Theoretical Economics Letters

Vol.4 No.1(2014), Article ID:42804,8 pages DOI:10.4236/tel.2014.41009

Disequilibrium Pricing Theory—Bubbles and Recessions

1SUNY Korea, Incheon, South Korea 2Portland State University, Portland, USA

Email: fbetz@venture2reality.com

Copyright © 2014 Frederick Betz. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. In accordance of the Creative Commons Attribution License all Copyrights © 2014 are reserved for SCIRP and the owner of the intellectual property Frederick Betz. All Copyright © 2014 are guarded by law and by SCIRP as a guardian.

Received December 9, 2013; revised January 9, 2014; accepted January 16, 2014

KEYWORDS

Economic Recessions; Financial Bubbles; Bank Panics

ABSTRACT

How can one track a financial bubble as a likely precursor to bank panics and subsequent recessions? We model the Minsky-Keynes depiction of a financial market—by extending the “equilibrium-price” model to a “disequilibrium-price” model, through adding a third dimension of time. In this way, we use a topological graphic approach to see how the models from the two schools of economics, exogenous and endogenous, relate to each other as complementary models of production and financial sub-systems. These economic models are partial models in an economy—not a model of the whole economy. However, such partial models can be used to anticipate financial bubbles—hence bank runs and recessions due to bank runs—which typically follow.

1. Introduction

One problem with traditional economic theory has been its “post-facto” rather than “pre-emptive” mode—fixing economic recessions after they occur rather than preventing them. This was true of the 2009 US recession triggered by the 2008 global bank panic. Binyamin Appelbaum wrote: “The Fed (Federal Reserve System) began 2007 still deeply immersed in complacent disregard for problems in the housing market. Fed officials knew that people were losing their homes. They knew that subprime lenders were blinking out of business with every passing week. But they did not understand the implications for the broader economy. August 2007 was the month that the Fed began its long transformation from somnolence to activism.” [1]. The Fed started the biggest bank “bail-out” in US economic history.

What was the soporific which had put the Fed to sleep? It had been the so-called “mainstream economic theory”— which had assumed all markets was perfectly self-regulating, even financial markets. This soporific was not only in US regulatory policy but also in British. Sir Meryn King (Governor of the Bank of England in 2007) later said: “With the benefit of hindsight, we (Bank of England) should have shouted from the rooftops that a system had been built in which banks were too important to fail, that banks had grown too quickly and borrowed too much, and that so-called ‘light-touch’ regulation hadn’t prevented any of this” [2]. The big banks had gained such large capital assets and at risk, that their failure would bring down a whole economy.

In particular, “mainstream economic theory” had paid little attention to the role of “financial-bubbles-and-bankpanics” as precursors to recessions. For example in 2009, Paul Krugman wrote: “It’s hard to believe now, but not long ago economists were congratulating themselves over the success of their field. Those successes—or so they believed—were both theoretical and practical, leading to a golden era for the profession. Few economists saw our current crisis coming, but this predictive failure was the least of the field’s problems. More important was the profession’s blindness to the very possibility of catastrophic failures in a market economy. There was nothing in the prevailing models suggesting the possibility of the kind of collapse that happened last year in 2008. Macroeconomists (remain) divided in their views. The main division was between those who insisted that free-market economies never go astray and those who believed that economies may stray now and then (but that any major deviations from the path of prosperity could and would be corrected by the all-powerful Fed). Neither side was prepared to cope with an economy that went off the rails despite the Fed’s best efforts. And in the wake of the crisis, the fault lines in the economics profession have yawned wider than ever.” [3].

For example in the economic history of the United States, there have been several events of financial crises, bank panics, and recessions—from the early 1800s to 2000s, [4]:

1) Panic of 1857—This was triggered by a excessive railroad investments, leading up to a stock market collapse, which triggered a bank panic and created an economic recession.

2) Panic of 1873—Again, excessive investment created a stock bubble, whose collapse triggered a bank panic and subsequent economic recession.

3) Panic of 1893—Again excessive investments in railroads, resulted in temporary overbuilding, triggering again a bank panic and recession—financial excess, market crash, bank panic, recession.

4) Panic of 1896—Monetary policy about US currency began to be based both upon silver and gold, which, as monetary policy, created an economic depression when silver reserves declined.

5) Panic of 1907—This was a again a stock market failure, which began to trigger bank runs; but this was halted by JP Morgan bank. Stopping the bank panics prevented a recession. In this instance, there was no depression. This event stimulated, six years later, the establishment of the US central bank system (Federal Reserve System).

6) Panic of 1929—A New York stock market bubble triggered three years of bank panics, resulting in the US Great Depression, which lasted a decade.

7) Panic of 2007—A US real estate bubble was followed by the crash of a Wall Street financial derivatives market, and a global bank panic, creating a recession in the US.

Earlier in Asia in 1997, there was an Asian crisis, triggered first by real estate and stock bubbles in Thailand, and then by a sharp decline in exchange-rate and out-flow of foreign capital [5]. In Europe in 2011, there were bank panics in Euro countries, due to excessive sovereign debts, which triggered bank panics, and resulting depressions, particularly in Southern Europe, in Greece, Portugal, Spain, Italy.

We develop a model of financial bubbles which trigger bank panics, leading to economic recessions—using the Minsky-Keynes description of financial market activity.

