Journal of Mathematical Finance

Vol.06 No.04(2016), Article ID:70614,6 pages

10.4236/jmf.2016.64037

Research on the Portfolio Optimization Model under Quantitative Constraint Based on Genetic Algorithm*

Shunquan Zhu

School of Finance, Guangdong University of Finance & Economics, Guangzhou, China

Copyright © 2016 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: June 12, 2016; Accepted: September 13, 2016; Published: September 16, 2016

ABSTRACT

This paper is based on covariance and expected return, building portfolio risk optimization model. Using Genetic Algorithm and Quadratic Programming, three securities portfolio Optimization model is resolved, and we find that Genetic Algorithm having priority for Restraint Conditions is not a linear model.

Keywords:

Portfolio Optimization Decision Making, Quadratic Programming, Genetic Algorithm

1. Background

The number of securities transactions is generally limited in the capital market. For example, the minimum number of regular trading stocks is 100 shares, and trading less than 100 shares is not accepted in Shanghai Stock Exchange and Shenzhen Stock Exchange. On the other hand, for various considerations, investment institutions and investors often set certain requirements for funds allocation, and portfolio needs to meet these requirements. In order to adapt the need for capital market and practical operation, it is necessary to research portfolio decision problem under risk constraint. But it is difficult to express the portfolio optimization model under numeric constraint from existing literature [1] - [5] .

2. Build the Portfolio Optimization Model under Numeric Constraint [6]

Consider investment institution (e.g. Fund Company) or investors invest in n kinds of risky assets. We denote the expected returns and portfolio weights of risky assets by the vectors ,

, . The variance-covariance matrix of the risky assets’ returns matrix is

. The variance-covariance matrix of the risky assets’ returns matrix is , it is positive definite.

, it is positive definite. ,

,  represents all components of the column vector,

represents all components of the column vector, .

.  represents all components of the column vector is 1. The efficient portfolio decision model under number constraint is denoted by

represents all components of the column vector is 1. The efficient portfolio decision model under number constraint is denoted by

However, it is difficult to obtain the optimal analytical expression for this problem, so we try to solve this problem by genetic algorithms.

3. Use Genetic Algorithms to Solve Portfolio Decision Model under Numeric Constraint [7]

3.1. Initialization

1) Determine population size M, crossover probability pc, mutation probability pm, maximum evolution generation maxgen, the vector of upper and lower bounds  ,

,  ,

, .

.

2) Use real-code, each chromosome contains n gene loci which represent insecurities, the genevaluation represents the proportion in securities portfolio.

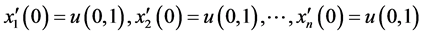

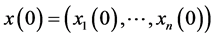

3) It is easy to know the following super geometry contains feasible set from the constraints. Consider , where U(0,1) re- presents a random number that should be uniformly distributed between (0,1), then

, where U(0,1) re- presents a random number that should be uniformly distributed between (0,1), then

normalize  denoted by

denoted by , and

, and .

.

If the result does not satisfy the constraint, reject it. Then we need to use the third step to generate a new chromosome, if the chromosome is feasible, we can accept it as a member of population, then we use the notation  to denote M feasible chromosome after finite sampling. Consider the code of x is v, and denoted by

to denote M feasible chromosome after finite sampling. Consider the code of x is v, and denoted by

4) Calculate the fitness value of

5) Set k = 0.

3.2. Selection

1) According to the principle that the more adaptable the chromosomes are, the more chance they would be selected to reproduce. Breeding probabilities for each

j = 1means that the chromosome is the best, j = M explains the chromosome is the worst.

2) Calculate the cumulative probability

3) Generate a random number r in

4) Repeat step 2 and 3 for m times in total, then we can obtain m replicated chromosomes denoted by

3.3. Hybridization

1) Define

2) We use the notation

3) We can use hybridization on the other group as the same way.

3.4. Mutation

1) First, define the mutation probability pm. For the individuals through crossover operation mutate from j = 1 to M, repeat the following step: generate a random number r from [0,1], if

2) Generate random integer i and j from [1,n], random r1 and r2 are generated from (0,1), the mutation result value r that is the valuation of aij, aij represents the gene which is number I on the chromosome aij. Similarly, aij represents the gene which is number j on the chromosome aij. If the constraints are not satisfied, refuse the result. Follow step 2 to generate a new chromosome, if this one is feasible, accept it as a population member. It will generate s new mutated individuals after finite sampling.

3) Consider s new individuals by mutation operation and L-s new individuals that are not selected from hybridization in step 2, calculate their valuation. And then put them back simultaneously. There are M-L remaining individuals by choosing operation. All of them consist of a new generation denoted by

4) Termination test

If reach the maximum number of evolution, evolution is terminated, otherwise set k = k + 1, turn to the selection operation.

