Modern Economy

Vol.07 No.14(2016), Article ID:72793,16 pages

10.4236/me.2016.714147

An Empirical Research on Agricultural Trade between China and “The Belt and Road” Countries: Competitiveness and Complementarity

Min He1, Zequn Huang1, Ningning Zhang2

1School of International Economics, China Foreign Affairs University, Beijing, China

2Institute of Agricultural Economy and Development, Chinese Academy of Agricultural Sciences, Beijing, China

Copyright © 2016 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: October 26, 2016; Accepted: December 13, 2016; Published: December 16, 2016

ABSTRACT

The Belt and Road Initiative provides excellent opportunities of developing agricultural products trade. This paper presents the overview and the prospect of the agricultural trade between China and the Belt and Road countries, and uses RCA and TCI index to empirically analyze trade competition and complementarity of agricultural products between China and the Belt and Road countries. Results show that trade competition and complementarity of agricultural products between China and the Belt and Road countries coexist, but its complementarity appears to be more remarkable. China and the Belt and Road countries should strengthen and diversify the trade cooperation on agricultural products on the basis of existing bilateral and multilateral mechanisms to achieve common development.

Keywords:

The Belt and Road, China, Agricultural Products Trade, Competition, Complementarity

1. Introduction

The Belt and Road Initiative, namely the Silk Road Economic Belt and 21st-Century Maritime Silk Road, is China’s major move to expand and deepen the opening-up policies to the outside world, arousing wide concern in the international community. The Silk Road Economic Belt is a new economic development zone on the basis of the ancient Silk Road which is along Southeast and Northeast Asia respectively, and finally into Europe, forming an Eurasian economic integration, while the 21st-Century Maritime Silk Road connects China with Europe, Asia and Africa from the sea, thus the Belt and Road constructs a sea and land loop connecting China with countries all over the world [1] . Throughout the history of the Silk Road, agricultural trade and exchange have led a major role on both the ancient overland and maritime silk roads, and signalized Chinese products such as tea and silk worldwide. With the advance of economic society and agricultural technology, the economic and trade cooperation on agriculture between China and the Belt and Road countries (hereafter as the B&R countries) has shown its new characteristics and trends.

However, most previous studies on the Belt and Road focused on the industries of energy, mineral and manufacturing but not agriculture; and most studies on agriculture focused on macro qualitative analysis but not specific quantitative analysis [2] [3] [4] . China has a large population of more than 1.3 billion people. Agriculture bears the important responsibility to maintain the livings of farmers and the base of the national economy. With the gradual enlargement of opening, not only has China’s agriculture developed fast, but its structure has changed significantly. Meanwhile, it also faces the double squeeze of the “high floor” of cost and the “ceiling” of price and subsidy as well as the constraint of the two “hoops” of resource shortage and environmental pollution. [5] As a large agricultural country, agriculture is not emphasized in the Belt and Road Initiative compared with other industries like energy, railway, mineral and so on1.

The Belt and Road Initiative has brought a series of practical issues. What new characteristics and trends would the Belt and Road Initiative bring about to the agricultural cooperation? How is this economic and trade cooperation conducted? What kinds of agricultural products are appealing? Where would be the competition? How would China and the countries along the route seize the opportunity and make full use of the domestic and foreign “two resources and two markets” and make an organic combination of “going out” and “bringing in” strategy to achieve a win-win result for the agricultural cooperation between China and the B&R countries? These are all realistic problems urged to be solved when the Belt and Road Initiative is into pragmatic phase.

Starting with the agricultural product trade between China and the B&R countries, this paper firstly depicts the characteristics and trend of the trade, and then uses RCA and TCI index to identify its competition and complementarity of main agricultural products. At last, after summarizing the existing cooperative mechanisms of agricultural economy and trade in the B&R countries, this paper explores how to further the opening-up and cooperation on agriculture between China and the B&R countries.

2. Data and Methodology

2.1. Data

According to WTO definition, agricultural products include all goods of the 0, 1, 2, and 4 categories (except chapter 27, 28 of category 2) by the classification of United Nations SITC (Standard International Trade Classification), namely SITC category 0 (food and live animals), SITC category 1 (Beverages and tobacco), chapter 21 (Hides, skins and furskins, raw), chapter 22 (Oil seeds and oleaginous fruits), chapter 23 (Crude rubber, including synthetic and reclaimed), chapter 24 (cork and wood), chapter 25 (pulp and waste paper), chapter 26 (textile fiber and waste), chapter 29 (crude animal and vegetable materials) of SITC category 2 (Crude materials, inedible, except fuels) as well as SITC category 4 (animal and vegetable oils, fats and waxes). For data consistency and integrity, SITC Rev. 3 is adopted as the commodity classification method and the database of United Nations Conference on Trade and Development (UNCTAD) is adopted as the data source in this paper.