2. Modeling a Commodity Market in the Neo-Classical Synthesis School

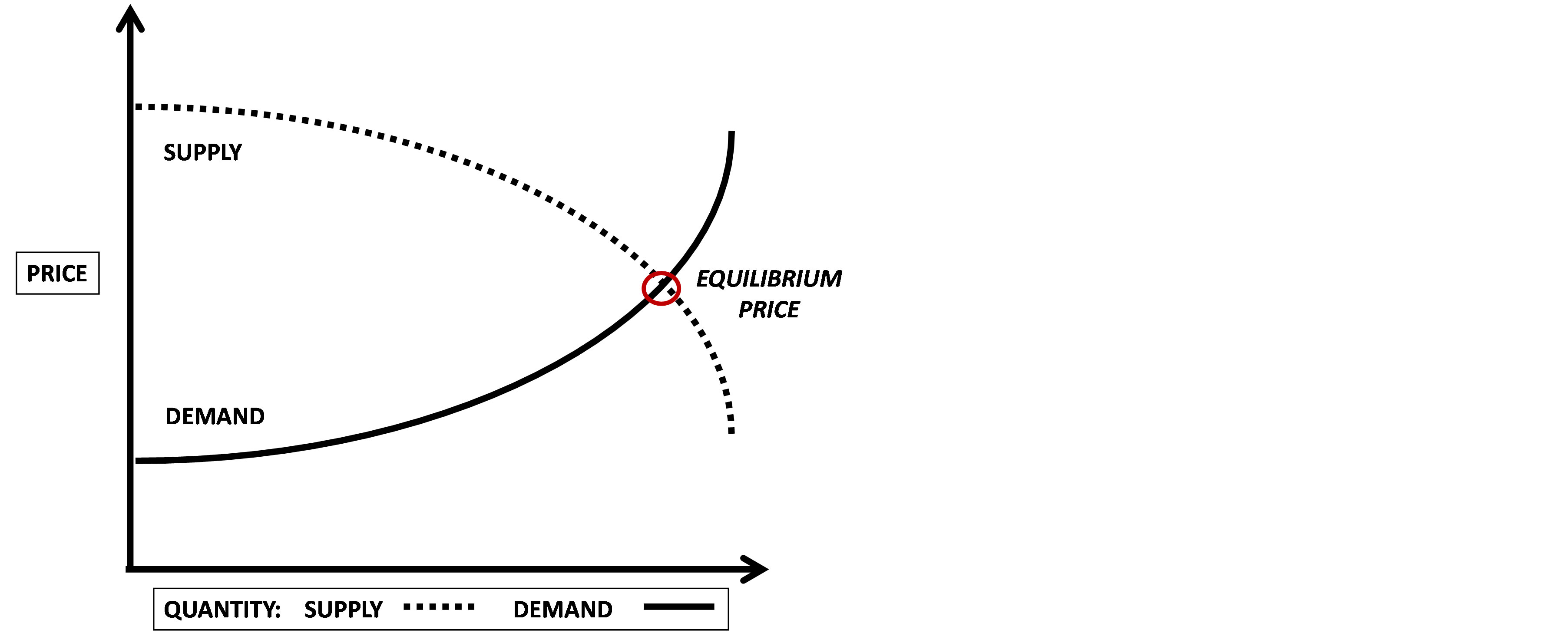

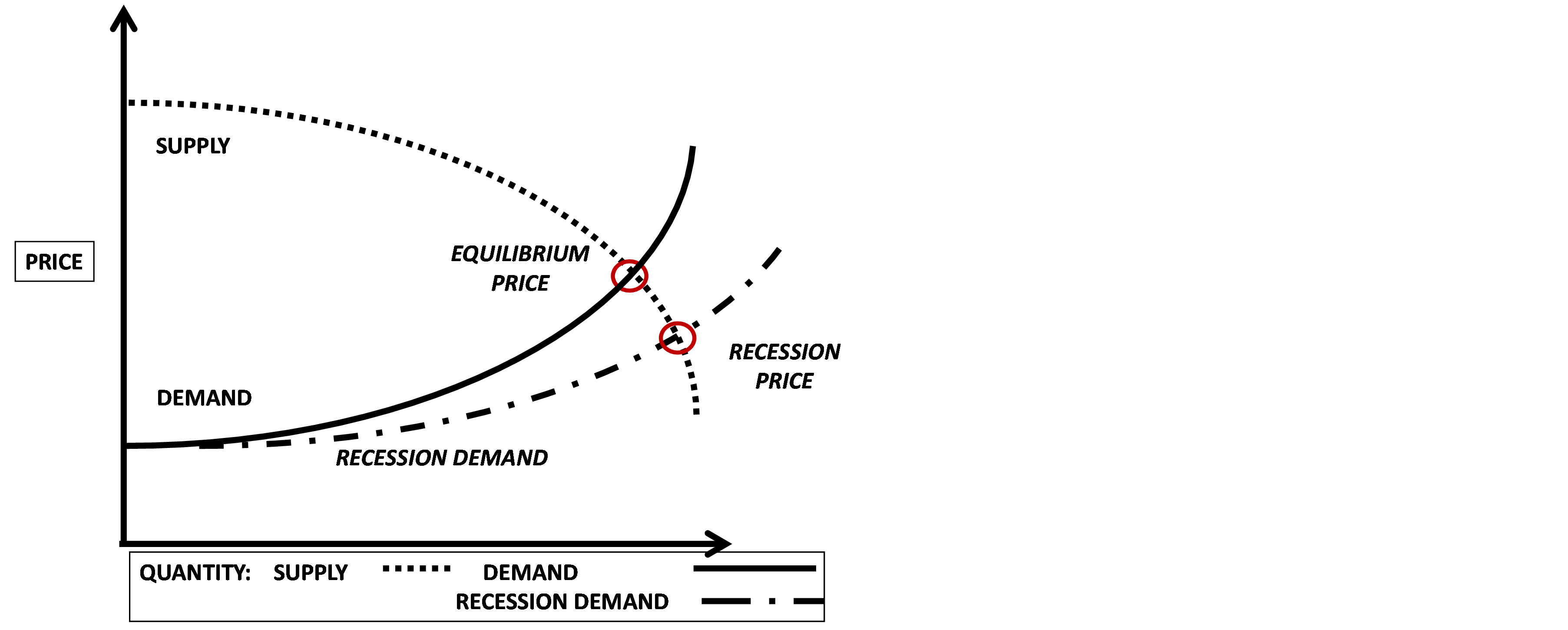

As is well known, the central model in the Neo-Classical Synthesis School of economics has been the supply-demand curve of “equilibrium pricing” in an economy, Figure 1.

