Journal of Mathematical Finance

Vol.07 No.02(2017), Article ID:76056,36 pages

10.4236/jmf.2017.72013

The Economics of XVA Trading

Peter J. Zeitsch

Calypso Technology Inc., San Francisco, CA, USA

Copyright © 2017 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: March 2, 2017; Accepted: May 6, 2017; Published: May 9, 2017

ABSTRACT

The theory of trading with value adjustments, or XVA, is well established. However, the market still differs significantly in pricing practice with houses applying varying numbers of adjustments to the same trade; or none at all. Here the aim is to outline the basic trading strategies used by XVA desks and to explore the implications in terms of the risk transfer involved and the resulting profit and loss. This is achieved through case studies of actual traded structures including details of the positions themselves and the motivation for executing them. The mark-to-market impact is also quantified. Following one case study, a methodology to calculate the cost of funding Initial Margin, or MVA, for linear products will be developed.

Keywords:

XVA Trading, Credit Value Adjustment, Funding Value Adjustment, Margin Value Adjustment, CVA, FVA, MVA

1. Introduction

XVA is the term now used to encompass the value adjustments, i.e. “VA”, that are applied to the mark-to-market (m2m) of derivatives to correct the pricing of classic risk-free models. The literature on the theory of XVA is increasingly comprehensive [1] [2] [3] . However, the understanding of XVA within capital markets remains variable. For trading, there is no market standard. As of mid- 2015, only 29 banks have announced the impact of XVA to their books by formally adjusting their profit and loss (P & L) to reflect these risks [4] . In all cases, large losses were incurred [5] - [13] . The consequence of these divergent pricing views is that there is a two-tier market forming: those who price XVA and those that don’t.

The “X” in XVA refers to the number of value adjustments that are now applicable. Credit Value Adjustment, or CVA, is the credit risk that an arranger will price into a trade to face a given uncollateralized counterparty. Likewise, Debt Value Adjustment, or DVA, is the credit risk that the client should take into account when facing the dealer. There are funding considerations, which are quantified using a Funding Value Adjustment, or FVA. The FVA can be either a cost, when collateral is posted, or a benefit, when collateral is received. An originator will probably also track their LVA, or Liquidity Value Adjustment. This is the slippage that a bank will incur by funding at LIBOR but only receiving an overnight swap rate (OIS) in return, on posted collateral. Margin Value Adjustment, MVA, is the cost of funding Initial Margin when trades are cleared. KVA, or Capital Value Adjustment, is the cost of holding regulatory capital against derivative portfolios. CollVA quantifies the value of the optionality, embedded in a Collateral Support Agreement (CSA), to post collateral in different currencies.

The Basel Committee on Banking Supervision (BCBS) has formally recognized CVA by including its risk management as part of the Fundamental Review of the Trading Book [14] . Accounting standards now also require CVA to be recorded in the general ledger [15] . This has led to an increase in awareness of XVA in the market [16] but there has not been a consistent response from sovereign regulators, nor banks [17] [18] [19] [20] . BCBS has also announced a review of FVA [21] , but the other adjustments remain unaddressed. This is all indicative of the two-tier market that now exists.

Increasing transaction costs will naturally encourage clients to seek out arrangers who don’t price XVA. So clients may change their trading patterns. They will shop trades with high costs around the street. Dealing rooms that price XVA are motivated to trade in different ways from those that don’t consider it. The value they see in trades is very different from the old-school view of P & L. Houses that don’t price these costs will generally have a queue of other banks and clients out their door wanting to execute certain trades with them.

Very little has been written about the effect of XVA on capital markets. Several short articles have appeared in the general press [22] [23] [24] [25] [26] , but nothing has been published that either outlines the traded strategies, nor quantifies the impact. This article seeks to address that. The aim here is to summarize the basic trading strategies used by XVA desks and to explore the risk transfer involved, as well as the P & L implications. In section 2, an overview of the theory is presented. Then case studies of actual transactions will be given in section 3. This will include details of the positions themselves, the incentives for executing those trades and the resulting P & L. Under all scenarios, the XVA P & L will be shown to have similar magnitude to the profitability of the underlying flow trading desk. In some cases, the XVA P & L is an order of magnitude greater. Motivated by one case study, a methodology to calculate MVA for linear products will be developed in section 4. The findings will show that MVA is of equivalent importance to FVA when trades are cleared. Section 5 concludes the study.

2. The Model

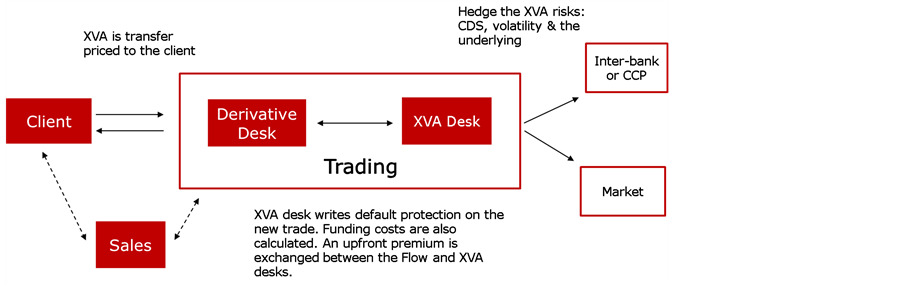

When banks include XVA as part of the m2m of derivatives, they will typically have dedicated front office desks to manage the risk as shown in Figure 1. They

Figure 1. XVA trading desk.

look to transfer price the XVA to clients. These desks are typically run as any other derivative business with daily m2m and P & L that is reported as part of the bottom line of Capital Markets. At their most advanced, XVA desks hedge the exposures into the market like any other derivative book; what is known as risk-neutral pricing.

Perhaps the most important function of an XVA desk is to write protection against losses to the flow trading desks for the various VA components. Take CVA. At trade inception, the CVA costs are transfer priced to the client. An upfront payment is then exchanged between the flow desk and the XVA desk. The XVA desk has now written protection against any loss from the counterparty defaulting. If the client does default, the flow desk will pass the affected trades to the XVA desk for the default workout process. The XVA desk then makes a payment to the flow desk equal to

, (1)

where LGD is the loss Given Default. This is also known as a Contingent CDS (CCDS).

Quantifying XVA risk requires modelling the evolution of the product in question to maturity. Typically, a Monte Carlo approach is used. The advantage of such a technique is that portfolios can be considered in their entirety. Netting from various positions can be calculated, likewise any effects from collateralization. The case studies here will focus on interest rate (IR) and foreign exchange (FX) derivatives.

2.1. Monte Carlo Simulation

Calculating XVA risk consists of:

・ Choosing simulation dates where the last date is the longest maturity in the portfolio.

・ Generating market scenarios.

・ Pricing individual trades and collateral for each scenario and simulation date.

・ Calculating the portfolio exposure, considering netting and collateral.

・ Calculating XVA at the counterparty level.

Scenario generation involves simulating Monte Carlo paths for the IR and FX market factors required for pricing the trades. Credit spreads are also used to infer default probabilities, but they are not simulated.

To generate the Monte Carlo simulations, a shifted Libor Market Model (LMM) [27] [28] [29] is used. Start with a set of tenor dates with associated simple forward Libor rates and tenors , so that

, (2)

where is the value of a zero-coupon bond maturing at . In the spirit of the original Black model, each forward rate for a given currency evolves per a displaced stochastic differential equation

(3)

and is the shift associated with the appropriate forward rate. The drift term, , is a function of the forward rates and their volatilities which is determined by no-arbitrage arguments as

(4)

where ‘base’ represents the domestic currency and ‘foreign’ adjusts the drift for the volatility of the FX rate. The market standard is to report XVA in the base currency in which the bank reports P & L. Here the base currency is USD. is the index of the closest forward rate that has not reset yet. The volatility of each forward rate, , is specified using the parametrization due to Rebonato [30]

(5)

and a, b, c, d are constants calibrated to user-selected swaptions. is the FX volatility where, is the next tenor date. The forward FX rate between a given currency and the base currency follows a log-normal process

. (6)

The instantaneous correlation between two forward LIBOR rates is determined by the reset time distance

, (7)

with being a user input that is typically calibrated to historic data.

