Modern Economy

Vol.08 No.07(2017), Article ID:77815,13 pages

10.4236/me.2017.87063

The Marginal Propensity to Import in China and the Composition of Australia’s Exports: Some Interesting Revelations

Andrew Marks

School of Business, Western Sydney University, Sydney, Australia

Copyright © 2017 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: May 29, 2017; Accepted: July 18, 2017; Published: July 21, 2017

ABSTRACT

The marginal propensity to import manufacturing products is rising more rapidly than the marginal propensity to import primary products in China, yet Australia’s exports to this country are concentrated in primary products thereby leading to large export revenue and hence output and employment losses. The over-reliance on primary product exports to China has also led to fluctuations export revenue and hence output and employment growth. These problems have been compounded due to these products dominating the export base. Adopting industry policy to stimulate manufacturing exports and thus broaden the export base has the potential to alleviate the losses and fluctuations in export revenue and hence output and employment growth when Australia trades with China and the rest of the world.

Keywords:

Australia, China, Marginal Propensity to Import, Primary Exports, Manufacturing Exports, Industry Policy

1. Introduction

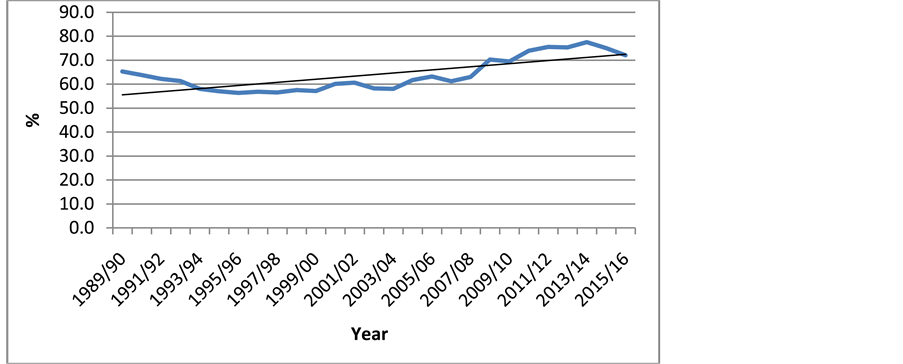

The Chinese market has progressively been absorbing an increasing proportion of Australia’s (merchandise) exports in recent times. This is displayed by the following figure in the period 1989/1990-2015/2016.

Figure 1 displays a sustained increase in the proportion of Australia’s exports diverted to China. Of interest also is the more pronounced increase since 2000/01 which appears to largely reflect the upsurge in demand and hence value of Australia’s primary and in particular mining exports to this country. This latter trend implies particularly strong export revenue growth which is likely to have made China a more prominent export destination relative to other coun-

Figure 1. Exports to China as a proportion of total Australian exports.

Table 1. The relative importance of the Chinese export market to Australia.

Source: ABS Cat. No. 5368.0, Merchandise exports and ABS Cat. No. 5302.0 Balance of payments and international investment position. [2]

tries, a phenomenon depicted by the following Table 1.

Table 1 reveals China to have absorbed $34,860 m of Australia’s exports which constitutes 30.8 percent of total exports thereby becoming the highest ranked export market in 2015/16. Japan is ranked a distant second with $34,860 m which contributes 14.5 percent of Australia’s exports. S. Korea, the U.S. and India are ranked as the third, fourth and fifth most important export markets constituting 7.0, 5.4 and 3.9 percent of Australia’s exports respectively1.

Despite the significant inroads made by Australian exporters in the Chinese market, a number of challenges nevertheless exist, one of which is to maximise export revenue2. An underlying factor that will determine the extent to which this objective is achieved will involve assessing whether Australia’s exports are concentrated in those goods that exhibit the strongest growth in the marginal propensity to import in China. The major objective of this paper therefore is to estimate the marginal propensity to import manufacturing and primary products in China in order to undertake a comparison with the composition of Australia’s exports to this country. This in turn will determine whether there is a “match” between the imports in strongest demand in China with the products dominating Australia’s exports to this country. This will have critical implications for export revenue and hence output and employment growth in Australia. Apart from these important macroeconomic implications, this exercise will also reveal dimensions of export trade between Australia and China which will be interesting in light of the fact that there have not been previous formal studies on trade in exports and imports between these countries.