When the price of a commodity is charted as the quantity of the supply of the product (dotted line), then the price will decrease in an economy as the supply increases. Because of business competition, more goods flooding a market will force prices down. Also if the demand for a product (solid line) increases, then the price will increase (as more consumers buy a limited amount of product). The optimal pricing of a product (commodity) in an economy will occur when supply equals demand. This is the equilibrium price, as supply and demand meet in quantity If a market behaves like this, it is perfect. No control over pricing is necessary, as a “supply-demand equilibrium” in the market sets the optimal price. (One notes that there is no time-dimension in this graph, which assumes that the equilibrium of pricing was quickly attained in a market and remained stable.)

This was the theory, that financial markets were perfect, which was used to deregulate banking in the US In 1999, the Glass-Steagle Act separating investment and commercial banking was repealed. And this allowed the creation of integrated banks—which proved “too-big-tofail” and then needed the huge bailing out by the Federal Government in 2008 [6]. The “too-large banks” created a major economic risk in the whole financial system, if and when they made too large risky trades and bad investments.

3. Modeling a Financial Market in the Neo-Keynesian School

In contrast, the Neo-Keynesians had argued that the NeoClassical Synthesis School economists were too narrowly focused on viewing an economy only as a production system. Ben Bernanke wrote: “Economists have not always fully appreciated the importance of a healthy finan-

Figure 1. Economic equilibrium pricing of a product when supply equals demand.

cial system for economic growth or the role of financialconditions in short-term economic dynamics.” [7]. Bernanke was pointing out the school of classical economists had assumed that “instability” of financial markets had little or no effect upon an economy.

About this, Hyman Minsky commented: “As Ben Bernanke points out the dominant microeconomic paradigm is an equilibrium construct that determines relative prices. (The assumption is that) money and financial interrelations are not relevant to the determination of these equilibrium variables. But if the basic microeconomic model is opened to include ‘yesterdays, todays, and tomorrows’ (then finance can influence price equilibrium).” [8]. Minsky was pointing out that the temporal dynamics (time-dimension) of financial markets did have an effect upon the stability of an economy.

Minsky was instead insisting that the “dimension-oftime” needs to be introduced into economic models. Drawing upon John Maynard Keynes work, Minsky wrote: “In the General Theory, Keynes sought to create a model of the economy in which money is never neutral (to pricing). He did this by creating a model in which the price level of financial assets is determined in (financial) markets. Each capital and financial asset yields an income stream, (which) has carrying costs and possessing some degree of liquidity. The price level of assets is determined by the relative value (of) income and liquidity.” [9].

In Keynes’ model of a financial system, a “time-dependence” is implicit in the concept of a “capital asset” having both a “present-income” and a “future-liquidity”. A capital-asset is an investment which creates income and can later be sold. It produces an income stream (present-income) and also can be sold in the future (future-liquidity). The time dimension is from (T1) of a present-income to (T2) of future-liquidity. This presentto-future (T1 to T2) temporal process occurs in a financial system as a transaction of “credit-debt”.

Minsky wrote: “Every capitalist economy is characterized by a system of borrowing and lending. The fundamental borrowing and lending act is an exchange of ‘money-now’ for ‘money-in-the-future’. This exchange takes place in a negotiation in which the borrower demonstrates to the satisfaction of the lender—that the money of the future part of the contract will be forthcoming. The money in the future is to cover both the interest and the repayment of the principle of the contract.” (Minsky, 1993)

