American Journal of Industrial and Business Management

Vol.05 No.03(2015), Article ID:55021,10 pages

10.4236/ajibm.2015.53014

Study on the Fiscal Budget Deviation and Its Structural Impact Factors

Qingjie Liu, Huachun Wang

Beijing Normal University, School of Government, Beijing, China

Email: liuren8788@163.com, huachunwang@bnu.edu.cn

Copyright © 2015 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 5 March 2015; accepted 23 March 2015; published 25 March 2015

ABSTRACT

Based on the background of fiscal budget balance deviation increasing year by year, this paper detects causal relationship between excess revenue and overspend in government finances with the granger causality method, and analyzes the influence of excess revenue to overspend with impulse response function under the VAR model. The result shows that the overrun is caused by excess revenue. To dig deep the structural factors that cause the budget income deviation, from the angle of tax in excess, the paper analyzes contribution to fiscal excess of value-added tax, busi- ness tax, personal income tax, enterprise income tax, consumption tax through multiple linear regression models. The results show that Business tax and individual income tax have a significant influence on fiscal budget deviation. The focus of correcting the fiscal budget balance deviation is to control the business tax and individual income tax in excess. The government should comprehensively promote the tax reform on personal income tax and VAT instead of business tax to establish and perfect the system of modern finance.

Keywords:

Budget Revenue Deviation, Divergence from Budget Spending, Tax Structure

1. Introduction

Public finance is the economic base of the country and is an important guarantee for the pillars. Building a scientific and rational tax system is conducive to optimize the allocation of resources, and to maintain a unified market and orderly competition. In the process of budget, it is allowed to be a certain number and not too large gap range between the amount of the budget and final accounts; otherwise there will be problems on the use of financial resources, thereby affecting the socio-economic structure and national economic development. However, the high degree of finance budget deviation has been the critical problems. The phenomenon of financial overruns is becoming seriously. Finance budget data over the years have shown that finance budget deviation has present abnormal fluctuations, and the degree on budgetary control is weak. It is highly in urgent need to take effective measures to improve budget management.

Since 1998, China has done a lot for the budget system reform, including the reform of departmental budgets, two lines of budgetary revenues and expenditures and reform of the revenues and expenditures subject, and achieved some success. However, the degree of finance budget deviation is still becoming higher and higher, which seriously influences the ability of government on budget control (Figure 1 and Figure 2).

In our country, since the reform of tax allocation, finance budget is mainly characterized by the following features: firstly, excess revenue and overspend is becoming normalization, especially the growth rate of excess revenue keep higher than overspend for a long time. Secondly, the ability to control the budget revenue is weaker than budget expenditure; financial budget income deviation is greater than expenditure. So it is in the urgent need to strengthen budgetary control and budget management. From the point of view of social stability, controlling the excessive growth of revenue is contributed to improve the social welfare.

2. Literature Review

Hick (2006) [1] proposed a long time budget authority of the executive and the legislature in the shift in the competitive state, few can achieve balance. Foreign scholars focused on the behavior of the budget revenue forecasts and budget execution to explore the formation mechanism of the deviation on final accounts.

In terms of budget revenue projections, Stephen (1995) [2] considered that forecasting method is better than the regular simple empirical prediction method in the selection of scientific technology budget revenue projections. John Mick Purcell (2005) [3] pointed out that the federal or central government budgets tend to use more formal way during the budget revenue forecasts, however, the local government budget revenue forecasts tend to only work carried out by the office of budget or finance department. Prediction of budget of local government is not standard, which in turn led to the prediction of non-standard deviation increased. He also mentioned the impact of fluctuations in the economic cycle earnings forecast accuracy, the economic cycle fluctuations causes the

Figure 1. Finance budget surplus overruns (unit: 100 million). Source: Ministry of Finance: “China Financial Yearbook” 1995-2013 year data rearranging.

Figure 2. Budget revenue deviations and expenditure deviation (%). Source: Ministry of Finance: “China Financial Yearbook” 1995-2013 year data rearranging.

government to take the corresponding decisions, such as intensify tax, etc., which have led to final accounts bias. In the process of budget implementation actors selection, the reasons for the deviation from the budget and final accounts is analyzed during the process of budget implementation, which is mainly from the monitoring role of representative bodies (Arron Wildavsky, 1992) [4] , transparent implementation of the budget (Cleveland, 2006) [5] , budget maximizing bureaucrats (W. A. Niskanen, 2004) [6] , resulting in the fragmentation of power decentralization (Shirk, 2007) [7] , and several other aspects.

