Theoretical Economics Letters

Vol.05 No.02(2015), Article ID:55175,15 pages

10.4236/tel.2015.52024

A Theoretical Model of Competitive Equilibria in the New Car Market

Rebecca Abraham1, Mark W. Zikiye2, Charles Harrington1

1Huizenga School of Business, Nova Southeastern University, Fort Lauderdale, USA

2Zikiye Tactic Nutrition, Fort Lauderdale, USA

Email: Abraham@nova.edu, zikitnbusiness@gmail.com, charlieh@nova.edu

Copyright © 2015 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 14 February 2015; accepted 22 March 2015; published 30 March 2015

ABSTRACT

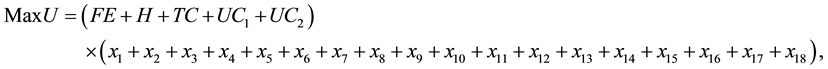

In the United States, the automobile purchase decision is consequential for both households and car producers. In households, adults typically own their own vehicles for personal use such as commuting to work or college. The need for multiple, safe cars per household represent a significant allocation of household income on an ongoing basis as old vehicles are replaced. Customer needs are represented by groups of demand utility functions which specify the demand for increas- ingly expensive safety features and styling changes. Auto manufacturers respond to the need for a variety of styles and safety features by producing vehicles in as many as 16 different product- market segments. They offer multiple financing options such as leases, late models, and stretching out payments to accommodate capital rationing by their customers. The quantity sold in each segment provides the profit per segment which adds across segments to provide the overall profit for the firm. This is a monopolistically competitive environment in which brand loyalty drives sales per segment, with each segment being considerably different from others in vehicle characteristics and customer income. This paper theoretically develops the demand utility functions within each segment, develops the producer’s profit function and then equates the supply and demand functions to obtain the optimal quantity per segment. Practical implications are discussed. One such implication is that the quantity of sales may not be realized in any one market, so that sales may have to be realized across markets for auto firms to achieve consistent, long-term profits. Thus, our quantity specification may provide a justification for the globalization of the auto industry.

Keywords:

Monopolistic Competition, Utility Functions, Competitive Equilibrium, Consumer Preferences

1. Introduction

The foundations of classical capitalist economic theory were pioneered by Adam Smith [1] , who viewed consumers as being engaged in the lifelong pursuit of betterment of their conditions. This goal was achieved by consuming goods that provided personal gratification. The production of these goods was the responsibility of the producer who was compelled to respond appropriately to meet the needs of the consumer. If producers effectively met consumer needs, consumers would continue to purchase their products to ensure continuous production that met costs and provided producers with a surplus [2] . The Marginalist Revolution [3] [4] specified consumer demand through the introduction of utility theory. Each consumer made rational choices to gain maximum satisfaction from goods purchased. Regarding the market for automobiles, consumers may purchase new cars or less expensive used cars. New cars are more expensive, but since they have never been driven usually have lower repair and maintenance costs than used cars. Therefore, consumers who purchase new cars generally are willing to pay higher prices for greater reliability. Dealers and manufacturers benefit from the higher prices received on new cars. In the 1970s, new cars were scarce. Consumers maximized their utility for new cars by paying monopoly prices for the limited number of units available. If a new model did not provide utility for any consumer, it was either leased or sold at cost as presented by Coase in his seminal paper on the subject [5] . The Malthusian conceptualization of continuous, profitable production prevailed with producers engaging in the release of few models and makes that consumed existing inventory [2] . In subsequent decades, the number of producers increased to the extent that monopoly prices could no longer be charged. We have identified 16 different product-market segments of subcompact, compact, large, etc. A number of models compete within each segment. For example, the subcompact category has 18 models, such as the Hyundai Accent SE, Ford Fiesta, Honda Fit and Chevrolet Sonic. The compact category has 26 models, such as the Volkswagen Golf, Subaru Impreza and Kia Forta. Consumers reveal a range of preferences within each segment. In the subcompact segment, one consumer may prioritize fuel economy over handling and turning circle, while another may select handling over the other criteria. Manufacturers produce models that meet these varying needs, or have different production functions to meet consumer utility functions. Monopoly profits disappear, as no single make or model dominates across product-market segments. Producers earn modest profits within each product market segment. Given the high initial cost of investment to enter the auto industry which acts as a barrier to entry, existing firms are engaged in intense competition to maintain market share by segment, the sum total of all market shares in all segments providing sufficiently high volume of total production for short-run profits > 0 per segment, and are obtained by (Average Revenue/Unit-Average Cost/Unit)*Sales Volume, thereby keeping each competing firm in operation. The new car producer has evolved from a monopoly to monopolistic competition, whereby there are many producers and many consumers, the product is differentiated and producers have limited control over price [6] .

