Open Access Library Journal

Vol.03 No.08(2016), Article ID:69904,12 pages

10.4236/oalib.1102863

Geometric Fractional Brownian Motion Perturbed by Fractional Ornstein-Uhlenbeck Process and Application on KLCI Option Pricing

Mohammed Alhagyan1,2*, Masnita Misiran1, Zurni Omar1

1Department of Mathematics and Statistics, School of Quantitative Sciences, Universiti Utara Malaysia, Sintok, Kedah, Malaysia

2Department of Mathematics, Community College in Al-Aflaj, Sattam University, Al Kharj, KSA

Copyright © 2016 by authors and OALib.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 30 June 2016; accepted 16 August 2016; published 19 August 2016

ABSTRACT

This paper presents an enhanced model of geometric fractional Brownian motion where its volatility is assumed to be stochastic volatility model that obeys fractional Ornstein-Uhlenbeck process. The method of estimation for all parameters (α, β, m, μ, H1, and H2) in this model is derived. We calculated the value of European call option using the estimates based on the methods of Masnita [1] [2] and Kukush [3] , traditional Black-Scholes European option price, in addition to proposed model in order to make comparison study.

Keywords:

Geometric Fractional Brownian Motion, Fractional Ornstein-Uhlenbeck Process, Long Memory Stochastic Volatility, Innovation Algorithm, Constraint Transcription Method, Segmentation, Option Pricing, KLCI

Subject Areas: Financial Mathematics

1. Introduction

One of the most important models in financial world is a geometric Brownian motion (GBM) introduced by Samuelson in 1964 [4] . This model is widely used as the underlying process of a risky market. Extension of this model includes the added long memory properties named geometric fractional Brownian motion (GFBM). GFBM model includes important parameters that are used in fractional Black-Scholes model which is a natural improvement of standard Black-Scholes model widely used in options market.

Based on the literature, early works on GBM assumed volatility to be a constant. However this assumption is rejected by most empirical studies [5] - [8] which led to some market crashes such as Black-Monday in 1987, the Asian crisis in 1989 and housing bubble and credit crisis 2007-2009. Thus, GBM is later studied with the assumption that volatility is stochastic [9] - [14] . Moreover, researchers showed that time series data depending on this model exhibited the existence of memory (some trend-like behavior) which implied deducing the incorporation of the long memory parameter (H), thus leading to the introduction of geometric fractional Brownian motion (GFBM).

GFBM model includes important parameters that are normally used in fractional Black-Scholes model which is a natural improvement of standard Black-Scholes model, widely accessible in options market. However, there are few contributions in the literature that estimate these parameters. The expressions of parameters in this model are too involved; in particular in covariance and its inversion of the likelihood function, thus hinder works of estimation.

However, some ground works have been recently established. Kukushin [1] developed an incomplete maximum likelihood estimation approach for this model, where the Hurst index H (the long memory parameter) is estimated by some other heuristic methods, such as the variation analysis or R/S analysis. To extend further this work, complete maximum likelihood estimation (CMLE) method was introduced by Misiran et al. [1] and [2] that are able to simultaneously estimate all parameters involved in GFBM (μ, σ and H). However, in Misiran and Kukush’s works, the volatility is assumed constant for the simplicity of calculation. Such assumption was rejected by empirical studies as previously explained. Thus, in this article, we aim to extend the previous work by considering the stochastic volatility in the said model.

Stochastic volatility (SV) can be referred to the volatility and common dependence between variables that are permitted to fluctuate over time, instead of remain constant. The main idea in stochastic volatility is that asset returns are well approximated by mixture distribution. This mixture reflects the level of new arrivals activity of data in the financial market. These models are able to overcome weaknesses in Black-Choles model.

One of the most important continuous settings of stochastic volatility is the Ornstein-Uhlenbeck (OU) model, developed by Uhlenbeck and Ornstein in [15] . It is the analogue of the famous autoregressive moving average (ARMA) process in discrete time. The main property of this model is the mean-reverting property, i.e. the mean acts as an equilibrium level for the process. OU model is habitually applied to model exchange rates, stochastic volatility, and interest rate [16] - [20] . In this work, we replace constant volatility in GFBM model by stochastic volatility that obeys the fractional Ornstein-Uhlenbeck process to provide better accuracy in describing real market behavior.

This article follows the sequence. First, a brief background on the GFBM and stochastic volatility are introduced. Then, the model is derived and followed by the estimation method. The application study is conducted to compare the proposed method with other methods.

