Open Journal of Statistics

Vol.06 No.05(2016), Article ID:71274,9 pages

10.4236/ojs.2016.65066

The Performance of Double Bootstrap Method for Large Sampling Sequence

Muhamad Safiih Lola, Nurul Hila Zainuddin*

School of Informatics and Applied Mathematics, University Malaysia Terengganu, Kuala Nerus, Malaysia

Copyright © 2016 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: July 22, 2016; Accepted: October 15, 2016; Published: October 18, 2016

ABSTRACT

Studies on the iteration procedure in double bootstrap method have given a great impact on confidence interval performance. However, the procedure was claimed to be complicated and demand intensive computer processor. Considering this problem, an alternative procedure was proposed in this research. Despite of using small sampling sequence, this research was aimed to increase the accuracy estimation using a second replication number which resulted in a large sampling sequence of double bootstrap. In this paper, the alternative double bootstrap method was hybrid onto an example model and its performance was based on Studentised interval. The performance was examined in simulation study and real sample data of sukuk Ijarah. The result showed that hybrid double bootstrap model gave more accurate estimation in terms of its shorter length when dealing with various parameter values and has shown to improve the single bootstrap estimation.

Keywords:

Double Bootstrap, Confidence Interval, Sampling Sequence, EWMA, Sukuk Ijarah

1. Introduction

The iteration procedure is basically used in double bootstrap method to construct confidence interval in situation where the uncertainty estimation is questionable. Firstly introduced by Efron in 1983 [1] , basically, the procedure is considered to use the plug-in method in each set of sample sequences of first bootstrap, and the replication size is done using small number than first replication. As proven by [2] - [6] , this procedure eventually helps to increase the accuracy estimation which is focusing on the confidence interval estimation.

Despite of its great advantage in improving the first bootstrap accuracy estimation, the procedure seems to demand a high computer processing and eventually provide a range of time to complete the whole algorithm of iteration [2] [7] - [9] . Motivated by these problems, this paper proposes an alternative procedure of double bootstrap method which aims to increase the accuracy estimation by constructing the interval and reduce the computer processing. The proposed method considers a large sampling sequence of double bootstrap replication where the replication size is obtained and from approximation bias estimation method; refer to [10] .

Instead of directly do the sampling procedure on sample data, this paper is motivated to conduct a hybrid modelling procedure, which is considered an example model of exponentially weighted moving average and hybrid it with proposed double bootstrap method. Next, the performance of this hybrid model is valued upon its accuracy estimation by constructing two-sided Studentised confidence interval [4] [11] . In terms of sample data, three set data from Gaussian distribution are generated in Monte Carlo simulation study and a set of real data of sukuk Ijarah from Bursa Malaysia are considered in this research. Generally, the sukuk Ijarah is a branch of Islamic investment certificate which is prohibited the element of usury, uncertainty (gharar) and gambling along its financial process.

Thus in this paper, Section 2 presents a discussion on the example model and purposed double bootstrap method. Next, Section 3 presents the sukuk Ijarah sample data and the number of double bootstrap replication that obtained from using sukuk data. In Section 4, the performance evaluation of hybrid model is presented and Section 5 is for research conclusion.

2. Methodology

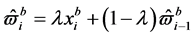

Let  denote exponentially weighted moving average model. Consider that

denote exponentially weighted moving average model. Consider that  is independent variable and

is independent variable and  is desirable parameter of

is desirable parameter of  which could be known as decay factor of

which could be known as decay factor of  model. T thus the one-step-ahead of

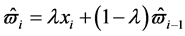

model. T thus the one-step-ahead of  estimation can be referred to following recursion:

estimation can be referred to following recursion:

(1)

(1)

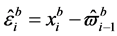

(2)

(2)

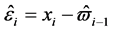

where  is a white noise process and the one-step-ahead residual estimation of Equation (1) can be made using formula of

is a white noise process and the one-step-ahead residual estimation of Equation (1) can be made using formula of .

.

