Journal of Mathematical Finance

Vol. 3 No. 1A (2013) , Article ID: 29353 , 8 pages DOI:10.4236/jmf.2013.31A021

Risk-Sensitive Asset Management under a Wishart Autoregressive Factor Model

1Department of Mathematics, Faculty of Education, Shizuoka University, Ohya, Japan

2Division of Applied Mathematics for Social Systems, Graduate School of Engineering Science, Osaka University, Toyonaka, Japan

Email: ehhata@ipc.shizuoka.ac.jp, sekine@sigmath.es.osaka-u.ac.jp

Received December 25, 2012; revised January 28, 2013; accepted February 15, 2013

Keywords: Risk-Sensitive Asset Management; Wishart Autoregressive Stochastic Factor; Stochastic Covariance; Stochastic Interest Rate; Stochastic Risk Premium; Riccati Differential Equation

ABSTRACT

The risk-sensitive asset management problem with a finite horizon is studied under a financial market model having a Wishart autoregressive stochastic factor, which is positive-definite symmetric matrix-valued. This financial market model has the following interesting features: 1) it describes the stochasticity of the market covariance structure, interest rates, and the risk premium of the risky assets; and 2) it admits the explicit representations of the solution to the risk-sensitive asset management problem.

1. Introduction

1.1. Risk-Sensitive Asset Management

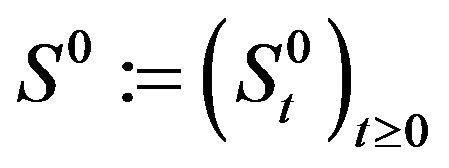

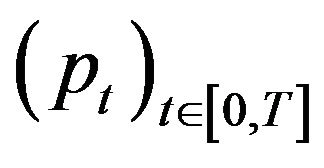

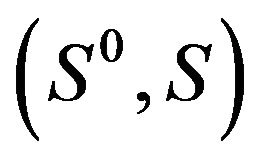

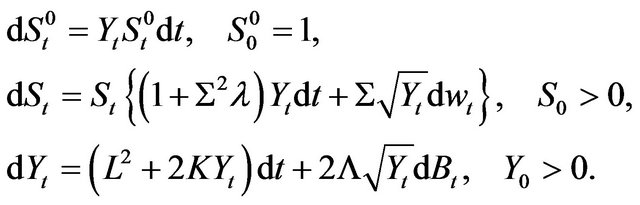

Consider a continuous-time financial market that consists of one riskless asset and  risky assets. The price process of the riskless asset

risky assets. The price process of the riskless asset  and that of the

and that of the

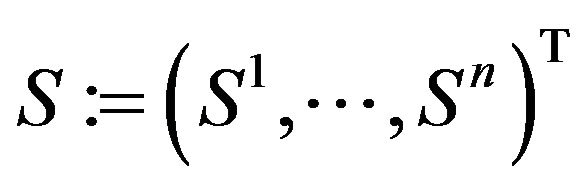

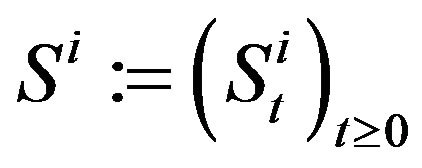

risky assets

risky assets ,

,  , where

, where

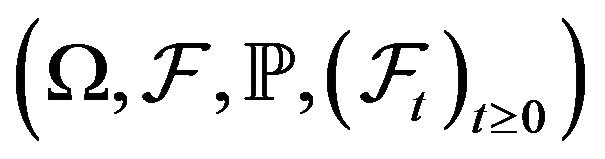

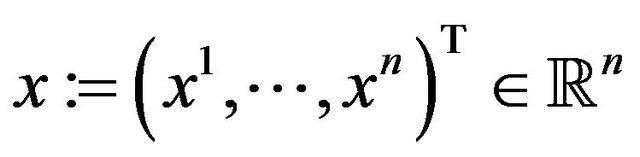

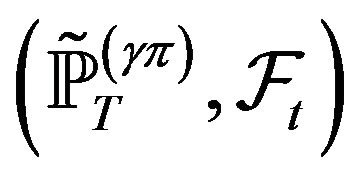

denotes the transpose of a vector or matrix, are semimartingales defined on a filtered probability space

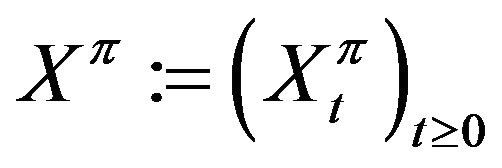

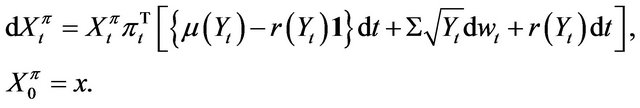

denotes the transpose of a vector or matrix, are semimartingales defined on a filtered probability space . Define the wealth process

. Define the wealth process  of a self-financing investor governed by the following stochastic differential equation (SDE):

of a self-financing investor governed by the following stochastic differential equation (SDE):

(1.1)

(1.1)

where  is the initial wealth of the investor, and

is the initial wealth of the investor, and ,

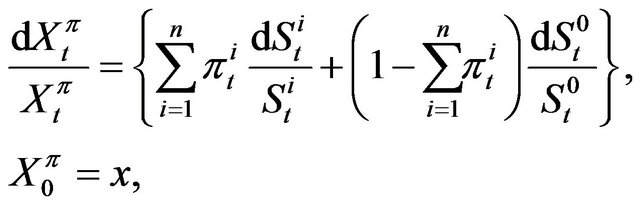

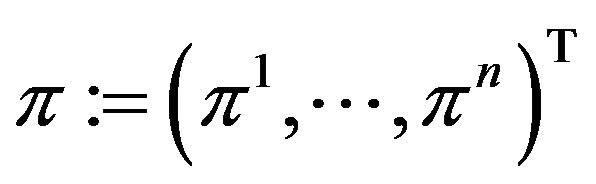

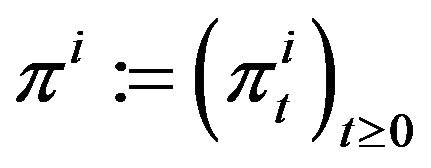

,  is the dynamic investment strategy of the investor. Let

is the dynamic investment strategy of the investor. Let

(1.2)

(1.2)

be the growth rate of the wealth at time . For given constants

. For given constants  and

and , define the risksensitized expected value of

, define the risksensitized expected value of  by

by

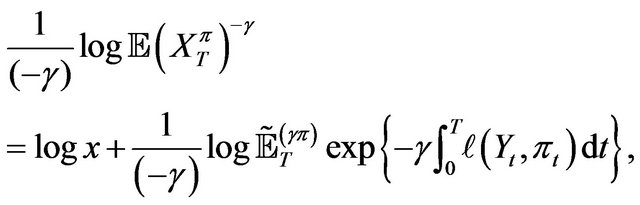

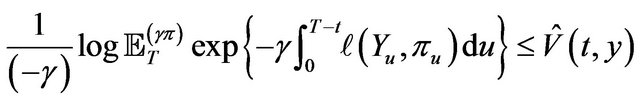

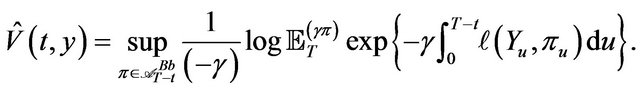

which is rewritten as

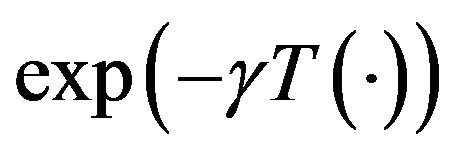

and interpreted as the certainty equivalent value of  with respect to the exponential criterion function

with respect to the exponential criterion function . We are interested in maximizing