It is well known that when LIBOR rates are log-normal, only one forward FX rate can be log-normal. We adopt a commonly used technique where we specify the volatility of the forward FX rate maturing at the next tenor date, , deterministically. This means that is also deterministic and can be calibrated to the FX option market. Knowing the forward FX rate, , maturing at the next tenor date, , other forward rates are obtained from interest rate parity.

Calibrating (2) - (5) requires specifying a swaption implied volatility surface. The model solves for the optimal parameters in (5) that replicate the swaption prices. Calibrating the 4 parameters requires the user to specify a minimum of 4 points on the surface. Here the diagonal of the swaption surface from 1 to 10 years is chosen. Likewise, calibrating (6) requires the specification of an FX implied volatility surface. The shift, , will be set to 2%. See the appendix for the market data.

2.2. XVA Formulation

For a given portfolio of trades, the LMM is used to generate Monte Carlo simulations of the underlying risk factors for a given time horizon, T, with pre-specified time increments. At each time step, the portfolio of trades is m2m for each simulation. All scenarios that result in a positive m2m are then aggregated. Likewise, all negative m2m outcomes are also summed. For a given number of time steps, i and a number of simulations, j, define the expected positive exposure, or EPE, as

(8)

and the expected negative exposure, or ENE, as

, (9)

where I is the indicator function. From the definitions of (8) and (9), it also follows that . In the presence of a CSA agreement, the m2m is modified to

(10)

where , and is the collateral amount. The definitions of and , as given by (8) and (9), will hold for all calculations in the remainder of this article.

Following [1] [2] [3] , when a dealer trades with an uncollateralized client, the exposures are typically hedged back into the street, with professional counterparties, under two-way zero threshold Credit Support Annexes (CSA). As the trades mature, if there are m2m gains on the client side, the dealer then has a credit exposure to that client. Likewise, if the m2m is negative, the counterparty has credit risk facing the arranger. Hence,

, (11)

(12)

and is the Loss Given Default of the bank and counterparty, respectively. is the risk-free discount factor for time step . are default probabilities for the bank and counterparty respectively and is the size of the time step. Equations (11) and (12) are known as the bilateral representation of the risk. A unilateral formulation can also be used which omits the survival probability . Here Equations (6) and (7) will be used with LGD = 60% and a 5-year CDS equal to 100 basis points (bp). See the appendix for the full curve details.

The survival probabilities are risk neutrally derived from the CDS curve of the counterparty [31] . Recall that a CDS spread is the ratio of the premiums paid by the protection buyer divided by any pay outs from the protection seller, or,

. (13)

Without loss of generality, (11) - (13) imply that the CVA, as well as the other VA, vary approximately linearly versus the credit spread. All default probability calculations in the remainder of this article are calculated using (13).

BCBS recently released guidelines for marking non-traded credits [14] . It requires mapping those counterparties to traded CDS based on rating, industry and geography. An alternative, that has been used on the street previously, is to use historic default probabilities. It is well documented [32] that the implied default rates from traded credit spreads have a much greater magnitude than historic default rates. CVA varies linearly with the default probability. Consequently, moving from historic to implied default rates will have a large P & L impact as shown in [8] .

FVA is gaining increasing acceptance by the market. It is the cost over and above the risk-free rate incurred by an institution to fund derivative positions. FVA arises primarily due to the asymmetry in the funding of uncollateralized client trades versus the hedges that are executed in the professional market under a CSA. Again, if the m2m of a client portfolio is positive, then the m2m of the hedges will be negative. Ignoring posting lags and minimum transfer amounts, the book runner will be required to post collateral to the counterparty under the CSA. Typically, a bank will fund this collateral by borrowing the required cash at its funding rate of LIBOR + S where S is the bank’s forward term funding cost. Likewise, if the client portfolio shows a loss, there will be an offsetting m2m gain on the hedges. In this case, under the CSA, the bank will receive collateral which can then be invested per the rehypothecation terms. Applying a bid-offer to S allows the investor to earn a net return.

Analogously to CVA, define the FVA as the expected funding cost over the life of the portfolio. This is broken down into a cost, where collateral is posted, and a benefit, where collateral is received. Or

, (14)

where

, (15)

(16)

and is the forward funding spread given by

, (17)

which holds for small . The bid and offer applied to S reflect the spreads paid or earned by the desk. Similarly to the CDS, here a funding curve with a 5-year spread equal to 100 bp is employed to facilitate comparison between (14) and (11). See the appendix for further details of the funding curve.

An argument exists that FVA should not be included in the valuation of a derivative [33] [34] [35] [36] [37] . Another school of thought says that including FVAbenefit as well as DVA in a calculation is “double counting” the risk [26] . For a trader, the argument is irrelevant. If DVA is to be included and transfer priced to a client, then it must be possible to monetize that price through hedging. That would require the ability for a bank to enter the CDS market and sell protection on itself―which is not possible. Alternatively, a trader might seek to sell protection on a financial institution that is trading at a similar spread to the bank and that is highly correlated. Again, flow CDS traders will generally not buy that protection. Consequently, DVA cannot readily be monetized. On the other hand, a trader will have funding costs charged back to the book, typically from Treasury. FVAbenefit can be hedged by rehypothecating the posted collateral. Hence, transfer pricing FVA to clients is essential to maintaining profitability.

Another consideration under a CSA is the interest accrued. Typically, a bank will fund at LIBOR, but will only receive OIS in return on posted collateral. The value of a trade needs to be adjusted for this slippage. Today, it is known as Liquidity Value Adjustment, or LVA. Define LOIS as

. (18)

Where collateral has been posted, an LVAcost will apply which is equal to the interest shortfall attributable to LOIS. Likewise, when collateral is received, the desk can retain the LOIS differential as an LVAbenefit. LVA is calculated analogously to FVA

, (19)

. (20)

Houses may in fact choose to incorporate LVA into the FVA calculation. This will be influenced by the desk structure in the trading room. If different desks manage different components of the risk, then a bank will seek to split the risk based on those lines. Here we shall assume that LOIS is negligible thereby minimizing LVA.

In terms of the other value adjustments, CollVA arises from multi-currency CSAs. Due to interest rate differentials, at any one time, a given currency will be cheapest to deliver, as the calculations given in (2) to (20) assume discounting in only one currency. Banks are increasingly reluctant to sign such CSAs, due to the embedded optionality. Here we shall assume that any CSA agreement is single currency.

The use of KVA remains limited. It is computationally difficult as it is a simulation intensive calculation. The magnitude of the KVA can be much greater than the other value adjustments combined [38] [39] . If anything, banks use KVA as a hurdle rate, that the P & L on a potential trade must meet, in order to be dealt. Other houses may call this “Return on Equity”. Transfer pricing such a cost to clients in isolation on the street would render a Bank uncompetitive― hence the use only as a profitability measure. However, given the capital that banks must now hold and the pressure to be profitable, it is unclear whether this position is tenable in the long term. MVA is also a computationally intensive calculation, but with the introduction of central and now OTC clearing, MVA has drawn significant attention [40] - [46] .

When a trade is cleared, there are two margin requirements. One is the Initial Margin (IM), which is paid upfront and recalculated at least daily. The second is the Variation Margin (VM). The VM is equal to the m2m movement of the trade itself. If the m2m moves against the clearing member, then VM equal to that m2m loss must be posted. Similarly, if there is a m2m gain, the clearing member will receive VM in the form of cash or securities. The m2m is also calculated at least daily. Hence, funding the VM is directly analogous to FVA. IM is intended to cover the potential losses from further m2m movement from the time of a counterparty’s default to the actual closeout of the position. The calculation of the IM varies depending on the clearing house. Generically, it is a Vale-at-Risk (VaR) calculation, corresponding to an assumed closeout period of risk, using historic simulation based on 5 - 10 years of market data. As such, it is a portfolio level calculation, where the incremental effect of a new trade is considered. The specific tail loss statistic defining the IM will vary depending on the exchange. The IM is recalculated and re-margined at least daily. In contrast to FVA, there is no benefit to IM. The IM is always posted to the exchange. Following [2] ,

, (21)

where is the forward initial margin for time step i. Here is the survival probability of the clearing house in the case of central clearing, or the counterparty, if a trade is OTC cleared. The calculation of the forward IM is highly non-trivial. In section 4, an approach to calculate forward IM for linear products will be developed.