In terms of the domestic research budgets, Aim (2008) [8] discussed the meaning of final accounts deviation proposed initially by the Chinese government from passively accept the “surplus” to actively pursuit the evolu- tion of “surplus” target. Yilmaz Hui (2008) [9] studied the causal relationship between revenue and expenditure of the provincial government, and Granger causality test and panel data co-integration presented that at the provincial government level, revenue causing expenditure, there exists a causal relationship between them. On the whole, empirical studies and cost overruns in the causation aspect overcharges fewer loopholes in existing research, research methods and data need to be supplemented and improved; in terms of the formation mechanism of the surplus, mainly in the impact on the financial surplus of economic environment (Yongjun Wang, 2002) [10] , the budget revenue forecasts (Ma Caichen, 2009) [11] , defect bureaucratic budget maximization (Yinmei Wang, 2012) [12] , the legal system (Xu Sun, 2011) [13] and so on.

With the study of the formation of the surplus of the gradual deepening of factors, scholars began to study the scope of the tax structure introduced fiscal surplus, tax research group institute of Central University of Finance (2007) [14] showed that the fiscal surplus is the results of tax reform and the central policy adjustment. Wu Mingming (2013) [15] showed that the fiscal surplus is caused by the consumption tax, VAT and other taxes in the point of view of deviation from the budget and final accounting, but the paper had no in-depth quantitative reasoning. Hu Yijian et al. (2007) [16] found that change of tax policy could explain changes in the growth rate of tax, based on the time series data of tax and GDP. Wang Xiuzhi (2009) [17] demonstrated the impact of taxes on all taxable GDP and its long-run equilibrium relationship through a simple unit root test and integration test, with the explanatory variable of turnover tax and income tax.

According to previous studies, this paper attempts to answer in depth and solve the following problems: Firstly, analyzing the causal relationship between excess revenue and overspend through the Granger causality test and impulse analysis chart with the budget and final balance of payments data of fiscal year from 1994 to 2012. Secondly, choosing the contribution of fiscal surplus tax overcharges as a new perspective of the research on finance budget deviation, the paper analyzes structural factors affecting budget and final accounts bias, and provides the final policy basis for a balanced fiscal budget.

3. Causality Analysis

3.1. Variables and Data

To search for a causal relationship between financial surplus and cost overruns, since the tax reform is started from 1994, this article chose budget and final data from1994 to 2012 in china as the study sample. Study variables involved include overcharges (CS), cost overruns (CZ), final accounts revenue degree of deviation (SP), the degree of deviation expenditure budget and final accounts (ZP) and GDP growth (GDPZ). According to the calendar year, “China Financial Yearbook” fiscal budget and final balance of payments data, the paper calculated the data of surplus, overruns, budget and final budget and final accounts of income and expenditure of the degree of deviation, and to draw on the surplus over the number from the “China Statistical Yearbook” calculate GDP growth rate. Causality detection methods include Granger causality test and impulse response function diagram analysis.

3.2. Granger Causality Test

According to the normal distribution test results, variables are not all normally distributed, in order to ensure the validity of the correlation analysis, we choose to calculate the Spearman correlation coefficient. In order to ensure the other three variables to minimize its interference, we control the degree of deviation revenue budget and final accounts, final accounts deviation spending, GDP growth rate of the three variables with the partial correlation coefficients estimate correlation between the surplus and cost overruns. The results are presented in Table 1 and Table 2.

From the spearman correlation coefficient and partial correlation coefficients, it can be seen that there have a significant positive correlation between surplus and cost overruns, in order to analyze the causal relationship between them, We test causality between variables of overcharges and overruns with granger test, which relies on the use of certain past point on the best least-squares prediction variance of all information. Granger causality test is a prerequisite for the time series must be smooth; otherwise there may be a false return, so stationary test should be done before the granger test. The purpose of stationary test is to judge whether the time series have unit root, if there is a unit root, time series are non-stationary. Test methods are mainly ADF test and KPSS test, the null hypothesis of ADF test for time series is contain a unit root, the null hypothesis of KPSS test is that the time sequence does not contain a unit root. To ensure the validity of the test, this section uses the combination of methods with ADF and KPSS test, the results are shown in Table 3 and Table 4.

