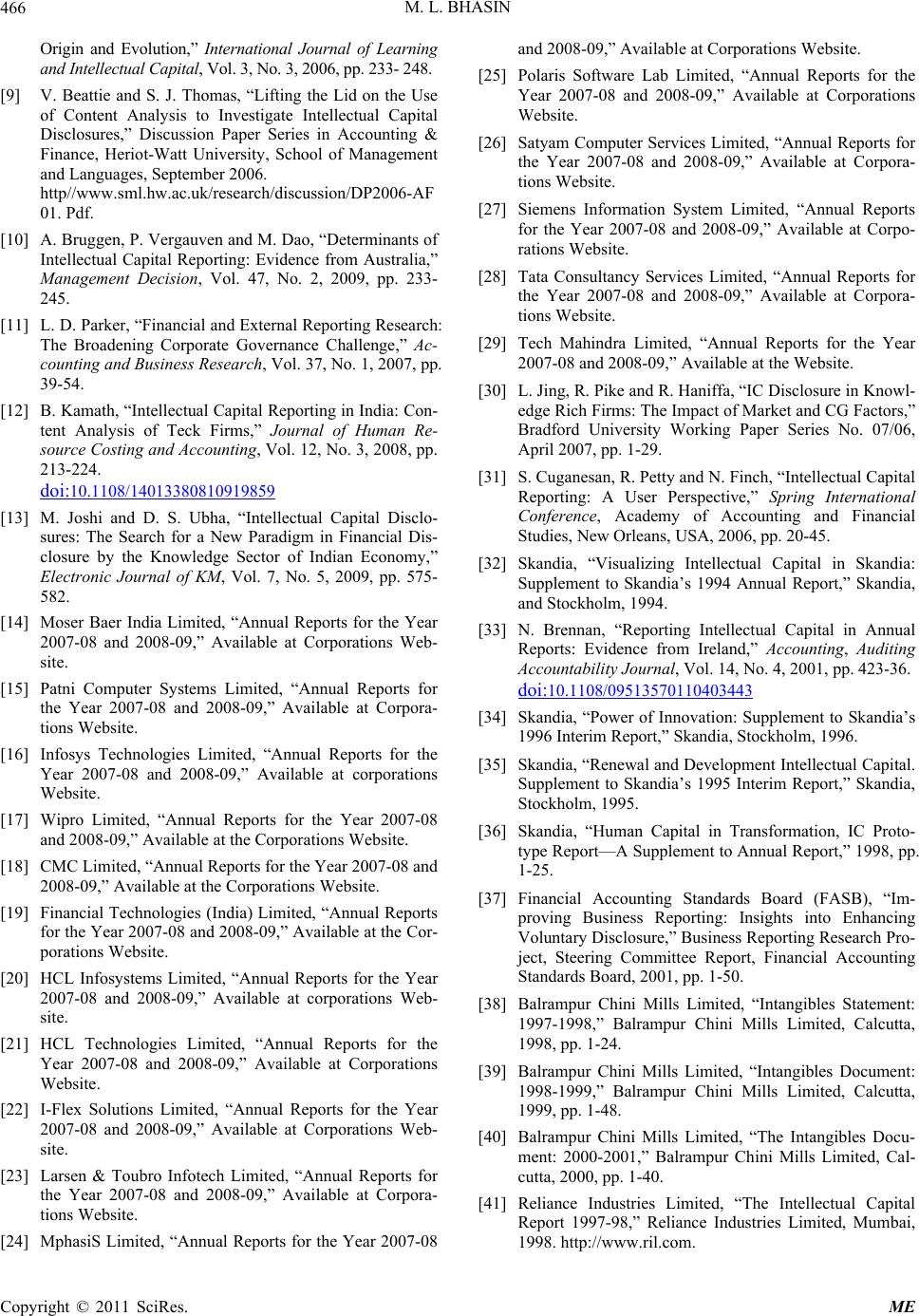

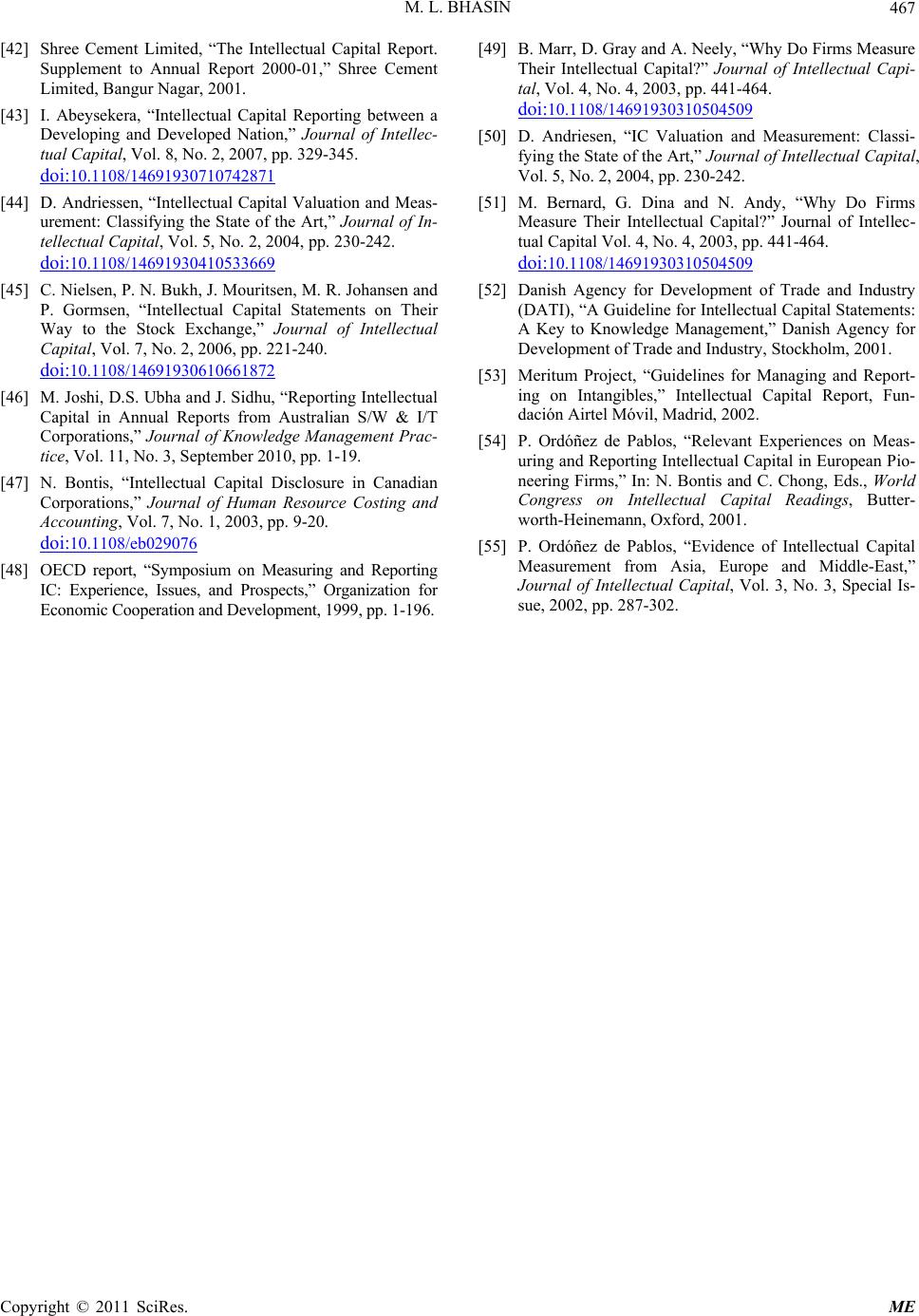

Modern Economy, 2011, 2, 455-467 doi:10.4236/me.2011.24051 Published Online September 2011 (http://www.SciRP.org/journal/me) Copyright © 2011 SciRes. ME Disclosure of Intellectual Capital in Annual Reports: An Empirical Study of the Indian IT Corporations Madan Lal Bhasin Bang College of Business, Kazakhstan Institute of Management, Economics and Strategic Research (KIMEP), Almaty, Republic of Khazakhstan E-mail: madan.bhasin@rediffmail.co m Received January 27, 2011; revised March 25 , 20 1 1; accepted April 12, 201 1 Abstract At present, disclosure of IC information across the globe is done by very few leading corporations purely on a “voluntary” basis. Unfortunately, the omission of IC information may adversely influence the quality of decisions made by shareholders, or lead to material misstatements. This study attempts to provide an insight in to the “narrative” style of IC disclosures done by Indian corporations. Initially, a longitudinal study was carried out to analyze how Indian firms—Reliance Industries Limited, Balrampur Chini Mills, and Shree Cement Limited—measure and report their IC reports. In order to survey the recent IC disclosure scenario, we conducted another study of 16 Indian IT corporations in which the “content analysis” was done on their 2007 to 2009 annual reports. The results of this study confirmed that IC disclosure in these IT corporations is almost negligible and its disclosure had not received any preference from the mentors of these corporations. IC reports may initially be used for “internal” management purposes; but an “external” stakeholder-focus of IC report should be the ultimate goal. Keywords: Intellectual Capital, Disclosure, Annual Reports, IT Corporations, Empirical Study, IC Reports 1. Introduction Business dynamics of the 21st century are increasingly determined and driven by Intellectual Capital (IC) elem- ents. The future drivers of any economy will no longer be capital, land or equipment, but the “people” and their “knowledge” reservoir. A knowledge-intensive corpor- ation leverages their know-how, innovation and reput- ation to achieve success in the marketplace (Jose et al., 2010) [1]. Market participants, practitioners and regul- ators alike argue that there is an important need for gre- ater investigation and understanding of IC disclosure (or reporting) as the usefulness of financial information in explaining firm profitability con tinues to deteriorate. Bu- kh (2005) [2], for example, asserts that traditional disclo- sure mechanisms are not able to cope adequately with the disclosure requirements of new economy firms. He obse- rved an increasing dissatisfaction with traditional finan- cial disclosure and its ability to convey to investors the wealth-creation potential of firms. Despite growing inte- rest and demand for IC information, prior research till date suggests a persistent and significant variation, both in the “quantity” and “quality” of information reported by firms on this pivotal resource. As existing economic and business metrics track a declining proportion of the real economy, the deficiency and inconsistency in the disclosure of IC-related information is creating growing information “asymmetry” between “informed” and “uni- nformed” investors. This provides a fertile ground for informed investors to extract higher abnormal returns (Chiucchi et al., 2008) [3]. Thus, IC is increasingly b eing recognized as having much greater significance in crea- ting and maintaining competitive advantage and share- holder value. This clearly calls for a refreshed underst- anding of business principles, information disclosure, and decision-making processes. The concept of IC measurement, management and disclosure is still relatively new. Accountants, business managers and policy makers hav e still to grapple with its concepts and detailed application. As expected, defi- nition of IC varies substantially. According to Stewart (2002) [4]: “It has become standard to say that a corpora- tions’ IC is the sum of its human capital (talent), struc- tural capital (intellectual property, methodologies, soft- ware, documents, and other knowledge artifacts), and customer capital (client relationships).” One of the most  M. L. BHASIN 456 comprehensive definitions of IC is offered by the Char- tered Institute of Management Accountants (CIMA, 2001) [5]: “The possession of knowledge and experience, pro- fessional knowledge and skill, good relationships, and technological capacities, which when applied will give organizations competitive ad vantage.” An expert opine, IC is a combination of human capi- tal—the brains, skills, insights, and potential of those in an organization—and structural capital—things like the capital wrapped up in customers, processes, databases, brands, and IT systems. It is the ability to transform kno- wledge and intangible assets into wealth creating res- ources, by multiplying human capital with structural cap- ital. For instance, Sveiby (2004) [6] first proposed a classification for IC into three broad areas of intangibles, viz., Human capital, Structural capital and Customer capital—a classification that was later modified and ext- ended by replacing customer capital by relational capital. Some examples of IC are shown in Table 1. When there is a large disparity between a firm’s “market” value and “book” value, that difference is often attributed to “IC”. Market value is, of course, the corpo- ration’s total shares outstanding times the stock market price of each. Book value is the excess of total assets over total liabilities. But what is the value of IC? Meas- uring the value of IC is difficult, but there are methods that can do it (Holmen 2005) [7]. As per a study con- ducted by Pike and Ross (2006) [8], they have catego- rized 12 different approaches to measuring IC, and an- other researcher has identified more than 30. The various forms of IC disclosure provide valuable information for investors as they help reduce uncertainty about future prospects and facilitate a more precise valuation of the corporations. However, financial reports fail to reflect such a wide-range of value-creating intangible assets, giving rise to increasing information asymmetry between firms and users, and creating inefficiencies in the resource allocation process within capital markets. 2. Literature Review on IC Disclosure Studies The main IC disclosure studies were typically cross- sectional and country-specific, although some longitudinal studies have been reported too. Some of the leading IC disclosure studies, widely reported in the literature, were conducted in Australia, U K & Ireland, Sweden, Canada, Malaysia, Sri Lanka, New Zealand, Bangladesh and India. While most studies employed “content analysis” as the research methodology, other studies have used question- naire surveys (Beattie 2007) [9]. Despite the fact that the importance of IC has increased in recent times, there are inadequate dis closures of IC in the financial sta tements of corporations (Bruggen et. al. 2009) [ 10]. Table 1. Components of intellectual capital. Human Capital Structural Capital Customer Capital Customer relations Customer Loyalty Repeat business... Relational Capital Knowledge Competence Skills Individual & Collective Experiences Training Communities of prac- tice... Business processes Manuals/ policies Information systems Research findings Trademarks Brands... Relations with vendors Investor trust and feedback... In a review of the current state of financial and external disclosure research, Parker (2007) [11] identified IC accounting as a major area for further research. However, most of the IC disclosure studies were cross-sectional and country-specific. Examples include studies in Aust- ralia (e.g. Guthrie and Petty; Sujan and Abeysekera), Ireland (Brennan), Italy (e.g. Bozzolan et al.), Malaysia (Goh and Lim), UK (e.g. Williams), and Canada (Bontis). Relatively very few longitudinal studies have been repo- rted (e.g. Abeysekera and Guthrie). Moreover, some stu- dies focused on the specific aspects of IC disclosure, such as human capital disclosure (e.g. Subbarao and Zeg- hal), while others conducted international comparative studies (e.g. Vergauwen