Applied Mathematics, 2011, 2, 699-704 doi:10.4236/am.2011.26092 Published Online June 2011 (http://www.SciRP.org/journal/am) Copyright © 2011 SciRes. AM G-Contractive Sequential Composite Mapping Theorem in Banach or Probabilistic Banach Space and Application to Prey-Predator System and A & H Stock Prices Tianquan Yun Department of En gi ne eri n g Mechanics, School of Civil Engineering and Transportation, South China University of Technology, Guangzhou, China E-mail: cttqyun@scut.edu.cn Received March 21, 201 1; revised April 7, 2011; accepted April 10, 2011 Abstract Theorems of iteration g-contractive sequential composite mapping and periodic mapping in Banach or prob- abilistic Bannach space are proved, which allow some contraction ratios of the sequence of mapping might be larger than or equal to 1, and are more general than the Banach contraction mapping theorem. Application to the proof of existence of solutions of cycling coupled nonlinear differential equations arising from prey-predator system and A & H stock prices are given. Keywords: G-Contractive Mapping, Periodic Mapping, Probabilistic Banach Space, Prey-Predator System, Differential Equation of Stock Price 1. Introduction Fixed point theorems play an important role for the proof of existence of solution of equations of algebra, differen- tial, and integral, etc. It has been applied to many areas such as mathematical economics, game theory, dynamic optimization, functional analysis, etc. A lot of research work on fixed point theorems of various mappings on different spaces have been done (see [1,2] and their ref- erences). Among these works, the Banach contraction mapping theorem is a basic theorem for many research works. However, the Banach contraction mapping theo- rem needs a serious restriction, that is, all contraction mapping ratios must less than a constant less than 1. In- stead of this restriction, a loosed restriction which allows some contraction mapping ratios to be greater or equal to 1 but the geometric mean of contraction mapping ratios of the sequential mapping (simplifying as “g-contraction mapping”) must less than a constant less than 1, is pro- posed by the author [2]. In this paper, the iterative g-contraction mapping and periodic mapping theorems in Banach or probabilistic Banach space are proved and application to cycling coupled nonlinear differential equations arising from prey-predator system and A & H stock prices are given.. The A-stock market in mainland China is a new de- veloping market and is going to connect the rule with international market. The H-stock market in Hong Kong is a district international stock market. Many companies have their shares in both A- and H-markets, e.g., the China Petrol (601857) and Petro China (HK0857), a sig- nificant share in A-stock market. Although there are some papers on computational stock price based on cer- tain model [3,4], however, no paper on quantitative analysis of stock prices on different stock markets has been found. This paper establishes a cycling coupled differential equations of stock prices of A & H shares, and uses the theorem to prove the existence of solutions and further more find the solution as well as the prey- predator pro ble m. 2. Main Results In the following, let us consider a sequential mapping i T, 1, 2,iN , 1, i : ii i TX X M , M is a probability Banach space, i.e., a comp lete non empty metric space satisfied probabilistic requirements. Definition 2.1. A sequential mapping i T satisfied (1) is called the sequential composite mapping. 