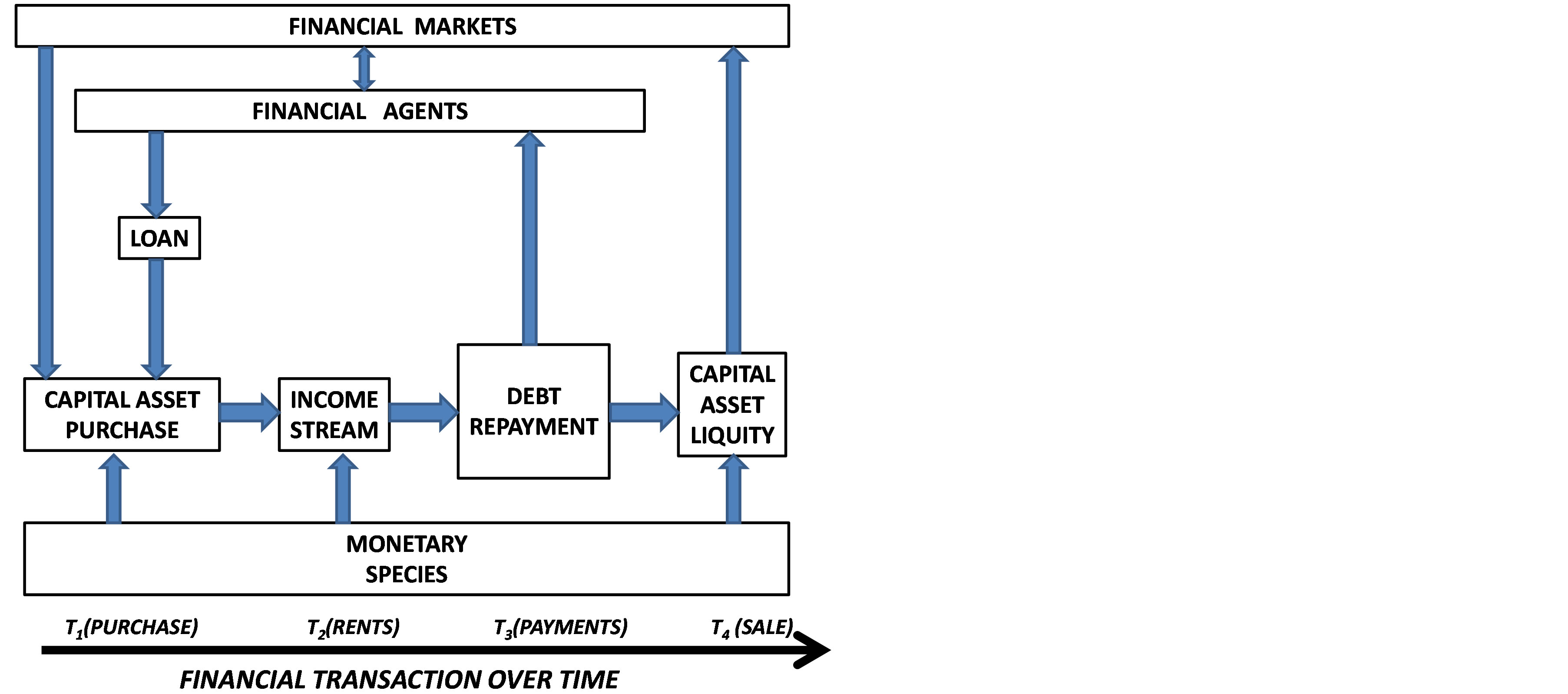

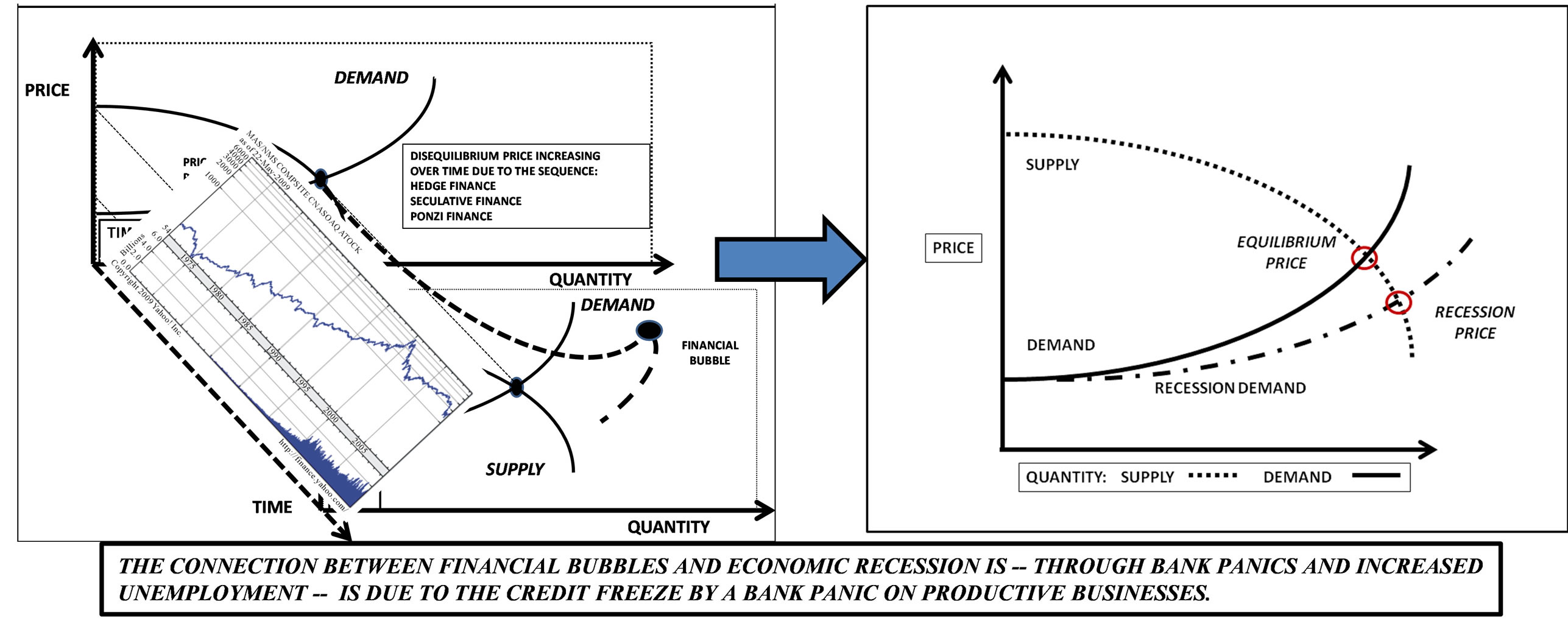

A financial market makes the credit-debt contracts sellable over time, as a future-liquidity. Thus in a financial sub-system, three things are essential: 1) credit-debt transactions as a fundamental financial process; and 2) a capital-asset market for liquidity of the asset; and 3) money as a medium of value-exchange. Using Minsky’s emphasis on a time dimension to model a financial market, the author diagramed such a temporal financial process, as in Figure 2 [10].

A financial capital-asset transaction occurs over time, beginning with a loan for an asset purchase, followed by rents (income stream) from the productivity of the capital asset, which are used for payments of the loan until the sale of the asset. Financial agents provide a purchase loan to the purchaser of the asset, receiving in turn, from the purchaser, loan payments on the debt over time from T1 through T3. Financial markets price the capital asset for purchase at time T1 and later for sale at time T4.