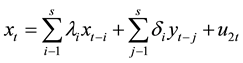

Results of ADF test can be seen that values of ADF test sequence are less than the significance level of 5% and 10% threshold, and therefore the null hypothesis is rejected, there is not enough evidence to prove that the time series contains a unit root. As can be seen from the KPSS test results, KPSS test values are greater than 1%, 5% and 10% of the critical value, so the null hypothesis is accepted, so there is no unit root sequence in the time series, they are the time-stationary series, and zero-order single whole. Then we will build regression model estimation. Granger causality test hypotheses about x and y. The forecast information is reflected in the corresponding time series, based on the estimated regression testing in following requirements:

(1)

(1)

(2)

(2)

Firstly, the VAR model for AR root test, if the estimated VAR model all root reciprocal mode is less than 1, which is located inside the unit circle, the VAR model is stable under conditions in which the Granger causality test and impulse response Standard error function effectively. From the output in Figure 3, it can be seen no roots outside the unit circle. Indicating VAR model building is stable. As can be seen from Table 5, VAR model under test concluded that the LNCS is the Granger reason of the LNCZ, that is excess revenue is the Granger cause of overspend.

Table 1. Spearman correlation results.

Table 2. Partial correlation analysis.

Table 3. ADF test.

Table 4. KPSS test.

Table 5. Granger test results under the VAR model.

Figure 3. VAR model test results: AR root.

3.3. Impulse Response Function

It has been known that the VAR model satisfies the stability condition, and the results from Granger causality test shows that the surplus is the Granger cause of overspend. To further observe the effect of the surplus on the impact of cost overruns, we analyze model under the VAR impulse response function. This part is constructed generalized pulse (Generalized Impulses), the impulse function describes residuals orthogonal matrix constructed by Hashem et al. (1998) [18] which does not depend on the order of the variable VAR model, analysis of the selection criteria error in the form. Lag period were used for 20 years and 50 years in the function, the variables have an impact on the number of surplus LNCS, hoping to observe its impulse response variable for overspend LNCZ. In the two variable VAR model, LNCS presents the excess revenue, overspend is presented by LNCZ, give LNCS a positive impact on unit size, get LNCZ impulse response function graph.

Figure 4 and Figure 5 are the pulse diagrams with the lag period of 20 years and 50 years, the broken line shows the standard deviation of plus or minus twice the deviation band. On the horizontal axis represents the number of units during the lag effect of the impact of the vertical axis represents the logarithm of cost overruns. As can be seen from Figure 5 and Figure 6, when the surplus revenue in the current period is given a positive impact, spending overruns in the second stage reached its highest point, the surplus close to 0.8 in response to cost overruns, and then began to fluctuate around zero axis, and ultimately achieve stable, close to zero. This suggests that the finance budget revenues and expenditures after the impact caused by the excess revenue with shocks to spending overruns, which has a significant impact on the promotion of the role and longer lasting effect, which further confirms the impact of the surplus of overspending.

Figure 4. Impulse response for 20-year lag period.

Figure 5. Impulse response for 50-year lag period.

Figure 6. Compares the results with the financial surplus and tax overcharges. Source: Ministry of Finance: “China Financial Yearbook” 1995-2012 year data.

4. Structural Factors

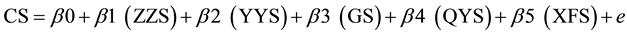

These statistical tests considered excess revenue is the granger cause of overspend, but can also be seen by the pulse diagram influence changes in the surplus of cost overruns, whereby we propose to control overcharges, reduce the financial budget and final income bias, will directly benefit expenditure budget and final deviation narrowing. From the budget and final accounts statistics over the years, the tax surplus and fiscal surplus is basically in the same situation to change, and a larger proportion of the surplus revenue (Figure 6) in the fiscal surplus. At present, the tax levied taxes in total tax revenue of a large proportion of the value-added tax, consumption tax, business tax, corporate income tax and personal income tax, tax accounts for each year income data from 1999 to 2012, five kinds of tax revenue to total tax revenue in proportion 75% or more. This section attempts to overcharges caused by overspending on causation, as the end result of a tax to VAT, business tax, corporate income tax, personal income tax, consumption tax of five types of taxes as the main explanatory variable is interpreted as a fiscal surplus variables, data from “China Financial Yearbook” in previous years and use Eviews6.0 stepwise regression analysis and regression results validation. This sector tries to find the key factors surplus, so in practice the key points of the surplus to be adjusted to help further control over financial overcharges.