Given the previous definitions, we now have that XVA is a subset of, or equal to,

. (22)

The exact combination of the adjustments depends on the trade in question. For example, if a trade is cleared then CVA can be ignored but the MVA should be included. Similarly, if a counterparty has not signed a CSA and there is no clearing component, CVA should be included with FVA but not MVA. Houses in North America may also include DVA as it is an accounting requirement. Here it was excluded due to the hedging argument mentioned previously. The fair value m2m of any derivative is then the classical risk-free valuation adjusted for the XVA.

Unless explicitly specified, we shall assume the date for pricing all exposures is September 29th 2014. The market data used for calibrating (1) - (22) is given in the appendix.

3. Case Studies

In this section, the aim is to understand the economics of the risk transfer involved in XVA trading and to quantify the P & L impact.

3.1. Incremental XVA

3.1.1. Client Reverse Enquiry

The most important concept in XVA trading is that of an incremental price. No XVA risk should be calculated without understanding the portfolio effect of any proposed trade at the level of the counterparty. Any new position can certainly increase the riskiness of the portfolio to the bank, but it can also offset existing positions, thereby reducing XVA exposures. Generally, corporate clients have floating receivables and they look to control their interest rate risk by swapping those exposures into a fixed rate. Hence a client book will typically pay fixed and receive floating as shown in Table 1. For the given

Table 1. Corporate client IR portfolio without CSAa.

aXCY denotes cross currency. P: Pay. R: Receive.

counterparty, there is a mix of swaps and cross currency swaps for 3 currencies. Maturities vary from 5 to 10 years. Assume there is no CSA in place with the bank. This is common as the cash requirements to post collateral can be non-trivial for smaller corporate accounts.

Running the Monte Carlo calculations summarized by Equation (22) produces the exposure profile, shown in Figure 2. The m2m of the portfolio, which is calculated as the sum of the EPE and the ENE, equals USD 16.6 million (MN). The portfolio then evolves through time to a peak exposure of USD 100 MN. The reductions in the EPE and ENE in late 2019 and 2021 are due to the cross-currency swaps maturing. The principal exchange at maturity on those positions represents a large exposure. The EPE and ENE then pull to par as the remaining coupon risk rolls off from the swaps. Note also that the magnitude of the EPE has a much larger peak exposure than the ENE. The reason is that the portfolio is paying fixed in a low rate environment. The ability for IR to move against the dealer is reduced (rates can only go to zero). However, the arranger does have the upside from receiving floating. Any increase in IR will translate to m2m gains for the book runner. The ‘saw tooth’ pattern of the profiles is capturing the semi-annual versus quarterly coupon risk of the portfolio.

Applying (11) - (17), the calculation shows that

The FVA is lower than the CVA due to the FVAbenefit partially offsetting the FVAcost whereas DVA has not been included in the calculation. In terms of the m2m of the book, the valuation should be adjusted down to reflect the embedded credit risk and term funding costs. This yields the fair value m2m as

Figure 2. EPE and ENE profiles for an IR swap portfolio.

The large P & L write down is indicative of what has occurred on the street. Any bank which has instituted an XVA revaluation, in whatever form that has taken, has incurred significant losses [5] - [13] . At first glance, it might be argued that instituting an XVA desk will render capital market operations uncompetitive. However, that is not the case. What will occur is that a bank will change the way it looks at risk and the way it trades. To illustrate this, we shall consider the impact of two new trades to the exposures in the portfolio.

Using the portfolio from Table 1, assume now that there is a new reverse enquiry from the client:

1) Bank to pay fixed semi-annually, receive 3-month LIBOR + 100 bp on USD 100 MN for 5 years.

Recall from Table 1 that the existing portfolio pays fixed. Hence, the new trade is purely additive to the existing risk profile. The XVA risk must be calculated incrementally against that portfolio. Let the trade k be the new trade and E denote the existing portfolio to which trade k is to be added. The incremental XVA corresponding to trade k is defined as

. (23)

Incremental XVA depends on the order in which new trades are executed. Calculating for trade 1 gives

, or 1.7 bp running,

, or 1.1 bp running,

where bp represents a basis point adjustment to the fixed leg. The upfront XVA charge equals USD 130,000. This is translated to a running spread adjustment to the fixed leg of the swap. Assume that the par rate is 2.56%. The flow market maker on the swap will typically take 2 bp in day-1 P & L on trade 1. For a bank with an XVA desk, a further adjustment of 2.8 bp, or 3 bp say, must be applied. The price to the client is then 2.51% per annum. Note that the XVA P & L itself has a greater magnitude than the flow P & L. This is a common finding for any bank with an XVA desk. For houses without such desks, the immediate response is that charging XVA will make the business uncompetitive. However, consider the next reverse enquiry from the client:

2) Bank to receive fix, pay floating quarterly. USD 100 MN, 5-year maturity.

Such a trade might simply be a position clean up by the client or a more general risk reduction. In this case, trade 2 will offset the existing portfolio and there will be an XVA release. Again, running the incremental calculation produces

,

which is a running spread of −2.8 bp. The flow desk will offer to receive fixed at 2.58%. The XVA is also transfer priced to the client. Adjusting for the XVA release, the bank is now in a position to improve the price to the client or even pay through the mid to win the trade, if desired. Alternatively, Sales can keep the XVA release as a hard dollar mark up.

In conclusion, with an XVA desk, the way banks approach trading changes. Without an XVA desk, banks will win trades they should lose and lose trades they should win.

3.1.2. Pricing Grid

Continuing the incremental argument, counterparties in London and New York now routinely expect XVA to be factored into quoted prices―at least where they know that the dealer has an XVA desk. Assume that a client is undertaking a new bond issue which will be denominated in a single currency. The client may nevertheless have capital requirements in several currencies. This is achieved by swapping the cash flows into the desired currencies as needed. As the issuance date approaches, clients will approach XVA desks from dealers that cover them with the following generic request:

Please provide indicative XVA costs for the following:

1) Pay fixed EUR: 3 Y, 5 Y, 7 Y, 10 Y

2) Pay Fixed GBP: 5 Y, 7 Y, 10 Y, 15 Y

3) Pay Fixed USD: 3 Y, 5 Y, 7 Y, 10 Y

All trades are versus receiving floating on USD 100 MN.

The first two scenarios represent cross-currency swaps for different tenors. The third option denotes interest rate swaps. Not all options are necessarily desired by the counterparty. Clients expect to receive the responses, usually as an upfront dollar amount, within a prescribed time horizon, usually days. There will often be a request to refresh the quotes depending on moves in the underlying interest rates or even the clients own credit curve. The entire process can take several months.

What clients seek is the best portfolio offset versus any given position i.e. the lowest incremental XVA charge against their existing portfolio with the dealer. When the bond is issued, tickets for the required swaps will also print over the course of the ensuing days. Counterparties will shop these trades across the street looking for best execution. Achieving this is straight forward. The client will start with the houses that quoted the lowest incremental XVA charge, fill them, then move on to the next highest charge. The range of quoted XVA prices will vary dramatically. At the tight-end will be those houses that do not price XVA. Their appetite will be exhausted immediately. Then those houses with low XVA costs will be hit. If a dealer is seeing business from new clients, especially for longer dated trades, or if the client seeks to increase the size of trades, then these are all signs that XVA is underpriced.

3.2. Strip of FX Forwards

An XVA desk will often focus on longer dated portfolios as that is where the risk is concentrated. For most houses this will be the IR desk but other desks such as commodities, can also fall into that category. As maturities increase, survival probabilities decrease rapidly, thereby making those positions the riskiest. FX derivative businesses tend to be much shorter dated. Liquidity for FX volatility trading does not extend much beyond 1 year. Structured trades, such as a strip of FX forwards can extend out 2 - 3 years but not often more than that. Nevertheless, there is still XVA risk in those trades. FX derivative desks operate on a high volume, low margin, business model. Any P & L erosion from XVA would therefore have a significant effect on the bottom line of such desks. There is an argument that such short-dated trading carries limited credit risk. Certainly, the CVA is reduced, but it is non-zero. Similarly, the need to fund positions remains constant. To illustrate this, consider Table 2. It shows a quarterly strip of forwards, buying euros and selling dollars out to 2 years.

