Open Journal of Business and Management

Vol.04 No.02(2016), Article ID:65300,6 pages

10.4236/ojbm.2016.42019

Comprehensive Evaluation of Online Peer-to-Peer Lending on the Province-Level Regions in China Based on Generalized Principle Component Analysis

Hang Yang

Institute of Industrial Economics, Jinan University, Guangzhou, China

Copyright © 2016 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 19 January 2016; accepted 29 March 2016; published 1 April 2016

ABSTRACT

This article is based on recent development of peer-to-peer lending industry in China. With the design of regional quality in mobile payment, this article constructs a multi-index evaluation system made by the current situation of economic and social foundation. By using principal component analysis, the article makes a comprehensive quantitative evaluation of quality and level of its development. Analysis results show that there are obvious gaps in the development of the P2P industry of China, which indicates the trend that peer-to-peer lending, will spread from developed regions to developing regions. Coordination between indicators and evaluation results are basically consistent with the evaluation results.

Keywords:

Peer-to-Peer Lending, Industry Development Quality, Principal Component Analysis

1. Introduction

Recommendations for the 13th Five-Year Plan for Economic and Social Development first make it clear that we make efforts to regulate and develop Internet finance that means that Internet finance, especially P2P net loan has access to national policy support. In the current asset allocation shortage period, Internet finance has been included in the central policy and will lead to the development of Internet finance, especially P2P industry ushered in the golden period of development. P2P (peer-to-peer) is also known as the Internet financial point to point lending, it is a small scale lending transaction between individuals and individuals. People complete the matching of funds and establish the relationship between the two sides of the loan through the effective information matching on the electronic commerce professional network platform. The borrowers issue interest and repayment time, etc., the lenders make specific loan decision according to the information of the bidding. The two sides eventually achieve self-service lending through the free auction.

The penetration of Internet technology in the field of financial services is gradually deepening. Internet financial services have emerged in the new form of payment and financing. At the same time, the traditional financial system has been gradually difficult to meet the huge financing needs from our various types of small and micro enterprises. P2P represents a development trend of the financial services industry in the future. It is based on the progress of information technology and Internet finance, and creates a new credit and security model. 2015 national P2P net loan turnover reached 1180.6 billion yuan. This figure increased 258.62% compared to 2014, and the number of P2P platforms had also increased to 3844.

P2P net loan is not only able to provide additional market financing channels to tens of millions of small and medium-sized micro enterprise owners as a supplement to social credit loans, but also can effectively reduce transaction costs, improve the utilization efficiency of regional internal idle funds. At the same time, P2P net loan industry needs a higher level of user credit rating and certification in the demand for risk control and transaction security. The development of P2P will have a positive effect on the construction of personal credit evaluation system through the credit rating and registration before trading and the monitoring and recording of trading behavior. P2P net loan eliminates the obstacles between the borrower and the lender, so that the loan process is more convenient and simple. Currently security mechanisms and supervision and management level of major P2P net loan platforms are more perfect, so that the flow of funds will be more in line with the specification through the third party depository system. Therefore, in the current vigorous development of various types of financial services, P2P net loan can improve investors idle funds utilization, optimize the allocation of funds, its interest on loans and the interest rate are more transparent, and it is easy to monitor. It also can curb the private usury. So it is a kind of financial innovation mechanism to meet the needs of the market, to achieve inclusive win-win.

In the P2P net loan related foreign literature, Herzenstein et al. (2008) found the influence factors of Internet lending behavior [1] . Davis & Gelpern (2010) and Paul (2013) studied the behavior of the lender in the online lending [2] , and explored the way to supervise the network lending platform [3] . These researches are mainly based on the foreign capital market, and pay less attention to the emerging capital market. Domestic first P2P net loan platform appeared in 2007, P2P net loan industry has developed for 8 years, but the degree of improvement of the data statistics is relatively low, so the academic community has less research about P2P net loan industry development level. Wang Huijuan and other (2014) consider that P2P network lending is a financial innovation model which like the combination of Internet technology and private lending, credit is an important factor affecting the P2P network lending transactions [4] . Qian Jinye (2012) analyzed the current situation of the domestic P2P network lending industry, found P2P net loan is a new financing channel and a convenient financing facility, which is a necessary and effective supplement to the existing bank credit system. In view of this, this paper select the P2P net loan industry in China’s regional distribution as main point of view, to explore the P2P net loan industry the corresponding development process in each province, and through the cluster analysis to explain the future development of P2P net loan industry in various provinces and autonomous regions [5] . This paper helps to evaluate the future development trend of the provinces in the P2P net loan industry and provide targeted policy implications.