and van Alem; Cerbioni and Pa- rbonetti). Some IC disclosure studies have looked beyo- nd annual reports to examine other communication chan- nels, such as, analyst p resentations. Studies have also been conducted to explor e IC re lated issues from the firm’s perspective. Chaminade and Rob- erts investigate the implementatio n of IC disclosure syst- ems in Norway and Spain. Habersam and Piper emplo- yed case studies to explore the relevance and awareness of IC in hospitals. Studies that look ed at possible determ- inants of voluntary IC disclosure include García-Meca et al. and Cerbioni and Parbonetti. Based on analyst presen- tation reports of listed Spanish corporations, García- Meca et al. found significant association between IC disclosure and size and type of disclosure meeting but not ownership diffusion, international listing status, indu- stry type and profitability. Guthrie and Petty’s (2004, 2006) analysis of IC disclosure practices suggests that disclosure has been expressed in discursive rather than numerical terms and that little attempt has been made to translate the rhetoric into measures that enable perfor- mance of vari o us f o rms of IC to be evaluated. India presents an ideal case for the analysis of IC disclosures by the IT corporations because the economy has been undergoing rapid economic transformation in the financial services, tourism, IT sectors and the niche manufacturing gaining momentum. In the Indian-context, there has been very limited number of IC disclosure studies, as compared to its European counterparts. How- ever, two recent studies are available on IC disclosu re in Copyright © 2011 SciRes. ME  M. L. BHASIN457 India using content analysis, which were done by Ka- math (2008) [12], and Joshi et al. (2009) [13]. The foregoing discussion suggests that the literature on the determinants of IC disclosure in Indian-context is very limited and inconclusive. Thus, our study builds on the previous literature of IC disclosure practice and overall IC disclosure scenario in the Indian corporate sector, especially knowledge-based IT firms. The scope of the study has been confined to 16 corporations from the IT sector [14-29], and a content analysis was performed on their annual reports for two years, namely, 2007-2008 and 2008-2009 re spectively. 3. Research Methodology Used With the rise of the “knowledge economy,” the man- agement of IC is becoming even more important and, therefore, it should be disclosed in the annual reports. In the knowledge-based economy, therefore, most of the organizations have realized that the true potential of cre- ating value for their organizations lies in the measure- ment, valuation, and disclosure of their IC (Jing et al., 2007) [30]. However, due to lack of “regional” research on IC disclosures in India, we decided to focus on a “longitudinal” study of IC reports published by the In- dian pioneer firms. After some initial research on busi- ness and intangible resources in the Indian corporations, we found that three corporations had published their first IC reports in 1997, which were discontinued later on. These firms are: Balrampur Chini Mills Limited, Reli- ance Industries Limited, and Shree Cement Limited. Af- ter some initial difficulties, we collected copies of IC reports published by these firms. The aim was to study the idiosyncrasy of th e reports built in the Indian sub con- tinent. This r esear ch also aims a t mapping the current state of IC-related disclosures in the Indian scenario. Accord- ingly, the sample-size of this study consists of 16 top IT- sector corporations. However, these corporations were primarily selected on the basis of their total income, as per the 2008 publication of “Dun and Bradstreet,” a pre- mier survey agency of the country. The electronic copies of the annual reports for these selected corporations were obtained for two years, 2007-08 and 2008-09 from their respective corporate Websites. In the past, several re- search studies have been conducted in various countries, using the “content analysis” of annual reports, to analyze the IC disclosure practices. A list of IC related terms was searched within the annual reports yielding a signify- cantly small number of instances in which IC disclosure took place. Therefore, an attempt has been made here to use the same technique (i.e., content analysis) to analyze the extent of disclosure of IC by these IT corporations. However, research in other countries revealed that dis- closure practice stays well behind on a global scale, de- spite the perceived importance by corporate managers. 4. Development of Intellectual Capital Reports Endeavors to reconstruct corporate annual reports to in- clude IC indicators were spearheaded in the early 1990 s by a small number of corporations, such as, the Swedish insurance corporations “Skandia and Celemi,” the Dan- ish corporations “Ramboll and the “Dow Chemical Cor- porations”. In fact, all these pioneering corporations in- cluded various aspects of their IC in their 1994 annual reports. As per Cuganesan et al., (2006) [31], “An IC Report (ICR) consists of three components: 1) vision of the organization and the values that it seeks to follow; the strategic objectives, competencies, critical intangibles or ‘dream tickets’ (intangible assets that a corporations cannot do without to achieve its objectives); 2) a sum- mary of the IC (intangible assets, intellectual resources, intangible activities) and the efforts undertaken by the organization to nurture the IC; and 3) indicators or pa- rameters that quantify the IC. Indicators, in fact, provide measurable quotients for the audience of the ICR to cor- rectly estimate the value of an organization’s IC and its expected poten t i al and payoff .” The Skandia Navigator (1994) [32] incorporated a to- tal of 30 key indicators in the various areas, which are monitored internally on a yearly b asis. To give an exam- ple, the key indicators for “customer” focus include number of accounts, number of brokers and number of lost customers, “process” focus include number of ac- counts per employee and administrative costs per em- ployee, “human” focus include personnel turnover, pro- portion of managers, proportion of female managers, and training and/or education costs per employee, and finally, “development/renewal” focus include satisfied employee index, marketing expense/customer, and share of training hours. The ICR serves to make the organizational “intangi- ble” resources “visible” and to measure them. The ICR could be prepared for the purpose of giving external partners’ relevant information ‘supplementary’ to the other parts of the annual report and/or for using it as an ‘ad-hoc’ management tool for the development of the organization. Although the primary target groups of the ICR are existing and potential customers and employees, it also catches the attention of capital investors, the press, and the university researcher community (Brennan 2001) [33]. Some leading European and a few Indian firms had in the past published two types of reports: the intellectual capital report and the financial report. Some firms, in- deed, elaborate and publish the ICR separately as a “sup- Copyright © 2011 SciRes. ME  M. L. BHASIN 458 plement” to their financial report. However, both types of reports are complementary and seek to offer a more “holistic” view of the firm. The ICR is aimed at provid- ing a ‘holistic’ picture of the firm on the basis of chosen strategies, actions taken and current challenges. Rather than focusing on financial resources in accounting re- ports, the ICR is focused on “softer” resources, such as, intellectual capital (CIMA 2001) [5]. In essence, it is a “supplement” to the financial accounts, as well as, a valuable strategic management tool. 4.1. The Birth of World’s First Intellectual Capital Report The first ICR was born and made public in the year 1994 . Its ‘father’ was Leif Edvinsson at Skandia, and its birth constituted a milestone in the field of IC measurement, management and disclosure. From that year onwards, many firms realized the strategic importance of measure- ing and disclosure IC but so far just a few firms decided to build it. Looking at Skandia’s first, and subsequent IC reports, this pioneer firm decided to assume