Running the Monte Carlo generates the EPE and ENE profile shown in Figure 3. The profile is symmetric which captures the ability of the FX forward rate to move in either direction in the market. The portfolio is not constrained the way the IR portfolio was in Figure 2. Applying (11) - (17) produces

It is immediately apparent that the reduced maturity has also reduced the magnitude of the risk. Also, the symmetry in the profile has reduced the FVA as the benefit largely offsets the cost. However, recall that FX derivative desks survive on a high volume, low margin, flow model. For the structure shown in

Table 2. Strip of FX forwards out to 2-years.

a“Fwd Pts” denotes the forward points of each trade from a Euro spot rate of 1.245.

Figure 3. EPE and ENE profiles for a strip of FX forwards.

Table 2, the P & L would typically be approximately “4 pips” of the total notional which gives

Hence, the XVA is half the day-1 P & L. Recall that the counterparty 5-year CDS equals 100 bp. By post Lehman standards, that is a tight, high quality credit curve. As previously mentioned, the XVA varies approximately linearly with the credit spread. As the credit curve widens to 200 bp, the P & L is entirely eroded. The results shown here do not mean that FX derivative trading is unprofitable. Instead there is a need to reassess the current low margin business model. Either the XVA costs need to be transfer priced to clients, or other risk mitigants such as CSAs, need to be introduced.

3.3. The CSA Effect

In general, CSAs hold significant value for an XVA desk. All uncollateralized clients will draw the XVA desk’s attention. Even with a CSA in place, there are still strategies that the desk will exploit.

3.3.1. Signing a CSA

Take a client who is receiving fixed on a portfolio of trades and paying floating in a variety of currencies. Assume there are several deals that printed pre-Lehman at high coupons. As fixed rates collapsed following the default, these trades showed large m2m losses for the dealer. The remaining trades are all much longer dated, but show little P & L, as they were dealt at rates which have remained quite stable since 2010. The risk is summarized in Table 3.

Running the Monte Carlo simulation and calculating (11) - (17) produces the EPE and ENE profiles shown in Figure 4. The portfolio XVA equals

Table 3. Deep out-of-the-money IR portfolio without CSA.

Figure 4. EPE and ENE profiles for a swap portfolio with negative m2m.

The Expected Exposure, or EE, is the average path the XVA desk sees the portfolio taking through time. On day 1, that is the current m2m. For the client in question, there is a large negative m2m of the order of USD 110 MN. However, under simulation this rolls off quickly as the pre-Lehman legacy trades mature. At the same time, the simulation suggests that the remaining longer dated trades will move substantially in the dealer’s favor as IR increase.

The opportunity for the XVA desk is straight forward. To start, the XVA desk will speak to Sales. The conversation will be very simple. It will revolve around calling the client and asking them to sign a 2-way zero-threshold CSA. The client is told that when the CSA is signed the bank will “post them USD 110 MN”. Unless the client is sophisticated and understands XVA costs, what they won’t be told is that the XVA desk will mark their book up by USD 6.8 MN when the CSA is inked (remember the XVA desk is fully m2m and reports their P & L like all other derivatives desks). The reason is that on a net present value basis, the initial collateral posting of USD 110 MN is in fact small compared to the long- dated credit risk which remains in the book as well as the funding cost required to maintain the hedges on the street. The net present value of all XVA exposures swamps the initial collateral outlay. Any client approached to sign a CSA by a dealer should look to negotiate a payment of at least part of the XVA m2m release that results from signing the agreement.

The idea behind risk reduction and XVA release is an important one. Whenever a client unwinds risk or enters into trades that offset existing exposures, an active XVA dealer will see a P & L release from the XVA desk. Usually, this will be held by either the XVA desk itself or by Sales as a hard dollar mark up. Knowing that different trades produce different incremental costs can be important to achieving best execution. If a client is adding risk, they will look to shop that to non-XVA dealers. Wherever they can achieve a risk reduction, they will look to execute with an XVA desk and they will apply pressure for that release to be incorporated into the traded price. Whether trading as a client, or a professional counterparty, the more sophisticated the analytics, the better the ability to horse trade.

3.3.2. Cross-Currency Swap Intermediation

Take a 7-year cross currency swap, paying fixed in EUR and receiving USD floating, printed in late 2007. Following the Lehman default, liquidity was highly stressed well into 2010. Banks globally were struggling for funding. Any position receiving US dollars traded at a premium. The default also led to large FX moves, a significant drop in IR rates and the collapse of the euro cross-currency basis. The net result was that such swaps now had large m2m impacts of approximately 10% of the trade notional. If there was no CSA in place with the client, then this m2m and the associated US dollar cash flows were at risk.

A common dealer strategy for such positions is to ask another bank to intermediate the trade. This involves an XVA desk approaching another bank where they have a two-way zero-threshold CSA already in place. The basic idea is shown in Figure 5.

The intermediating bank steps in between the client and the dealer. The intermediating bank now faces the client and the dealer faces the bank via the CSA. On day 1, the intermediating bank must post collateral to the dealer, under the terms of the CSA, to offset the positive m2m. The question is: what is the fair value to charge for such an intermediation?

Without an XVA desk, a bank might charge the LIBOR-OIS risk free price of 2 - 3 bp thereby giving the dealer a large m2m gain on the XVA reduction. In principal, this applies to any trade where the m2m may move substantially in the arranger’s favor and there is no CSA in place with the client. The EPE and ENE profiles for the swap are shown in Figure 6. The remaining tenor is 4 years. Given the moves in the underlying rates, the simulation shows that the trade has a large positive m2m with very little chance of further movement. Calculating (11) - (17) gives

or 19 bp running. By stepping in, the intermediating bank’s CSA will collapse these risks as collateral will be immediately posted to the dealer. This is an order of magnitude greater than the typical flow P & L.

Figure 5. Cross-currency swap intermediation.

Figure 6. EPE and ENE profile for a deep in-the-money cross-currency swap.

Recall that all calculations are undertaken with a 5-year CDS and funding rate equal to 100 bp. In 2010, credit spreads were substantially wider. Dealer credit spreads were routinely more than 300 bp. Widening the credit spreads and funding rates in these calculations to those post-Lehman levels can elevate the XVA to as much as 5% of the trade notional. The magnitude of the risk only heightens the dealer’s desire to novate the position. Consequently, not calculating XVA can leave significant economic value on the table for the intermediating bank.

In conclusion, trade novation is not a recent development. Prior to the Lehman default, the same structure as Figure 5 was used to intermediate Collateralized Debt Obligations (CDOs). Inevitably the CDOs were highly rated, typically A to AAA. The rating may make the intermediation appear less risky. However, when mortgage delinquencies increased in the United States in 2007 and clients were bankrupted by losses on those CDOs, the intermediating banks incurred substantial losses [47] . The arranger was protected by the CSA.

3.3.3. One-Way CSA

A common request from highly rated counterparties, usually A to AAA, is to ask their arrangers to sign one-way CSAs. Such a request may typically originate from Debt Capital Markets (DCM) where a new bond issue is being negotiated with the client. As part of the debt issuance, underlying swaps will also be traded to meet the client’s capital needs across a variety of currencies. Assume the client requires a 5-year cross currency swap, paying fixed in GBP semi-annually, receiving USD 3-month LIBOR floating, as part of the new issue. The EPE and ENE profiles for such a trade are shown in Figure 7. Note that the profile does not pull to par as there is substantial risk in the principal exchange at maturity. Should the bank sign the CSA to win the DCM business?

As an uncollateralized trade, the XVA produces

or a running spread of 15.5 bp. The proposed one-way CSA would see the bank post collateral at a threshold of USD 20 MN and the client would not post collateral. The effect of signing the CSA would be the immediate loss of any FVAbenefit. Hence, the XVA costs would increase to USD 800,000, or 18 bp running.

Now assume that the client trades a second cross-currency swap with the same terms under the proposed CSA. The CSA will come into effect as the EPE breaches the collateral threshold. The incremental XVA is now:

or a running spread of 9 bp. The argument from DCM will be that the client will issue more than one bond over time and the relationship should be developed. The total P & L for DCM from a new debt issue is approximately 9 bp. The question is then: How many trades are needed for the bank to be profitable? As shown in Table 4, the bank will not see profitability until the 4th trade or USD 400 MN in notional equivalent has been dealt.

The portfolio effect is crucial under a one-way CSA. The incremental risk can be negligible if the CSA thresholds have been breached. But to reach those levels, the bank may need to incur short term losses―which is a difficult proposition for any capital markets business. Consequently, the costs need to be priced into the new bond issue or the arranger should not trade the swaps. Another obvious question is whether the Credit Risk department will have the appetite to in fact trade adequate notional with the client to make the business viable. Alternatively,

Figure 7. 5-year cross-currency swap, paying fixed in GBP versus receing USD floating. USD 100 MN equivalent.

