, Reutlingen, Germany

Email: Bodo.Herzog@Reutlingen-University.de

Copyright © 2014 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 18 April 2014; revised 20 May 2014; accepted 5 June 2014

ABSTRACT

I utilize a differentiable dynamical system á la Lotka-Voletrra and explain monetary and fiscal interaction in a supranational monetary union. The paper demonstrates an applied mathematical approach that provides useful insights about the interaction mechanisms in theoretical economics in general and a monetary union in particular. I find that a common central bank is necessary but not sufficient to tackle the new interaction problems in a supranational monetary union, such as the free-riding behaviour of fiscal policies. Moreover, I show that supranational institutions, rules or laws are essential to mitigate violations of decentralized fiscal policies.

Keywords:

Differential Equations, Monetary-Fiscal Interaction, Monetary Union Theory

1. Introduction

This paper studies the theoretical implications of monetary and fiscal interaction in a monetary union. This is an urgent and interesting topic, especially since the European sovereign debt crisis in 2010. I utilize an approach from applied mathematics in order to model the economic interactions in a supranational monetary union. A dif- ferentiable dynamical system, similar to a Lotka-Volterra model, turns out to be well suited for studying this pro- blem. Overall, my mathematical model is literally interdisciplinary and links two, up to now, hardly unconnect- ed areas: the theory of differential equations and monetary economics.

It is not surprising that there are relatively few economic models that capture the sophisticated subspace of monetary-fiscal interaction. This has to do with the complexity and dynamics in this field of economics. So far, it is common practice in the economics literature to apply a game theoretic approach to study this question [1] - [4] . However, these models lack of dynamics and fail to incorporate the complexity of monetary-fiscal interac- tion. Consequently, a new applied mathematical model in theoretical economics needs to be both tractable and comprehensible for mathematical economists. I build such a model based on differential equations.

The remainder of the paper is structured as follows: Section 2 explains the model and discusses some propo- sitions. I show the existence, stability and solution of the model as well as the economic implications in general. Finally, Section 3 concludes the paper.

2. The Model

2.1. Economic Model

The model’s framework consists of three interacting institutions. The first institution is the European Central Bank (ECB) that is centralized in a monetary union. The primary objective of monetary policy is to maintain price-stability according to Article 105 in the Treaty on the Functioning of the European Union (TFEU). The ECB, however, interacts with the decentralized fiscal policies, the second institution in the model. Both insti- tutions, in particular the central bank, determine the common interest rate. At the moment, there are 18 member countries and thus fiscal policies in the euro area. The main difference between monetary and fiscal policy is that the fiscal authorities retain full sovereignty at the national level. The third institution is supranational law or governance, such as the Stability and Growth Pact (SGP), the European Stability Mechanism (ESM) and other legal constraints [5] . The supranational rules and laws mainly limit the decentralized fiscal policies and support the goals of the centralized monetary policy. The major problem in a monetary union is known as fiscal policy free-riding and moral hazard [6] - [8] . Consequently, the model consists of three interaction channels:

a) Monetary policy interacts with fiscal policy. The decision about the level of public deficits and debts have an impact on the common central bank.

b) Fiscal policy in one member country interacts with the other fiscal policies in the monetary union. There is competition about the public good “price-stability” provided by ECB. One fiscal policy can undermine the supranational objective and transfer the cost to all countries; i.e. through free-riding.

c) Supranational law defines the level playing field for all institutions. These rules interact with both fiscal policies and the central bank. The main objective is the mitigation of fiscal heterogeneity as well as free-riding and moral hazard.

The paper analyzes these interaction channels in a monetary union in general. I utilize a mathematical model that consists of differential equations. Until now, economic literature has studied these interactions mainly in game theoretic models [2] . The first model in this field of literature was developed by Beetsma and Uhlig [5] . All economic models lack of a rigorous modeling of the full interactions and the simultaneous linkages. More- over, the economic literature focuses on the level of nominal and real variables and it does not study the dy- namic processes [9] . To my knowledge, there is no paper that utilizes a mathematical model based on diffe- rential equations to capture these interactions in a monetary union. Given the current policy challenges in Eu- rope, my model offers important policy lessons.

