Theoretical Economics Letters

Vol.06 No.06(2016), Article ID:72731,11 pages

10.4236/tel.2016.66121

Financial Integration and Portfolio Diversification: Evidence from CIVETS Stock Markets

Kashif Saleem1, Osama Al-Hares1, Sheraz Ahmed2

1Faculty of Business, Department of Finance and Accounting, University of Wollongong in Dubai, Dubai, United Arab Emirates

2School of Business and Management, Lappeenranta University of Technology, Lappeenranta, Finland

Copyright © 2016 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: November 2, 2016; Accepted: December 11, 2016; Published: December 14, 2016

ABSTRACT

This paper investigates the extent of financial integration among a new group of six frontier markets called “CIVETS” by utilizing the multivariate GARCH framework of Engle and Kroner [1] . These countries are expected to show sustainable growth in productivity and domestic consumption over the next decade and are considered as potential corridor for the international investor from portfolio diversification point of view. We utilize weekly stock market return series of all the CIVIETS nations, and results exhibit significant return and volatility spillovers among all the markets under investigation. Our results reveal that there are significant linkages among CIVETS stock markets during the time of our analysis. However, the direction of relationship is asymmetric depending on the countries in the model. We believe, CIVIETS stock markets have full potential of being the future investment targets worldwide.

Keywords:

GARCH-BEKK, Volatility Spillovers, Contagion, CIVETS Equity Markets, Portfolio Diversification

1. Introduction

In 2001, Jim O’Neill of Goldman Sachs coined the term BRIC in his report “Building Better Global Economic BRICs”. Since then an emerging market boom has been witnessed and in particular, this block of four largest developing economies of the world has attracted most of the annual investment flows. However, the early mover advantage for investing in BRICs―Brazil, Russia, India and China which was present since the introduction of these emerging markets block, seems to be mitigating over time.

Recently, another block of such economies emerged to the investment scene when Mr. Robert Ward of Economic Intelligence Unit coined the acronym CIVETS consisting of six countries namely Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa. These countries not only provide diversity in terms of geographical location but also share some common aspects such as political stability (especially when compared to previous generations), young populations that focus on education and overall growing economic trends. We believe that despite of economic and political turmoil that may have increased the country level risks for investments all over the world, the diversification opportunities that this block of new frontier markets provides have not declined. These countries are expected to show sustainable growth in productivity and domestic consumption over the next decade. Moreover the CIVETS are not heavily dependent on external demand as compared to BRICs. Therefore, studying the financial integration and portfolio diversification among CIVETS is an essential step forward towards future investment opportunities.

Globally, the CIVETS have become a new arena for financial linkages and stock market integration academic research, besides being a topic for global business discussion. There has been widespread stream of literature on the financial markets of individual CIVETS countries along with emerging markets of different regions of the world1, however, the research on inter-linkages of these markets in cross-market settings among CIVETS is almost non-existent. Recently, Korkmaz et al. [15] , using the Granger-Cheung-Ng-Hong causality tests for mean and variance of weekly stock market returns, have studied the return and volatility spillovers among CIVETS stock markets and found generally lower contemporaneous spillover effects among countries. They utilized and saw rather weak evidence of inter- or intra-regional interdependencies effects. Only 10 of the possible 30 country pair-wise directional casual relationships were found to be statistically significant. There is no further study found on the intra-market linkages of these six economies2.

We use the multivariate GARCH framework of Engle and Kroner [1] of time-varying volatility to determine the intra-market linkages of return and volatility among CIVETS markets. Both return and volatility linkages are tested in bivariate setting where bi-di- rectional relationship of return and time-varying volatility is analyzed. The diversity in the geographical location and other trade and economic factors among CIVETS countries implies no relationship among each other because there is no significant commonalities and trade among these countries. However, since the introduction of the acronym “CIVETS” has been widely used in academic and investment circles around the world, the interest towards this block of frontier economies may have induced linkages among the stock markets due to generally high level of portfolio investments in these countries. Hence, we argue that our contribution is primarily empirical in nature and to provide the first hand evidence on the economic relationship among six emerging markets which have full potential of being the future investment targets worldwide. Our results reveal that there are significant linkages among CIVETS stock markets during the time period of our analysis. However, the direction of relationship is asymmetric depending on the countries in the model.