the chal- lenges of building IC reports without the existence of any IC “guidelines” put forward by any regulatory bodies and/or any other certifying agency. Skandia’s first ICR was focused on “intellectual capi- tal as a whole.” It addressed organizational hidden values, indicators for the future, a vision of the satisfied cus- tomer, the search for success factors, quality of the sys- tem, people and technology, competency, renewal and growth, the path forward, and a glossary of terms related to IC. The first IC report had 22 pages, and subsequent ones issued in 1995 and 1996 had 7 and 11 pages, re- spectively. The first, 1994 report also described a “new” disclo- sure model called, the “Skandia Navigator”. As it is well- known, this famous tool was designed to describe and measure the IC of an organization. The Navigator models (1996) [34] visualize value components that make up IC, as well as, the method of managing them and disclosure on their development. It is designed to provide a bal- anced picture of the financial and IC (1995) [35]. Its greatest advantage is “the balanced total picture it pro- vides of the operations” (Skandia, 1998) [36]. The focus on financial results, capital and monetary flows is com- plemented by a description of IC and its development. Indicators that specify both the level and change are highlighted. At Skandia, the IC ratios are grouped into four major focus areas viz., the customer, human, proc- ess, and renewal & development focus, as shown in Ta- ble 2. The Skandia Navigator is not intended to “provide a specific value for the various components of its IC. Rather, the navigator is designed to provide a balanced Table 2. Assigning Values to Skandia’s Intellectual Capital (Measurement Me thodology). 1997 1996 1995 1994* Financial Focus Operating income (MSEK)** 104 86 85 75 Total operating income (MSEK) 398 373 351 226 Income/expense ratio after loan losses 1.35 1.30 1.32 1.49 Capital ratio (%) 12.90 14.95 24.48 25 Customer Focus Number of customers 197,000 157,000 126,00038,000 Human Focus Average number of employees 218 200 163 130 Of whom, women (%)56 49 45 42 Process Focus Payroll costs/administrative ex- penses (%) 49 46 42 38 Renewal & Development Focus Total assets (MSEK) 9100 8100 5600 3600 Share of new customers, 12 months (%) 25 25 232 N/a Deposits and borrowing, general public (MSEK) 7600 6200 4300 1300 Lending and leasing (MSEK) 8500 7600 3700 3200 Net asset value of funds (MSEK) *** 9900 7400 6300 4700 *Accounting-based indicators for 1994 have not been recalculated in accor- dance with the new Swedish Insurance Annual Accounts Act, which took effect on January 1, 1996. **MSEK = Million Swedish Krona ***Changed calculation methods for 1996 and 1997. (Source: Skandia, “Human Capital in Transformation,” Intellectual Capital Prototype Report—A Supplement to Skandia’s 1 998 Annual R eport.) overview, as well as, a basis for the systematic manage- ment process that is essential for the creation a future value. The four focus areas of Skandia’s model are the same for the other parts of Skandia’s organizational, while the indicators vary from unit to unit.” 4.2. The Second Generation of Intellectual Capital Report The second milestone in the ICR field happened in the year 1997. In that year, most of the pioneer firms pub- lished their first IC reports. Mainly these corporations were from Denmark, Sweden, Spain and India. The ex- perience of the European IC reports is well covered in the literature: the Danish case (Danish Agency for Trade and Industry), the Nor wegian case (Roberts), the Spanish case (Ordóñez de Pablos) and the Swedish case (Celemi; Sveiby). However, we should not fo rget that th ere is a long way to march ahead to cover in the field of the IC report. It is necessary to design IC report “guidelines,” which are accepted and carried out by those firms that decide to Copyright © 2011 SciRes. ME  M. L. BHASIN459 measure and report their IC or in a not-so-distant future may be enforced by regulatory bodies—as it is the case of physical and financial resources and certain intangible resources like goodwill and intellectual property (FASB 2001) [37]. 5. Intellectual Capital Disclosure S c e nario in India: A Longitudinal Study Attracted by the lack of “regional” research on IC dis- closures in India, we decided to focus on a “longitudinal” study of IC reports published by the pioneer Indian firms. After some initial research on business and intangible resources in the Indian corporations, we found that three private-sector corporations had published their first IC report in the year 1997. These firms are: Balrampur Chini Mills Limited, Reliance Industries Limited, and Shree Cement Limited. After some initial difficulties, we collected IC reports published by these firms. The aim was to study the “idiosyncrasy of the reports built in the Indian subcontinent.” Why did these firms decide to build this innovative report? The reason is that the IC report contributes to the management of intangible re- sources, and also provides the shareholders’ with a “ho- listic” picture of the organizational resources. Let us study the experience of three leading firms, which had taken the lead by providing IC-related disclosures, so as to learn some valuable lessons from them. 5.1. Balrampur Chini Mills Limited The Balrampur Chini Mills Limited (visit www.chini. com) is one of India’s largest sugar corporations, with three factories in Uttar Pradesh. In addition to the core sugar business, the corporation also produces and sells molasses and alcohol. In 1996-97 Annual Report the firm elaborates about the rationale of IC and intangible report as: “to provide share owner a different and broader perspective of the corporations, and the fundamentals that drive its busi- ness.” The Balrampur Model is specific to the corpora- tions (1997-98) [38] as “it reflects our priorities, our method of working, our attitude and our people.” If suc- cessfully activated, this model becomes regenerative. The corporation states in its 1998-99 [39] report, “As we keep this intellectual capital wheel in motion, the Bal- rampur will always be a growing corporation.” According to the firm, the five elements of IC are: credibility, efficiency, human, structural, and customer capital. Customer capital has a strategic importance for the firm. As it states, “This is the apex of Balrampur’s intellectual capital model. All the expertise built up on the manufacturing and marketing side s of the business is eventually judged on the ability of the corporations to produce sugar of acceptable quality.” (2000-2001) [40] Moreover, the corporation stresses the benefits of valuing brands. The ability to outperform the sugar in- dustry average is a reflection of the considerable intel- lectual capital that it has built into its business—at the farm, factory and marketing levels (2000-2001). The Balrampur Chini Mills’ ICR constitutes an independent document to the annual report. These reports had 11 pages (1996- 1997), 24 (1997-1998), 48 (1999-2000) and 40 (2000-2001), respectively. 