Modern Economy

Vol.3 No.8(2012), Article ID:26282,6 pages DOI:10.4236/me.2012.38119

The Simulation Study on the Control of Credit Risk of the Enterprise Group Based on the Intensity of Affiliated Transactions*

School of Economics and Management, University of Electronic Science and Technology of China, Chengdu, China

Email: xcwdl@126.com

Received October 14, 2012; revised November 18, 2012; accepted November 27, 2012

Keywords: Enterprise Group; Related Party Transactions; The Proliferation of Credit Risk; Simulation

ABSTRACT

Related party transactions make the credit risk proliferate rapidly in the network formed by the transactions. Not only it will be more difficult for the enterprise Groups to control themselves, but also it will be more challenging for the crediting commercial banks to monitor. In this paper, we built a theoretical model of the proliferation of credit risk based on the simplified model. Further, from the two basic factors that influence the intensity of related party transactions—the scale of enterprise Groups and the intensity of the related relationship, we did a simulation research. The study found: when the two basic factors are controlled in a reasonable range, enterprise Group’s credit risk can be controlled at a lower level.

1. Introduction

Since China entered the WTO in 2001, the socialist market economic system is gradually maturing. With strong competitive advantage, the Groups quickly become the expanding customers that commercial banks focus on, and the trend that commercial banks credit to the Groups customers becomes increasingly obvious. Although the Group customers have the advantage of large volume of business, high comprehensive return rate, however, due to the enterprise Group’s too many subsidiaries and the complexity of the relationship, the bank has increasingly difficulty in managing and controlling the enterprise Group’s credit risk. Often the credit risk, induced by the breaking of funds strand of a subsidiary, will lead to a link reaction and finally proliferates to the whole Group, causing great loss to the commercial banks. No matter for the case of “Enron” in America, or the economic cases of “Nongkai”, “DeLong” and “Huaguang” that occurred in China, all prove this without exception. The existence of related party transactions makes the proliferation of the credit risk more hidden. Frequent events of default of enterprise Groups not only expose the commercial banks’ weakness in the mechanisms of credit risk control of Group customers, but also seriously affect the local financial order and social stability. Therefore, we can not purely and naturally affix enterprise Group with the label of “quality customers” any longer. And no doubt, how can we control the credit risk of the enterprise Group effectively is a problem badly needed to be solved.

At present, the research on the credit risk of the Group, both at home and abroad, is mainly focused on two aspects: the qualitative analysis of the sources of the credit risk and the quantitative measurement of the credit risk. From the qualitative point of view, Duffee GR (1999) analyzed of the root cause of the credit risk of the enterprise Group [1]. While the Chinese scholars Xiao Yongjie, and Huo Dongping (2006) analyzed and summarized the characteristics of the credit risk of enterprise Groups [2]. Xia Hong (2008) pointed out three characteristics of the credit risk of the enterprise Group: higher systemic risk, the higher risk of related default, EAD delay [3]. Besides the macro analysis, a number of scholars from different angles did quantitative research on the credit risk management and control issues of the enterprise Group. Khanna T. and Yafeh Y. (2005) thought that the enterprise Group’s internal capital market could be seen as a risk-sharing mechanism, which led to the delay of the credit risk exposure [4]. Luciano and Nicodano (2008), studied the relationship between the ownership structure of the enterprise Group and credit risk through empirical research [5]. Chen Lin and Zhou (2009) built the links between the enterprises within Enterprise Group by equity ratio [6,7]. Fu Shenghua and Fan Jianxue (2006) thought that the credit risk of the enterprise Group stepped from the related party transactions [8]. The related party transactions between enterprises have become increasingly complex and hidden. In that case, enterprise Group can transfer assets through the related party transactions within its subsidiaries, or even escape the debts, thus causing a serious risk to commercial bank loans. However, as for the quantitative study of the credit risk of the enterprise Group ,most of the scholars still regard enterprise Group as a whole, and do researches based on the framework of the classic structured model [9,10] and the simplified model [11,12]. For example, Chen Lin and Zhou (2009) established a framework for the proliferation of credit risk, based on the structured mode [6]. While based on the simplified model, Xu Chao (2010, 2011) built a simulation model [13,14]. But, when the existing researches are actually applied into the assessment of the credit risk of the enterprise Groups, it will be accompanied with the problems of non-conformance, so the parameters can not accurately be determined, and that the significance of the empirical data is not evident, and so on. Under the statistical significance, simulation is a feasible way to examine the proliferating path of enterprise Group’s credit risk. At present, the simulation method has been gradually and increasingly recognized in social sciences researches, such as the stability analysis of the strategic alliance [15], the characterization of managers’ cognition [16], as well as the management of organizational performance. We have already done some basic work about the application of multi-agent simulation technology in the aspects like the delay effect of the Enterprise Group’s risk [17]. Based on the intensity of the related party transactions, to establish the simulation model of the enterprise Group, will provides a wide range of interfaces and support for the follow-up study of the enterprise Group management, industrial organization, and the Group’s risk. In that way, more will be dig out to close to the real situation gradually, which will be extremely helpful to recognize the mechanisms of the proliferation of credit risk within the enterprise Group and carry out the follow-up research.