2. Research Technique

2.1. Principal Component Analysis Method and Index System

Principal component analysis is a multivariate statistical method for dimensionality reduction and feature extraction. The principal component analysis is based on the minimum information loss, and it turns the large number of the original variables into a few comprehensive indexes. If the data consists of some m dimensional vector, that is, each sample includes m variables, Variable matrix is . The purpose of principal component analysis is to find k new variables: (k < m)

. The purpose of principal component analysis is to find k new variables: (k < m) . It will reduce the dimension of multiple variables into fewer main variables to explain the internal structure of the multi variable, so that it can explain most of the variance of the original data contained in the information. The relationship between principal component variables and basic data:

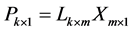

. It will reduce the dimension of multiple variables into fewer main variables to explain the internal structure of the multi variable, so that it can explain most of the variance of the original data contained in the information. The relationship between principal component variables and basic data: . Among them, P is the principal component matrix, and L is the coefficient matrix.

. Among them, P is the principal component matrix, and L is the coefficient matrix.

Using principal component analysis method to evaluate the quality of P2P net loan industry is as follows: It then needs to collect and process the data, filtering it and normalizing it into a standard format, establish the correlation coefficient matrix of the variables. It extracted the factors whose characteristic value more than 1, then establish the correlation coefficient matrix R. The characteristic value and the variance contribution rate of the correlation matrix R are calculated; calculates the factor load score and sort, and makes the variance contribution rate of each factor as the weight, finally calculates the principal component comprehensive score of P2P net loan industry development of the province of the quality of the industry.

This paper uses the data indicators from statistical yearbook of all provinces and cities in 2014 and China Internet development statistics report which provided by CNNIC in 2014. A comprehensive index system (Table 1), which is composed of eight kinds of related basic evaluation points, is established.

P2P net loan industry development quality index is based on various types of data which can reflect the P2P net loan industry connotation and impact factor, all of the above indicators reflect the connotation and status of the P2P net loan industry in our country, the various aspects of the field are included in the quantitative evaluation system, so as to establish a feasible measure of P2P net loan industry in provinces and autonomous regions. The following analysis steps are completed using SPSS19.0 statistical analysis software. Standardized indexes shall be credited as NETI, RATE, PLAT, RECA, INVE, GDP, TRAD, INCO.

2.2. Data Analysis

Data analysis results show that variance contribution rate of the principal component F1 and F2 reached 86.75%, contains the main information of the provinces P2P net loan industry. According to the principal component analysis method, the original data of 26 provinces and autonomous regions of China were analyzed, according to the output result analysis, the model can be used to extract two principal components: 5.518 > 1 and 1.422 > 1, cumulative variance contribution rate is 86.75% > 85%, this means that the two principal components can reflect the original information content of all 86.75% of the information (Table 2). Therefore, the two main components can be selected as the country’s 2014 P2P net loan industry development quality evaluation of comprehensive variables (Table 3).

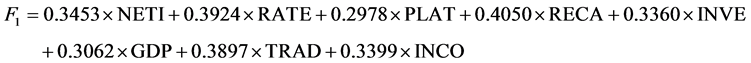

After the standardized treatment of the 8 indexes, the corresponding characteristic vector is the weight coefficient. The function expression of the first principal component and the second principal component can be got.

Table 1. 2014 annual provincial regional P2P net loan industry development quality indicators.

Table 2. Principal component factor analysis results.

Table 3. Principal component factor analysis results.

(1)

(1)

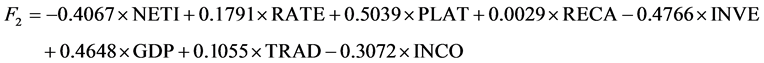

(2)

(2)

This paper puts the data into the expression, the expression is the sum of product score and contribution rate of each principal component: F = 79.51% × F1 + 20.49% × F2, Gets P2P net loan industry development quality principal component comprehensive score and ranking of all provinces and municipalities in 2014 (Table 4).

2.3. Results of Data Analysis

This paper compares the comprehensive score of P2P development quality level in all provinces (Figure 1). 2014 P2P net loan regional development quality ranking in the top 10 are Guangdong 1), Beijing 2), Shanghai 3), Zhejiang 4), Jiangsu 5), Shandong 6), Fujian 7), Tianjin 8), Liaoning 9), Hebei 10). All ten provinces and municipalities in the East, the central and western provinces and cities in the rankings in a backward position. This shows that the early capital accumulation and stable customer groups of the P2P net loan industry are derived from the coastal developed areas, since then, it has been gradually formed the spreading trend in the inland provinces and cities. Guangdong, Beijing and Shanghai scored in the top three, occupy the leading growth pole of the P2P net loan industry technology innovation and scale development. Due to the gap between the eastern provinces and the central province in economic base, residents financing habits and technological level, the P2P net loan industry in central province still has a large development space. In 2014, Xinjiang, Qinghai, Tibet and other provinces in the region of the P2P net loan industry development has just started, develops lowly. From the perspective of the whole society, the basis of the market size of P2P net loan industry in various provinces and cities is always the size of the region’s economic activity and income and consumption levels, and show the trend of diffusion from east to west, the economically developed areas to less developed areas.