. We are interested in maximizing , that is,

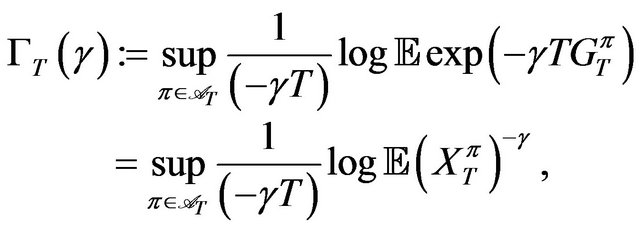

, that is,

(1.3)

(1.3)

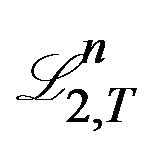

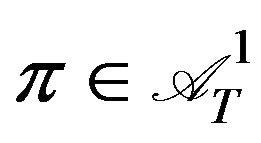

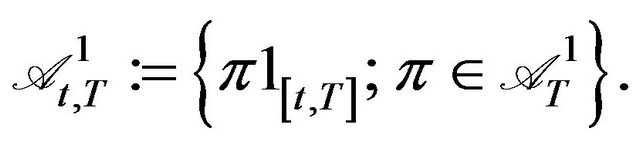

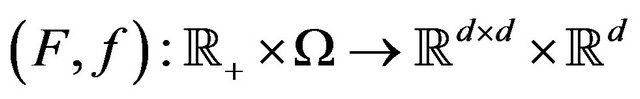

which we call the risk-sensitive asset management problem. Here,  is a space of admissible investment strategies and is a subset of

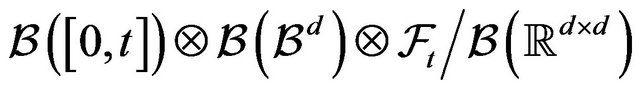

is a space of admissible investment strategies and is a subset of , the totality of

, the totality of  -dimensional

-dimensional  -progressively measurable processes

-progressively measurable processes

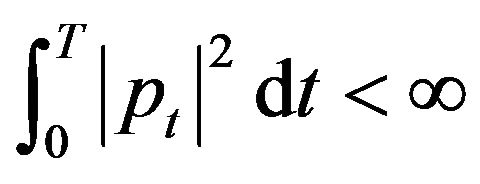

on the time interval

on the time interval  such that

such that  almost surely.

almost surely.

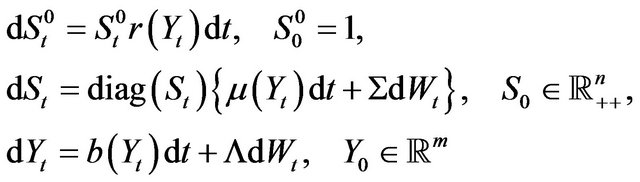

Remark 1.1 The risk-sensitive asset management problem (1.3) has been well-studied under a linear-Gaussian market model, for example, by [1-7]. In those works, the price processes  are given by the solutions to the following system of SDEs:

are given by the solutions to the following system of SDEs:

(1.4)

(1.4)

on a filtered probability space  endowed with the

endowed with the  -dimensional

-dimensional  -Brownian motion

-Brownian motion ,

, . Here,

. Here,  denotes the diagonal matrix whose

denotes the diagonal matrix whose  th element is equal to the

th element is equal to the  th element

th element  of

of ,

,  ,

,  , and

, and

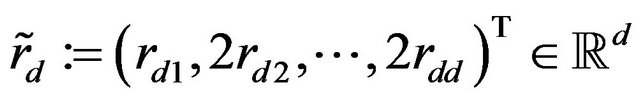

(1.5)

(1.5)

with ,

,  ,

,  ,

,  ,

,  ,

,  , and

, and . We reformulate (1.3) with (1.1), (1.2), (1.4), and (1.5) as a linear exponential quadratic Gaussian stochastic control problem, and the optimal investment strategy (portfolio)

. We reformulate (1.3) with (1.1), (1.2), (1.4), and (1.5) as a linear exponential quadratic Gaussian stochastic control problem, and the optimal investment strategy (portfolio)

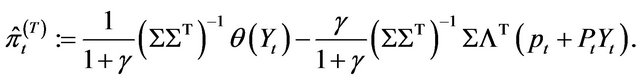

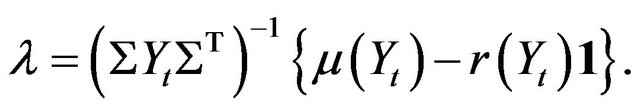

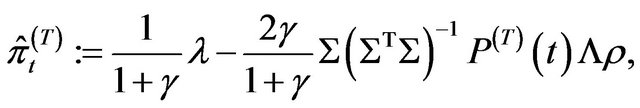

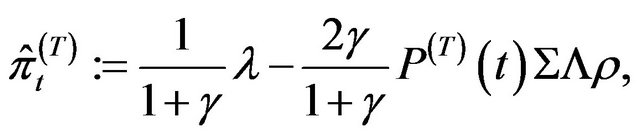

for (1.3) is represented explicitly:

for (1.3) is represented explicitly:

Here,  is the solution to a matrix differential Riccati equation, and

is the solution to a matrix differential Riccati equation, and  is the solution to a linear differential equation, including

is the solution to a linear differential equation, including .

.

Remark 1.2 Intuitively, recalling the cumulant expansion,

where  denotes variance, we interpret (1.3) as a risk-sensitized optimization of the expected growth rate maximization,

denotes variance, we interpret (1.3) as a risk-sensitized optimization of the expected growth rate maximization,

1.2. Wishart Factor Model

The main aim of the present paper is to introduce a simple and tractable market model that satisfies the following requirements:

• The model describes the stochasticity of the covariance structure of , interest rates, and mean-return rates of

, interest rates, and mean-return rates of .

.

• The model admits an explicit representation of the optimal investment strategy for (1.3).

For the purpose, we employ a Wishart autoregressive process as a stochastic factor, which is positive-definite symmetric matrix-valued. Such matrix-valued processes have been introduced and studied by [8], and recently, generalizations have been intensively studied, for example, see [9,10], and the references therein. Moreover, these processes are now extensively utilized for financial modeling. We can refer to the examples given below.

• Modeling of multivariate stochastic volatility (covariance) under the risk-neutral probability: see [11-16].

• Modeling of multivariate asset price process under physical probability with stochastic covariance and mean-return rates: see [14,17,18].

• Modeling of (term structure of) interest rates and stochastic intensity for credit risk: see [14,17,19,20].

Our market model defined by (2.1)-(2.4) in Section 2 is an extension of the model employed by [18], (see Example 2.1), who studied the expected CRRA-utility ma ximization of terminal wealth, which is essentially equivalent to (1.3). A main contribution of the present paper is a rigorous mathematical analysis of portfolio optimization problem (1.3) under a flexible Wishart autoregressive stochastic factor model: We strengthen the mathematical results in [18] by formulating an appropriate space of admissible trading strategies (see (3.5)) and showing a verification theorem for the candidate of the optimal strategy (see Theorem 3.1), both of which are omitted in [18].

In the next section, we introduce our market model with a Wishart autoregressive factor and present preliminary calculations of the associated Hamilton-JacobiBellman (HJB) equation for solving risk-sensitive asset management problem (1.3). In Section 3, we introduce our main results. In Section 4, we show the proof of the main theorem after preparing lemmas.