Firstly, this paper summarized the mechanism of the proliferation of credit risk of the Group based on the intensity of related party transactions, and built a theoretical model of the proliferation of credit risk based on the simplified model. And then the process of the proliferation of credit risk of the Group was simulated through multi-agent simulation method. Finally, under the statistical significance, some conclusions and recommendations were obtained by the analysis of data from the simulation result.

2. A Theoretical Model of the Proliferation of Credit Risk of the Group Based on the Intensity of Related Party Transactions

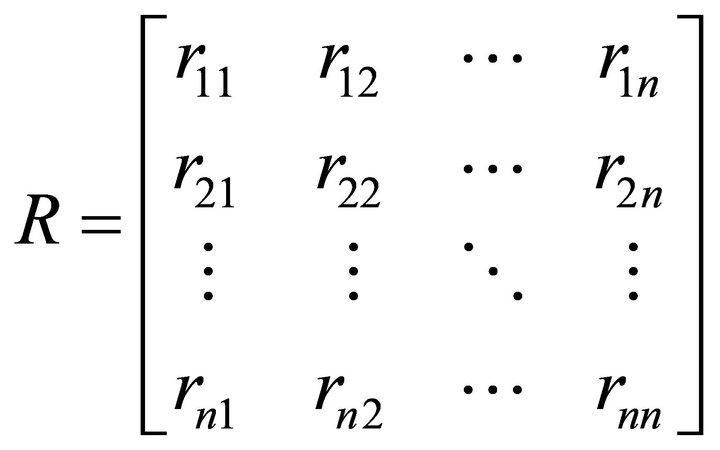

As related party transactions between the enterprise Group subsidiary is so frequent, that unfair related party transactions have become one of the main reasons, which lead to the credit risk of the enterprise Group. This paper will study the effects of related party transactions on the process of the proliferation of credit risk of the enterprise Group, and explore the issues about risk management and control. Generally, the relationship of related party transactions between the subsidiaries of the enterprise Group can be shown in the structure of Figure 1.

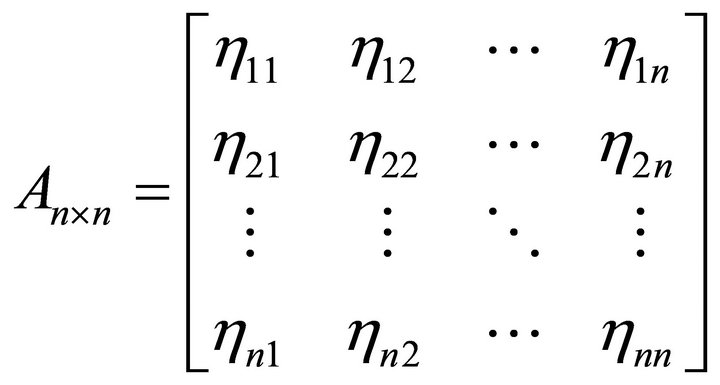

In Figure 1, the vertices of the graph represent the subsidiaries of the enterprises Group, while the edges represent the relationship of the related party transactions between the subsidiaries. Without loss of generality, we assumed that the enterprise Group had n subsidiaries, and numbered them from .