The purpose of this paper is to 1) theoretically model the utility functions that describe consumer demand in 16 product-market segments, 2) mathematically develop the production functions for producers operating in a monopolistically competitive environment, and 3) provide an explanation for dealer practices such as leasing, accepting trade-in vehicles, selling last year’s vehicles and extending payment periods. We contribute to existing research in two ways. Firstly, we document that the car purchase decision devolves to a quantity equilibrium in contrast with the price equilibrium of an earlier era. Secondly, we integrate various aspects of the car buying experience from both the consumer’s and the producer’s perspective in contrast with the existing literature has been confined to either one or the other. The consumer position has been analyzed in terms of leasing [7] , brand loyalty [8] , brand name [9] , price responsiveness to taste [10] , socio-demographic profile [11] , and fuel economy [12] . The producer position has been examined from the standpoint of consumer rebates [13] , lemons [14] and consumer loans [15] .

2. Consumer Expectations

The consumer has been assumed to approach the dealer with utility functions composed of personal and product characteristics to be satisfied. Research in personal characteristics has found that they are of limited usefulness as determinants of new car expenditure [11] . The influence of product characteristics has been theorized as the additional price that consumers are willing to pay. It is based upon the value they place on the contribution made by a certain vehicle beyond other vehicles in its product-market segment [10] . For example, a customer in the subcompact market segment who is very concerned about fuel efficiency will be willing to pay an additional amount up to a limit for each additional unit of improvement in fuel efficiency standards, and select the vehicle that meets this standard. There may be intangible product characteristics such as prestige, which was observed to explain a significant amount of the demand for the Mercedes Benz E-class and the Saab 9.5. Within a product- market segment, there is high price elasticity, though such elasticity diminishes across segments. The Range Rover and VW Touareg in the SUV market are easily substituted, but a customer who is say, dissatisfied with the towing capability of such SUVs is unlikely to purchase a pickup truck, i.e. purchase outside the preferred product-market segment. This finding has been supported in that the mini, supermini, small family car, large family car, multipurpose vehicle, executive car, convertible, coupe, roadster, luxury car SUV and sport utility vehicle which showed segment-specific intercepts at 0.01 level of significance [9] . We wish to expand the number of classes in this study which was conducted from a European perspective, to be more suited to the US market.

The principal unobservable characteristic is brand name which has been considered to signal quality and thus reduce risk and cost for buyers [16] . Car purchases follow a complex decision-making process given the large size of the investment. Brand names facilitate this process by providing instant recognition which in turn makes favorable associations between brand names and quality [17] . In subsequent empirical studies, each of the 48 brands studied displayed highly significant brand-specific parameters at the 0.01 level [8] with repeat purchases for Chrysler leading Ford, General Motors and foreign manufacturers across both a national and a state sample [9] .

The practice of leasing emerged in the mainstream market in the 1990s as lower monthly lease payments permitted lessees to drive new cars in higher product-market segments than those acquired through purchase. For example, it was found that in the 50th-70th percentile of the income distribution, the median value of a leased vehicle was $5000 more than a purchased vehicle [7] .

3. Consumer Utility Functions

Subcompact Cars. We define the following objective function and constraints in a constrained maximization model for the choice among  automobiles seeking to maximize fuel economy, handling, turning circle, and unobserved product characteristics such as friend’s recommendations or positive press reviews of a new model.

automobiles seeking to maximize fuel economy, handling, turning circle, and unobserved product characteristics such as friend’s recommendations or positive press reviews of a new model.

(1)

(1)

Subject to

The list price must remain within a range of $14,770 - $17,241, the maximum and minimum for this category.