The rest of the paper is organised as follows. Section 2 will canvas the theory of trade with the following section estimating the marginal propensity to import manufacturing and primary products in China. Section 4 will disclose the composition of Australia’s exports to this country. The following section will compare the magnitude of the marginal propensity to import manufacturing and primary products in China with the type of goods exported by Australia to this market in order to assess the impact on the economy and hence undertake a brief discussion of the implications for policy. Section 6 will provide an overview of the main results of the paper.

2. Theory of Trade

International trade theory emphasises free trade will prompt the reallocation of resources from the less to relatively more efficient sectors of the economy which exhibit a comparative advantage on the international market. This constitutes specialisation which leads to higher exports from these sectors thereby buoying growth in output. Australia also engages in free trade that has led to a comparative advantage in primary products which dominate the export base3. This is highlighted by the following figure in the period 1989/90-2015/16.

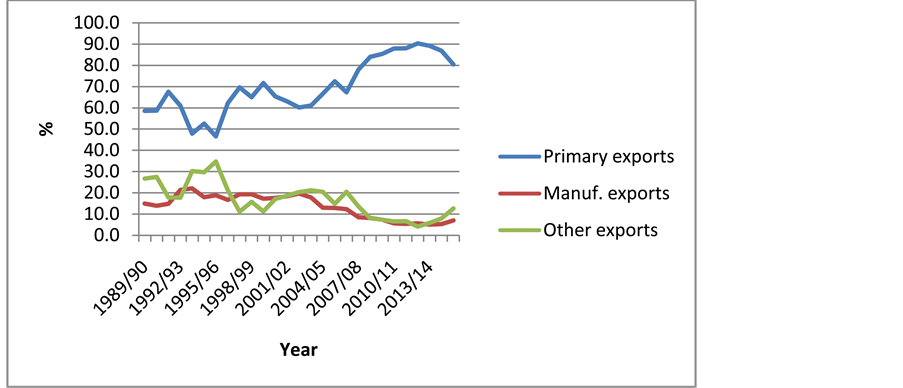

The first interesting dimension of Figure 2 is the high and increasing contri-

Figure 2. Primary product exports as a proportion of total exports.

bution of primary products to total exports. The upward trend line indicates an appreciably rapid increase in this contribution. Another interesting aspect is the particularly heavy dependence on primary products by the end of the period 1989/90-2015/16.

3. The Marginal Propensity to Import in China

Movements in the marginal propensity to import manufacturing and primary products in China in the period 1980-2013 are displayed by Figure 34.

There are a number of striking features related to Figure 3 which includes the upward trend in the marginal propensity to import both manufacturing and primary products. However, this trend is more pronounced for manufacturing compared to primary products thereby leading to divergence. The diverging trend highlights the interesting phenomenon whereby the marginal propensity to import manufacturing products is rising relatively quicker than the marginal propensity to import primary products. This indicates stronger growth in de-

Figure 3. The marginal propensity to import manufacturing and primary products in China.

mand for imported manufacturing compared to primary products in China.

The upward trend in the marginal propensity to import manufacturing and primary products is fundamentally the product of the sustained strong (real) economic growth rate which has averaged 9.7 percent in the period 1978-2015. The market oriented reforms that were initiated in 1978 such as the move towards privatisation and the “Open Door” policy which increased the exposure of the economy to trade and foreign investment have underpinned this robust economic growth performance. The diverging trend in the marginal propensity to import manufacturing and primary products in favour of the former products is basically explained by their higher value added which leads to a higher income elasticity of demand relative to primary imports. Other factors that have contributed to divergence include the existence of free trade in manufacturing goods which has fuelled the rise in the marginal propensity to import these goods whilst the prevalence of trade barriers for primary products such as tariffs and domestic and export subsidies has restrained the rise in the marginal propensity to import these products. Moreover, another contributing factor has been the re-location of the low value added manufacturing products to other low labour costs Asian economies in order to overcome the appreciation of the exchange rate and rising labour costs and hence preserve the international market share of these products i.e. see Yueh [6] . These manufacturing products are likely to have been eventually imported back to China in order to supply the domestic market thereby further increasing the marginal propensity to import these products.