Debt makes a financial process operate. Yet one aspect of debt can destabilize the process; and this is “leverage”. To increase profit, a financial system uses debt to finance the purchase of capital assets. Profits can be increased through financial leverage; and this is the financial rational of “leverage” (more “present-debt” toward greater “future-wealth”). However, when present-debt is too large (too highly leveraged), it might not create futurewealth but, instead, bankruptcy! Excessive “leverage” increases the likelihood of bankruptcy and not futurewealth. This was earlier pointed out by Irving Fisher, who called a financial state of excessive-leverage as “debt deflation.” [11]. Later Hyman Minsky called a state of excessive financial leverage as a “Ponzi finance”.

Even later, Paul McCulley continued to emphasize the importance of the economic role of “leverage”: “At its core, capitalism is all about risk taking. One form of risk taking is leverage. Indeed, without leverage, capitalism could not prosper. And it is grand, while the ever-larger application of leverage puts upward pressure on asset prices. There is nothing like a bull market to make geniuses out of levered dunces. (Speculation) begets ever riskier debt arrangements, until they have produced a bubble in asset prices. Then the bubble bursts” [12].

Figure 2. Keynes/minsky financial process.

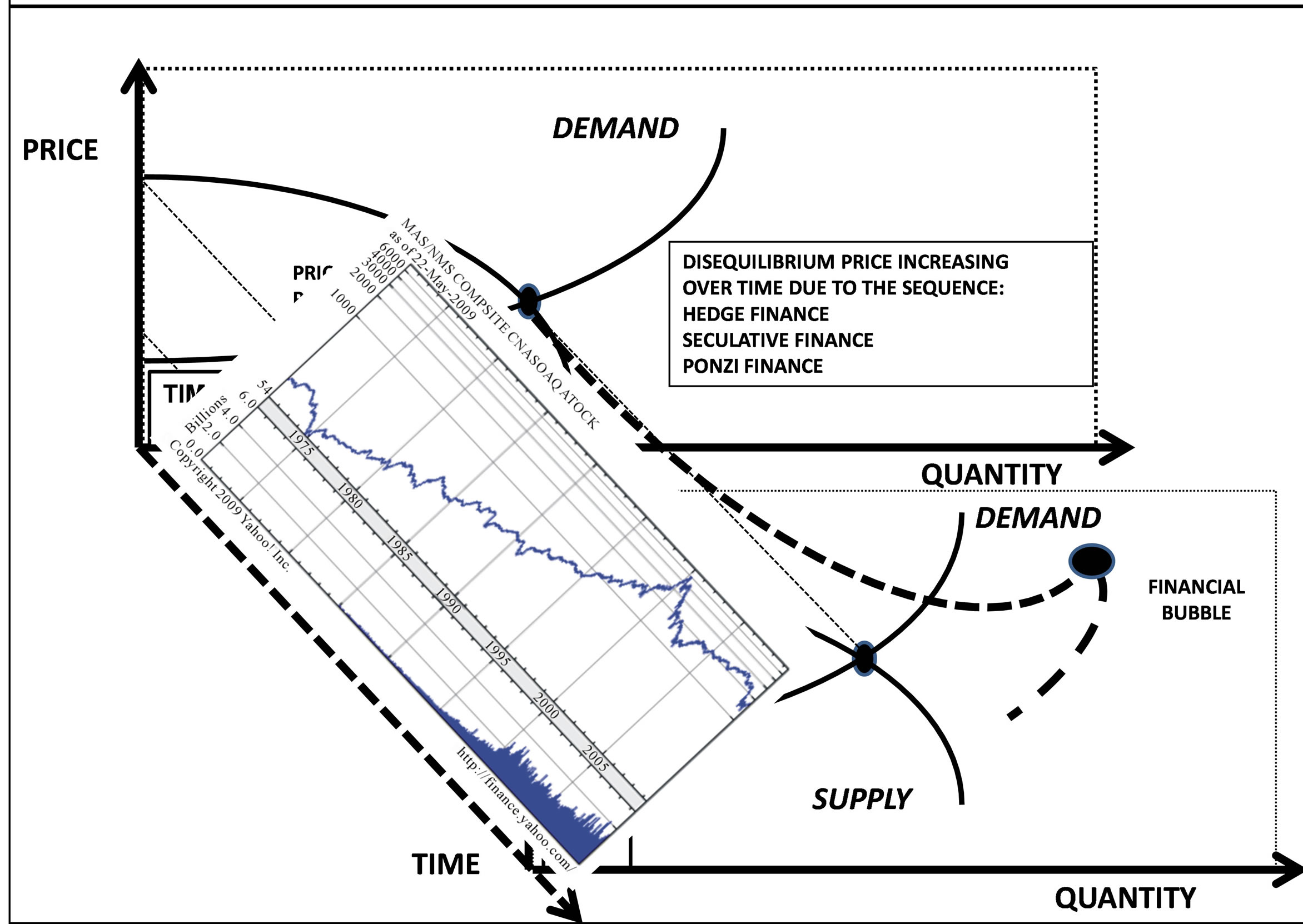

Thus leveraged “present-debt” can increase “futurewealth”; but “excessive leverage” can lead to “bankruptcy”. In Figure 3, we graph this impact of leverage on a price equilibrium model—by modifying the 2-dimentional “price-equilibrium chart”—with the addition of a 3rd-dimension of time. This graph shows a supply-demand curve at two different times, T1 and later T2. In the time-dimension, one can see how a “price-disequilibrium” situation can arise over time, as a “financial bubble”.