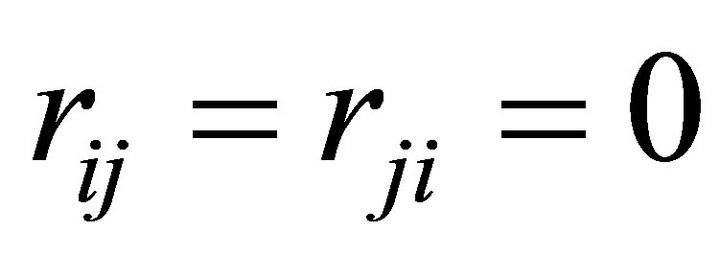

.  was used to reprent the weight of the related party transactions between subsidiary i and subsidiary j

was used to reprent the weight of the related party transactions between subsidiary i and subsidiary j , and

, and  . (i.e. the effect of the related party transactions on both parties is equal). If there does not exist related party transactions between the subsidiary i and j

. (i.e. the effect of the related party transactions on both parties is equal). If there does not exist related party transactions between the subsidiary i and j , then

, then . We labeled the effect on itself of subsidiary with

. We labeled the effect on itself of subsidiary with

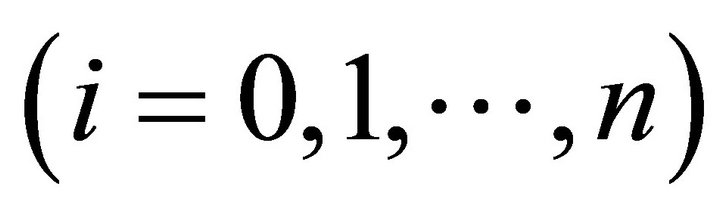

. With the knowledge of graph theory, we got the weight matrix R of related party transactions between the subsidiaries of the enterprise Group:

. With the knowledge of graph theory, we got the weight matrix R of related party transactions between the subsidiaries of the enterprise Group:

In this paper, the normalized weight was seen as the intensity of related party transactions between subsidiary

Figure 1. The structure formed from related party transactions between the subsidiaries of the enterprise group.

i and subsidiary j. Through the normalization processing, we got the matrix of the intensity (the matrix represented all the interacted effect between all subsidiaries within the enterprise Group),

