Open Journal of Social Sciences

Vol.04 No.05(2016), Article ID:66850,12 pages

10.4236/jss.2016.45010

Comovement of Stock Markets―An Analysis by Nonlinear Cointegration*

Kazumi Asako1, Zhentao Liu2

1Faculty of Economics, Rissho University, Tokyo, Japan

2Institute for Financial and Accounting Studies, Xiamen University, Xiamen, China

Copyright © 2016 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 19 April 2016; accepted 13 May 2016; published 16 May 2016

ABSTRACT

This paper proposes and estimates a statistical model of nonlinear cointegration, with applications to the stock markets of Japan and the United States. We define nonlinear cointegration as a long-run stable relationship between two time series variables even in the presence of temporary nonlinear divergence from this long-run relationship. More concretely, extending the bubble model of Asako and Liu (2013) [1] to stock price ratio variables, both upward and downward divergent bubble processes are estimated at a time. We conclude that, although two stock price indexes are not linearly cointegrated, they are considered to be cointegrated nonlinearly.

Keywords:

Booms and Busts, Stock Prices, Nonlinear Cointegration, Bayesian Estimation

1. Introduction

In this paper we propose and develop the recursive estimation method of a nonlinear statistical model of speculative bubbles and utilize this model in establishing an idea of nonlinear cointegration. We then apply this idea to the stock market indexes of Japan and the United States, and we detect how these indexes commove in the long run although they deviate from the long-run relationship nonlinearly in the short run.

So far, whether stock markets of different countries commove together has mainly been tested by utilizing the linear cointegration relationship à la Engle and Granger (1987) [2]. We owe the main idea of cointegration to this line of research. However, what we propose in this paper is a statistical model that incorporates latent cointegration relationship not linearly but nonlinearly. The nonlinearity here stems from the consideration of booms and busts in stock price indexes (and thereby the ratio of indexes of different markets). When bubbles are born and boom for certain periods only to crash in due course, time series of these events are hardly captured by linear models.

As empirical investigation of comovement of stock markets, there have been a number of research and the results vary depending on the countries and sample periods. Asako, Zhang and Liu (2014) [3] conduct linear cointegration test among any pair of Japan, the United States and China and reach the conclusion that the linear cointegration is rejected. This is the origin of our analysis here because our daily observation suggests that the worldwide stock markets commove at any rate.

The construction of the present paper is as follows. In Section 2, we propose a time series model of the boom and bust and develop its recursive estimation method. Section 3 modifies this basic model to apply for a ratio variable, which has more restrictive feature within the model of booms and busts. In Section 4, we apply the modified model to detect the nonlinear cointegration relationship between the stock price indexes of Japan and the United States. Section 5 conclude the paper.

2. Model of Nonlinear Cointegration

In this section, we develop a model of nonlinear cointegration and explain how to estimate the relevant parameters.

2.1. The Basic Model

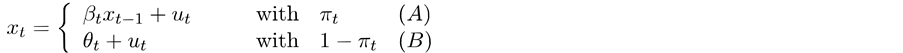

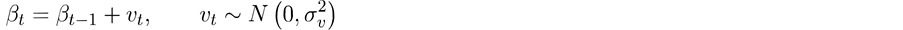

As an extended model to Asako and Liu (2013) [1], which in turn has its origin in Asako, Kanoh and Sano (1990) and Liu, Asako and Kanoh (2011) [4] [5], we propose a model of bubble booms and busts by, for  > 0,

> 0,

(1)

(1)

where  denotes a sequence of variables measured as the ratio of stock prices in different countries and

denotes a sequence of variables measured as the ratio of stock prices in different countries and  denotes a probability that

denotes a probability that  follows model (A) depending on

follows model (A) depending on  . A newly arisen bubble

. A newly arisen bubble  is a serially independent and normally distributed random variable with mean 0 and constant variance

is a serially independent and normally distributed random variable with mean 0 and constant variance  which is unknown to us. The coefficient

which is unknown to us. The coefficient  is a time dependent parameter whose variation is given by the following random walk process:

is a time dependent parameter whose variation is given by the following random walk process:

(2)

(2)

Like  , the constant variance of innovations

, the constant variance of innovations  is unknown to us. Since we assume

is unknown to us. Since we assume  > 0, the probability that

> 0, the probability that  and

and  happen to bring about

happen to bring about

Let us consider briefly the implication of this model. Our basic model consists of two regimes or models (A) and (B). At period t, xt is expressed by a divergent time series model when a speculative bubble continues. We describe this phenomenon by the autoregressive model (A) with parameter

More concretely, we assume that the probability of bubble continuation

where α and γ are positive unknown parameters. This formulation implies that πt decreases as the deviation between xt and θt becomes grater in its absolute value. To put it another way, the probability of a bubble crash, 1-

In principle, we can generalize our formulation by considering a broader class of stochastic models for ut such as ARMA process or by introducing the fundamental values into the functional form of the transition probability (3). However, we have tried to keep our model as simple as possible because this paper is only meant to be a first step in this research direction. The specification, (3), of the probability turns out to be one of the few analytically tractable formulations in the following analyses.

When the probability structure of crashes is taken into consideration, we see that the bubble cannot continue forever. As it grows, the probability of a crash approaches unity and xt will sooner or later be pulled back to the fundamental value θt. In this way, the time series of xt never diverges, but exhibits more or less stable behavior in the longer run.

Note that letting θt = 0 and assuming away the constraint xt > 0 leads us to the models of Asako, Kanoh and Sano (1990) [4], Liu, Asako and Kanoh (2011) [5] and Asako and Liu (2013) [1]. In those models, xt is not a ratio variable but is a stock price bubble measured as deviations from their fundamental values. The model of nonlinear cointegration, which is developed in Section 4, adds to this basic model the property that ratio bubbles are symmetric between upwards and downwards.

2.2. On Recursive Estimation

In Liu, Asako and Kanoh (2011) [5] and Asako and Liu (2013) [1], the entire Bayesian recursive estimation process is described for the periods from 0 to 1 and from period t-1 to period t, thus establishing by way of mathematical induction the validity of the recursive estimation method. We develop here only the recursive way of estimating parameters at period t conditioned on the available data up to period t-1. For more in detail of the entire estimation, refer to Liu, Asako and Kanoh (2011) [5] or Asako and Liu (2013) [1].

One notable difference between the present model (1)-(4) and the earlier ones is that Liu, Asako and Kanoh (2011) [5] and Asako and Liu (2013) [1] assume θt = 0. Once we allow for θt > 0, whether θt is known or unknown causes a big difference in the Bayesian recursive estimation. If it is unknown and to be estimated in the same way as the other parameters of the model, the estimation process becomes too complicated for us to manipulate the model explicitly. On the other hand, if θt is known and treated as a predetermined parameter even though we have to somehow “estimate” it eventually, this estimation can be separated from the estimation of the entire model and its recursive estimation process remains, in terms of hardness, almost at the same level as Asako and Liu (2013) [1]. In fact, we let θt be known and propose its two candidates in Section 3.

2.3. Recursive Estimation at Period t

In this section, we describe a Bayesian recursive technic to estimate the parameters of our model. Before proceeding to this task, we put

With these new notations, we write down the joint density for

where

Now our main task is to calculate the updated posterior density (6) by utilizing the Bayes’ theorem:

Introducing a new parameter

for the sake of later convenience in notation, from (1) and the normality of ut, we have

Therefore, in view of (7), the multiplication of (6) and (9) yields the updated formula of (6) for period t if and only if we have, to begin with

where the first and second terms within the large brackets represent, respectively, the probability density function of exponentially and mutually independently distributed

is introduced to simplify the mathematical expression.