It is also interesting to note the fluctuating growth path of the marginal propensity to import both manufacturing and primary products. For example, the strong rise in the marginal propensity to import manufacturing products in the years leading to China’s entry into the World Trade Organisation (W.T.O) in 2001 appears to fundamentally reflect the imputes provided to specialise in production in order to improve international competitiveness hence import those products no longer produced in the domestic market5. The other interesting aspect of the marginal propensity to import manufacturing products is the less profound but nevertheless appreciable increase in the late 1980s and early 1900s which appears to fundamentally reflect an acceleration in domestic income and hence import demand. There have also two sharp falls in the marginal propensity to import primary products. The first in 1990 appears to predominately mirror lower primary product prices deriving from the marked slowdown of world economic activity. The more pronounced fall in 2011 is likely to reflect a transitory weakness in import demand due to the lingering uncertainty related to sustained strong economic and hence income growth after the depressing impact of the Global Financial Crisis (GFC).

4. The Composition of Australia’s Exports to China

The more rapidly rising marginal propensity to import manufacturing compared to primary products in China has important implications for export revenue and hence output and employment growth in Australia. Specifically, export revenue and hence output and employment growth will be maximised if exports are concentrated in manufacturing products which are associated with stronger growth in import demand in China. Export revenue and hence output and employment losses will occur however if exports are concentrated in primary products which are associated with relatively slower growth in import demand in China. The major objective of this section therefore is to ascertain the composition of Australia’s exports and in particular disclose the relative importance of primary and manufacturing exports to this country. The following figure will be useful for this purpose.

The striking Figure 4 is the increasing contribution of primary products to total exports to China in the period 1989/90-2015/16 from a high base. Manufacturing products constitute a small and falling proportion of total exports to this country from a low base6. The “other exports” category has exhibited a similar trend to manufacturing exports7. These trends indicate an increasingly heavy reliance on primary exports to China which however are associated with a relatively slower growing marginal propensity to import compared to manufacturing products in this country. This indicates relatively weaker growth in demand for the bulk of Australia’s exports to China that leads to losses in export

Figure 4. The contribution of primary, manufacturing and other exports to total exports to China.

revenue and hence output and employment growth. These losses are significant in light of the heavy dependence on primary products in this market. Furthermore, the strong dependence on total exports to China, as indicated by Figure 1, implies fluctuations in export revenue and output and employment growth when economic conditions and hence import demand change in this country e.g. a severe economic downturn in the domestic market will lead to a commensurate slowdown in import demand which will have a significant dampening effect on export revenue and hence output and employment growth in Australia. Moreover, the dominance of primary exports to China is associated with the gyrations in primary product prices as determined by the international market which in turn aggravates the fluctuations in export revenue and output and employment growth in Australia.

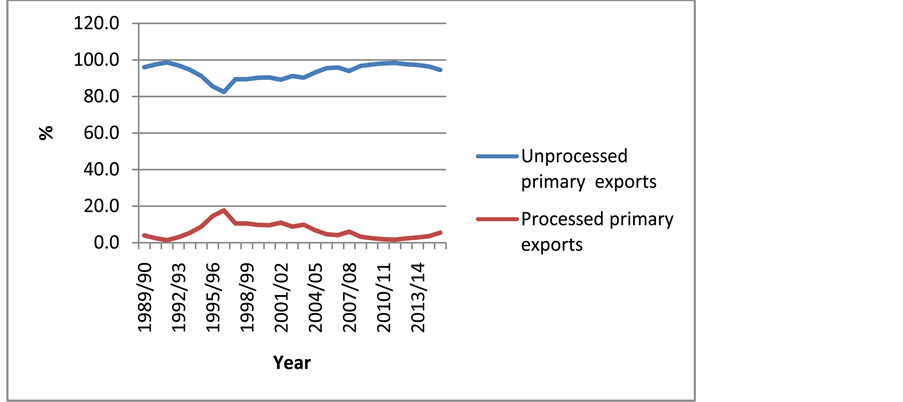

Primary and manufacturing exports to China however conceal a number of interesting structural features which are worthwhile noting due to the implications for export revenue and hence output and employment growth. Specifically, the structural features of primary exports in the period 1989/90-2015/16 are displayed by Figure 5.

