Modern Economy, 2011, 2, 757-768 doi:10.4236/me.2011.25084 Published Online November 2011 (http://www.SciRP.org/journal/me) Copyright © 2011 SciRes. ME 757 A Different Development Model in China’s Western and Eastern Provinces? Meine Pieter van Dijk Water Services Management UNESCO-IHE Institute for Water Education, Erasmus Un iversity Rotterdam, Rotterdam, Netherlands E-mail: m.vandijk@unesco-ihe.org Received June 7, 2011; revised July 28, 2011; accepted August 9, 2011 Abstract Economic growth in China has declined between 2008 and 2009. The global financial crisis of 2008/9 has shown a number of structural weaknesses in the Chinese economy, such as the functioning of its capital and labor markets and the substantial income differences between the developed eastern and less developed western provinces. Migration is the linchpin of China’s development model; workers move from the western to the eastern provinces and back, in particular because of the crisis. How has China reacted to the financial crisis of 2008? After assessing the Chinese stimulus program and its negative effects on liquidity in general and the financial sector in particular some of the resulting issues, such as a dual development model for the eastern and western part of China and the development of the internal market at the expense of more export will be reviewed, before assessing which factors can still constrain China’s ascent. Keywords: China Dual Development Crisis Provinces 1. Introduction A number of structural weaknesses in the Chinese econ- omy became clear during the crisis of 2008/9. We will discuss distortions in the functioning of China’s labor and capital markets and the substantial income differ- ences between the developed eastern and less developed western provinces. Migration is very important in ex- plaining the success of China’s development model. Workers from the western provinces have moved in large numbers to the eastern provinces. Some of them were forced to go back during the recent crisis. In this article we analyze what the consequences of the global financial crisis for China are and how China has reacted to the crisis of 2008. We start with assessing the Chinese stimulus program and its positive and negative effects. In particular we assess its effects on liquidity in general and the financial sector in particular. Then some of the resulting issu es, such as a dual developmen t model (different for the eastern and western part of China) and the issue of developing local consumption instead of depending on exports will be analyzed, before assessing what all this means for the relative position of China in the world economy. We will argue that China in the meanwhile continued its ascent as a superpower. 2. The Financial Crisis in General The 2008 crisis started as a financial crisis in the United Sates (US) and became an economic crisis with world- wide repercussions. It came to Europe and Asia, origi- nally in the form of less trus t in the financial markets, but also resulted in a decline in demand, and eventually re- sulted in a global economic crisis. A number of structural weaknesses of China’s capital and labor market became clear during the recession. In the labor market we note that in times of crisis migration flows may reverse, as it happened in China in 2008/09. Currently there are short- ages of skilled labor in eastern provinces and some of the migration flows have reversed again in 2009. To solve these problems unskilled migrant workers were hired for higher wages for job s requiring skills. In the capital mar- ket we see additional lending, which is promoted by the Chinese government to stimulate the economy, but which has also undesira ble effects. Because of the economic crisis of 2008/09 economic growth in China declined at the end of 2008. Exports decreased rapidly and it is estimated that millions of Chi- nese workers lost their jobs and many returned to their provinces in the western part of China. Subsequently in November 2008 the Chinese government launched an  M. P. VAN. DIJK 758 important stimulus program. A lot of funds for infra- structure development were made available and cities and provinces were also invited to make a contribution. Much of the currently rapidly increasing growth is due to the stimulus package of 500 billion do llar [1]. What were the effects of the recession for the Chinese economy? Van Dijk [1] distinguishes short and medium term ef- fects and looks at the rebound (Table 1). 3. The Crisis in China The Chinese economy has grown rapidly since 1978 in particular in the big cities in the eastern part of the coun - try, fueled by the Special Economic Zones located closely to these cities. Because of the recent economic crisis growth declined from an averag e of 10 to 7 pe rcen t in 2008, but exports declined almost 40 percent at the end of 2008 (for August 2009 the decrease was 23 per- cent compared to a year earlier; NRC, 14-10-2009). Ac- cording to the Asian Development Bank economic growth in Asia was only 5 percent at the end of 2008 [2]. The IMF announced that China’s growth would decline from 9.3 to 8.5 (Ch ina Daily, 8-11-2008). Feb ruary 2009 the figures would be adjusted to 6.7 percent. The Chinese government later announced 8.9 percent growth for 2009, indicating the crisis did not last long. Rapid urbanization is a key driver for socio-economic change in China!1 Agglomeration played a major role in China’s growth and was reinforced by increased gov- ernment investments in cities which later attracted more foreign direct investment (FDI). Big cities benefited in particular from these policies and investments made by the national, provincial or municipal authorities. How- ever, the crisis resulted in 23 million unemployed work- ers, who mostly had to go back to their province of ori- gin. In particular textile, games and furniture industries suffered (Financial Times, 25-8-2009). The Chinese press also pointed to the decline in the ship building and machine industry (China Daily, 8-11-2008) . This number of unemployed workers would be about 20 percent of the 130 million migrants that moved to the eastern cities during the last decade. During the first half of 2008 60.000 companies closed down and FDI dipped. In the second half of 2008 another 80.000 companies closed down and that only in the Chinese power house the Pearl River Delta near Hong Kong. Reasons mentioned in the Chinese press, besides the financial crisis, were the Olympic Games, heavy snow storms at the beginning of 2008 and the earthquake in Sichuan in May 2008. Western provinces have grown more slowly in the past than the eastern provinces and many workers from these provinces migrated to the eastern provinces to find a job , sending back a substantial part of their revenues. At least 130 million migrated during the last decade and another 200 million is expected to leave the rural areas in the next decade, willing to work for a low income and con- tinuing China’s competitive advantage, until a serious graying