2. Setup

2.1. Market Model with Wishart Autoregressive Factor

Let  be a filtered probability space endowed with the

be a filtered probability space endowed with the  -dimensional

-dimensional  -Brownian motion

-Brownian motion ,

,  , and the

, and the

-dimensional

-dimensional  -Brownian motion

-Brownian motion ,

,

, which is independent of

, which is independent of . Using a constant vector

. Using a constant vector  so that

so that , we define another

, we define another  -dimensional Brownian motion

-dimensional Brownian motion

,

,  by

by

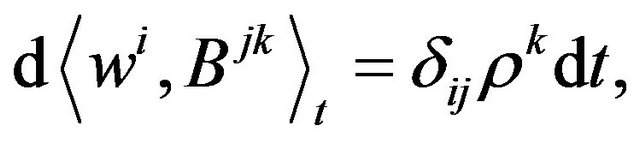

which is correlated with  as

as

where  denotes the quadratic covariation, and

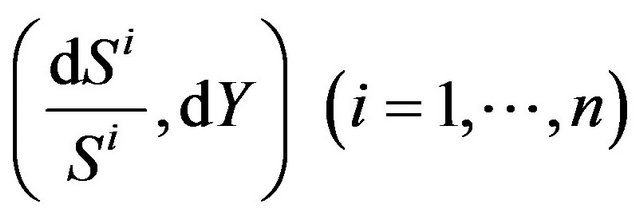

denotes the quadratic covariation, and  denotes Kronecker’s delta. We consider the price processes

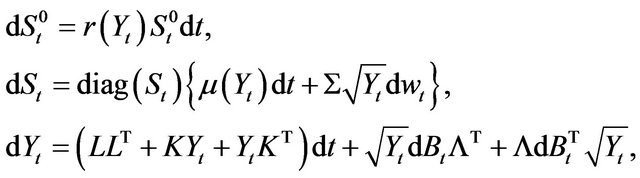

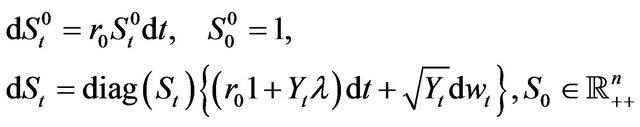

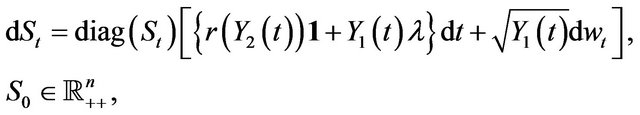

denotes Kronecker’s delta. We consider the price processes , described by the following system of SDEs:

, described by the following system of SDEs:

(2.1)

(2.1)

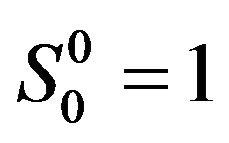

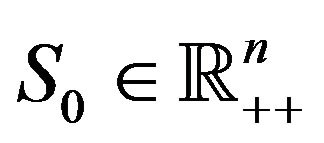

with the initial values ,

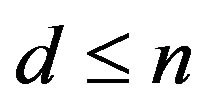

,  and

and . Here, we denote by

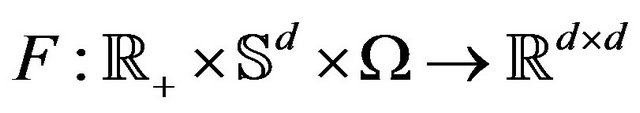

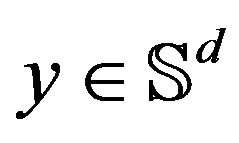

. Here, we denote by  the totality of

the totality of  -dimensional, real, symmetric matrices, and

-dimensional, real, symmetric matrices, and . Furthermore, for

. Furthermore, for , we define

, we define

(2.2)

(2.2)

where ,

,  , and

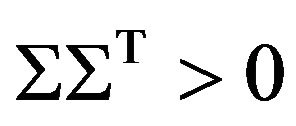

, and . Also, we assume that

. Also, we assume that  is full rank, that is,

is full rank, that is,

(2.3)

(2.3)

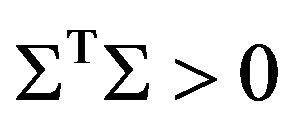

We also assume that , and that

, and that  satisfies

satisfies

(2.4)

(2.4)

Condition (2.4) ensures  almost everywhere on

almost everywhere on , which was established by Mayerhofer et al. (2011) using a generalized form of SDE, including a jump martingale part. The

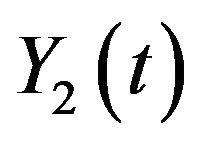

, which was established by Mayerhofer et al. (2011) using a generalized form of SDE, including a jump martingale part. The  -valued process

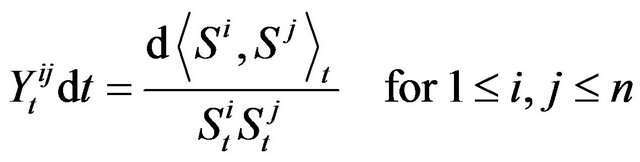

-valued process  is a stochastic factor process, which linearly depends on the covariance structure of

is a stochastic factor process, which linearly depends on the covariance structure of  as

as

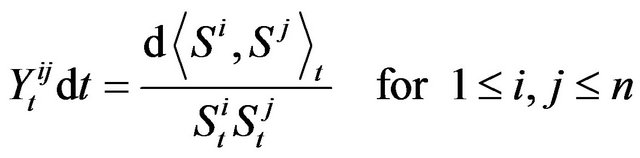

(2.5)

(2.5)

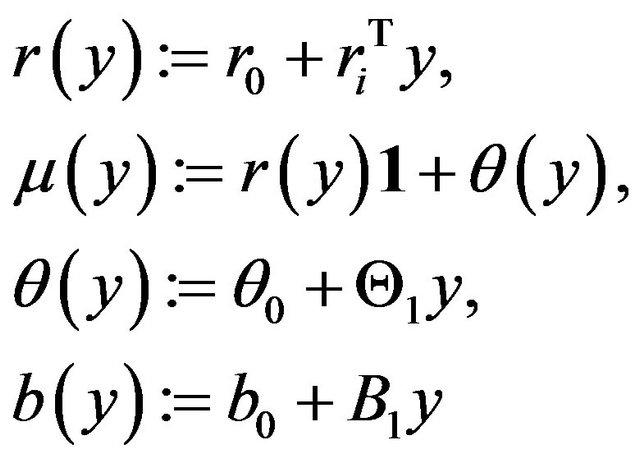

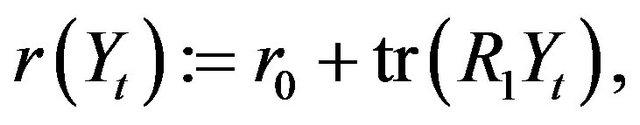

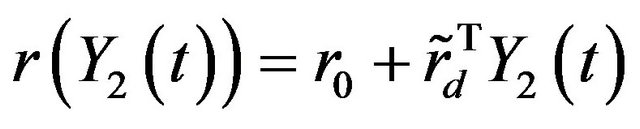

as well as on the interest rate

(2.6)

(2.6)

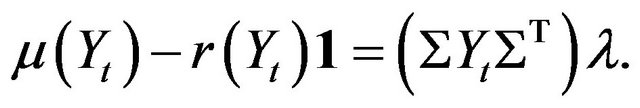

and on the so-called risk premium of ,

,

(2.7)

(2.7)

Remark 2.1 From (2.6), we see that the interest rate process  is included in the so-called affine class:

is included in the so-called affine class:  is an affine function of

is an affine function of  and the process

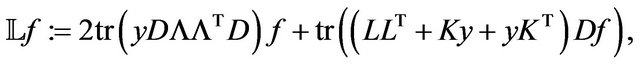

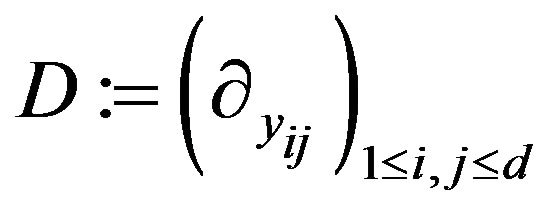

and the process , whose infinitesimal generator is given by

, whose infinitesimal generator is given by

(2.8)

(2.8)

where  and

and

(2.9)

(2.9)

is indeed an affine diffusion. To review affine processes and their financial applications, see, for example, [21], [22], and the references therein.

