Open Journal of Statistics

Vol.4 No.4(2014), Article

ID:47087,22

pages

DOI:10.4236/ojs.2014.44030

Factor Vector Autoregressive Estimation of Heteroskedastic Persistent and Non Persistent Processes Subject to Structural Breaks

Claudio Morana1,2

1Department of Economics, Management and Statistics, University of Milan, Milan, Italy

2Center for Research on Pensions and Welfare Policies, Collegio Carlo Alberto, Moncalieri, Italy

Email: claudio.morana@unimib.it

Copyright © 2014 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 22 March 2014; revised 18 April 2014; accepted 6 May 2014

ABSTRACT

In the paper, a general framework for large scale modeling of macroeconomic and financial time series is introduced. The proposed approach is characterized by simplicity of implementation, performing well independently of persistence and heteroskedasticity properties, accounting for common deterministic and stochastic factors. Monte Carlo results strongly support the proposed methodology, validating its use also for relatively small cross-sectional and temporal samples.

Keywords:Long and Short Memory, Structural Breaks, Common Factors, Principal Components Analysis, Fractionally Integrated Heteroskedastic Factor Vector Autoregressive Model

1. Introduction

In the paper, a general strategy for large-scale modeling of macroeconomic and financial data, set within the factor vector autoregressive model (F-VAR) framework, is proposed.1

Following the lead of dynamic factor model analysis proposed in [2] , it is assumed that a small number of structural shocks are responsible for the observed comovement in economic data; it is, however, also assumed that commonalities across series are described by deterministic factors, i.e., common break processes. Comovement across series is then accounted by both deterministic and stochastic factors; moreover, common factors are allowed in both mean and variance, covering the I(0) and I(1) persistence cases, as well as the intermediate case of long memory, i.e., I(d), . As the common factors are unobserved, accurate estimation may fail in the framework of small scale vector autoregressive (VAR) models, but succeed when cross-sectional information is employed to disentangle common and idiosyncratic features.

. As the common factors are unobserved, accurate estimation may fail in the framework of small scale vector autoregressive (VAR) models, but succeed when cross-sectional information is employed to disentangle common and idiosyncratic features.

The proposed fractionally integrated heteroskedastic factor vector autoregressive model (FI-HF-VAR) bridges the F-VAR and (the most recent) G-VAR literature, as, similarly to [3] , a weakly stationary cyclical representation is employed; yet, similarly to [4] , principal components analysis (PCA) is employed for the estimation of the latent factors. Consistent and asymptotically normal estimation is performed by means of QML, also implemented through an iterative multi-step estimation procedure. Monte Carlo results strongly support the proposed methodology.

Overall, the FI-HF-VAR model can be understood as a unified framework for large-scale econometric modeling, allowing for accurate investigation of cross-sectional and time series features, independent of persistence and heteroskedasticity properties of the data, from comovement to impulse responses, forecast error variance and historical decomposition analysis.

After this introduction, the paper is organized as follows. In Section 2, the econometric model is presented; in Section 3, estimation is discussed, while Monte Carlo analysis is performed in Section 4; finally, conclusions are drawn in Section 5.

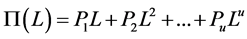

2. The FI-HF-VAR Model

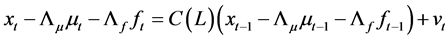

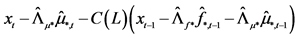

Consider the following fractionally integrated heteroskedastic factor vector autoregressive (FI-HF-VAR) model

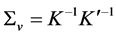

(1)

(1)

(2)

(2)

where  is a

is a  vector of real valued integrated I(d) (

vector of real valued integrated I(d) ( ) and heteroskedastic processes subject to structural breaks,

) and heteroskedastic processes subject to structural breaks,  in deviation from the unobserved common deterministic (

in deviation from the unobserved common deterministic ( ) and stochastic (ft)

) and stochastic (ft)

factors;  is a finite order matrix of polynomials in the lag operator with all the roots outside the unit circle,

is a finite order matrix of polynomials in the lag operator with all the roots outside the unit circle,  ,

,  , is a square matrix of coefficients of order N;

, is a square matrix of coefficients of order N;  is a

is a

vector of zero mean idiosyncratic i.i.d. shocks, with contemporaneous covariance matrix

vector of zero mean idiosyncratic i.i.d. shocks, with contemporaneous covariance matrix , assumed to be coherent with the condition of weak cross-sectional correlation of the idiosyncratic components (Assumption E) stated in [5] p. 143. The model in (1) actually admits the same static representation of [5] , as it can be rewritten as

, assumed to be coherent with the condition of weak cross-sectional correlation of the idiosyncratic components (Assumption E) stated in [5] p. 143. The model in (1) actually admits the same static representation of [5] , as it can be rewritten as .

.

2.1. The Common Break Process Component

The vector of common break processes  is

is , with

, with , and

, and  matrix of loadings

matrix of loadings ; the latter are assumed to be orthogonal to the common stochastic factors

; the latter are assumed to be orthogonal to the common stochastic factors , and of unknown form, measuring recurrent or non recurrent changes in mean, with smooth or abrupt transition across regimes; the generic element in μt is μi,t≡zμ,i(t), where

, and of unknown form, measuring recurrent or non recurrent changes in mean, with smooth or abrupt transition across regimes; the generic element in μt is μi,t≡zμ,i(t), where  is a function of the time index t,

is a function of the time index t, .

.

The idiosyncratic break process  can take different forms. For instance, [6] use a discontinuous function,

can take different forms. For instance, [6] use a discontinuous function,

(3)

(3)

where  is the indicator function, such that

is the indicator function, such that  if

if  and is 0 otherwise; in [6] the break points

and is 0 otherwise; in [6] the break points

are determined through testing; a Markov switching mechanism, as in [7] , could however also be employed to this purpose.

Differently, [8] [9] and [10] model the break process as a continuous and bounded function of time, by means of a Fourier expansion, i.e.,

(4)

(4)

Similarly [11] , using a logistic specification

(5)

(5)

where the logistic function is ,

,  ,

,  and

and

are parameters,

are parameters,  , and

, and  is the estimated standard deviation of

is the estimated standard deviation of . In particular, as

. In particular, as ,

,

becomes the indicator function, yielding therefore a generalization of the specification in [6] .

becomes the indicator function, yielding therefore a generalization of the specification in [6] .

Also similarly [12] and [13] , using a spline function

, (6)

, (6)

where  is a spline function of order p,

is a spline function of order p,  are unknown regression coefficients and the functions

are unknown regression coefficients and the functions  are spline basis functions defined as

are spline basis functions defined as ,

,  ,

, ,

,  , and

, and

, with

, with .

.

A semiparametric approach has also been suggested by [14] , using a kernel function, i.e.,

, (7)

, (7)

where b is the bandwidth and  is the kernel function, specified as

is the kernel function, specified as  for

for  and

and

for

for ;

;  and the coefficient

and the coefficient  are such that

are such that .

.

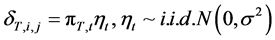

Finally, a random level shift model has been proposed by [15] -[18] ; for instance, [18] define the break process as

(8)

(8)

where  and

and  for

for .

.

In the case , there are no common break processes, i.e., each series is characterized by its own idiosyncratic break process and the

, there are no common break processes, i.e., each series is characterized by its own idiosyncratic break process and the  factor loading matrix

factor loading matrix  is square, diagonal and of full rank; when

is square, diagonal and of full rank; when , there exist M common break processes and the factor loading matrix is of reduced rank (M). Hence, in the latter case the series

, there exist M common break processes and the factor loading matrix is of reduced rank (M). Hence, in the latter case the series  are cotrending, according to [19] , nonlinear cotrending, according to [20] , or cobreaking, according to [21] and [22] . The representation in (1) emphasizes however the driving role of the common break processes, rather than the break-free linear combinations (cobreaking/cotrending relationships) relating the series

are cotrending, according to [19] , nonlinear cotrending, according to [20] , or cobreaking, according to [21] and [22] . The representation in (1) emphasizes however the driving role of the common break processes, rather than the break-free linear combinations (cobreaking/cotrending relationships) relating the series .

.

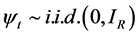

2.2. The Common Break-Free Component

The vector of (zero-mean) integrated heteroskedastic common factors  is

is , with

, with , and

, and

matrix of loadings . The order of integration is

. The order of integration is  in mean, and

in mean, and  in variance,

in variance,  ,

,  ,

,

.

.