of the one child population will start after 2020. China wants to change the regional imbalance by stimu- lating the economic development of the western part of the country. Policies like promoting investments in the west, stressing the availability of cheap labor and space and facilitating loans have been imple mented. At the same time economic growth is leveling off in the mega cities in the eastern part of China and picking up in the regional capitals in the western provinces. The eastern provinces need investments for the upgrading of their infrastructure and housing stock and to move to- wards a more capital intensive model of production, while labor and space intensive industries move to the western provincial capitals. These developments may change the migratory flows, where the eastern provinces need more skilled workers and the potential migrants from the western provinces can find employment in the more labor intensive industries that shifted west. This development would also contribute to the development of China’s internal market and wean it off from its export bias. Table 1. Repercussions of the financial crisis for Chinese cities. Higher unemploymen t and the ne ed to support unemployed wor kers Problems with social services for migrant labor: schooling, health, housing, etc Short term Reversal in migration flows The impact of the one child policy Growth of intermediate towns Medium term Decline of Chinese export-oriented development mo d e l Urban spending has in c reased Shortage of skilled labor Rebound A different kind of ur ba n d ev elo pment, including attention to e cological aspects 1We do not discuss the negative impact of economic growth on the expansion of cities and the resulting demand for rural land [3]. They found that economic growth of 10 percent results in 3 percent expansion of urban land! Copyright © 2011 SciRes. ME  759 M. P. VAN. DIJK China reacted to the crisis by putting together a stimu- lus plan of more than 500 billion dollar to be spent in 2009 and 2010 (Table 2). According to some estimates the program concerns between 15 and 17 percent of the Gross Domestic Product (GDP; Financial Times, 22-10- 2009). The focus is very much on improving infrastruc- ture and dealing with the consequences of the Sichuan province earth quake of May 2008. Most of the money is spent on infrastructure and only a small part on services, such as housing or health care. One may wonder whether all this money is new money, or whether planned investments have just been moved forward. In total about US$ 409 billion has been made available in the form of loans since the crisis started (Fi- nancial Times, 25-8-2009). Some of these expenditures had to be financed by the provinces or cities th emselves. The stimulus program is meant to be temporary. What is going to stimulate the economy once these funds are ex- hausted? The current program is certainly going to lead to a substantial government debt, which needs to be served and could lead to crowding out of private invest- ments by dynamic small enterprises in China. Usually these smaller companies create the jobs that China needs desperately. Early 2009 the Chin ese Prime minister announced that a second stimulus program was considered (Financial Times, 2-2-2009). The second program of fiscal meas- ures would help to keep the growth of the economy at 8 percent. The fir st program was already consider able. 500 billion dollar additional expenditures in two years is al- most as much as the 800 billion president Obama re- ceived from congress after his election to fight the reces- sion, although the American economy is three times the Chinese. The Chinese New Year in 2009 was really the turning point for the Chinese economy. In the eastern Guang- dong province by the end of Feb ruary 2009 more th an 90 percent of migrants had come back to this province, Table 2. First Chinese stimulus plan of more than 500 bil- lion dollar for 2009 and 2010. Type of expenditure Share (%) Infrastructure: rail roads, highroads, airports & electricity grid 45 Repair activities after the Sichuan province earth q u a k e 25 Rural development and infrastructure projects 9.25 Ecological and environmenta l a c ti vi t ie s 8.75 Housing projects 7 Innovation activities 4 Health care, cultural and education activities 1 Source: Wall Street Journal (28-11-2008). meaning three things. It shows determination among migrant workers to move permanently to the east coast. Secondly, these workers still seem to be necessary and finally a large numbers of these migrant workers is still living outside the Chinese social security system [4]. Fleischer et al. [5] summarize the major factor deter- mining economic development, which so far tended to favor the eastern provinces. According to Fleischer et al. [5] regional development is the resu lt of physical capital, human capital, infrastructural capital, new technologies and market reforms. Out of a 20 million population in Shanghai there ar e at least three million migrant workers2. They represent one third of all workers in Shanghai. This is one of the rea- sons why the municipal government decided to allow inhabitants who are both ‘only child’ to have two chil- dren. Su ch a policy would also r esult in a more ev en age distribution of the future population, which currently tends to be skewed because of the one child policy. Cur- rently the debate on illegal labor heats up in China, be- cause some workers in the eastern provinces now come from neighboring countries. The official slogan for mi- grants is “special group, equal treatment”, but it would be quite a step forward if these poor people would be given citizen’s rights! Migration leads to problems in the city and in the country side3. Migrant labo r is often misused in the cities, for example in Shanghai, although officially rights of migrants are inviolable4. The average wage of unskilled labor in China is about US$ 7 dollar per day. Plans to deal with the current social exclusion of migrants are developed. Changing the situation of migrants in the big eastern cities require different policies, such as legal ad- justments: changing the Hukou (residency permit) sys- tem and recognition of migrant rights. In the past the migrants would just get temporary residence permits. The Guangdong Province subsequently announced plans to safeguard the rights of migrant workers and their 2On a trial basis by the end of 2002 already 770,000 such workers had received an integrated assurance, covering medical expenses, occupa- tional injuries and allowances for retirement paid by their employers [6]. 3Chinese newspapers describe the problems under heading like: “Fear over countryside childcare” (or: Home alone in country side). Anothe type of problems is battles over the user rights for the land the migrants have left behind. The China Daily recently wrote about these protests under the title “Suzhou protests over payouts for seized land”. 