Modern Economy

Vol.07 No.09(2016), Article ID:69817,12 pages

10.4236/me.2016.79100

Technological Progress, Spatial Competition and Industrial Location: Estimation and Predictions of Cement Industry in Northwest China

Fei Wang1*, Qiliang Mao2

1School of Public Policy and Management, Tsinghua University, Beijing, China

2School of Urban Economics and Public Administration, Capital University of Economics and Business, Beijing, China

Copyright © 2016 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 18 July 2016; accepted 14 August 2016; published 17 August 2016

ABSTRACT

This study estimates a theoretical multi-region industrial location model by adopting real statistics to investigate the intuition of shaping spatial pattern of economic activities in a case of cement industry in Northwest China. Based on the estimation of key parameters, we simulate the impact of technological progress on variation of location. We find that, given trade cost, with technological progress, operating cost decreases, it is profitable for firms to expand sale range. In long term, technological progress would induce server spatial competition and promote further spatial concentration of industry. Original areas with larger market and fine industrial base are still main agglomerations, while original peripheral areas are further to a downward trend, and parts of original areas located next to hot pot areas have become peripheries. Our study on influence of technological progress on industrial location confirms the importance of investigation on intuition of spatial pattern of economic activities. Technological progress is essentially achievement of sustainable development. However, neglecting substantial spatial competition induced by technology improvement turns against spatial allocation of resources. Hence, optimal location of industries is one of important factors to ensure sustainable development.

Keywords:

Spatial Competition, Industrial Location, Technological Progress, Market Access, Computable Spatial Economic Model

1. Introduction

Industrial location is the projection of economic activities on the territory. It is the common fact that economic activities unevenly distribute across space. Both New Economic Geography and Traditional Trade Theory confirm that industrial special pattern is closely related to its own characteristics. Technology level is one of the key industrial characteristics measuring the mode of production. With technology progress, one given industry substantially updates its own features. It is interesting as well as meaningful to penetrate the impact of technology progress on evolution of industrial location, and furthermore helpful to understand the endogenous mechanism of industrial spatial pattern.

Location theories argue that industrial spatial distribution depends on the interaction of industries with different characteristics and locations with various features, and the pattern is a temporal equilibrium under severe spatial competition of economic activities. Predicted by NEG, the interplay between trade costs, increasing returns to scale and market size lies at the heart of the pattern of regional disparities [1] . In the mechanism of spatial competition, the balance of the forces induces concentration of production due to scale economy and forces cause dispersion due to trade cost that shapes distribution of the economic activities. In the framework of spatial economics, there are usually two forces that determine equilibrium: one is the advantage to access of market, which is the agglomeration force that induces economic activities to concentrate in a given region; the other one is market competition which is the dispersion force that induces the spread of economic activities in a densely agglomerated region of firms, and severe completion limits the profitability and prevents from further concentration. In long term, it is the tug of war of agglomeration and dispersion forces that determines the equilibrium of economic geography. The industrial locations, which are stable, come out to have a reasonable transport radius, and make the firm sizes fit market potential. By concerning about technology progress on evolution of industrial location, Tabuchi et al. (2014) [2] argue that rising labor productivity may foster the agglomeration of activities; when labor is heterogeneous, the number of workers residing in the more productive region increases by decreasing order of productive efficiency when labor productivity rises.

Recently, there are lots of studies about industrial characteristics and industrial location. Brulhart and Torstensson (1996) [3] find that the industries with relatively obviously scale economy are mostly spatially concentrated. Amiti (1999) [4] also finds agglomerated industries have the feature of intensive intermediate inputs. Midelfart-Knarvik et al. (2000) [5] analyzed the spatial pattern of industries within EU, then they argued uneven distribution of industries across countries or interior of a country was closely related to industrial characteristics such as labor intensity, R&D investments, etc. There are differences for industries with different features of forward-backward linkages or scale economy trend to location in developed countries or in backward countries. Vogiatzoglou (2006) [6] analyzed industrial specialization and geographic concentration patterns within the NAFTA, and found that manufacturing was increasingly relocating to Mexico, which came at the expense of the US. In addition, labor-intensive and low-technology activities appear to be the most spatially concentrated industries, exhibiting a strong increasing trend to relocate to Mexico. The researches on China reach similar conclusions. He and Xie (2006) [7] pointed out the spatial distribution of industries characterized by industrial differential inherent features when specialization pattern had been clear across provinces of China since 1990s. The industries indicate differential spatial pattern in terms of export-oriented, material-oriented, consumption- oriented, highly profitability, and high taxation.