5.2. Reliance Industries Limited The Reliance Industries Limited (RIL) activities include exploration and production of oil and gas, refining and marketing, power, telecommunications, petrochemicals, textiles, financial services and insurance, and info-com initiatives. It has emerged as India’s most admired busi- ness house, for the third successive year in a TNS Mode survey for 2003. The Reliance’s employee skills are its competitive muscle. Its skills differentiate Reliance fro m its competitors—whether it be through the speedier im- plementation of a project or in its implementation at a cost which is significantly lower than that of the compe- tition, or in the ability to extract more out of capital equipment, even when it ages. These skills are germi- nated in the Reliance culture (1998) [41]. The ICR of RIL (www.ril.com) aims to: “redress the imbalance between non-financial and financial data, in recognition of the belief that value of organizations will, in times to come, increasingly reside in their intangible assets.” (1998) The ICR is just focused on intellectual capital and addresses several key topics: the importance of the IC report itself, IC and value creation, human capital, structural capital, customer capital, and investor capital. However, it does not address the business model. It constitutes an independent document from the annual report with a total of 20 pages. The firm recognizes that “the development and the use of human potential and a learning organization is Reli- ance’s bridge to continued success in the future.” It uses the term “customer capital” not “relational capital” as most firms do. In this area, variables that matter are market creation, quality of customers, customer retention and growth, market share and the quality facto r. Regard- ing structural capital, the firm admits that it must develop an organizational capability covering “strategy, speed of decision processes, ability to raise funds and priortiza- tion…Organizational ability covers system architecture, the business process (horizontal integration), people processes, as well as, education, learning and knowledge building.” Finally, investor capital was the growth engine of Reliance. In this section (1998), the firm discusses issues focused on institutional shareholding, return to Copyright © 2011 SciRes. ME  M. L. BHASIN 460 investors, stability in ownership, awareness initiatives, investor education and investor servicing. 5.3. Shree Cement Limited The Shree Cement Limited (visit www.shreecementltd. com) is operating in the cement industry, which pos- sesses two cement plants at Beawar, Rajasthan. It also has one of the few R&D centres in the Indian cement industry. It has a worldwide reputation for maximizing capacity utilization an d low energy consumption lev e l. Shree Cement Limited’s IC report is an independent document (having 28 pages) that constitutes a ‘Supple- ment’ to the Annual Report 2001 [42]. The firm under- stands that IC is “capturing our various experiences for organizational benefit, cross-pollinating our collective knowledge across various operational tiers, maximizing output with the minimum of resources, and doing things right the first time.” The Corporations IC resides in its own employees. Thus, the firm has retained the majority of its members possessing valuable technical, financial and manufacturing skills. Shree Cement Limited’s drivers of excellence have an intangible nature. As it recognizes, they are: “an achiev- ement-oriented culture, continuous innovation, widesp- read employee participation, sustained plant moderniza- tion, cross-functional information sharing, constructive dissatisfaction, personal pride in collective achievement, a family work culture, operational discipline, caring ma- nagement, aggressive empowerment, reward and recog- nition system, workplace enthusiasm, mix of youth and experience, informal environment, spirit of “must do”, and quality obsessio n.” The ICR of the firm is in “narra- tive style” as it does not incorporate double-entry tables with indicators for its intellectual capital. 6. Peculiarities of Intellectual Capital Reports in India There is a vast difference in the disclosure mechanisms and methodology followed by the Indian corporations. In this context, Dr. Kamath (2008) [12] lucidly concludes as: “Some firms have been considering IC as an insepa- rable part of their total assets and disclosed it in their annual reports as ICR using the standard disclosure models. And, others publish those reports as a supple- ment to their annual reports, and some others give the details of growth in their IC over th e previous p eriod in a separate section in their annual report.” There is no doubt that in India, IC disclosure is still in its “evolutionary” stages and all the three means of disclosure are accepted. Moreover, we appreciate the growing awareness and attempts made by some leading IT corporations to dis- close IC in their annual reports. The Indian I CR does no t fo cus on any bu siness model, values, mission and vision, and/or knowledge manage- ment issues, as is the case with the European ICR. It presents information in a “narrative” style: it describes a firm’s IC and analyses its components without focusing extensively on specific indicators that measure these components. This is a major distinctive feature of Indian ICR. In sharp contrast with the European Union ICR, Indian reports do not combine a “narrative” and “quanti- fying” style (Abeysekera 2007) [43]. All Indian ICR analyzed in this study constitute an “independent” docu- ment that “complement” the Annual Reports. However, their length is much larger than the European Union re- ports. It is clear that corporations in the European Union are way ahead of their counterparts elsewhere when it comes to the measurement, disclosure and management of their IC (Andriessen 2004) [44]. Finally, one of the firms in this study—Reliance Industries Limited—even created a specific term for investor relations (the investor capital) and provides an in-dep th analysis of this capital. 7. Study of IC Disclosures Done by the IT Corporations in India In the knowledge economy, most of the organizations have realized that the true potential of creating value for their organization lies in the measurement, valuation and disclosure of their IC. Therefore, measurement and dis- closure of IC is no more a choice but imperative for the IC driven firm’s performance. Nielsen et al., (2006) [45] very forcefully asserts: “Annual reports are an ideal place to apply an IC framework because they allow us to compare IC positions and trends across different corpo- rations, industries and countries. They are an instrument for communicating issues comprehensively and con- cisely, and they are produced regularly, so they can be used to analyze manag ement attitud es and policies acro ss reporting periods.” One objective of the present study was “to survey the prevailing practices of IC disclosure by the informa- tion-technology ( IT) sector in India.” The sample size of this study consists of 16 IT corporations of India. They were primarily selected on the basis of their total income as per the 2008 publication of “Dun and Bradstreet,” a premier survey agency of the country. The annual report s of the selected corporations were obtained directly from the Websites of these corporations, and the annual re- ports for two years (2008 & 2009) were ex amined. The “content analysis” of annual reports involves codification of qualitative and quantitative information into pre-defined categories in order to derive patterns in the presentation and reporting of information (Joshi et al., 2010) [46]. Moreover, the coding process involved read- ing the annual report of each corporations and coding the Copyright © 2011 SciRes. ME  M. L. BHASIN461 information according to pre-defined categories of IC. Over the last decade, content analysis has been used by several leading researchers to study the IC performance and reporting (Beattie 2 006 ) [9 ]. Therefore, as pa rt of the present study, “content analysis” has been used to ana- lyze the extent of IC disclosure by the IT corporations. By looking at the disclosure of terminology within their annual reports, one can examine the extent to which In- dian corporations publicly document the presence (or importance) of IC. In identifying corporations disclosing IC, a list of related “IC-terminology” was compiled. Subsequently, a survey and review of several IC books and articles was conducted. According to Bontis (2003) [47], “The panel of researchers from the World Congress on Intellectual Capital finalized the list of IC ite ms into a collection of 39 terms that encompassed much of the IC literature.” The list used by Bontis was considered com- prehensive for this type of research on knowledge-based information-technology corporations. The final list of IC terms is shown in Table 3. Each of these terms was “electronically” searched individually in the annual re- ports to find out the presence or absence of the said terms, and count of how many times. By and large, most IC terms were disclosed only once in each annual report, and there was lack of consistency about the terms dis- closed. Results were tabulated on the basis of the number of corporations disclosing these terms in their annual reports. Corporations-wise analysis, along with testing the degree of variance, has also been undertaken. The content-wise analysis has been shown in Table 4, corpo- rations-wise analysis in Table 5, and the variation in Table 3. The intellectual capital--39 search terms. Employee efficien cy Intellectual property Corporations reputation Employee skill Intellectual resources Competitive intelligence Employee value KM Corporate learning Knowledge assets Expert networks Corporate university Expert teams Knowledge management Cultural diversity Knowle d g e sharing Human ass e t s Customer capital Knowledge stock Human capital Customer knowledge Mana gement quality Human value Economic Value added IC Organizational culture Employee expertise Information systems Organizational learning Employee know-how Relational capital Intellectual assets Employee knowledge Intellectual capital Structural capital Employee productivity Intellectual material Superior knowledge (Source: Bontis, Nick, “Intellectual Capital Disclosure in Canadian Corpo- rations,” Journal of Human Resource Costing and Accounting, 2003, page 7). Table 4. Content-wise analysis of intellectual capital terms disclosure. S. No.Items of Intellectual Capital No. of Corporations Disclosing 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16 17. 