2.2. Applied Mathematical Model

First of all, I model the interaction of fiscal policies and the supranational law respectively. Suppose,  is the number of fiscal policies with excessive national public deficit and debt levels. Hence,

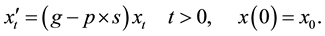

is the number of fiscal policies with excessive national public deficit and debt levels. Hence,  measures the number of countries in violation of supranational law, i.e. the Stability and Growth Pact (SGP) which is a simple deficit and debt rule1. The dynamic yields

measures the number of countries in violation of supranational law, i.e. the Stability and Growth Pact (SGP) which is a simple deficit and debt rule1. The dynamic yields

(1)

(1)

The  represents the benefits fiscal policies obtain through debt accumulation and free-riding. Deficit spending induces a short-run growth stimulus and thus higher domestic GDP. But the costs of higher deficits in one country, i.e. higher interest rates, have to be paid by all euro area member countries. The product

represents the benefits fiscal policies obtain through debt accumulation and free-riding. Deficit spending induces a short-run growth stimulus and thus higher domestic GDP. But the costs of higher deficits in one country, i.e. higher interest rates, have to be paid by all euro area member countries. The product  re- presents the punishment in case of violation with the supranational debt rule. According to the rule, the punish- ment is a fixed amount,

re- presents the punishment in case of violation with the supranational debt rule. According to the rule, the punish- ment is a fixed amount,  , of the GDP (cf. SGP). The parameter,

, of the GDP (cf. SGP). The parameter,  , represents the probability of detection of a fiscal policy failure. Hence, the first-order differential Equation (1) has an intuitive economic interpretation. The higher domestic benefits from deficit spending than punishment

, represents the probability of detection of a fiscal policy failure. Hence, the first-order differential Equation (1) has an intuitive economic interpretation. The higher domestic benefits from deficit spending than punishment , the greater the number of fiscal policies violating the supranational debt rule. However, if countries do not consolidate the public budget according to the supranational rule, they have to pay a sanction if it is detected. Hence, the rule should mitigate the number of violating countries.

, the greater the number of fiscal policies violating the supranational debt rule. However, if countries do not consolidate the public budget according to the supranational rule, they have to pay a sanction if it is detected. Hence, the rule should mitigate the number of violating countries.

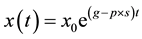

The solution of the model is . This solution reveals, again, as long as debt accumulation (free-riding incentive) is greater than the sanction

. This solution reveals, again, as long as debt accumulation (free-riding incentive) is greater than the sanction , countries prefer free-riding. Only sufficiently high sanctions,

, countries prefer free-riding. Only sufficiently high sanctions,  , or a high detection probability,

, or a high detection probability,  , mitigate the problem. Unfortunately, the enforcement of European law is rather weak and thus,

, mitigate the problem. Unfortunately, the enforcement of European law is rather weak and thus,  , is low in reality [10] [11] . Moreover, the sanction scheme,

, is low in reality [10] [11] . Moreover, the sanction scheme,  , is ra- ther limited today as well2. A more comprehensive modeling of the sanction scheme is

, is ra- ther limited today as well2. A more comprehensive modeling of the sanction scheme is

(2)

(2)

The sanction payment  depends on a fixed rate

depends on a fixed rate

where

Finally, I solve the equation for

This solution has the following boundaries for

If supranational law is fully effective, i.e. the detection probability

2The sanction is a linear function of GDP with a minimum payment

Next, I study monetary policy. The main instrument of a common central bank is the interest rate level

where

where

where

2.3. General Mathematical Model

Analyzing the complete dynamics of the fiscal-monetary-law interaction reveals new insights about the ne- cessary and sufficient conditions for a long-run stable and sustainable monetary union. Using Equations (3) and (7) together with conditions (8) and (9), yields the following system:

Interestingly, this system of two differential equations is similar to a so-called “Lotka-Volterra” model, de- veloped by Alfred James Lotka (1880-1949) and Vito Volterra (1860-1949), and is an useful concept in appli- ed mathematics [12] . To understand how the fiscal-monetary-law model evolves over the time, I first simplify the equations and assume

The asymptotic stability or instability of the model can be studied. I define the function

The first derivative for the two solutions yields

Consequently, the eigenvalues of

This implies

instability can also be seen from

solve the following problem

The second solution of the model

or vice versa. But if

This implies no real solution. Finally, I describe the solution behaviour of the model near a point

Next, I integrate and obtain,

where

The integration constant

solution in the environment

where

The second-order Taylor approximation of the solution

This shows that that the specific solution solves the model for

Finally, I study the full model of Equation (10) with

The general model has four solutions:

and

Applying Cramer’s rule, I obtain

For later computation purposes, I define

The point

if

eigenvalues of Equation (20) for

where

The first constellation becomes a reality if free-rider incentives are small

Proposition 1 The number of fiscal policies

The proof of this proposition follows from Equation (21). First, the constellation

nomically not realistic because the common interest rate converges for

Proposition 2 For

a) the detection probability,

b) the marginal sanction fee,

c) central bank commitment, d, is high (i.e. c is low).

