iBusiness

Vol. 4 No. 2 (2012) , Article ID: 19964 , 7 pages DOI:10.4236/ib.2012.42018

FDI of Vietnam; Two-Way Linkages between FDI and GDP, Competition among Provinces and Effects of Laws

![]()

1School of Management, Huazhong University of Science and Technology, Wuhan, China; 2College of Economics, Hue University, Hue, Vietnam.

Email: chienkttdhh@yahoo.com

Received March 6th, 2012; revised March 19th, 2012; accepted April 8th, 2012

Keywords: FDI—Foreign Direct Investment; Economic Growth (GDP); Vietnam

ABSTRACT

This study focuses on problems related to foreign direct investment (FDI) in the North Central Area and South Central Coast of Vietnam in the period from 2000 to 2010, they consist of bidirectional relationship between foreign direct investment and economic growth (GDP), competition among provinces and effects of laws in attracting FDI. By using panel data and Ordinary Least Square (OLS) Method. Empirical analysis results found that: 1) There is a strong bidirectional relationship between FDI and GDP in this area of Vietnam. Both FDI and GDP also contributed significantly and positively in explaining each other in the provinces which was extremely difficult socio-economic conditions, however this is especially accurate in provinces having better conditions such as Da Nang city; 2) There is no strong competition between provinces in attracting FDI, provinces having better governance in economics attracted less registered FDI; 3) Ability to access information and infrastructure quality of provinces affects significantly and positively to attract FDI in this region; 4) After promulgating Common Investment Law as well as Unified Enterprises Law in 2005 and Vietnam joined the World Trade Organization (WTO) in 2007, the amount of registered FDI capital has increased rapidly in provinces of North Central Region and South Central Coast—Vietnam.

1. Introduction

Only a short time after the period of renovation, Vietnam has made considerable progress in all fields, especially on the field of attraction of foreign direct investment (FDI). It is quite successful for Vietnam to be rated as the most attractive FDI emerging market by the economic research center—Economist Intelligence Unit (EIU), second only to Brazil, Russia, India and China. This capital has a strong impact on the socio-economic development of Vietnam in general and in provinces of the North Central region and the South Central Coast in particular. The relationship between foreign direct investment and economic growth has been an issue of intense argument for many past years. However, there are not many empirical studies of this topic in Vietnam compared to other countries in the world. According to recently study in Vietnam. They found that there is a bidirectional relationship between FDI and GDP in Vietnam in the period from 1995-2005 but this is not the case for each and every region of Vietnam, in which include North Central Region and South Central Coast [1]. So the question is raised as “Whether is there a significantly bidirectional relationship between FDI and GDP in this region of Vietnam in the period from 2000-2010”?

North Central Region and South Central Coast is the area having quite difficult socio-economic conditions, including 13 provinces and one city directly under Central. This region stretches from North to South on the map of Vietnam with characteristics as one face borders Highlands, Laos and Cambodia, another face borders the East Sea. Therefore, provinces in this region have advantages and certain difficulties. Besides being get more benefits from the abundant resources of East Sea, this area also frequently suffers severe consequences of natural disasters such as hurricanes, floods and so on. The frequent natural disasters caused a large effect on the process of socio-economic development, resident life and especially domestic and foreign investment attraction, However, statistics show that in recent years, FDI tends to grow strongly and account for a relatively large proportion compared to the whole country. Though, there is no equal in allocating the fund among the provinces in this area. Therefore, “whether there is strong competition among provinces of this region in attracting FDI or not”? And “what factors strongly affect on the ability to attract FDI of the provinces in the above area”? Another aspect is the law. After joining the World Trade Organization (WTO), Vietnam has also amended and promulgated several new Laws in order to match the trend of integration and international practice, such as a Unified Enterprise Law and Common Investment Law (2005). So that, the question is raised as “whether the changes of Vietnamese Laws affect the attraction of FDI in the provinces of this area or not”? Those are the main problems this study needs to solve.

2. Literature Review

Relationship between FDI and economic growth has been studied by many researchers all over the world so far. By many different approaches to the study of the relationship between FDI and GDP, they have conducted studies not only within one nation but also in other regions or continents. Authors have made conclusions consistently with each other, but conclusions of others are not the same even contradictory.

