American Journal of Operations Research

Vol.05 No.03(2015), Article ID:56444,6 pages

10.4236/ajor.2015.53015

Ordering and Pricing Strategies for Fresh Products with Multiple Quality Levels Considering Consumer Utility

Peiqi Ma

School of Management, Jinan University, Guangzhou, China

Email: Page-Mar@foxmail.com

Copyright © 2015 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 9 April 2015; accepted 17 May 2015; published 20 May 2015

ABSTRACT

In this paper, considering a scenario in which there are two quality levels of fresh products and introduction of consumer utility function, we studied the optimal ordering and pricing strategies under certain quantity. Our results showed that, facing the two quality levels of fresh products, retailers would not benefit from sales of lower quality of fresh products with the deterministic demand. In the pursuit of profit maximization, the initial order quantity is smaller than the potential demand for market.

Keywords:

Fresh Products, Consumer Utility, Multiple Quality Level, Pricing and Ordering

1. Introduction

Given the technological advancements and logistical capabilities over the last seven decades or so, perishables have become a large part of supermarket retailing sales. For instance, a report by FMI (2009) indicates that of the $430 billion plus in US supermarket sales registered for the year 2008, 81% or over $348 billion is due to sales of groceries directly related to foods and beverages (F & B). And there is no doubt that fresh foods have played a dramatically important role in china.

Motivated by the common practice, retailers usually divide fresh products, which may decay or deteriorate during the sale process, into different quality levels, and sell them in a separate way. In this paper, considering a scenario in which there are two quality levels of fresh products and introduction of consumer utility function, we studied the optimal ordering and pricing strategies under certain quantity. Then, we discussed how environmental factors, such as demand volatility and ordering costs, affected retailers’ decision. By considering consumer utility to study the optimal ordering and pricing decisions of multi-quality fresh products, we found corresponding answers of the above questions, and gave the management suggestions.

2. Literature Review

Ordering and pricing of fresh products are within the scope of supply chain management, which has become a hot issue for discussion and research. Goyal et al. (2001), Li et al. (2010), and Bakker et al. (2012) provided a comprehensive introduction about deteriorating items inventory management research from different perspectives [1] -[3] . Under certain quantity, Xiao et al. (2010) assumed that there are two quality levels of fresh products; retailer balances supply and demand of fresh products with price discount to study the optimal selling strategies, but they do not take characteristics of fresh product into account [4] . Bai and Kendall (2008) proposed a single-period inventory and shelf-space allocation model for fresh produce. The demand rate is assumed to be deterministic and dependent on both the displayed inventory and the items’ freshness condition [5] . Avinadav Tal et al. (2009) presents an extension of the classical EOQ model for items with a fixed shelf life and a declining demand rate due to a reduction in the quality of the item in the course of its shelf-life [6] . However, Perishable products are subject to both obsolescence and deterioration, but above researches that study both types of loss are limited. Dan and Chen (2008) created an exponential function with downward slope, trying to denote valuable loss with greenness, and studies the coordination in two-level fresh agricultural supply chain [7] . Cai et al. (2010) considered a supply chain in which a distributor procures from a producer a quantity of a fresh product [8] . During the transportation process, the distributor has to make an appropriate effort to preserve the freshness of the product, and his success in this respect impacts on both the quality and quantity of the product delivered to the market. In reality, each consumer has different preferences to fresh products, which may influence retailer’s ordering and pricing strategies. Above two references do not model consumer behavior. Some scholars analyzed pricing decision that involves modeling customer behavior. Ferguson and Koenigsberg (2007) have presented a two-period model where the quality of the leftover inventory is often perceived to be lower by customers, and the firm can decide to carry all, some, or none of the leftover inventory to the next period [9] . This is also a model involving quality drop and quantity change. Akcay et al. (2010) considered a dynamic pricing problem facing a firm that sells given initial inventories of multiple substitutable and perishable products over a finite selling horizon. They modeled this multiproduct dynamic pricing problem as a stochastic dynamic program and analyzed its optimal prices [10] . Li et al. (2012) studied the joint pricing and inventory control problem for perishables when a retailer does not sell new and old inventory at the same time [11] . Sainathan (2013) considered pricing and ordering decisions faced by a retailer selling a perishable product with a two-period shelf life over an infinite horizon [12] . Those scholars considered multiple quality levels of deteriorating or decaying products, however, they are not on the background of fresh products.

The remainder of this article is organized as follows. In Section 2, I review the related literature. In Section 3, I describe demand model and the retailer’s profit model, and then I find the solution of base model. In Section 4, I examine how demand affects the retailer’s problem. In Section 5, I give a sensitivity analysis for the results.

3. Base Model

Considering a scenario in which a single retailer sells one category fresh product throughout the whole sale period with two stages, there may be residual at the end of one stage, and the retailer can sell the low quality product at the next stage. We assumed that there exist two different quality levels (high and low) to discuss effectiveness of retailers selling decision, ordering and pricing strategies. At the start of period, the retailer procure  unit fresh product with per unit procurement cost of

unit fresh product with per unit procurement cost of  from producer, and the procurement lead time is assumed to be zero. In sales process, retailer can do preservation effort at

from producer, and the procurement lead time is assumed to be zero. In sales process, retailer can do preservation effort at  rate,

rate,  , then its cost is

, then its cost is

assumed to be . Then I describe the choice process among customers. Any customer who visits the

. Then I describe the choice process among customers. Any customer who visits the

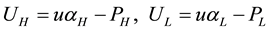

retailer has three choices: buy one unit of the low quality product, buy one unit of the high quality product, or do not buy anything. The high and low quality products compete among customers in their attributes and prices. Each customer selects his preferred choice based on his utility from purchasing a unit of product type , which is given by