11 : or , iiii ii ii TXXx Tx xX MiN , (1)  T. Q. YUN 700 1 By induction, and d efine 1111 i iii TTTx Tx , (2) where 11 1 and , ii i TTT TT (3) The symbol F G represents the composition of map- ping F and mapping G. Definition 2.2. shown in (4) is called the contrac- tion ratio of . i r i T 11 sup d,d,0 , iii i i i rTxTyTxTy xy X (4) where , y are continuous random variables, d, y is the distance between and in y , and 01T . Obviously, we have 12 d, d, , nn n TxTyrrrxy xyM , (5) Definition 2.3. i shown in (6) is called the iterative contraction ratio of . i T 11 Sup d,d,0, , ii ii i sTxTxTxTx xM (6) Obviously, we have 11 12 d,d,, nn n TxTx sssTxxxM (7) Definition 2.4 A sequential composite mapping is called the g-contraction mapping, if for each i T iN , there exits a constant G, such that the geometric man contraction ratio satisfies. i G 1 12 0,,,1, i ii Grr rGiN (8) Definition 2.5. A sequential composite mapping is called the iterative g-contraction mapping U, U if for each , there exists a constant G, such that the iterative geometric mean contraction ratio satisfies. i T iN i G 1 12 0,,,1, i ii Gss sGiN (9) Obviously, condition (9) is weaker than condition (8). Theorem 2.6. Any sequential composite iterative g- contraction mapping of a complete nonempty metric space M into M has a unique fixed point in M. Proof: Suppose that the sequential composite mapping satisfies (9). i TChoose any point in M , then ,we have 11 d,, nn n n TxTx GTxxn 0 By the triangle inequality, we have for mn 112 1 12 12 1 d, d,d,d , d, mn mmm mn n mm n mm n TxTx TxTx TxTxTxTx GG GTxx By (9), we have 12 1 d, d, mnm mn TxTx GGGTxx 1 limd,1d ,0, , mn n TxTx GGTxx mn Since, M complete, the sequence has a limit z in M. i.e., n Tx , n Txzx Mn z . This fixed point in unique, if there are two fixed points z and w, i.e., 1n Tx and n Txw , then 11 d,d,d ,0 nn n n zwT xTxGTxxn , i.e., z = w. Obviously, this theorem allows part of contraction ra- tio if (9) holds. But the Banach contraction map- ping theorem needs each contraction ratio r less than1, so this theorem is more general. If , only 1 1 i s 1iTT , then Theorem 1 reduces to the Banach contraction mapping theorem. Definition 2.7. A sequential composite mapping T is called the periodic mapping with period k, if , 1,2,,. , jjnk TT jknN (10) and is denoted by 1 n P . Where the superscript n denotes the times of cycling, the subscript 1, 2,,jKk indicates the mapping at the corresponding space , we have 1 11 11 11 1 :, or , ,, jjj 11 jjjjjkj k jjk jjk j TXX xTxTT Tx Px xx X 1 (11) 11 jj jk PTT T , (12) 1 111 11 nn 1 nk jjjjjj TP PPPPP , (13) , :, , jjjk j kjj jjkjj PX XX Pxx xX (14) Theorem 2.8. Any periodic iterative g-contraction mapping of complete nonempty metric space M has a unique set of k related fixed points in M. That is *jj XM, such that ****** 1 , , , jjjjjkjj Pxx Txxxx (15) Copyright © 2011 SciRes. AM  T. Q. YUN701 Proof: For a periodic iterative g-contraction mapping, (7) becomes 1 1 d, d, d,, n k nn jjj j j n kj PxPxsPxx GPxxxM (16) where 1 1 k kj j GsG , (17) The same treatment as Theorem 1 for each n P in- stead of , we can prove that i Tn P has a unique fixed point * , i.e., *n* j Px x **nn j 1 then 1 * , jj jjjj jj xPxPPx Pxn * (18) ** * 1 jj jk Tx xx , (19) ** , jk j xjK (20) 3. Applications 3.1. Application to the