According to [2] concluded that mutually reinforcing two-way linkage between FDI and economic growth exists in Vietnam. FDI effects directly and positively on GDP in the period 1996-2005 and its impacts on economic growth in Vietnam will be larger if more resources are invested in education and training, financial market development and in reducing the technology gap between the foreign and local firms. Agreeing with this verdict, [3] also indicated that there is a bidirectional relationship between FDI and GDP in Vietnam. When examines the bi-directional connection between FDI and economic growth in Cameroon for the period 1980-2009. [4] confirmed that the positive link between FDI and economic growth and external resources are more efficient than domestic investment for economic growth. By using time-varying coefficients in an augmented production function and let FDI indirectly affect GDP growth through labor productivity. [5] shown that FDI has significant and positive effect economic growth in Vietnam, but the effect is not equally distributed among economic sectors.

By using the panel data model across 61 provinces of Vietnam in the period 1995-2006. [6] shown that there is a strong and positive effect of FDI on economic growth in Vietnam. [7] proved that FDI contribution to growth was estimated to be about 7% out of 37% of total capital contribution to growth in the period 1988-2002. FDI has the positive relation with domestic investment and economic growth and FDI generates both significantly positive short-run and long-run impacts on economic growth in Vietnam. [8] explored the hypothesis that foreign direct investment can promote growth in developing countries and he indicated that FDI has positive and significant effect on economic growth in 85 developing countries covering Asia, Africa, and Latin America and the Caribbean for the period 1980-2007. [9] found that the growth effects of FDI increase when we account for the quality of FDI.

To study the relationship between FDI and economic growth in Malaysia for the period 1970-2005 by using time series data. They showed that there is a significant relationship between economic growth and FDI in Malaysia. FDI has direct positive impact on GDP, which FDI rate increase by 1% will lead to the growth rate increase by 0.046072% [10]. Based on the statistical data of 2000-2008 year, covering 31 provinces of panel data, to analyze and estimate the relationship between FDI and the provincial gross domestic product growth rate. [11] found that FDI inflows on regional economic growth greatly influence an increase of 1 percentage point per input, it will promote economic growth of 4.8 percentage points. Increase in investment in fixed assets also promote the region’s Economic growth, an increase of 1 percentage point per input, it will promote economic growth by 1.2 percentage points.

According to [12] examining relationships between FDI and economic growth in Ireland. They indicated that FDI, domestic capital, and trade are statistically significant in both the long-run and the short-run, having positive effects on economic growth in this country. They also found that there is a bi-directional Granger causality between GDP and FDI, therefore FDI-led growth. By raising question as whether the effect of FDI on economic growth of 62 countries covering the period from 1975 to 2000. [13] found that FDI alone plays an ambiguous role in contributing to economic growth. FDI have a positive and significant impact on growth when host countries have better levels of initial GDP and human capital. [14] study examines the possible impact and relationship between FDI and Economic Growth in Nigeria in the period 1987-2006. They concluded that there is a positive relationship between FDI and GDP, one Naira increase in the value of FDI will lead to Naira 104.749 increase in GDP. Examining the causal relationship between FDI and economic growth for three developing countries the period 1969-2000, namely Chile, Malaysia and Thailand, based on the Toda-Ya-mamoto test for causality. [15] found that GDP is causes FDI in the case of Chile and not vice versa, while for both Malaysia and Thailand, there is a strong evidence of a bi-directional causality between FDI and GDP. Concurrence with this notion, [16] found that no robust link between FDI and growth in Sri Lanka. By empirical investigating the relationship between U.S. foreign direct investments and economic growth in the 4 ASEAN countries of Malaysia, Indonesia, Thailand, and the Philippines. [17] shown that a negative relationship exists between the 4 ASEAN countries’ economic growth and the US foreign direct Investments. FDI can be growth enhancing, if it complements domestic investment.

To examine the relationship between FDI and economic growth in Shanxi (China), [18] showed that FDI played a certain role but not the main character in promoting economic growth, expansion of foreign direct investment scale could promote economic growth. There is only a single-directional causality from FDI to domestic investment and to economic growth but there is a bi-directional causality between domestic investment and economic growth in China for the period 1988-2003 [19]. By investigating the effect of FDI on economic growth by employing the data of 132 countries for the period from 1995 to 2008. [20] found that although FDI alone does not promote economic growth, it has asignificant effect on economic growth if the interactionterm between FDI and corruption is considered. [21] examines the long-run impact of FDI and trade on economic growth in Ghana. They indicated the impact of FDI on growth to be negative. By examining the effectiveness of foreign aid, FDI, and economic freedom for selected 28 Asian countries for the period 1998-2007. [22] indicated that inflow of FDI and foreign aid were significant factors negatively affecting economic growth. [23] found that there is no strong evidence of a bi-directional causality and long-run relationship between FDI and economic growth. FDI has indirect effect on economic growth in Malaysia in the period 1970-2005. [24] confirmed an insignificant link between FDI and economic growth in Latin America.