Proof: The proof follows by direct differentiation of

Part (ii), follows by differentiation in respect to

Part (iii) is shown by

3. Conclusion

This paper explains the unique fiscal-monetary-law interaction in a supranational monetary union. I conclude the paper by discussing some generalizations and by touching on some issues that the model did not address. First, the argument is much more general than initially considered. The results reveal new insights about the interac- tion of the key institutions in a monetary union. The model demonstrates that without effective laws and fiscal and economic governance, a monetary union is doomed to fail. Consequently, the fiscal and economic govern- ance scheme, together with the common cental bank, plays an important role in a monetary union. Second, the model is well designed to analyze the institutional drawbacks and interaction relationships in the EMU. The re- sult suggests a tough sanction scheme for unsound fiscal policies. Only this can mitigate the potential benefits of free-riding. The major omission of the model is an endogenous economic-political element that considers for in- stance strategic policy decisions or veto power. Furthermore, an empirical investigation of the proposition is also an important study object in future research. Moreover, I do not consider the fact that small and weak agents ty- pically pay more attention to supranational law than powerful agents do.

Acknowledgements

I would like to thank for comments Mr. Gassmann and the two anonymous referees. I gratefully acknowledge financial support from the RRI-Reutlingen Research Institute.

References

- Libich, J. and Stehlik, P. (2012) Monetary Policy Facing Fiscal Indiscipline under Generalized Timing of Actions. Journal of Institutional and Theoretical Economics, 168, 393-431. http://dx.doi.org/10.1628/093245612802920962

- Dixit, A. and Lambertini, L. (2003) Interactions of Commitment and Discretion in Monetary and Fiscal Policies. The American Economic Review, 93, 1522-1542. http://dx.doi.org/10.1257/000282803322655428

- Beetsma, R. and Jensen, H. (2003) Contingent Deficit Sanctions and Moral Hazard with a Stability Pact. Journal of International Economics, 61, 187-208. http://dx.doi.org/10.1016/S0022-1996(02)00083-1

- Beetsma, R. and Bovenberg, L. (1999) Does Monetary Unification Lead to Excessive Debt Accumulation? Journal of Political Economics, 74, 299-325.

- Beetsma, R. and Uhlig, H. (1999) An Analysis of the Stability and Growth Pact. The Economic Journal, 109, 546-571. http://dx.doi.org/10.1111/1468-0297.00462

- Beetsma, R. and Bovenberg, L. (2001) The Optimality of a Monetary Union without Fiscal Union. Journal of Money, Credit, and Banking, 33, 179-204. http://dx.doi.org/10.2307/2673880

- Beetsma, R. and Bovenberg, L. (2002) Strategic Debt Accumulation in a Heterogeneous Monetary Union. Journal of Political Economics, 19, 1-15. http://dx.doi.org/10.1016/S0176-2680(02)00126-X

- Gali, J. and Monacelli, T. (2008) Optimal Monetary and Fiscal Policy in a Currency Union. Journal of International Economics, 76, 116-132. http://dx.doi.org/10.1016/j.jinteco.2008.02.007

- Kirsanova, T. and Wren-Lewis, S. (2012) Optimal Fiscal Feedback on Debt in an Economy with Nominal Rigidities. Economic Journal, 122, 238-264. http://dx.doi.org/10.1111/j.1468-0297.2011.02458.x

- Hallet, A.H. and Svend, H.J. (2012) Fiscal Governance in the Euro Area. Journal of European Public Policy, 19, 646- 664. http://dx.doi.org/10.1080/13501763.2011.646773

- Herzog, B. and Hengstermann, K. (2013) Restoring Credible Economic Governance to the Eurozone. Economic Affairs, 33, 2-17. http://dx.doi.org/10.1111/ecaf.12009

- Torbati, A.S. and Chakoli, A.N. (2013) Empirical Examination of Lotka’s Law for Applied Mathematics. Life Science Journal, 10, 601-607.

NOTES

1The Stability and Growth (SGP) limits public deficits to 3% of GDP and debt to 60% of GDP.

3According to article 105 TFEU “... the primary objective of the... [European Central Bank]... is price stability.” The US-Federal Reserve Bank, however, has a dual mandate which means a lower d.