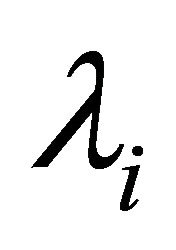

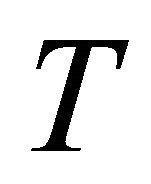

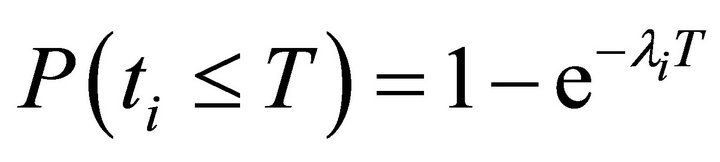

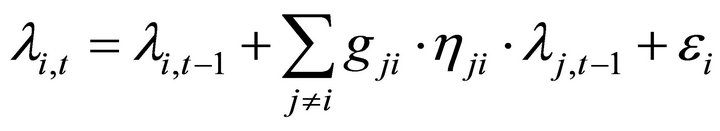

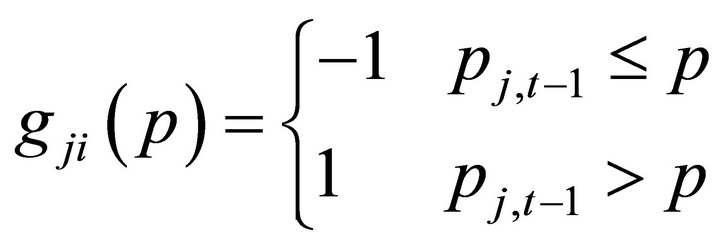

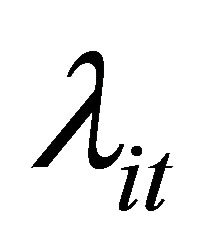

The simplified model did not discuss the specific mechanism of default, but regarded the event of default itself as a random process, thus making it more easy and flexible. Therefore, this paper followed the usual assumptions of the simplified model to the analysis. We assumed that the first default time of the ith subsidiary was a random variable, and further assumed that the number of the default event of the ith subsidiary follows Poisson random process with the intensity of , then the default probability of the ith subsidiary within the time interval of

, then the default probability of the ith subsidiary within the time interval of was:

was:

(1)

(1)

Generally, the number of the default event in per unit time is defined as the default intensity. While the default intensity is mainly affected by the common risk like macroeconomic situation and special risk factors that are generated by the enterprises’ own state. In particular, at the moment , the default intensity

, the default intensity  of the ith subsidiary, is determined by its own state, however, it is also mainly affected by the Group’s internal and external aspects as well:

of the ith subsidiary, is determined by its own state, however, it is also mainly affected by the Group’s internal and external aspects as well:

1) The effect of the Group’s internal, i.e. the effect generated from the interaction of other subsidiaries with related party transactions at the moment ;

;

2) The effect of the external environment, i.e. the effect led by the factor that the ith subsidiary is affected by the external market conditions within the time interval of .

.

Therefore, the default intensity of subsidiary i at moment t can be defined as the following form:

(2)

(2)

Among that,

is used to express whether the effect on subsidiary i of subsidiaries j is positive or negative. This is because when the default probability of a certain member of the Group increases, it will have an obvious negative external effect on other related members; while if Group shareholders give financial support to the Group members through internal capital allocation, it will do great help to control and defuse the internal risk of the Group.

From the above analysis, given all enterprises of the Group with the initial state at the moment

at the moment , according to the rules above, through (1) and (2), we got the default probability of every subsidiary at the moment

, according to the rules above, through (1) and (2), we got the default probability of every subsidiary at the moment , and then calculate the average default probability of the enterprise Group.

, and then calculate the average default probability of the enterprise Group.

3. Multi-Agent Simulation of the Proliferation of Credit Risk of the Group

According to the theoretical model above, we established the simulation model on the platform of netlogo. In the simulation model, the agent represented the individual subsidiaries with independent decision-making; the working environment of the agent was a network structure generated according to the related party transactions between the subsidiaries; the agent connected the agent through the link, which was used to represent the existence of related party transactions between subsidiaries, while the normalized weight coefficient on the link represented the intensity of the related party transactions.

3.1. Simulation Environment Was Designed as Follows

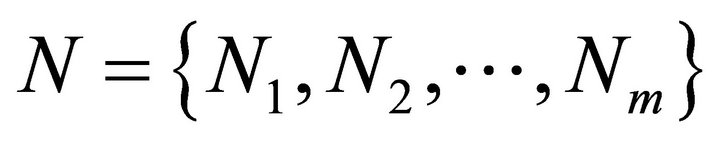

1)  was the collection of all the Agent, representing the whole enterprise Group. Without loss of generality, we assume its size was n, i.e.

was the collection of all the Agent, representing the whole enterprise Group. Without loss of generality, we assume its size was n, i.e. , each Agent corresponded to a subsidiary.

, each Agent corresponded to a subsidiary.

2)  was the state space, for simplification, this paper divided the state of the subsidiaries into two types: normal enterprises and defaulted enterprises, denoted

was the state space, for simplification, this paper divided the state of the subsidiaries into two types: normal enterprises and defaulted enterprises, denoted  . When the default probability was greater than a pre-set threshold P, then the enterprise defaulted, denoted with the abnormal state; conversely, the normal state.

. When the default probability was greater than a pre-set threshold P, then the enterprise defaulted, denoted with the abnormal state; conversely, the normal state.