The polynomial matrix  is of finite order, with all the roots outside the unit circle;

is of finite order, with all the roots outside the unit circle; ,

,  , is a square matrix of coefficients of order

, is a square matrix of coefficients of order ;

;  is a

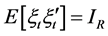

is a  vector of common zero mean i.i.d. shocks, with identity covariance matrix

vector of common zero mean i.i.d. shocks, with identity covariance matrix ,

,  all

all , respectively.

, respectively.

The matrix  is a square diagonal matrix in the lag operator of order

is a square diagonal matrix in the lag operator of order , specified according to the integration order (in mean) of the common stochastic factors, i.e.,

, specified according to the integration order (in mean) of the common stochastic factors, i.e.,  for the case of

for the case of  integration (

integration ( );

); for the

for the  or no integration (short memory) case (

or no integration (short memory) case ( );

);

for the case of fractional integration (

for the case of fractional integration ( , long memory)

, long memory)

( ), where

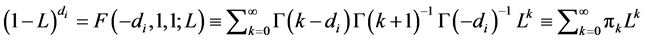

), where  is the fractional differencing operator; the latter admits a binomial expansionwhich can be compactly written in terms of the Hypergeometric function, i.e.,

is the fractional differencing operator; the latter admits a binomial expansionwhich can be compactly written in terms of the Hypergeometric function, i.e.,

, where

, where  is the Gamma function.

is the Gamma function.

In the case  there are no common stochastic processes, i.e., each series is characterized by its own idiosyncratic persistent stochastic component, and the

there are no common stochastic processes, i.e., each series is characterized by its own idiosyncratic persistent stochastic component, and the  factor loading matrix

factor loading matrix  is square, diagonal and of full rank; when

is square, diagonal and of full rank; when , then there exist R common stochastic processes and the factor loading matrix is of reduced rank (R). Hence, in the latter case the series

, then there exist R common stochastic processes and the factor loading matrix is of reduced rank (R). Hence, in the latter case the series  show common stochastic features, according to [23] . The concept of common feature is broad, encompassing the notion of cointegration ([24] ), holding for the

show common stochastic features, according to [23] . The concept of common feature is broad, encompassing the notion of cointegration ([24] ), holding for the  case. The representation in (1) emphasizes however the driving role of the common stochastic factors rather than the feature-free linear combinations (cofeature relationships) relating the series

case. The representation in (1) emphasizes however the driving role of the common stochastic factors rather than the feature-free linear combinations (cofeature relationships) relating the series .

.

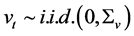

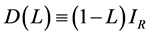

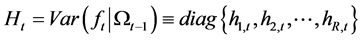

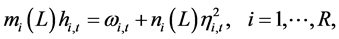

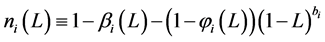

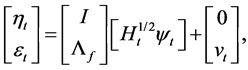

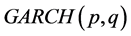

2.3. The Conditional Variance Process

The  conditional variance-covariance matrix for the unconditionally and conditionally orthogonal common factors

conditional variance-covariance matrix for the unconditionally and conditionally orthogonal common factors  is

is , where

, where  is the information set available at time period

is the information set available at time period . Consistent with the constant conditional correlation model of [25] , the ith generic element along the main diagonal of

. Consistent with the constant conditional correlation model of [25] , the ith generic element along the main diagonal of  is

is

(9)

(9)

where  for the case of fractional integration (long memory) in variance

for the case of fractional integration (long memory) in variance

( );

); for the case of

for the case of  integration in variance (

integration in variance ( );

);

for the

for the  or no integration (short memory) in variance case (

or no integration (short memory) in variance case ( ). In all cases

). In all cases ,

,  ,

,  ,

,

and all the roots of the

and all the roots of the  and

and  polynomials are outside the unit circle.

polynomials are outside the unit circle.

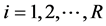

The conditional variance process ,

,  , is therefore of the

, is therefore of the

type [26] , with , or the

, or the  type, for the fractionally integrated and integrated case, respectively; of the

type, for the fractionally integrated and integrated case, respectively; of the  type for the non integrated case. The model is however not standard as the intercept component

type for the non integrated case. The model is however not standard as the intercept component  is time-varying, allowing for structural breaks in variance; similarly to the mean part of the model, structural breaks in variance are assumed to be of unknown form, measuring recurrent or non recurrent regimes, with smooth or abrupt transition; then,

is time-varying, allowing for structural breaks in variance; similarly to the mean part of the model, structural breaks in variance are assumed to be of unknown form, measuring recurrent or non recurrent regimes, with smooth or abrupt transition; then,  , where

, where  is a continuos or discontinuous bounded function of the time index

is a continuos or discontinuous bounded function of the time index ,

,  , which can be parameterized as in (3), (4), (5), (6), (7), or (8).

, which can be parameterized as in (3), (4), (5), (6), (7), or (8).

The following ARCH (∞) representation can be obtained from each of the three above models

(10)

(10)

where  and

and .

.

The term  then bears the interpretation of break in variance process, or time-varying unconditional variance process (no integration case), or long-term conditional variance level (unit root and fractional integration cases).

then bears the interpretation of break in variance process, or time-varying unconditional variance process (no integration case), or long-term conditional variance level (unit root and fractional integration cases).

To guarantee the non negativity of the conditional variance process at eachpoint in time all the coefficients in the  representation must be non-negative, i.e.,

representation must be non-negative, i.e.,  for all

for all  and

and  for any

for any . Sufficient conditions, for various parameterization, can be found in [26] and [27] .

. Sufficient conditions, for various parameterization, can be found in [26] and [27] .

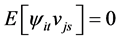

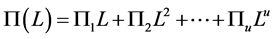

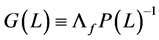

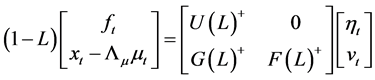

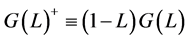

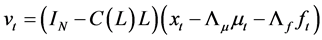

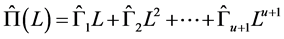

2.4. The Reduced Fractional VAR form

By substituting (2) into (1) and rearranging, the vector autoregressive representation for the factors  and the gap series

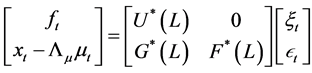

and the gap series  can be written as

can be written as

(11)

(11)

where  and

and  is differently defined according to persistence properties of the data. In particular, for the case of fractional integration (long memory)

is differently defined according to persistence properties of the data. In particular, for the case of fractional integration (long memory) , by means of the binomial expansion, it follows

, by means of the binomial expansion, it follows ,

,  , where

, where ,

,  , is a square matrix of coefficients of dimension

, is a square matrix of coefficients of dimension , and

, and ; since the infinite order representation cannot be handled in estimation, a truncation to a suitable large lag for the polynomial matrix

; since the infinite order representation cannot be handled in estimation, a truncation to a suitable large lag for the polynomial matrix  is required.2 Hence,

is required.2 Hence, . For the case of no integration (short memory) (

. For the case of no integration (short memory) ( ), recalling that

), recalling that  , and therefore

, and therefore , then

, then ; for the case of integration (

; for the case of integration ( ), it should be firstly recalled that

), it should be firstly recalled that

, with

, with ; the latter may be rewritten in the equivalent polynomial matrix form

; the latter may be rewritten in the equivalent polynomial matrix form , where

, where ,

,  , is a square matrix of coefficients of dimension

, is a square matrix of coefficients of dimension , and

, and ,

,

; then,

; then, .

.

Reduced Form and Structural Vector Moving Average Representation of the FI-HF-VAR Model

In the presence of unconditional heteroskedasticity, the computation of the impulse response functions and the forecast error variance decomposition (FEVD) should be made dependent on the estimated unconditional variance for each regime. In the case of (continuously) time-varying unconditional variance, policy analysis may then be computed at each point in time. For some of the conditional variance models considered in the paper, i.e., the FIGARCH and IGARCH processes, the population unconditional variance does not actually exist; in the latter cases the  component might bear the interpretation of long term level for the conditional variance; policy analysis is still feasible, yet subject to a different interpretation, FEVD referring, for instance, not to the proportion of forecast error (unconditional) variance accounted by each structural shock, but to the proportion of forecast error (conditional) long term variance accounted by each structural shock. With this caveat in mind, the actual computation of the above quantities is achieved in the same way as in the case of well defined population unconditional variance.

component might bear the interpretation of long term level for the conditional variance; policy analysis is still feasible, yet subject to a different interpretation, FEVD referring, for instance, not to the proportion of forecast error (unconditional) variance accounted by each structural shock, but to the proportion of forecast error (conditional) long term variance accounted by each structural shock. With this caveat in mind, the actual computation of the above quantities is achieved in the same way as in the case of well defined population unconditional variance.