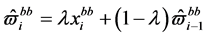

The one-step-ahead of  is implemented to residual double bootstrap scheme. In this research, an alternative double bootstrap sampling that proposed by [12] is applied. Note that, basically the bootstrapping method required a replication size for sampling with replacement procedure. As proposed by [10] , a bootstrap replication size can be obtained by finding the converge value of bootstrap bias estimation. Motivating by this study, a simple modification has been made. Let a true estimator denote as

is implemented to residual double bootstrap scheme. In this research, an alternative double bootstrap sampling that proposed by [12] is applied. Note that, basically the bootstrapping method required a replication size for sampling with replacement procedure. As proposed by [10] , a bootstrap replication size can be obtained by finding the converge value of bootstrap bias estimation. Motivating by this study, a simple modification has been made. Let a true estimator denote as  and

and  be expected estimation of

be expected estimation of  which engaged from Equation (1). Thus, the bias estimation can be referred to following recursion:

which engaged from Equation (1). Thus, the bias estimation can be referred to following recursion:

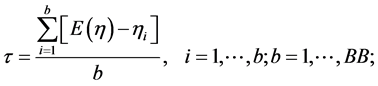

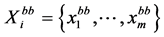

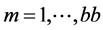

(3)

(3)

where b denotes as current bootstrapping replication size, and note that two bootstrap procedure are used in this research, thus the respective bias estimation for single and double bootstrap are denotes as  and

and . The rational replication size is obtained when Equation (3) is shown to be converged at certain value. By using this result, it can further be used in bootstrapping procedure.

. The rational replication size is obtained when Equation (3) is shown to be converged at certain value. By using this result, it can further be used in bootstrapping procedure.

First procedure is to sample the one-step-ahead of  with replacement to obtained a set of single bootstrap independent variable,

with replacement to obtained a set of single bootstrap independent variable,

Consider to draw the

This research is motivated to examine the efficiency of

where

3. Materials

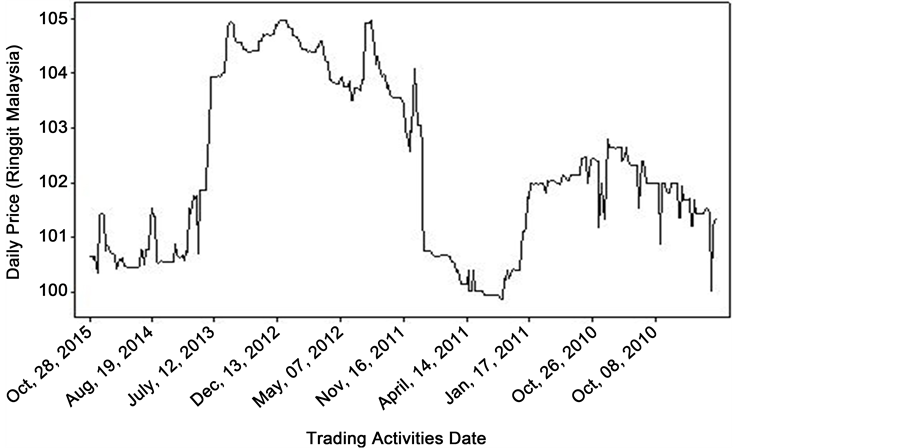

A set sample data with respect to sukuk of Ijarah instrument investment issued by Malaysia Airports Capital Berhad is applied in this research. The selected instrument is coded as VN100268 under Islamic Medium-Term Notes Programme starting from 2010 until its maturity year of 2015. For this research, the available daily price that has been issued is taken from October 08, 2010 until October 28, 2015 with sample size of 300. This sample data is plotted in Figure 1.

Based on Figure 1, the historical information price of sukuk Ijarah has shown to be increasing starting from its issuance in 2010 and slightly decrease in early 2011. The challenging year of 2011 gave a great impact of Malaysia Airports Capital Berhad trading activities which result to be its worst price issued on its historical trading. Learned by previous market trend, positive activities recorded along 2012 until early 2014. However, a slow activity is shown in 2014 and 2015.

Figure 1. Daily price of sukuk Ijarah starting from 08 October 2010 until 28 October 2015.

For further step in estimating volatility of sukuk, a set of daily return sample is obtained using the formula proposed by [13] - [15] . By using this returns sample, the parameter of Equation (1) can be calculated using the proposed method by [16] [17] . Having a complete information needed to estimate one-step-ahead of Equation (1), further steps is to find the replication size of single and double bootstrap using the respective

Table 1 shows bias estimation results for finding the rational single bootstrap replication size. It is found that the

Table 2 shows the bias estimation for rational double bootstrap replication size. Based on this table, it is found that the convergence starts at size of 2100 until 2200. Thus, based on this result and it is consider to choose a lower

4. Performance Evaluation and Comparison

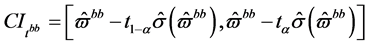

In this section, the performance evaluation is based on estimation efficiency of single and double bootstrap model using the 90% and 95% of two-sided Studentised confidence interval. Instead of directly applied on daily return of sukuk Ijarah sample data, this research is motivated to firstly test the comparison of one-step-ahead

Table 1. Bias estimation for single bootstrapping replication size.