(2)

(2)

(3)

(3)

Equations (4)-(8) are common to all formulations. To maintain brevity, they will be assumed to be included in all subsequent formulations.

Monthly fixed expenses must sum to less than 35% of wage income to maintain stability of household income,

(4)

(4)

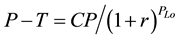

The car payment is the present value of price of the vehicle less the trade-in value or rebate discounted at the interest rate,  , for the life of the loan,

, for the life of the loan,  ,

,

The standard purchase loan is of a duration of 5 years or less,

(5)

(5)

(6)

(6)

As a single car is to be purchased, the selected car will assume the value of 1, while the other 17 rejected choices will assume the value of 0.

(7)

(7)

(8)

(8)

where

Monthly Car Payment = Principal + Interest

Monthly Car Payment = Principal + Interest

Fuel Economy

Fuel Economy

Handling

Handling

Turning Circle

Turning Circle

Case 1: The buyer leases the car for 2 years and then buys it back at the end of 2 years. As leasing permits the purchase of a more expensive vehicle, we may add a constraint indicating an elevation of status from leasing,

where

As the lease term ≤ 2 years, we replace constraint (5) with the following constraint,

The interest rate, r, is greater than the annual depreciation percentage of the value of the vehicle.

where d = Depreciation Percentage.

And an allowance must be made for buyback at the end of the lease period,

where

The loan repayment term on the buyback vehicle is at least 5 years,

where

Given that leased cars are just 2 years old, their repair and maintenance expenses may be constrained to remain within 5% of wages,

where

Door Small Cars. Utility functions for two-door small cars include the variable E for ease of entry. We add the additional constraint that there be 2 doors. Equations (2) and (3) are replaced with new limits, while Equations (4)-(14) are just adjusted for the number of cars, i.e. 6 instead of 16.

Subject to

where

Case 1 remains unchanged from Subcompact Cars.

Compact Cars. The criteria for evaluation of cars changes as do price and size dimensions. Fuel Economy, Handling, Rear Seat and Reliability are the criteria for most compact cars; However, color and styling specifications can be of importance for specific customers. Unobserved characteristics such as brand loyalty may be listed as a separate factor. We make the necessary adjustments.

Subject to

where

Case 1 remains unchanged from Subcompact Cars.

Midsized Cars. Evaluation criteria for new cars include Fuel Economy, Roominess, Powertrain and Quietness for 24 models. We state a new objective function and alter the right side of the price constraints to accommodate the new price limits for this category for 24 vehicles.

Subject to

where

As Case 1 is identical to Case 1 for Subcompact Cars, it is not repeated here.

Large Cars. Evaluation criteria for new cars include Fuel Economy, Roominess, Handling and Braking for 12 models. We state a new objective function and alter the right side of the price constraints to accommodate the new price limits. Brand Loyalty may be more noticeable with additional constraints signifying repeat purchase.

Subject to

Brand Loyalty is represented by the same model,

where

Case 1 applies unchanged.

Luxury Compact Cars. Evaluation criteria for new cars include Fuel Economy, Acceleration, Fun to Drive and Fit and Finish for 15 models. We state a new objective function and alter the right side of the price constraints to accommodate the new price limits. Brand Loyalty may be more noticeable with additional constraints signifying repeat purchase. Status is very much higher for a luxury vehicle, being well beyond a late-model lease.

Subject to

Brand Loyalty is represented by the same model,

where

Case 1 applies unchanged with the exception Equation (9) which is replaced by (32).

Luxury Convertible Cars. These vehicles are favored by men who value acceleration and high-technology features. They may increase in value over time and confer high status upon the owner.

Subject to

Status

Gender

Acceleration occurs in 30 seconds or less,

where

Case 1 remains unchanged except that the status constraint (5) is replaced by (36) to denote the higher status of the luxury convertible.

Luxury Midsized Cars. This segment values Fuel Economy, Safety Features (determined by performance on crash tests), Roominess and Acceleration. There are 17 separate models. Brand Loyalty prevails as does prestige, given the luxury designation.

Subject to

Status is included for the luxury brand,

Brand Loyalty is represented by the same model,

where

Case 1 applies unchanged with the exception of Equation (9) which is replaced by expression (44).