Hence, the computation of the vector moving average (VMA) representation for the FI-HF-VAR model depends on the persistence properties of the data. The following distinctions should then be made.

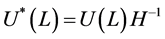

For the short memory case, i.e., the zero integration order case , the VMA representation for the factors

, the VMA representation for the factors  and gap series

and gap series  can be written as

can be written as

, (12)

, (12)

where ,

,  and

and .

.

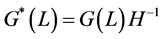

For the long memory case ( ) and the case of

) and the case of  non stationarity (

non stationarity ( ), the VMA representation should be computed for the differenced process, yielding

), the VMA representation should be computed for the differenced process, yielding

, (13)

, (13)

where ,

,  and

and . Impulse responses can then be computed as

. Impulse responses can then be computed as  for

for  and

and  and

and  for

for ,

,

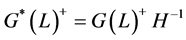

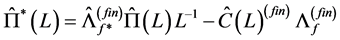

The identification of the structural shocks in the FI-HF-VAR model can be implemented in two steps. Firstly, denoting by  the vector of the

the vector of the  structural common factor shocks, the relation between reduced and structural form common shocks can be written as

structural common factor shocks, the relation between reduced and structural form common shocks can be written as , where

, where  is square and invertible. Therefore, the identification of the structural common factor shocks amounts to the estimation of the elements of the

is square and invertible. Therefore, the identification of the structural common factor shocks amounts to the estimation of the elements of the  matrix. It is assumed that

matrix. It is assumed that , and hence

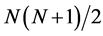

, and hence . As the number of free parameters in

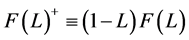

. As the number of free parameters in  is

is

, at most

, at most  parameters in

parameters in  can be uniquely identified through the

can be uniquely identified through the

system of nonlinear equations in the unknown parameters of . Additional

. Additional  restrictions need then to be imposed for exact identification of

restrictions need then to be imposed for exact identification of , by constraining the contemporaneous or long-run responses to structural shocks; for instance, recursive (Choleski) or non recursive structures can be imposed on the VAR model for the common factors through exclusion or linear/non-liner restrictions, as well as sign restrictions, on the contemporaneous impact matrix

, by constraining the contemporaneous or long-run responses to structural shocks; for instance, recursive (Choleski) or non recursive structures can be imposed on the VAR model for the common factors through exclusion or linear/non-liner restrictions, as well as sign restrictions, on the contemporaneous impact matrix .3

.3

Secondly, by denoting  the vector of

the vector of  structural idiosyncratic disturbances, the relation between reduced form and structural form idiosyncratic shocks can be written as

structural idiosyncratic disturbances, the relation between reduced form and structural form idiosyncratic shocks can be written as , where K is square and invertible. Hence, the identification of the structural idiosyncratic shocks amounts to the estimation of the elements of the K matrix. It is assumed that

, where K is square and invertible. Hence, the identification of the structural idiosyncratic shocks amounts to the estimation of the elements of the K matrix. It is assumed that , and hence

, and hence . Then, in addition to the

. Then, in addition to the  equations provided by

equations provided by ,

,  restrictions need to be imposed for exact identification of

restrictions need to be imposed for exact identification of similarly to what required for the common structural shocks.

similarly to what required for the common structural shocks.

Note that preliminary to the estimation of the  matrix,

matrix,  should be obtained from the residuals of an OLS regression of

should be obtained from the residuals of an OLS regression of  on

on ; the latter operation would grant orthogonality between common and idiosyncratic residuals.

; the latter operation would grant orthogonality between common and idiosyncratic residuals.

The structural VMA representation can then be written as

, (14)

, (14)

where ,

,  ,

,  , or

, or

, (15)

, (15)

where ,

,  ,

,  , according to persistence properties, and

, according to persistence properties, and  any

any .

.

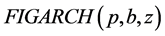

3. Estimation

Estimation of the model can be implemented following a multi-step procedure, consisting of persistence analysis,  estimation of the common factors and VAR parameters in (1),

estimation of the common factors and VAR parameters in (1),  estimation of the conditional mean model in (2) and the reduced form model in (11),

estimation of the conditional mean model in (2) and the reduced form model in (11),  estimation of the conditional variance covariance matrix in (2).

estimation of the conditional variance covariance matrix in (2).

3.1. Step 1: Persistence Analysis

Each component ,

,  , in the vector time series

, in the vector time series  is firstly decomposed into its purely deterministic (trend/break process;

is firstly decomposed into its purely deterministic (trend/break process; ) and purely stochastic (break-free,

) and purely stochastic (break-free, ) parts.

) parts.

It is then assumed that the data obey the model

, (16)

, (16)

where  and

and  are orthogonal,

are orthogonal,  , with

, with  a bounded function of the time index

a bounded function of the time index , evolving according to discontinuous changes (step function) or showing smooth transitions across regimes.

, evolving according to discontinuous changes (step function) or showing smooth transitions across regimes.

Depending on the specification of , a joint estimate of the two components can be obtained following [7] [10] [11] [13] [14] [30] , by setting up an augmented fractionally integrated ARIMA model

, a joint estimate of the two components can be obtained following [7] [10] [11] [13] [14] [30] , by setting up an augmented fractionally integrated ARIMA model

, (17)

, (17)

where  is the integer differencing parameter,

is the integer differencing parameter,  is the fractional differencing parameter

is the fractional differencing parameter

( ),

), is a stationary polynomial in the lag operator and

is a stationary polynomial in the lag operator and  is a white noise disturbance.

is a white noise disturbance.

Heteroskedastic innovations can also be considered, by specifying , with

, with  and the conditional variance process

and the conditional variance process  according to a model of the GARCH family.

according to a model of the GARCH family.

Consistent and asymptotically normal estimation by means of , also implemented through iterative algorithms, is discussed in [10] [13] [14] [18] [31] . Extensions of the Markov switching [7] , logistic [11] and random level shift [15] -[18] models to the long memory case have also been contributed by [32] [33] and [34] , respectively.

, also implemented through iterative algorithms, is discussed in [10] [13] [14] [18] [31] . Extensions of the Markov switching [7] , logistic [11] and random level shift [15] -[18] models to the long memory case have also been contributed by [32] [33] and [34] , respectively.

Alternatively, following [6] , a two-step procedure can be implemented: firstly, structural break tests are carried out and break points estimated; then, dummy variables are constructed according to their dating and the break process is estimated by running an OLS regression of the actual series  on the latter dummies, as in (3); this yields

on the latter dummies, as in (3); this yields  computed as the fitted process and the stochastic part as the estimated residual, i.e.,

computed as the fitted process and the stochastic part as the estimated residual, i.e., ;

;

and

and  are then orthogonal by construction.4

are then orthogonal by construction.4

As neglected structural breaks may lead to processes which appear to show persistence of the long memory or unit root type, as well as spurious breaks may be detected in the data when persistence in the error component is neglected, testing procedures robust to persistence properties are clearly desirable. In this respect, the RSS-based testing framework in [6] yields consistent detection of multiple breaks at unknown dates for  processes, as well as under long range dependence [35] ;5 moreover, under long range dependence, the validity of an estimated break process (obtained, for instance, by means of [6] ) may also be assessed by testing the null hypothesis of long memory in the estimated break-free series (

processes, as well as under long range dependence [35] ;5 moreover, under long range dependence, the validity of an estimated break process (obtained, for instance, by means of [6] ) may also be assessed by testing the null hypothesis of long memory in the estimated break-free series ( ), as antipersistence is expected from the removal of a spurious break process [36] [37] . Structural break tests valid for both

), as antipersistence is expected from the removal of a spurious break process [36] [37] . Structural break tests valid for both  and

and  series have also recently contributed in the literature.

series have also recently contributed in the literature.

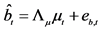

3.2. Step 2: Estimation of the Conditional Mean Model

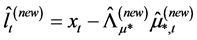

estimation of the reduced form model in (11) is performed by first estimating the latent factors and VAR parameters in (1); then, by estimating the conditional mean process in (2); finally, by substituting (2) into (1) in order to obtain a restricted estimate of the polynomial matrix

estimation of the reduced form model in (11) is performed by first estimating the latent factors and VAR parameters in (1); then, by estimating the conditional mean process in (2); finally, by substituting (2) into (1) in order to obtain a restricted estimate of the polynomial matrix .

.

3.2.1. Estimation of the Common Factors and VAR Parameters

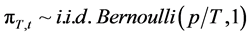

Estimation of the common factors is performed by , writing the (misspecified) approximating model as

, writing the (misspecified) approximating model as

(18)

(18)

with log-likelihood function given by

. (19)

. (19)

QML estimation of the latent factors and their loadings then requires the minimization of the objective function

(20)

(20)

which can be rewritten as

, (21)

, (21)

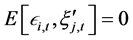

where , as

, as  and

and  are orthogonal vectors, as well as

are orthogonal vectors, as well as  and

and .