Table 2. Bias estimation for double bootstrapping replication number.

4.1. Monte Carlo Simulation

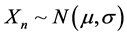

Three sample size, {n: n1, n2, n3} are generated randomly from Gaussian distribution,

In Table 3 and Table 4, it shows the comparison of Studentised confidence interval estimation for one-step-ahead of single,

Moreover, the length estimation of both models is shown to be consistently decreased as sample size increase. For example

Table 3. Comparison of 90% of two-sided studentised confidence interval.

aRefer to greater parameter value of 1.00 down to 0.30. bRefer to small parameter value of 0.25 down to 0.03.

Table 4. Comparison of 95% of two-sided studentised confidence interval.

a,bThe abbreviation can be refer to Table 3.

Table 5. Studentised confidence interval using sukuk Ijarah sample data.

and 95% interval estimation are respectively start from {0.40602 → 0.33016 → 0.18110} and {0.48872 → 0.39534 → 0.21611}. Note that, the estimation value of

4.2. Example of Real Sample Data

The daily return sample data of sukuk Ijarah is used to estimate the single and double bootstrap model. In this estimation procedure, the rational parameter value is found to be 0.94. By using the same replication number of single and double bootstrap sampling procedure, the length of Studentised confidence interval could be proceed to be estimated. Thus, the result can be fevered to Table 5.

Based on Table 5, it is shown that by using double bootstrap model as the estimator for Studentised interval, the interval length is found to be shorter compare to single bootstrap. For example 90% confidence interval, the respective estimation of

5. Conclusion

In this paper, an alternative procedure of double bootstrap was proposed and considered to be hybrid into an example model. The performance of this hybrid model was tested in terms of its accuracy estimation in simulation study and a real sample data known as sukuk Ijarah. A large sampling sequence of double bootstrap was found to shorter the Studentised interval estimation when using small range parameter of example model in simulation study. The length estimation found to be shorter as sample size increased. Moreover, for sukuk Ijarah sample data, it was shown that double bootstrap model has the shortest confidence interval compared to single bootstrap model. Based on both studies, it can conclude that large sampling sequence of double bootstrap has increased the accuracy estimation and improved the single bootstrap estimation.

Acknowledgements

A special gratitude for School of Informatics and Applied Mathematic (SIAM) and Research Management Centre (RMC), Universiti Malaysia Terengganu for supported this research paper.

Cite this paper

Lola, M.S. and Zainuddin, N.H. (2016) The Performance of Double Bootstrap Method for Large Sampling Sequence. Open Journal of Statistics, 6, 805-813. http://dx.doi.org/10.4236/ojs.2016.65066

References

- 1. Efron, B. (1990) More Efficient Bootstrap Computations. Journal of the American Statistical Association, 85, 79-89.

http://links.jstor.org/sici?sici=0162-1459%28199003%

http://dx.doi.org/10.1080/01621459.1990.10475309 - 2. Martin, M.A. (1990) On the Double Bootstrap. Technical Report No. 347.

- 3. Vinod, H.D. (1995) Double Bootstrap for Shrinkage Estimators. Journal of Econometrics, 68, 287-302.

http://dx.doi.org/10.1016/0304-4076(94)01639-H - 4. Nankervis, J.C. (2005) Computational Algorithms for Double Bootstrap Confidence Intervals. Computational Statistics and Data Analysis, 49, 461-475.

http://dx.doi.org/10.1016/j.csda.2004.05.023 - 5. Buckley, C. and Carney, P. (2013) The Potential to Reduce the Risk of Diffuse Pollution from Agriculture While Improving Economic Performance at Farm Level. Environmental Science and Policy, 25, 118-126.

http://dx.doi.org/10.1016/j.envsci.2012.10.002 - 6. Chang, J. and Hall, P. (2015) Double-Bootstrap Methods That Use a Single Double-Bootstrap Simulation. Biometrika, 102, 203-223.

http://dx.doi.org/10.1093/biomet/asu060 - 7. Hall, P. and Martin, M.A. (1988) On Bootstrap Resampling and Iteration. Oxford Journal, 75, 661-671.

http://www.jstor.org/stable/2336307

http://dx.doi.org/10.1093/biomet/75.4.661 - 8. Teyarachakul, S., Chand, S. and Tang, J. (2006) Estimating the Limits for Statistical Process Control Charts: A Direct Method Improving Upon the Bootstrap. European Journal of Operational Research, 178, 472-481.