Moreover, for the unspecified coefficient functions, we must have

and

Also for means and variances of the normal distributions, it must be

and

Finally, it must be recalled, that by making use of the relationship that applies for conditional density functions

and knowing that

which appears in the denominators of (7) and (11). This establishes all requirement that enable Bayesian recursive estimation to update consistently.

2.3.1. Parameter Estimates

The estimates of

and

We also obtain the probability estimate of bubble continuation from period t-1 to t as

or we can directly obtain the conditional expectation as

Finally, the estimate of the variance of

2.3.2. Maximum Likelihood Estimates of Variances

In carrying out the recursive procedure explained above, two variance parameters are to be specified. These are the dispersions of the random terms in (1) and (2), i.e.,

Let us put

On the other hand, since

and

we have, like (16)

Therefore, the log likelihood function of

and the resulting set of variances

2.3.3. Condensation of Recursive Estimation

So far is the complete and mathematically rigorous description of the Bayesian recursive estimation and we can estimate parameters for any length of sample periods. However, the number of terms we need to compute in equations from (11) to (14) and others increases at a rate of 3t to exceed a standard capacity of computer as the number of time series data increases. For this reason and to reduce the computational burden, we introduce the so-called condensation procedure first proposed by Harrison and Stevens (1981) [7] and applied for the estimation of the basic model by Liu, Asako and Kanoh (2011) [5] and Asako and Liu (2013) [1]. By condensation, we update the parameters of the next period’s prior distribution by utilizing the first and second moments of the approximated marginal posterior distribution. This enables the computational burden to remain at a constant level over time.

What we have to do in practice is to approximate the posterior density (5) at period t or the left hand side of (7) by a joint density of the following form

where we utilize the fact that

so that the joint prior density at period t + 1 can be written as

where

whereas

2.4. Nonliner Cointegration

The basic bubble model (1)-(4) formulates the feature that a ratio variable returns to its fundamental value in the long run as the probability that a bubble crashes reaches 100% insofar as the divergent bubble continues. In other words, although short-run bubbles generate explosive discrepancies between

Unlike the definition of linear cointegration, the definition of nonlinear relationship is model-specific. There may be other models of nonlinear cointegration and our nonlinear cointegration should more restrictively be named speculative bubble nonlinear cointegration or boom and bust nonlinear cointegration.

Such being the case, there is no established method to test the nonlinear cointegration relationship. Instead, we are obliged to accept the existence of the nonlinear relationship only passively. We especially put emphasis on the bubble process in (2) and thereby we detect whether

In the empirical analysis in Section 4, we compute the pseudo-t statistics:

in order to sense the “significance“ regarding the validity of βt > 1. Since the present estimation technic is Baye- sian in the sense that we utilize prior information besides the information extracted from the data, statistics like (33) may not obey Student’s t-distribution. Nonetheless, we would presume that t = 1.65, which is one sided 5% significant for a standard t test, is a critical level to rely on.

In detecting the validity of the nonlinear cointegration, we may as well examine into the probability of bubble continuation

3. Nonlinear Cointegration: Modification of the Basic Model

The basic model we developed in Section 2 is applicable to any series of xt. In this section, we modify the basic model to deal with a ratio variable xt > 0.A ratio variable may exhibit both upwards and downwards bubble processes with θt > 0, which necessitates certain nontrivial revision in recursive estimation.

3.1. Modification of the Basic Model

We alter the basic model into a double regime switching model. One regime switching is that the basic model is of the boom-and-bust type. The other regime switching is that a ratio variable has both upwards (or positive) and downwards (or negative) bubble processes. On the other hand, we maintain (2) or the transition equation of

Then, we can naturally regard it a bubble by βt > 1 once

Let

With this new xt,, we assume that every aspect of the basic model (1)-(4) is valid, i.e.,

except that

replaces (8).