More specific explanation is that comprehensive score of development of P2P quality in eastern coastal provinces can be higher, not only because of the earlier development of P2P net loan industry, large amount of the trading platform for enterprises and the third party hosting services providers, strong capital, more complete information infrastructure [6] , but also because of updated financing habits of the people and micro enterprises in these region. The reason for the gap of the quality of P2P development between the western provinces and eastern provinces lies in: The remote location and the smaller size of the economy are obstacles, technical level and management model of the financial and information industry which related to P2P net loan platforms needs to be improved, The financing needs of residents and small and micro enterprises in these region may be small. These factors are the upper limit for expanding the size of P2P net loan transaction market in the western provinces and cities. Backward regional P2P trading platform security management and control is one of the reasons for the slow development of P2P net loan industry in the western provinces as well.

Thus, provinces and cities in developed areas are the forefront of financial innovation, they rely on its huge economic and information advantages, occupy the leading position in the P2P net loan industry developing trends. However, the dynamic diffusion effect of Internet technology and the huge amount of local financing demand also provide power for other provinces in the development of P2P. Hainan, Qinghai and other western provinces also began to establish their new P2P trading platform in 2014, the future development can be expected.

3. Conclusions and Policy Implications

In this paper, the principal component analysis method is used to evaluate the quality of P2P net loan industry in

Figure 1. Comprehensive evaluation of the quality of P2P development in all prov- inces in China in 2014.

Table 4. China’s P2P net loan industry development quality comprehensive score and ranking in 2014.

China. From the point of view of quantitative analysis, P2P net loan, as a new type of financial service, its developing speed is not balanced in each area. In the current view, P2P net loan must go through a long process, and may become a common and convenient common financing channel in China. Due to the gap of the regional economic scale and the level of industry norms, P2P net loan transactions mostly occur in the eastern coastal provinces, most of the western provinces have still been in the stage of initial development of the market. Therefore, P2P net loan environment, such as the user network lending habits, facilities conditions, requires local government support and continuous cultivating of the regional trading platform.

Mainly the loss of contact, difficulties of withdrawals and stop of operation, this reflects the reality of the industry reshuffle which is accelerating. Firstly, in the face of such problems, the provincial government should clear regulatory objects, improve the regulatory organization system in the field of P2P net loan industry. The government should not only promulgate P2P regulatory rules, include risk monitoring, technical support, service specification P2P, but also improve the future of the P2P net loan industry access threshold.

Secondly, Local government should strengthen the enforcement of laws and regulations on the illegal trading of P2P net loan in the region, protect the legitimate rights and interests of the participating subjects, and promote the development of industry standards. The local government should establish and improve laws and regulations of the network transaction, strictly control payment channels and regulate credit certification according to the virtual characteristics of net loan deal, based on the need of P2P net loan, to establish personal credit authentication system and risk warning system, make public appearance of credit rating timely [7] , establish and improve the protection mechanism of the rights and interests of the two parties in electronic trading, monitor abnormal network transactions, improve the anti money laundering monitoring mechanism and pay attention to network lending platform of public funds management [8] .

Finally, market participants should share interests from the value chain of P2P net loan, establish cooperative relationship of Interest sharing and risk taking. In order to create an orderly and win-win P2P net loan transaction system, companies in the market should speed up technological progress and innovation, give full play to the radiation and diffusion efficiency of P2P net loan, that will promote efforts to move towards the effective resolution of the pressing issues of development that will solving financing difficulties of all peoples.

Cite this paper

Hang Yang, (2016) Comprehensive Evaluation of Online Peer-to-Peer Lending on the Province-Level Regions in China Based on Generalized Principle Component Analysis. Open Journal of Business and Management,04,171-176. doi: 10.4236/ojbm.2016.42019

References

- 1. Herzenstein, M., Andrews, R.L., Dholakia, U.M. and Lyandres, E. (2008) The Democratization of Personal Consumer Loans? Determinants of Success in Online Peer-to-Peer Lending Communities. Bulletin of the University of Delaware, 15, 274-277.

- 2. Davis, K.E. and Gelpern, A. (2010) Peer-to-Peer Financing for Development Regulating the Intermediaries. American University Washington College of Law, 11, 24-27.

- 3. Paul, S. (2013) Square Pegs in a Round Hole: SEC Regulation of Online Peer-to-Peer Lending and the CFPB Alternative. Yale Journal on Regulation, 30.

- 4. Wang, H.J. and Liao, L. (2014) Chinese P2P Platform’s Credit Authentication Mechanism Research—Evidence from Renrendai. China Industrial Economics, 4, 136-147.

- 5. Qian, J.Y. and Yang, F. (2012) The Development Status and Prospects of Chinese P2P Network Lending. Finance Forum, 1, 46-51.

- 6. Geng, H.Q., Chen, F., Zhan, C.W., Qiu, X.X. and Liu, L. (2009) Comprehensive Evaluation of Urbanization Level on the Province-Level Regions in China Based on Generalized Principle Component Analysis. Human Geography, 5, 47- 51.

- 7. Wu, X.G. and Cao, Y. (2011) The Empirical Study on Pro-Cyclical Effect of the Listed Companies’ Default Rate. South China Finance, 4, 32-35.

- 8. Wang, J.H. and Li, C. (2011) Analysis and Countermeasures of Money Laundering Risk under the Network Lending Model. Journal of Finance and Economic, 9, 9-11.