2. Model Derivation

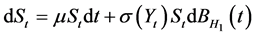

We briefly introduce the derivation of the model as follows. For detail derivation, we refer readers to Appendix A. Let  represent the stock price process with the dynamic assumed by:

represent the stock price process with the dynamic assumed by:

(1)

(1)

where  is the mean of return,

is the mean of return,  is the stochastic process and

is the stochastic process and  is fractional Brownian motion with Hurst index

is fractional Brownian motion with Hurst index , and

, and  is deterministic function. For simplicity of computations, in this work we choose

is deterministic function. For simplicity of computations, in this work we choose  as in [21] .

as in [21] .

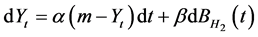

Let the dynamics of the volatility  be described by fractional Ornstein-Uhlenbeck (FOU) process which is the solution of the following stochastic differential equation:

be described by fractional Ornstein-Uhlenbeck (FOU) process which is the solution of the following stochastic differential equation:

(2)

(2)

where α, β and m are constant parameters that represent mean reverting of volatility, volatility of volatility, and mean of volatility, respectively.  is another fractional Brownian motion. We assume that

is another fractional Brownian motion. We assume that  and

and  are independent, and

are independent, and .

.

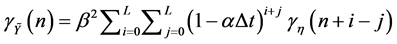

We present the covariance functions involved in this derivation, as follows:

(3)

(3)

3. Method of Estimation

To estimate the said parameters

By maximizing (7), we are able to get the efficient estimator of all the parameters. However, it is complicated to analytically maximizing such log likelihood function that is too involved, in particular the expression for the covariance function and its inversion. Alternatively, the innovation algorithm will be applied.

We use the definition of best linear prediction for stationary process from [22] as follows:

Definition: Given data

where

(8) is called prediction equations, and are able to solve coefficients

Suppose that

By the definition of best linear predictors the coefficient

(A.10) can be written in matrix form as follows:

where

By (11), we get

Let

Thus,

Let

where

(15) can be written in matrix form as follows:

or

where

From (17), we have

So the autocovariance function is

and

The determinant is

The likelihood function is now transformed into the following optimization problem.

Problem P

Maximizes the cost function

subject to

From some calculations we obtained

and

The constraints in this optimization problem are too involved with covariance functions, so the optimization is difficult to solve. In order to simplify this problem, we use the constraint transcription method described in [23]

Maximizes the cost function:

subject to

where

where

Problem Pε,γ

where

4. Application to European Option Pricing

To determine the value of option, there are some factors to be taken into account, such as intrinsic value, time of expiration, volatility, interest rate and cash dividends paid. There are a number of option pricing models that use these parameters to control the fair market value of the option. The Black-Scholes model is the most widely used.

4.1. Classical Black-Scholes Model for European Option Pricing

Black-Scholes option pricing model constructed by Fischer Black and Myron Scholes in 1973. This model created for describing the market value of call option. Its formulated as:

Here,

and

where

4.2. Fractional Black-Scholes Model for European Option Pricing

FBS model is the accepted improvement of BS model. The price at time

where

and

where S is the underlying stock price at time t, r is the risk free interest rate, and

4.3. Data

Kuala Lumpur Composite Index (KLCI) is announced in 1986 in order to be a guideline of the actual performance indicator for the economy in general and especially for the overall Malaysia stock market. It includes of more than one-handed multi-sector companies from the Main Board in Bursa Malaysia which previously named as Kuala Lumpur Stock Exchange (KLSE).

We used a data set from KLCI which available online on http://www.econstats.com. The daily close price data set of KLCI from 3rd of January, 2005 to 29th of December, 2006 is studied; with total of observations of 494. The return series is then calculated in logarithm. The return is considered to avoid the high volatility in the data. The fluctuations in the price appear to be more practical as these fluctuations are stationary. In order to compute all parameters contained in fractional geometric Brownian motion and fractional Orenstein-Uhlenbeck, we obtained log return of adjust closed, daily volatility of log return and daily volatility of adjust closed. Figure 1 and Figure 2 show the price and return series.

The values of all parameters of the return series can be found in Table 1.

Figure 1. Daily returns series of KLCI from 3rd of January 2005 to 29th of December 2006.

Figure 2. Daily close price series of KLCI from 3rd of January 2005 to 29th of December 2006.

Table 1. Summary of parameters.

4.4. Estimation Based on Proposed Method

In this subsection we present the results of our study of modeling the data of KLCI, between the 3rd of January 2005 and 29th of December 2006 using GFBM by the assumption of stochastic volatility based on daily return series.