4. The Example of the Risk on Optimal Portfolio by Genetic Algorithms and Analysis

Obtain three monthly securities’ returns from financial database [8] by downloading and sorting (as shown in Table 1).

Table 1. Historical data of returns for three securities.

Calculate covariance matrix for three securities with function corvar() in Excel

Calculate expected return on three securities, denoted by R, with function average,

Consider the minimum expected return on the three securities is 0.13, calculate the optimal proportion and lowest risk under the condition of no short sale.

We use genetic function GA in Matlab, the program is as follows.

The M file by Genetic Algorithm denoted by tzga.m

Obj = @tzfitness;

Nvars = 3; % Number of variables

A = [−0.1130, −0.1850, −0.0755];

b = [−0.13]; Aeq = [1,1,1]; beq = [1] ;

LB = [0 0 0]; % Lower bound

UB = [1 1 1]; % Upper bound

% Constraint Function = @tzconstraint;

[x,fval] = ga(Obj,nvars,A,b,Aeq,beq,LB,UB,[])

The function by genetic algorithm denoted by tzfitness.m

function y =tzfitness(x)

The results are running as the above program in Matlab as follows:

>> tzga

x = 0.5044 0.3245 0.1718

fval = 0.0143

Compare the above results and the results get by quadratic programming with Matlab function quadprog() [9] and Excel Solver tool, calculate them and show them in Table 2.

As shown in Table 2, the results of Portfolio Optimization Model with three methods are close. But the function qudprog() in Matlab and solver tool in excel are only

Table 2. Results of calculation of the three methods.

adapted to linear and quadratic programming model. In addition to Quadratic Programming under liner, genetic algorithm can solve quadratic programming under nonlinear constraint, even to the complex model in which the objective function is a Nonlinear model that is not quadratic programming and the constraint is nonlinear, genetic algorithm also can solve it. Therefore, the advantages of genetic algorithms are incomparable in modeling complex social and economic life.

5. Overview

In order to make the portfolio optimization problems close to reality, we often need to study the portfolio optimization problem under numeric constraint. This paper is based on this model to calculate the optimal portion by code; selection, crossover and mutation are adapted to portfolio decisions successfully, and optimal solution can be obtained. In order to prove the reliability of the genetic algorithm, we use quadratic programming with function quadprog() in Matlab and solver tool for quadratic programming in excel to solve this problem. This paper shows that the genetic algorithm is better than quadratic programming, because the genetic algorithm can solve non-quadratic programming problems. It is foreseeable that in the future genetic algorithms will be used widely for practical application in portfolio optimization.

Cite this paper

Zhu, S.Q. (2016) Research on the Portfolio Optimization Model under Quantitative Constraint Based on Genetic Algorithm. Journal of Mathematical Finance, 6, 465-470. http://dx.doi.org/10.4236/jmf.2016.64037

References

- 1. Markowitz, H. (1952) Portfolio Selection. Journal of Finance, 7, 77-91.

http://dx.doi.org/10.1111/j.1540-6261.1952.tb01525.x - 2. Sharpe, W.F. (1963) A Simplified Model for Portfolio Analysis. Management Science, 1, 277-293.

http://dx.doi.org/10.1287/mnsc.9.2.277 - 3. Sharpe, W.F. (1967) A Linear Programming Algorithm for Mutual Fund Portfolio Selection. Management Science, 3, 499-510.

http://dx.doi.org/10.1287/mnsc.13.7.499 - 4. Sharpe, W.F. (1967) A Portfolio Analysis. Journal of Finance and Quantitative Analysis, 6, 76-84.

- 5. Zhu, S.Q. (2012) Investment. Theory. Application. Experiment. Tsinghua University Press, Beijing, 1.

- 6. Zhang, W.G. (2007) Modern Portfolio Theory—Model, Methods and Application. Science Press, Beijing, 3.

- 7. Lin, D. (2005) Improved Portfolio Investment Model with Genetic Algorithm. Systems Engineering, 8, 68-72.

- 8. Zhu, S.W. (2007) Financial Database. Tsinghua University Press, Beijing, 12.

- 9. Guo, R.S. (2007) Analytical Optimization Design Example Based on Matlab. China Machine Press, Beijing, 7.

*This paper is supported by Guangdong Provincial Scientific Plan Project (Soft Science, No.: 2015-A070704058), Guangdong Provincial Universities’ Social Science Fund Project (No.: 2015WTSCX031), The Natural Science Foundation of Guangdong (No.: 2015A030313629), The Graduate Student Education Innovation Projects in Guangdong (No. 2-2015), and the National Natural Science Foundation of China.