Prey-Predator System Problem in Banach Space 3.1.1. Considering the Following Cycling Non-Linear Coupled Differential Equa tions Arisin g from a Model of Prey-Predator System [5] 12 d, d xkax kxy t (21) 2 d, d ykxyk t 3 (22) where X, and Y are continuous variables, and represent the numbers of prey and predator respectively; , are the sets symbolised the prey, and predator respectively; , , , are constants. Equation (21) shows that the increasing rate of Ya1 2 kk 3 k is proportional to the product of and the amount of food ; and is decreasing with the produ ct of a and . Equation (22) shows that the increasing rate of is proportional to the product of y y and ; and is decreasing with (natural death). y y 3.1.2. The Proof of Existence of Solution of (21), (22) by Theorem 2.8 Equations (21) and (22) are rewritten as (23) and (24) respectively: 1 2 1dln , d x ykaTx kt 32 2 1dln , d y kTy kt (24) or 12 1 ,yTTyPy (25) 21 2 , TTxPx (26) Then, Equations (25) and (26) can be solved by itera- tion method, we have 11 111111 , , 1,2, i ii i yPyPP PyPy yYi (27) 12 222121 2 , , 1,2, i ii ii PxP PPxPx xTyXi (28) , are Banach spaces. 1, 2 are continuous mappings. 1, 2 are periodic mappings. Since 1 T, 2 are continuous functions, 1, 2 as well, therefore it must be bounded. We choice the supper norm as the distance on YT T P P TP P and Y, i.e., 11 22 Sup, Sup, for ,, and 1,2,, ii Py RPxR xXyYiN (29) Then, (16) becomes 11 1 11 1111 21 1 d, d,d,, ii iiii ii PyPyPyPy PyPy GPyy G Pyy (30) where the constant is chosen G 12 11, 2, max,GS SRRRR , (31) According to Theorem 2.8, in (25) has a fixed point y ** 1 Py in Y. Similarly, in (26) has a fixed point * 2* Px in X, and ** 2 Ty, ** 1 Tx. 3.1.3. An Exact Solution of (21), (22) The solution of (21), (22) had been developed by Lotka (1925) and Vollerra (1926) independently (Refs. 1.7 and 1.8 of [5 ]). How ev er, we can’t f ind th ese articles f or long ages far from now. Notice that (21), (22) may have no exact solution in general, except the food amount in a special case. Let us find an exact solution by guest. a Suppose that expsin , bc t (32) Substituting into (24), we get y 32 cos , tk k (33) Substituting into (23), if the food amount is a special function of t shown in the following form a 1 (23) Copyright © 2011 SciRes. AM  T. Q. YUN 702 2 2 12 sin exp sin, cos kct abct kkc t (34) then, (23) is satisfied, and (32), (33) are solutions of (21) and (22). It should be mention that the supposition of food amount to be a periodic function is reasonable and confirm with the fact than that of the supposition of to be a constant. a aThe exact solution of (21), (22) has a referent meaning for understanding the relationship among food, prey and predator quantitatively. The number of predator mainly depends on the number of prey y ; and mainly depends on the food amount . , a a and are periodic functions with the same period y . 3.2. Application to the Prey-Predator System Problem in Probabilistic Banach Space Equation (21) shows that the growing rate of prey num- ber is proportional to the product of the food amount and the number of prey a , if other elements keep unchanged. The proportion constant is 1. Equation (22) shows that the growing rate of predator number is inverse proportional to the product of ky and , if other elements keep unchanged. The inverse proportional constant is . And constant 3 represents the natural death rate of . It is reasonable