It is “excessive leverage” in the financing of a financial market which allows a financial bubble to occur. If no speculation occurs in an asset market (financial market) then the equilibrium prices at T1 and T2 could be the same. But if speculation in the future-price at time T2 occurs in a financial market, a price bubble can begin. Fueled by “leveraged speculation” in the future price of an asset, a “disequilibrium pricing” of the asset grows— increases and increases until the financial bubble bursts. Then the banks which funded the “leveraged speculation” hold assets greatly decreased in value (from the bursting of the bubble); and this places these banks at risk of “insolvency”. When depositors perceive a bank has put itself at risk, through funding too much speculation, depositors run to take their money out of the bank—a bank panic. Bank panics close down risky banks, and freeze available credit. When too much credit is frozen in an economy, businesses have no access to operating funds, lay off workers or close doors.

Financial bubbles have led to bank panics, which created credit freezes, which have led to business failures and unemployment—triggering an economic recession/ depression.

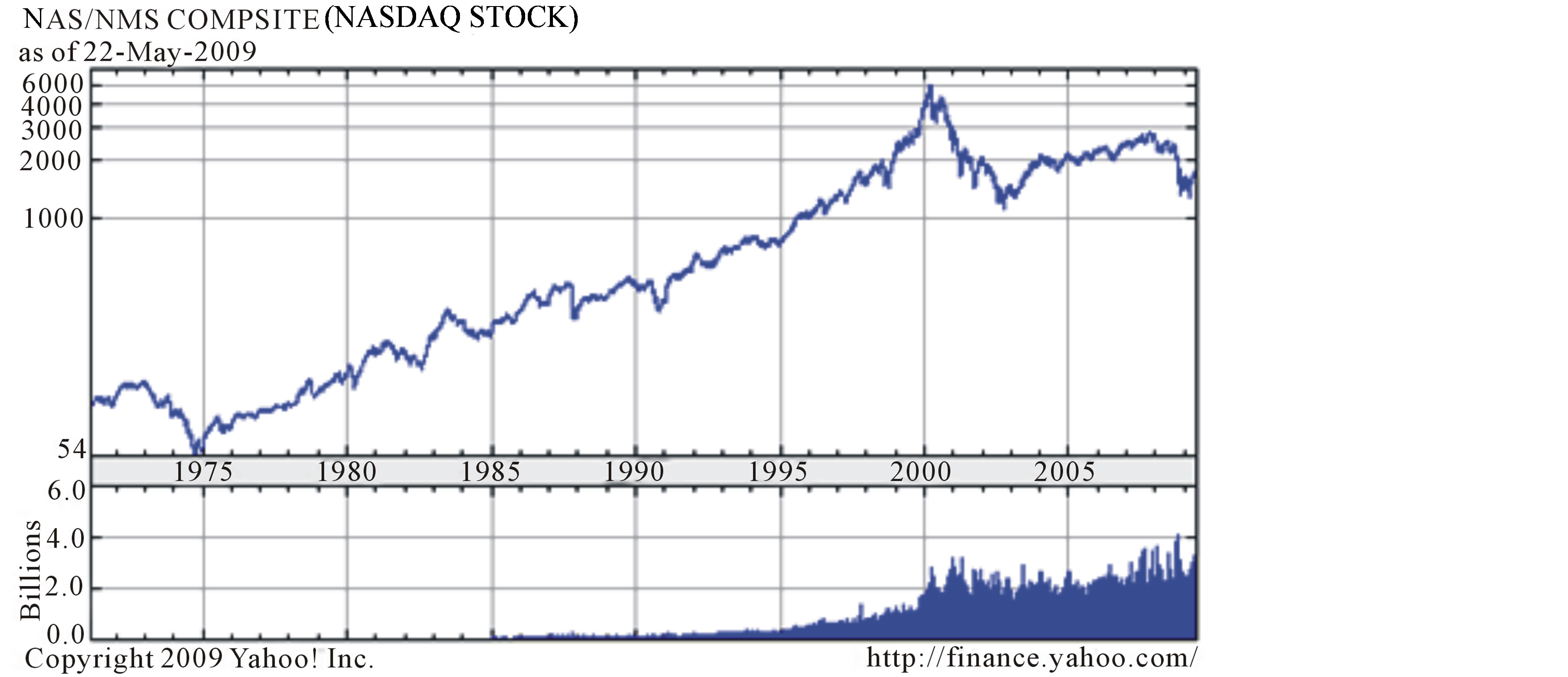

Financial bubbles can be seen in stock markets. Figure 4 shows the NASDAQ stock market index in the United States for the time period from 1970 to 2010.

Therein one sees the “dot.com” stock bubble from 1995 to 2000. Investor enthusiasm for businesses in the new Internet financed the start-up of hundreds of dotcom new ventures from 1998 to 2000. And the price index of the NASDAQ market rose from the index of “2000” in the year 1998 to the index of “6000” in the year 2000—a three-fold growth in two years—a stock market bubble. The financial bubble burst in the year 2000, declining back to the index level of “2000”—a three-fold drop—wiping out the earlier stock market increase. Billions of dollars were lost by venture capitalist funds in this sudden collapse, due to their investments in new Internet companies—hence called the “dot.com” stock bubble. Later in the year of 2003, a terrible attack of terrorism with airplanes crashing into the twin-towers of New York City and into the US Pentagon in Washington, DC brought the US economy into a recession with the NASDAQ index dropping further from “2000” to nearly “1000”. Then the Chair of the US Federal Reserve put in place a policy of “cheap money”, leading next to a real-estate bubble in 2005 and a financial crash of the US banking system in 2008, due to the sale of fraudulent mortgage-asset-based financial derivatives.

Upon a price-disequilibrium curve, one can fit a chart of a stock-market index over time onto the “Price-Time” plane of the three-dimensional price-disequilibrium graph, as in Figure 5.