As an open international network of regional economic cooperation, the scope of space of The B&R has not been defined accurately. Released on March 28, 2015, Prospect and Action Plan of the Belt and Road Initiative only outlines the general direction of the B&R. The Silk Road Economic Belt is composed of three directions: the first is to reach Europe (Baltic Sea) through Central Asia and Russia; the second is to reach the Persian Gulf and the Mediterranean Area through Central Asia and West Asia; the third is to reach Southeast Asia, South Asia and the Indian Ocean right from China. While the 21st-century Maritime Silk Road contains two main directions: one is to reach the Indian Ocean and then to Europe through the South China Sea from Chinese harbors; the other one is to reach the South Pacific Ocean. As for the research convenience, the research range in this paper covers 64 countries in total as the Belt and Road countries, including 5 countries in Central Asia, Mongolia and Russia, 11 countries in Southeast Asia, 8 countries in South Asia, 19 countries in Central and Eastern Europe and 19 countries in West Asia and Middle East, see Table 1.

2.2. Methodology

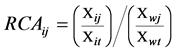

1) Revealed Comparative Advantage

Revealed Comparative Advantage (RCA) analyzes the comparative advantage of one

Table 1. Range of the Belt and Road Countries.

Data source: Organized according to references.

country’s trade with other countries [6] , and its computation formula is as follows:

(1)

(1)

reveals the comparative advantage index of product j in country i.

reveals the comparative advantage index of product j in country i.  represents the export turnover of product j in country i.

represents the export turnover of product j in country i.  represents the export turnover of all the products in country i.

represents the export turnover of all the products in country i.  represents the export turnover of product j in the world.

represents the export turnover of product j in the world.  represents the total export turnover of all the products in the world.

represents the total export turnover of all the products in the world.

If RCA index is higher than 1, it indicates that the product j in country i has its advantage in trade, and the greater the index is, the stronger the advantage is. If different countries or areas all have comparative advantage of product j, it indicates that these countries are in competition of product j in international market. If one country has advantage of product j while another country has not, it indicates complementarity between these countries on product j, and potential benefit will be gained if they cooperate with each other on trade.

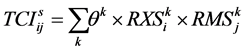

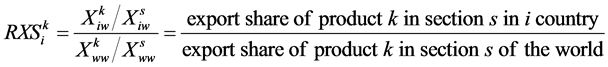

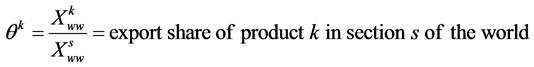

2) Trade Complementarity Index

Trade Complementarity Index (TCI) [7] [8] reflects the corresponding relation between the structure of export in one country and structure of import in another country. It is computed as follows:

(2)

(2)

(3)

(3)

(4)

(4)

(5)

(5)

TCI = 1 is a critical limit of complementarity. TCI > 1 shows the complementary between the agricultural products exported from i country and imported by j country is above the average, indicating the potential trade gains. The higher the index is, the stronger the complementarity is and the greater the potential will be, while TCI < 1 means the weak trade complementarity.

3. The Results

3.1. Changing Pattern of Agricultural Trade between China and the B&R Countries

1) Trend Changes of Agricultural Trade between China and the B&R Countries

With long history of agricultural civilizations and rich natural and market resources, the B&R countries has become an essential part in world agriculture, as well as important partner of China on agricultural products trade and cooperation. According to UNCTAD, in 2014, the total agricultural products trade (export + import) of all the B&R countries reaches $878 billion, accounting for 13% of the world agricultural trade. The total agricultural products trade between China and the B&R countries reaches $62.1 billion, accounting for 7% of the total agricultural products trade of the B&R countries and 30% of China’s total agricultural products trade. China has exceeded the United States, Germany, India, Netherlands and other countries, become the biggest trade partner of the B&R countries.