and reflect the fact that 1, 2 and 3 k are considered as independent random variables than that of constants. Let 1, 2 y kv 2 kyk k kku , be independent continuous random variables , , , then, 3 k vwwu ,,, xtuvw, ,, , ytuvw, are continuous random variables and satisfy the probabilistic properties, i.e., 0, 0,fx gy 1, 1, 1, 1, (35) 0 0 00 d 00 d x y pxFx fxx pyGy gyy (36) 0 0 dd dd M M x y fx xfx x gy ygy y (37) where , , , are the density function, distrib- uted function of G and respectively; is the probability. y p Comparing xt X and yt Y of (23) and (24) in Banach space with ,,,0,M xtuvwx M and ,,,0,M ytuvwyM in probabilistic. Banach space , we found that there is no differ- ence between the distanc e s d efined by Sup norm, i.e., Sup, , ,Sup, Sup,, ,Sup, M xtuvwxt x yytuvw yty Mappings 1, 2 and 1, 2 of (25) and (26) in Banach space are continuous mappings, so these map- pings are still continuous mappings in probabilistic Ba- nach space ((Lemma 4.3 continuous mapping) of [2]) and the proof of ex isten ce of fix ed po in ts in Section 3.1.2 is still suited for the case of probabilistic Banach space. T TP P 3.3. Application to A & H Stock Prices 3.3.1. Cycli n g Co up l ed Di f ferential Equa tions of Stock Prices of A & H Shares Let xt and yt be the stock prices of China Petrol (601857) and Petrol China (HK0857) re- spectively. Follows the set up of differential equation of stock price [3,4], we have: 1) Equations of amount of purchasing and selling of t 1 12 , p tpxtpxtayt (38) 1, s tsxtayt (39) where p t and s tp are the amount of purchasing and selling respectively; 1, 2, 1 p , are constants; (36) shows that a p t is inversely proportion to t and proportion to the difference of tayt; (37) shows that s t is proportion to tayt. 2) Assumes that the changing rate of stock price is proportion to the difference of demand and supply, we have d dps x At At t , (40) where constant g keeps the same of dimensions in both sides of (40). 3) Substituting (38) an d (39) into (40), we have 1 1 321 11d , d p yTxx x apsagt (41) Similarly, we have 1 121 421 21 1d , d pps y xTy yy psps gt (42) In which, the right hand side of (36) is changed to 1 12 pyp ayx , and (39) is unchanged. Equations (41), (42) are cycling coupled non-linear differential equations, and 3, 4 are continuous map- pings. Similarly to (25) and (26), (41) and (42) have T T Copyright © 2011 SciRes. AM  T. Q. YUN703 fixed poi nt s and 34 43 **yTTy** TTx. If the coefficients in (41) and (42) are viewed as ran- dom variables, then, and y are the functions of random variables, like the case in Section 3.2, and y also have fixed points in probabilistic Banach space. 3.3.2. An Exact Solution of Speculating Type Differential Equations of Stock Price for A & H Stocks Usually, (41), (42) may have no exact solution. However, for a simplest case, for example, the second term in (38) is much larger than the first term, i.e., the speculation on the difference of stock prices in A & H stock market (and suppose that there is no limit for money freely to pur- chase a stock in A or H stock market) forms a major part of the purchasing volume. In such case, , and (41), (42) become 10p 11d , d yx ag t (43) 21 21 1d , d y gt ps xy ps (44) Equations (43), (44) are cycling coupled differential equations of stock prices in A and H stock markets. Substituting (44) in to (43), we have 2 2 dd 0,y d d yy RS t t (45) where Rgakg, 2 kgSa, 21 21 p ks ps . Equation (45) has exact solution, depended on the root of characteristic function . 