Figure 3. Three-dimensional (price, quantity, time) supply-demand-price-disequilibrium chart—over time.

Figure 4. US NASDAQ stock market index 1970-2010.

Figure 5. US stock market index as a price-disequilibrium chart.

This shows the stock-market index charts are actually “price-disequilibrium graphs” of a stock-price-index over time. The advantage of looking at it in this way is to allow one to apply Minsky’s categories of financial status to the stock-market graphs.

When the average “price-to-earnings” (P/E) of a stock market is in the 10 - 15 range, then the financial state of the stock market is in a “Conservative-financial” range.

When the average “price-to-earnings” (P/E) of a stock market is in the 16 - 25 range, then the financial state of the stock market is in a “Speculative-financial” range.

When the average “price-to-earnings” (P/E) of a stock market is above 26, then the financial state of the stock market is in a “Ponzi-financial” state.

And Minsky emphasized that when any financial market is in a “Ponzi-financial” state, a financial bubble exists, just ready for bursting.

Because of the phenomena of financial bubbles, economic instability was seen by Neo-Keynesians as inherent to economic financial models. For this reason, the Neo-Keynesian School has also been called an “endogenous” school of economics, meaning instability is indigenous (inside) an economy—through the disequilibrium pricing of asset markets in a financial bubble. The Neo-Classical Synthesis School was then called an “exogenous” school of economics—because they believed instability was external to the economic system, of perfect markets.

As a precursor—when financial markets track away from an equilibrium pricing point (demand increasing dramatically over time with excessive leverage and without supply increasing)—then a financial bubble can be anticipated.

Regulatory intervention should occur before the critical time of Ponzi financing, as this time indicates a forthcoming devaluation—a bursting of the bubble.

What happens to the Neo-Classical model of production (price-equilibrium model), when a financial instability (Minsky financial bubble) occurs? As shown in Figure 6, an economically-recessed production system happens.

A financial instability (as a market bubble followed by bank panic) induces an economic recession—through the freezing of credit in the economy. This can be depicted as a commodity-market-in-recession. Prices decrease in a recession, as demand declines due to unemployment— when suppliers lay off workers. Unemployed workers purchase less, and overall demand declines—resulting in a recession.

The connection between financial bubbles and economic recession is—through bank panics and increased unemployment—due to the credit freeze by a bank panic on productive businesses. We can show this connection between models of financial bubbles and economic recessions in Figure 7.

The connection between financial price-disequilibrium models and commodity price-equilibrium models consists of: 1) excessive financial leverage; 2) leading to Ponzi finance; 3) creating a financial instability (bubble burst); 4) triggering bank runs in the banks involved in the Poni financing; 5) closing down the needed credit for businesses to continue operating; 6) resulting in reduction in commodity production; 7) through laying off workers; 8) resulting in increasing unemployment; 9) resulting in decreased consumption; 10) leading to more workers laid off to reduce production expenses; 11) creating more unemployment; 12) resulting in reduced consumption and demand—and so on—from financial instability to bank runs to economic recession.

Figure 6. Economic equilibrium pricing of a product when supply = demand and pricing when recession reduces demand.

Figure 7. Impact of instability in financial markets upon commodity markets.

4. Integrating Models of Commodity and Financial Markets

We have reviewed two kinds of economic models for commodity markets and financial markets, indicating their connection. The Neo-Classical Synthesis School had focused upon the production sub-system (in which the present price of a commodity is the key factor of control in a production sub-system); while the NeoKeynesian School focused upon a financial sub-system (in which future price of a capital asset is the key factor of control in a financial sub-system).