4The Shanghai Star (9 December 2004) gives an example of seven migrants from the countryside who had been working under a labor contractor who was in charge of the construction job but fled withou aying the workers’ wages when the project was almost finished. They then attempted to commit suicide by consuming large quantities o drugs in their temporary shed in the city of Shenyang in Northeas China. The solution the Chinese have found for these kinds of problems is that the workers should start registering themselves in the city, which is not very likely for most migrants, who know they are not supposed to leave their rural areas. Copyright © 2011 SciRes. ME  M. P. VAN. DIJK 760 families in this province. This floating population of about 23.3 million temporary workers is about one third of the 78.5 million permanent residents in the province5. 4. China’s Unequal Development China has a large number of provin ces and can be sp lit in three (west-central-east) or two parts (taking middle and far west together) as will be done in this contribution. Table 3 provides the basic data for three regions. Table 4 provides the names of the provinces and their capital city. Four cities are so-called city provinces. The differ- ences in development level between the provinces are big. Inequality exists in China between the urban and rural areas, between the Eastern and Western provinces and between the workers in the industrial sector and the farmers. China’s western provinces are less developed than its eastern provinces. China's increasing Gini coef- ficient is an indicator of the personnel income distribu- tion. It increased from 41.5 in 1995 [7] to 49.6 in 2006 (Financial Times, 27-12-2006). Also differences in wages, investments and per capita production illustrate the inequa lity. The western provinces are less developed than the eastern provinces. The increasing ineq ua lity is a poten tial source of dissatisfaction and the government would like to develop the western provinces. China has shown high annual rates of economic growth since Deng Xiaoping started the economic reforms in 1978 with liberalizing agriculture. However, the income distribution has be- come very unequal [5], which can also be noticed from Figure 1 comparing the per capita Gross Regional Prod- uct (GRP) in western and eastern provinces. Both areas have grown, but the gap between them has become big- ger. Increasing inequality has been noted in particular since the 1990s [8]. The reforms continued with stimu- lating Special Economic Zones (SEZ), located mainly in the south eastern provinces. Typically the per capita GDP in these provinces is now even higher than in the north eastern provinces where the traditional large scale Table 3. The three regions of China data for 2008. Area Population GDP Resident Consumption Level Per capita Million km2 Percent Million Percent Billion YuanPercent Yuan Percent Northeast and East Coastal part 1.70 17.8588.3844.320577.52 62.9158294 58.8 Middle and Near-Reach-West part 3.13 32.6666.0350.210812.2 33 88086 32.7 Far-Reach-West part 4.78 49.853.865.5 1332.27 4.1 22984 8.5 Source: calculated base d on the provinci al data available on the website of China Sta tistics Bureau, 20 09. Figure 16. Per capita Gross Regional Product in Yuan 2004 until 2008 (Source: CSP [9]). 5The floating population in China is defined as people who are not entitled to be registered as permanent residents according to current laws and regu- lations. It usually implies that travelling is more difficult and these people have no access to services such as housing, education and health in the city where the migrants are working. The urban residency rules were designed after the founding of the People’s Republic in 1949 and intended to restrain farmers from entering the c i ti e s a n d have the same status as permanent residents (China Daily, 11 March 2004). 6Figures 1 and 2 are the result of research with Paul Libaudiere (Erasmus University), ba se d on CSP [9]. Copyright © 2011 SciRes. ME  761 M. P. VAN. DIJK Table 4. The basic information of three areas of China. Area Province Capital City Liaoning Shenyang Jilin Changchun Heilongjiang Haerbin Beijing Tianjin Hebei Shijiazhuang Shandong Jinan Shanghai Jiangsu Nanjing Zhejiang Hangzhou Fujian Fuzhou Guangdong Guangzhou East Area Hainan Haikou Chongqing Sichuan Chengdu Hubei Wuhan Hunan Changsha Anhui Hefei Jiangxi Nanchang Shanxi Xian Gansu Lanzhou Ningxia Yinchuan Shanxi Taiyuan Henan Zhengzhou Yunnan Kunming Guizhou Guiyang Middle and Near-Reach-West Area Guangxi Nanning Inner Mongolia Huhehaote Xinjiang Wulumuqi Tibet Lasa Far-Reach-West Area Qinghai Xining industries we r e located. Shortly half of China’s 1.3 billion population will be living in urban areas and this number is expected to in- crease rapidly, if only because the authorities take a posi- tive attitude towards migration and argue that the eco- nomic growth is higher in the urban than in the rural ar- eas.7 The current Chinese situation with respect to mi- gration can be summarized as 200 million Chinese peo- ple that are expected to move to the cities during the next ten years [10]8. In China most migrant workers come from poorer western provinces. They go to the more de- veloped parts of the country, such as the Pearl and Yangtze River Deltas in the eastern part of the country. Inequalities tend to increase in times of crisis. 5. The Positive Effects of the Chinese Stimulus Program Package The economy recovered more quickly than expected. After the positive effects of the stimulus packages China now needs to deal with the negative consequences of the high economic growth of 10.3% in 2010 [11] and the resulting inflation (4.6% in 2010 and 5.3% in April 2011; Financial Times, 12-5-2011). Can development be spread more equally in China? The enterprises in the developed eastern provinces have to choose between facing strikes, or paying higher salaries. They can also move their business to cities in western provinces, where the agglomeration economies are not yet the same, but many incentives are provided for labor intensive, space intensive and even polluting industries. Urban private spending on real estate and the stock market has increased substantially since the crisis, this may lead to bubbles. Mega cities in the east see their economic growth leveling off, since they are facing con- gestion, environmental and governance issues. China is one of the few countries that actually wants to accelerate urbanization and hence encourages migration and emi- gration. It is actively promoting migration since it con- siders cities to have more potential than China’s rural areas. In the medium term we can expect the impact of the one child policy, namely a graying of the population by 2020. A decline of the Chinese export-oriented de- velopment model is also due because of the development of the medium and smaller size cities in western China, which will generate more local demand. The effects of the economic crisis on the Chinese economy were higher unemployment and a need to sup- port the unemployed migrants in the eastern cities. It meant a temporary reversal of migration flows and more unemployment. China recovered very fast from the in- ternational financial crisis, because of its important stimulus program and despite stagnating FDI in 2009 and despite increasing Chinese investments abroad. Foreign direct investments declined in China in 2009 with 40 percent compared to the record of 60 billion US dollar invested in China in 2008. The expectations are that China will continue to try to attract foreign investments and enjoy the technology, the management skills and markets that will come with it. 7Chinese farmers have at the average only half a hectare of land at thei disposal and often this consists o f se veral plots. 