The striking feature of the above figure is the overwhelming contribution of unprocessed primary products to total primary exports to China8. Indeed, the contribution of this category has persistently been above 80 percent and on numerous occasions has reached over 95 percent. This contrasts sharply with the minimal contribution of processed primary products to total primary exports to this country9. Of note is the exception in the early to mid-1990s which reflects the relatively quicker growth in processed compared to unprocessed primary exports This appears to be explained by the deep recession of the early 1990s

Figure 5. Structure of primary exports to China.

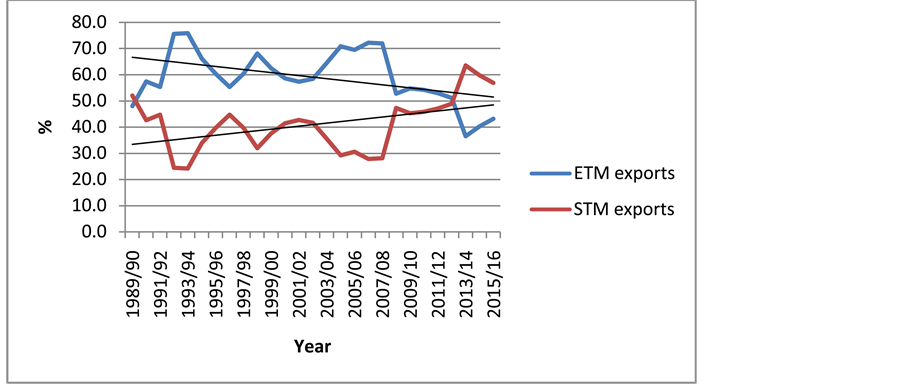

Figure 6. ETM and STM exports as a proportion of total manufacturing exports to China.

which provided a strong incentive to firms to increase exports of these primary products in order to offset the domestic market losses. This structural weakness indicates a very heavy dependence on unprocessed primary exports to China which are low value added in nature and hence command relatively lower prices compared to the higher value added processed primary products on the international market thereby accentuating the export revenue and hence output and employment losses in Australia.

There are also interesting features of the structure of manufacturing exports to China which are revealed by the following figure in the period 1989/90-2015/16.

The first interesting dimension of Figure 6 is the tendency of elaborately transformed manufactures (ETMs) to constitute the bulk of manufacturing exports to China. In contrast, simply transformed manufactures (STMs) have generally made a lower contribution. However, of relatively greater significance appears to be the downward trend in ETMs and the upward trend in STMs exports to China which has eventually led to the latter making a higher contribution compared to the former. This implies lower than otherwise export revenue growth due to the relatively lower prices which the low value added STMs are likely to command compared to the higher value added ETMs on the international market. This compounds the export revenue and hence output and employment losses emanating from the structural weakness of primary exports where the low value added unprocessed primary products constitute the overriding contribution to primary exports to China.

5. Implications for Policy of Main Results

The bulk of Australia’s exports to China are primary products. This structural weakness is representative of the economy’s export base where primary products also dominate as depicted by Figure 2. This over reliance on primary exports and the traditional heavy dependence on imported manufacturing goods i.e. see Gilbert [8] and ABS Cat. No. 5302.0 [2] for more recent evidence on this latter

Figure 7. The percentage change in the terms of trade.

trend, have combined to lead to adverse movements in the terms of trade which is revealed by the following figure over the longer period 1960/61-2015/16.

The interesting aspect of Figure 7 is the volatility in the terms of trade as reflected by the sharp movements in the percentage change, which on occasions are pronounced. For example, there have been five noticeable improvements in the terms of trade in 1964/65, 1972/73, 1988/89, 2005/06 and 2011/12 which fundamentally reflects a sharp increase in primary product prices on the international market. The increase in primary products prices, with the exception of 1973/74, appears to be underpinned by an acceleration in world economic growth that leads to stronger international demand and hence higher prices for primary products. The improvement in the terms of trade in 1973/74 appears to be related both to strong world economic growth and the spike in oil prices on the international market that led to higher demand and hence prices for substitute forms of energy such as coal and uranium which are produced and exported by Australia in large quantities. There has also been a deterioration in the terms of trade in 1964/65, 1974/75, 1977/78, 1985/86, 2012/13 and 2014/15. This appears basically to reflect slower world economic growth and hence weaker international demand for primary products which in turn lowers prices. The volatility in the terms of trade is therefore the product of the gyrations in export prices which largely reflect primary products that dominate the export base. This in turn leads to fluctuations in export revenue and hence output and employment growth. An additional problem emanating from the economy’s heavy dependence on primary exports is the losses in export revenue and hence output and employment growth due to the likelihood the trends in the marginal propensity to import manufacturing and primary products in China will mirror global trends.