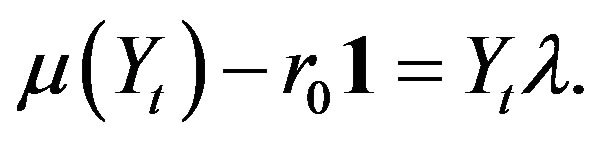

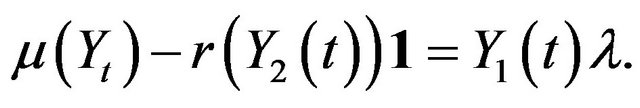

Remark 2.2 The condition (2.7) on the structure of the risk-premium vector is rewritten as

So we interpret that the so-called mean-variance term in portfolio optimization theory is assumed to be constant.

The following are concrete examples of setting up (2.1) and (2.2).

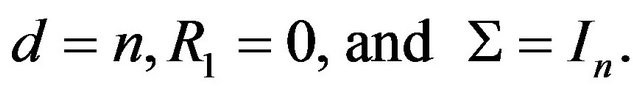

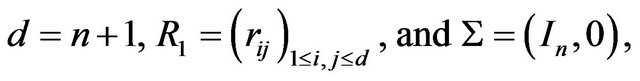

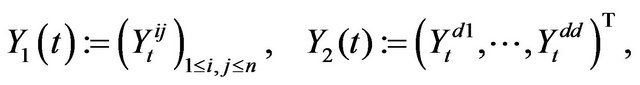

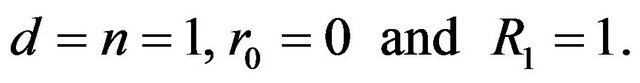

Example 2.1 (Stochastic Covariance) Let

Concretely, we have

with the third equation in (2.1).  describes the infinitesimal covariance and the risk premium of

describes the infinitesimal covariance and the risk premium of  as

as

and

This is exactly the model employed in Section 1 of [18] to study expected CRRA-utility maximization of terminal wealth.

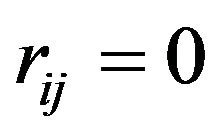

Example 2.2 (Stochastic Covariance and Interest Rate) We present a slight generalization of Example 2.1 to include stochasticity of interest rates. Let

where we set  if

if . Then, letting

. Then, letting

and , we see that

, we see that

is the risk-free interest rate with the latent factor  and that

and that

where  describes the infinitesimal covariance and the risk premium of

describes the infinitesimal covariance and the risk premium of  as

as

and

Example 2.3 (Cox-Ingersoll-Ross Interest Rate Factor) Let

Then, we see

This financial market model with Cox-Ingersoll-Ross’s interest rate  is treated in [23] to study (1.3).

is treated in [23] to study (1.3).

Under the financial market model comprising (2.1) and (2.2) with the assumptions (2.3) and (2.4), we are interested in treating the risk-sensitive asset management problem (1.3).

2.2. Deriving the HJB Equation

To tackle (1.3), we employ a dynamic programming approach: Recall that wealth process (1.1) of a selffinancing investor, combined with (2.1), is rewritten as

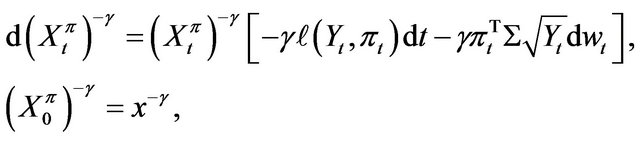

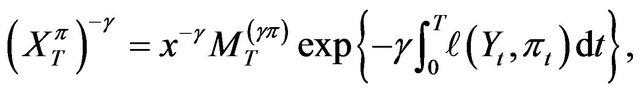

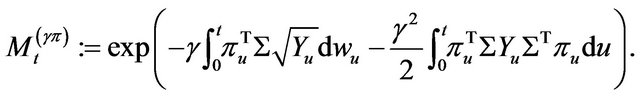

So, we see

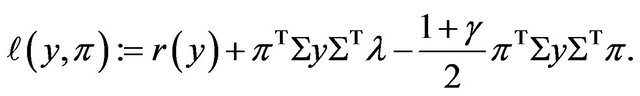

where we set

(2.10)

(2.10)

Hence, we have

where we define

(2.11)

(2.11)

Let

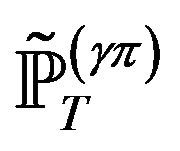

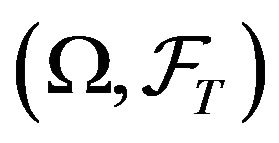

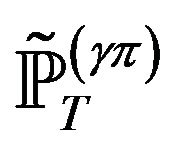

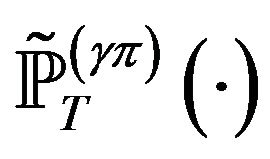

For , we define the probability measure

, we define the probability measure  on

on  by the formula

by the formula

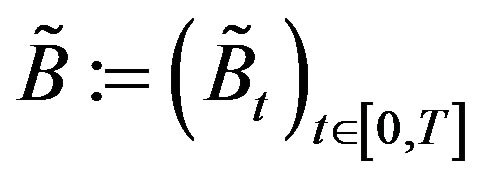

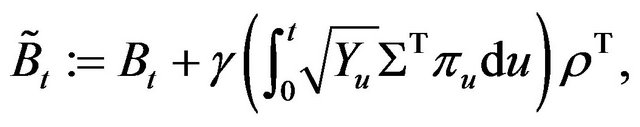

By Cameron-Martin-Maruyama-Girsanov’s theorem, we see that the  -valued process

-valued process , defined by

, defined by

is a  -Brownian motion. Moreover, we see that

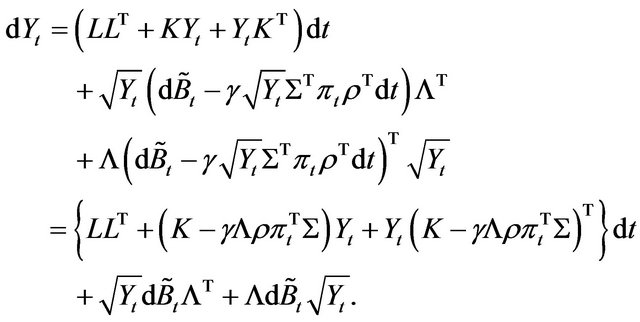

-Brownian motion. Moreover, we see that  has the

has the  -dynamics

-dynamics

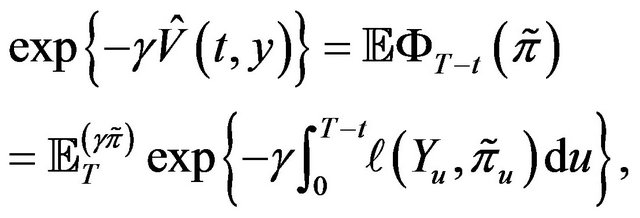

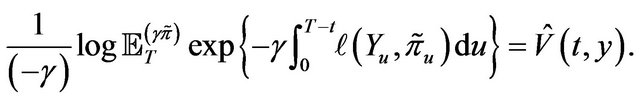

Recall that, for , we have

, we have

(2.12)