.

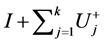

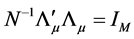

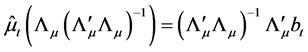

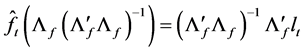

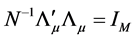

The solution to the minimization problem, subject to the constraints  and

and![]() , is given by firstly minimizing with respect to

, is given by firstly minimizing with respect to  and

and , given

, given  and

and , yielding

, yielding

and then concentrating the objective function to obtain

, (22)

, (22)

which can be mimized with respect to  and

and . This is equivalent to maximizing

. This is equivalent to maximizing

, (23)

, (23)

which in turn is equivalent to maximizing

(24)

(24)

subject to , and

, and

(25)

(25)

subject to .

.

The solution is then found by setting:

Ÿ  equal to the scaled eigenvectors of

equal to the scaled eigenvectors of , i.e., the sample variance covariance matrix of the break processes

, i.e., the sample variance covariance matrix of the break processes , associated with its

, associated with its  largest eigenvalues; this yields

largest eigenvalues; this yields , i.e., the scaled first

, i.e., the scaled first

principal components of ;

;

Ÿ  equal to the scaled eigenvectors of

equal to the scaled eigenvectors of , i.e., the sample variance covariance matrix of the break-free processes

, i.e., the sample variance covariance matrix of the break-free processes , corresponding to its

, corresponding to its  largest eigenvalues; this yields

largest eigenvalues; this yields , i.e., the scaled first

, i.e., the scaled first

principal components of .

.

Note that PCA uniquely estimates the space spanned by the unobserved factors; hence,  and

and  (

(

and ) are not separately identified, as the common factors

) are not separately identified, as the common factors  and factor loading matrix

and factor loading matrix  are uniquely estimated up to a suitable invertible rotation matrix

are uniquely estimated up to a suitable invertible rotation matrix , i.e., PCA delivers estimates of

, i.e., PCA delivers estimates of

and

and , and therefore a unique estimate of the common components

, and therefore a unique estimate of the common components  only, which is however all what is required for the computation of the gap vector.

only, which is however all what is required for the computation of the gap vector.

As shown by [38] , exact identification of the common factors can also be implemented, by appropriately constraining the factor loading matrix while performing PCA or after estimation. In particular, three identification structures are discussed, involving a block diagonal factor loading matrix, yield by a statistical restriction imposed in estimation, and two rotation strategies, yielding a lower triangular factor loading matrix in the former case and a two-block partitioned factor loading matrix in the latter case, with identity matrix in the upper block and an unrestricted structure in the lower block.

Moreover, the number of common factors  is unknown and needs to be determined; several criteria are available in the literature, ranging from heuristic or statistical eigenvalue-based approaches [39] [40] to the more recent information criteria [41] and “primitive” shock ([42] ) based procedures.

is unknown and needs to be determined; several criteria are available in the literature, ranging from heuristic or statistical eigenvalue-based approaches [39] [40] to the more recent information criteria [41] and “primitive” shock ([42] ) based procedures.

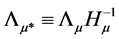

Finally, in order to enforce orthogonality between the estimated common break processes  and stochastic factors

and stochastic factors , the above procedure may be modified by computing the stochastic component

, the above procedure may be modified by computing the stochastic component  as the residuals from the OLS regression of

as the residuals from the OLS regression of  on

on ; then PCA is implemented on (the break-free residuals)

; then PCA is implemented on (the break-free residuals)  to yield

to yield .

.

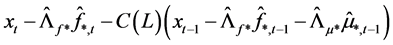

Estimation of the VAR parameters. Conditional on the estimated (rotated) latent factors, the polynomial matrix  and the

and the  and

and  (rotated) factor loading matrices are obtained by means of OLS estimation of the equation system in (1). This can be obtained by first (OLS) regressing the actual series xt on the estimated common break processes

(rotated) factor loading matrices are obtained by means of OLS estimation of the equation system in (1). This can be obtained by first (OLS) regressing the actual series xt on the estimated common break processes  and stochastic factors

and stochastic factors  to obtain

to obtain  and

and ;

;

alternatively,  and

and  can be estimated as yield by PCA, i.e., from the scaled eigenvectors of the matrices

can be estimated as yield by PCA, i.e., from the scaled eigenvectors of the matrices  and

and , respectively; then, the gap vector is computed as

, respectively; then, the gap vector is computed as , as

, as  and

and

, and

, and  is obtained by means of OLS estimation of the VAR model in (1).

is obtained by means of OLS estimation of the VAR model in (1).

3.2.2. Iterative Estimation of the Common Factors and VAR Parameters

The above estimation strategy may be embedded within an iterative procedure, yielding a (relatively more efficient) estimate of the latent factors and the VAR parameters in the equation system in (1).

The objective function to be minimized is then written as

(26)

(26)

where .

.

Ÿ Initialization. The iterative estimation procedure requires an initial estimate of the common deterministic  and stochastic

and stochastic  factors and the

factors and the  polynomial matrix, i.e., an initial estimate of the equation system in (1). The latter can be obtained as described in Section 3.2.1.

polynomial matrix, i.e., an initial estimate of the equation system in (1). The latter can be obtained as described in Section 3.2.1.

Ÿ Updating. An updated estimate of the equation system in (1) is obtained as follows.

° First, a new estimate of the  (rotated) common deterministic factors, and their factor loading matrix, is obtained by the application of PCA to the (new) stochastic factor-free series

(rotated) common deterministic factors, and their factor loading matrix, is obtained by the application of PCA to the (new) stochastic factor-free series

, yielding

, yielding  and

and .6

.6

° Next, conditional on the new common break processes and their factor loading matrix, the new estimate of the common long memory factors is obtained from the application of PCA to (new) break-free processes

7 yielding

7 yielding  and

and .8

.8

° Finally, conditional on the new estimated common break processes and long memory factors, the new estimate of the gap vector  is obtained, and the new estimate

is obtained, and the new estimate  can be computed by means of OLS estimation of the VAR model in (1).

can be computed by means of OLS estimation of the VAR model in (1).

° The above procedure is iterated until convergence, yielding the final estimates ,

,  and

and . Convergence may be assessed in various ways. For instance, the procedure may be stopped when the change in the value of the objective function is below a given threshold.9

. Convergence may be assessed in various ways. For instance, the procedure may be stopped when the change in the value of the objective function is below a given threshold.9

3.2.3. Restricted Estimation of the Reduced Form Model

Once the final estimate of the equation system in (1) is available, the reduced VAR form in (11) is estimated as follows:

1) For the case of fractional integration (long memory) ( ), the fractional differencing parameter is

), the fractional differencing parameter is

(consistently) estimated first, for each component of the (rotated) common factors vector , yielding the estimates

, yielding the estimates ,

,  , collected in

, collected in  matrix.

matrix.

Considering then the generic element ,

,  consistent and asymptotically normal estimation of the ith fractional differencing parameter can be obtained, for instance, by means of

consistent and asymptotically normal estimation of the ith fractional differencing parameter can be obtained, for instance, by means of  estimation of the fractionally integrated ARIMA model in (17); alternatively, consistent and asymptotically normal estimation can be obtained by means of the log-periodogram regression or the Whittle-likelihood function.10

estimation of the fractionally integrated ARIMA model in (17); alternatively, consistent and asymptotically normal estimation can be obtained by means of the log-periodogram regression or the Whittle-likelihood function.10

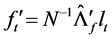

Then, conditionally to the estimated fractionally differencing parameter,  is obtained by means of OLS estimation of the

is obtained by means of OLS estimation of the  model for the fractionally differenced common factors

model for the fractionally differenced common factors  in (2); hence,

in (2); hence,

, where

, where  is the diagonal polynomial matrix in the lag operator of order R, containing the

is the diagonal polynomial matrix in the lag operator of order R, containing the  th order

th order  truncated binomial expansion of the elements in

truncated binomial expansion of the elements in . Then,

. Then,

and

and .

.

Alternatively, rather than by means of the two-step Box-Jenkins type of approach detailed above, VARFIMA estimation of the R-variate version of the model in (17) can be performed by means of Conditional-Sum-ofSquares [45] , exact Maximum Likelihood [46] or Indirect [47] estimation, still yielding  consistent and asymptotically normal estimates.11 OLS estimation of a VAR approximation for the VARFIMA model has also been recently proposed in [48] , which would even avoid the estimation of the fractional differencing parameter for the common stochastic factors.

consistent and asymptotically normal estimates.11 OLS estimation of a VAR approximation for the VARFIMA model has also been recently proposed in [48] , which would even avoid the estimation of the fractional differencing parameter for the common stochastic factors.