As shown in Figure 1, the agricultural products trade between China and the B&R countries has increased from $5.9 billion in 1995 to $62.1 billion in 2014, with an average growth rate of 12.5% per year. The first expansion of agricultural products trade between China and these countries appeared since 2001 and was then interrupted by the 2008-2009 financial crisis. The second expansion came out right after the establishment of the China-ASEAN Free Trade Area in 2010. Though slowed slightly due to the 2012 financial crisis, the trade situation is recently recovering. In general, regardless of the disturbance of the two financial crises, the first characteristic of agricultural products trade between China and the B&R countries turns out to be a steady and sound grow trend.

The second characteristic of agricultural products trade between China and the B&R countries is the overall deficit, see Table 2. The volume of import is approximately twice of that of export. China’s import volume from the B&R countries has risen from $3.4 billion in 1995 to $40.09 billion in 2014, increasing by 12 times and the proportion has increased from 19% to 25%, with an average growth rate of 13% per year. China’s export volume of agricultural products to the B&R countries has risen from $2.47 billion to $22.01 billion, increasing by 9 times, and the proportion has increased from 16% to 30%, with an average growth rate of 12% per year which is below the import growth rate. The increasing volume and proportion also suggests that China and the B&R countries are much more interdependent in agricultural products trade.

Figure 1. Agricultural trade between China and the B&R countries: 1995-2014.

Table 2. Agricultural trade flows between China and the B&R Countries.

Data source: UNCTAD. Million Dollars.

2) Structure Changes of Agricultural Trade between China and the B&R Countries

In terms of geographical structure, see Figure 2, the growth of agricultural product trade between China and the B&R countries is mainly from Southeast Asian countries. The tie between China and Southeast Asian countries in agricultural product trade are increasingly closer. The total trade amount of agricultural product between 11 Southeast Asian countries and China has accounted for 73% of that between the B&R countries and China in 2014. Many factors account for this phenomenon. As neighbors, Southeast Asian countries are privileged directions of China’s neighboring diplomacy, which is advantageous to the development of bilateral trade. Besides, the official enforcement of China-ASEAN FTA in 2010 greatly strengthened the trade links between Southeast Asian countries and China. Furthermore, among Southeast Asian countries, the trade links of agricultural products between China and Indonesia, Malaysia, Thailand and Vietnam are stronger, which reached $34.74 billion in 2014, accounting for 56% of the total trade amount of agricultural product between China and the B&R countries. This also indicates a high degree of concentration on the agricultural pro-

Figure 2. Agricultural products trade between China and the B&R countries by region.

ducts trade between China and the B&R countries. In terms of specific areas, subsequent plates are Mongolia and Russia (8%), 8 South Asian countries (7%), 19 West Asian and Middle East countries (5%), 19 Central and East European countries (4%), 5 Central Asian countries (2%).

The product structure of agricultural trade between China and the B&R countries relatively concentrates on several chapters. On the export side, see Figure 3, the agricultural products that China exports to the B&R countries are mainly vegetables and fruits (chapter 05), which increases from $450 million in 2000 to $8.92 billion in 2014, increasing by 18.8 times. Its proportion in total export of agricultural products from China to the B&R countries rocketed from 21% in 2000 to 41% in 2014. Fish and fish products (chapter 03) is the second biggest chapter of agricultural products that China exports to the B&R countries, which increased from $76 million in 2000 to $3.92 billion in 2014, soaring by nearly 50 times. Its proportion in the total export volume of agricultural products between China and the B&R countries is 18% in 2014. Though China’s exports have covered sugar, tobacco, textile fiber and raw animal and plant materials, the export growth of these products is dawdling, and their total share in the total export volume of agricultural products between China and all the B&R countries gradually declined from 27% in 2000 to 20% in 2014.

Compared with export, see Figure 4, the agricultural products that China imports from the B&R countries are more dispersed. The biggest import chapter of agricultural products is cork and wood (chapter 24) from the B&R countries in 2014, with a volume of $8.78 billion, accounting for 22% of the total import volume between China and the B&R countries and surpassing that of natural rubber (chapter 23) for the first time. From 2003 to 2013, crude rubber (chapter 23) had been the biggest chapter, reaching $11.58 billion and 29% of the total import volume of agricultural products between China and the B&R countries in 2011 and beginning to decline since 2012. Its total import volume is $6.22 billion in 2014. Fixed vegetable oils and fats(chapter 42) and textile fiber (chapter 26) are respectively the third and fourth biggest chapters of agricultural products that China imports from the B&R countries, touching $4.95 billion and $3.02 billion and 12% and 8% respectively of the total import volume of China from the B&R countries in 2014.