Concerning research methods, spatial economists usually apply general equilibrium theory to industrial location. It has been the main framework to analyze impact factors of industrial location. But equilibrium condition of spatial economic model consists of nonlinear equations, which are hardly to reach analytic solutions. And in consequence solution of models rely on numerical simulation. This restricts spatial economic models to be applied in the real world. Combes and Lafourcade (2011) [8] made an attempt to a computable spatial equilibrium simulation; they employed real statistics to estimate parameters of theoretical model, then used estimated parameters to simulate landscape of economy. This method, to a certain degree, overcomes the defects that core-pe- riphery model excessively rely on numerical simulation and improve utility of spatial economic model. The exercises in computable spatial equilibrium under imperfect competition are rooted in studies by Smith and Venables (1988) [9] , Haaland and Norman (1992) [10] , and Gasiorek et al. (1992) [11] . Gasiorek and Venables (1997) [12] produced the first study that was close to economic geography: it focused on the impact that improvements in infrastructures had on the spatial concentration of activities.

The main contribution of our paper is to provide further intuition on the balance between agglomeration and dispersion forces in high-dimension economic geography models with strategic interactions among firms. We use our estimated parameters to simulate the distribution of economic activities, market fragmentation, and the determinants of firm location (prices, costs, mark-ups, marginal profits, demand and total profits).

2. The Economic Geography Model

Both economists and geographers generally believe market with larger scale more likely to be a location of production [1] . As a sort of friction force, transportation cost is closely related to economic geography, which is a main force affect industrial location and spatial expand. It implies that proximity to market is one of the factors determine a location. It was taken up by Weber (1962) [13] to analyze a firm’s optimal location. Weber assumes that the firm aims at minimizing total transport costs, which are defined by the sum of weighted distances to several markets, each weight expressing the importance of the corresponding market to the firm. This amounts to assuming that a firm seeks a location that gives it the best access to several markets, which have different sizes and relative positions. However, Weber’s framework ignores the spatial competition, he assumes fixed price for both sellers and buyers, and there is no substantial competitors. This assumption seems appropriate in the context of single firm, but it is not right as considering several locations of firms in the same sector. Palander (1936) [14] recognizes the importance of spatial competition between firms, he commits to analyze firms in different location delimitate market. However, his work is based on given location. It is still unknown how location settled. It is more reliable to predict industrial location if combine agglomeration force (access to market) and dispersion force (firm competition). Hotelling (1929) [15] developed a location model involved spatial competition, which implies industrial location is endogenous.

In next paragraphs, we add technology variable to Combes and Lafourcade (2011) [8] ’s general equilibrium model of industrial location, which aims to evaluate impact of technological progress on change of location by adopting data of cement industry in Northwest China.

2.1. Theoretical Model

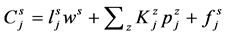

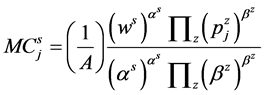

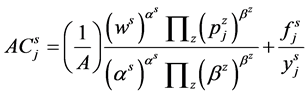

Production function. Within industry s,  single-plant firms operate in region j where they produce the same homogenous good. Technology differs across industries but not across regions. The production of a representative firm operating in industry s and region j,

single-plant firms operate in region j where they produce the same homogenous good. Technology differs across industries but not across regions. The production of a representative firm operating in industry s and region j,  , is

, is

(1)

(1)

(2)

(2)

where  is the number of employees and

is the number of employees and  the quantity of good z used as an intermediate input.

the quantity of good z used as an intermediate input.  and

and  are constant parameters. Moreover, we assume that firms incur fixed production costs,

are constant parameters. Moreover, we assume that firms incur fixed production costs,  , which are industry- and region-specific. In order to focus on technological progress affect the location of firms, we improve the production function by employing total factor productivity A which refers technological level. The larger A is, the more goods produced for given l and K. Under technology (1) and (2), marginal cost and average cost are respectively given by

, which are industry- and region-specific. In order to focus on technological progress affect the location of firms, we improve the production function by employing total factor productivity A which refers technological level. The larger A is, the more goods produced for given l and K. Under technology (1) and (2), marginal cost and average cost are respectively given by

(3)

(3)

(4)

(4)

where  is the wage in industry s, that assumes not vary across regions to simplify our analysis.

is the wage in industry s, that assumes not vary across regions to simplify our analysis.  denote the price in intermediate input z and region j. Through cost function, we can carry out our interests. The marginal cost is constant if wages and intermediate input prices are fixed. The cost function not only indicates to what extent marginal cost change as production factors but make clear that marginal cost declines in the circumstance of technological progress.

denote the price in intermediate input z and region j. Through cost function, we can carry out our interests. The marginal cost is constant if wages and intermediate input prices are fixed. The cost function not only indicates to what extent marginal cost change as production factors but make clear that marginal cost declines in the circumstance of technological progress.

