Theoretical Economics Letters

Vol.06 No.03(2016), Article ID:67088,6 pages

10.4236/tel.2016.63048

Weighted Bootstrap Approach for the Variance Ratio Tests: A Test of Market Efficiency

Dilip Kumar

Indian Institute of Management Kashipur, Kashipur, India

Copyright © 2016 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 30 March 2016; accepted 31 May 2016; published 3 June 2016

ABSTRACT

By means of Monte Carlo experiments using the weighted bootstrap, we evaluate the size and power properties in small samples of Chow and Denning’s [1] multiple variance ratio test and the automatic variance ratio test of Choi [2] . Our results indicate that the weighted bootstrap tests exhibit desirable size properties and substantially higher power than corresponding conventional tests.

Keywords:

Monte Carlo Experiment, Weighted Bootstrap, Variance Ratio, Return Predictability

1. Introduction

The foundation of the efficient market hypothesis lies in the ground-breaking works of Bachelier [3] , Cootner [4] , Samuelson [5] and Fama [6] . According to the efficient market hypothesis, the current level of the asset price fully reflects all available information, so no extraordinary gain can be made with publicly available information which directly points to random walk or martingale hypothesis. The study of the efficiency characteristics of the market impacts the regulatory framework, as well as the evolution of the market in terms of transparency and disclosures. It has policy implications which can help policy makers and regulators take steps towards financial innovations and economic development.

The existing literature provides several methods to investigate whether a given time series is a martingale or not. The variance ratio test is one of the most commonly employed procedures to study this property of the time series. The Lo and Mac Kinlay’s [7] individual variance ratio test and its multiple variance ratio variant, as proposed by Chow and Denning [1] , are widely used to test the martingale behaviour of the time series. These tests are asymptotic in nature and so can give rise to misleading results in small samples. Choi [2] proposes the automatic variance ratio test, spectral domain tests and average exponential tests to test the weak form efficiency of US real exchange rates. Wright [8] proposes a nonparametric variance ratio test based on the ranks and signs and Belaire-Franch and Contreras [9] use the principle of Chow and Denning’s [1] approach on Wright’s [8] individual rank and sign tests and develop joint nonparametric variance ratio tests.

In this paper, the weighted bootstrap procedure is proposed as an alternative to improve the small sample properties of the Chow and Denning [1] multiple variance ratio test and also the automatic variance ratio test. The weighted bootstrap is a resampling procedure which is applicable to data with conditional heteroskedasticity and provides a better approximation to the sampling distribution of the statistics concerned.

Section 2 presents the methodology used in this study. Section 3 presents the results of the Monte Carlo experiments. Section 4 provides conclusion of the study.

2. Methodology

2.1. Variance Ratio Test

Suppose Pt is an asset price at time t, where , and xt be ln(Pt), the log price series. The first order autoregressive model is given by:

, and xt be ln(Pt), the log price series. The first order autoregressive model is given by:

where  is an arbitrary drift parameter and

is an arbitrary drift parameter and  is a random disturbance term. The random walk hypothesis (RWH) corresponds to

is a random disturbance term. The random walk hypothesis (RWH) corresponds to  and it implies that the variance of the log price increments is linear in the observation interval. It plays a very important role in testing for the weak-form market efficiency. The variance ratio test exploits the property that, if a series of asset returns is purely random, then the variance of the k-period return (k-period differences of xt) is k times the variance of a one-period return.

and it implies that the variance of the log price increments is linear in the observation interval. It plays a very important role in testing for the weak-form market efficiency. The variance ratio test exploits the property that, if a series of asset returns is purely random, then the variance of the k-period return (k-period differences of xt) is k times the variance of a one-period return.