(1)

(1)

where  is a customer’s quality sensitivity,

is a customer’s quality sensitivity,  ,

,  is product type ’s quality factor that is a measure of its desirability (therefore

is product type ’s quality factor that is a measure of its desirability (therefore ), and

), and  is its price. Then, I define

is its price. Then, I define  to be the probability that a customer buying one unit of the high (low) quality product. Next, I discuss how demand certainty impacts the retailer’s optimal strategy

to be the probability that a customer buying one unit of the high (low) quality product. Next, I discuss how demand certainty impacts the retailer’s optimal strategy

Based on the utility model, I first derive expression for  and

and  as functions of the prices and quality factors. The percentage of a customer buying the high quality level

as functions of the prices and quality factors. The percentage of a customer buying the high quality level , and that of buying the old product,

, and that of buying the old product,  , are as follows:

, are as follows:

In the expression 2, there is need to compare

Case 1 When

Case 2 When

Suppose the total number of customers is

The symbol “+” means the expression,

4. Optimal Ordering and Pricing Decision

In this section, we solve the optimal ordering and pricing decision according to the retailer’s demand and profit model. As the same, there is different relationship between

Scenario 1: Suppose that

Senario 2: Suppose that

The Hessian for the objective function is given by:

Which is negative definite (

Suppose that

5. Numerical Analysis

Giving a fresh product as an example, we assume that u is a customer’s quality sensitivity,

are discussions about the optimal decision of retailer and fluctuation of the potential demand for market. We have assumptions about some values of parameters as following tables (Table 1 and Table 2).

Proposition 1: Facing the two quality levels of fresh products, retailers will not benefit from sales of lower quality of fresh products with the deterministic demand.

Proof 1: From the optimal retailer’s profit

related to high quality factor, ordering and preserving costs. This is because retailer sells low quality products at a discount price, which still needs to undertake ordering and preserving costs. Therefore, the retailer sells low quality fresh products only to minimum the loss and does not make profit from it.

Proposition 2: To realize the optimal profit, the retailer’s initial ordering quantity is smaller than the potential demand for market.

Table 1. Value of parameters.

Table 2. Sensitivity analysis.

Proof 2: From

mainly because the retailer sells high quality fresh product at a higher price to make more profit. As long as the retailer has low ordering and preservation costs, it will have the motive to repeat order, which is consistent with zero inventory and rapid inventory turnover in operation management.

6. Conclusion and Future Research

This paper focuses on multiple quality fresh products and considers consumer utility to analyze the retailer’s optimal ordering and pricing strategies. Our results showed that, facing the two quality levels of fresh products, retailers would not benefit from sales of lower quality of fresh products with the deterministic demand. In the pursuit of profit maximization, the initial order quantity is smaller than the potential demand for market. Possible extensions of this paper involve relaxing some of assumptions, for example, considering random customer arrival process and demand substitution of high and low quality products.

References

- Goyal, S.K. and Giri, B.C. (2001) Recent Trends in Modeling of Deteriorating Inventory. European Journal of Operational Research, 134, 1-16. http://dx.doi.org/10.1016/S0377-2217(00)00248-4

- Li, R., Lan, H. and Mawhinney, J.R. (2010) A Review on Deteriorating Inventory Study. Journal of Service Science and Management, 3, 117-129. http://dx.doi.org/10.4236/jssm.2010.31015

- Bakker, M., Riezebos, J. and Teunter, R.H. (2012) Review of Inventory Systems with Deterioration since 2001. European Journal of Operational Research, 221, 275-284. http://dx.doi.org/10.1016/j.ejor.2012.03.004

- Xiao, Y., Wu, P. and Wang, Y. (2010) Pricing Strategies for Fresh Products with Multiple Quality Levels Based on Customer Choice Behavior. Chinese Journal of Management Science, 18, 58-65.

- Bai, R. and Kendall, G. (2008) A Model for Fresh Produce Shelf-Space Allocation and Inventory Management with Freshness-Condition-Dependent Demand. INFORMS Journal on Computing, 20, 78-85. http://dx.doi.org/10.1287/ijoc.1070.0219

- Tal, A. and Teijo, A. (2009) An EOQ Model for Items with a Fixed Shelf-Life and a Declining Demand Rate Based on Time-to-Expiry Technical Note. Asia-Pacific Journal of Operational Research, 26, 759-767. http://dx.doi.org/10.1142/S0217595909002456

- Dan, B. and Chen, J. (2008) Coordinating Fresh Agricultural Supply Chain under the Valuable Loss. Chinese Journal of Management Science, 5, 6.

- Cai, X., Chen, J., Xiao, Y., et al. (2010) Optimization and Coordination of Fresh Product Supply Chains with Freshness-Keeping Effort. Production and Operations Management, 19, 261-278. http://dx.doi.org/10.1111/j.1937-5956.2009.01096.x

- Ferguson, M.E. and Koenigsberg, O. (2007) How Should a Firm Manage Deteriorating Inventory? Production and Operations Management, 16, 306-321. http://dx.doi.org/10.1111/j.1937-5956.2007.tb00261.x

- Akcay, Y., Natarajan, H.P. and Xu, S.H. (2010) Joint Dynamic Pricing of Multiple Perishable Products under Consumer Choice. Management Science, 56, 1345-1361. http://dx.doi.org/10.1287/mnsc.1100.1178

- Li, Y., Cheang, B. and Lim A. (2012) Grocery Perishables Management. Production and Operations Management, 21, 504-517. http://dx.doi.org/10.1111/j.1937-5956.2011.01288.x

- Sainathan, A. (2013) Pricing and Replenishment of Competing Perishable Product Variants under Dynamic Demand Substitution. Production and Operations Management, 22, 1157-1181.