Ultra Luxury Cars. Ultra luxury cars maintain competitive advantage for 8 models by having special 1) convenience features such as changing inside lights, massage, and voice control of the navigation system, 2) safety features including rear view camera and stoppage in close traffic 3) acceleration in less than 30 seconds and 4) prestige which elevates an individual’s social position beyond the aforementioned Status variable. Depreciation is high with at 2 - 3 times the straight line rate.

Subject to

Brand Loyalty is represented by the same model,

We add a constraint to account for annual depreciation percentages at 2 - 3 times the straight-line rate,

where

Case 1 applies unchanged with the exception of Equation (9) which has been removed as we have included a prestige variable in the objective function.

Sports Cars. Sports cars are high-performance vehicles which are perceived as fun to drive while accelerating rapidly. Their distinguishing feature is that they have 2 doors and an acceleration that may outperform the typical vehicle. We may include a 4A factor in the objective function, i.e. 4 × Acceleration to account for the superior acceleration. Price is indeterminate with a wide range of prices ranging from $ 23,175 - $110,630 for 27 models, so that price limits and the status variable must be excluded from the constraints

Subject to

Brand Loyalty is represented by the same model,

where

Case 1 applies unchanged.

Small Sport Utility Vehicles (SUVs). The demand for sport utility vehicles over cars is driven by family size. The more children under the age of 18, the greater is the need for transportation of additional family members and their equipment to athletic and recreational activities. It follows that roominess and safety features must be maximized. Given the large size of the vehicles and the daily travel to multiple locations, the vehicles must dis- play agility in turning corners and evading high-speed traffic. There are 19 vehicles in this category, suited for small, 1 - 2.

Child families.

Subject to

Family Size must consist of more than 2 individuals

To justify the purchase of a small sport utility vehicle, there must be fewer than 3 children,

Brand Loyalty is represented by the same model,

where

Case 1 applies unchanged.

MidSized Sport Utility Vehicles and Large Sport Utility Vehicle shave identical models to Small Sport Utility.

Vehicles, with the exception of the objective function, price limits, and the removal of the family size constraint (54).

For MidSized Sport Utility Vehicles, the objective function is

Subject to

For Large Sport Utility Vehicles, the objective function is

Subject to

where

Luxury Compact Sport Utility Vehicles and Midsized/Large Luxury Sport Utility Vehicles are identical in model to Small Sport Utility Vehicles, with the exception of the objective function, price limits, the removal of the family size constraint (54) and the addition of a wage constraint to stipulate luxury, i.e. that wages be ³$150,000.

For Luxury Compact Sport Utility Vehicles, the objective function is

Subject to

For Large Luxury Sport Utility Vehicles, the objective function is

Subject to

where

Pickup Trucks. Pickup Trucks compete on the basis of hauling strength measured by powertrain, transmission and towing. They have a unique price range for 8 models and may be used by individuals engaged in home improvement or construction, so that an additional constraint may be included for the occupation variable.

Subject to

where

Case 1 remains unchanged.

4. The Solution to the Consumer’s Utility Maximization Function

In this section, we develop a sample solution to the models presented in Section 2.5 using Subcompact Cars as an example. Consumer 1 has the following utility function subject to constraints expressed as equalities. He or she will select 1 of 18 models that optimize needs for fuel efficiency, handling and turning circle and 2 unobserved characteristics.

Subject to

We deduct the extra amount, FF, that Consumer 1 is willing to pay for product characteristics from the minimum price for subcompact cars, such as an extra amount for fuel efficiency.

We add the extra amount, C, that Consumer 1 is unwilling to pay for product characteristics to the maximum price, such as a different color for the cup holder.

We add an amount, E, for unexpected fixed expenses to the monthly mortgage payment, car payment and other fixed expenses to equate to 35% of wages.

For Case 1: Leasing a New Car

V is a subjective level of prestige that Consumer 1 elects to eschew in order to purchase the low-cost, less- prestigious subcompact car.

R = d + g (87)

The interest rate on the auto loan is the sum of the depreciation rate, d, and g, a risk premium which is sufficiently high so that average revenue > average cost.