The rest of the paper is organized as follows: next section describes the specifications of model used in the analysis with a review of earlier studies. Section 3 provides a detailed outlook of the data and its descriptive characteristics. In Section 4, we present and discuss the results of the empirical analysis. Section 5 outlines the diagnostic tests to verify the results and finally Section 6 concludes the paper.

2. Model Specification

The Autogressive Conditional Heteroscedasticity (ARCH) process proposed by Engle [16] and the generalized ARCH (GARCH) by Bollerslev [17] are well known in volatility modelling of stock returns. In examining volatility linkages between countries, however, a multivariate GARCH approach is preferred over univariate settings.

We start our empirical specification with a bivariate VAR-GARCH (1, 1) model that accommodates each market’s returns and the returns of other markets lagged one period3.

(1)

(1)

(2)

(2)

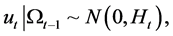

where rt is an n × 1 vector of weekly returns at time t for each market. The n × 1 vector of random errors mt represents the innovation for each market at time t with its corresponding n × n conditional variance-covariance matrix Ht. The market information available at time t − 1 is represented by the information set Wt−1. The n × 1 vector, α, represents the constant. The own market mean spillovers and cross-market mean spillovers are measured by the estimates of matrix b elements, the parameters of the vector autoregressive term. This multivariate structure thus facilitates the measurement of the effects of innovations in the mean stock returns of one series on its own lagged returns and those of the lagged returns of other markets.

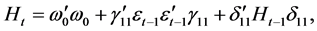

Given the above expression, and following Engle and Kroner [1] , the conditional covariance matrix can be stated as:

(3)

(3)

where the parameter matrices for the variance equation are defined as w0, which is restricted to be lower triangular and two unrestricted matrices g11 and δ11. Thus, the second moment can be represented by:

. (4)

. (4)

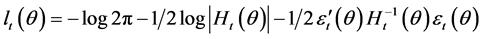

Following Engle and Kroner [1] the above system can be estimated by the maximum likelihood estimation which can be optimised by using the Berndt, Hall, Hall and Hausman (BHHH) algorithm. From Equation (4) we obtain the conditional log likelihood function L(q) for a sample of T observations:

(5)

(5)

, (6)

, (6)

where q denotes the vector of all the unknown parameters. Numerical maximisation of Equation (4) yields the maximum likelihood estimates with asymptotic standard errors.

Finally, to test the null hypothesis that the model is correctly specified, or equivalently, that the noise terms, mt, are random, the Ljung-Box Q-statistic is used. It is assumed to be asymptotically distributed as χ2 with (p − k) degrees of freedom, where k is the number of explanatory variables.

3. Data and Descriptive Statistics

The data comprise weekly price indices for the countries under investigation. More precisely, we use COLOMBIA IGBC INDEX for Colombia, IDX COMPOSITE index for Indonesia, HO CHI MIN VSE index for Vietnam, EGYPT EGX 30 for Egypt, and ISTANBUL SE NATIONAL 100 for Turkey and for South Africa, we utilize FTSE/JSE ALL SHARE. The dataset starts from July 2001 and ends at December 2013, yielding 652 weekly observations in total for each series. All the data are retrieved from DataStream. Weekly returns are constructed as the first difference of logarithmic prices multiplied by 100. Table 1 presents a wide range of descriptive statistics for the seven series under investigation. As a first step, stationarity in the time series is checked by applying the Augmented Dickey Fuller (ADF) test. The results (Table 1) allow us to reject the null hypothesis that returns have unit root in favor of alternate hypothesis of stationarity (even at 1% MacKinnon critical value). The development of equity market indices shown in Figure 1 clearly exhibits non-stationarity.