18 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. Business Knowledge Corporations reputation Competitive intelligence Corporate learning Corporate university Cultural diversity Customer capital Customer knowledge Economic Value added Employee expertise Employee know-how Employee knowledge Employee productivity Employee efficiency Employee skill Employee value Knowledge assets Expert teams Knowledge sharing Knowledge stock Management quality IC Information systems Relational capital Intellectual capital Intellectual material Intellectual property Intellectual resources KM Expert networks Knowledge management Human assets Human capital Human value Organizational cultu re Organizational learning Intellectual assets Structural capital Superior knowledge 1 Nil Nil Nil Nil Nil Nil Nil 3 Nil Nil Nil 1 Nil 1 1 1 Nil 3 Nil 1 Nil 8 Nil 2 Nil 15 Nil 1 Nil 5 Nil 6 1 2 1 1 Nil Nil (Source: Compiled by the author from the Annual Reports of Corporations for the ye ar 2007-2008 and 2008-200 9). disclosure has been presen ted in Table 6. Findings of Study and Analysis of Results Table 4 indicates that only 18 (46%) items, out of the total list of 39 IC-terms, were disclosed in the annual reports of the 16 Indian IT corporations. Most of the IC-terms (viz., business knowledge, employee productiv- ity, employee skill and value, knowledge assets, man- agement quality, KM, human value, organizational lear- ning, and intellectual assets) were disclosed only “once” in the annual reports, and there was utmost “lack of con- sistency” across-time about the terms disclosed. Our findings are very much similar to the findings of other studies done in the past. Surprisingly, the most popular term disclosed in this study was “intellectual property rights (IPR),” which represents such intangibles as pat- ents, brands valuations, and the outcomes of R&D in- Copyright © 2011 SciRes. ME  M. L. BHASIN 462 vestment. This is quite obvious due to the vital role played by the “intangible assets (or IC)” in the case of knowledge-intensive IT corporation s. However, this term has a very specific legal connotation from an accounting and legal perspectives. Therefore, the term “intellectual property” (IC term No. 27) had the maximum (93%) disclosure done by all the 16 IT corporations, followed by the 50% disclosure of the term “information systems” (IC term No. 23). This was not surprising due to the na- ture of knowled ge-based IT corporations under study. Unfortunately, the term “intellectual capital (IC),” was specifically disclosed by just 2 ou t of the 16 corporations , namely, Moser Baer India Limited, and Patni Computer System Limited. A closer examination of both these corporations clearly revealed that the presence of “IC” term was generally used in the “management discussion & analysis (MD&A)” section of the annual reports. It is very strange, there is no evidence at all in any of the firm’s identified, that an actual IC statement/report was developed, or that any other IC metrics were being pub- lished. Moreover, our survey and subsequent analysis of the IC disclosure practices suggests that disclosure has been vaguely expressed in very “discursive,” rather than “numerical” terms, and that little or no attempt has been made to translate the rhetoric into measures that enable performance of various forms of IC to be evaluated. For instance, Moser Baer India Limited [14] declared in its annual report, under the MD&A section, for the year 2007-08 as: “Quality of our human resources charts the success and growth potential of our business. The Cor- porations has managed to keep attrition rates well in control by imbibing a sense of ownership and pride, and strong HR initiatives geared to nurturing latent talent, and unlocking the power of IC. The Corporations con- tinues to drive organization development and also build management resources for a multi-business enterprise.” Recently, Moser Baer had stated in its 2008-09 annual report, as follows: “Your corporations continuously benchmarks HR policies and practices with the best in industry and carries out necessary improvements to at- tract and retain best talent and build in tellectual capital.” Similarly, another IT corporation, Patni Computer Sys- tems Limited [15] makes a “casual” mention of its IC in its annual report for the year 2007-08 as under: “The global sourcing market has matured from those days when India was considered to be a source of ‘low-cost manpower’. Today, it has earned the distinction of being a ‘preferred destination for intellectual capital’ that ac- celerates the trend—globalization of services. Going ahead, Indian corporations are bracing up for the chal- lenge of providing end-to-end business domain-focused solutions, leveraging intellectual property (IP) in form of solution accelerators, frameworks and service delivery technologies.” Table 5. Corporations-wise analysis of intellectual capital terms, count of disclosures. S. No. Name of Corporations Terms of IC Disclosure (Count of Item) Total No. of IC Terms Dis- closed 1Infosys Technologies Limited 1(1), 9(6) , 16(2), 17(2), 19(1), 21(1), 23(8), 27(15), 29(3), 31(7), 33(6), 36(1), 37(1) 13 2Moser Baer India Limited 25(1), 27(1), 33(4), 34(1), 35(1) 05 3Patni Computer Systems Limited 23(1), 25(1), 27(10) 03 4Tata Consultancy Services Limited 9(2), 23(1), 27(5), 31(5), 33(1) 05 5Wipro Limited 27(5) 01 6H CL Infosystems Limited 23(1) 01 7MphasiS Limited 23(2), 27(2), 35(1) 03 8CMC Limited 19(1), 27(1) 02 9Polaris Software Lab Limited 15(1), 23( 1), 27(14) 03 10 Siemens Information System Limited 23(2), 27(1) 02 11 Financial Technologies (India) Limited 23(2), 25(1), 27(3) 03 12 I-Flex Solutions Limited 27(1), 31(2), 33(2) 03 13 Satyam Computer Services Limited 27(1) 01 14Tech Mahindra Limited27(4) 01 15 HCL Technologies Limited 27(3), 33(1) 02 16 Larsen &Toubro Infotech Limited 9(2), 13(2), 19(1), 27(4), 31(1), 33(1) 06 (Source: Compiled by the author from the Annual Reports of Corporations for the ye ar 2007-2008 and 2008-200 9). Table 6. Variation in item-wise disclosure. Number of Items Covered 2007 to 2009 No. of Disclosing Corporations 0 - 3 3 - 6 6 - 9 9 - 12 12 - 15 7 6 1 0 1 Mean Disclosure 3.9 Standard Deviation 3.12 Coefficient of Variation 80% (Source: Compiled by the author from the Annual Reports of Corporations for the ye ar 2007-2008 and 2008-200 9). The term “knowledge management (KM)” (IC term No. 31 & 29), which is supposed to occupy a place of prominence in the knowledge-based IT corporations of India, was disclosed by a meager 6 (37%) corporations. However, most of the terms relating to the employees (except employee productivity, skill, value), and cus- tomers could not find any deserving place in the annual reports of the selected corporations. The most important constituents of IC—relational capital, structural capital and customer capital—did not figure even once in any of the annual reports of the corporations under study. Copyright © 2011 SciRes. ME  M. L. BHASIN463 Table 5 very clearly highlights that Infosys Technolo- gies Limited, a corporations acclaimed widely by the international community