The loan repayment period for the lessee’s vehicle purchase after surrendering the leased vehicle is 5 years and an additional period, Y, that will assure that that average revenue > average cost for the dealer.

We add O, for unexpected repairs and maintenance to routine maintenance expenses which equate to 5% of wages for pre-leased car.

We express the constraints as multiple Lagrangian functions, with Lagrange multipliers,

If the vehicle is purchased,

If the vehicle is leased,

Differentiating the reciprocal of the objective function, we obtain the rate of change in the automobile choice based upon, say fuel efficiency, or handling, etc. The selected model will have a first derivative = 1, all others will be 0. If

For a purchased car,

For a leased car,

Consumer 1’s choice of x1 will locate on a boundary of all possible optimal choices of models. Another consumer’s choice will locate at another point on the boundary of combinations of product characteristics, so that all consumers will find their optimal choice of product characteristics at some point on the boundary. Each of the 8 constraints will be represented by a line tangent to the boundary. The point of intersection of all tangent lines on the boundary will represent the ideal choice for a particular customer or a group of customers, say for

For a purchased car,

For a leased car,

5. Producer Strategies

Under monopolistic competition, any price differential is immediately mimicked by competitors so that prices remain within a narrow range. Profitability is achieved by selling the entire quantity produced. Since each model only attracts a limited number of customers, product characteristics such as make and model become powerful determinants of dealer sales [18] .

First, the dealer attempts to sell at list prices offering rebates to first-time buyers and trade-ins to repeat customers. Such discounts are usually generous as they offer a means to distinguish the dealer from the competition. Any loss is recovered by increasing interest rates or stretching the loan repayment period, which over the years has increased from 4 - 5 years to 6 - 7 years [18] . Offers of 0% financing result in substantially higher interest rates over the life of the loan as the loan payment remains higher than the annual depreciation charges. Secondly, the dealer may reduce the inventory of new cars by leasing them. Approximately, 30% of new cars are leased [19] . Not only does leasing reduce the inventory of new cars, it reduces the adverse selection problem in the used-car market by providing an inflow of newer, higher quality used cars with lower repair costs than the typical used car [20] making it possible for dealers to charge higher prices for these cars. Further, about 20% - 25% of the leased cars are purchased by the lessee upon expiration of the lease thereby permitting further reduction of new car inventories.

The Producer’s Supply Function

We begin with a standard stochastic differential equation where

This equation can be rearranged discretely to serve our econometric application:

Production volume is a variable predicated on consumer demand. It fluctuates in accordance with interdependent and independent factors. For example, vehicle affordability and fuel economy are separable variables that are strongly codependent in view of the vehicle’s selling potential. Our theoretical model homogenizes these independent variables, positing that the profit function is not substantially influenced by codependent variable separation. The incentives for vehicle purchase vary among income, age, gender and demographic cohorts. Purchasing incentives that are mutually shared between cohorts or within a cohort takes precedence over non-uni- versal incentives (i.e. cup-holder color, seat stitching pattern, etc.). The subsidiary features can be relegated to statistical outliers for buyers in lower purchasing brackets. The higher the purchasing bracket the more relevant otherwise subsidiary features become, making attention to detail on the part of the manufacturer a staple of production. Note that we distinguish between buyer income and purchase bracket since the two are not always linked. Factors are denoted

where

Our goal is to minimize production cost and maximize dealer profit by underscoring an optimal equilibrium between buyer purchasing incentive and the manufacturer’s ability to follow through. Buyer incentive represents a family of factors each coefficient of which is mutually separable between each other but in totality drives the likelihood of purchase for potential buyers. We use a gradient to designate a class of variables that, when fluc- tuate, influence production cost and final price.

We use an estimation function

Minimizing combinatorial factors that strengthen the vehicle’s selling points saves the manufacturer time and money while allowing for profit enhancement and sustainability. We thus maintain that the manufacturer’s profit function is influenced by

6. Competitive Equilibria

The optimal production quantity per segment is given by Equation (97).

If we substitute the solutions to the demand functions specified in Equation (92) and Equation (93) in Equation (97)

We will obtain the equilibrium quantity of automobile

For a purchased car,

For a leased car,

As production costs increase, these costs may only be recovered through sales of automobiles in multiple national markets. Such an occurrence increases the globalization of the automobile industry.