3.2. Competition and Complementarities of Agricultural Trade between China and the B&R Countries

1) RCA Index and Competition

The RCA indexes of China and the B&R countries in 2014 shows noticeable differences in agricultural products, see Table 3, which indicates complementarity. The RCA indexes of China’s agricultural products are all smaller than 1, which means no com-

Figure 3. Top 7 Agricultural Products that China Exports to the B&R Countries.

Figure 4. Top 10 Agricultural Products China Imports from the B&R Countries.

Table 3. RCA indexes of agricultural products in China and the B&R countries, 2014.

Data source: Calculated by the author. The italic shows RCA index which is greater than 1.

parative advantage, except chapter 03 (Fish, crustaceans, molluscs and preparations thereof), with which RCA index is 1.18. While the six regions (listed in Table 1) of the B&R countries have strong comparative advantages in many chapters, also see Table 3, except West Asia and Middle East.

The Central Asian countries (5) have comparative advantages in land-intensive products such as grain and cotton because of rich land resources. Kazakhstan is world’s main exporter of grain, exporting 2 - 5 million tons of grain every year. Uzbekistan is world’s fifth largest producer and second largest exporter of cotton, with an annual output of about 3.7 million tons. All of these mentioned result in the RCA index of chapter 04 (Cereals and cereal preparations) is 1.65 and that of chapter 26 (Textiles fibres and their wastes) is 6.77 in central Asian countries (5).

Mongolia and Russia (2) have vast land and forest, so the RCA index of chapter 04 (Cereals and cereal preparations) is 1.60, as well as that of the chapter 23 (Crude rubber, including synthetic and reclaimed) and chapter 24 (cork and wood) is 1.68 and 2.98, respectively.

As for the West Asian and Middle East countries (19), only the RCA index of chapter 05 (Vegetables and fruits) is over 1, owing to the harsh climate, water shortage and political instability.

In Southeast Asian countries (11), attribute to the high temperature with abundant rainfall, crop diversity, broad forest coverage and lengthy coastline, the comparative advantage lies in more chapters. For instance, the RCA indexes of Chapter 03 (Fish, crustaceans, molluscs and preparations thereof), Chapter 06 (Sugar, sugar preparations and honey), Chapter 07 (Coffee, tea, cocoa, spices, and manufactures thereof), Chapter 09 (Miscellaneous edible products and preparations), Chapter 12 (Tobacco and tobacco manufactures), Chapter 23 (Crude rubber, including synthetic and reclaimed), Chapter 24 (cork and wood), Chapter 42 (Fixed vegetable oils and fats, crude, refined or fractionated) and Chapter 43 (Processed Animal and vegetable oils and fats) are all over 1. In addition to food production, rubber, palm oil, manila hemp, coffee, tobacco, sugar cane, tropical fruit and other economic crops are also high-yielding in this region.

South Asian countries(8) have comparative advantages in 11 chapters of agricultural products including Chapter 01(Meat and meat preparations), Chapter 03 (Fish, crustaceans, molluscs and preparations thereof), Chapter 05 (Vegetables and fruits), Chapter 06 (Sugar, sugar preparations and honey), Chapter 07 (Coffee, tea, cocoa, spices, and manufactures thereof), Chapter 08 (Feedstuff for animals, excluding unmilled cereals), Chapter 12 (Tobacco and tobacco manufactures), Chapter 22 (Oil seeds and oleaginous fruits), Chapter 26 (Textiles fibres and their wastes), Chapter 29 (Crude animal and vegetable materials, n.e.s.) and Chapter 43 (Processed Animal and vegetable oils and fats). Within the region, countries like India and Pakistan are all important producers of grain, cotton and fruit in the world.

Central and Eastern European countries (19) have a good foundation for agriculture with massive arable land, abundant water resources and labor forces. They have comparative advantages in Chapter 00 (live animals), Chapter 01 (Meat and meat preparations), Chapter 04 (Cereals and cereal preparations), Chapter 06 (Sugar, sugar preparations and honey), Chapter 07 (Coffee, tea, cocoa, spices, and manufactures thereof), Chapter 08 (Feedstuff for animals, excluding unmilled cereals), Chapter 09 (Miscellaneous edible products and preparations), Chapter 12 (Tobacco and tobacco manufactures), Chapter 21 (Hides, skins and furskins, raw), Chapter 22 (Oil seeds and oleaginous fruits), Chapter 24 (cork and wood) and Chapter 42 (Fixed vegetable oils and fats, crude, refined or fractionated).