We used the parameters in Table 1 in order to compute the value of stochastic volatility. We depend on the equation

the average. We adopt this average value to be the volatility. With respect to long memory parameters are estimated by already command in |Mathematica 10 software. Finally, we obtained the following results

4.5. Calculating the Value of European Call Option

With the purpose of calculate the value of European call option, we use several maturity times (days) for a traded option. According to with the actual Malaysia conventional interest rate on 29th of December, 2006, the risk-free interest rate is fixed at 3.5% per annum. We consider MYR1096.24, following the price on 29 December, 2006 as the underlying price. The volatility and Hurst exponent are estimated based on our method for the historical daily return data of KLCI, with estimates listed subsection 4.3 to compare our work with others, we calculated the value of European call option using the estimates based on the methods of Masnita [1] , [2] and Kukush [3] , in addition to the traditional Black-Scholes European option price. The results are listed in Table 2.

From Table 2, it is clear that the longer time to expiry means the higher value of call price. The reader can observe that the call price of the proposed method of this work is closed to Masnita work and there is fairly different with Kukush et al. and traditional Black-Sholes. Call prices obtained by Kukush et al. with the R/S analysis, presents the lowest values. While the highest value calculated by traditional Black-Sholes model where the long memory is not taken into account. The prices which valued by proposed method and Masnita method are between those valued by the method of Kukush et al. and traditional Black-Scholes. However the method of Masnita is based on theoretical reasoning, but the volatility is assumed to be constant which was rejected by empirical studies as previously explained in chapter one [5] [6] [8] , whereas our model assumed that the volatility is stochastic and this is agree with empirical studies [9] - [14] [25] [26] .

Table 2. Comparison of European call option prices using different methods with H in (.) and

5. Summary

We presented a new model which is a GFBM providing that the volatility is assumed stochastic that obeys fractional Orenstein-Uhlenbeck process. To estimate the parameters involved in this model, we have to maximize the likelihood function. Regrettably, the analytic solution of likelihood function is very hard, since the covariance function is very expensive. According to this we used innovation algorithm to simplify the problem. This leads to converting the likelihood function to constrained problem with some constrains. These constrains are appended to cost function using constraints transcription method which obtain unconstrained optimization problem. Finally, we solved the unconstrained optimization problem.

In order to know the performance of the proposed model with respect to other methods we calculated the value of European call option using the estimates based on the methods of Masnita [1] [2] , Kukush et al. [3] , traditional Black-Scholes European option price in addition to the proposed method. The results show that the call price of the proposed method of this work is closed to Masnita work and it is fairly different with Kukush et al. and traditional Black-Sholes.

Cite this paper

Mohammed Alhagyan,Masnita Misiran,Zurni Omar, (2016) Geometric Fractional Brownian Motion Perturbed by Fractional Ornstein-Uhlenbeck Process and Application on KLCI Option Pricing. Open Access Library Journal,03,1-12. doi: 10.4236/oalib.1102863

References

- 1. Kukush, A., Mishura, Y. and Valkeila, E. (2005) Statistical Inference with Fractional Brownian Motion. Statistical Inference for Stochastic Processes, 8, 71-93.

http://dx.doi.org/10.1023/B:SISP.0000049124.59173.79 - 2. Misiran, M. (2010) Modeling and Pricing Financial Assets under Long Memory Processes. Doctoral Dissertation, Curtin University of Technology, Bentley.

- 3. Misiran, M., Zudi, L.U., Teo, K.L. and Grace, A.W. (2012) Estimating Dynamic Geometric Fractional Brownian Motion and Its Application to Long-Memory Option Pricing. Dynamic Systems and Applications, 21, 49-66.

- 4. Samuelson, P.A. (1964) The Random Character of Stock Market Prices, Chapter Rational Theory of Warrant Pricing. MIT Press, Cambridge, 506-532.

- 5. Bakshi, B.S. and Tso, M.M.H. (2002) US Patent No. 6345300. US Patent and Trademark Office, Washington DC.

- 6. Aït-Sahalia, Y. and Lo, A.W. (1998) Nonparametric Estimation of State-Price Densities Implicit in Financial Asset Prices. The Journal of Finance, 53, 499-547.

http://dx.doi.org/10.1111/0022-1082.215228 - 7. Lo, A.W. (1991) Long-Term Memory in Stock Market Prices. Econometrica, 59, 1279-1313.

http://dx.doi.org/10.2307/2938368 - 8. Stein, J.C. (1989) Overreactions in the Options Market. Journal of Finance, 44, 1011-1023.

http://dx.doi.org/10.1111/j.1540-6261.1989.tb02635.x - 9. Scott, L.O. (1986) Option Pricing When the Variance Changes Randomly: Theory and an Application. Working Paper, Department of Finance, University of Illinois, Illinois.