2 rR 0rS 2 2 p , 1) when , 240RS 11 exp ex CrtCrt (46) where , are arbitrary constants, and 1 C2 C 2 1 rRR 42,S 2 242rRRS , 2) When , 240RS exp, 2,yCrtr R 0 (47) 3) When , the characteristic function has complex roots and there is no real meaning for has complex value and thus is out of discussion. 24RS y Similarly, substituting (43) into (44), we have, 2 2 dd 0, d d xxS Rx ta t (48) 4) When 240RSa , 3344 expexp , CrtCrt (49) where , are arbitrary constants, and 3 C4 C 2 342rRRSa , 2 442rRRSa , 5) When 240RSa , 55 exp, 2,xCrtr R (50) 6) When 240RSa , has no real meaning and is out of discussion. 4. Discussion on the Solution We are interested in “what is ” and “how to find ”. a a *axt yt* is the ratio of A-share price to H-share price at the equilib rium time . If , then the “hot money” (money can freely purchase or sell stocks in A and H markets) rushes into H-stock market to purchase the cheaper shares; if *t 0y 0xay xa , then the hot money rushes into A-stock market to purchase the cheaper shares. And if 0xay , then it is the equilibrium state, in which no profits can be made by speculating the dif- ference of sto ck prices in A-stock or H-stock m a rke t s. a is an important value for decision making of op- erators. But how to find = ? a From (41), if dd0xt , then, **axt yt. From (42), if dd 0yt , then, 11 tkyt. If both stock prices are in equilibrium state at the same time 1 *tt , then ak . The determination of coefficients via market data may be referr ed to [3], or we can directly use the share prices both in temporary equilibrium states (the so-called “Doji” or the Chinese stock market saying “cross star”) of A and H stock markets at the same time to find . For example, 2008-04-10, a “Doji” for China Petrol (601857) (op ening price 17.11, closing price 17.35 RMB) and a near “Doji” for Petrol China (HK0857) (opening price 10.20, closing price 9.82 HKD). Then, = a a y = 17.35×0.88/9.82 = 1.554. (where 0.88 is the changing rate for RMB to HKD) The analysis of this example might be useful to deci- sion making of operators and is referred [6] for details. 5. References [1] A. T. Bharucha-Reid, “Fixed Point Theorems in Prob- abilistic Analysis,” Bulletin of the American Mathemati- cal Society, Vol. 83, No. 5, 1976, pp. 641-657. doi:10.1090/S0002-9904-1976-14091-8 Copyright © 2011 SciRes. AM  T. Q. YUN Copyright © 2011 SciRes. AM 704 [2] T. Q. Yun, “Fixed Point Theorem of Composition G-Conaction Mapping and Its Applications,” Applied Mathematics and Mechanics, Vol. 22, No. 10, 2001, pp. 1132-1139. doi:10.1023/A:1016337014775 [3] J. S. Yu, T. Q. Yun and Z. M. Guo, “Theory of Computa- tional Securities,” In Chinese, Scientific Publication House, Beijing, 2008. [4] T. Q. Yun and G. L. Lei, “Simplest Differential Equation of Stock Price, Its Solution and Relation to Assumption of Black-Scholes Model,” Applied Mathematics and Me- chanics, Vol. 24, No. 6, 2003, pp. 654-658. doi:10.1007/BF02437866 [5] C. W. Gardiner, “Handbook of Stochastic Methods, for Physics, Chemistry and the Natural Sciences,” Springer- Verlag Press, Berlin, 1983. [6] T. Q. Yun and T. Yun, “Simple Differential Equations of A & H Stock Prices and Application to Analysis of Equi- librium Stat e,” Technology and Investment, Vol. 1, No. 2, 2010, pp. 111-114. doi:10.4236/ti.2010.12013

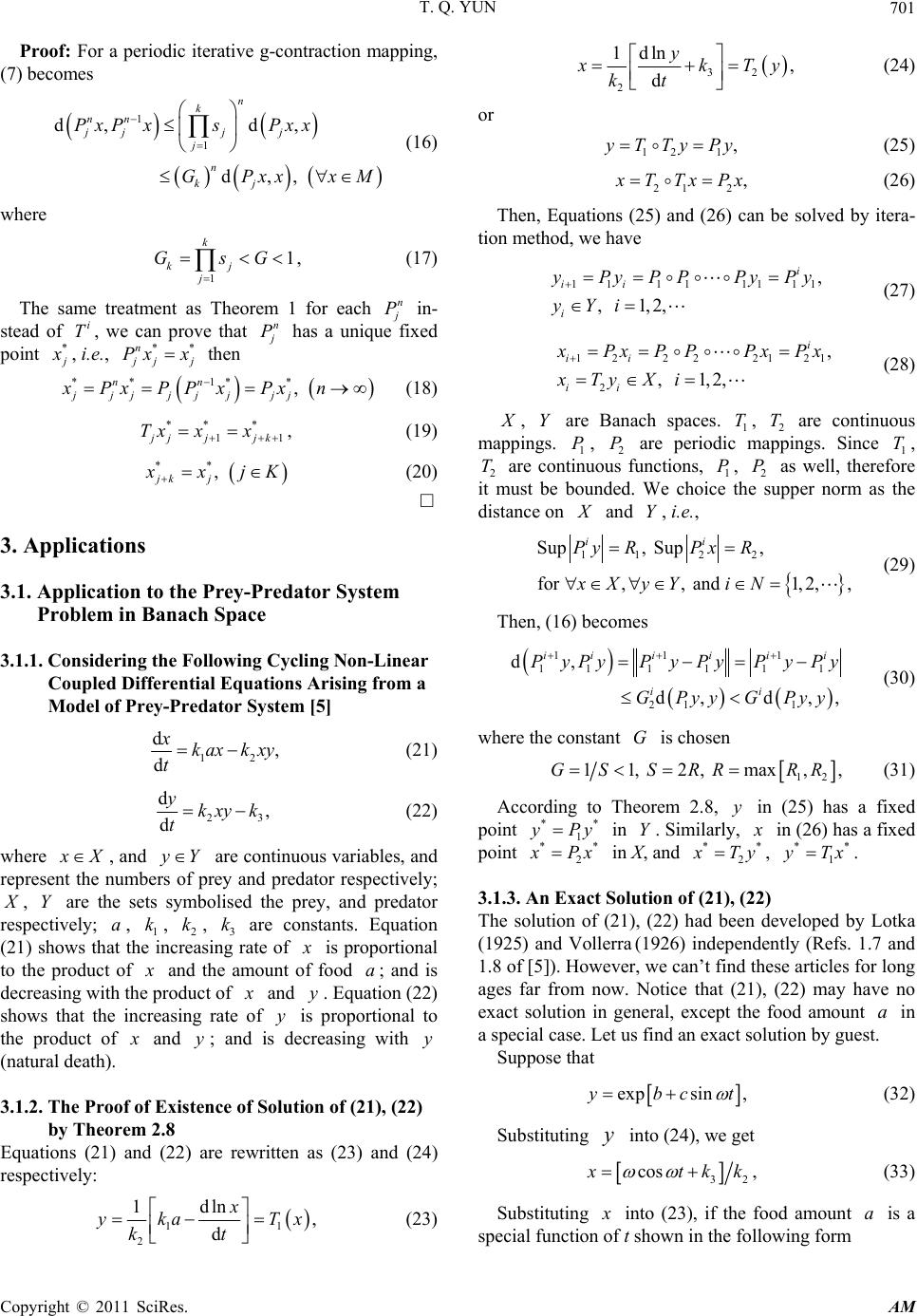

|