Table 4. XVA costs under a one-way CSAa.

aXVA as a running bp adjustment to the fixed rate of the swaps.

the bank could approach the client and ask to trade the required swap notional as part of the bond issue to ensure profitability.

3.3.4. Counterparty CSA Arbitrage

Once trading desks actively manage XVA, the way they approach risk will change. The simple fact that XVA is m2m automatically generates trading opportunities with counterparties that do not price it. Generically, the aim is to reduce the XVA exposure to a given counterparty. This will result in an upfront P & L release from the XVA desk to the affected flow book.

Take Figure 8. Here a swaption dealer identifies that selling volatility to a regional counterparty, where there is no CSA in place, will reduce the overall exposure to that counterparty. The trader then executes that trade. Consequently, the XVA desk pays the incremental XVA release to the swaption desk. The swaption desk then executes an offsetting hedge, or buys back the volatility from a street counterparty, under a two-way zero-threshold CSA. The hedge effectively negates the market risk. The trader is then free to pass the cash position to Treasury and earn the funding on the released P & L.

The offsetting hedge with the regional bank does not introduce new XVA due to the CSA. There is no market risk as the positions offset and crucially there will be no capital charge as there is no increase in VaR. Neither the regional bank, nor the client, will understand the motivation for the trades by the dealer as they only see one leg of the structure. The regional client has generated the XVA exposure by trading without a CSA. The dealer exploits the CSA with the regional bank to offset the risk. As previously discussed, XVA Trading does not shut down flow trading businesses but it does alter the way a bank views and trades risk.

3.4. Long Dated Swap Trading

Trading long-dated swaps generates risks that are easily overlooked. Here two risk mitigants are examined in light of their effect on such trades.

3.4.1. The Collateralization Effect

Large international dealers will commonly trade IR swaps with maturities out to

Figure 8. Counterparty CSA arbitrage.

30 years. They will seek banks that do not price XVA, as counterparties to hedge those transactions, wherever possible. The reason is that under a CSA agreement a Bank might assume that the XVA is trivial and not price it. In fact, that is not the case. The mechanism for posting collateral was given in (10). Beyond that, within a CSA there are three key terms:

・ Collateral threshold.

・ Minimum transfer amount.

・ Posting lag.

The threshold specifies the m2m above which counterparties will post collateral. The minimum transfer amount quantifies the minimum size of the exposure before a collateral call can be made. The posting lag specifies the number of days between the margin call and when the actual collateral must be delivered. Even with a zero-threshold, the remaining two terms carry risk; especially for long- dated trades. In Figure 9, the uncollateralized and collateralized exposures for a zero threshold CSA, with a USD 500,000 minimum transfer amount and a 10-day posting lag, are shown for a USD 100 MN swap paying fixed at-the- money. Despite the CSA, the collateralized EPE routinely exceeds USD 1 MN and can approach USD 2 MN. The reason is that between making the margin call and receiving the collateral, the exposure continues to increase; in this case, more than doubling. Hence for the collateralized position, (11) - (17) yield

which equates to a total of USD 563,000 or 3 bp running. Certainly, this is lower than for the uncollateralized trade. The same calculation on the uncollateralized exposures produces a total XVA equal to USD 5.3 MN. However, under no circumstances does the CSA eliminate the risk. In fact, the residual XVA from collateralization effectively equals the day-1 P & L for the trade. The magnitude of the residual XVA is magnified by the survival probabilities in (11) - (16). Recall that the CDS spread used in these calculations was 100 bp. After 15 years, the survival probabilities drop below 70%. After 25 years, this decreases further to

Figure 9. Collateralized and uncollateralized EPE and ENE profiles for a 30-year swap.

50% (see the appendix for the details). Hence the residual XVA is greater the longer the maturity of the trade.

3.4.2. Mandatory Breaks

The United Kingdom market for long-dated interest rate and inflation swaps has grown significantly since 2005 to approximately GBP200 billion (BN) in outstanding notional [48] . Funds trying to manage the risk resulting from paying inflation-linked pensions to members drive the market. Tenors commonly extend to 30 years but can trade out as far as 50 years. Pension funds may opt to have tight two-way zero threshold CSAs in place with their arrangers. As just seen, even under such a CSA, the XVA on a 30-year interest rate swap will still impact the yield by approximately 3 bp which amounts to non-trivial P & L. The fund will also be forced to post collateral under the CSA―a fact which will further impact the funds ability to invest. Pension funds can look at other options to reduce risk, such as increasing the collateral quality further, or allowing bigger haircuts (i.e. a percentage of over-collateralization) on the assets used. Another option is for pension funds to post an initial margin, in cash or other assets; all of which will drag on the performance of the fund. Instead the market has evolved a mechanism to reduce the XVA by reducing the length of the trades by adding mandatory breaks to the term sheet. The common break tenor is 5 years.

In Figure 10, the effect of introducing the mandatory break is shown. With the EPE and ENE profiles truncated, the calculated XVA equals

under the effect of the break clause. This is certainly higher than the collateralized figure for the full swap but now there are no collateral calls. Two issues should be addressed with any counterparty looking to execute trades with break clauses. Firstly, an assessment must be made of whether the counterparty will be able to fund the break. From the sum of the EPE and ENE in the simulation of Figure 10, the expected m2m at the break is USD 9 MN. Unwinding the trade requires the client to have the requisite liquidity to fund that payment to the bank on the break date. Secondly, the break must be mandatory. As part of the

Figure 10. 30-year swap with a 5-year mandatory break.

relationship with the client, Sales will not want to break the trade. If the break is optional then the XVA desk should price the risk to the full maturity of the trade. The only exception is if the XVA desk owns the optional break and can trigger it.

Another consideration is how the XVA is quoted. The client may seek to price the XVA to the break clause, but have it included in the spread of the swap, which is quoted to term. This is not ideal for the XVA desk. However, it is often non-negotiable with the counterparty. In those instances, the term sheet must be modified to reflect that fact. At the break date, the universal question that is asked is, “What is the XVA cost to roll the trade for 5 more years?”. An understanding of whether there is residual XVA from the previous break is then important for calculating the costs to roll the position.

3.5. Risk Participation Agreements

Corporate clients can fall into a grey area, where they need to raise large amounts of capital, but the wholesale debt market is not readily open for issuance. In such a case, they may seek a syndicated loan. Assume a notional of USD 1 BN, which will exceed any individual credit line for a single institution. The client will appoint one agent bank to orchestrate the loan via multiple other banks, known as participant banks. Assume USD 200 MN per bank, as shown in Figure 11. Fees, interest payments and the repayment schedule will all be governed by the Loan Participation Agreement (LPA).

The agent bank will also need to provide underlying swaps to the client to facilitate the movement of the capital. Again, the notional required will exceed the credit lines of the agent bank. To offset this, the agent bank enters into risk participation agreements (RPA) with each of the participant banks in the syndicated loan. Under the RPA, if the corporate client defaults on the underlying interest rate swap, the participant bank is responsible for any m2m loss to the agent bank. Typically, a participant bank’s risk participation is pro rata to its participation in the loan. The participant bank receives an initial fee and then has no further involvement with the swap unless the counterparty defaults. For the structure shown in Figure 11, the agent bank and each participant bank fund 20% of the loan facility. Similarly, each participant bank would also take a 20% risk participation in the corresponding interest rate swap.

Assume the counterparty defaults with a 40% recovery. The agent bank’s loss from the default would be USD 600 MN. Each participant bank would then

Figure 11. Syndicated loan structure.

absorb USD 120 MN in losses under the LPA. Similarly, each participant bank would pay 20% of the loss of any positive m2m on the underlying swaps from the RPA. This is exactly the cash flow given by Equation (1). In other words, an RPA is simply a CCDS. The value, or m2m, of the CCDS is the CVA calculated using (11).

A provision in Dodd-Frank [49] has created the possibility that RPAs could be interpreted as swap agreements. Lobbying against treating RPAs as swaps has been undertaken [50] [51] . The case has been made that RPAs do not transfer the risk of IR movements. In fact, from Equation (11), the RPA derives its value directly from IR movements. There is also a claim that RPAs are banking products. Certainly, the LPA is a banking product as identified under Dodd-Frank. However, the RPA is clearly a non-trivial credit derivative. Hence, an RPA should not be characterized as a “simplified CDS” [51] .