8Emigration abroad has been promoted by a number of provincial gov- ernments. Some Chinese provinces have an active migration policy suggesting people even to go abroad, in particular to Africa and Latin America. It is expected that these Chinese working abroad will send money back to their family members, who were left behind and their departure diminishes the pressure on the land [18]. Copyright © 2011 SciRes. ME  M. P. VAN. DIJK 762 6. Chinese Stimulus Program the Negative Effects The Chinese government actively tries to promote de- velopment in the western part of the country. However, the inequalities in per capita GDP are very clear as can be seen in Table 5 where the differences between per capita GDP between eastern and western provinces in 2008 are presented. The per capita GDP is on average more than twice as high in the eastern than in the western provinces. Differences in average wages in selected eastern and western capitals also illustrate the in equality. But even between western provinces the difference be- tween the highest and the lowest ranking province is a factor four. The same gap can be found in the eastern provinces between for example Hainan and Shanghai. Also the wages paid in the eastern cities are on aver- age 1.5 to 2 times what is paid in a city like Chongqing in the west ( 26985 Yuan in 2008). Th e wage differences are an argument for entrepreneurs to go west. However, other factors, such as the lack of a skilled labor force, cost of transportation and the speed of developing the internal market are also important. The total population of the western provinces is slightly smaller than the total population of the eastern provinces. However, according to Table 6, the eastern are doing better than the western provinces, in all other respects. Government expenditures are almost twice as high and in 2008 investments in the eastern provinces are 8.5 times bigger than in the western provinces. This dif- ference is statistically significant and suggests also sub- stantial government investments still go to the eastern rather than to the western provinces. Per capita FDI is currently 11.7 times higher in the eastern than in the western provinces. Exports are 139 times higher and even the number of patents is significantly higher in the eastern provinces. However, the average growth of GRP is slightly higher in the western provinces in Table 7 than in east- ern provinces since 2006. This is not because of the dif- ferences in per capita FDI or total investments (ten times more in Eastern than in Western capitals), but may be related to the fact that the western capitals are at average smaller than those of the eastern provinces and govern- ment has invested substantially in infrastructure (for example the length of highroads exceeds the eastern provinces). Also, the number of graduates in the western provinces is gradually increasing and now almost the same as in the eastern provinces (Figure 2). The length of highroads is significantly higher in the western provinces. This is related to the fact that most of the city provinces (Beijing, Shanghai and Tianjin) are located in the eastern part of the country and require fewer high roads, while the western provinces tend to b e big. An increasing number of industries is going west, but what is the impact of these developments in particu lar on economic growth of the western provinces and cities? The growth rates of per capita GDP are indicative for the changes that have taken place between the eastern and western provinces since 2005 (Table 7) . The tab le show s that cities make an important contribution to economic development and that as of 2006 the GDP of cities in the western provinces is growing faster than in the eastern provinces. Although cities in the eastern part of the country are bigger in population terms, the western capitals are growing slightly faster in economic terms. Newspapers and Chinese bank reports suggest that many industries Table 5. Per capita GDP between selected eastern and west- ern provinces in 2008. Eastern provinces Per capita GDP in renminbi Western provinces Per capita GDP in renminbi Beijing Heilongjiang Tianjin Hebei Fujian Guangdong Jiangsu Shandong Shanghai Zhejiang 61,876 21,723 54,034 23,164 30,031 37,402 39,483 32,945 75,536 41,967 Chongqing Sichuan Shanxi Gansu Ningxia Yunnan Guizhou Xinjiang Tibet Qinghai 17,891 15,368 20,345 12,085 17,784 12,547 8,789 19,727 13,795 17,347 Source CSP [9, different years]. Table 6. Indicators of the differences between Eastern and Western provinces in 2008. Variables Eastern provinces Western provinces Statistical significance 1. Government expenditure 2. Total investments 3. FDI 4. Exports 5. Number of graduates 6. Number of patents 7. Length highroads (km) 7664 E10 66,710 E10 10,035,443 100,080 E10 197,620 20,547 54,253 4568 E10 7624 E10 856,780 721 E10 141,690 3661 70,293 ANOVA 0.000 0.000 0.001 0.002 0.171 Not significant 0.002 0.000 Copyright © 2011 SciRes. ME  763 M. P. VAN. DIJK Figure 2. Eastern versus western provinces: share of number of graduates per 1000 persons, 1992-2008. Table 7. Growth of per capita GDP in eastern and western provinces. Year East er n p ro v i n ce s ( %) Western provinces (%) 2001 2002 2003 2004 2005 2006 2007 2008 13.65 10.28 13.53 17.38 24.60 13.40 16.54 12.87 6.80 8.73 11.01 20.51 17.07 15.05 19.56 19.46 are already moving west, given the lower wages, the in- vestments made by the government, the positive gov- ernment policies and the less strict enforcement of labor and environmental laws. In the western provinces of China, municipalities are happy to attract some invest- ments and not being too strict on labor and environ- mental conditions. Hence in first instance the more labor intensive, space con suming (given the lease price of land and buildings in the eastern provinces) and polluting industries move west. Given the incentives and the de- velopment of the interior market, it may be expected that more will follow. 