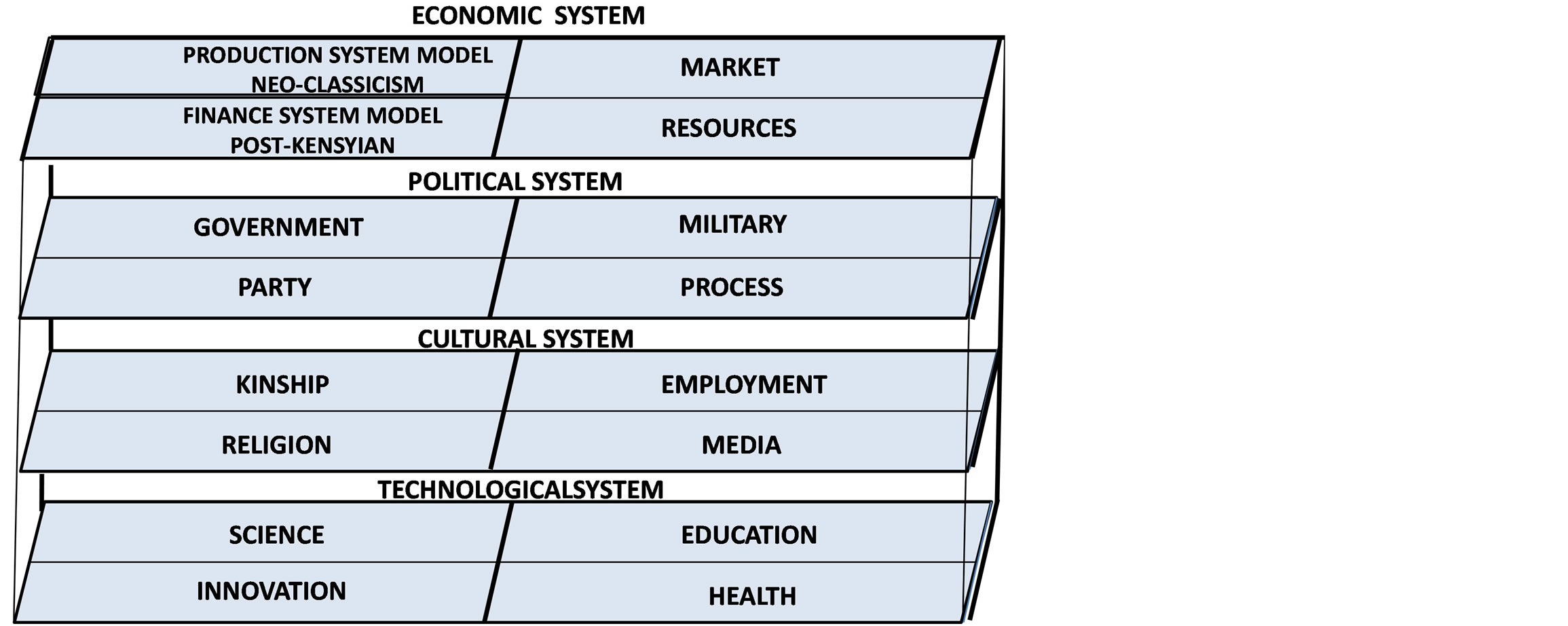

How can one formally integrate these models in a consistent modeling framework? The modeling challenge for an “integrated economics” is to use both economic models (theories) in a complementary framework. One can use a societal dynamics topology for this integration. In societal dynamics, the major systems in an industrialized society are classified into four kinds of sub-systems (economic, cultural, political, and technological [13].

An economic system is itself composed of different sectors for production, finance, markets, and resource. The production sub-system produces the goods and services from material/energy resources and financed by a financial system. These goods/services are consumed within a market. Thus any economic system can be partitioned into four sub-systems of production, market, finance, and resources. (Betz, 2013) We show this in Figure 8. One places the “exogenous” economic school’s model (of an economy as a production-system) within the “production sub-system” of the economic system. One places the “endogenous” economic school’s model (of an economy as a financial-system) within the “financial sub-system” of the economic plane. This cross-disciplinary meta-framework of societal dynamics can facilitate seeing the economic theories (models) of two schools of economics—exogenous (Neo-Classical Synthesis) and endogenous (Neo-Keynesian)—as complementary within the larger context of a societal system.

In this way, one can place the two models (of commodity and financial markets) respectively on the production and financial subsystems of the economic system plane, as in Figure 9.

This shows is how models from the two schools of economics, exogenous and endogenous, relate to each other as complementary models—in production and in financial sub-systems—both in the framework of a society's economic system. These two economic models are partial models in an economy—not a model of the whole economy. The information relationships between such societal partial models are functional and not causal. Therefore data specific to each model needs to be empirically developed from research and statistics, functionally defined as appropriate for each model.

Data do not necessarily feed automatically from one model to another, because societal models are not causally connected but functionally related. If societal models were mechanistic with causality, then the partial models could be integrated into one large causal model. (But this is only possible in the physical sciences, such as special-relativity-mechanics integrating down to Newtonian-mechanics at slower speeds than light.) Social science models are functional models and not mechanistic models. Hence data for each economics partial model must be functionally defined properly for each model. The connectedness between societal partial models is by the flow of information from one model to another. Information flows connect together the whole of a societal model; but information must be functionally translated from one part to another.

5. Results and Conclusion

We have modeled the Minsky-Keynes depiction of a financial market—by extending the “equilibrium-price” model to a “disequilibrium-price” model through adding

Figure 8. Topological model of society as interacting systems of economy, politics, culture, and technology.

Figure 9. Economic system plane with production & financial sub-systems.

a third dimension of time. This allows the tracking of a financial bubble as a disequilibrium-price path. Such tracking as the path moves from conservative pricing in the financial market to speculative pricing in the market to Ponzi pricing, anticipates a bursting of a growing financial bubble. Historically, bursting financial bubbles often trigger bank panics, which induce economic recessions as credit markets collapse. A stock-market-priceindex chart is actually a “Price-Time plane” on the financial Price-Disequilibrium Graph of a financial market.

REFERENCES

- B. Appelbaum, “Days before 2007 Crisis, Fed Officials Doubted Need to Act,” New York Times, 2013.

- C. Giles, “King admits failing to ‘shout’ about risk,” Financial Times, May 2, 2012.

- P. Krugman., “The B Word,” The New York Times, 2009.

- C. P. Kindelberger and Z. A. Robert, “Manias, Panics, and Crashes: A History of Financial Crises,” 6th Edition, Palgrave Macmillan, Basingstoke, 2011.

- P. Blustein, “The Chastening: Inside the Crisis That Rocked the Global Financial System and Humbled the IMF,” Public Affairs Books, New York, 2003.

- M. Wolf, “Why Greenspan Does Not Bear Most of the Blame,” Financial Times, 2008.

- B. S. Bernanke, “Global Imbalances: Recent Developments and Prospects,” Budesbank Lecture, Berlin, 2007. http://www.federalreserve.gov/newsevents/speechbernanke20070911a.htm

- H. P. Minsky, “Can ‘It’ Happen Again? Essays on Instability and Finance,” M.E. Sharpe Inc., 1982.

- Hyman. Minsky, “Comment on Ben Bernanke, ‘Credit in the Macro-Economy’,” Hyman P. Minsky Archive, Paper 361, Betz, Frederick. 2011. Societal Dynamics. Springer, New York, 1993.

- F. Betz, “Why Bank Panics Matter,” Springer, New York, 2013.

- I. Fisher, “The Debt-Deflation Theory of the Great Depression,” Econometrica, 1933. http://dx.doi.org/10.2307/1907327

- P. McCulley, “Saving Capitalistic Banking from Itself,” PIMCO, 2009.

- F. Betz, “Societal Dynamics,” Springer, New York, 2011.