Cite this paper

RebeccaAbraham,Mark W.Zikiye,CharlesHarrington, (2015) A Theoretical Model of Competitive Equilibria in the New Car Market. Theoretical Economics Letters,05,196-211. doi: 10.4236/tel.2015.52024

References

- 1. Smith, A. (1776) An Enquiry into the Nature and Causes of the Wealth of Nations. Liberty Classics, Indianapolis.

- 2. Malthus, T.E. (1798) An Essay on the Principle of Population. Oxford Classics, Oxford.

- 3. Jevons, W.S. (1876) The Future of Political Economy. Fortnightly Review, 20, 617-631.

- 4. Menger, C. (1876) Principles of Economics. Ludwig von Mises Institute, Alabama.

- 5. Coase, R.H. (1972) Durability and Monopoly. Journal of Law and Economics, 15, 143-149. http://dx.doi.org/10.1086/466731

- 6. Chamberlin, E.H. (1933) Theory of Monopolistic Competition. Harvard University Press, Cambridge.

- 7. Aizcorbe, A., Starr, M. and Hickman, J. (2004) Vehicle Purchases, Leasing and Replacement Demand. Business Economics, 1, 7-17.

- 8. McCarthy, P.S., Kannan, P.K., Chandrasekharan, R. and Wright, G. (1992) Estimating Loyalty and Switching with an Application to the Automobile Market. Management Science, 38, 1371-1393. http://dx.doi.org/10.1287/mnsc.38.10.1371

- 9. Baltas, G. and Saridakis, C. (2009) Brand-Name Effects, Segment Differences and Product Characteristics: An Integrated Model of the Car Market. Journal of Product & Brand Management, 18, 143-151. http://dx.doi.org/10.1108/10610420910949040

- 10. Thomassen, O. (2014) A Pure Characteristics Demand Model for Automobile Variants. Seoul Journal of Economics, 27, 187-222.

- 11. Prieto, M. and Caemmerer, B. (2013) An Exploration of Factors Influencing Car Purchasing Decisions. International Journal of Retail & Distribution Management, 41, 738-764. http://dx.doi.org/10.1108/IJRDM-02-2012-0017

- 12. Jeihani, M. and Sibdari, S. (2010) The Impact of Gas Price Trends on Vehicle Type Choice. Journal of Economics and Economics Education Research, 11, 1-11.

- 13. Johnson, J. and Waldman, M. (2003) Leasing, Lemons and Buybacks. The RAND Journal of Economics, 34, 247-265. http://dx.doi.org/10.2307/1593716

- 14. Goldberg, P.K. (1996) Dealer Price Discrimination in New Car Purchases: Evidence from the Consumer Expenditure Survey. Journal of Political Economy, 104, 622-654. http://dx.doi.org/10.1086/262035

- 15. Phelps, C.W. (1944) Monopolistic and Imperfect Competition in Consumer Loans. Journal of Marketing, 8, 382-393. http://dx.doi.org/10.2307/1246159

- 16. Erdem, T. and Swait, J. (1998) Brand Equity as a Signaling Phenomenon. Journal of Consumer Psychology, 7, 131-157. http://dx.doi.org/10.1207/s15327663jcp0702_02

- 17. Keller, K.L. (1993) Conceptualizing, Measuring and Managing Consumer-Based Brand Equity. Journal of Marketing, 57, 1-22. http://dx.doi.org/10.2307/1252054

- 18. Goldberg, P.K. (1996) Price Discrimination in New Car Purchases: Evidence from the Consumer Expenditure Survey. Journal of Political Economy, 104, 622-654. http://dx.doi.org/10.1086/262035

- 19. Desai, P. and Prohit, D. (1998) Leasing and Selling; Optimal Marketing Strategies for a Durable Goods Firm. Management Science, 44, S19-S34. http://dx.doi.org/10.1287/mnsc.44.11.S19

- 20. Johnson, J. and Waldman, M. (2003) Leasing, Lemons and Buybacks. The RAND Journal of Economics, 34, 247-265. http://dx.doi.org/10.2307/1593716