3)  was the collection of all enterprises neighbor,

was the collection of all enterprises neighbor,

, representing the collection of subsidiaries that had related party transactions with subsidiary i.

, representing the collection of subsidiaries that had related party transactions with subsidiary i.

4)  was the simulation cycle, representing the process of the realization of the related party transactions. Although in reality, the transaction cycle is different from each other, in order to facilitate the calculation and discussion, we assumed that all related party transactions were in each T-cycle.

was the simulation cycle, representing the process of the realization of the related party transactions. Although in reality, the transaction cycle is different from each other, in order to facilitate the calculation and discussion, we assumed that all related party transactions were in each T-cycle.

5) A was the collection of Agent properties, including the default intensity , the environmental effect

, the environmental effect , and so on.

, and so on.

6) L was the collection of the link properties, including the existence of links, the intensity of the related party transactions , and so on.

, and so on.

7)  was the collection of properties of the complex network systems, including network size n, i.e. the number of members of the Enterprise Group; the intensity of the related structure, i.e. the average degree network

was the collection of properties of the complex network systems, including network size n, i.e. the number of members of the Enterprise Group; the intensity of the related structure, i.e. the average degree network ; the initial default rate of credit risk

; the initial default rate of credit risk , and so on.

, and so on.

3.2. Setting of the Initial State and Interactive Rules of the Agent in Simulation

According to the standards of the companies like Standard & Poor, the credit of the subsidiary can be equivalently divided into different levels. Through the default probability formula, we can deduce the default intensity corresponding with different credit rating. The credit rating of the various subsidiaries within the Group may not be the same. In that case, that is to say the initial default intensity is not consistent for each subsidiary, so we can select the form of the default intensity to make sure the initial . In fact, the sensitivity of the impact of the environment on the subsidiaries with the different credit rating, is also not the same, so we can estimate

. In fact, the sensitivity of the impact of the environment on the subsidiaries with the different credit rating, is also not the same, so we can estimate , the scope of the environmental impact according to the c credit rating of the subsidiaries.

, the scope of the environmental impact according to the c credit rating of the subsidiaries.

In the process of continuous interaction, the enterprise Group subsidiaries exhibit the evolving learning behavior. By adjusting the intensity of the related party transactions with other subsidiaries, each subsidiary can control its credit risk. However, in reality, subsidiaries can not completely do rational decision-making, because it will be influenced by some factors like: the historic habits (such as the long-term cooperation that has long existed between enterprise Group subsidiary), the development environment (such as the related transaction that affected by the enterprise Group’s strategic decisionmaking), and also the pursuit of minimizing the risk for the enterprise itself as well, and so on. Therefore, this paper designed a set of evolving rules in a blended learning mode, which had taken a comprehensive consideration of their own situation, development environment and historic habits.

In cycle 0, according to the situation of the enterprise Group, we set initial the credit rating of each subsidiary Agenti, and then determined its initial default intensity , and the impact of external environment

, and the impact of external environment . With the intensity of the related party transactions

. With the intensity of the related party transactions , we built (i.e. the average degree network

, we built (i.e. the average degree network ) network structure. In turn, we set the weight values of each link of related party transactions, and then did the normalization process, thus gaining the intensity matrix of the related party transactions. Generally speaking, the related party transactions between subsidiaries within the Group are determined by the Group’s strategy. Therefore, the structure of related party transactions may change. Since each subsidiary still purse the maximization of its own interests, though they can not change fact that they have inevitably related party transactions with other subsidiaries, however, they can through adjusting the intensity of related party transactions to avoid risks. When the credit rating of subsidiary j (the related party transactions partner of subsidiary i) falls below a pre-set threshold, it means a potential loss for subsidiary i, thus leading to the increase of its own credit risk. Therefore, subsidiary i will tend to decrease the amount or frequency of related party transactions with subsidiary j in next cycle, which will weakened the intensity of the related party transactions. Of course, whether it is capable to make the choice independently is related with the Group’s control of the subsidiary. With an increase in the Group’s c control efforts, the ability of making choice independently will gradually be lowered. We assume in cycle T, the willingness for subsidiary i to maintain its original intensity of the related party transactions is