7. The Stimulus Plan’s Negative Effects on Liquidity and the Financial Sector What did the government do to mitigate the negative effects of the financial crisis? The Chinese population started to spend more in 2009. Th e av erage in come in th e urban areas increased about 10.5 percent in the first nine months of 2009, more than the economy in total. This did partially offset the lack of demand from the United States. Kuijs [12] points to the fact that savings and in- vestments are high in China and only gradually will de- crease in the coming 20 years. This has to do with the graying of the population in China, which is influenced by the one child policy since the end of the 1970s. High savings are necessary because social security in China is no longer arranged collectively. Pensions are not avail- able or very low, housing is more and more th e responsi- bility of the individual citizen and education and health care are relatively expensive. Consequently families save up to 40 percent of their income. Private firms also save substantial amounts because it is difficult for them to obtain loans and their profit margins are thin [12]. To promote consumption the government offers all kinds of products at lower prices in the interior of the country. Purchasing power of the people also increased because of deflation in the first half of 2009. Su bsequently defla- tion turned into inflation in July 2009 (China Daily, 28- 7-2009). Other measures taken to boost consumption concerned an increase in pensions paid by the govern- ment, additional ben efits for low inco me workers and the distribution of vouchers in certain cities (China Daily, 28-7-2009). Through a sales tax reduction people were also stimulated to buy smaller cars. What has the government done to deal with the in- creasing inequality? The recen tly launched 12 th Five year development plan intends to promote regional develop- ment and to create a more equal income distribution in China. The strategy comes from the national level and needs to be elaborated at the provincial level. Table 8 gives the details per region. Until recently migration was officially discouraged. However, it is expected that eco- nomic growth generated by migration to cities will lead to higher econo mic growth, which will also solve a nu m- ber of China’s other problems. According to the plan rural-urban integration must be hastened and the plan suggests granting citizenship rights to migrants, which would provide basic entitlements, which are missing under the current registration (Hukou) system for mi- rants and mean a reversal of the policies of the past. g Copyright © 2011 SciRes. ME  M. P. VAN. DIJK 764 Table 8. Regional development strategy in 12th five year development plan. Region Strategy Focused policies Western National western development strategy Special policy support Infrastructure development Protection of environment Development of science and techno l og y Development of industrie s with unique character Development of areas where minorities live Northeastern Rejuvenation strategy gi v en challenges of heavy industry in regionEstablishment of modern industry system Transition activities for areas with exhausted resources Middle National Central Region Development Strategy Improvement of investment environment Development of competitive industries Establishment of modern industry system Establishing comprehensi v e na t i o na l transport hub Eastern National leading strategy Competition & cooperation in the world economy Transformation patt ern of economic development Adjustment of economic structure Encouragement of independent inn ovation 8. A Weaker Financial Sector and Inflation Because of the governments fiscal policy and its pressure on the banks to provide loans th e total loan portfolio has increased substantially and the financial sector will end up with a number of bad loans. Money supply grew 40 percent in 2009. Bank lending ballooned at 9,600 billion Yuan in 2009 (Financial Times, 22-11-2010). The target for 2010 was 7,500 billion, but that figure had been reached almost after ten months. Some interesting news- paper articles refer to the inflationary pressures because of the importance of informal finance in China (Financial Times, 22-11-2010, 1-4 and 9-4-2011). Some of the loans have been used for consumption or even led to speculation in the stock exchange or to buy- ing houses. The index of the Shanghai stock exchange increased rapidly in 2009 and it was estimated that 20 percent of the loans ended up in stocks or bonds (Finan- cial Times, 25-8-2009). Also the number of sold cars increased to 12 million in 12 months (China became the biggest market for cars in 2009, by passing the US), par- tially because of a tax cut for the smaller models (South China Morning Post, 31-7-2009) and an increase of the prices of real estate was observed (30 percent of the loans may have been used to buy property; Financial Times, 25-8-2009). Recently the government has reacted to the increase of money supply by making lending slightly more difficult (International Herald Tribune, 31-7-2009), but this may also discourage investment. Without loans no jobs are created. In the past China has often provided new loans if the old ones were not repaid. However, this does not lead to the necessary restructuring of the economy to make companies internationally competitive. Securitization of loans is also a possibility to allow banks to issue new loans. However, securitization of bad loans is inviting problems in the financial sector (J. Foley in NRC 22-10- 2009). The increased liquidity can contribute to new bub- bles, in particular in the stock and real estate markets, which can lead to inflatio n, wh ich can lead to an in crease of the rate of interest with a negative effect on invest- ments. The government announced that wage increases of 15 percent per year in the private sector could be ex- pected (China Daily, 20-4-2011). This would certainly fuel inflation even more. The most important question is whether the loans will be paid back. Otherwise they will weaken the financial sector even further. Finance companies created by pro- vincial and local governments were encouraged to take up loans for infrastructure. An estimated one third of these ‘directed loans’ will not be repaid. According to the Financial Times (12-8-2009) economic growth was lower in July 2009 becau se government controlled bank s had received the instruction: “to rein in excessive lend- ing”. The volume of new loans was 77 percent lower than the month before. Reserve requirements for the banks increased another 0.5 percent (China Daily, 18-4- 2011). 