It is important to emphasise the dual costs of a narrow primary product dominated export base in the form of losses and instability in export revenue and hence output and employment growth when Australia trades with other countries which includes China. These adverse consequences disadvantage countries such as Australia that specialise in the production and export of primary products thereby weakening the concept of comparative advantage. Consequently, there is a need to undertake policy action to remedy this situation by promoting manufacturing and in particular ETM exports in order to restructure the export base in favour of these goods. Moreover, policy action is necessary to restructure primary exports from unprocessed to processed products in light of the over reliance on unprocessed primary products. The magnitude of this challenge necessitates complementary policy action. Specifically, whilst microeconomic reforms are important in improving international competitiveness and hence encouraging manufacturing exports, there also appears to be a wider role for industry policy which includes incentives to boost investment expenditure such as depreciation allowances, conditional grants or subsidised interest costs to accelerate the introduction of advanced manufacturing technology, incentive for research and development expenditure, national procurement development schemes and measures to promote venture capital.

The crucial role of this policy in promoting manufacturing exports in the Australian context has also been emphasised by numerous other studies. For example, Hampson [10] notes the need to adopt industry policy initiatives to boost these types of exports in order to broaden the economic base and hence combat the volatility in the terms of trade. Furthermore, Hart [11] and Hart and Marks [12] highlight the significance of implementing this policy to stimulate manufacturing exports and hence diversify the export base in order to alleviate both the fluctuations as well as deterioration in the terms of trade that Australia has experienced over prolonged periods in the past due to primary product prices rising relatively slower than the price of manufacturing goods on the international market. It is important to emphasise the specific need to promote ETM (rather than STM) exports which are higher value added goods and hence likely to command higher prices on the world market thereby maximising the favourable impact on export revenue and hence output and employment growth and alleviating the losses in the terms of trade. Producing and exporting these types of manufacturing goods is also cost effective as a result of the high wage cost structure in Australia thereby enhancing their international competitiveness. The significance of ETM exports is consistent with the view of Whiteman [13] who stresses the importance of adopting industry policy initiatives to create a competitive advantage in the production and export of skill and technology intensive manufacturing goods due to their increasing dominance of world trade.

It is interesting to note that despite the limited use of this policy, it has nevertheless been effective in the areas of the manufacturing sector in which it has been used i.e. by promoting higher export oriented production in two of the major segments of the manufacturing sector in the form of the motor vehicle and textile, clothing and footwear (TCF) industries within the framework of industry plans i.e. see Marks [14] . The potential of industry policy to be effective in stimulating manufacturing exports is further highlighted by the positive experience of a number of other countries. This includes China i.e. see Ng and Tuan [15] , Huang [16] and Yueh [6] , South Korea and Taiwan i.e. see Rodrik [17] , the high performing Asian economies (HPAE’s) of S. Korea, Taiwan Japan, Hong Kong, Singapore and Malaysia i.e. see Jono (2001) and South East Asia and Scandinavia i.e. see Hampson [10] . A contribution from industry policy in stimulating manufacturing and in particular ETM exports will broaden the export base and hence bolster and stabilise export revenue and hence output and employment growth when Australia trades with China and other countries. Furthermore, the use of this policy to restructure primary exports from unprocessed to processed products will further enhance export revenue and hence output and employment growth. Additional stability in export revenue and hence output and employment growth will also be achieved if Australia reduces its overreliance on the Chinese market by diversifying exports away from China towards other countries. A higher contribution of manufacturing exports to the export base will also help insulate the economy from the deterioration in the terms of trade that Australia has experienced over prolonged periods in the past. Hart and Marks [12] also emphasise the restructuring of exports towards manufacturing goods will provide a major lift to national income and hence saving due to stronger international demand for manufacturing compared to primary products thereby alleviating the persistent current account deficits that have characterised the Australian economy. Moreover, Hampson [10] cites the benefit of preserving the manufacturing capabilities of the labour force when broadening the economic base in favour of manufacturing goods.