) network structure. In turn, we set the weight values of each link of related party transactions, and then did the normalization process, thus gaining the intensity matrix of the related party transactions. Generally speaking, the related party transactions between subsidiaries within the Group are determined by the Group’s strategy. Therefore, the structure of related party transactions may change. Since each subsidiary still purse the maximization of its own interests, though they can not change fact that they have inevitably related party transactions with other subsidiaries, however, they can through adjusting the intensity of related party transactions to avoid risks. When the credit rating of subsidiary j (the related party transactions partner of subsidiary i) falls below a pre-set threshold, it means a potential loss for subsidiary i, thus leading to the increase of its own credit risk. Therefore, subsidiary i will tend to decrease the amount or frequency of related party transactions with subsidiary j in next cycle, which will weakened the intensity of the related party transactions. Of course, whether it is capable to make the choice independently is related with the Group’s control of the subsidiary. With an increase in the Group’s c control efforts, the ability of making choice independently will gradually be lowered. We assume in cycle T, the willingness for subsidiary i to maintain its original intensity of the related party transactions is . That is to say, faced with the situation that a subsidiary of the related party transactions defaults, subsidiary i will choose to maintain the original intensity related party transactions with the probability of

. That is to say, faced with the situation that a subsidiary of the related party transactions defaults, subsidiary i will choose to maintain the original intensity related party transactions with the probability of , while choose to reduce the intensity with the probability of

, while choose to reduce the intensity with the probability of .

.

4. Simulation and Results Analysis

The average number of the related party transactions between the subsidiaries within enterprise Group is 6. Without loss of generality, we generated structures of the transactions randomly, making the average degree be 6. Based on the network structures and the setting rules, simulation experiments were carried out about the system. According to the Standard and Poor’s case that the default probability was corresponded with different credit rating, we set the initial default intensity and let it be effected by the risk shocks. The related party transactions weights were randomly generated, and then we gained the normalized intensity matrix. In order to overcome the problem of error caused by the randomness, we simulated 100 times to get the average intensity of related party transactions. In that case, some characteristic parameters directly related with the intensity of related party transactions would be available, thus enabling us to analyze some relationships between the intensity and credit risk level of enterprise Group.

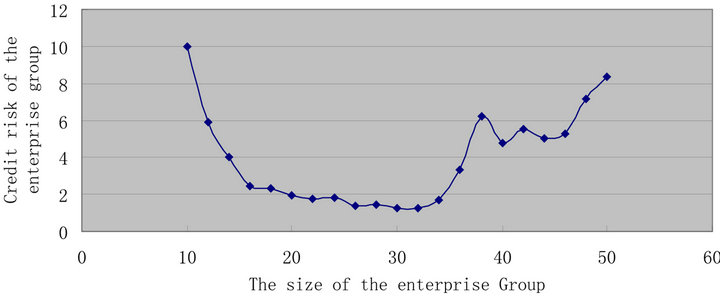

4.1. Simulation Analysis of the Effect of the Size of the Enterprise Group on the Level of Credit Risk

As in the following, we denoted the number of the members within enterprise Groups (referred to as the size of the enterprise Group) as the characteristic parameters of the Enterprise Group size, which were directly related with directly related with the intensity of related party transactions. We did simulation about the relationship between the enterprise Group size (from 10 - 50) and the credit risk level of the enterprise Group, and we got the credit risk levels under the condition of different enterprise Group sizes, as was shown in Figure 2.

As can be seen from Figure 2, the enterprise Group size could affect the proliferation of credit risk and the degree of high and low. In the set of parameters, when the number of enterprise members was between [20,30], the credit risk would be controlled in a lower level, and the enterprise Groups in a stable developing state. While the enterprise Group size was less than 20 or more than 30, the credit risk would be higher. Because it could not take the scale advantages when the size was small; and when the size was too big, with the increase in the number of enterprise members, the economies of scale could not resist the negative effect generated by the increase risk. Therefore, there existed an optimal scale, which was suitable for the development of the enterprise Group, and it could enable the enterprise Group to resist of the risk effectively and maintain the enterprise Group in a stable and healthy development.