For the case of no integration (short memory) ( ) and integration (

) and integration ( ), we also have:

), we also have:

2) For the case of no integration (short memory) ( ),

), is obtained by means of OLS estimation of the VAR(u) model for the (rotated) common stochastic factors (

is obtained by means of OLS estimation of the VAR(u) model for the (rotated) common stochastic factors ( ) in (2); then

) in (2); then ;

;

3) For the  case (

case ( ),

), is obtained by means of OLS estimation of the

is obtained by means of OLS estimation of the  model in levels for the (rotated) common stochastic factors

model in levels for the (rotated) common stochastic factors  implied by (2); then,

implied by (2); then,

.

.

Consistent with [49] and [50] , in all of the above cases VAR estimation can be performed as the estimated common factors were actually observed.

Following the thick modelling strategy in [51] , median estimates of the parameters of interest, impulse responses and forecast error variance decomposition, as well as their confidence intervals, can be computed through simulation.

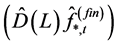

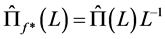

3.3. Step 3: Estimation of the Conditional Variance-Covariance Matrix

The estimation of the conditional variance-covariance matrix for the factors in (2) can be carried out using a procedure similar to the O-GARCH model of [52] :

1) Firstly, conditional variance estimation is carried out factor by factor, using the estimated factor residuals yielding

yielding ,

, ; qml estimation can be performed in a variety of settings, ranging from standard

; qml estimation can be performed in a variety of settings, ranging from standard

and

and  models to their “adaptive” generalizations [9] [12] [53] [54] , in order to allow for different sources of persistence in variance;

models to their “adaptive” generalizations [9] [12] [53] [54] , in order to allow for different sources of persistence in variance;

2) Secondly, consistent with the assumption of conditional and unconditional orthogonality of the factors, the conditional variance-covariance  and correlation

and correlation  matrices for the actual series may be estimated as

matrices for the actual series may be estimated as

(27)

(27)

(28)

(28)

where , and

, and .

.

Relaxing the assumption of conditional orthogonality of the factors is also feasible in the proposed framework, as the dynamic conditional covariances, i.e., the off-diagonal elements in , can be obtained, after step i) above, by means of the second step in the estimation of the Dynamic Conditional Correlation model [55] or the Dynamic Equicorrelation model [56] .

, can be obtained, after step i) above, by means of the second step in the estimation of the Dynamic Conditional Correlation model [55] or the Dynamic Equicorrelation model [56] .

3.4. Asymptotic Properties

The proposed iterative procedure for the system of equations in (1) bears the interpretation of QML estimation, using a Gaussian likelihood function, performed by means of the EM algorithm. In the E-step, the unobserved factors are estimated, given the observed data and the current estimate of model parameters, by means of PCA; in the M-step the likelihood function is maximized (OLS estimation of the  matrix is performed) under the assumption that the unobserved factors are known, conditioning on their E-step estimate. Convergence to the one-step QML estimate is ensured, as the value of the likelihood function is increased at each step [57] [58] . The latter implementation of the EM algorithm follows from considering the estimated factors by PCA as they were actually observed. In fact, the E-step would also require the computation of the conditional expectation of the estimated factors, which might be obtained, for instance, by means of Kalman smoothing [59] [60] . As shown by [49] and [50] , however, when the unobserved factors are estimated by means of PCA in the e-step, the generated regressors problem is not an issue for consistent estimation in the M-step, due to faster vanishing of the estimation error, provided

matrix is performed) under the assumption that the unobserved factors are known, conditioning on their E-step estimate. Convergence to the one-step QML estimate is ensured, as the value of the likelihood function is increased at each step [57] [58] . The latter implementation of the EM algorithm follows from considering the estimated factors by PCA as they were actually observed. In fact, the E-step would also require the computation of the conditional expectation of the estimated factors, which might be obtained, for instance, by means of Kalman smoothing [59] [60] . As shown by [49] and [50] , however, when the unobserved factors are estimated by means of PCA in the e-step, the generated regressors problem is not an issue for consistent estimation in the M-step, due to faster vanishing of the estimation error, provided  for linear models, and

for linear models, and  for (some classes of) non linear models, i.e., the factors estimated by means of

for (some classes of) non linear models, i.e., the factors estimated by means of

can be considered as they where actually observed, therefore not requiring a Kalman smoothing step.

can be considered as they where actually observed, therefore not requiring a Kalman smoothing step.

Note also that the Expectation step of the  algorithm relies on consistent estimation of the unobserved components. In this respect, under general conditions,

algorithm relies on consistent estimation of the unobserved components. In this respect, under general conditions,  consistency and asymptotic normality of

consistency and asymptotic normality of , at each point in time, for the unobserved common components

, at each point in time, for the unobserved common components , has been established by [5] and [61] for

, has been established by [5] and [61] for  and the case of I(0) and I(1) unobserved components;12 this implies the consistent estimation of the gap vector

and the case of I(0) and I(1) unobserved components;12 this implies the consistent estimation of the gap vector  at the same

at the same  rate, for

rate, for

, as well. Based on the results for

, as well. Based on the results for  and

and  processes, the same properties can be conjectured also for the intermediate cases of long memory and (linear/nonlinear) trend stationarity; supporting Monte Carlo evidence is actually provided by [63] and in this study.13

processes, the same properties can be conjectured also for the intermediate cases of long memory and (linear/nonlinear) trend stationarity; supporting Monte Carlo evidence is actually provided by [63] and in this study.13

Moreover, likewise in the Maximization step of the  algorithm,

algorithm,  consistent and asymptotically normal estimation of the polynomial matrix

consistent and asymptotically normal estimation of the polynomial matrix  is yield by OLS estimation of the VAR model for the

is yield by OLS estimation of the VAR model for the

gap vector

gap vector , which, according to the results in [49] and [50] , can be taken as it were actually observed in the implementation of the iterative estimation procedure.

, which, according to the results in [49] and [50] , can be taken as it were actually observed in the implementation of the iterative estimation procedure.

Similarly,  consistent and asymptotically normal estimation of the block of equations in (2) is obtained by means of OLS estimation of the conditional mean process first, holding the estimated latent factors as they were observed, still relying on the results in [49] and [50] and on a consistent estimate of the fractional differrencing parameter if needed, and then performing

consistent and asymptotically normal estimation of the block of equations in (2) is obtained by means of OLS estimation of the conditional mean process first, holding the estimated latent factors as they were observed, still relying on the results in [49] and [50] and on a consistent estimate of the fractional differrencing parameter if needed, and then performing  estimation of the conditional variance-covariance matrix.

estimation of the conditional variance-covariance matrix.

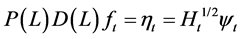

4. Monte Carlo Analysis

Consider the following data generation process (DGP) for the  vector process

vector process

(29)

(29)

where  is a

is a  matrix of coefficients,

matrix of coefficients,  and

and  are

are  vectors of loadings, and

vectors of loadings, and  and

and  are the common deterministic and long memory factors, respectively, at time period

are the common deterministic and long memory factors, respectively, at time period , with

, with

. (30)

. (30)

Then, for the conditionally heteroskedastic case it is assumed

![]()

while

while

for the conditionally homoskedastic case.

Different values for the autoregressive idiosyncratic parameter ρ , common across the N cross-sectional units , have been considered, i.e.,

, have been considered, i.e.,  , as well as for the fractionally differencing parameter

, as well as for the fractionally differencing parameter  and the common factor autoregressive parameter

and the common factor autoregressive parameter , setting

, setting

for the non integrated case and

for the non integrated case and  for the fractionally integrated and integrated cases;

for the fractionally integrated and integrated cases;  is always assumed in the experiment. For the conditional variance equation it is assumed

is always assumed in the experiment. For the conditional variance equation it is assumed  and

and  for the short memory case, and

for the short memory case, and ,

,  and

and  for the long memory case. The inverse signal to noise ratio

for the long memory case. The inverse signal to noise ratio  is given by

is given by , taking values

, taking values

. Finally,

. Finally,  and

and  are set equal to unitary vectors.

are set equal to unitary vectors.