(2.12)

where  denotes the expectation with respect to

denotes the expectation with respect to . We now consider, for

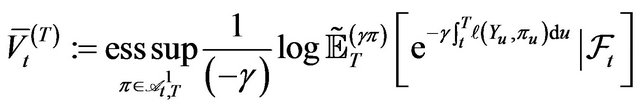

. We now consider, for ,

,

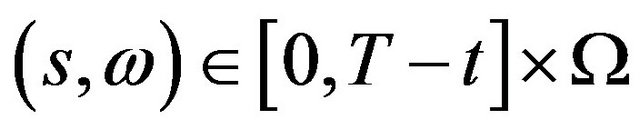

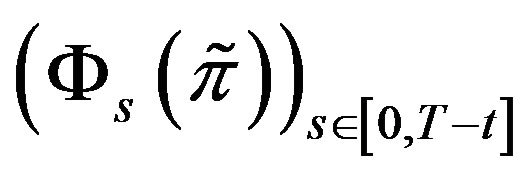

where

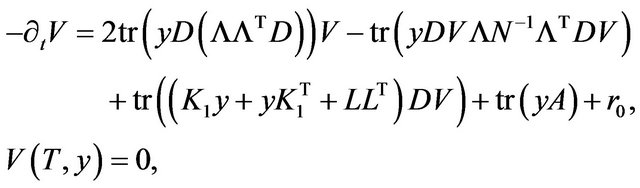

The associated HJB equation is written as

(2.13)

(2.13)

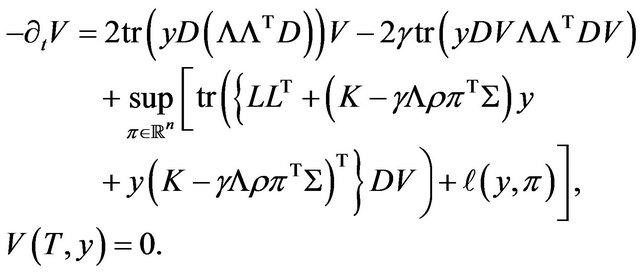

By direct calculation, we can see the following.

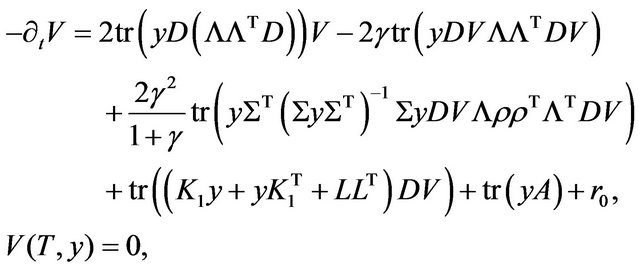

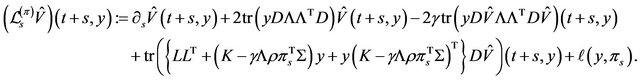

Lemma 2.1 1) If  and

and , then HJB Equation (2.13) is rewritten as

, then HJB Equation (2.13) is rewritten as

(2.14)

(2.14)

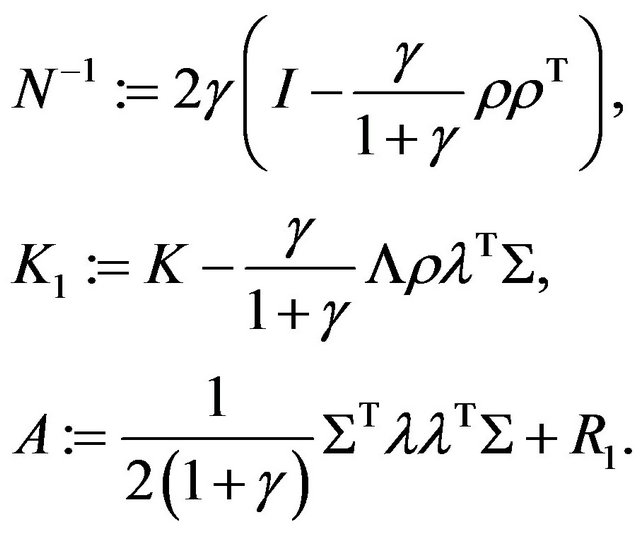

where we define

(2.15)

(2.15)

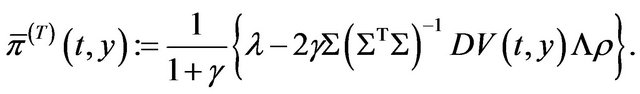

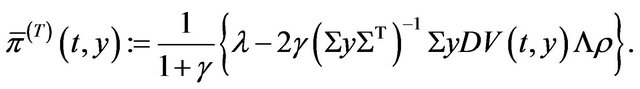

The maximizer for (2.13) is given by

2) If  and

and , then HJB equation (2.13) is rewritten as

, then HJB equation (2.13) is rewritten as

(2.16)

(2.16)

where  and

and  are given by (2.15). The maximizer for (2.13) is given by

are given by (2.15). The maximizer for (2.13) is given by

3. Results

With the help of Lemma 2.1, it is straightforward to see the following.

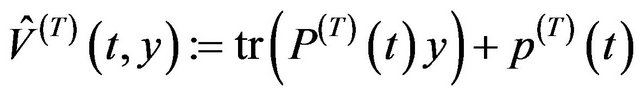

Proposition 3.1 (Solution to the HJB equation) 1) If , then

, then

(3.1)

(3.1)

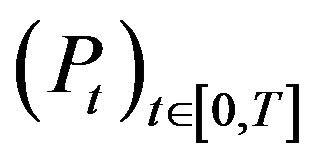

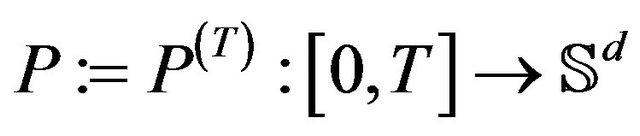

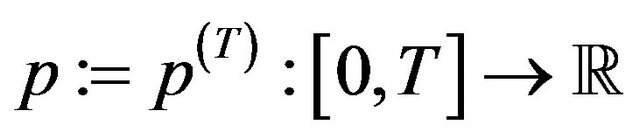

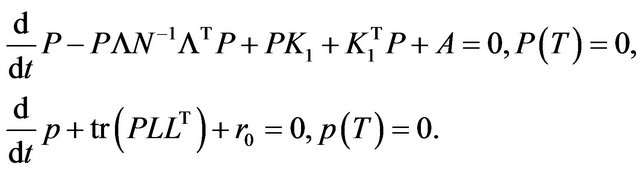

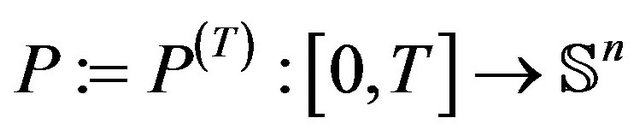

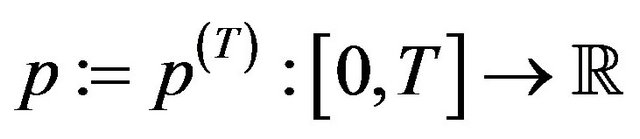

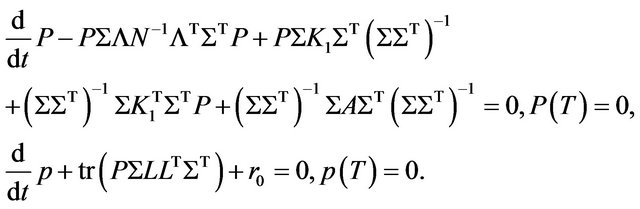

solves (2.13), or equivalently (2.14). Here,  and

and  solve the following system of ordinary differential equations:

solve the following system of ordinary differential equations:

(3.2)

(3.2)

2) If , then

, then

(3.3)

(3.3)

solves (2.13), or equivalently (2.16). Here,  and

and  solve the following system of ordinary differential equations:

solve the following system of ordinary differential equations:

(3.4)

(3.4)

Using this proposition, we obtain the following.