In all, it is clearly stated from the RCA index that there are huge differences in the comparative advantages of agricultural products among the B&R countries and China. For countries in Southeast Asia (11), South Asia (8) and Central and Eastern Europe (19), all the agricultural products except fish and fish products with comparative advantages are complementary with those of China, implying enormous potential for cooperation on agricultural products trade. At present, China and Southeast Asian countries (11) has benefited from the neighboring geolocation and China-ASEAN Free Trade Agreement, wheras the agricultural products trade between China and countries in South Asia(8) and Central and Eastern Europe (19) only accounts for a small part (7% and 4% respectively in 2014). Therefore, China should promote and enhance the cooperation with all the B&R countries, especially South Asian (8) and Central and Eastern European countries (19) based on both the existing economic and trade cooperative mechanism and the Belt and Road Initiative.

2) TCI Index and Complementarity

As reflected in Figure 5, the TCI index of China’s import and the B&R countries’ export is significantly higher than that of China’s export and the B&R countries’ import. The complementary pairs are accordingly China’s import and the Central Asian

Figure 5. TCI index of agricultural trade between China and the B&R countries, 2014.

countries (5)’ export, China’s import and Mongolian and Russian (2) export, and China’s import and the Southeast Asian countries’ export (11). It is visibly demonstrated that, first of all, the Chinese market is indispensable to the export of agricultural products as for these B&R countries, but the market brought by the Belt and Road is comparatively less complementary for China’s agricultural export. Second, in terms of specific agricultural products, grain and cotton from Central Asian countries (5), food, rubber and cork from Russia and Mongolia (2), and food, fruit, tobacco, oil and etc. from Southeast Asian countries (11) are complementary for China’s import. Third, TCI indexes of the countries in South Asia (8) and Central and Eastern Europe (19) are not indicative due to their small volume and the dispersive distribution of products. Another prominent feature of TCI index is a sliding trend in recent years caused by the frequent outbreaks of international financial crises, especially in the regions with high complementarities. These crises fired up the uncertainties of world economy and the adjustments on national trade policies. Furthermore, the rise of China, which would lead its neighbor countries to be anxious for their cooperation with China, is resulting in a variety of policy barriers on trade. All above may have direct or indirect effects on the bilateral agricultural products trade.

4. Conclusions and Policy Implication

4.1. Conclusions

Different from most previous studies which focus on macro qualitative analysis [9] [10] [11] , this paper uses specific data to measure the competitiveness and complementarity between China and the Belt and Road countries, specifically of agricultural products. It provides convincing evidence that competition and complementarity coexist, but the latter is more significant. It also lays solid foundation for further research and practice of the Belt and Road Initiative. Through the above analysis, the following conclusions can be drawn:

1) Agricultural product trade between China and the Belt and Road countries has developed rapidly, and has a tendency to keep increasing. However, the status of two parties is unequal. China has a relatively larger and expanding trade deficit, which is totally different from the impression of Chinese export “dumping” and capacity transfer.

2) The agricultural product trade between China and the Belt and Road countries is highly concentrated, mostly in Indonesia, Malaysia, Thailand and Vietnam in Southeast Asia. The amount of agricultural product trade with these four countries has surpassed half of the total amount of agricultural trade between China and the Belt and Road countries.

3) In term of the commodity structure of agricultural products, China’s exports to the Belt and Road countries relatively concentrate on vegetables and fruits, fish and fish products, China’s imports are mainly cork and wood, natural rubber, solid plant oils and textile fiber.

4) The difference in comparative advantages between China and the B&R countries is evident. The advantageous agricultural products, especially those from Southeast Asian, South Asian and Central and Eastern European countries, are well complementary to China’s imports and showing great trade potential.

The complementarity of the B&R countries’ export to China is much higher than that of China’s export to these countries, denoting a bright future of the agricultural products trade. Strengthening the cooperation on agricultural products trade with the B&R countries will be beneficial to both sides.

4.2. Policy Implication

It is observed that the B&R countries play essential roles in China’s agriculture and agricultural products trade. Therefore, under the Belt and Road initiative, China should uphold spirit of the ancient Silk Road―openness, tolerance, mutual benefit and win-win, and actively promote the agricultural products trade and cooperation with these countries.