3. Research Method

Descriptive and empirical analysis methods are used in this study. In order to solve these problems, assumptions as well as regression models in this study were based on previous researches in domestic and abroad. Then we collected secondary data, analyzed description and tested hypotheses by using Eviews Software. Gathering data table (panel data) of 154 samples collected in 14 provinces of the North Central region and South Central Coast of Vietnam in the period 2000-2010. In the regression models, i represents the provinces and t represents time.

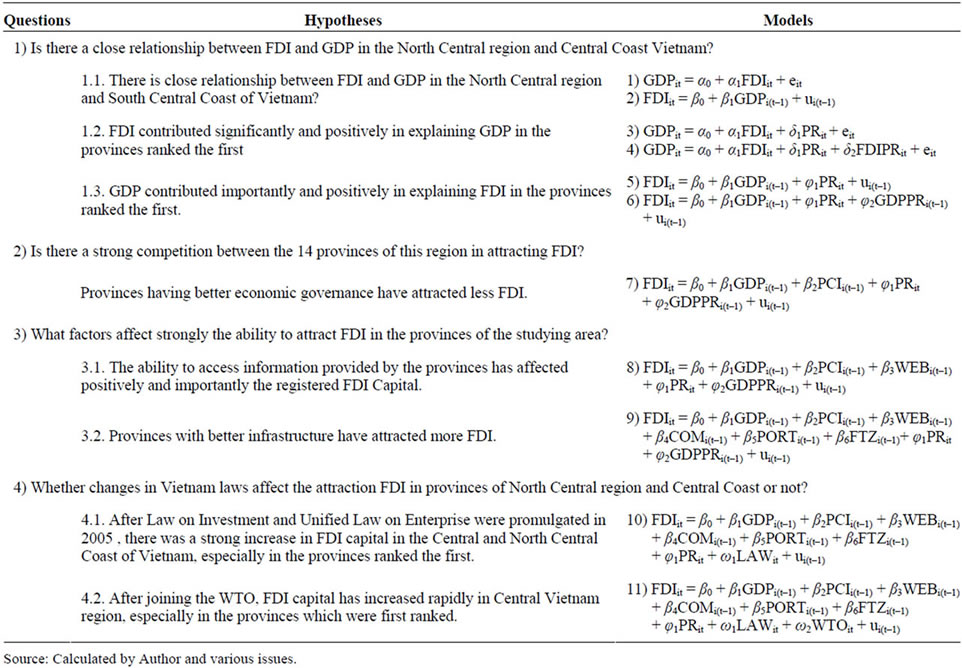

Table of variables definition is presented in Table 1.

4. Results of Empirical Research

4.1. Relationship between FDI and GDP in the North Central Area and South Central Coast

Using Least Squares Panel method to test hypothesis 1.1 (Table 2). Results show that there are a close two-way linkage between FDI and GDP in the Central North region and South Central Coast—Vietnam. When exclud-

Table 1. Definition of variables.

Table 2. Questions, hypotheses and research models.

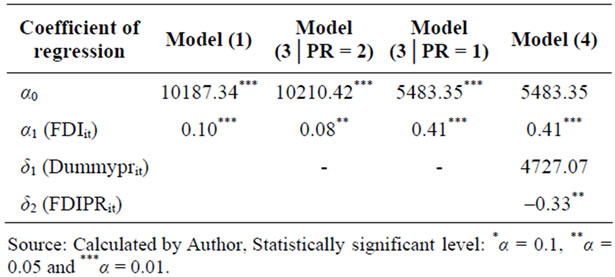

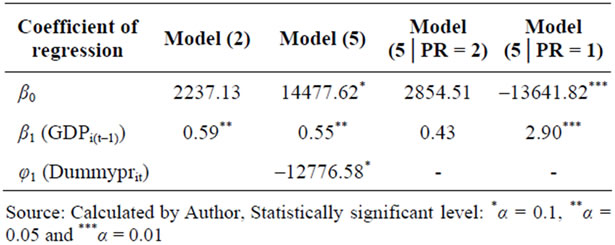

ing the impact of Periods, FDI is directly proportional to GDP at the 1% significance level (model 1, Table 3) and GDP is directly proportional to FDI at the 5% significance level (model 2, Table 4).