The first two moments of the data, i.e., mean and standard deviation, are multiplied by 52 and the square root of 52 to show them in annual terms. As one would anticipate, most of the markets offer high returns, Colombia and Egypt seems to be the most favorite investments, offering 20% and 19% returns per annum respectively, Indonesia, Turkey and South Africa offer 18%, 14% and 13% respectively while Vietnam found as the least interesting market with an annualized market return of just 0.22%. However, the high returns are associated with high risk (standard deviations) as well. All the markets under investigation found to be highly risky ranging from South Africa (lowest) at 20% to Turkey (highest) at 33% standard deviation. All the return series are, without exception, highly leptokurtic and exhibit strong negative skewness. This suggests the presence of asymmetric trends towards negative values. To check the null hypothesis of normal distribution, we calculated the Jarque-Bera test statistic and reject the null of normality in all cases.

Table 1. Descriptive statistics.

Figure 1. Index values of CIVETS markets for the period July 2001-December 2013.

Since we are using a GARCH process to model variance in asset returns, we also test for the presence of the ARCH effect. Table 1 reports values for the ARCH LM-statistic (five lags) on each returns series. The results show evidence of an autocorrelation pattern in both residuals and their squares. This suggests that GARCH parameterization could be appropriate for the conditional variance processes.

Panel A reports summary statistics of the logarithmic weekly returns of all six CIVETS stock markets. Panel B reports pairwise correlation coefficients among all markets returns. Sample period is from July 2001 to December 2013. The sample includes 652 weekly observations. Mean and standard deviation have been annualized. The p-value for the Jarque-Bera test statistic of the null hypothesis of normal distribution is provided in the table.

4. Empirical Results

Our empirical results answer the theoretical questions formulated in the previous sections. First, to examine the return and volatility transmission of CIVETS stock markets, fifteen (15) pair-wise models are estimated utilizing bivariate GARCH frame work, for which a BEKK representation is adopted [1] .

The results obtained from bi-variate GARCH (1,1) with BEKK specifications [1] are summarized in Tables 2-4. We first look at matrix β in the mean equation, Equation (1), captured by the parameters βij and βji, in order to see the relationship in terms of returns across the countries and sectors in each pair. Parameters γij and γji, captures cross-market ARCH effects and parameters δij and δji measure own and cross-market GARCH effects. LB and LB2 presents the Ljung-Box Q-statistic for standardized and standardized squared residuals.

The results shown in Tables 2-4 represent there is no generalized pattern in terms returns and volatility spillovers among all CIVETS markets. Some of the markets are more integrated with other markets than others. The direction of return and volatility transmission is also different for each country. Country specific analysis shows that Colombian market receives return spillovers from Indonesia, Egypt, Turkey and South Africa but does not transmit any significant return spillovers to other CIVETS markets. However in terms of the shock transmission (ARCH effect), Colombian markets spill positive shocks to Indonesia, Egypt, Turkey and South Africa and receives positive shock transmission from Vietnam. In case of volatility spillovers (GARCH effect) Colombian market is again significantly connected to all other markets in lieu if bi-direc- tional volatility spillovers.

In case of Indonesian stock market, the returns and volatility spillovers are also significant with Colombia, Turkey, Egypt and South Africa. However, it neither transmits significant shocks to other markets nor receives shocks from others except Colombia. In case of volatility spillovers, Indonesian market shows a significant bi-directional relationship with only Colombia and South Africa. Vietnam seems to be the least integrated market among CIVETS. It mainly operates independent of the return and volatility spillovers from other markets within CIEVTS. Egypt seems to be more integrated with countries that have close trade ties with it i.e. Turkey and South Africa. Egyptian market sends positive return signals to Turkey but receives only negative spillovers. Similarly, Egyptian stock market sends and receives significant volatility spillovers to Turkey, South Africa and Colombia. Turkey is also important market in terms of the integration with CIVETS markets. The analysis shows that Turkish stock market has significant bi-directional ties with Egypt and uni-directional ties with Colombia, Indonesia and South Africa.

South African stock market is also closely integrated within CIVETS sending and receiving return and volatility spillovers to mainly Indonesia, Colombia, Turkey and Egypt. The respective parameters of return (β), shocks (γ) and volatility (δ) clearly show that all these CIVETS markets are more or less connected with each other except Vietnam.

Table 2. Return and volatility spillovers estimated from a bivariate VAR (1) - GARCH (1, 1)-BEKK model of weekly return indices.