Moreover, in addition to the structural stability case, i.e.,  , two designs with breaks have been considered for the component

, two designs with breaks have been considered for the component , i.e.1) Single step change in the intercept at the midpoint of the sample case, i.e.,

, i.e.1) Single step change in the intercept at the midpoint of the sample case, i.e.,

2) The two step changes equally spaced throughout the sample case, with the intercept increasing at one third of the way through the sample and then decreasing at a point two thirds of the length of the sample, i.e.,

The sample size investigated is , and the number of cross-sectional units is

, and the number of cross-sectional units is . For the no breaks case also other cross-sectional sample sizes have been employed, i.e.,

. For the no breaks case also other cross-sectional sample sizes have been employed, i.e., . The number of replications has been set to 2,000 for each case.

. The number of replications has been set to 2,000 for each case.

The performance of the proposed multi-step procedure has then been assessed with reference to the estimation of the unobserved common stochastic and deterministic factors, and the  and ρ autoregressive parameters. Concerning the estimation of the common factors, the Theil’s inequality coefficient (

and ρ autoregressive parameters. Concerning the estimation of the common factors, the Theil’s inequality coefficient ( ) and the correlation coefficient (

) and the correlation coefficient ( ) have been employed in the evaluation, i.e.,

) have been employed in the evaluation, i.e.,

where

where  is the population unobserved component and

is the population unobserved component and  its estimate. The above statistics have been computed for each Monte Carlo replication and then averaged.

its estimate. The above statistics have been computed for each Monte Carlo replication and then averaged.

In the Monte Carlo analysis, the location of the break points and the value of the fractional differencing parameter are taken as known, in order to focus on the assessment on the estimation procedure contributed by the paper; the break process is then estimated by means of the OLS regression approach in [6] . The Monte Carlo evidence provided is then comprehensive concerning the no-breaks  and

and  cases, as well as the no-break

cases, as well as the no-break  case, concerning the estimation of the common stochastic factor. A relative assessment of the various methodologies which can be employed for the decomposition into break and break-free components is however of interest and left for further research.

case, concerning the estimation of the common stochastic factor. A relative assessment of the various methodologies which can be employed for the decomposition into break and break-free components is however of interest and left for further research.

4.1. Results

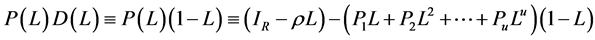

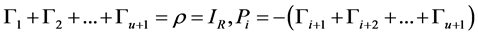

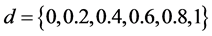

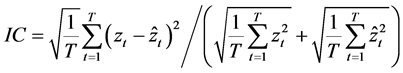

The results for the non integration case are reported in Figure 1, Figure 2 (and 5, columns 1 and 3), while Figure 3, Figure 4 (and 5, columns 2 and 4) refer to the fractionally integrated and integrated cases (the integrated case, independent of the type of integration, thereafter). In all cases, results refer to the estimated parameters for the first equation in the model. Since the results are virtually unaffected by the presence of condi-

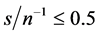

Figure 1. In the figure, Monte Carlo bias and RMSE statistics for the autoregressive parameter (f) are plotted for the case of no breaks (top and center plots) and one (break 1) and two (break 2) breaks (bottom plots), and a conditionally heteroskedastic common I(0) factor. Results are reported for various values of the persistence spread f ‒ ρ (0.2, 0.4, 0.6, 0.8) against various values of the (inverse) signal to noise ratio (s/n)−1 (4, 2, 1, 05, 0.25). The sample size T is 100 and 500 observations, the number of cross-sectional units N is 30, and the number of replications for each case is 2000. For the no breaks case, Monte Carlo bias statistics are also reported for other sample sizes N (5, 10, 15, 50) (center plots).

tional heteroskedasticity, for reasons of space, only the heteroskedastic case is discussed. Moreover, only the results for the  case are reported for the integrated case, as similar results have been obtained for the

case are reported for the integrated case, as similar results have been obtained for the  case.14

case.14

4.1.1. The Structural Stability Case

As shown in Figure 5 (top plots 1-4), for a cross-sectional sample size N = 30 units, a negligible downward bias for the  parameter (on average across (inverse) signal to noise ratio values) can be noted (−0.02 and −0.03, for the non integrated and integrated case, respectively, and

parameter (on average across (inverse) signal to noise ratio values) can be noted (−0.02 and −0.03, for the non integrated and integrated case, respectively, and  (top plots 1-2); −0.01 and −0.006, respectively, and

(top plots 1-2); −0.01 and −0.006, respectively, and  (top plots 3-4)), decreasing as the serial correlation spread,

(top plots 3-4)), decreasing as the serial correlation spread,  or

or , or the sample size

, or the sample size  increase.

increase.

On the contrary, as shown in Figure 1 and Figure 3 (top plots 1 and 3), the downward bias in f is increasing with the degree of persistence of the common factor , the (inverse) signal to noise ratio s/n-1 , and the serial correlation spread,

, the (inverse) signal to noise ratio s/n-1 , and the serial correlation spread,  or

or , yet decreasing with the sample size

, yet decreasing with the sample size .

.

For the non integrated case (Figure 1, plots 1 and 3), there are only few cases ( ) when a 10%, or larger, bias in

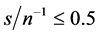

) when a 10%, or larger, bias in  is found, occurring when the series are particularly noisy

is found, occurring when the series are particularly noisy ; for the stationary long memory case a 10% bias, or smaller, is found for

; for the stationary long memory case a 10% bias, or smaller, is found for , while for the non stationary long memory case for

, while for the non stationary long memory case for  and a (relatively) large sample (

and a (relatively) large sample ( ) (Figure 3, plots 1 and 3). Increasing the cross-sectional dimension

) (Figure 3, plots 1 and 3). Increasing the cross-sectional dimension  yields improvements (see the next section).

yields improvements (see the next section).

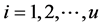

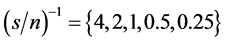

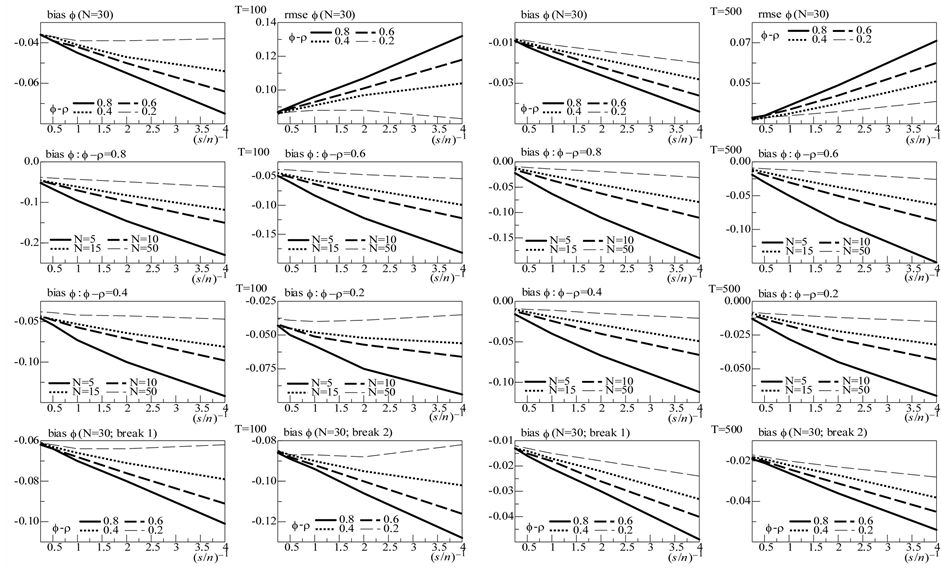

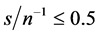

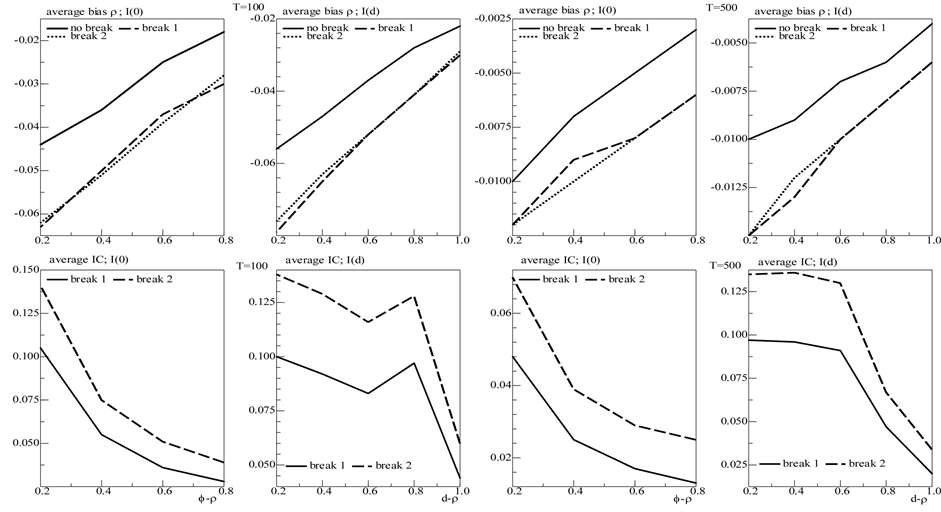

Also, as shown in Figure 2 and Figure 4 (top plots 1-4), very satisfactory is the estimation of the unobserved common stochastic factor, as the  statistic is always below 0.2 (0.14 (0.10)), on average, for

statistic is always below 0.2 (0.14 (0.10)), on average, for  (

( ) for the non integrated case (Figure 2, top plots 2 and 4); 0.06 (0.03), on average, for