1) To Plan Reasonably and Scientifically and Focus on the Key Regions and Countries as well as Key Products and Industries

The agricultural cooperation between China and the B&R countries can be traced back to the 1950s or 1960s, with both foreign agricultural aid and investment on farms and farm machinery extending stations under the “going-out” strategy, and agricultural science and technology exchanges and cooperation of introducing species, technologies and investment into China under the “bringing-in” strategy. Since the differences on domestic situations and development levels in all the B&R countries, the agricultural resource endowment and markets are varied from each other. As a result, China should carry out a reasonable and scientific plan and focusing on the key regions and countries as well as the key products and industries on the basis of deeply understanding the agricultural resources and markets of these countries and perfectly balancing the multilateral interests. The specific suggestions are as follows:

・ China should attach prior importance to the agricultural cooperation with Southeast Asian, South Asian and Central and Eastern European countries, especially those in South Asia and Central and Eastern Europe, on account of the strong complementarity.

・ China should focus on the chapters such as grain, cotton, rubber and cork, which are structurally complementary and comprehensively beneficial and on the industries like crop planting and processing, agricultural products logistics and ecological protection.

・ China should make full use of cooperative methods like aid, investment and technology transfer in order to establish a long-term mechanism on multilateral or bilateral level, and should make and implement short-term, medium-term and long- term plans step by step in order to help the structural adjustments of China’s agriculture while constantly enhancing its international competitiveness.

2) To Build a Pragmatic Platform to Enrich and Diversify the Agricultural Cooperation and to Intensify Policy Support

Building a community of common interests, responsibility and destiny with political mutual trust, economic integration and culture tolerance will create favorable conditions for the agricultural cooperation between China and the B&R countries. In fact, China has signed a series of cooperation agreements with the B&R countries both in regional and country level. As shown in Table 4, China has signed Shanghai Cooperation Organization with Mongolia, Russia and Central Asian countries, China-ASEAN FTA with Southeast Asian countries, and South Asian Association for Regional Cooperation with South Asian countries, Bucharest Outline with Central and East Asian countries and China-Arabic Countries Cooperative Forum with West Asian and Middle East countries. These agreements and cooperative mechanisms are consensuses on one or several aspects of agricultural cooperation. Relying on these cooperative mechanisms and these established friendly political relations of mutual trust, China should further set up agricultural cooperation platform, establish and implement agricultural working group and its cooperative mechanisms, constantly enrich and diversify the agricultural cooperation and deepen the communication over the field of products trade, products processing, fertilizer producing, machinery manufacturing, technology training, financial cooperation and animal and plant epidemic prevention and control. It is not only conducive to the more beneficial agricultural cooperation agreements, but also to satisfy the concerns of the B&R countries.

・ First of all, for the neighbor countries of ASEAN, both sides could execute transportation and trade facilitation cooperative mechanisms such as the construction of infrastructure, mutual confirmation of customs inspection and quarantine in aspects like transportation connection and trade boost to strengthen bilateral policy coordination and thus to promote the bilateral trade and trade cooperation.

・ As for the regions with special geolocations like South Asia, West Asia and North Africa, China should address the cooperative mechanism of transportation infrastructure and connectivity, offering preferential policies to modern agricultural pro- duct logistics management in the process of promoting international shipping lines, multimodal transport and port construction.

・ On food security, the issue that concerns most in developing countries, China could launch a multilateral food cooperation, reinforcing the cooperation with the B&R countries as well as the international organizations such as WTO, FAO and G20, and keeping away from conflicts on national interests to actively create a harmonious international community.

3) To Prevent Risk Effectively, Strengthen Relevant Training and Education and Improve the Overall Quality

The Belt and Road Initiative heightens the connectivity between China and the B&R countries, setting up a new platform for the enterprises conducting external trade, while risks and friction coming along at the same time. [13] [14] For instance, if China continues to fully open its market, some competitive agricultural products (such as food etc.) will flood into the domestic market, causing the structural risk of high external dependency and widening deficit. These enterprises are also confronted with the challenge of understanding different situation of the industrial, religious and cultural, po-

Table 4. Multilateral cooperative mechanisms between China and the B&R countries.

Data source: Organized by author according to Zhao Yuxin [12] .

litical and even terrorism in different countries. Therefore, training and education of enterprises and organizations which had or would involve in the Belt and Road countries should be strengthened. They should give consideration to public welfare undertakings and local customs, get along with the local government and people in order to establish a good image of China’s agriculture to promote all-round cooperation. What’s more, these enterprises should be guided and regulated to avoid vicious competition. The enterprises should make full use of technology home and abroad to enhance competitiveness of products when exploiting the foreign markets, and improve the comprehensive capability of handling trade frictions and all kinds of challenges, and better adapt to the trend of internationalization and integration.