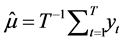

Suppose yt is an asset return at time t ( ). The variance ratio for holding period k is defined as:

). The variance ratio for holding period k is defined as:

(1)

(1)

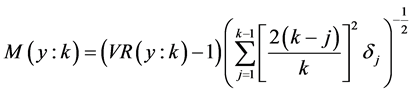

where . Lo and MacKinlay [7] propose the following test statistics under the null hypothesis VR(k) = 1,

. Lo and MacKinlay [7] propose the following test statistics under the null hypothesis VR(k) = 1,

(2)

(2)

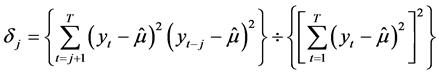

which follows the standard normal distribution asymptotically if yt is a martingale difference sequence, where

2.2. Multiple Variance Ratio Test

Chow and Denning [1] propose a multiple variance ratio test for the joint null hypothesis VR(ki) = 1 for . The test statistics is given by:

. The test statistics is given by:

(3)

(3)

The decision to reject the null hypothesis is based on the maximum of the absolute value of the individual variance ratio statistics.

2.3. Automatic Variance Ratio Test

Choi [2] suggests a data-dependent procedure to find the optimal value of k. Choi propose a variance ratio test based on the frequency domain. Cochrane [10] shows that the estimator of VR(k) which uses the usual consistent estimators of variances is asymptotically equal to 2π times the normalized spectral density estimator at zero frequency which uses the Bartlett kernel. Andrews [11] finds that the Quadratic Spectral kernel is optimal in estimating the spectral density at zero frequency. Choi also employs the Quadratic Spectral kernel to estimate the variance ratio. Choi’s variance ratio estimator is defined as

(4)

(4)

where

and

and

where m(z) is the quadratic spectral kernel. Choi [2] stated that VR(k) is a consistent estimator of 2πfy(0), where fy(.) denotes the normalized spectral density of the time series {yt}. Choi [2] has stated that under the null hypothesis (H0: 2πfy(0) = 1) the AVR(k) statistic is defined as

as

2.4. Weighted Bootstrap Procedure

The following steps define the procedure of using the weighted bootstrap on variance ratio test statistics:

1. Find normalized returns

2. For each t, draw a weighting factor

3. Form a bootstrap sample of T observations

4. Calculate the required test statistic (suppose VRS*(k*)), the VRS statistic obtained from

5. Repeat steps 1 to 4 sufficiently many (say m) times to form a bootstrap distribution of the test statistics

The two tailed p-value of the test can be obtained as the proportion of absolute values of

3. Results Based on Monte Carlo Simulation Experiment

To evaluate the quality of Chow and Denning’s [1] multiple variance ratio (MVR) test and also the automatic variance ratio (AVR) test statistics, we undertake Monte Carlo simulation experiments to study their size and power properties for samples of different sizes (N = 100, 500, 1000). For MVR and MVR* test, we set holding periods (k1, k2, k3, k4, k5, k6) = (2, 5, 10, 20, 40, 80). The following models are considered to evaluate the size properties of the tests used:

Model 1: GARCH(1,1)

Model 2: Stochastic volatility

In these model, we use two types of random errors: the standard normal distribution (εt ~ N(0,1)) and the Student-t distribution with 3 degree of freedom (as suggested by White (2000)). To evaluate the power properties of the MVR and AVR test statistics, we use model 3 and model 4 which take the error term from model 1 and model 2 (that is, ut term from model 1 and model 2 also act as error term in model 3 and model 4).

Model 3: AR(1) model

Model 4: Long memory (ARFIMA (0, 0.1, 0)) model

For all the cases, the number of Monte Carlo trials is set to 1000 and the significance level is set at 5%. In the following tables for evaluating size and power properties, GARCH_N and SV_N represents model 1 and model 2 with error term from Standard Normal distribution; and GARCH_t and SV_t represents model 1 and model 2 with error term from the Student-t distribution with 3 degrees of freedom. To modify the size and power properties of MVR and AVR tests for smaller samples (N = 100, 500 and 1000), we propose the weighted bootstrap procedure. The number of bootstrap iterations is set to 500.

Table 1 presents the size properties of the MVR, AVR, MVR* and AVR* test. We find severe size distortion across all data generating processes for all sample sizes for MVR and AVR test. But even after applying weighted bootstrap procedure on MVR and AVR test statistics, we find size distortion for sample sizes of 100 and 500. We find the size distortion to be less of a problem for MVR* and AVR* test statistics for a sample size of 1000.