To quantify the economic value of an RPA, there are two further considerations. Firstly, the tenor is generally shorter than the swaps that have been considered here so far; typically, 2 - 4 years. Also, as mentioned, a syndicated loan is often traded with a counterparty that can’t access the wholesale debt market. Often, such counterparties are less credit-worthy or even sub-investment grade. This will translate to a credit curve in Equation (11) that is much wider than the curve used in these case studies. In Table 5, the CVA for a USD 200 MN swap paying fixed, at-the-money, is given for short-dated tenors against several high yield credit curves. The main take-away is that the upfront fee for the RPA is non-negligible and the marking of the credit curve is crucial. Also, if the tenor extends much beyond 3 years, the CVA increases markedly. Finally, comparing to the results of section 3.3.3, if the underlying swaps are cross-currency, the CVA in Table 5 will increase by a factor of 3.

Another consideration is funding. The RPA only insures against credit risk. The agent bank will still have funding costs for the entire notional of the swap. In Table 6 the equivalent funding risk for the same swap tenors is given. For the

Table 5. CVAby swap tenor and CDS spread per USD 200 MN in notionala.

aCVA as an upfront amount in USD and as a running bp spread in brackets.

Table 6. FVA by swap tenor for USD 1 BN in notionala.

aFVA versus the 5-year funding spread of 100 bp as given in the appendix.

full USD 1 BN in notional, the FVA equals USD 525,000 for the 5-year swap. Again, note that extending the tenor quickly increases the FVA. The agent bank should transfer price this to the corporate client. Likewise, the client needs an understanding of XVA costs to ensure best execution.

3.6. Asymmetric CSA and Clearing

Beyond the immediate portfolio offset from netting, the structure of individual deals and their inherent cash flows can materially alter the relative magnitude of the XVA. Consider the scenario given in Figure 12. There a bank is asked to intermediate a trade between a dealer and a triple-A rated client. In this case, the client approaches the intermediating bank, not the dealer. The motivation to novate the swap is to free up lines for further trading between the client and the dealer. There is a CSA in place between the intermediating bank and the client. Under the CSA, the intermediating bank will post collateral when exposures reach USD 10MN. The triple-A client, leveraging their rating, will not post collateral until the m2m exceeds USD 30 MN. The intermediated trade is cleared through a central counterparty (CCP) to the dealer.

Assume there is an existing portfolio of trades as shown in Table 7. The effect of the existing portfolio is to significantly reduce the perceived risk of the intermediated trade as the incremental exposures are assumed to quickly move through the CSA thresholds. Nevertheless, there is still risk up to those thresholds. The trade to be intermediated is a 4-year, USD 2 BN swap, paying fixed at-the-money semi-annually versus receiving 3-month LIBOR floating. On the leg facing the client there is incremental XVA risk on the new trade up to the CSA thresholds. That is shown in Figure 13. There will be incremental CVA, but also FVA, as the clearing house will call for variation margin to offset any m2m movement in the cleared position. Calculating the incremental XVA produces:

Figure 12. Asymmetric CSA and clearing.

Table 7. IR portfolio facing the triple-A clienta.

aWith a two-way asymmetric CSA. Arranger posts at USD 10 MN, client posts at USD 30 MN.

Figure 13. EPE and ENE profiles for the portfolio in Table 7.

or a running spread of 0.6 bp. As a comparison, the XVA for the new trade on a stand-alone basis equals USD 2.03 MN. Hence the existing portfolio and the CSA thresholds reduce the risk significantly.

Once the leg with the clearing house settles, there will be a margin call for IM. In section 4, we will show that the margin call will equal USD 36 MN. The posted initial margin will continue to vary for the life of the trade. As the trade matures, the initial margin requirement will progressively roll off. In the interim, the initial margin position must be funded analogously to FVA. Funding initial margin was defined in Equation (21). Again, in section 4, we will show that

. (24)

In summary, MVA has become the primary risk in the trade. This also adds another 0.6 bp to the running spread XVA charge. The total running spread of 1.2 bp for the XVA will be comparable to the IR desk P & L on day 1. Failing to transfer price the XVA to the client essentially leaves the intermediating bank with little to no profit on the transaction.

4. Margin Value Adjustment

The main difficulty in applying (21), to calculate (24), lies in defining the forward initial margin, . Within CCPs, IM is calculated using full revaluation historical VaR calibrated from 5 to 10 years of data. A period of stress, essentially the Lehman default, is also included. At its most fundamental, Equation (21) requires running the VaR inside the Monte Carlo simulation, i.e. at each simulated market scenario defined by (2) - (7), the historic VaR should be calculated. If the CCP uses 5 years of data, that will equate to a further 1250 revaluations per time step and simulation. Essentially, this is a nested Monte Carlo problem. If brute force is used, the calculation quickly becomes computationally intractable. In [45] , this was overcome by calculating the MVA using Graphics Processing Units and Longstaff-Schwartz regression [52] .

Ideally, the MVA would run on existing bank infrastructure. To achieve this, a simplifying argument is required. For IR swaps, the simplification exploits the inherent linearity of the product. As an asset class, swaps exhibit minimal convexity. In Figure 14, a series of perturbations are applied to the USD yield curve used in calculations to price swaps (see the appendix for details). Figure 15 shows the corresponding m2m across all yield curve shocks and through time for a 10-year swap paying fixed at-the-money and receiving floating. At any given time-step, the m2m varies essentially linearly versus the underlying simulation. In Figure 16, this can be seen more clearly as the m2m impact is plotted across all perturbations at the 5 and 10-year points. Some limited convexity is present; but in the tails of the simulation. Hence, the impact of the convexity will be negligible as the is calculated as the mean across all simulations at each time step. What this implies is that for IR swaps, second order effects can be ignored. The can be approximated by purely calculating the VaR from the yield curve used to value the swap. The nested Monte Carlo problem is then avoided with minimal loss of accuracy. This greatly reduces the computational burden.

Figure 14. Yield curve purtabations (in black) versus the closing yield curve for base valuation (in red).

Figure 15. 10-Year IR swap m2m through time for the yield curve scenarios in Figure 14.

Figure 16. m2m slice at 10 years and 5 years from Figure 15.

What does need to be addressed is the portfolio effect. The existing trade set can materially reduce the netted incremental IM of a new trade. Furthermore, the portfolio composition will change through time; as trades mature and the netting effect rolls off. Capturing the portfolio aging can be done by rolling the valuation date forward to maturity. To model the portfolio effect, define the effective date as and the maturity date as T. The initial trade to be margined can be written as

, (25)

where F represents the pricing of the derivative in question. Rolling the valuation date forward to , we obtain

(26)

and is the future valued trade. There are several ways to roll the valuation date forward. For the purposes of illustration, the methodology will be kept relatively simple. Consider the yield curve instance at . Now seek a valuation at . The forward rates are left unchanged between the two dates. In particular, when pricing at , the discount factors for pricing cash flows are the same as the discount factors at which were obtained from the curve. The initial margin is then the incremental VaR charge of the future valued trade against the existing portfolio, :

. (27)

In (27), the vector of historic shocks is held constant against the forward trades for . In effect, the portfolio is aged through time and the VaR calculation is run by holding the historic time series of perturbations constant.

It is now possible to quantify the MVA. To illustrate the application of (21), take a 5-year, USD 100 MN notional interest rate swap, paying fixed semi- annually at-the-money versus receiving LIBOR floating quarterly. For the historical simulation, yield curve data from 1250 days spanning 2007 to 2012 were employed. Choosing this time period generically replicates the CCP methodology of including a stressed period represented by the Lehman default. For the historical simulation, absolute basis point shifts were calculated and applied to closing price data from September 29th 2014. The IM is calculated as a 1-day, 99th percentile, one tailed VaR. Applying (17) and (21), the MVA is then calculated. For illustrative purposes, yearly time increments are used and the CCP is assumed to be riskless. The MVA is then broken down by time step for clarity in Table 8. For the trade in question, the calculated MVA is of the order of USD 18,000.

Is this significant? A simple way to assess the importance is to quantify the MVA against the FVA. To this end, define a series of USD 100 MN notional swaps, paying fixed at-the-money, with maturities from 3 years to 20 years. Calculating both FVA and MVA, the results are summarized in Table 9. What the results show is that the MVA is of comparable magnitude to the FVA.