4.1. Empirical Study

4.1.1. Stability Test

It should be done to verify the existence of panel data unit root for stationary test data, to avoid spurious regression, or false return, to ensure the validity of estimates, the results can be seen in Table 6 and Table 7.

Firstly, the null hypothesis of ADF test is that time series contain a unit root. ADF test can be seen that the value of the sequence is less than the significance level of 5% and 10% threshold, and therefore reject the null hypothesis; there is not enough evidence to prove that the time series contains a unit root. Followed by the KPSS unit root test variables, the null hypothesis of time sequence, there is no unit root. The null hypothesis for the time series is stationary, so the zero-order one when KPSS test is greater than 1%, 5% and 10% of the critical value, and therefore accept the null hypothesis, and therefore does not exist in the time series unit root, time series are stationary.

4.1.2. Correlation Analysis

In the sector, we analyze the correlation with spearman correlation method, the results are shown in Table 8, it can be seen from the correlation analysis results: consumption tax, business tax, corporate income tax, personal income tax and fiscal surplus correlations are high, the correlation coefficient is above 0.7, indicating that these taxes related fiscal surplus are strong correlation. Correlation sales tax and fiscal surplus of more than 80%, the correlation coefficient is 0.82, which may be due to sales tax collection process in the actual cause of double taxation, fixed tax actually collected, such as the formation of a serious error of overcharges phenomenon.

Table 6. ADF test results.

Table 7. KPSS test results.

4.1.3. Multiple Linear Regressions

Stepwise regression’s aim is to combine selecting variables forward with eliminating variables backward under the guidance of the principle of cost-efficiency, and find out the key variable combination with a high level of explanation, that is the optimal regression equation. First, build the model formula (3), the regression results are shown in Table 9 and Table 10.

(3)

(3)

Judging whether the regression model is optimal with following reasons: firstly, gradually adding the variable after adjustment R-squared value is incremented, but the R-squared value added variables before and after the VAT increase by only 0.021, little change in the fit, taking into account the factors that control costs, in order to find the cause of financial surplus of critical control points, select the model 2 as the most satisfactory model; secondly, analyzing the degree of fit of the most satisfactory model: the coefficient of determination can be seen from the R-squared value is 0.962, the total variation in the dependent variable in the fiscal surplus can be explained by the regression model part of the personal income tax and business tax variables explained96.2% proportion, and the correction coefficient R-squared value become 0.955 after excluding the error, which is good simulation result. This sector tests the effectiveness of the most satisfactory model 2 through multicollinearity test, normality test, autocorrelation test and Heteroscedasticity test with Eviews6.0. Test results show that the model does not exist two multicollinearity, residual normal distribution, and there is no serial correlation between the variables of random variables and their lags in time, the random error term of overall regression function meet the same variance, and therefore estimating of the regression parameter has good statistical properties, the final estimate of the model assumptions is consistent with the premise of the theory, the regression model 2 is valid.

Table 8. Spearman correlation results.

Note: ** indicates a significant level by 1% of the test, * is indicated by a significant level of 5% of the test.

Table 9. Fit testing on the final model.

Table 10. Regression results of the model 2.

4.2. Empirical Results

On the interpretation of the level of surplus, on the one hand, personal income tax and sales tax on the explana- tory power of the surplus of the strongest explanatory variables, standardized regression coefficients are 0.552 and 0.498. The regression results are reflected in our tax surplus situation in the personal income tax and sales tax total surplus for the financial impact of ability, in higher fiscal surplus revenue contribution, the ability to budget constraints personal income and business tax revenue is weak. On the other hand, the affect ability of consumption tax, corporate income tax, and value added tax on the surplus of explanatory variables is weak, excluding the final regression model does not affect the interpretation levels. The results from the statistical point of view, consumption tax, corporate income tax and value added tax for the fiscal surplus situation less influence, to some extent, this may explain the budget income and consumption tax, corporate income tax and VAT control strong bias phenomenon relatively seriously, do not focus on the surplus as a control.