Note that integrating artificially two regimes most likely causes heteroscedasticity in innovation term ut in (1) or (35). In fact, we will introduce proportional variance of ut to

Lastly, we need to revise the probability of bubble continuation. That is, in (3), we have

or

that replaces (4). In (38) or (39), the greater deviation is

3.2. Known θt

As we have already noted, the fundamental stock prices ratio θt is assumed known and given to us exogenously at period t. There may be several candidates for θt. Here we propose two alternative ones3.

3.2.1. Past Average

The first candidate is the simple arithmetic average of all the past data:

Although we put equal weight on each data, the informational role of the current data decreases over time as (40) by definition is rewritten as θt = {(t-1) θt-1+yt}/t, which in turn is rewritten as

Equation (41) implies that θt follows a random-walk type sticky movement except that the drift term is not stochastic but is given deterministically. As t increases, the contribution of the second term on the right hand side of (41) decreases over time.

3.2.2. Fixed Period Moving Average

The second candidate approximates the fundamental value by the fixed period (say 12 months) moving average up to the current one. Thus in place of (40) we have

And thereby in place of (41), we have

for t > 12. As for the first 12 months, we use the simple average (40).

3.3. Estimation Procedure at Period t

At period t, we compute θt once we get a new data yt and we determine which regime we are in, i.e., whether a positive bubble (yt ≥ θt) or a negative bubble (yt < θt). If we are rigorously interested in whether the stock price ratio is in positive upwards phase or in negative downwards phase, we may watch where we have been in the past. For example, we would recognize regime shifts only if the opposite new regime continues at least a few consecutive periods. This will exclude a fake regime shift that occurs unsystematically. The idea of this rule of thumb stems from the Bry-Boschan method in the judgment of the business cycle phase.

Once θt and thereby the data xt of (34) is obtained, we are ready to utilize the recursive estimation technic developed in Section 2. We estimate the basic model as applied to the stock market prices of Japan and the United States.

4. Stock Prices of Japan and the United States

Asako, Zhang and Liu (2014) attempted to apply the nonlinear cointegration to the stock markets of Japan, the United States and China. They first checked whether there is a linear cointegration relationship between these countries and concluded negatively for any pair of countries. Then they estimated the basic model of (1)-(4) and of three ways of the known fundamental stock prices ratio including (40) and (42). Among these, in what follow, we develop the most representative case of the nonlinear cointegration; namely the one between the stock price indexes of Japan and the United State.

4.1. Preparatory Steps

The monthly time series data we have chosen are the Nikkei225 index (hereinafter Nikkei225) for Japan and the Dow-Jones Industrial Average Stock Price Index (hereinafter DJ) for the United States. Figure 1 plots these stock prices and their ratio (DJ/Nikkei225) from January 1970 to December 2012.

4.1.1. Derivation of Known θt

Figure 2 exhibits the fundamental stock prices ratio given by (40) and (42). Not surprisingly, (i) the past average

4.1.2. Artificial Dependent Variable

Next, we construct from the time series yt that of the artificial variable xt by (34). Referring to the realized yt and two fundamental stock prices ratio θt, the time series of xt consists of negative bubble (yt < θt) up to the mid 1990s and thereby, by definition, xt equals the reciprocal of yt. On the contrary, during the latter half of the sample period, xt consists of positive bubble (yt > θt) and xt is yt itself. In the case of

4.1.3. Maximum Likelihood Estimates of Variances

We need to obtain the maximum likelihood estimates for the variances of

Judging on the log likelihood, between the two fundamental stock prices ratio,

Figure 1. Stock Price Indexes: Japan and the US. Note) The Nikkei225 for Japan and DJ for the United States.

Figure 2. Fundamental value θt.

4.2. Necessary Condition for the Bubble

With the above preparation, Figure 3 exhibits the estimate of the key parameter βt. The percentage of samples that satisfies the necessary requirement for bubbles βt > 1 amounts to 82.9% for

To answer to this question, we checked the pseudo t t-statistic (33) and found, as summarized in Table 1, that βt > 1 is one sided 5% “pseudo-significant” is nil for

A clue to this is that the maximum likelihood variance estimate

βt = βt-1 + constant,

and βt can be different from βt-1. Moreover, even if the constant term is 0 and βt = βt-1, in theory, because βt is estimated as the expected value of the posterior distribution à la Bayesian, it can differ from βt-1 once the data increases information in the posterior distribution in (18).