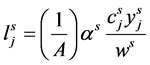

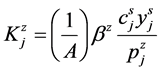

For the representative firm operating in industry s and region j, labor and intermediate demands are therefore:

,

,  ,

,

Consumer demand and good-market equilibrium

Let

where

The total demand for good s in region j,

We further assume that markets are segmented.

Firms’ strategies under Cournot competition

Due to markets segmentation, we use

We assume that firms behave as Cournot-Nash oligopolists. Eachfirm chooses to maximize its profit. The first order conditions are given by

In the short-run equilibrium, the number of firms is exogenous. Let

Spatial equilibrium mechanisms and influence of technological progress

Economic activities are determined by interaction between agglomeration and dispersion. Competition tends to disperse firms across space. Due to strategic interactions, the equilibrium price from Equation (12) falls with the total number of competitors in each industry (Ns) and with proximity to these competitors: the closer are the other producers in industry s, the smaller is

Even so, the influence of technological progress on industrial location to some extent still can be correctly forecasted in common-sense. Given the other conditions, technological progress leads to reduce marginal cost as well as home price of goods. The price of exports from region j to region i maybe decrease, and the negative profit before (

2.2. Empirical Model and Estimable Specification

Data on value-added, capital, price, or intermediate input costs do not exist in West-north China at the disaggregated spatial scale (county specific) considered here. However, data on employment and number of firms are available. Our baseline estimation therefore builds on firm labor demand. We derive a specification of area- industry employment per firm

Equations ((2), (3) and (14)), yield

We assume that trade costs per unit exported,

By adopting specification of Combes and Lafourcade (2011), we build up aempirical model of industrial location:

where

We adjust the estimated specification of Equation (17) by considering the features of cement industry, in which intermediate inputs are mainly the energy of electricity and natural resources such as limestone and mine, besides rare products of other industries included. So a multi-region model with intermediate inputs from own industry only is derived as Equation (18). Equations ((19)-(23)) are the expression of variables.

In this case, we have

3. Data and Estimation

3.1. Data

For the number of firms and employment, we use the Annual Survey of Industrial Firms (ASIF) dataset for 2010 conducted by National Bureau of Statistics (NBS) in China. This dataset provides exhaustive information on the universe of Chinese firms with turnovers more than 5 million per year. In addition, it provides detailed geographical and industrial coverage, as it can be disaggregated into up to counties at the 3-digit industrial level. We derive the social fixed investment and wages by quoting Statistical Yearbook of China’s regional economic 2011. With respet to technology and preference parameters, we investigated cement firms in Pingliang, Gansu province. We use highway mileage to indicate distance between pair of counties, which is gained through China’s electronic map of last edition.

3.2. Descriptive Industrial Location and Technological Progress

Compared to other regions (East China, North China, Northeast China, Middle China, and Southeast China), aggregated economy is relatively smaller which induce less demand of cement, but the average price is higher, it just confirm the argument that the weaker competition is, the higher price will be.

The spatial pattern of cement industry in Northwest China exhibits two evident features: first, most of firms concentrate in south of Shaanxi, east of Gansu, areas along Yellow river of Ningxia and Inner Mongolia, parts of Xinjiang, and east of Inner Mongolia, where population and economic activities densely located; second, cement industries mainly locate city-intensive zones and their surrounding areas, where economic activities highly agglomerate, demand for cement is relatively large. Briefly analyzed, location of cement industry significantly relates to market size. Through further analysis of annual social fixed investment, scale of cement demand and supply closely correlate to local fixed investment (Figure 1 & Figure 2).

3.3. Evaluation of Technological Progress of Cement

We evaluate technological progress of cement industry based on investigation of cement firms of Pingliang, Gansu Province, where locate two large corporations, Hailuo and Qilianshan, the former is representative of China’s cement industry, which represents the highest technological level in his domain; the latter was representative firms of local Northwest China. Qilianshan’s technological level lagged behind Hailuo, however, had to improve operating technology since Hailuo’s entry. Hence, investigation on the cement industry of this area provides us decent materials before and after technological progress, which helps us to evaluate performance of

Figure 1. Spatial distribution of cement industry in Northwest China (2010).