Personal income tax and sales tax surplus for fiscal surplus is more significant impact, mainly because of the surplus from the system level of personal income tax. At present, our country will be divided into 11categories of personal income tax, each of which applies to different tax rates, impose a more concise manner, using a source of tax levied higher collection efficiency, but this extensive tax collection system makes it difficult to control the sources of revenue and understanding of the taxpayer’s real ability to pay, so that a single source of income for many working-class taxes, and diversify sources of income of high-income tax less, working-class tax burden is too heavy, a major source of tax overcharges, but also caused social injustice; sales tax caused excess revenue. On the one hand, business tax levy limits itself fuzzy, especially in today’s services and merchandise sales to bind, causing blurred the boundaries of business tax and VAT tax, resulting in double taxation of sales tax; on the other hand, it is designed for business tax rate higher level, and for each level is difficult to targeted tax adjustment depending on the complexity of collection objects, resulting collection is not standardized, overcharges more. Sales tax once the tax account for a large proportion of the components in our integrated nearly 19 years of data, the proportion of the total sales tax revenue of close to 20% tax. Division of VAT and sales tax is intangible personal property for business tax, value added tax for tangible personal property, but the actual collection process, through a sales tax levied for the same double taxation, imposition of value-added tax and service companies cannot deduct other services, such as caused by the sales tax, which also led to repeated levy.

We explain the reasons why consumption tax, corporate income tax, value added tax on the financial surplus is not significant. Narrow scope of consumption tax, strong controllability compared to other types of taxes, and therefore the overall stability of the financial budget and final deviation, overcharges modest, contribution to the overall fiscal surplus is smaller extent; corporate income tax collection scope is clear, and tax levied on “corporate income” is easy to determine, strongly controllability on execution accounts. The socialist nature of China decided corporate income tax is in a large proportion of state-owned enterprises income tax, relatively strong in terms of tax planning and execution control capabilities, enterprise income tax surplus for fiscal surplus of influence is weak; VAT is of value added goods produced in the transfer process that output tax and input tax is the difference between the VAT tax payable can better avoid duplication of tax. The international VAT tax collection methods as a reference, and make the tax rate reduction, make the tax method specification, then it will have a strong ability to control the system level, and make the amount of overcharges become lower.

5. Conclusions

The paper analyzes causality relationship between excess revenue and overspends and the structural factors impacted on finance budget revenues deviation. The results show that: firstly, overspending is caused by excess revenue, so it should be done first to control revenue deviation to reduce the amount of surplus revenue in order to effectively reduce the budget surplus, which in turn reduce overspending expenditures.

The contribution of overcharges case of personal income tax and sales tax to the financial total surplus is the largest, and the impact of sales tax overcharges to fiscal surplus compared to the personal income tax is more significant, our government should make revenue budget control more emphasis on sales tax overcharges control; the level of consumption tax, corporate income tax and VAT control to budget revenue maintain a strong level, and contribution to the financial total surplus is smaller, which may not be the key to budget revenue to be used as control. Combined research findings, government should make the following aspects efforts.

It should be done to reform and improve the personal income tax system. Personal income tax overcharges affect the fairness of the distribution of wealth, which indicates that there is also a tax cuts room for tax levy. Firstly, reform the personal income tax system with the goal of “expand”. Considering the wealth distribution structure level, middle class has become the main source of tax, which leads to the result that the wealthy class has less commitment than middle class, so raising of the income tax threshold should be the key factor in the reform. Secondly, it is necessary to implement mixed income tax system, and reduce the burden for the working class. Comprehensive income tax system should be introduced and make income of taxpayers together to decide the tax policy, which will instead the current income tax system classification which lead single source of income for many working-class paying more taxes, and diversify sources of income of high-income tax paying less taxes. The tax burden of working-class is too heavy, which in turn aggravate social injustice. In transition time, we should take mixed income tax system with a comprehensive combination of classification. Thirdly, the gradual introduction of family taxation system is contributed to fully understand the burden on taxpayers, and transverse achieve a fair tax burden. It is highly need to change the current tax on an individual basis while ignoring the family burdens, gradually promote the family unit of a tax levy system to ensure the fairness of the tax burden.