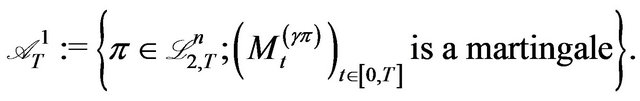

Theorem 3.1 (Verification and optimal strategy)

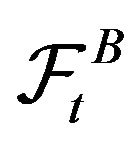

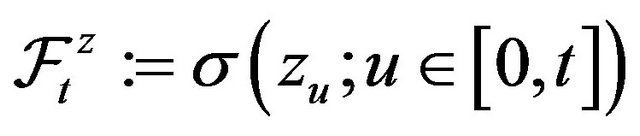

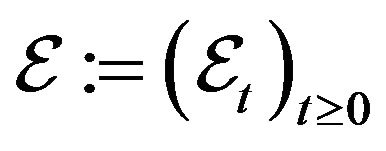

Define the filtration  by

by

. Let

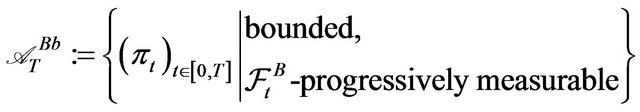

. Let

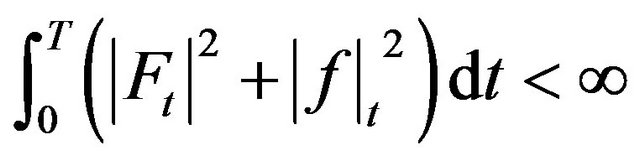

(3.5)

(3.5)

and consider (1.3) with . Then, the following assertions hold.

. Then, the following assertions hold.

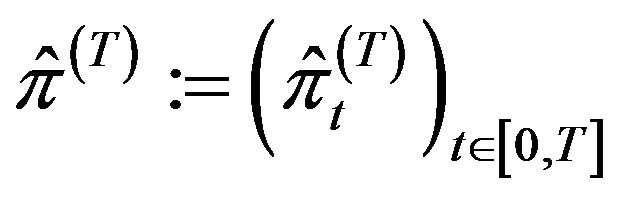

1) If , then

, then , defined by

, defined by

(3.6)

(3.6)

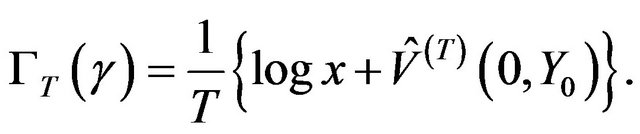

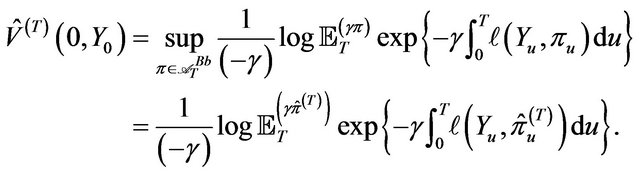

is optimal for (1.3). It holds that

(3.7)

(3.7)

2) If , then

, then , defined by

, defined by

(3.8)

(3.8)

is optimal for (1.3). The relation (3.7) holds.

The proof of the above theorem is given in Subsection 4.2 after preparing lemmas in Subsection 4.1.

4. Proofs

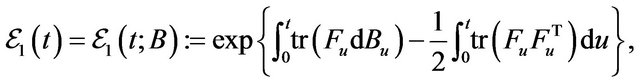

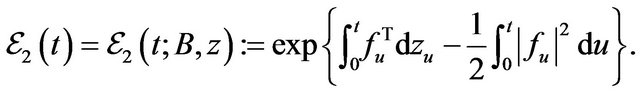

4.1. Lemmas for Exponential Martingale

We prepare the following two lemmas.

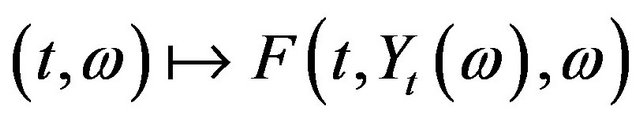

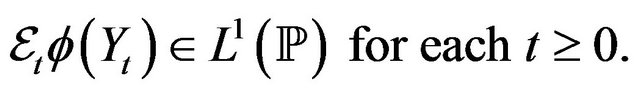

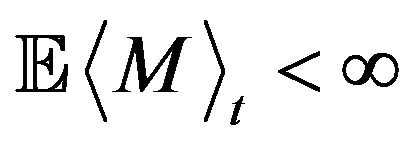

Lemma 4.1 Let  be

be  -progressively measurable so that

-progressively measurable so that

almost surely for all

almost surely for all .

.

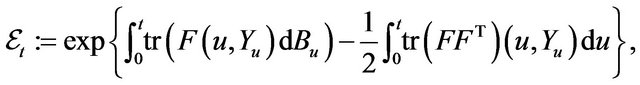

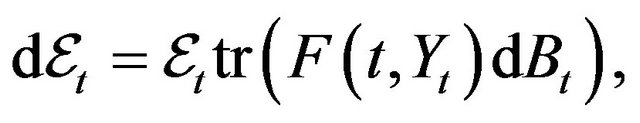

Define

Then,  is an

is an  -martingale if and only if

-martingale if and only if  is an

is an  -martingale.

-martingale.

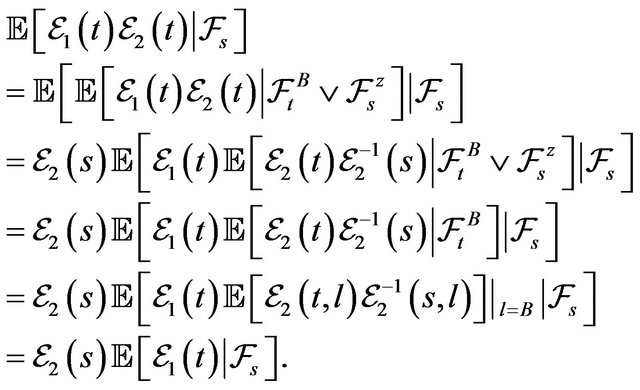

Proof. Denote . For

. For  , we have

, we have

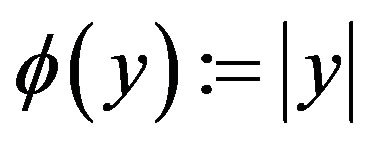

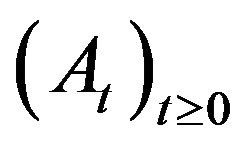

Lemma 4.2 Let  satisfy the following: for each

satisfy the following: for each ,

,  is

is  -measurable, and

-measurable, and

with some bounded , where we write

, where we write  for

for . Then, the process

. Then, the process , defined by

, defined by

is a martingale.

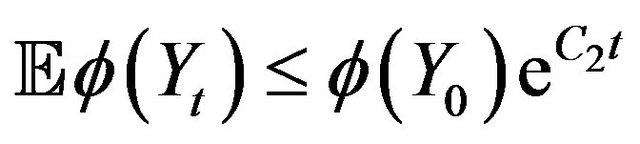

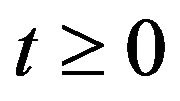

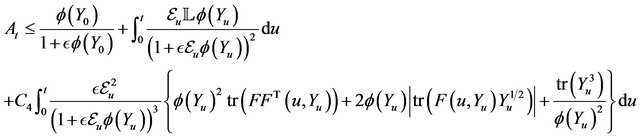

Proof. The lemma follows from Lemma 4.1.5 of [24], an extension of Lemma 4.1.1 of [25]. Below, we reproduce the proof for self-containedness. Note that it suffices to show

(4.1)

(4.1)

Recall that  is progressively measurable. The proof of (4.1) consists of several steps.

is progressively measurable. The proof of (4.1) consists of several steps.