In practice, calculating a 1-day VaR is only a starting point. Generally, a clearing house will apply a 5-day margin period. This will lead to a substantially more conservative IM calculation. For non-cleared trades, regulators have proposed a 10-day standard margin period of risk [53] [54] . Recall that

. (28)

Scaling the results from Table 9 by indicates that the MVA is equivalent to the FVA.

In [45] , the calculated MVA was approximately 50% of the magnitude of the FVA, using a 10-day margin period of risk and the same data set to generate the perturbations. However, there were two differences. Firstly, in [45] the yield curve shocks were applied relatively i.e. as a percentage change to the yield curve, whereas here they were calculated absolutely, or as an absolute basis point shift

Table 8. MVA for a 5-year USD swap paying fixeda.

aUSD 100 MN, paying fixed at-the-money semi-annually, receiving 3 month Libor floating quarterly.

Table 9. MVA versus FVAa.

aUSD 100 MN per swap, all at-the-money, paying fixed and receiving floating.

to the yield curve. In a low yield environment, relative perturbations, will produce a lower VaR than absolute shocks, thereby partly explaining the difference. Secondly, and most importantly, the MVA in [45] was calculated against the FVA for a portfolio where the m2m was deeply in favor of the dealer. This minimizes the effect of the FVAbenefit and also increases the FVAcost substantially. Here the magnitude of the FVA is much lower and reflective of the types of costs that new trades would generate.

Clearing was introduced following the Lehman default to reduce counterparty credit risk. Based on the magnitude of the numbers from Table 9, what clearing has effectively done is to transform credit risk, i.e. CVA, into a funding risk in the form of MVA. The net result for banks is that the overall magnitude of the risk profile remains predominantly unchanged.

Clearing houses also apply multiplicative factors to the VaR to capture either perceived lower counterparty credit quality, or concentration risk in that counterparty’s portfolio. Generically such a factor varies between 1 and 2. Hence for a lowly rated, highly concentrated name, the MVA could be substantially higher again. CCPs may also employ expected shortfall, which averages across the tail risk, instead of VaR which is a specific percentile. With these extra adjustments, the MVA could easily exceed the FVA. Given the size of the FVA write-downs that have been reported [5] [6] [7] [9] [10] [13] , quantifying MVA and transfer pricing it to clients becomes an immediate concern. Given that IR swaps are the main cleared asset class, developing an MVA calculation, even using the simplifying assumptions made here, will allow banks to correct for these costs. From Table 8, it is now possible to calculate (24). Firstly, using a 5-day margin period of risk, the VaR for the 4-year swap equals USD 36 MN. The calculated MVA is then

.

As indicated previously, there are also portfolio considerations. The numbers in Table 8 will hold where IM is calculated on a gross basis. If netting is employed there may be portfolio offsets. Consider the original 5-year swap paying fixed, from Table 8, with an offsetting 3-year trade, receiving fixed, with the same USD 100 MN notional. In the presence of netting, the resulting MVA is calculated in Table 10. For the first 3 years, there is a reduction in the IM but once the 3-year trade matures, the portfolio effect is lost. Crucially the total MVA is reduced by 1/3. Maximizing portfolio offset and netting across exchanges, while controlling concentration penalties, can provide a substantial benefit.

Another requirement of clearing house membership is the participation in Fire Drills. This is the process where the portfolio of a defaulted counterparty is reassigned to another member via auction. Bidding on such a portfolio requires quantifying the cost of facing the CCP for that portfolio. The FVA generated from the variation margin is well understood. Considering the results here, failing to include MVA in the calculations can underestimate the costs by as much as 50%.

Table 10. MVA for an offsetting portfolioa.

aUSD 100 MN, 5-year swap paying fixed versus a 3-year swap receiving fixed.

5. Conclusion

Going forward, there is no agreed model. Many houses still ignore XVA. Others only look at CVA or see it simply as a regulatory or accounting requirement. The function itself might sit within capital markets, but it may also be within the remit of a portfolio management function, or even treasury. Historically, trading owns the market risk and sales owns the credit risk. But with XVA, that paradigm is changing. Credit risk is now increasingly part of trading, under the XVA umbrella. Every time sales originate a trade, XVA risk enters the bank. Some arrangers are now considering centralized business models where the XVA desk also handles the collateral optimization function for capital markets. This may or may not include treasury. For large organizations with global sales networks, the XVA desk might also be tasked with internally transfer pricing XVA back to the desk that originated it. A global bank will find it hard to keep track of every sales representative and the prices they are executing at, thereby making this centralized function valuable.

Taking this a step further, one structure that is being implemented at certain banks in Europe is the idea of consolidating the client facing role. The trade flow is shown in Figure 17. Under this business model, the only desk facing clients is the XVA desk. All trades are entered with the XVA desk, which then mirrors the risk to the respective flow desks, after stripping the XVA from the trades. The fact that this new structure for capital markets is being proposed at all reflects the changing nature of the market itself. The centralized model is considered an advantage when complex trades or unwinds are considered. Rather than trying to assess risk across multiple flow desks, the XVA desk has a consolidated position view. It is also an indication of the magnitude and changing importance of the trading functions. Flow trading is relatively transparent. The client knows their price is 1 - 2 bp from mid, whereas the XVA costs can be an order of magnitude higher and depend on a variety of variables such as where the counterparty’s credit curve is marked, to the legal documents in place with the client, to whether or not the trades have a clearing component. That’s without even considering the complexity of the simulation itself. One downside of the centralized model is that it may run significant human risk. Existing sales relationships between clients and the flow desks will be affected. There may also be other legacy issues within a dealing room such as booking systems that prevent the transition.

Figure 17. Centralized booking model.

Acknowledgements

The case studies presented here were all traded by the author while employed at National Australia Bank between 2010 and 2013. All exposure profiles and XVA calculations were produced using version 15 of the enterprise software designed and built by Calypso Technology Inc. An abbreviated version of this research was privately distributed to Calypso clients in 2014 and 2015. However, the views and opinions expressed in this document are those of the author and do not necessarily reflect the official policy, or position, of Calypso Technology, Inc. All market data was sourced from Bloomberg.

Cite this paper

Zeitsch, P.J. (2017) The Economics of XVA Trading. Journal of Mathematical Finance, 7, 239- 274. https://doi.org/10.4236/jmf.2017.72013

References

- 1. Green, G. (2016) XVA: Credit, Funding and Capital Valuation Adjustments. 1st Edition, John Wiley & Sons Ltd., Chichester.

- 2. Gregory, J. (2015) The XVA Challenge: Counterparty Credit Risk, Funding, Collateral and Capital. 3rd Edition, John Wiley & Sons Ltd., Chichester. https://doi.org/10.1002/9781119109440

- 3. Ruiz, I. (2015) XVA Desks—A New Era for Risk Management. 1st Edition, Palgrave Macmillan, New York. https://doi.org/10.1057/9781137448200

- 4. Becker, L. (2015) Small Banks Underpricing FVA, Dealers Say. Risk, April 15.

- 5. Becker, L. and Rennison, J. (2014) Citi Takes $474 Million FVA Charge. Risk, October 15.

- 6. Becker, L. (2014) UBS Takes Sfr267 Million FVA Charge. Risk, October 30.

- 7. Becker, L. (2015) BAML Takes $497M FVA Loss. Risk, January 15.

- 8. Becker, L., Vaghela, V., Wood, D. and Woolner, A. (2016) Traders Shocked by $712M CVA Loss at StanChart. Risk, March 16.

- 9. Cameron, M. (2014) JP Morgan Takes $1.5 Billion FVA Loss. Risk, January 14.

- 10. Cameron, M. (2014) Nomura Books ¥10 Billion FVA Loss. Risk, February 6.

- 11. Carver, L. (2013) Deutsche Bank €94 million CVA Loss Was “Good Business”, Dealers Say. Risk, October 28.

- 12. Carver, L. (2013) Capital or P&L. Deutsche Bank Losses Highlight CVA Trade-Off. Risk, October 31.