For the Hypothesis 1.2 (Table 2), FDI has contributed positively and significantly in explaining GDP in the provinces which was first ranked. However, this is especially accurate in the provinces having better condition (second ranked) such as Da Nang city. Among the 14 provinces of the North Central region and Central coast of Vietnam, there is no any provinces ranked 0, only one city first ranked is Da Nang city. Therefore, we set Dummypr variable = 1 if PR = 2; set Dummypr = 0 if PR = 1. (The higher value of Dummypr variable is, the more difficult the condition of these provinces). The quite different results were on the α0 vertical axis coefficients and α1 slope coefficients of the model (Table 3) when we compare models (model 3│PR = 2) and (model 3│PR = 1). Because the α0 coefficient decreases when Dummypr = 0 or PR = 1, there is a distinction between the two properties of qualitative variables, and that is at 1% statistically significant level. Because coefficients of αincreases when Dummypr = 0, there is a distinction between the two properties of quantitative variables and

Table 3. The effect of FDI on GDP in the studying area.

Table 4. The effect of GDP on FDI in the studying area.

that is at 1% statistically significant level. Thus, in provinces having difficult socio-economic conditions, foreign direct investment has contributed significantly and positively in explaining economic growth.

FDIPR variable (FDI × Dummypr) was added to the model (3) to test the difference in slope between two above model. Coefficient of δ2 is called the slope difference because it is the difference slopes between of two regression model. Testing statistical significance of this difference by assessing the significance level of statistical value for estimating of δ2. Because P-value of FDIPR variable is at 5% statistical significance level, it can be concluded that there are major differences in the interpretation GDP through FDI in provinces are differently ranked (model 4, Table 3). If Dummypr = 0, regression coefficient of FDI and GDP is 0.41 (at 1% statistically significant level). If Dummypr=1, regression coefficient of FDI and GDP is 0.41 – 0.33 = 0.08.

Thus, in the provinces having difficult socio-economic conditions such as Da Nang city, FDI explain GDP more powerfully and positively than provinces having those extremely difficult conditions. Testing hypotheses 1.3 (Table 2) through the models in Tables 4 and 5. The results show that GDP has contributed importantly and positively in explaining FDI in the provinces with extremely difficult socio-economic conditions (ranked first). However, this is especially accurate in local with better conditions (ranked second) such as Da Nang city.

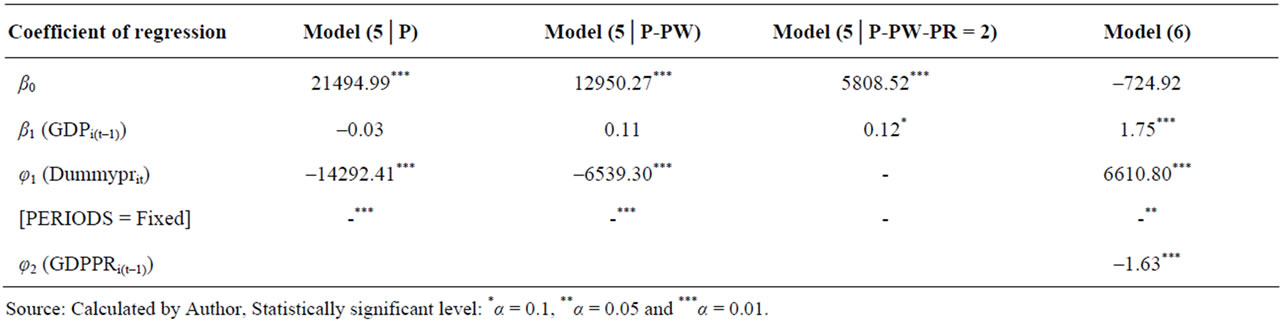

Although Dummypr variable indicates provinces with extremely difficult conditions have attracted less FDI than other localities (at 10% statistically significant level) as to whether or not to mention the influence of Periods, through the comparison coefficients of β0 with β1 of model (5) when Dummypr = 0 (PR = 1), the results obtained were opposite model (5│PR = 2), (5│PR = 1) in Table 4 and model (5│P-PW), (5│P-PW-PR = 2) in Table 5.