http://dx.doi.org/10.1016/j.ejor.2006.01.038 - 9. Nedelea, I.C. and Fannin, J.M. (2013) Technical Efficiency of Critical Access Hospitals: An Application of the Two-Stage Approach with Double Bootstrap. Health Care Management Science, 16, 27-36.

http://dx.doi.org/10.1007/s10729-012-9209-8 - 10. Akhmad, F., Ibrahim, N.A., Isa, D. and Mohd. Rizam, A.B. (2003) Interval Selisih Rata-Rata dengan Metode Bootstrap Persentil. Jurnal Teknik Industri, 8, 110-117.

- 11. Pascual, L., Romo, J. and Ruiz, E. (2006) Bootstrap Prediction for Returns and Volatility in GARCH Models. Computational Statistic & Data Analysis, 50, 2293-2312.

http://dx.doi.org/10.1016/j.csda.2004.12.008 - 12. Nurul Hila, Z. and MuhamadSafiih, L. (2016) The Performance of BB-MCEWMA Model: Case Study on Sukuk Rantau Abang Capital Berhad, Malaysia. International Journal of Applied, Business and Economic Research, 2, 639-653.

- 13. Schwartz, A.R. and Whitcomb, K.D. (1977) Evidence on the Presence and Cause of Serial Correlation in Market Model Residuals. The Journal of Finance and Quantitative Analysis, 12, 291-313.

http://www.jstor.org/stable/2330436

http://dx.doi.org/10.2307/2330436 - 14. Laurence, M., Cai, F. and Qian, S. (1997) Weak-Form Efficiency and Causality Test in Chinese Stock Market. Multinational Finance Journal, 1, 291-307.

http://dx.doi.org/10.17578/1-4-3 - 15. Okpara, G.C. (2010) Stock Market Prices and the Random Walk Hypothesis: Further Evidence from Nigeria. Journal of Economics and International Finance, 2, 49-57.

- 16. Cox, D. R. (1961). Prediction by Exponentially Weighted Moving Averages and Related Methods.Journal of the Royal Statistical Society, Series B (Methodological), 23(2): 414-422.

- 17. Ramjee, R., Crato, N. and Ray, B.K. (2002) A Note Moving Average Forecasts of Long Memory Processes with an Application to Quality Control. International Journal of Forecasting, 18, 291-297.

http://dx.doi.org/10.1016/S0169-2070(01)00159-5 - 18. Chen, B., Gel, Y.R., Balakrishna, N. and Abraham, B. (2011) Computationally Efficient Bootstrap Prediction Intervals for Returns and Volatilities in ARCH and GARCH Processes. Journal of Forecasting, 30, 51-71.

http://dx.doi.org/10.1002/for.1197 - 19. Pascual, L., Romo, J. and Ruiz, E. (2006) Bootstrap Prediction for Returns and Volatility in GARCH Models. Computational Statistic & Data Analysis, 50, 2293-2312.

http://dx.doi.org/10.1016/j.csda.2004.12.008 - 20. Nedelea, I.C. and Fannin, J.M. (2013) Technical Efficiency of Critical Access Hospitals: An Application of the Two-Stage Approach with Double Bootstrap. Health Care Management Science, 16, 27-36.

http://dx.doi.org/10.1007/s10729-012-9209-8 - 21. Efron, B. and Tibshirani, R.J. (1993) An Introduction to the Bootstrap. Chapman & Hall, New York, London.

http://dx.doi.org/10.1007/978-1-4899-4541-9 - 22. Serel, D. A. and Maskowitz, H. (2008) Joint Economic Design of EWMA Control Charts for Mean and Variance. European Journal of Operational Research, 184, 157-168.

http://dx.doi.org/10.1016/j.ejor.2006.09.084 - 23. Tosasuku, J., Budsaba, K. and Volodin, A. (2009) Dependent Bootstrap Confidence Intervals for a Population Mean. Thailand Statistician, 7, 43-51.

- 24. Lucas, J.M. and Saccucci, M.S. (1990) Exponentially Weighted Moving Average Control Schemes: Properties and Enhancements. Technometrics, 32, 1-12.

http://dx.doi.org/10.1080/00401706.1990.10484583 - 25. Montgomery, D.C. and Mastrangelo, C.M. (1991) Some Statistical Methods for Autocorrelated Data. Journal of Quality Technology, 23, 179-204.