- 13. Levine, M. (2014) It Cost JPMorgan $1.5 Billion to Value Its Derivatives Right. Bloomberg, January 15. https://www.bloomberg.com/view/articles/2014-01-15/it-cost-jpmorgan-1-5-billion-to-value-its-derivatives-right-draft

- 14. Basel Committee on Banking Supervision (2016) Minimum Capital Requirements for Market Risk, Bank for International Settlements, Basel, January. http://www.bis.org/bcbs/publ/d352.pdf

- 15. International Financial Reporting Standard 13. Fair Value Measurement. http://www.ifrs.org

- 16. Woolner, A. (2015) Audit Firms Driving CVA Uptake by Hong Kong and Singapore Banks, Asia Risk, April 15.

- 17. Evans-Pritchard, B. (2015) Banks in India Face CVA Fees Double European Levels. Asia Risk, March 31.

- 18. Lee, J. (2013) Thai SMEs at Risk from Basel III CVA Charge—Bank of Thailand Profile. Asia Risk, May 2.

- 19. Maxwell, F. (2015) Sovereigns Facing Price Hike if CVA Exemption Is Axed. Risk, January 6.

- 20. Wang, X. (2015) Taiwan Mandates CVA Implementation for All Listed Banks. Risk, April 9.

- 21. Becker, L. (2015) Basel Committee Launches FVA Project. Risk, March 20.

- 22. Cameron, M. (2013) No Exit: The Problems Facing UBS in Its Fixed Income Retreat. Risk. February 6.

- 23. Cameron, M. (2014) Dealers Charging FVA on Collateralised Swaps. Risk, April 29.

- 24. Rennison, J. (2012) Traders of the Lost Art. Risk, December 6.

- 25. Rennison, J. and Wood, D. (2012) Bank of England to Post Collateral in OTC Derivatives Trades. Risk, June 22.

- 26. Cameron, M. (2013) The Black Art of FVA: Banks Spark Double-Counting Fears. Risk, March 28.

- 27. Brace, A., Gatarek, D. and Musiela, M. (1997) The Market Model of Interest Rate Dynamics. Mathematical Finance, 7, 127-147. https://doi.org/10.1111/1467-9965.00028

- 28. Jamshidian, F. (1997) Libor and Swap Market Models and Measures. Financial Stochastics, 1, 293-330. https://doi.org/10.1007/s007800050026

- 29. Miltersen, K. R., Sandmann, K. and Sondermann, D. (1997) Closed Form Solutions for Term Structure Derivatives with Log-Normal Interest Rates. Journal of Finance, 52, 409-430. https://doi.org/10.1111/j.1540-6261.1997.tb03823.x

- 30. Rebonato, R. (2002) Modern Pricing of Interest Rate Derivatives: The LIBOR Market and Beyond. Princeton University Press, Princeton.

- 31. ISDA CDS Model. http://www.cdsmodel.com.

- 32. Emery, K., Ou, S., Tennant, J., Matos, A. and Cantor, R. (2009) Corporate Default and Recovery Rates, 1920-2008. Moody’s Investor Services. https://www.moodys.com/sites/products/DefaultResearch/2007400000578875.pdf

- 33. Carver, L. (2012) Traders Close Ranks Against FVA Critics. Risk, September 6.

- 34. Hull, J. and White, A. (2012) The FVA Debate. Risk, August 1.

- 35. Hull, J. and White, A. (2016) XVAs: A Gap between Theory and Practice. Risk, April 22.

- 36. Hull, J. and White, A. (2014) Collateral and Credit Issues in Derivatives Pricing. Journal of Credit Risk, 10, 3-28. https://doi.org/10.21314/JCR.2014.180

- 37. Hull, J. and White, A. (2014) Valuing Derivatives: Funding Value Adjustments and Fair Value. Financial Analysts Journal, 70, 46-56. https://doi.org/10.2469/faj.v70.n3.3

- 38. Green, A., Kenyon, C. and Dennis, C. (2014) KVA: Capital Valuation Adjustment. Working Paper.

- 39. Green, A., Kenyon, C. and Dennis, C. (2014) KVA: Capital Valuation Adjustment by Replication. Risk, November 21.

- 40. Sherif, N. (2016) MVA: Swaps Scale New Heights in Complexity. Risk, January 8.

- 41. Sherif, N. (2016) Dealers Wake Up to MVA Impact of New Funding Rules. Risk, July 16.

- 42. Woodall, L. (2016) Clients Should Prepare to Pay MVA Costs, Say Dealers. Risk, November 10.

- 43. Mackenzie-Smith, R. (2016) Banks and Clients Clash Over Novation MVA Charges. Risk, December 14.

- 44. Mackenzie-Smith, R. (2016) Banks Warn Prime Brokerage Clients of “Material” MVA Costs. Risk, Spetember 27.

- 45. Green, G. and Kenyon, C. (2015) MVA by Replication and Regression. Risk, April 28.

- 46. Armenti, Y. and Crépey, S. (2016) Central Clearing Value Adjustment. Working Paper.

- 47. Sayce, K. (2008) ANZ Bank Writes Off $1.9 Billion. Money Morning, October 23. https://www.moneymorning.com.au/20081023/anz-bank-writes-off-19-billion.html

- 48. Sinead L. and Hurrell, S. (2012) New Capital Rules Set to Impact Pension Fund Swap Deals. Euromoney, October 1. http://www.euromoney.com/Article/3130546/New-capital-rules-set-to-impact-pension-fund-swap-deals.html

- 49. Dodd-Frank Wall Street Reform and Consumer Protection Act. https://www.sec.gov/about/laws/wallstreetreform-cpa.pdf

- 50. Whiting, R.M. (2011) Letter to the Commodity Futures Trading Commission. Financial Services Roundtable, Washington DC. http://www.sec.gov/comments/s7-16-11/s71611-35.pdf

- 51. Petro, T.M. (2012) Letter to the Federal Reserve. Fox Chase Bank, Philadelphia. https://www.federalreserve.gov/SECRS/2012/November/20121101/R-1442/R-1442_101012_108766_394775096300_1.pdf

- 52. Longstaff, F. and Schwartz, E. (2001) Valuing American Options by Simulation: A Simple Least-Squares Approach. The Review of Financial Studies, 14, 113-147. https://doi.org/10.1093/rfs/14.1.113

- 53. ISDA (2016) ISDA SIMM Methodology, Version R1.0. International Swaps and Derivatives Association Inc., September 1. http://isda.link/simmmethodology

- 54. Basel Committee on Banking Supervision (2015) Margin Requirements for Non-Centrally Cleared Derivatives, Bank for International Settlements, Basel, March. http://www.bis.org/bcbs/publ/d317.pdf

Appendix: Market Data

To calibrate (1) - (22), market data was sourced for September 29th, 2014. Yield curves are shown in Figure A1. The CDS and funding curve used in (11) is given in Figure A2. The corresponding survival probabilities from that CDS curve are plotted in Figure A3.

The swaption volatility surfaces used to calibrate Equations (2) - (5) are given in Figures A4-A6.

The FX volatilities employed to calibrate (6) are shown in Table A1, Table A2. Risk reversals and butterflies are converted to 25 and 10-delta put and call volatilities applied to a 5-point volatility surface.

Figure A1. Yield curves for USD, EUR and GBP.

Figure A2. Funding and counterparty CDS curve by tenor (in bp).

Figure A3. CDS survival probabilities.

Figure A4. USD Log-Normal swaption volatilities, SA 30/360 vs. 3 M LIBOR (QTR Act/360).

Figure A5. EUR Log-Normal swaption volatilities, PA 30/360 vs. 6 M EURIBOR (SA Act/360).

Figure A6. GBP Log-Normal swaption volatilities, SA Act/365 vs. 6 M LIBOR (SA Act/365).

Table A1. EUR FX implied volatilitiesa.

aATM: at-the-money; RR: risk-reversal; BF: butterfly.

Table A2. GBP FX implied volatilitiesa.

aATM: at-the-money; RR: risk-reversal; BF: butterfly.

Submit or recommend next manuscript to SCIRP and we will provide best service for you:

Accepting pre-submission inquiries through Email, Facebook, LinkedIn, Twitter, etc.

A wide selection of journals (inclusive of 9 subjects, more than 200 journals)

Providing 24-hour high-quality service

User-friendly online submission system

Fair and swift peer-review system

Efficient typesetting and proofreading procedure

Display of the result of downloads and visits, as well as the number of cited articles

Maximum dissemination of your research work

Submit your manuscript at: http://papersubmission.scirp.org/

Or contact jmf@scirp.org