First, writing , we recall that

, we recall that

(4.2)

(4.2)

where  is defined by (2.8). From this, we can check that

is defined by (2.8). From this, we can check that

for each  with some constant

with some constant . Also, we can check that

. Also, we can check that

(4.3)

(4.3)

This follows from the relation

(4.4)

(4.4)

where  is arbitrary and the constant

is arbitrary and the constant  is independent of

is independent of . Indeed, in (4.4), letting

. Indeed, in (4.4), letting  and using Fatou’s lemma, (4.3) is deduced. To see (4.4), use (2.1) and Itô’s formula to deduce

and using Fatou’s lemma, (4.3) is deduced. To see (4.4), use (2.1) and Itô’s formula to deduce

where we use notation (2.8) and (2.9). From these, we see, from Itô’s formula,

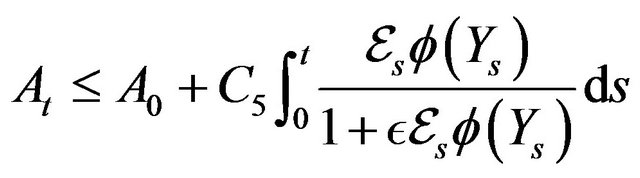

where

is the local-martingale part and  is the bounded-variation part, which satisfies

is the bounded-variation part, which satisfies

with some constant , independent of

, independent of . We can check that

. We can check that ; hence,

; hence,  is a square-integrable martingale. Further, using (4.2) and recalling that

is a square-integrable martingale. Further, using (4.2) and recalling that  for conformable matrices

for conformable matrices  and

and , we can check that

, we can check that

with some positive constant , independent of

, independent of . So, taking the expectation, we deduce that

. So, taking the expectation, we deduce that

and that (4.4) follows from Gronwall’s inequality.

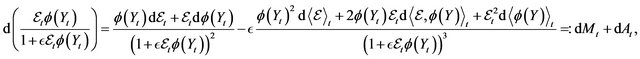

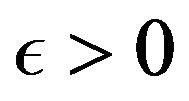

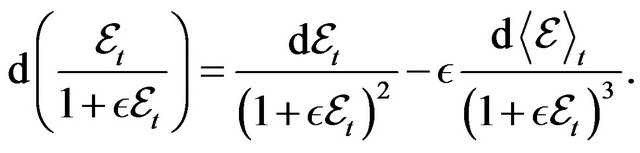

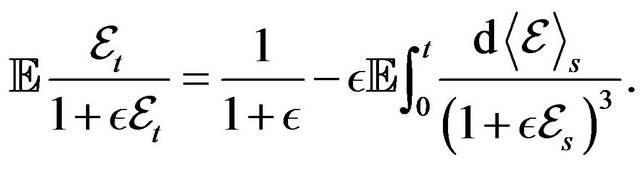

Next, use Itô’s formula for the following computation:

(4.5)

(4.5)

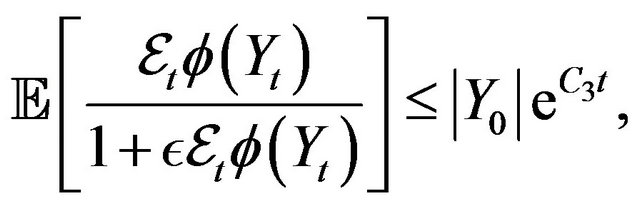

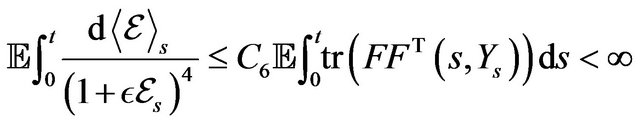

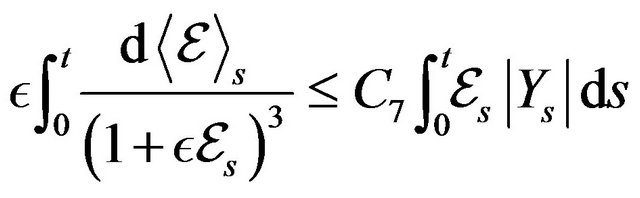

Here, we see that

with some constant ; hence, the first term of the righthand side of (4.5) is a square-intergrable martingale. Also, we can deduce that

; hence, the first term of the righthand side of (4.5) is a square-intergrable martingale. Also, we can deduce that

where  is a positive constant, independent of

is a positive constant, independent of . Taking the expectation, we see

. Taking the expectation, we see

Letting  and using the dominated convergence theorem, we obtain (4.1).

and using the dominated convergence theorem, we obtain (4.1).

4.2. Proof of Theorem 3.1

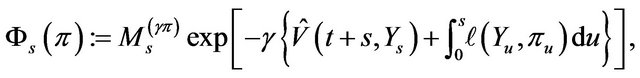

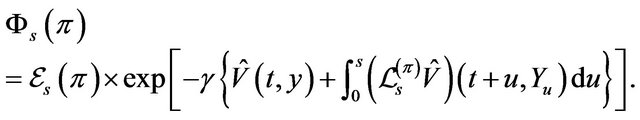

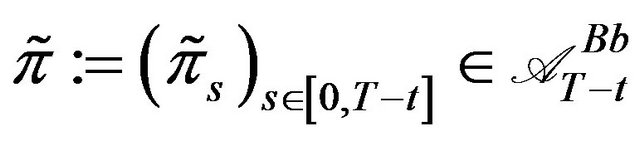

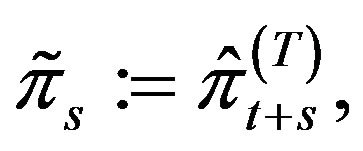

Let  be given by (3.1). Fix

be given by (3.1). Fix  and take

and take . Using these, define

. Using these, define

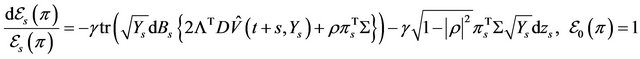

(4.6)

(4.6)

where we use (2.10), (2.11), and the process  given by (2.1), and we set

given by (2.1), and we set . Using Itô’s formula, we see that

. Using Itô’s formula, we see that

(4.7)

(4.7)

where we define the process  by

by

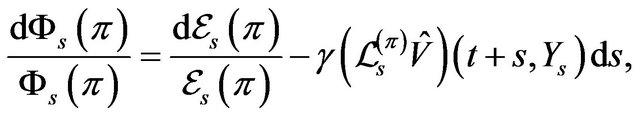

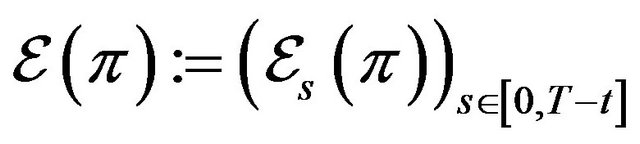

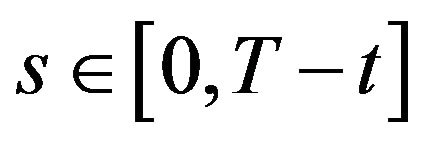

(see below)