9. Developing the Internal Market and the Rate of Exchange The problem with the rate of exchange (6.5 yuan to the dollar in April 2011; NRC 10-5-2011) is that it is fixed by the government and is at a low level compared to the dollar, to help China to build up market share in the global markets. According to Martin Wolf (Financial Times, 30-1-2009) the real problem is the internal con- sumption in China. He calculated that the expenditures within China have to increase ten percent to allow the Copyright © 2011 SciRes. ME  765 M. P. VAN. DIJK trade deficit to disappear. According to Guo and N’Diaye [13] the Chinese ex- port model is no longer sustainable, for a number of rea- sons. Guo and N’Diaye [13] state that China is already such an important producer that in certain sectors it can only step up its expor t by lowering prices. They consider that if a further increase of export can only be achieved through even lower prices, this economically does not make sense, because it would go at the expense of the already low wages. The alternatives are an increase in productivity, or value added or a change in the composi- tion of exports, which is also not very likely. According to the IMF [11] China would grow out of the crisis if it would stimulate the internal market. The IMF considers this is a more realistic alternative than continuing to step up exports, even to more non conventional markets such as Africa and Latin-America where the purchasing power is relatively low. During the first three months of 2011 China imported more than it exported, but in April it had again a record surplus of 11.4 billion US$ (Financial Times 3-5-2011). Th e irony is that China is now inclin ed to revalue the renminbi slowly because it helps to fight inflation at home (Wall Street Jou rnal, 21-4-2011)! The stimulus program and the increase in loans re- sulted in increased purchasing power stimulating the local economy, but these effects are only temporarily. Increased government spending also increases the gov- ernment’s debt and may crowd out investments by dy- namic private companies in China, while these small ones are the ones to create employment. The internal market can only develop in a sustainable way if the gov- ernment takes action to improve social security in China. More money is also needed because the environment becomes more and more important. Doing the necessary investments will lead to higher produ ction cost however. 10. A Dual Development Model for Eastern and Western China? Does the increased attention for the western provinces mean that China's development is moving west? What are the consequences for China’s development model of such a trend? The party leader in the southern Guang- dong province, which is part of the Pearl River Delta, suggested that China should use the crisis to become a more modern country. He argues to make the transition to a more capital and knowledge intensive economy and points to the fact that there is a shortage of skilled labor in the Guangdong province (South China Morning Post, 31-7-2009). The question is whether he is not too early with his suggestion given that every year still 20 million low skilled Chinese farmers want to move to the cities and that such a lab or reserve will keep th e wages low. Some regional development in the western provinces is taking place. We showed that since 2005 the western provinces are growing slightly faster than the eastern. In the development of the western provinces and their capi- tals agglomeration economies play a role like they played a role in the development of the eastern provincial capi- tals [10]. Investments play an important role, but it is necessary to distinguish between government invest- ments, and investments by enterprises and foreigners, which follow government investments in infrastructure the past and are attracted by incentives provided as part of the development policies for the western provinces. Space is available and provided at more favorable condi- tions than in the eastern cities. Similarly more labor is available and substantially cheaper. The fact that these workers do not have to migrate means that their income is spent locally and contributes to development in the western provinces. Labor intensive technologies are available. Even in the eastern part of the country usually the core technology is up to date, but activities around it are carried out in a relatively labor intensive way. This pattern is changing because some of the eastern provinces have used the 2008 recession to change to a different development model of more capital and skill intensive technologies. This trend is reinforced because most of the mega-cities are also in the eastern part of China and suffer from diseconomies of urbaniza- tion, such as for example congestion in Beijing where 700,000 new cars have hit the road in 2010. An impor- tant part of the investments is still going into construc- tion and a more capital intensive development of the in- dustrial sector in the eastern provinces. The development of the western part of China is not as quick yet as the government had hoped. However, the lower wages and the incentives provided to investors do convince more and more enterprises to move to the west. Cities which are competitive receive more of these firms. Enrollment of students in higher education is also higher in these cities, implying that the knowledge economy is also starting to play a more important role. However, social problems are also increasing and the question is whether the Chinese government can control all these developments. Given the policies announced in the last plan and the importance of government investment for urban devel- opment in the west, it is expected that fewer migrants will go from the western part of the country to the cities in the eastern provinces, which are going for more capi- tal intensive activities requiring more skilled labor. This may lead China to develop its internal market more and to focus less on export. This process can be reinforced by a revaluation of the currency, or a round of wage in- creases in eastern China, which will, however, erode Copyright © 2011 SciRes. ME  M. P. VAN. DIJK 766 China’s current competitive advantage. If Chinese work- ers earn more they will spend it mainly on local products. Local consumption is enhanced if migrants remain in their respective provinces, where they will be more in- clined to invest, while in the eastern cities the migrants would send an important part of their income to their relatives in their home provinces, but spend the rest of the money in eastern cities, partially on imported goods. These developments lead to a dualistic development model, with a more capital intensive industrialization in the eastern and more labor intensive industrialization in the western part of China. 11. China Ascent as a Superpower Economic power has moved from the Western countries to the Far East. While the whole world was suffering from the financial crisis, China continued its ascent as a superpower. There are many indicators of this ascent. The more factual ones are that China surpassed Germany as the major exporting country in 2009 and Japan as the world's second largest economy in 2010 and has the am- bition to bypass the US as the biggest economy in the world. On one arb itrary day three head lines in the Finan- cial Times give the same impression (12-4-2011): ‘Bur- mese junta grows wary of China’s ever closer embrace’, ‘Brazil’s president will be checking on China’ s statist experiments’ and ‘Levi’s Chinese jeans brand poised for US market launch’. The latter article notes that this is an example of the growing influence of emerging econo- mies on product innovation. This happ ens in the clothing sector, where developments were always dominated by trends in western tastes. Other indications of China’s ascent are that China has modernized its army and in particular its navy (Financial Times 19-1-2011). Although the size of the economy is now about one third of the US economy we should real- ize that if the renminbi would revalue 40 percent (an estimate of its real value), the Chinese economy all of sudden becomes almost half the US economy. If the Chinese economy continues to grow at 10 percent (ver- sus the US at 2 percent) it will also not last very long before both countries will be in the same league. The question is whether this growth can continue at the cur- rent pace ? 