In order to draw conclusions, GDPPR variable (GDP x Dummypr) was added to the model (5│P-PW). φ2 coefficient is the slope difference. As P-value of GDPPR variable is at 1% statistically significant level (model 6, Table 5), it means that there are major differences in explaining FDI through GDP in the provinces ranked differently. If Dummypr = 0, correlation coefficient between GDP and FDI is 1.75 and this coefficient is at 1% statistically significant level. If Dummypr = 1, the correlation coefficient is 1.75 + 6610.80 = 6612.55. Therefore, in the localities which have difficult socio-economic conditions, GDP has explained FDI more considerably and actively in local which have those extremely difficult conditions.

4.2. Competition to Attract FDI in Studying Area

Model (7) is used to test the hypothesis “provinces having better economic management have attracted more FDI” (Table 1). Index of PCI shows the economic management capability of provinces. Using the method of Least Squares Panel (Fixed Period, Period Weight, White Diagonal) to test this hypothesis. The results were not as expected because PCI index is inversely proportional to FDI. Thus, the higher PCI index of provinces less FDI attracted in the period 2001-2010, besides, coefficient of PCI wasn’t any statistical significance in explaining FDI (Table 6).

4.3. Factors Affecting the Ability to Attract FDI in the Studying Area

Using the method of Least Squares Panel (Fixed Period, Period Weight, White Diagonal) to test the hypothesis 3.1 through (model (8), Table 2) The results were not as expected because of the ability to access information provided by the provinces (WEB) is inversely proportional to the amount of registered FDI capital (WEB P-value = 0.0012 < 0.05, so it is very significant in explaining FDI). The higher ability of providing information on website of the provinces is the lower the amount of registered FDI capital.

Similarly, testing Hypothesis 3.2, the result obtained is that provinces with higher infrastructure quality (more Airports, Sea ports and more Free Trade Zones), the registered capital of FDI is higher. Telecommunications factor has also effected positively on FDI, but not statistically significant. model (9) indicates that all 3 variables of COM, PORT, and FTZ have a positive impact on FDI as expected. Both two PORT and FTZ variables are at

Table 5. The effect of GDP on FDI in the studying area (including the impact of fixed periods).

Table 6. Factors affecting the ability to attract FDI in the studying area.

1% and 5% statistically significant levels in explaining FDI value, respectively.