) for the non integrated case (Figure 2, top plots 2 and 4); 0.06 (0.03), on average, for  (

( ) for the integrated case (Figure 4, top plots 2 and 4). Moreover, the correlation coefficient between

) for the integrated case (Figure 4, top plots 2 and 4). Moreover, the correlation coefficient between

Figure 2. In the figure, Monte Carlo Carlo Theil’s index (IC) and correlation coefficient (Corr) statistics, concerning the estimation of the conditionally heteroskedastic common I(0) factor, are plotted for the case of no breaks (top and center plots) and one (break 1) and two (break 2) breaks (bottom plots). Results are reported for various values of the persistence spread f ‒ ρ (0.2, 0.4, 0.6, 0.8) against various values of the (inverse) signal to noise ratio (s/n)−1 (4, 2, 1, 05, 0.25). The sample size T is 100 and 500 observations, the number of cross-sectional units N is 30, and the number of replications for each case is 2000. For the no breaks case, Monte Carlo correlation coefficient statistics are also reported for other sample sizes N (5, 10, 15, 50) (center plots).

the actual and estimated common factors is always very high, 0.98 and 0.99, on average, respectively, for both sample sizes (Figure 2 and Figure 4, top plots 1 and 3).

Results for smaller and larger cross-sectional samples. In Figures 1-4 (center plots, i.e., rows 2 and 3), the bias for the  parameter and the correlation coefficient between the actual and estimated common factors are also plotted for different cross-sectional dimensions, i.e.,

parameter and the correlation coefficient between the actual and estimated common factors are also plotted for different cross-sectional dimensions, i.e.,  , for the non integrated and integrated cases, respectively; statistics for the

, for the non integrated and integrated cases, respectively; statistics for the  parameter are not reported, as the latter is always unbiasedly estimated, independently of the cross-sectional dimension.

parameter are not reported, as the latter is always unbiasedly estimated, independently of the cross-sectional dimension.

As is shown in the plots, the performance of the estimator crucially depends on ,

,  , and

, and .

.

For the non integrated case (Figure 1), when the (inverse) signal to noise ratio is low, i.e.,  the downward bias is already mitigated by using a cross-sectional sample size as small as

the downward bias is already mitigated by using a cross-sectional sample size as small as , for

, for

; as

; as  increases, similar results are obtained for higher

increases, similar results are obtained for higher , i.e.,

, i.e.,  and

and , or

, or

and

and  (center plots, column 1-2). For a larger sample size, i.e.,

(center plots, column 1-2). For a larger sample size, i.e.,  (center plotscolumn 3-4), similar conclusions hold, albeit for the

(center plotscolumn 3-4), similar conclusions hold, albeit for the  the (inverse) signal to noise ratio can be higheri.e.,

the (inverse) signal to noise ratio can be higheri.e., ; similarly for

; similarly for  with

with .

.

For the integrated case (Figure 3) conditions are slightly more restrictive; in particular, for the stationary long memory case, when the (inverse) signal to noise ratio is low, i.e.,  , the downward bias is already mitigated by setting

, the downward bias is already mitigated by setting  and

and ; similar results are obtained for higher

; similar results are obtained for higher  and N, i.e.,

and N, i.e.,  and

and , or

, or  and

and  (center plots, column 1-2). Similar conclusions can be drawn for

(center plots, column 1-2). Similar conclusions can be drawn for  (center plots, column 3-4), albeit, holding

(center plots, column 3-4), albeit, holding  constant, accurate estimation is

constant, accurate estimation is

Figure 3. In the figure, Monte Carlo bias statistics for the autoregressive parameter (f) are plotted for the case of no breaks (top and center plots) and one (break 1) and two (break 2) breaks (center and bottom plots), and a conditionally heteroskedastic common I(d) factor ( ). Results are reported for various values of the persistence spread d − ρ (0.2, 0.4, 0.6, 0.8, 1) against various values of the (inverse) signal to noise ratio (s/n)−1 (4, 2, 1, 05, 0.25). The sample size T is 100 and 500 observations, the number of cross-sectional units N is 30, and the number of replications for each case is 2000. For the no breaks case, Monte Carlo bias statistics are also reported for other sample sizes N (5, 10, 15, 50) (center plots).

). Results are reported for various values of the persistence spread d − ρ (0.2, 0.4, 0.6, 0.8, 1) against various values of the (inverse) signal to noise ratio (s/n)−1 (4, 2, 1, 05, 0.25). The sample size T is 100 and 500 observations, the number of cross-sectional units N is 30, and the number of replications for each case is 2000. For the no breaks case, Monte Carlo bias statistics are also reported for other sample sizes N (5, 10, 15, 50) (center plots).

obtained also for higher . Similarly also for the non stationary case (long memory or

. Similarly also for the non stationary case (long memory or ); yet, holding

); yet, holding  constant, either larger

constant, either larger , or lower

, or lower , would be required for accurate estimation.

, would be required for accurate estimation.

Coherently, the correlation coefficients between the actual and estimated common factors (Figure 2 and Figure 4, center plots) point to satisfactory estimation (a correlation coefficient higher than 0.9) also in the case of a small temporal sample size, provided the (inverse) signal to noise ratio is not too high, and/or the cross-sectional dimension is not too low  and

and ;

;  and

and ;

;  and

and ).

).

4.1.2. The Structural Change Case

While concerning the estimation of the  parameter no sizable differences can be found for the designs with structural change, relatively to the case of structural stability15, the complexity of the break process may on the other hand affect estimation accuracy for the

parameter no sizable differences can be found for the designs with structural change, relatively to the case of structural stability15, the complexity of the break process may on the other hand affect estimation accuracy for the  parameter, worsening as the number of break points increases, particularly when the temporal sample size is small (

parameter, worsening as the number of break points increases, particularly when the temporal sample size is small ( ).

).

Yet, for the no integration case (Figure 1, bottom plots), already for  the performance is very satisfactory for both designs, independently of the (inverse) signal to noise ratio

the performance is very satisfactory for both designs, independently of the (inverse) signal to noise ratio  (bottom plots, columns 3 and 4); on the contrary, for

(bottom plots, columns 3 and 4); on the contrary, for  the performance is satisfactory (at most a 10% bias) only when the series are not too noisy (

the performance is satisfactory (at most a 10% bias) only when the series are not too noisy ( ) (bottom plots, columns 1 and 2). Also, similar to the structural stability case, the (downward) bias in the

) (bottom plots, columns 1 and 2). Also, similar to the structural stability case, the (downward) bias in the  parameter is increasing with the degree of persistence of the common factor d, the (inverse) signal to noise ratio

parameter is increasing with the degree of persistence of the common factor d, the (inverse) signal to noise ratio , and

, and  or

or , yet decreasing with the sample size

, yet decreasing with the sample size .

.

Coherent with the above results, satisfactory estimation of the unobserved common stochastic factor (Figure 2, bottom plots) and break process can also be noted (Figure 5, bottom plots, columns 1 and 3); for

Figure 4. In the figure, Monte Carlo Carlo correlation coefficient (Corr) statistics, concerning the estimation of the conditionally heteroskedastic common I(d) factor ( ), are plotted for the case of no breaks (top and center plots) and one (break 1) and two (break 2) breaks (bottom plots). Results are reported for various values of the persistence spread d − ρ (0.2, 0.4, 0.6, 0.8, 1) against various values of the (inverse) signal to noise ratio (s/n)−1 (4, 2, 1, 05, 0.25). The sample size T is 100 and 500 observations, the number of cross-sectional units N is 30, and the number of replications for each case is 2000. For the no breaks case, Monte Carlo correlation coefficient statistics are also reported for other sample sizes N (5, 10, 15, 50) (center plots).