and the media too, had dis- closed the maximum number (13) of IC-related items from the total list of 39 items. It is worth mentioning here that Infosys was the first Indian corporations to win the ‘Most Admired Knowledge Enterprise in Asia’ award in the year 2002. However, it is surprising to note that this corporation did not make any mention of term “IC” in its annual reports for the years 2007 to 2009 . Perhaps, Infosys is the only IT-corporations in India, which has been regularly disclosing its “Intangible Assets Score Sheet,” as a measure of intangible assets (or IC), as shown in Appendix 1. For example, the corporation in its 2008-09 annual report makes the following remarks: “We published models for valuing two of our most im- portant intangible assets—human resources and the “In- fosys” brand. This score sheet is broadly adopted from the intangible asset score sheet provided in the book ti- tled, ‘The New Organizational Wealth,’ written by Dr. Karl-Erik Sveiby, and published by Barrett-Koehler Pub- lishers Inc., San Francisco. We believe such representa- tion of intangible assets provides a tool to our investors for evaluating our market-worthiness.” Based on the “content analysis” of this study, Larsen & Toubro Infotech Limited disclosed the second-highest 6 out of 18 (33%) IC-terms, which were followed up by Tata Consultancy Services and Moser Baer India Limited, respectively, both with a disclosure score of 5 out of 18 IC-terms. However, we are surprised to note that Patni Computers Limited, MphasiS Limited, I-Flex Solutions Limited, Polaris Software Lab Limited and Financial Technologies (India) Limited, by far comprising the largest segment of the IT corporations having 6 corpora- tions from the sample size of 16 corporations, disclosed just 3 out of 18 IC-related terms in their annual reports for the period of study. Rest of the 7 corporations, form- ing a big chunk of our study, disclosed in the range of just 1 to 2 terms, as for as the disclosure of IC-terms are concerned. For example, CMC Limited, Siemens Infor- mation System Limited and HCL Technologies Limited disclosed just 2 items, while only 1 item was disclosed by Wipro Limited, HCL Infosystems Limited, Satyam Computer Services Limited, and Tech Mahindra Limited. It is also important to note that the disclosed IC items have been shown at widely “scattered-places” in the an- nual reports, and there appears to be an utmost “lack of consistency” across-time regarding the terms disclosed. The “mean” disclosure, as shown in Table 6, comes to be as low as 3.9 items. There is a variation of 3.12 items, on average, as suggested by the value of “standard devia- tion”. The “coefficient of variation” comes to be as high as 80%, which indicates a sign ificant variation in item- - wise disclosure in the annual reports of the corporations. However, there is no “specific” disclosure of IC as a sp- ecial part or content of the annual report, despite its very high relevance in the knowledge-intensive IT industries. Mr. Nandan Nilekani, CEO, President and MD of Infosys Technologies [16] remarked: “At Infosys, we are effectively transforming enterprise knowledge into we- alth-creating ideas, products and solutions. We are building portfolios of intellectual capital (IC) and intan- gible assets, which will enable them to out-perform their competitors in the fu ture. We consider KM as a po werful medium for creating sustainable networks of people across intra-organizational boundaries. It also provides a symbol- ism for aligning individual initiative and crea- tivity with organizational growth.” Thus, Infosys has been duly recognized for its organizational learning and for transforming enterprise knowledge into shareholder value. It is worth mentioning here that Infosys is regu- larly disclosing in its annu al report details about the “In- tangible Assets Score-Sheet,” as developed by Dr. Sev- eiby, human resources accounting, brand val uation, etc. Similarly, Mr. Sambuddha Deb, Chief Quality Officer, Wipro Technologies [17], observed: “Our knowledge management initiative continues to be one of the most strategic initiatives and our knowledge portal, “Knet,” provides an effective and efficient means of capturing knowledge, both tacit and explicit across the organiza- tion, distilling it through a review process and making it available in a form which is ready to use. Our conscious and significant investment in the KM initiative is pro- viding an important edge that the business needs.” No doubt, comprehensive IC disclosures would not only help in retaining the competitive advantage in the long- run, when other firms start emulating such pioneering practices, but it would also prove as an added informa- ion available, which can also be used to measure the lin k between the performance, growth and stability of the firm with its IC. Based on the results of the present research study, the following broad generalizations can be made: 1) IC dis- closure is very much an academic discussion; 2) There is no evidence at all that IC disclosure has generated any traction for Indian corporations; 3) IC reports published by the Indian corpo rations is almost negligible; and 4) IC disclosure has not received any priority from the mentors of the Indian corporations. Obviously, using the language of IC is an important antecedent to developing IC reports, but Indian corporate sector seems to be significantly be- hind its Scandinavian and other counterparts. We are hopeful that as the field of IC gains momentum, disclo- sure of IC evidence would also gradually increase. How- ever, the average number (3.9) of items reported by the Indian IT-sector corporations is very low, which suggests that there is neither awareness nor any interest to record and report IC variables by these corporations. Even the Copyright © 2011 SciRes. ME  M. L. BHASIN 464 few items which were just reported were expressed in “discursive” rather than in “numerical” terms. Moreover, it has also been found that there exists no clear-cut pat- tern or system of IC disclosure in the annual reports. The disclosure was not uniform and no evidence of its well- defined measurement basis (except for the Infosys “In- tangible Score-Card”) was found in the annual reports. It is very surprising to note that the Information Technol- ogy corporations, which are most dominating group in the knowledge sector, have failed to report IC in their annual reports. Undoubtedly, Indian corporations are far lagging behind in the field of measurement, management and disclosure of IC, as compared to the Scandinavian and/or European corporations. Thus, there is an urgent need to highlight the importance of IC disclosure to these knowledge-based IT firms and encourage them to pro- vide “voluntary” IC disclosures. Surprisingly, our findings are very similar in comp- arison to the various other studies on the same subject (viz., Bontis, 2003, Brennan, 200, Ordonez de Pablos, 2002, Kamath, 2008 etc.), which also signify very low level of IC disclosures. For instance, as per the OECD (1999) [48] research report, “corporations in the Europe are way ahead of their counterparts elsewhere when it comes to the measurement, disclosure and management of their IC.” While there is some evidence that Austra- lian enterprises are engaging in the process of identifying their stock of IC, overall Australian corporations do not com- pare favorably with their overseas counterparts in their ability to manage, develop, support, measure and report their IC (Bruggen et al., 2009) [10]. Similarly, Bontis (2003) [47] concludes: “There is no evidence at all that IC disclosure has garnered any traction for the Canadian corporations. Only a small percentage of Can- adian corporations (68 out of 10,000) even used the terms in their annual reports. Obviously, using the lan- guage of IC is an important antecedent to developing IC statements, but Canada seems to be significantly behind its Scandinavian counterparts.” 