Acknowledgements

The author would like to thank professor Tian Weiming for his helpful comments and Zhou Wenyue from CFAU for her excellent assistant work.

This paper is supported by the National Social Science Youth Project, The Impact of TPP Agreement to the World Agricultural Trade Pattern and China (ID: 16CGJ02).

Cite this paper

He, M., Huang, Z.Q. and Zhang, N.N. (2016) An Empirical Research on Agricultural Trade between China and “The Belt and Road” Countries: Competitiveness and Complementarity. Mo- dern Economy, 7, 1671-1686. http://dx.doi.org/10.4236/me.2016.714147

References

- 1. Chen, C. (2006) Changing Patterns in China’s Agricultural Trade after WTO Accession. In: Ross, G. and Song, L., Eds., The Turning Point in China’s Economic Development, Asia Pacific Press, Australian National University, Canberra.

- 2. Song, S.S. (2014) Enlarging Foreign Agricultural Cooperation under the Background of “One Belt and One Road” Strategy. Journal of International Economic Cooperation, 9, 63-66. (In Chinese)

- 3. Cheng, G.Q. (2015) Chinese Agricultural Development under the Belt and Road Initiative. Agricultural Economics, 7, 74-77. (In Chinese)

- 4. Yu, M. (2015) “One Belt and One Road” Takes Agriculture Out. Countryside, Agriculture, Farmer, 4, 9-10. (In Chinese)

- 5. Hu, B.C. (2015) Analysis of Chinese Agricultural Products Markets and Policy Assessment. Chinese Rural Economics, 4. (In Chinese)

- 6. Balassa, B. (1965) Trade Liberalization and Revealed Comparative Advantage. The Manchester School of Economic and Social Studies, 33, 99-123.

https://doi.org/10.1111/j.1467-9957.1965.tb00050.x - 7. He, M., Tian, W.M. and Cassey, A. (2012) Structure and Evolution of Exporting Trade Technology in China, Japan and Korea—An Empirical Study Based on Exporting Complexity. Journal of Agrotechnical Economics, 5, 104-113. (In Chinese)

- 8. He, M. and Tian, W.M. (2012) Comprehensive Description of the Measurement of Trade Model and Evolution Regularity. Contemporary Economics, 19, 120-123. (In Chinese)

- 9. Huang, C.Q. and Wei, S. (2012) Analysis of Trade Dynamics and Trade Potentials of Agricultural Products between China and India. International Economics and Trade Research, 7, 15-26. (In Chinese)

- 10. Yang, J., Yang, W.Q., Li, M. and Wang, X.B. (2012) Analysis on Changes in the Structure, Comparative Advantages and Complementarity of Agricultural Products Trade between China and Africa. Chinese Rural Economy, 3, 44-52, 67. (In Chinese)

- 11. Vollrath, T.L. and Paul, V.J. (Year) The Changing Structure of Agricultural Trade in North America: Pre- and Post-CUSTA/NAFTA: What Does It Mean? Economic Research Service, USDA.

- 12. Zhao, Y.X. and Ma, Q. (2015) Promoting Food Cooperation of “One Belt and One Road” Region Based on Multilateral Cooperative Mechanisms. Journal of International Economic Cooperation, 10, 69-73. (In Chinese)

- 13. Yu, C.Y. and Qi, C.J. (2015) Research on the Complementarity and Comparative Advantages of Agricultural Product Trade between China and CEE Countries—Taking Poland, Romania, Czech Republic, Lithuania and Bulgaria as Examples. Journal of Service Science and Management, 8, 201-208.

https://doi.org/10.4236/jssm.2015.82022 - 14. Zou, J.L., Liu, C.L., Yin, G.Q. and Tang, Z.P. (2015) Spatial Patterns and Economic Effects of China’s Trade with Countries along the Belt and Road. Progress in Geography, 5, 598-605. (In Chinese)

NOTES

1The initiative only mentions that “China should conduct in-depth cooperation on agriculture, forestry, animal husbandry, fishery, agricultural machinery and the production and processing of agricultural products, and actively promote the cooperation on mariculture, pelagic fishery and aquatic product processing”.