Progressively fully open “VAT instead Business Tax” policy. Needle on sales tax and VAT taxes two parallel formation may lead to double taxation and tax overcharges, taxpayers of business tax may burden VAT, the taxpayer of VAT may burden sales tax, early in 2012, Shanghai as a pilot started “VAT instead Business Tax “policy, introducing modern service industry to range of VAT, to avoid double taxation because the business tax and VAT caused parallel, and control business tax overcharges. On the one hand, you need to sort out the original business tax plan and re-enactment “VAT instead Business Tax” tax collection program. On the other hand, as soon as possible to improve the provisional regulations of the law, improve the legislative level of the tax system, and to strengthen the control on tax code.

To promote the reform of tax administration and budget control. Firstly, from the administrative control levels, the assessment mechanism should be improved and change the policy to encourage the overcharges to develop a more reasonable tax incentives and disincentives. The second is to ensure the transparency of budgetary information, we could refer to the US Government Accounting Standards Board standard (GASB) management transparency enacted budget management to accept citizen monitoring. Thirdly, it should be done to reform the budget preparation methods, and improve the scientific zero-based budgeting. Zero-based budgeting will help improve efficiency in the use of funds under the cost-benefit principle. Last but not least, in the respect of pre-control on financial budget, revision and improvement “Budget Law” which was developed and implemented in 1994, especially for overcharges project. Change the phenomenon that the various departments do not require being approval by the Standing Committee in the transition to informed of the surplus to overspending, thereby forming convert a large number of surplus unfettered overruns. It should be done to strengthen the role of supervisory control and the ability of Standing Committee of the NPC on control the financial budget, and ensure that it perform well on the deputies of the budget and timely execution supervision.

References

- Hick (2006) Evolution of the Federal Budget: Surplus and Then from Surplus to Deficit Rare. Shanghai University of Finance and Economics Press, Shanghai, 155.

- McNees, S.K. (1995) An Assessment of “Official” Economic Forecast. New England Economics Review, 13-23.

- John, M.S. (2005) Public Financial Management―Analysis and Applications. 6th Edition, China Renmin University Press, Beijing, 520-532.

- Wildavsky, A. (1992) Political Implications of Budget Reform: A Retrospective. Public Administration Review, 52, 594-599. http://dx.doi.org/10.2307/977170

- Cleveland (2006) Evolution of the American Public Budgeting Concept. Shanghai University of Finance and Economics Press, Shanghai, 12.

- Niskanen, W.A. (2004) Bureaucracy and Public Economics. China Youth Press, Beijing, 38.

- Shirk, S.L. (2007) China: Fragile Superpower. Oxford University Press, New York, 6-8.

- Gao, P.Y. (2008) Concern Final Accounts Deviation. International Taxation, 1, 5-6.

- Ma, Z.H. (2008) Chinese Local Financial Revenue and Expenditure―The Whole Causal Association Study Panel Data. Management World, 3, 40.

- Wang, Y.J. (2002) Public Budget Management. Economic Science Press, Beijing, 126.

- Ma, C.C. (2009) The Formation Mechanism of Chinese Government Budget Surplus Funds and Counter Measures. Finance and Trade Economics, 4, 18-22.

- Wang, Y.M. (2012) Bureaucratic Budget Surplus Maximization Theory and Financial Problems Analysis. Fiscal Studies, 2, 46-49.

- Xu, Y.G. (2011) Revenue Forecasts and Budget Law―Legal Assessment of Final Accounts of Income Deviation. Social Sciences, 4, 43-51.

- Task Force Taxation Institute of the Central University of Finance (2007) Research on the Fiscal Surplus Revenue. Central University of Finance and Economics, 4, 1-5.

- Wu, M.M. (2013) Phenomenon of Our National Budget Surplus Study. Economic Perspectives, 2, 136.

- Hu, Y.J. and Chi, P.L. (2007) 1978-2006: Research on the Causes of Tax Rate Changes. Tax Research, 3, 3-13.

- Wang, X.Z. (2009) 1994-2007: Survey of China’s Fiscal Revenue and Expenditure Budget and Final Deviation. Economic Issues, 9, 164-167.

- Pesaran, H.H. and Shin, Y. (1998) Generalized Impulse Response Analysis in Linear Multivariate Models. Economics Letters, 58, 17-29. http://dx.doi.org/10.1016/S0165-1765(97)00214-0