The parameter β represents the return spillovers. The parameter matrices for the variance equation are defined as ω, which is restricted to be lower triangular and two unrestricted matrices γ, captures own and cross-market ARCH effects and δ measure own and cross-market GARCH effects. LB and LB2 presents the Ljung-Box Q-statistic for standardized and standardized squared residuals. (*) denotes the significance level at 10%, (**) denotes the significance level at 5%.

Table 3. Return and volatility spillovers estimated from a bivariate VAR (1) - GARCH (1, 1)-BEKK model of weekly return indices.

The parameter β represents the return spillovers. The parameter matrices for the variance equation are defined as ω. which is restricted to be lower triangular and two unrestricted matrices γ. captures own and cross-market ARCH effects and δ measure own and cross-market GARCH effects. LB and LB2 presents the Ljung-Box Q-statistic for standardized and standardized squared residuals. (*) denotes the significance level at 10%. (**) denotes the significance level at 5%.

5. Diagnostic Tests

We also estimate the Ljung-Box Q-statistic used to test the null hypothesis that the model is correctly specified, or equivalently, that the noise terms are random. We calculate both standardized and standardized squared residuals up to lag 24 for each modelled pair. Results show (not reported) no series dependence in the squared standardized residuals, indicating the appropriateness of the GARCH?BEKK model.

6. Summary and Conclusions

In this paper we have examined the return and volatility spillovers among a new group of six frontier markets called “CIVETS”. We analyze the inter-market linkages in a more advanced setting. We use a Generalized Autoregressive Conditional Heteroske-

Table 4. Return and volatility spillovers estimated from a bivariate VAR (1) - GARCH (1, 1)- BEKK model of weekly return indices.

The parameter β represents the return spillovers. The parameter matrices for the variance equation are defined as ω. which is restricted to be lower triangular and two unrestricted matrices γ. captures own and cross-market ARCH effects and δ measure own and cross-market GARCH effects. LB and LB2 presents the Ljung-Box Q-statistic for standardized and standardized squared residuals. (*) denotes the significance level at 10%. (**) denotes the significance level at 5%.

dacity (GARCH) models namely BEKK model (in a VAR-GARCH setting) of time-va- rying volatility to determine the inter-market linkages of return and volatility among CIVETS markets. Both return and volatility linkages are tested in bi-variate setting where bi-directional relationship of return and time-varying volatility is analyzed.

Our results show that after controlling for world market impacts on thesis markets, there are still inter-market linkages among CIVETS stock markets. Although there is no evidence of mutually consistent spillovers over the period of time, the geographical proximity increases the chances of spillovers of returns and time-varying volatility in these markets. Geographical location and the stage of economic development of these markets seem to be important determinants of stock market linkages.

These findings suggest that the portfolio investors who invest in emerging and frontier markets for better returns should take into account the correlation of risk and returns among CIVETS stock markets. The diversification benefits should be assessed keeping in view the extent of inter-market linkages of Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa.

Acknowledgements

We are grateful for the comments from the participants at 13th Eurasia Business and Economic Society, Conference in Istanbul, Turkey. An earlier version has been published in the conference proceedings of Eurasia Business and Economic Society.

Cite this paper

Saleem, K., Al-Hares, O. and Ahmed, S. (2016) Financial Integration and Portfolio Diversification: Evidence from CIVETS Stock Markets. Theoretical Economics Letters, 6, 1304-1314. http://dx.doi.org/10.4236/tel.2016.66121

References

- 1. Engle, R.F. and Kroner, K.F. (1995) Multivariate Simultaneous Generalized ARCH. Econometric Theory, 11, 122-150.

https://doi.org/10.1017/S0266466600009063 - 2. Abdul Karim, B., Abdul Majid, M.S. and Abdul Karim, S.A. (2009) Financial Integration between Indonesia and Its Major Trading Partners. MPRA Munich Personal RePEc Archive Paper No. 17277.

http://mpra.ub.uni-muenchen.de/17277 - 3. Aggarwal, R., Inclan, C. and Leal, R. (1999) Volatility in Emerging Markets. Journal of Financial and Quantitative Analysis, 34, 33-55.