8. Conclusions and Recommendations Intellectual capital can be a source of competitive ad- vantage for businesses and stimulate innovation that leads to wealth generation (Marr et al., 2003) [49]. The measurement and disclosure of IC is relatively new, with only a smattering of pioneering corporations using the “newer” measures. It is still too early to be making pre- dictions about whether or not a model or system for measuring IC will be successfully articulated and inte- grated into the existing management and financial dis- closure system. A careful examination of the history of IC clearly indicates that there is a long way to move ahead in this field. This brief review of the measurement and disclosure of IC terrain highlights the case for “re-engineering” the traditional accounting and management disclosure proc- esses (Daniel 2004) [50]. If efforts are not made towards incorporating the v alue o f in tangibles into a “formalized” disclosure framework then, for many public and private sector organizations, the management’s disclosure in the financial statements will become increasingly irrelevant as a tool supporting meaningful decision-making (Cuga- nesan et al. 2006) [31]. There is overwhelming evidence, as per Bernard et al. (2003) [51], in support of the notion that there are several benefits to managing, measuring and disclosing IC in the annual reports. Many firms across the EU are already publishing IC statements on a voluntary basis. They see it as a way of increasing “tra- nsparency” and explaining their view of the corpora- tion’s business model to the market. While separate IC statements may be appealing to users of information, es- pecially individual shareholders, they may place an “un- welcome burden” on corporations already facing greater demands for transparency. Much of what has been done to date in the field of re- searching IC has an intuitive appeal, but is this enough to attract and convince the critical mass of supporters (par- ticularly within the accounting profession) whose sup- port is very much needed for the change to take place? Both the CIMA and CICA, leading accounting bodies, have supported the IC disclosure initiatives of their FASB cousins. No doubt, some progress has already be- en made in this direction by the publication of IC guide- lines developed by the Danish Agency of Trade and In- dustry (2000, 2001) [52], the Meritum Project (2002) [53], the 3R Model (Ordóñez de Pablos, 2001, 2002) [54, 55], etc. Based on best practices observed in more than 100 European Union corporations, the Meritum projects have resulted in “guidelines” on how to report IC. Al- though the guidelines vary slightly in content and termi- nology, the underlying ideas are the same. Leading IT corporations in India that were applying IC measures have found that it gives them better under- standing of the “drivers of value” and is improving ma- nagement and growth of these vital assets. Both, Wipro Technologies and Infosys Technologies corporations ha- ve been recognized for their organizational learning and for transforming enterprise knowledge into shareholder value. Unfortunately, IC disclosure in the Indian IT firms, for the period of study, is seen to be almost negligible and partial, in tune with the developed countries. Only a small number of the total firms studied actually reported IC-related terms. Moreover, the disclosure of IC was not at all uniform, and there is lack of eviden ce regarding the usage of the measurement, management techniques, and tools by these firms. Thus, there is an urgent need to highlight the importance of IC disclosure to these kno- Copyright © 2011 SciRes. ME  M. L. BHASIN465 wledge-based IT firms and encourage them to provide voluntary IC disclosures. A brief summary of the present research study reveals the following aspects: The “key” components of IC are poorly understood, inadequately identified, inefficiently managed, and are not reported within a consistent framework. The findings of over 20 internatio nal research studies reflect the ‘exploratory’ nature of the IC disclosure work, and the fact that we are at an ‘embr yonic’ stage of investigation. The extent of disclosure is generally ‘minimum’ but the types of IC that tend to be most often reported in- clude human resources, technology and intellectual property rights, and organizational and workplace structure. A review of industry clusters within the study sug- gests that no individual industry is significantly ahead of any other in its IC disclosure practices. By and large, most corporations’ representatives be- lieve that the management of IC is an important fac- tor in determining future corporations’ success and facing competitiveness. However, few executives are able to identify initiatives within their organization that are designed to assist in managing IC. IC disclosures made by the Indian IT firms is very “negligible, partial, and descriptive, lack of consis- tency in reporting etc.,” in sharp contrast with the developed countries. A very small number of the total firms studied actually reported IC-related terms, dis- closure was not unifor m, and there is lack of evidence regarding the usage of the measurement, management techniques, and tools by these firms. So far, published guidelines represent good initiatives undertaken by the academics based on the experience of some pioneer firms in developed countries that build the IC report. They provide practical guidelines on how to measure and report IC. However, firms are not enforced to follow these guidelines, and therefore, they just offer an orientation. The development of a set of homogeneous norms, principles, indicators and structure is a high pri- ority in the IC report agenda. The following recommend- dations are made. Even though, IC has a very strong impact on the drivers of future earnings, but unfortunately, it is largely ignored in the financial disclosure. We strongly recommend that corporations must create a culture that emphasizes the importance of IC in achieving business a d vant a ge. Those corporations that are concerned with their rela- tionship with the capital markets are to develop ‘stra- tegic’ and ‘tactical’ initiatives that provide for ‘vol- untary’ IC disclosures. The IC reports may initially be used for “internal” management purposes but an “external” stakeholder focus report should be the long-term ultimate goal. The professional accounting bodies, at the global level, should join hands to develop an internationally accepted valuation system, and standardized and harmonized app r oaches for discl osu re of IC. The regulatory bodies should establish “key” pa- rameters for the disclosure of IC in a similar fashion, as have been defined for disclosure of Corporate Governance (CG), as per Clause 49 of the Securities Exchange Board of India (SEBI) in order to make a beginning in the field. To adopt “voluntary” IC disclosure practices, espe- cially for Indian IT firms in the knowledge-sector, where competitiveness of the firms are determined by their intangible assets. Indeed, the whole field of IC disclosure is still rela- tively ‘new’ and very slowly evolving. Therefore, ac- countants, business managers, and policy makers have all to grapple with its concepts, philosophy, and detailed methodologies for IC applications. Real-life corporate experience suggests that rushing into the details of IC measurement before understanding the fundamentals is going to prove counter-productive. Now, we feel the time is ripe for international professional bodies to de- velop that understanding and to develop new measures that will guide them more clearly to a prosperous future. 