Figure 2. Spatial distribution of annual social fixed investment in Northwest China (2006-2010).

technological progress for cement industry. Technological progress of cement industry mainly includes improvement of efficiency of resources utilization and changing structure of inputs. Recycling economy is key feature of technological progress. On one hand, firms reuse the waste generated by other industries and constructions to ease environmental deterioration; on the other hand, they utilize of heat from process of production to generate electricity to reduce energy demand. According to Kharel and Charmondusit (2008) [17] ’s approach about evaluation of eco-efficiency of production, by improvement of technology, energy eco-efficiency, material eco-efficiency and waste eco-efficiency respectively increased by 3.71%, 58.73% and 0.8%. In order to evaluate technological progress, we take the logarithm of Equation (1) to get model of production function (Equation (24)), and attribute residual aside from variation of inputs to technological progress, then estimate the function by OLS. In the function,

3.4. Baseline Estimation

We estimate the model (18) and (24) using OLS in 2009. The estimated A is 11.2329 and 12.3457 respectively which indicates significant technological progress in cement industry. Concerning on the economic geography model, it is 0.2331 before technological progress and 0.2054 after that, both of them are significant in 5% level. To be consistent with the model, the estimated

4. Simulated Location under Technological Progress

4.1. Location Incentives

The operating profit per firm is given by Equation (10). Under the assumption that fixed costs are the same across areas, it measures the incentive to create a new plant in the area. Figure 3 and Figure 4 shows that indi-

Table 1. Variation of eco-efficiency of cement industry.

Note: Energy only include coal, reduction of standard coal derived from monthly report of Qilianshan Cement Co.; data of 2010 is only from January to October.

Table 2. OLS estimation for production function.

Nore: ***Significant at the 1% level. **Significant at the 5% level. *Significant at the 10% level.

Table 3. OLS estimation for economic geography model.

Figure 3. Marginal profit before technological progress.

Figure 4. Marginal profit after technological progress.

vidual operating profits exhibit a clear pattern, with a negative gradient from the core to the periphery. Similar to spatial pattern of industrial scale, in the regions with cities densely located such as south of Shaanxi, east of Gansu, areas along Yellow river of Ningxia and Inner Mongolia, and parts of Xinjiang, operating profits is relatively higher than others, it indicates cement firms prefer to locate in those regions. Comparing Figure 3 and Figure 4, the change of operating profits before and after technological progress has been clearly showed. After technological progress, areas with high profits has been concentrated in more narrowed regions, especially urban areas in south of Shaanxi, east of Gansu and areas long Yellow river. This change implies that with progress of technology, firms are more incentive to be located in larger market and industrial base.

4.2. Location Variation

To further investigate the change of cement industry location with reference to production size, we evaluate the variation of hot pot. Practically, we respectively calculate local Moran’s I (Getis-Ord Gi*) before and after technological progress, then adopt GIS technique to achieve in visualization, the whole region are divided into four categories in descending order of Gi* statistic―hot pot, sub-hot pot, sub-cold pot, and cold pot (Figure 5 and Figure 6). Comparing Figure 5 and Figure 6, we can figure out shift of hot pot, meanwhile, the variation of location. Generally, before and after technological progress, distribution of cement industry is consistent with spatial pattern of profits. In terms of geographical pattern of hot pot, it is evident that cement industry mainly agglomerate in south of Shaanxi, east of Gansu, areas along Yellow river of Ningxia and Inner Mongolia, parts of Xinjiang and east of Inner Mongolia is sub-hot pot regions. In context of technological progress, the variation of location is similar to that of operating profits. Cement industry firms have been concentrated in more narrowed regions, original areas with larger market and fine industrial base still are main agglomerations,

Figure 5. Hot pot of cement industry before technological progress.

Figure 6. Hot pot of cement industry after technological progress.

while, original peripheral areas are further me marginalized, parts of original areas located next to hot pot areas have become peripheries. From the variation of production scale, most of areas experienced decline of production to varying degree, nevertheless, central cities in west of region exhibit obvious increment.

The impact of technological progress on distribution of industry closely relates to market size. Figure 7 indicates the relation between variation of production size before and after technological progress and social fixed investment, and Figure 8 exhibits the relation between variation of production size and change of market size. Both of them imply the important effect of market size on industrial location, that is, the larger the region’s home market size or its neighboring market size is, the higher possibility cement industry locate.

5. Conclusions

This paper estimates the theoretical economic geography model by adopting real statistics. Based on the estimation of key parameters, we simulate the impact of technological progress on location of cement industry in Northwest China. A multi-regions industrial location model is built to describe the intuition of shaping spatial pattern of economic activities. We find that with technological progress, operating cost of firms decreases, given trade cost, it is profitable for firms to expand sale range. In long term, technological progress would induce server spatial competition and promote further spatial concentration of industry. This prediction is proven in our

Figure 7. Change of Spatial distribution of cement product after technological progress.