), are plotted for the case of no breaks (top and center plots) and one (break 1) and two (break 2) breaks (bottom plots). Results are reported for various values of the persistence spread d − ρ (0.2, 0.4, 0.6, 0.8, 1) against various values of the (inverse) signal to noise ratio (s/n)−1 (4, 2, 1, 05, 0.25). The sample size T is 100 and 500 observations, the number of cross-sectional units N is 30, and the number of replications for each case is 2000. For the no breaks case, Monte Carlo correlation coefficient statistics are also reported for other sample sizes N (5, 10, 15, 50) (center plots).

the common stochastic factor, the ic statistic (not reported) is in fact always below 0.2 for  (0.11 and 0.13, on average, for the single break point and two-break points case, respectively) and below 0.3 for

(0.11 and 0.13, on average, for the single break point and two-break points case, respectively) and below 0.3 for  (0.17 and 0.20, on average; column 1), while the actual and estimated common stochastic factors are strongly correlated: for

(0.17 and 0.20, on average; column 1), while the actual and estimated common stochastic factors are strongly correlated: for  (

( ), on average, the correlation coefficient is 0.96 (0.98) for the single breakpoint case and 0.93 (0.97) for the two-break points case (column 3).

), on average, the correlation coefficient is 0.96 (0.98) for the single breakpoint case and 0.93 (0.97) for the two-break points case (column 3).

Very accurate is also the estimation of the common break process: the IC statistic is never larger than 0.15 for  and 0.075 for

and 0.075 for  (Figure 5, bottom plots, columns 1 and 3), while the correlation coefficient is virtually 1 for the single break case and never below 0.96 for

(Figure 5, bottom plots, columns 1 and 3), while the correlation coefficient is virtually 1 for the single break case and never below 0.96 for  and 0.99 for

and 0.99 for  for the two-break points case (not reported). Given the assumption of known break points, the performance in terms of correlation coefficient is not surprising; yet, the very small Theil’s index is indicative of success in recovering the changing level of the unobserved common break process.

for the two-break points case (not reported). Given the assumption of known break points, the performance in terms of correlation coefficient is not surprising; yet, the very small Theil’s index is indicative of success in recovering the changing level of the unobserved common break process.

Concerning the integrated case, some differences relatively to the nonintegrated case can be noted; as shown in Figure 5 (bottom plots, columns 2 and 4), albeit the overall recovery of the common break process is always very satisfactory across the various designs, independently of the sample size (the IC statistic is never larger than 0.14; bottom plots), performance slightly worsens as the complexity of the break process and persistence intensity (d ) increase: the average correlation coefficient between the estimated and actual break processes (center plots) falls from 1 when  (single break point case) to 0.93 when

(single break point case) to 0.93 when  (two-break points case).

(two-break points case).

Moreover, concerning the estimation of the common stochastic factor (Figure 4, center and bottom plots, columns 1-4), for the covariance stationary case ( ) results are very close to the non integrated case, i.e., an IC statistic (not reported) always below 0.2 for

) results are very close to the non integrated case, i.e., an IC statistic (not reported) always below 0.2 for  (0.12 and 0.14, on average, for the single break point and two-break points case, respectively) and below 0.3 for

(0.12 and 0.14, on average, for the single break point and two-break points case, respectively) and below 0.3 for  (0.21 and 0.24, on average, respectively); the correlation coefficient is also very high: 0.94 and 0.91, on average,

(0.21 and 0.24, on average, respectively); the correlation coefficient is also very high: 0.94 and 0.91, on average,  (columns 1

(columns 1

Figure 5. In the figure, average Monte Carlo statistics (across values for the inverse signal to noise ratio) for the bias in the autoregressive idiosyncratic parameter (ρ) (top plots) and Theil’s index (IC) statistic for the common break process (bottom plots) are plotted for the non integrated (I(0)) and integrated (I(d), ) cases. Results are reported for various values of the persistence spreads f − ρ (0.2, 0.4, 0.6, 0.8) and d − ρ (0.2, 0.4, 0.6, 0.8, 1). The sample size T is 100 and 500 observations, the number of cross-sectional units N is 30, and the number of replications for each case is 2000.

) cases. Results are reported for various values of the persistence spreads f − ρ (0.2, 0.4, 0.6, 0.8) and d − ρ (0.2, 0.4, 0.6, 0.8, 1). The sample size T is 100 and 500 observations, the number of cross-sectional units N is 30, and the number of replications for each case is 2000.

and 2); 0.97 and 0.96, on average,  (columns 3 and 4).

(columns 3 and 4).

On the contrary, for the non stationary case performance is worse, showing average IC statistics (not reported) of 0.32 (0.32) and 0.42 (0.44), respectively, for the single break point (center plots) and two-break points (bottom plots) case and  (

( ); the average correlation coefficient is 0.79 (0.78) and 0.68 (0.66), respectively. Coherently, a worsening in the estimation of the common factor autoregressive parameter

); the average correlation coefficient is 0.79 (0.78) and 0.68 (0.66), respectively. Coherently, a worsening in the estimation of the common factor autoregressive parameter , for the

, for the  and

and  case, can be noted (Figure 3, center and bottom plots), while comparable results to the short memory case can be found for

case, can be noted (Figure 3, center and bottom plots), while comparable results to the short memory case can be found for . The latter findings are however not surprising, as the stronger the degree of persistence of the stochastic component (and of the series, therefore) and the less accurate the disentangling of the common break and break-free parts can be expected; overall, Monte Carlo results point to accurate decompositions also for the case of moderate nonstationary long memory, albeit deterioration in performance becomes noticeable.

. The latter findings are however not surprising, as the stronger the degree of persistence of the stochastic component (and of the series, therefore) and the less accurate the disentangling of the common break and break-free parts can be expected; overall, Monte Carlo results point to accurate decompositions also for the case of moderate nonstationary long memory, albeit deterioration in performance becomes noticeable.

5. Conclusion

In the paper, a general strategy for large-scale modeling of macroeconomic and financial data, set within the factor vector autoregressive model (F-VAR) framework is introduced. The proposed approach shows minimal pretesting requirements, performing well independently of integration properties of the data and sources of persistence, i.e., deterministic or stochastic, accounting for common features of different kinds, i.e., common integrated (of the fractional or integer type) or non integrated stochastic factors, also heteroskedastic, and common deterministic break processes. Consistent and asymptotically normal estimation is performed by means of QML, implemented through an iterative multi-step algorithm. Monte Carlo results strongly support the proposed approach. Empirical implementations can be found in [37] [67] -[69] , showing the approach being easy to implement and effective also in the case of very large systems of dynamic equations.

Acknowledgements

A previous version of the paper was presented at the 19th and 21st Annual Symposium of the Society for Non Linear Dynamics and Econometrics, the 4th and 6th Annual Conference of the Society for Financial Econometrics, the 65th European Meeting of the Econometric Society (ESEM), the 2011 NBER-NSF Time Series Conference, the 5th CSDA International Conference on Computational and Financial Econometrics. The author is grateful to conference participants, N. Cassola, F. C. Bagliano, C. Conrad, R. T. Baillie, J. Bai, for constructive comments. This project has received funding from the European Union’s Seventh Framework Programme for research, technological development and demonstration under grant agreement no. 3202782013-2015 and PRINMIUR 2009.

As Mitsuo Aida wrote in one of his poems, somewhere in life/there is a path/that must be taken regardless of how hard we try to avoid it/at that time, all one can do is remain silent and walk the path/neither complaining nor whining/saying nothing and walking on/just saying nothing and showing no tears/it is then/as human beings, /that the roots of our souls grow deeper. This paper is dedicated to the loving memory of A.

References

- Stock, J.H. and Watson, M.W. (2011) Dynamic Factor Models. In: Clements, M.P. and Hendry, D.F., Eds., Oxford Handbook of Economic Forecasting, Oxford University Press, Oxford, 35-60.

- Geweke, J. (1977) The Dynamic Factor Analysis of Economic Time Series. In: Aigner, D.J. and Goldberger, A.S., Eds., Latent Variables in Socio-Economic Models 1, North-Holland, Amsterdam.

- Dees, S., Pesaran, M.H., Smith, L.V. and Smith, R.P. (2010) Supply, Demand and Monetary Policy Shocks in a Multi-Country New Keynesian Model. ECB Working Paper Series, No. 1239.

- Bai, J. and Ng, S. (2004) A Panic Attack on Unit Roots and Cointegration. Econometrica, 72, 1127-1177.

- Bai, J.S. (2003) Inferential Theory for Factor Models of Large Dimensions. Econometrica, 71, 135-171. http://dx.doi.org/10.1111/1468-0262.00392

- Bai, J.S. and Perron, P. (1998) Testing for and Estimation of Multiple Structural Changes. Econometrica, 66, 47-78. http://dx.doi.org/10.2307/2998540