6. Overview of Main Results

The marginal propensity to import manufacturing products is rising quicker compared to the marginal propensity to import primary products in China. This indicates the demand for imported manufacturing goods is growing more rapidly than imports of primary products. Australia’s exports to this country however are concentrated in primary products thereby incurring export revenue and hence output and employment losses. These losses are compounded due to the dominance of unprocessed primary products. Furthermore, the heavy dependence on exports to China has made export revenue and hence output and employment growth vulnerable to the fluctuations in the business cycle of this country. The structure of Australia’s exports to China is indicative of the structure of the export base thereby aggravating export revenue and hence output and employment losses due to the likely hood; the trends in the marginal propensity to import manufacturing and primary products in China are also likely to reflect global trends. Moreover, the dominance of primary products in the export base has led to volatility in the terms of trade due to the gyrations in the price of these products on the international market thereby also leading to fluctuations in export revenue and hence output and employment growth when Australia trades with other countries including China. These fluctuations are accentuated in the case of China when its business cycle fluctuates due to the over reliance on exports to this country.

Consequently, there is a need to improve the structure of exports in favour of manufacturing and in particular ETM products which are likely to be associated with a quicker increase in the marginal propensity to import compared to STMs in China and other countries. Furthermore, there is a necessity to improve the structure of primary exports from unprocessed to processed products. The magnitude of this challenge requires complementary policy action in the form of expanding the role of industry policy to reinforce microeconomic reforms in promoting manufacturing and processed primary exports. The positive impact of this policy in stimulating higher export oriented production in the motor vehicle and TCF industries in Australia within the framework of industry plans provides support for industry policy initiatives. Moreover, the effectiveness of industry policy in propelling higher manufacturing exports in numerous countries in South East Asia and Scandinavia provides reinforcing evidence of the potential of this policy to emulate this achievement in Australia. Success in broadening the export base in favour of manufacturing goods will lead to gains and the stabilisation in export revenue and hence output and employment growth when Australia trades with China and other countries. In addition, the restructuring of primary exports from unprocessed to processed products will further enhance export revenue and hence output and employment growth. Furthermore, a higher contribution from manufacturing exports will make it less likely Australia will experience prolonged periods in the deterioration of the terms of trade as has occurred in the past. An additional benefit of a broader export base in favour of manufacturing goods is a major boost to national income and hence saving due to stronger international demand for manufacturing compared to primary products thereby alleviating the persistent current account deficits in Australia. Finally, it is interesting to note that the area of trade between Australia and China is unexplored which implies there is significant scope for future research in the area.

Cite this paper

Marks, A. (2017) The Marginal Propensity to Import in China and the Composition of Australia’s Exports: Some Interesting Revelations. Modern Economy, 8, 897-909. https://doi.org/10.4236/me.2017.87063

References

- 1. Australian Bureau of Statistics (ABS) Merchandise Exports, Cat. No.5368.0. Canberra.

- 2. ABS. No. 5302.0 Balance of Payments and International Investment Position. Canberra.

- 3. Department of Foreign Affairs and Trade, Australia-Database. http://www.dfat

- 4. United Nations Centre for Trade and Development (unctad). http://www.unctad.org/

- 5. Chinadataonline.org-Database. http://www.chinadataonline.org/

- 6. Yueh, L. (2012) The Economy of China. Edward Elgar, Cheltenham.

- 7. Martin, W. and Lachovichina, E. (2001) Implications of China’s Accession to the World Trade Organisation. World Economy, 25, 1095-1219.

- 8. Gilbert, R.S. (1959) Structural Tends in Australia’s Imports. Economic Record, 35, 130-152.

https://doi.org/10.1111/j.1475-4932.1959.tb00451.x - 9. ABS Cat. No. 5204.0 Australian System of National Accounts. Canberra.