4.2. Simulation Analysis of the Effect of the Intensity of Related Party Transactions on the Level of Credit Risk the Enterprise Group

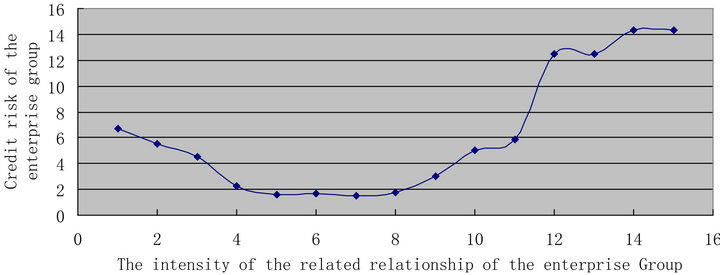

The other characteristic parameter, which was directly related to the intensity of related party transactions, was the intensity of the related relationship between the enterprise members within the enterprise Group. The following was the simulation about the relationship between the intensity of the related relationship and the enterprise Group’s credit risk level. Taking the size of the enterprise Group with 30, the rest of the parameters were the same, and we did the simulation with changing the intensity of the related relationship in turn from 1 - 15. Because the intensity of the related relationship reflected the intensity of related party transactions within the enterprise Group, the higher the intensity of the related relationship was, the more close of the related party transactions within the enterprise Group would be. Taking into account the fact that different average degrees led to different topologies of the network of the related party transactions, in order to overcome the error caused by the randomness, we still did 100 times simulation to calculate the average value of each set of the parameters. Finally, we got the enterprise Group’s credit risk level under different intensities of related relationships of the enterprise Group, as was shown in Figure 3.

As can be seen from Figure 3, the trend of credit risk changing with the intensity of the related relationship of the enterprise Group was a concave curve, which first decreased and then increased. Initially, with the increase in the intensity of the related relationship, the intensity of the related party transactions between the subsidiaries within the Group was getting stronger. It would be easier to achieve resource sharing and complementary, so the Group would have a greater ability to resist risks. However, with the continuous expansion of the intensity of the of the related party transactions, the negative impact would gradually be revealed, such as the internal related party transactions was more difficult to control, and regulatory cost more. Under this set of parameters, when the intensity of the related relationship was during [5,7], the Enterprise Group’s overall credit risk was controlled at a lower level, and no doubt, this was suitable for the development of the enterprise Group.

5. Conclusions

This paper demonstrated the process of the proliferation of the credit risk within the enterprise Group through the theoretical model. Furthermore, we analyzed the effect of the enterprise Group size and the intensity of the related relationship on the level of credit risk by simulation. This method helped the enterprise Group to improve the capability of resisting the risk and also provided a new researching way for the commercial banks to defend against the credit risk of the enterprise Group and its subsidiaries. The study showed that the enterprise Group size and the intensity of the related relationship have a great effect on the credit risk, and there exists a reasonable range that can make the level of credit risk be controlled at a low level.

This paper did an exploration of the problem of the

Figure 2. The trend of the level of credit risk changing with the size of the enterprise group.

Figure 3. The trend of the level of credit risk changing with the intensity of the related relationship of the enterprise group.

credit risk of the Group by the method of simulation. Not only it is a foreshadowing of the later studies of credit risk problem, also it has positive significance for other similar management issues. However, this paper simplified the role of other factors, and only discussed about the effect of two main factors of the intensity of related party transactions on the proliferation of the credit risk and the degree of high and low. It still needs us to figure out the interactive relationship between the factors, in order to reveal the internal mechanism in a more in-depth. However, in reality, the determinant of the default intensity and its distribution is still quite complicated, so how to set reasonable parameters through empirical means, and validate the model combined with empirical results, is the next issue that should be considered.