Figure 8. Correlation between variation of product and fixed investment of counties.

case study of cement industry in Northwest China.

Our study on influence of technological progress on industrial location confirms the importance of investigation on intuition of spatial pattern of economic activities. In the case of cement industry in Northwest China, technological progress is the essentially achievement of sustainable development. However, neglecting substantial spatial competition induced by technology improvement turns against spatial allocation of resources. As industrial location is projection of economic activities on geographic space, optimal location of industries is one of important factors to ensure sustainable development.

Our approach has the attractive feature of being easy to replicate for other industries. Nevertheless, we cannot overlook the disadvantages. The real world is more complicated than we assumed in this paper, market potential is only one of the factors that influence the location, and there are lots of other determinants. It is insufficient in this paper to consider solo factors. Besides, assumption of homogeneous areas is simplification of the real word which doesn’t favor more accurate estimations and simulations. Further research should focus on improvement of theoretical model which would involve more real variables precisely capture the different essence of various regions.

Cite this paper

Fei Wang,Qiliang Mao, (2016) Technological Progress, Spatial Competition and Industrial Location: Estimation and Predictions of Cement Industry in Northwest China. Modern Economy,07,984-995. doi: 10.4236/me.2016.79100

References

- 1. Combes, P.-P., Mayer, T. and Thisse, J.F. (2008) Economic Geography: The Integration of Regions and Nations. Princeton University Press, Princeton.

- 2. Tabuchi, T., Thisse, J.F. and Zhu, X. (2014) Technological Progress and Economic Geography. CEPR Discussion Papers.

- 3. Brülhart, M. and Torstensson, J. (1996) Regional Integration, Scale Economies and Industry Location in the European Union. Social Science Electronic Publishing, 142, 102-10.

- 4. Amiti, M. (1999) Specialization Patterns in Europe. Review of World Economics, 135, 573-593.

http://dx.doi.org/10.1007/bf02707385 - 5. Knarvik, K.H.M., Overman, H.G., Venables, A.J. and Redding, S.J. (2000) The Location of European Industry. Economic Papers, 1-76.

- 6. Vogiatzoglou, K. (2006) Agglomeration or Dispersion? Industrial Specialization and Geographic Concentration in NAFTA. Journal of International Economic Studies, 20, 89-102.

- 7. He, C. and Xie, X. (2006) Geographical Concentration and Provincial Specialization of Chinese Manufacturing Industries. Acta Geographica Sinica, 61, 21-222.

- 8. Combes, P.-P. and Lafourcade, M. (2011) Competition, Market Access and Economic Geography: Structural Estimation and Predictions for France. Regional Science and Urban Economics, 6, 508-524.

http://dx.doi.org/10.1016/j.regsciurbeco.2011.03.012 - 9. Smith, A. and Venables, A.J. (1988) Completing the Internal Market in the European Community, Some Industry Simulations. European Economic Review, 32, 1501-1525.

http://dx.doi.org/10.1016/0014-2921(88)90113-4 - 10. Haaland, J. and Norman, V. (1992) Global Production Effects of European Integration. In: Winters, L., Ed., Trade Flows and Trade Policies, Cambridge University Press, Cambridge, 67-88.

- 11. Gasiorek, M., Smith, A. and Venables, A.J. (1992) Trade and Welfare, a General Equilibrium Model. In: Winters, L., Ed., Trade Flows and Trade Policies, Cambridge University Press, Cambridge, 35-63.

- 12. Gasiorek, M. and Venables, A.J. (1997) Evaluating Regional Infrastructure: A Computable Equilibrium Approach. “Modelling Report” by the European Institute and the London School of Economics.

- 13. Weber, A. (1962) Theory of the Location of Industries. Chicago.

- 14. Palander, T. (1936) Instability in Competition between Two Sellers. In Papers Presented at the Research Conference on Economics and Statistics Held by the Cowles Commission at Colorado College, Colorado College Publications, General Series No. 208.

- 15. Hotelling, H. (1929) Stability in Competition. The Economic Journal, 39, 41-57.

http://dx.doi.org/10.2307/2224214 - 16. Krugman, P. (1991) Increasing Returns and Economic Geography. The Journal of Political Economy, 99, 483-499.

http://dx.doi.org/10.1086/261763 - 17. Kharel, G.P. and Charmondusit, K. (2008) Eco-Efficiency Evaluation of Iron Rod Industry in Nepal. Journal of Cleaner Production, 16, 1379-1387.

http://dx.doi.org/10.1016/j.jclepro.2007.07.004

NOTES

*Corresponding author.