9. References [1] J. G. Vargas-Hernández and M. R. Noruzi “How Intel- lectual Capital and Learning Organization Can Foster Organizational Competitiveness?” International Journal of Business and Management, Vol. 5, No. 4, April 2010, pp. 1-11. doi:10.1108/09513570510627685 [2] P. N. Bukh, C. Nielsen, P. Gormsen and J. Mouritsen, “Disclosure of Information on Intellectual Capital in Dan- ish IPO Prospectuses,” Accounting, Auditing and Ac- countability Journal, Vol. 18, No. 6, 2005, pp. 713-732. [3] M. S. Chiucchi, “Exploring the Benefits of Measuring Intellectual Capital, The Aimag Case Study, ” Human Systems Management, Vol. 27, No. 3, 2008, pp. 217-230. [4] T. A. Stewart, “The Wealth of Knowledge: Intellectual Capital and the Twenty-First Century Organization,” Cur- rency Doubleday, 2002, pp. 1-320. [5] CIMA, “Understanding Corporate Value: Managing and Reporting Intellectual Capital,” Cranfield University, Chartered Institute of Management Accountants, 2001, pp. 1-28. [6] K. E. Sveiby, “Methods for Measuring Intangibles,” 2004. http://www.sveiby.com. [7] J. Holmen, “Intellectual Capital Reporting,” Management Accounting Quarterly, Vol. 6, No. 4, Summer 2005, pp. 1-9. [8] S. Pike, L. Fernström and G. Roos, “Intellectual Capital: Copyright © 2011 SciRes. ME  M. L. BHASIN 466 Origin and Evolution,” International Journal of Learning and Intellectual Capital, Vol. 3, No. 3, 2006, pp. 233- 248. [9] V. Beattie and S. J. Thomas, “Lifting the Lid on the Use of Content Analysis to Investigate Intellectual Capital Disclosures,” Discussion Paper Series in Accounting & Finance, Heriot-Watt University, School of Management and Languages, September 2006. http//www.sml.hw.ac.uk/research/discussion/DP2006-AF 01. Pdf. [10] A. Bruggen, P. Vergauven and M. Dao, “Determinants of Intellectual Capital Reporting: Evidence from Australia,” Management Decision, Vol. 47, No. 2, 2009, pp. 233- 245. [11] L. D. Parker, “Financial and External Reporting Research: The Broadening Corporate Governance Challenge,” Ac- counting and Business Research, Vol. 37, No. 1, 2007, pp. 39-54. [12] B. Kamath, “Intellectual Capital Reporting in India: Con- tent Analysis of Teck Firms,” Journal of Human Re- source Costing and Accounting, Vol. 12, No. 3, 2008, pp. 213-224. doi:10.1108/14013380810919859 [13] M. Joshi and D. S. Ubha, “Intellectual Capital Disclo- sures: The Search for a New Paradigm in Financial Dis- closure by the Knowledge Sector of Indian Economy,” Electronic Journal of KM, Vol. 7, No. 5, 2009, pp. 575- 582. [14] Moser Baer India Limited, “Annual Reports for the Year 2007-08 and 2008-09,” Available at Corporations Web- site. [15] Patni Computer Systems Limited, “Annual Reports for the Year 2007-08 and 2008-09,” Available at Corpora- tions Website. [16] Infosys Technologies Limited, “Annual Reports for the Year 2007-08 and 2008-09,” Available at corporations Website. [17] Wipro Limited, “Annual Reports for the Year 2007-08 and 2008-09,” Available at the Corporations Website. [18] CMC Limited, “Annual Reports for the Year 2007-08 and 2008-09,” Available at the Corporations Website. [19] Financial Technologies (India) Limited, “Annual Reports for the Year 2007-08 and 2008-09,” Available at the Cor- porations Website. [20] HCL Infosystems Limited, “Annual Reports for the Year 2007-08 and 2008-09,” Available at corporations Web- site. [21] HCL Technologies Limited, “Annual Reports for the Year 2007-08 and 2008-09,” Available at Corporations Website. [22] I-Flex Solutions Limited, “Annual Reports for the Year 2007-08 and 2008-09,” Available at Corporations Web- site. [23] Larsen & Toubro Infotech Limited, “Annual Reports for the Year 2007-08 and 2008-09,” Available at Corpora- tions Website. [24] MphasiS Limited, “Annual Reports for the Year 2007-08 and 2008-09,” Available at Corporations Website. [25] Polaris Software Lab Limited, “Annual Reports for the Year 2007-08 and 2008-09,” Available at Corporations Website. [26] Satyam Computer Services Limited, “Annual Reports for the Year 2007-08 and 2008-09,” Available at Corpora- tions Website. [27] Siemens Information System Limited, “Annual Reports for the Year 2007-08 and 2008-09,” Available at Corpo- rations Website. [28] Tata Consultancy Services Limited, “Annual Reports for the Year 2007-08 and 2008-09,” Available at Corpora- tions Website. [29] Tech Mahindra Limited, “Annual Reports for the Year 2007-08 and 2008-09,” Available at the Website. [30] L. Jing, R. Pike and R. Haniffa, “IC Disclosure in Knowl- edge Rich Firms: The Impact of Market and CG Factors,” Bradford University Working Paper Series No. 07/06, April 2007, pp. 1-29. [31] S. Cuganesan, R. Petty and N. Finch, “Intellectual Capital Reporting: A User Perspective,” Spring International Conference, Academy of Accounting and Financial Studies, New Orleans, USA, 2006, pp. 20-45. [32] Skandia, “Visualizing Intellectual Capital in Skandia: Supplement to Skandia’s 1994 Annual Report,” Skandia, and Stockholm, 1994. [33] N. Brennan, “Reporting Intellectual Capital in Annual Reports: Evidence from Ireland,” Accounting, Auditing Accountability Journal, Vol. 14, No. 4, 2001, pp. 423-36. doi:10.1108/09513570110403443 [34] Skandia, “Power of Innovation: Supplement to Skandia’s 1996 Interim Report,” Skandia, Stockholm, 1996. [35] Skandia, “Renewal and Development Intellectual Capital. Supplement to Skandia’s 1995 Interim Report,” Skandia, Stockholm, 1995. [36] Skandia, “Human Capital in Transformation, IC Proto- type Report—A Supplement to Annual Report,” 1998, pp. 1-25. [37] Financial Accounting Standards Board (FASB), “Im- proving Business Reporting: Insights into Enhancing Voluntary Disclosure,” Business Reporting Research Pro- ject, Steering Committee Report, Financial Accounting Standards Board, 2001, pp. 1-50. [38] Balrampur Chini Mills Limited, “Intangibles Statement: 1997-1998,” Balrampur Chini Mills Limited, Calcutta, 1998, pp. 1-24. [39] Balrampur Chini Mills Limited, “Intangibles Document: 1998-1999,” Balrampur Chini Mills Limited, Calcutta, 1999, pp. 1-48. [40] Balrampur Chini Mills Limited, “The Intangibles Docu- ment: 2000-2001,” Balrampur Chini Mills Limited, Cal- cutta, 2000, pp. 1-40. [41] Reliance Industries Limited, “The Intellectual Capital Report 1997-98,” Reliance Industries Limited, Mumbai, 1998. http://www.ril.com. Copyright © 2011 SciRes. ME  M. L. BHASIN Copyright © 2011 SciRes. ME 467 [42] Shree Cement Limited, “The Intellectual Capital Report. Supplement to Annual Report 2000-01,” Shree Cement Limited, Bangur Nagar, 2001. [43] I. Abeysekera, “Intellectual Capital Reporting between a Developing and Developed Nation,” Journal of Intellec- tual Capital, Vol. 8, No. 2, 2007, pp. 329-345. doi:10.1108/14691930710742871 [44] D. Andriessen, “Intellectual Capital Valuation and Meas- urement: Classifying the State of the Art,” Journal of In- tellectual Capital, Vol. 5, No. 2, 2004, pp. 230-242. doi:10.1108/14691930410533669 [45] C. Nielsen, P. N. Bukh, J. Mouritsen, M. R. Johansen and P. Gormsen, “Intellectual Capital Statements on Their Way to the Stock Exchange,” Journal of Intellectual Capital, Vol. 7, No. 2, 2006, pp. 221-240. doi:10.1108/14691930610661872 [46] M. Joshi, D.S. Ubha and J. Sidhu, “Reporting Intellectual Capital in Annual Reports from Australian S/W & I/T Corporations,” Journal of Knowledge Management Prac- tice, Vol. 11, No. 3, September 2010, pp. 1-19. [47] N. Bontis, “Intellectual Capital Disclosure in Canadian Corporations,” Journal of Human Resource Costing and Accounting, Vol. 7, No. 1, 2003, pp. 9-20. doi:10.1108/eb029076 [48] OECD report, “Symposium on Measuring and Reporting IC: Experience, Issues, and Prospects,” Organization for Economic Cooperation and Development, 1999, pp. 1-196. [49] B. Marr, D. Gray and A. Neely, “Why Do Firms Measure Their Intellectual Capital?” Journal of Intellectual Capi- tal, Vol. 4, No. 4, 2003, pp. 441-464. doi:10.1108/14691930310504509 [50] D. Andriesen, “IC Valuation and Measurement: Classi- fying th e State of the Art, ” Jou rnal of I ntellectual Capital, Vol. 5, No. 2, 2004, pp. 230-242. [51] M. Bernard, G. Dina and N. Andy, “Why Do Firms Measure Their Intellectual Capital?” Journal of Intellec- tual Capital Vol. 4, No. 4, 2003, pp. 441-464. doi:10.1108/14691930310504509 [52] Danish Agency for Development of Trade and Industry (DATI), “A Guideline for Intellectual Capital Statements: A Key to Knowledge Management,” Danish Agency for Development of Trade and Industry, Stockholm, 2001. [53] Meritum Project, “Guidelines for Managing and Report- ing on Intangibles,” Intellectual Capital Report, Fun- dación Airtel Móvil, Madrid, 2002. [54] P. Ordóñez de Pablos, “Relevant Experiences on Meas- uring and Reporting Intellectual Capital in European Pio- neering Firms,” In: N. Bontis and C. Chong, Eds., World Congress on Intellectual Capital Readings, Butter- worth-Heinemann, Oxford, 2001. [55] P. Ordóñez de Pablos, “Evidence of Intellectual Capital Measurement from Asia, Europe and Middle-East,” Journal of Intellectual Capital, Vol. 3, No. 3, Special Is- sue, 2002, pp. 287-302.

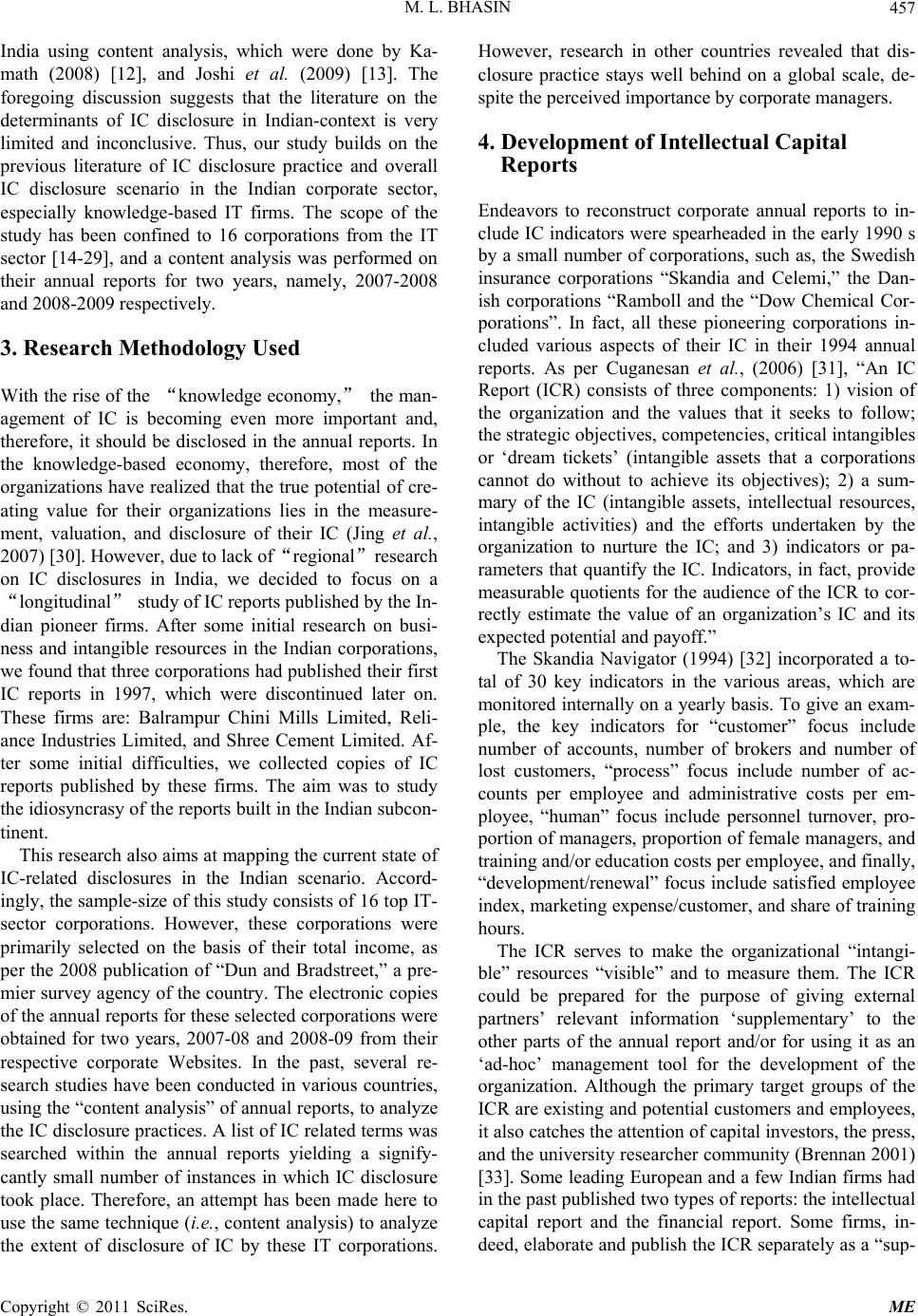

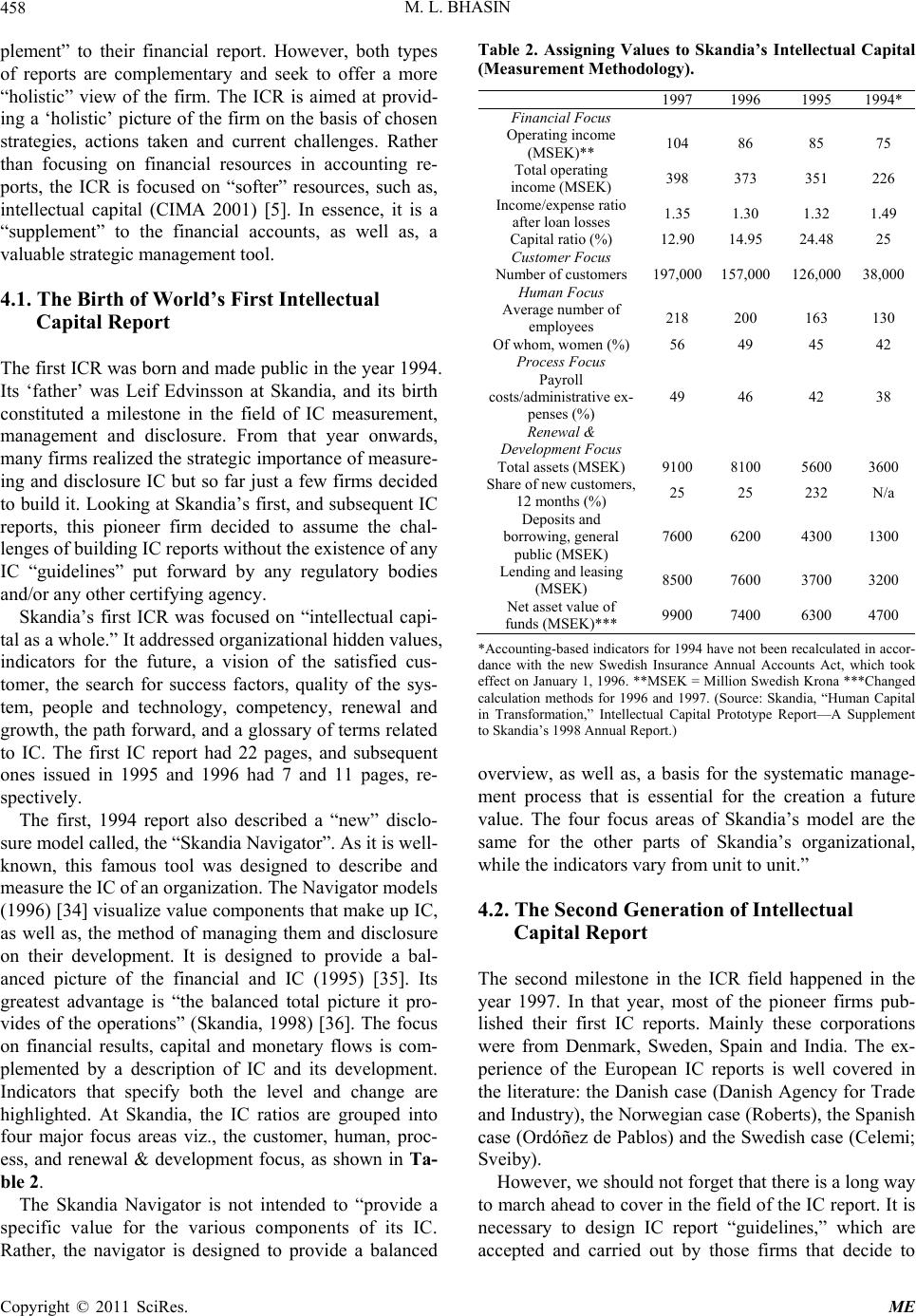

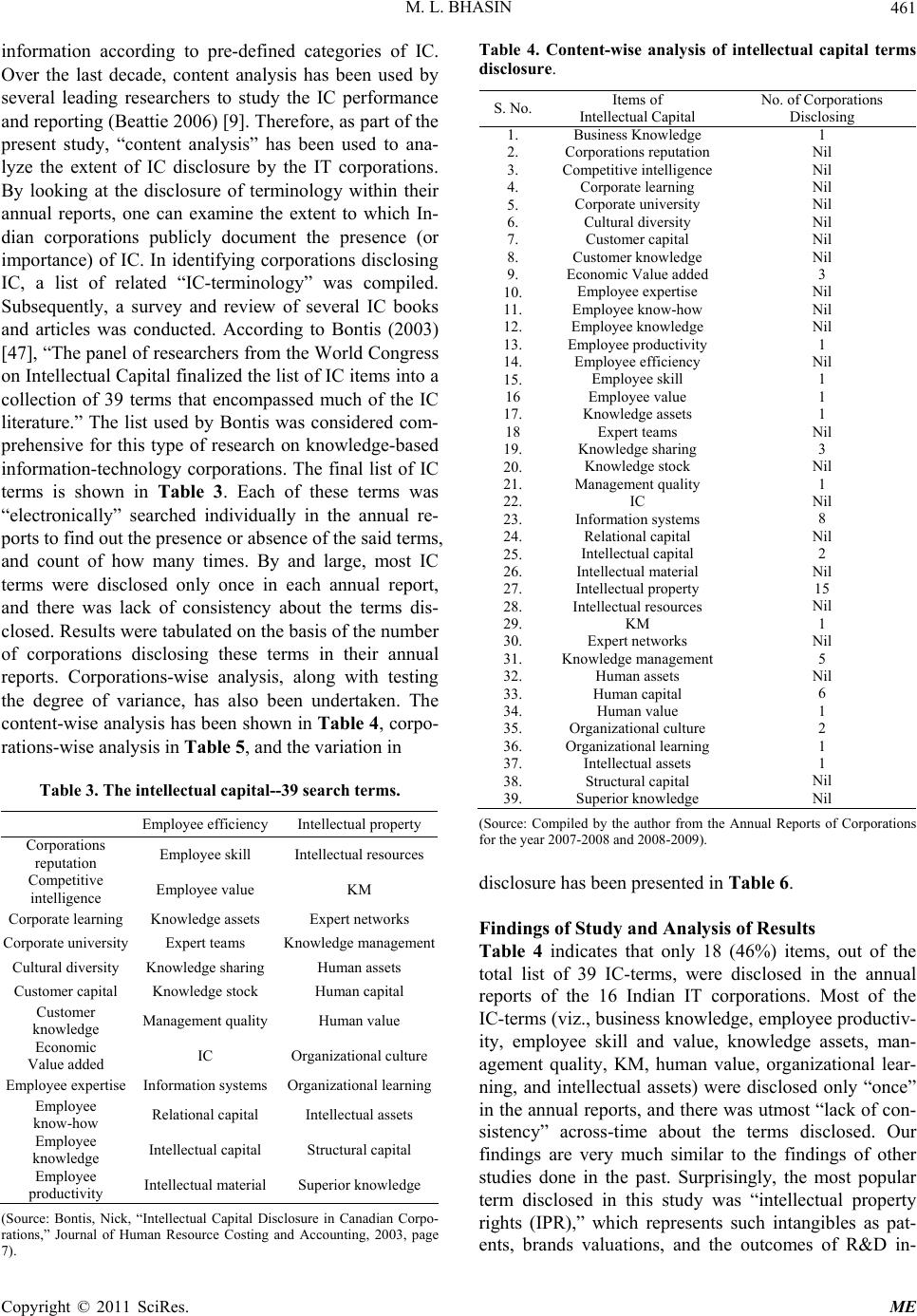

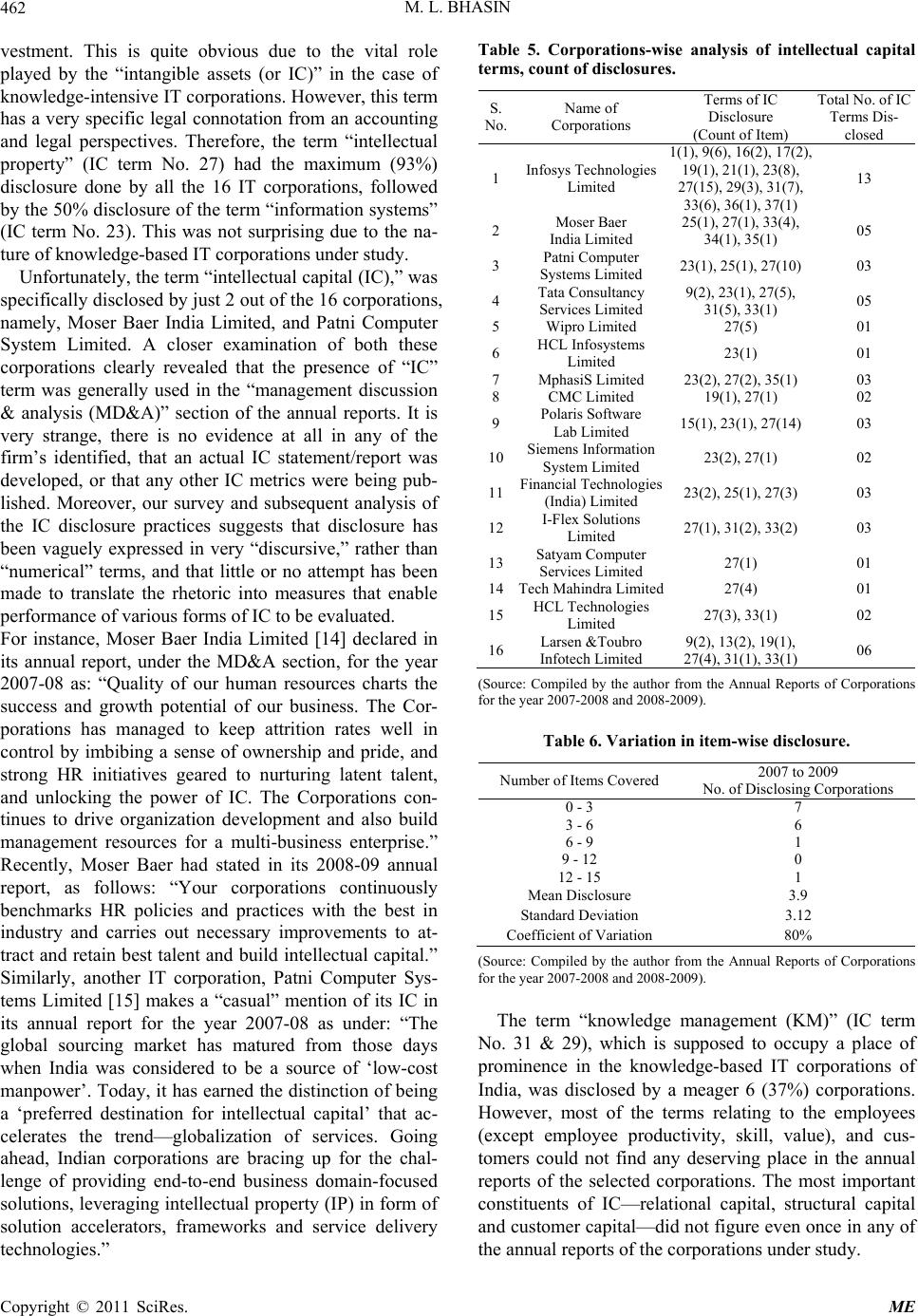

|