12. Why the Chinese Miracle May not Last China has recovered rapidly from the international finan- cial crisis and the world wide recession that resulted, but there are doubts about China’s recovery. Different indi- cators confirm positive developments, but there are also some more fundamental trends suggesting that the high economic growth of the past can not be sustained in the future. In the first place foreign investments seem to be declining in China, while China itself invests more and more abroad9. The development of the internal consumption in China has not been as fast as expected. There is also still a big gap between China and the western countries as far as the level of social services is concerned. Bridging this gap would require more government expenditure, but also a different kind of expenditure than the current ex- penditure focusing on providing infrastructure. Is the Chinese government ready to make that change? Also urban planning in China has resulted in “dissat- isfying urban sprawls featuring inadequate services and inconvenient settings, which are particularly unfavorable to the low-income families” (China Daily, 5-11-2008). The opposite way of planning would lead to a harmoni- ous society, “narrowing the expanding gap between dif- ferent social groups an d getting every member of society to benefit from economic growth”, but does not seem to take place. China’s substantial exports to the US lead to a huge trade deficit between the US and China, resu lting in a b ig dollar surplus in China. These dollars were used to buy US T-bonds to allow the US to continue to import Chi- nese goods. However, China has a problem investing its surplus of 2850 billio n US$ (Fin ancial Times 18-1-2011) and Sovereign wealth funds like the China Investment Corporation (CIC) have already invested 300 billion dollar abroad. The surplus also explains the wave of for- eign acquisitions that is currently taking place. In the meanwhile the country has to ration electricity supply again (Financial Times 18-5-2011) and announces that export prices are set to rise (China Daily 20-4-2011). Van Dijk [14] gives different reasons why the high economic growth may not continue for ever. Among them are congestion and environmental reasons [15]. Other factors mentioned, which could lead to a decrease of the future growth are strikes, demands for higher wages, the lack of social security for workers, unem- ployment, and more retired people10. Lack of freedom, for example on the web, or to travel, may also lead to more unsatisfied people and China seems to react in a very defensive way to the gulf of protests in the Middle East in 2011. A frequently heard argument why growth will slow 9The problem can be solved by allowing more foreign investors in China because China already plays an important role itself in othe countries. Van Dijk [18] argues that China has also become more vul- nerable by increasing its presence in Africa and Latin America in a very substantial way in a relatively short period. 10One of the reasons for the high current saving rate (40 percent) is that eople consider they have to take care themselves for a number o things other countries have solved collectively (pensions, education, health etc.). Copyright © 2011 SciRes. ME  767 M. P. VAN. DIJK down is China’s graying population. This will be acute by 2020 when the relative size of the population of 12 - 24 to the population of 25 - 60 will have changed from 60 (1950) to 30 percent. The dependency ration of popu- lation ages 0 - 14 and 65+ to the population between 15 and 64 will than be as high as 65 percent [1 6]. Finally, not all the positive figures published by the Chinese authorities are accepted by the experts (Finan- cial Times, 25-8-2009). The real growth of the internal consumption could be lower and not be enough to com- pensate for the decline in exports. If structural factors in the labor and capital markets continue this could lead to a next crisis (Financial Times 25-8-2009). The rebound could be temporarily and not lead to the same levels of growth China was used to in the 1980s and 1990s. Also China’s recovery could not be V, but rather W shaped, or what is called a double dip recession. Other reasons mentioned in the press why China may face problems are the number of students who can not find jobs. In particular 6.1 million young people who finish tertiary education each year will find it difficult to find jobs (Financial Times, 25-8-2009). This is also the group the authorities fear most for starting protests (Wall Street Journal, 23-12-2008). In terms of the Financial Times (22-12-2008) “Beijing prioritizes employment for graduates to head off unrest ”. Recently Park and Shin (Financial Times, 15-4-2011) argued that the sustainable rate of Chinese economic growth is set to decline by up to 2 percent points around 2015. They calculated that for developing countries like China the slowdown generally came when per capita income was in the US$ 13,000 to 18,000 range (with 15,058 as the median). The argument used is that the easy and fastest phase of growth lasts as long as un- skilled worker can be hooked into a rudimentary indus- trial economy. However, the next phase implies a low growth in industrial productivity and an increase of the service sector. Also Hung [17] noted that: “in China the decentralization of regulatory authority of the state ac- celerates overinvestment among local economic agents and hence more competition, which results in a source of potential instabilit y”. Nouriel Roubini (quoted in the Financial Times 18-1- 2011) says that the problem lies in the Chinese govern- ment’s attempt to keep the economy going through a huge increase in fixed investment. However, “no country can be productive enough to reinvest 50 percent of GDP in new capital stock without eventually facing immense overcapacity and a staggering non-performing loan prob- lem”. 