- 10. Hampson, I. (2012) Industry Policy under Economic Liberalism: Policy Development in the Prime Minister’s Manufacturing Task Force. Economic and Labour Relations Review, 23, 39-56.

https://doi.org/10.1177/103530461202300404 - 11. Hart, N. (1993) Australia’s Current Account Difficulties and the Role of Trade and Industry Policy. Economic Papers, 12, 32-46.

https://doi.org/10.1111/j.1759-3441.1993.tb00899.x - 12. Hart, N. and Marks, A. (1999) Australia’s Current Account Deficit, National Savings and Industry Policy. The Economic and Labour Relations Review, 10, 278-295.

https://doi.org/10.1177/103530469901000208 - 13. Whiteman, J. (1991) Globalisation: Some Analytical and Policy Implications. In: Hamilton, C., Ed., The Dynamics of Australian Industry, Allen and Unwin, Sydney, 55-69.

- 14. Marks, A. (2016) Measuring the Success of Industrial Policy in Australia. World Economics, 17, Oct.-Dec. issue.

- 15. Ng, L.F.Y. and Tuan, C. (2002) Building a Favourable Investment Environment: Evidence for the Facilitation of FDI in China. World Economy, 25, 1095-1114.

https://doi.org/10.1111/1467-9701.00483 - 16. Huang, Y. (2010) Ownership Biases and Foreign Direct Investment in China. In: Athukorala, P., Ed., The Rise of Asia-Trade and Investment in a Global Perspective, Routledge, London, 75-89.

- 17. Rodrik, D. (1995) Getting Intervention Right: How South Korea and Taiwan Grew Rich. Economic Policy, 10, 53-107.

https://doi.org/10.2307/1344538

NOTES

1The real value of exports is calculated by dividing the nominal value of exports by the export price deflator (in 2014/15 prices).

2Another challenge is to insulate the Australian economy from the fluctuations of the Chinese business cycle due to the heavy dependence on exports to China.

3Primary products are defined as the Trade Imports and Exports Classification (TRIEC) 3 digit subdivisions of unprocessed food and live animals, unprocessed minerals, unprocessed fuels and unprocessed other, processed food, processed minerals, processed fuels and processed other.

4The marginal propensity to import manufacturing products is calculated as the change in the real value of manufacturing imports divided by the change in real GDP. Manufacturing imports are defined as the categories of chemicals and related products, light and textile industrial products, rubber products, minerals and metallurgical products, machinery and transport equipment, miscellaneous products and products not otherwise classified. The data for the nominal value of manufacturing imports have been derived from the database chinadataonline.org. The real value of manufacturing imports has been ascertained by dividing the nominal value by the import price deflator for merchandise imports (at constant 2005 prices). The data for the latter variable have been provided by United Nations Centre for Trade and Development (UNCTAD) on request [4] . Real GDP is also in constant 2005 prices with the data derived from unctad.org. Primary imports are defined as food and live animals used chiefly for food, beverages and tobacco, non-edible raw materials, mineral fuels, lubricants and related materials, animal and vegetable oils and fats and wax. The data for these categories of primary imports have also been derived from the database chinadataonline.org. The real value of primary imports has been ascertained by dividing the nominal value of the sum of these categories by the import price deflator for merchandise imports (at constant 2005 prices). Real GDP as mentioned is in constant 2005 prices with the data derived from unctad.org.

5It is interesting to note that China’s entry into the WTO was not only motivated by economic interests but also had a political economy dimension. Specifically, the economic interests include the need for increased access to the international market and enhance the ability to undertake domestic reforms which were opposed by special interest groups. The political economy dimension includes protecting China against unilateral changes in the rules of the trading system by other nations and influencing these rules to promote Chinese interests i.e. see [7] .

6Manufacturing exports are defined as the (TRIEC) 3 digit subdivisions of simply transformed mineral manufactures (STM) which incorporate mineral manufactures and metals, chemicals and other semi manufactures and other. This definition also includes the 3 digit subdivisions of elaborately transformed manufactures (ETM) which include mineral manufactures and metals, chemicals and other semi manufactures, engineering products (excluding household equipment) and other.

7The category of “other exports” is defined as miscellaneous trade, non-monetary gold and confidential trade.

8Unprocessed primary exports are defined as the (TRIEC) 3 digit subdivisions of unprocessed food, and live animals, unprocessed minerals, unprocessed fuels and unprocessed other.

9Processed primary exports are defined as the (TRIEC) 3 digit subdivisions of processed food, processed minerals, processed fuels and processed other.