REFERENCES

- G. R. Duffee, “Estimating the Price of Default Risk,” Review of Finaucial Studies, Vol. 12, No. 1, 1999, pp. 197-226. doi:10.1093/rfs/12.1.197

- Y. J. Xiao and D. P. Huo, “Credit Risk Management of Group Customers by Commercial Banks,” Finance Forum, Vol. 11, No. 12, 2006, pp. 39-44.

- H. Xia, Z. Q. Li and Q. Dai, “The Reveal and Prevention of Credit Risk of Group Customers by Commercial Banks,” Prices Monthly, Vol. 9, No. 10, 2008, pp. 89-91.

- T. Khanna and Y. Yafeh, “Business Groups and Risk Sharing around the World,” The Journal of Business, Vol. 78, No. 1, 2005, pp. 301-340. doi:10.1086/426527

- E. Luciano and G. Nicodano, “Ownership Links, Leverage and Credit Risk,” International Financial Research Forum, Paris, 2008.

- L. Chen and Z. F. Zhou, “A Research Based Shareholding Ratio on Default Contagion between Parent and Subsidiary Company in an Enterprise Group,” Journal of Industrial Engineer Management, Vol. 23, No. 3, 2009, pp. 80- 84.

- L. Chen and Z. F. Zhou, “The Agent’s Risk Attitude, Moral Hazard and Credit Risk Contagion in an Enterprise Group,” Chinese Journal of Management, Vol. 7, No. 3, 2010, pp. 344-349.

- H. S. Fu and J. X. Fan, “The Analysis of the Regulatory Status and System of the Credit Risk by Affiliated Transactions of Enterprise Group,” Shanghai Finance, Vol. 32, No. 12, 2006, pp. 41-44.

- R. C. Merton, “On the Pricing of Corporate Debt: The Risk Structure of Interest Rates,” Journal of Finance, Vol. 29, No. 2, 1974, pp. 449-470.

- F. Black and J. C. Cox, “Valuing Corporate Securities: Some Effects of Bond Indenture Provisions,” Journal of Finance, Vol. 31, No. 2, 1976, pp. 351-367. doi:10.1111/j.1540-6261.1976.tb01891.x

- R. A. Jarrow, D. Lando and S. M. Turnbull, “A Markov Model for the Term Structure of Credit Risk Proliferates,” Review of Financial Studies, Vol. 10, No. 2, 1997, pp. 481-523. doi:10.1093/rfs/10.2.481

- G. R. Duffee, “Estimating the Price of Default Risk,” Review of Financial Studies, Vol. 12, No. 1, 1999, pp. 197-226. doi:10.1093/rfs/12.1.197

- C. Xu, Y. Yang and Z. F. Zhou, “Application of Cellular Automata Simulation in the Credit Risk Contagion of an Enterprise Group,” China Journal of Enterprise Operations Research, Vol. 5, No. 1, 2010, pp. 124-129.

- C. Xu, Y. Yang and Z. F. Zhou, “Simulation of Risk Transfer in Enterprise Group Based on Cellular Automata,” Chinese Journal of Management Science, Vol. 20, No. 4, 2012, pp. 144-150.

- Y. Xu, B. Hu and R. Qian, “Analysis on Stability of Strategic Alliances Based on Stochastic Evolutionary Game Including Simulations,” Systems Engineering Theory & Practice, Vol. 31, No. 5, 2011, pp. 920-926.

- X. G. Liu, N. D. Yang and T. Wei, “Simulation of Managerial Cognition Representation in the Context of Organizational Complexity Based on NK Model,” Chinese Journal of Management Science, Vol. 9, No. 4, 2012, pp. 516-521.

- D. H. Guan, M. Xiao, Z. F. Zhou and L. Chen, “Simulation of the Delayed Effect of Credit Risks in Enterprise Group Based on Multi-Agent,” The 1st National Symposium on Disaster Risk Analysis and Management in China’s Coastal Regions, Atlantis Press, Oxford, 2011, pp. 41-46.

NOTES

*This research was be supported by National Natural Science Foundation of China (No. 70971015, 71271043); the special research Foundation of Ph.D. program of China (20110185110021).