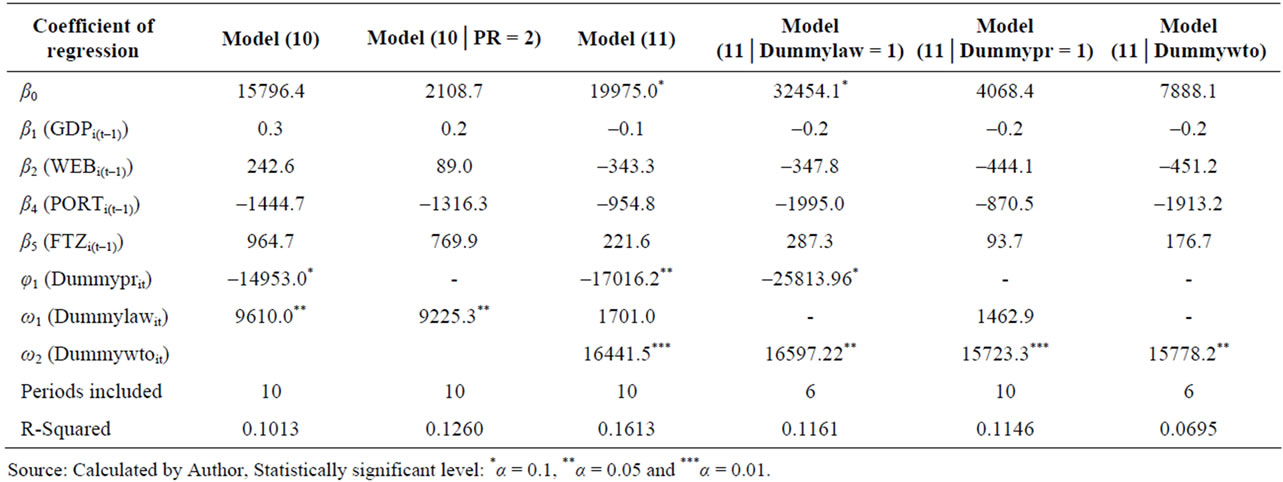

4.4. Impact of Law in Attracting FDI in the Studying Area

The model (10) is used to test the hypothesis 4.1 (Table 2). The results (Table 7) showed that after Common Investment Law and Unified Enterprise Law promulgated in 2005, the amount of registered FDI capital grew up rapidly in the North Central region and South Central Coast—Vietnam but no evidence indicates that the these influences were stronger in the provinces having extremely difficult socio-economic conditions (ranked first). Comparison of model 10 with (10│PR = 2), when Dummypr = 1, y-axis coefficient of β0 reduced, so there was a distinction between two properties of the qualitative variables, but this distinction is not at 10% statistically significant level. Slope coefficient of ω1 reduced so that there was distinction between two properties of quantitative variables and this distinction is at 5% statistically significant level.

Thus, promulgation of the Common Investment Law and Unified Enterprise Law has effected very positively on FDI. However, in the provinces having extremely difficult socio-economic conditions, the impact decreased from 9610.0 to 9225.3, but it is still at the 5% statistically significant level.

The model (11) is used to test the hypothesis 4.2 (Table 7). Results showed that after joining WTO in 2005, the registered FDI capital of Vietnam has strong growth in provinces of the North Central region and South Central Coast-Vietnam. However, no evidence indicates that the effect of WTO accession on FDI in provinces with extremely difficult socio-economic conditions was stronger than in the provinces with those better conditions. Dummywto variables have a positive impact on FDI as expected in all 3 models (model 11│Dummylaw = 1), (11│ Dummypr = 1), (11│Dummywto).

Besides, all the coefficients are statistically significant. Thus, after Vietnam joined WTO, the amount of registered FDI capital has strong growth in the North Central region and South Central Coast of Vietnam. When Dummypr = 1, the impact of WTO accession on FDI went down but it is still at 1% statistically significant level. When Dummypr = 1 in the period 2005-2010 (Common Investment Law and Unified Enterprise Law was born Dummylaw = 1), WTO accession’s impacts (2007-2010) on attracting FDI increased over the period 2005-2006, the corresponding coefficient is 15778.2 > 15723.3 and at 5%s statistically significant level (Table 7).

5. Conclusion

By Panel Least Squares Method, data set consist of 154 samples collected in 14 provinces in studying region in

Table 7. The impact of law on attracting FDI in the studying area.

the period from 2000-2010, hypotheses were tested by the statistical models, respectively. This paper found that; FDI and GDP in the North Central region and South Central Coast of Vietnam have close relationship with each other. Both FDI and GDP have contributed importantly and positively in the interpretation of each other in the provinces having extremely difficult socio-economic conditions, but this is especially true in localities with better socio-economic conditions such as Da Nang city. Besides, there is no strong competition between the provinces of North Central region and South Central Coast of Vietnam because provinces having PCI index higher have attracted less FDI in the period 2001-2010. Other factors as ability to provide information on the website and the quality of infrastructure impact strongly on attracting FDI of provinces in the North Central region and South Central Coast—Vietnam. After the Common Investment Law and Unified Enterprise Law promulgated in 2005 and Vietnam joined the WTO in 2007, the amount of registered FDI capital grew up strongly in this region.

REFERENCES

- S. Anwar and L. P. Nguyen, “Foreign Direct Investment and Economic Growth in Vietnam,” Research in International Business and Finance, Vol. 25, No. 1, 2011, pp. 39-52. http: //www.elsevier.com/locate/ribaf

- L. P. Nguyen, “Foreign Direct Investment and Its linkage to Economic Growth in Vietnam: A Provincial Level Analysis,” Centre for Regulation and Market Analysis, University of South Australia, Adelaide, 2006.

- P. Srinivasan, M. Kalaivani and P. Ibrahim, “FDI and Economic Growth in the ASEAN Countries: Evidence from Cointegration Approach and Causality Test,” Journal of Management Research, Vol. 9, No. 1, 2010, pp. 38-63.

- Z. K. Kang, “Foreign Direct Investment and Economic Growth in Cameroon,” The 2nd IEEE International Conference on Information Management and Engineering, Chengdu, 16-18 April 2010, pp. 235-237.