4.3. Probability of Bubble Crash

In Figure 4, we plot the probability of bubble crash, 1-πt. As πt, the conditional expectation (21), rather than the point estimate (20), is chosen5. With

4.4. Other Cases

Asako, Zhang and Liu (2014) [3] estimate several other cases including exchange rate adjusted stock prices, the

Figure 3. Estimate of βt.

Figure 4. Probability of bubble crash.

Table 1. Number of months of the estimated βt.

case of Var (

5. Concluding Remarks

In this paper we proposed and developed the recursive estimation method of the nonlinear cointegration. The purpose of this attempt has been to show the usefulness of introducing the idea of nonlinear cointegration. By applying this idea to the stock market indexes of Japan and the United States, we have seen that these indexes commove in the long run although they deviate from this relationship in the short run.

Cite this paper

Kazumi Asako,Zhentao Liu, (2016) Comovement of Stock Markets—An Analysis by Nonlinear Cointegration*. Open Journal of Social Sciences,04,64-75. doi: 10.4236/jss.2016.45010

References

- 1. Asako, K. and Liu, Z.T. (2013) A Statistical Moddel of Speculative Bubbles, with Applications to the Stock Markets of the United States, Japan, and China. Journal of Banking & Finance, 37, 2639-2651. http://dx.doi.org/10.1016/j.jbankfin.2013.02.015

- 2. Engle, R.F. and Granger, C.W.J. (1987) Cointegration and Error Correction: Representation, Estimation and Testing. Econometrica, 55, 251-276. http://dx.doi.org/10.2307/1913236

- 3. Asako, K., Zhang, Y. and Liu, Z.T. (2014) The Comovement in Stock Price Indexes of Japan, United States, and China: Estimation of a Nonlinear Cointe-gration. Economic Review, 65, 56-85 (in Japanese).

- 4. Asako, K., Kanoh, S. and Sano, H. (1990) Stock Price and Bubble. In: Nishimura, K. and Miwa, Y., Eds., Stock and Land Prices in Japan—Mechanism of Price Determination, University of Tokyo Press, 57-86 (in Japanese).

- 5. Liu, Z.T., Asako, K. and Kanoh, S. (2011) Estimation of Speculative Bubble—Application to the Stock Markets of Japan, the United States and China. In: Asakoand, K. and Watanabe T., Eds., Econometrical Analyses of Finance and Business Cycle, Minerva Shobou, 9-34 (in Japanese).

- 6. Blanchard, O.J. and Watson, M. (1982) Bubbles, Rational Expectations and Financial Markets. In: Wachtel, P., Ed., Crises in the Economic and Financial Structure, Lexington Books, 295-315.

- 7. Harrison, P.J. and Stevens, C.F. (1976) Bayesian Forcasting (with Discussion). Journal of the Royal Statistical Society: Series B, 38, 205-247.

NOTES

*We thank JSPS for Grants-in-Aid for Scientific Research B (24285062). Remaining errors are the whole responsibility of the authors.

1Even if we instead allow for time dependent α and γ, the computational burden remains the same as α and γ are at any rate estimated differently over time.

2We assume that α and γ are exponentially distributed in accordance with the exponential probability of the bubble continuation (3).

3We may find some variables Zt that are to be reflected in the fundamentals θt. Then the fitted value of an OLS regression equation of xt on Zt appears to be another candidate. However, the estimate of θt thus constructed is neither consistent nor efficient, if not unbiased.

4This ordering is not robust. When we assume away the heteroscedastic variance (37), log likelihood becomes larger with

5Two estimates are very close and are the same to three or four decimal places.