- 10. Hull, J. and White, A. (1987) The Pricing of Options on Assets with Stochastic Volatilities. Journal of Finance, 42, 281-300.

http://dx.doi.org/10.1111/j.1540-6261.1987.tb02568.x - 11. Stein, E.M. and Stein, J. (1991) Stock Price Distributions with Stochastic Volatility: An Analytic Approach. Review of Financial Studies, 4, 727-752.

http://dx.doi.org/10.1093/rfs/4.4.727 - 12. Heston, S.L. (1993) A Closed-Form Solution for Options with Stochastic Volatility with Applications to Bond and Currency Options. Review of Financial Studies, 6, 327-343.

http://dx.doi.org/10.1093/rfs/6.2.327 - 13. Comte, F. and Renault, E. (1998) Long Memory in Continuous-Time Stochastic Volatility Models. Mathematical Finance, 8, 291-323.

http://dx.doi.org/10.1111/1467-9965.00057 - 14. Chronopoulou, A. and Viens, F.G. (2012) Estimation and Pricing under Long-Memory Stochastic Volatility. Annals of Finance, 8, 379-403.

http://dx.doi.org/10.1007/s10436-010-0156-4 - 15. Uhlenbeck, G. E. and Ornstein, L.S. (1930) On the Theory of the Brownian Motion. Physical Review, 36, 823.

http://dx.doi.org/10.1103/PhysRev.36.823 - 16. Jong, F. and Santa-Clara, P. (1999) The Dynamics of the Forward Interest Rate Curve: A Formulation with State Variables. Journal of Financial and Quantitative Analysis, 34, 131-157.

http://dx.doi.org/10.2307/2676249 - 17. Luís, J.B. and Cassola, N. (2001) A Two-Factor Model of the German Term Structure of Interest Rates. (No. 0046)

- 18. Björk, T. and Christensen, B.J. (1999) Interest Rate Dynamics and Consistent Forward Rate Curves. Mathematical Finance, 9, 323-348.

http://dx.doi.org/10.1111/1467-9965.00072 - 19. Barndorff-Nielsen, O.E. and Shephard, N. (2001) Non-Gaussian Ornstein-Uhlenbeck Based Models and Some of Their Uses in Financial Economics. Journal of the Royal Statistical Society: Series B (Statistical Methodology), 63, 167-241.

http://dx.doi.org/10.1111/1467-9868.00282 - 20. Rossi, G. (2004) Kalman Filtering of Consistent Forward Rate Curves: A Tool to Estimate and Model Dynamically the Term Structure. Journal of Empirical Finance, 11, 277-308.

http://dx.doi.org/10.1016/j.jempfin.2003.02.002 - 21. Vasicek, O. (1977) An Equilibrium Characterization of the Term Structure. Journal of Financial Economics, 5, 177-188.

http://dx.doi.org/10.1016/0304-405X(77)90016-2 - 22. Shumway, R.H. and Stoffer, D.S. (2006) Time Series Analysis and Its Applications: With R Examples. 2nd Edition, Springer, New York.

- 23. Jennings, L.S. and Teo, K.L. (1990) A Computational Algorithm for Functional Inequality Constrained Optimization Problems. Automatica, 26, 371-375.

http://dx.doi.org/10.1016/0005-1098(90)90131-Z - 24. Mishura, Y. (2008) Stochastic Calculus for Fractional Brownian Motion and Related Processes. Vol. 1929, Springer, Berlin.

http://dx.doi.org/10.1007/978-3-540-75873-0 - 25. Hagan, P.S., Kumar, D., Lesniewski, A.S. and Woodward, D.E. (2002) Managing Smile Risk. In: Wilmott, P., Ed., The Best of Wilmott, Wiley, Hoboken, 249-296.

- 26. Wang, X. and Zhang, W. (2014) Parameter Estimation for Long-Memory Stochastic Volatility at Discrete Observation. Abstract and Applied Analysis, 2014, Article ID: 462982.

http://dx.doi.org/10.1155/2014/462982

Appendix A: Simplification of the Model

Let

Let the dynamics of the volatility

By using Euler’s discretization scheme for (A.2) we have:

Let

Assume

Following the iteration process and Cauchy criterion (A.5) can be restated as:

Based on (A.6) the covariance of

By sufficiently large L, (A.7) can be writing as:

where,

Now, return to equation (A.1), again by Euler’s discretization scheme, we get:

Let

Let

Assume that

By (A.13) the covariance of

Now we will compute every covariance function involved in (A.14)

where

But

Similarly,

With respect of the last term

Finally,

For sufficiently large L (A.21) con be written as

NOTES

*Corresponding author.