https://doi.org/10.2307/2676245 - 4. Alagidede, P. and Panagiotidis, T. (2009) Modelling Stock Returns in Africa’s Emerging Equity Markets. International Review of Financial Analysis, 18, 1-18.

https://doi.org/10.1016/j.irfa.2009.02.001 - 5. Alkulaib, Y.A., Najand, M. and Mashayekh. A. (2009) Dynamic Linkages among Equity Markets in the Middle East and North African Countries. Journal of Multinational Financial Management, 19, 43-53.

https://doi.org/10.1016/j.mulfin.2008.03.002 - 6. Angelidis, T. (2010) Idiosyncratic Risk in Emerging Markets. The Financial Review, 45, 1053-1078.

https://doi.org/10.1111/j.1540-6288.2010.00285.x - 7. Baur, D.G. and Fry, R.A. (2009) Multivariate Contagion and Interdependence. Journal of Asian Economics, 20, 353-366.

https://doi.org/10.1016/j.asieco.2009.04.008 - 8. Chancharoechai, K. and Dibooglu, S. (2006) Volatility Spillovers and Contagion during the Asian Crisis. Emerging Markets Finance and Trade, 42, 4-17.

https://doi.org/10.2753/REE1540-496X420201 - 9. Chang, H.L. and Su, C.W. (2010) The Relationship between the Vietnam Stock Market and Its Major Trading Partners—TECM with Bivariate Asymmetric Garch Model. Applied Economics Letters, 17, 1279-1283.

https://doi.org/10.1080/00036840902881892 - 10. Click, R.W. and Plummer, M.G. (2005) Stock Market Integration in ASEAN after the Asian Financial Crisis. Journal of Asian Economics, 16, 5-28.

https://doi.org/10.1016/j.asieco.2004.11.018 - 11. Edwards, S. and Susmel, R. (2001) Volatility Dependence and Contagion in Emerging Equity Markets. Journal of Development Economics, 66, 505-532.

https://doi.org/10.1016/S0304-3878(01)00172-9 - 12. Evans, T. and McMillan, D.G. (2009) Financial Co-Movement and Correlation: Evidence from 33 International Stock Market Indices. International Journal of Banking Accounting and Finance, 1, 215-241.

https://doi.org/10.1504/IJBAAF.2009.022711 - 13. Fernandez, V. (2006) The Impact of Major Global Events on Volatility Shifts: Evidence from the Asian Crisis and 9/11. Economic Systems, 30, 79-97.

https://doi.org/10.1016/j.ecosys.2005.09.004 - 14. Gebka, B. and Serwa, D. (2007) Intra- and Inter-Regional Spillovers between Emerging Capital Markets around the World. Research in International Business and Finance, 21, 203-221.

https://doi.org/10.1016/j.ribaf.2006.03.005 - 15. Turhan, K., Emrah, I.C. and Erdal, A. (2012) Return and Volatility Spillovers among CIVETS Stock Markets. Emerging Markets Review, 13, 230-252.

https://doi.org/10.1016/j.ememar.2012.03.003 - 16. Engle, R.F. (1982) Autoregressive Conditional Heteroskedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica, 50, 987-1007.

https://doi.org/10.2307/1912773 - 17. Bollerslev, T. (1986) Generalized Autoregressive Conditional Heteroskedasticity. Journal of Econometrics, 31, 307-327.

https://doi.org/10.1016/0304-4076(86)90063-1

NOTES

1See for example, Karim et al. [2] , Aggarwal et al. [3] , Alagidede & Panagiotidis [4] , Alkulaib et al. [5] , Angelidis [6] , Baur & Fry [7] , Chancharoechai & Dibooglu [8] , Chang & Su [9] , Click & Plummer [10] , Edwards & Susmel [11] , Evans & McMillan [12] , Fernandez [13] , Gebka & Serwa [14] .

2A search made on http://www.repec.org/ with keyword “CIVETS” returned only 2 relevant studies (including Korkmaz et al. 2012) as of 9 October 2014.

3This model is based on the bivariate GARCH (1, 1)-BEKK representation proposed by Engle and Kroner [1] .