Table 1. Size of the tests.

MVR* and AVR* represent the MVR and AVR tests with weighted bootstrap.

Table 2 reports the power properties of the MVR, AVR, MVR* and AVR* tests when model 3 (AR(1) model) is the alternative. We find a significant improvement in the power properties of MVR and AVR tests by the application of the weighted bootstrap procedure on the conventional tests used. When we compare the power properties of MVR* and AVR* test statistics, we can see that the power of AVR* test statistic is higher than that of MVR* test statistic for most of the cases against the AR(1) model alternative.

Table 3 presents the power properties of the MVR, AVR, MVR* and AVR* tests when model 4 (long memory) is employed as the alternative. We find higher power for MVR* and AVR* test statistics for sample size 1000. For other sample sizes, we find improvement in power properties of MVR and AVR test.

Table 2. Power of the tests against the AR(1) alternative.

Table 3. Power of the tests against long memory.

4. Conclusion

In this study, we evaluate the small sample size and power properties of the Chow and Denning’s [1] multiple variance ratio test and the Choi’s [2] automatic variance ratio test with and without weighted bootstrap approach. The size and power properties are examined based on different sample sizes (N = 100, 500 and 1000). The number of Monte Carlo trials and weighted bootstrap iterations is set to 1000 and 500 respectively. The results indicate that the size and power properties of the multiple variance ratio test and the automatic variance ratio test with weighted bootstrap are superior to the corresponding size and power properties of the multiple variance ratio test and the automatic variance ratio test without weighted bootstrap.

Cite this paper

Dilip Kumar, (2016) Weighted Bootstrap Approach for the Variance Ratio Tests: A Test of Market Efficiency. Theoretical Economics Letters,06,426-431. doi: 10.4236/tel.2016.63048

References

- 1. Chow, V. and Denning, K. (1993) A Simple Variance Ratio Test. Journal of Econometrics, 58, 385-401.

http://dx.doi.org/10.1016/0304-4076(93)90051-6 - 2. Choi, I. (1999) Testing the Random Walk Hypothesis for Real Exchange Rates. Journal of Applied Econometrics, 14, 293-308.

http://dx.doi.org/10.1002/(SICI)1099-1255(199905/06)14:3<293::AID-JAE503>3.0.CO;2-5 - 3. Bachelier, L. (1900) Theorie de la speculation. Annales scientifiques de l’école normale supérieure, 17, 21-86.

- 4. Cootner, P.H. (1964) The Random Character of Stock Market Prices. MIT Press, Cambridge.

- 5. Samuelson, P. (1965) Proof That Properly Anticipated Prices Fluctuate Randomly. Industrial Management Review Spring, 6, 41-49.

- 6. Fama, E. (1970) Efficient Capital Markets: A Review of Theory and Empirical Work. The Journal of Finance, 25, 383-417.

http://dx.doi.org/10.2307/2325486 - 7. Lo, A. and MacKinlay, A. (1988) Stock Market Prices Do Not Follow Random Walks: Evidence from a Simple Specification Test. The Review of Financial Studies, 1, 41-66.

http://dx.doi.org/10.1093/rfs/1.1.41 - 8. Wright, J. (2000) Alternative Variance-Ratio Tests Using Ranks and Signs. Journal of Business and Economic Statistics, 18, 1-9.

- 9. Belaire-Franch, J. and Contreras, D. (2004) Rank and Sign Based Multiple Variance Ratio Tests. Working Paper, Department of Economic Analysis, University of Valencia.

- 10. Cochrane, J.H. (1988) How Big Is the Random Walk in GNP? Journal of Political Economy, 96, 893-920.

http://dx.doi.org/10.1086/261569 - 11. Andrews, D.W.K. (1991) Heteroskedasticity and Autocorrelation Consistent Covariance Matrix Estimation. Econometrica, 58, 817-858.

http://dx.doi.org/10.2307/2938229 - 12. Anderson, T. (1971) Statistical Analysis of Time Series. Wiley, New York.