- T. B. Vu, “Foreign Direct Investment and Endogenous Growth in Vietnam,” Applied Economics, Vol. 40, No. 9, 2008, pp. 1165-1173. doi:10.1080/00036840600749433

- T. T. Hoang, “Does Foreign Direct Investment Promote Economic Growth in Vietnam?” ASEAN Economic Bulletin, Vol. 27, No. 3, 2010, p. 295.

- L. V. Anh, “FDI-Growth Nexusin Vietnam,” School of International Development, Nagoya University, Nagoya, 2003.

- E. M. Ekanayake and J. R. Ledgerwood, “How Foreign Direct Investment Affect Growth in developing countries? An Empirical Investigation,” International Journal of Business and Finance Research, Vol. 4, No. 3, 2010, pp. 43-53.

- L. Alfaro and A. Charlton, “Growth and the Quality of Foreign Direct Investment: Is All FDI Equal?” Conference on New Perspectives on Financial Globalization Research Department, Washington DC, 26-27 April 2007, p. 44.

- H. W. Mun, T. K. Lin and Y. K. Man, “FDI and Economic Growth Relationship: An Empirical Study on Malaysia,” International Business Research, Vol. 1, No. 2, 2008, pp. 11-18.

- Z. L. Ma, “Regional Economic Growth in China and the Relationship between Foreign Direct Investment Inflows: Based on 1998-2008 Panel Data,” International Conference on Business Management and Electronic Information, Vol. 4, 2011, pp. 301-303.

- K. Kyuntae and B. Hokyung, “The Impact of Foreign Direct Investment on Economic Growth: A Case Study of Ireland,” KIEP Working Paper, Korea Institute for International Economic Policy, Seoul, 2008, pp. 1-56.

- J. Y. Wu and C. C. Hsu, “Does Foreign Direct Investment Promote Economic Growth? Evidence from a Threshold Regression Analysis,” Economics Bulletin, Vol. 15, No. 12, 2008, pp. 1-10,

- E. O. Oyatoye, K. K. Arogundade, S. O. Adebisi and E. Oluwakayode, “Foreign Direct Investment, Export and Economic Gsrowth in Nigeria,” Journal of Humanities and Social Sciences, Vol. 2, No. 1, 2011, pp. 66-86.

- Chowdhury and G. Mavrotas “FDI and Growth: A Causal Relationship,” Research Paper, No. 2005/25, United Nationals University, Tokyo, 2005.

- P. P. A. Wasantha Athukorala, “The Impact of Foreign Direct Investment for Economic Growth: A Case Study in Sri Lanka,” 9th International Conference on Sri Lanka Studies, 28-30 November 2003, pp. 1-21.

- K. Nwala, “The Relationship between US Direct Investments and Economic Growth in Some Selected Asian Countries,” North American Journal of Finance and Banking Research, Vol. 2, No. 2, 2008, p. 13.

- S. B. Wang and Z. M. Wang, “Analysis on Relationship between FDI and Economic Growth in Shaanxi Based on OLS Model,” 3rd International Conference on Information Management, Innovation Management and Industrial Engineering, Kunming, 26-28 November 2010, pp. 194-196.

- S. M. Tang, E. A. Selvanathan and S. Selvanathan “Foreign Direct Investment, Domestic Investment, and Economic Growth in China: A Time Series Analysis,” Research Paper, No. 2008/19.

- K. Okada and S. Samreth, “How Does Corruption Influence the Effect of Foreign Direct Investment on Economic Growth?” MPRA Paper, No. 27572, 2010.

- F. J. Magnus and O. A. E. Fosu, “Bounds Testing Approach: An Examination of Foreign Direct Investment, Trade, and Growth Relationships,” MPRA Paper, No. 352, 2007.

- A. K. Tiwari, “Foreign Aid, FDI, Economic Freedom and Economic Growth in Asian Countries,” Global Economy Journal, Vol. 11, No. 3, 2011, Article ID: 4.

- M. S. Karimi and Z. Yusop, “FDI and Economic Growth in Malaysia,” MPRA Paper, No. 14999, 2009. http: //mpra.ub.uni-muenchen.de/14999/

- P. Nunnenkamp and J. Spatz, “Foreign Direct Investment and Economic Growth in Developing Countries: How Relevant Are Host-Country and Industry Characteristics,” Kiel Working Paper, Kiel Institute for World Economics, No. 1176, 2003.