13. Conclusions The developments since 2000 show that China is be- coming more and more like western economies. It suf- fered from the global economic crisis, it faces demand for higher wages in the eastern provinces and its in ternal market is starting to become more important, meaning that the export model may no longer be sustainable. Guo and N’Diaye [13] doubt that China’s export model can survive these economic developments. More expendi- tures will be needed in the near future for social security and to stop the deterioration of the environment. All these factors have a negative impact on China’s export growth model and will contribute to the development of the internal market with its consequences for migration. How has China reacted to the financial crisis of 2008? The Chinese stimulus program had positiv e and negative effects. The economy recovered quickly, but the stimulus plan has had also negative effects on the economy. It stimulated liquidity by increasing money supply and weakened the financial sector in particular because of the ‘directed’ loans to infrastructure. So many loans had an effect on liquidity in general and on the reputation of the financial sector in particular. Local consumption has not yet grown fast enough to replace the role of exports. A weakening of the financial sector took place, because the government stimulus program was financed partially by the banks which were forced to finance development projects of provincial and municipal special purpose ve- hicles, of which 30 percent is estimated no t to be able to serve the debt. We conclude that a dualistic development model is emerging: growth is accelerating in the western prov- inces and somewhat declining in the eastern provinces, in particular in the mega cities. Development of the western provinces also means the development of a new market and less dependence on export. If worker s come f ro m the western provinces they will also spend more money in that region, contributing to the economic growth of the western provinces [3]. Migration is the linchpin of China’s development model. Recently migration is considered a more positive phenomenon, despite all the social problems associated with it, such as the reservation, or Hukou system, which makes migrants second class citizens in cities with no rights to government housing, health care or education for their children, which has given rise to the increased number of informal education and training institutes11. Migration is the result of a certain development model. The economic crisis of 2008 and 2009 showed that mi- gration flows can also be reversed and that the eastern provinces tend to go for more capital and skill intensive 11The mayors of the major Chinese cities are aware that something needed to happen. Under the head ‘Mayors’ Promise to Help Their Residents’ the China Daily (9 March 2004) carried a story about the two major Chinese cities, Beijing and Shanghai, which revealed the circumstances under which many migrants and small entrepreneurs live. Copyright © 2011 SciRes. ME  M. P. VAN. DIJK Copyright © 2011 SciRes. ME 768 development with major consequences for migration. Migration issues in China are extremely important since migrants contributed to the high economic growth fig- ures of the country since 1978. The Chinese government has an active migration policy within China and even promotes migration abroad. For regional development it is important where income is being spent. This is in the eastern provinces if the workers move there to find em- ployment, but it will be spen t in the western provinces if more economic activities are located there. Some of the resulting issues, such as a dual develop- ment model (for the eastern and western part of China) and the development of the internal market were ana- lyzed. The combined effects of more capital intensive development in the eastern part of the country and the greater use of more expensive skilled labor means that the east is following a different development path, trig- gered off by the last economic crisis. The current model of bi-polar development, with capital intensive develop- ment in the eastern and more labo r intensive activities in the western provinces has important consequences for the flows of migrants and the future of China as an ex- porting nation, but developing the internal market may in the end be more sustainable. Increasing local household consumption would probably be a more sustainable op- tion for China’s economic growth than continuing its efforts to expand exports. However, such a development would also require a revaluation of the renminbi, which is politically very sensitive. 14. References [1] M. P. van Dijk, “The Consequences for China’s Mega Cities of the Global Economic Recession,” Forum on Urbanism and Neo-Liberals: The New Urban Question beyond Neo-Liberalism, Delft, 26 - 28 November 2009. [2] ADB, “Asian Development Outlook,” Asian Develop- ment Bank, Manila, 2010. [3] D. Xiangzheng, J. Huang, S. Rozelle and E. Uchida, “Economic Growth and the Expansion of Urban Land in China,” Urban Studies, Vol. 47, No. 4, 2009, pp. 813-843. doi:10.1177/0042098009349770 [4] L. T. Chang, “Factory Girls, Voices from the Heart of Modern China,” Picador, London, 2008. [5] B. Fleischer, H. Z. Li and M. Q. Zhao, “Human Capital, Economic Growth and Regional Inequality in China,” Journal of Development Economics, Vol. 92, No. 2, 2010, pp. 215-231. doi:10.1016/j.jdeveco.2009.01.010 [6] M. P. van Dijk, “Managing Cities in Developing Coun- tries, the Theory and Practice of Urban Management,” Chinese Renmin University Press, Beijing, 2006. [7] World Bank, “World Development Report,” World Bank, Washington, 2007. [8] D. T. Yang, “What Has Caused Regional Inequality in China?” China Economic Review, Vol. 13, No. 4, 2002, pp. 331-334. doi:10.1016/S1043-951X(02)00088-3 [9] CSP, “China Statistical Yearbook 2006,” China Statisti- cal Press, Beijing, 2006. [10] M. P. van Dijk, “The Contribution of Cities to Economic Development, An Explanation Based on Chinese and In- dian Cities,” LAP Lambert Academic Publishing, Saar- brucken, 2009. [11] IMF, “World Economic Outlook 2009,” International Monetary Fund, Washington, October 2009. [12] L. Kuijs, “How Will China’s Saving-Investment Balance Evolve?” World Bank Policy Research Working Paper No. 3958, Washington, 2006. [13] K. Guo and P. N’Diaye, “Is China’s Export-Oriented Growth Sustainable?” IMF Working Paper No. 09/172, Washington, 2009. [14] M. P. van Dijk, “Waarom de Chinese groei zal vastlopen en Europa iets te bieden heeft,” Fiducie, Vol. 15, No. 4, 2008, pp. 23-29. [15] M. P. van Dijk and M. Zhang, “Sustainability Indices as a Tool for Urban Managers, Evidence from Four Medium- Sized Chinese Cities,” Environmental Impact Assessment Review, Vol. 25, No. 6, 2005, pp. 667-688. doi:10.1016/j.eiar.2004.10.001 [16] World Bank, “World Development Report,” Oxford Uni- versity Press, New York, 2007. [17] H. F. Hung, “Rise of China and the Global Overaccumu- lation Crisis,” Review of International Political Economy, Vol. 15, No. 2, 2008, pp.149-179. doi:10.1080/09692290701869654 [18] M. P. van Dijk (Ed.), “The New Presence of China in Africa, The Importance of Increased Chinese Trade, Aid and Investments for Africa,” Amsterdam University Press, Amsterdam, 2009.

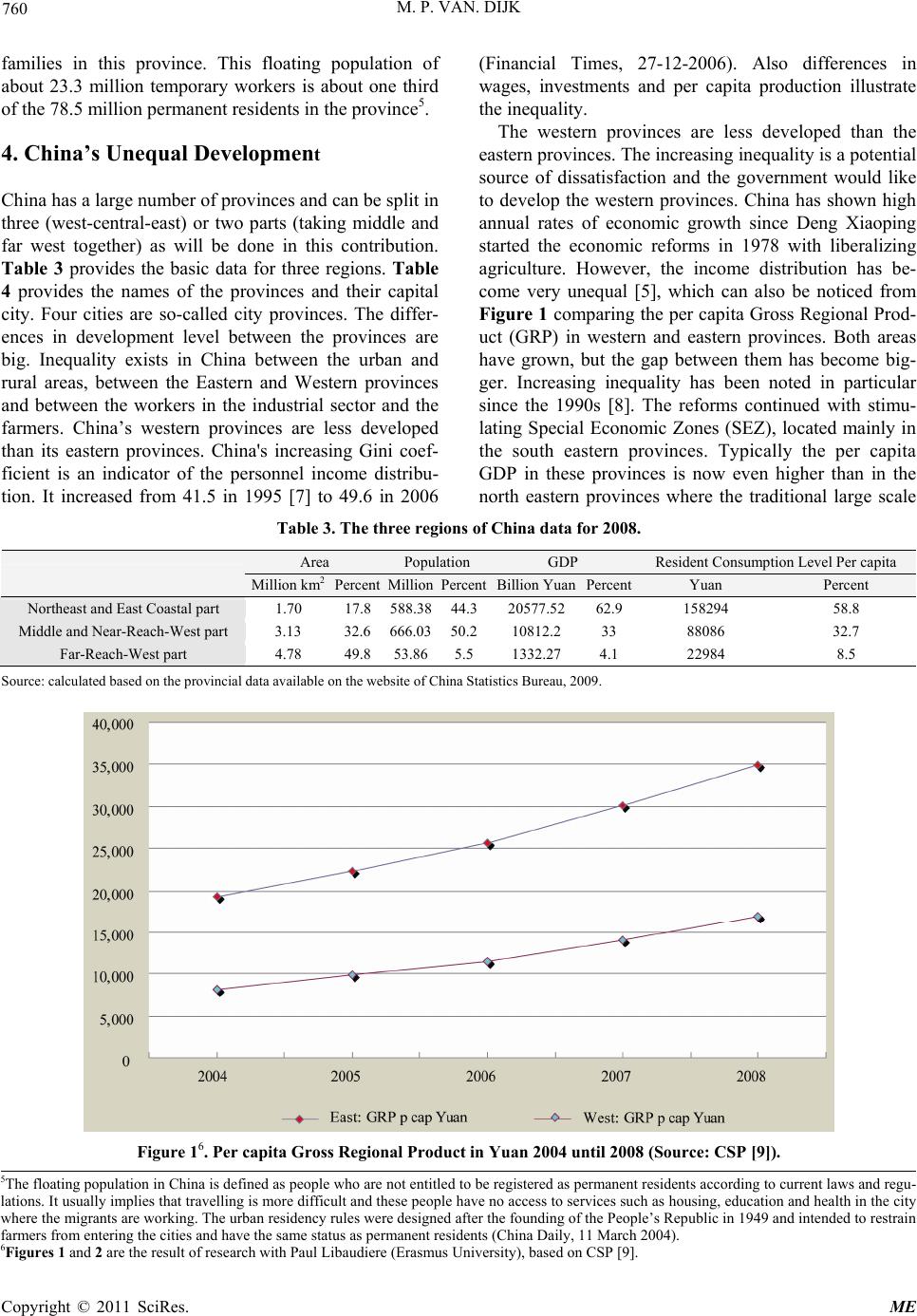

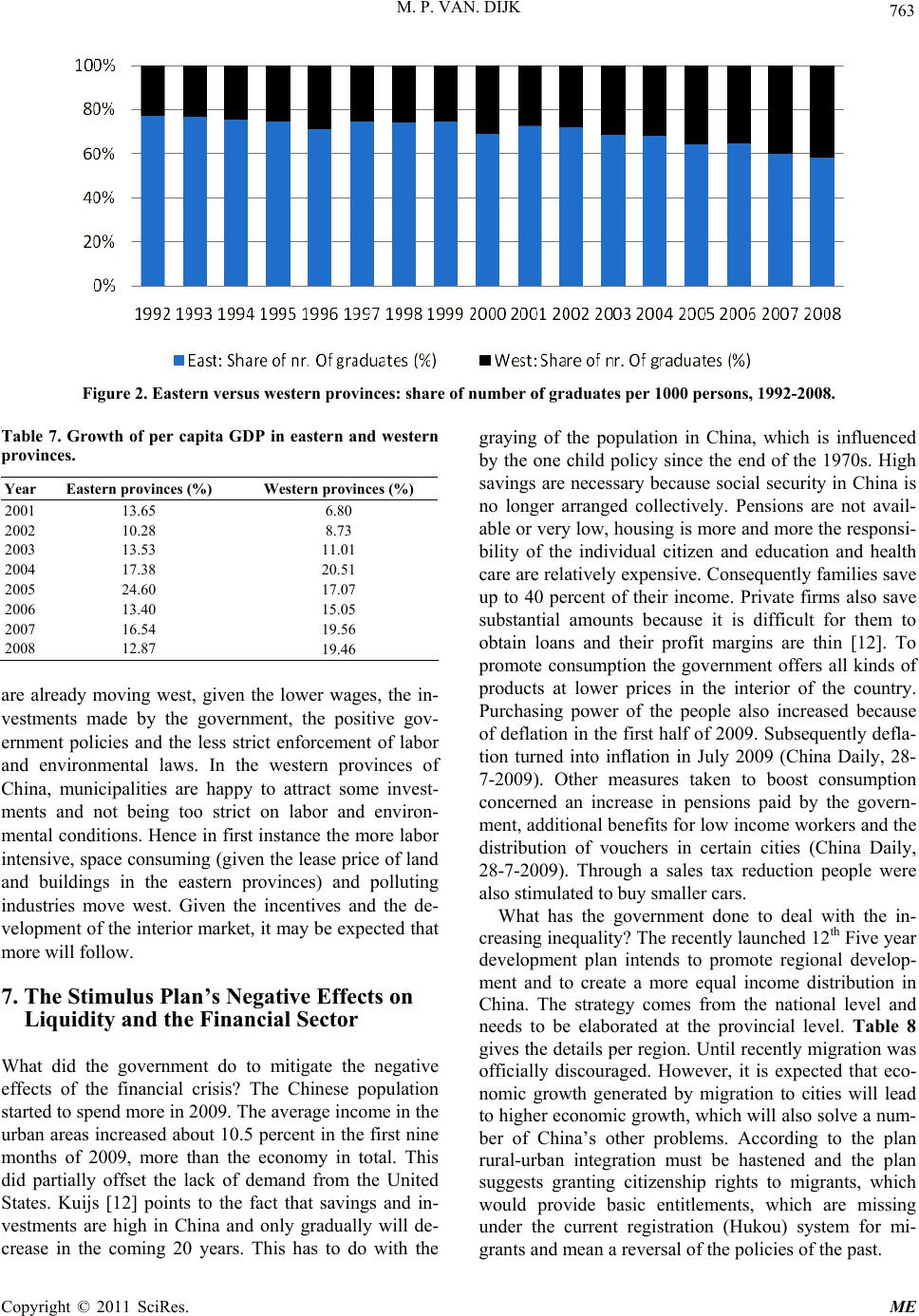

|