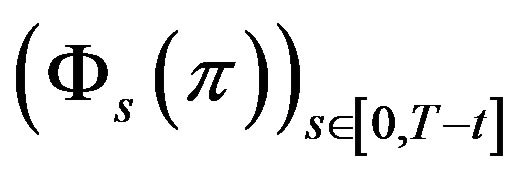

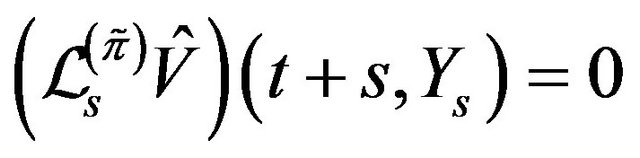

Combining (4.6)-(4.8), we have, for ,

,

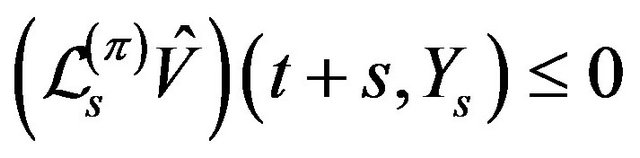

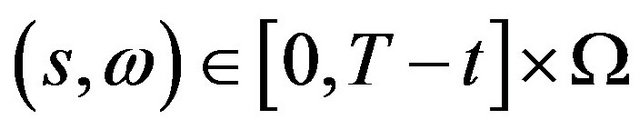

Here, note that  is a martingale for any

is a martingale for any  by using Lemma 4.1 and 4.2 and that

by using Lemma 4.1 and 4.2 and that  almost everywhere on

almost everywhere on

since

since  solves HJB-equation

solves HJB-equation

(2.13). So we deduce that  is a submartingale for each

is a submartingale for each . Taking the expectation, we see that

. Taking the expectation, we see that

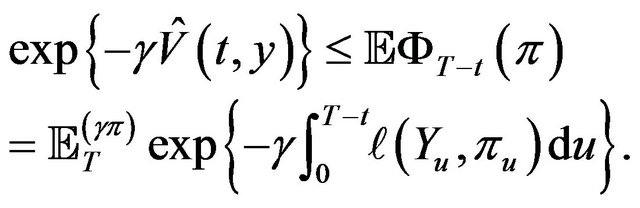

Thus, we see that

(4.9)

(4.9)

for any . Furthermore, if we define

. Furthermore, if we define  by

by

then, we deduce that  almost everywhere on

almost everywhere on , from which we see that

, from which we see that

is a martingale. Therefore, taking the expectation, we see that

is a martingale. Therefore, taking the expectation, we see that

that is,

(4.10)

(4.10)

Combining (4.9) and (4.10), we deduce that

(4.11)

(4.11)

Thus, letting  in (4.11), we have that

in (4.11), we have that

(4.8)and write

(3.7) follows from relation (2.12).

REFERENCES

- T. R. Bielecki and S. R. Pliska, “Risk Sensitive Dynamic Asset Management,” Applied Mathematics and Optimization, Vol. 39, No. 3, 1999, pp. 337-360. doi:10.1007/s002459900110

- T. R. Bielecki and S. R. Pliska, “Risk Sensitive Intertemporal CAPM, with Application to Fixed-Income Management,” IEEE Transactions on Automat. Control, Vol. 49, No. 3, 2004, pp. 420-432. doi:10.1109/TAC.2004.824470

- M. H. A. Davis and S. Lleo, “Risk-Sensitive Benchmarked Asset Management,” Quantitative Finance, Vol. 8, No. 4, 2008, pp. 415-426.

- W. H. Fleming and S. J. Sheu, “Risk-Sensitive Control and an Optimal Investment Model,” Mathematical Finance, Vol. 10, No. 2, 2000, pp. 197-213. doi:10.1111/1467-9965.00089

- W. H. Fleming and S. J. Sheu, “Risk-Sensitive Control and an Optimal Investment Model. II,” Annals of Applied Probability, Vol. 12, No. 2, 2002, pp. 730-767. doi:10.1214/aoap/1026915623

- H. Hata, H. Nagai and S. J. Sheu, “Asymptotics of the Probability Minimizing a ‘Down-Side’ Risk,” Annals of Applied Probability, Vol. 20, No. 1, 2010, pp. 52-89. doi:10.1214/09-AAP618

- K. Kuroda and H. Nagai, “Risk Sensitive Portfolio Optimization on Infinite Time Horizon,” Stochastics and Stochastics Reports, Vol. 73, No. 3-4, 2002, pp. 309-331.

- M. F. Bru, “Wishart Processes,” Journal of Theoretical Probability, Vol. 4, No. 4, 1991, pp. 725-751. doi:10.1007/BF01259552

- C. Cuchiero, D. Filipovic, E. Mayerhofer and J. Teichmann, “Affine Processes on Positive Semidefinite Matrices,” Annals of Applied Probability, Vol. 21, No. 2, 2011, pp. 397-463. doi:10.1214/10-AAP710

- E. Mayerhofer, O. Pfaffel and R. Stelzer, “On Strong Solutions for Positive Definite Jump Diffusions,” Stochastic Processes and Their Applications, Vol. 121, No. 9, 2011, pp. 2072-2086. doi:10.1016/j.spa.2011.05.006

- A. Benabid, H. Bensusan and N. El Karoui, “Wishart Stochastic Volatility: Asymptotic Smile and Numerical Framework,” Preprint, 2010.

- J. Da Fonseca, M. Grasselli and C. Tebaldi, “Option Pricing When Correlations Are Stochastic: An Analytical Framework,” Review of Derivatives Research, Vol. 10, No. 2, 2007, pp. 151-180. doi:10.1016/j.spa.2011.05.006

- J. Da Fonseca, M. Grasselli and C. Tebaldi, “A Multifactor Volatility Heston Model,” Quantitative Finance, Vol. 8, No. 6, 2008, pp. 591-604. doi:10.1080/14697680701668418

- C. Gouriéroux, “Continuous Time Wishart Process for Stochastic Risk,” Econometric Reviews, Vol. 25, No. 2, 2006, pp. 177-217.

- C. Gouriéroux, J. Jasiak and R. Sufana, “The Wishart Autoregressive Process of Multivariate Stochastic Volatility,” Journal of Econometrics, Vol. 150, No. 2, 2009, pp. 167-181. doi:10.1016/j.jeconom.2008.12.016

- M. Grasselli and C. Tebaldi, “Solvable Affine Term Structure Models,” Mathematical Finance, Vol. 18, No. 1, 2008, pp. 135-153. doi:10.1111/j.1467-9965.2007.00325.x

- A. Buraschi, A. Cieslak and F. Trojani, “Correlation Risk and the Term Structure of Interest Rates,” Working Paper, University of St. Gallen, 2008.

- A. Buraschi, P. Porchia and F. Trojani, “Correlation Risk and Optimal Portfolio Choice,” Journal of Finance, Vol. 65, No. 1, 2010, pp. 393-420. doi:10.1111/j.1540-6261.2009.01533.x

- C. Chiarella, C.-Y. Hsiao and T.-D. Tô, “Risk Premia and Wishart Term Structure Models,” Preprint, 2010.

- C. Gouriéroux and R. Sufana, “Wishart Quadratic Term Structure Models,” Working Paper, CREF, 03-10, HEC, Montreal, 2003.

- D. Duffie, D. Filipovic and W. Schachermayer, “Affine Processes and Applications in Finance,” Annals of Applied Probability, Vol. 13, No. 3, 2003, pp. 984-1053. doi:10.1214/aoap/1060202833

- D. Filipovic and E. Mayerhofer, “Affine Diffusion Processes: Theory and Applications,” Radon Series on Computational and Applied Mathematics, Vol. 8, 2009, pp. 125-164. doi:10.1515/9783110213140.125

- H. Hata, “Down-Side Risk Probability Minimization Problem with Cox-Ingersoll-Ross’s Interest Rates,” AsiaPacific Financial Markets, Vol. 18, No. 1, 2011, pp. 69- 87. doi:10.1007/s10690-010-9121-5

- Y. Watanabe, “Asymptotic Analyses for Certain Stochastic Control Problems under Partial Information and the Related Filtering Equation,” Thesis, Graduate School of Engineering Science, Osaka University, 2011.

- A. Bensoussan, “Stochastic Control of Partially Observable Systems,” Cambridge University Press, Cambridge, 1992. doi:10.1017/CBO9780511526503