Paper Menu >>

Journal Menu >>

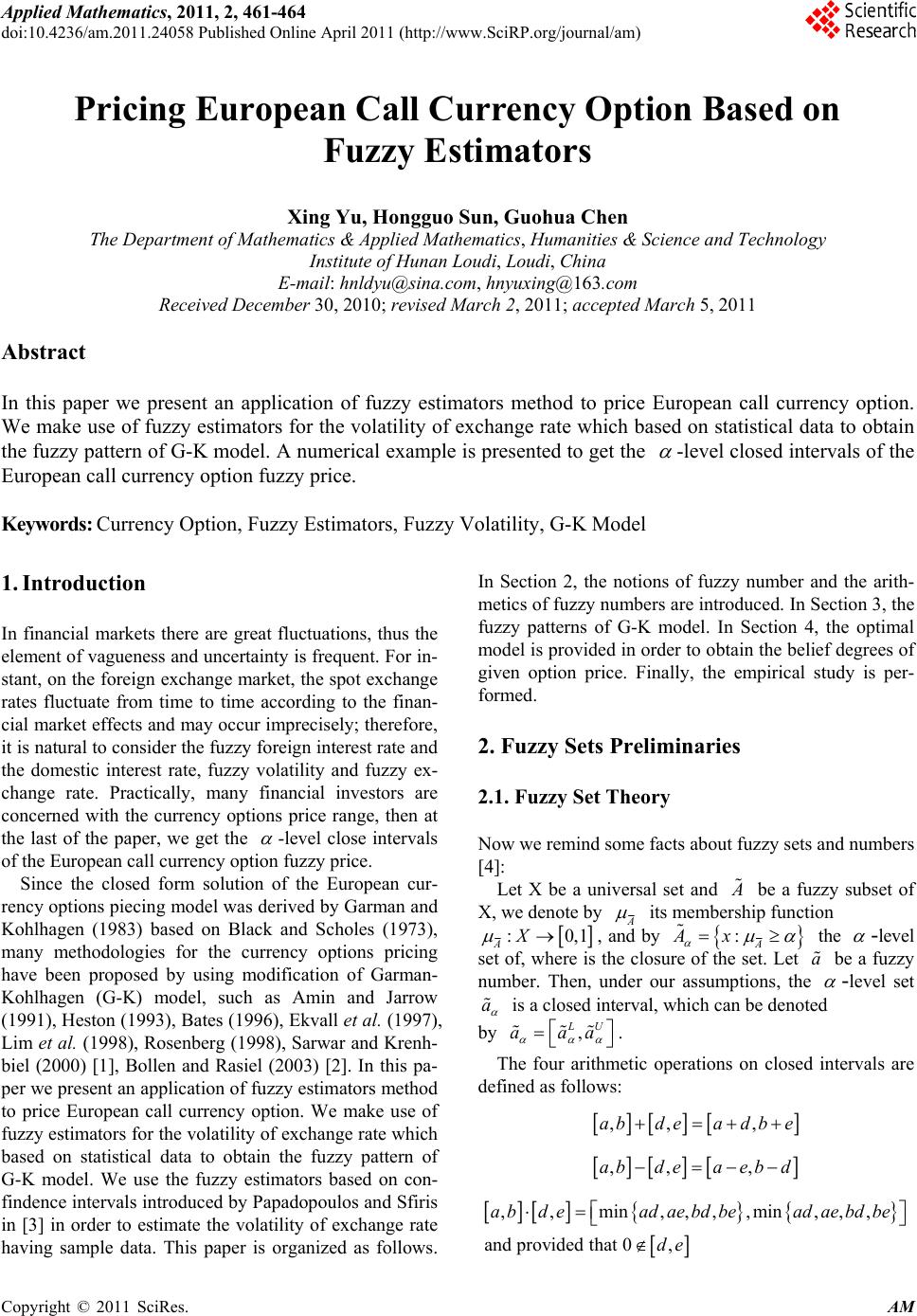

Applied Mathematics, 2011, 2, 461-464 doi:10.4236/am.2011.24058 Published Online April 2011 (http://www.SciRP.org/journal/am) Copyright © 2011 SciRes. AM Pricing European Call Currency Option Based on Fuzzy Estimators Xing Yu, Hongguo Sun, Guohua Chen The Departme nt of Mathematics & Appli ed Mat hematics, Humanities & Science and Technology Institute of Hunan Loudi, Loudi, China E-mail: hnldyu@sina.com, hnyuxing@163.com Received December 30, 2010; revised March 2, 2011; accepted March 5, 2011 Abstract In this paper we present an application of fuzzy estimators method to price European call currency option. We make use of fuzzy estimators for the volatility of exchange rate which based on statistical data to obtain the fuzzy pattern of G-K model. A numerical example is presented to get the -level closed intervals of the European call currency option fuzzy price. Keywords: Currency Option, Fuzzy Estimators, Fuzzy Volatility, G-K Model 1. Introduction In financial markets there are great fluctuations, thus the element of vagueness an d uncertainty is frequent. For in- stant, on the foreign exchange market, th e spot exchang e rates fluctuate from time to time according to the finan- cial market effects and may occur imprecisely; therefore, it is natural to consider the fuzzy foreign interest rate and the domestic interest rate, fuzzy volatility and fuzzy ex- change rate. Practically, many financial investors are concerned with the currency options price range, then at the last of the paper, we get the -level close intervals of the European call currency option fuzzy price. Since the closed form solution of the European cur- rency options piecing model was derived by Garman and Kohlhagen (1983) based on Black and Scholes (1973), many methodologies for the currency options pricing have been proposed by using modification of Garman- Kohlhagen (G-K) model, such as Amin and Jarrow (1991), Heston (1993) , Bates (1996), Ekvall et al. (1997), Lim et al. (1998) , Rosenberg (1998 ), Sarwar and Krenh- biel (2000) [1], Bollen and Rasiel (2003) [2]. In this pa- per we present an app lication o f fuzzy estimators method to price European call currency option. We make use of fuzzy estimators for the volatility o f exchang e rate which based on statistical data to obtain the fuzzy pattern of G-K model. We use the fuzzy estimators based on con- findence intervals introdu ced by Papadopoulos and Sfiris in [3] in order to estimate the volatility of exchange rate having sample data. This paper is organized as follows. In Section 2, the notions of fuzzy number and the arith- metics of fuzzy numbers are introduced. In Section 3, the fuzzy patterns of G-K model. In Section 4, the optimal model is provided in order to obtain the belief degrees of given option price. Finally, the empirical study is per- formed. 2. Fuzzy Sets Preliminaries 2.1. Fuzzy Set Theory Now we remind some facts about fuzzy sets and numbers [4]: Let X be a universal set and A be a fuzzy subset of X, we denote b y A its membership function :0,1 AX , and by :A Ax the -level set of, where is the closure of the set. Let a be a fuzzy number. Then, under our assumptions, the -level set a is a closed interval, which can be denoted by , LU aaa . The four arithmetic operations on closed intervals are defined as follows: ,, ,abdea db e ,, ,ab deaebd ,,min,,,,min,,, and provided that 0, a bdeadae bdbeadae bdbe de  X. YU ET AL. Copyright © 2011 SciRes. AM 462 if,,,0, t hen,,,abdeab deadbe 11 ,,,and provided that 0,ab deabde de 2.2. Triangular Fuzzy Number The membership function of a triangular fuzzy number a is defined by : ,if ,if 0, otherwise L cL LC aRRCCR x aaa axa x axaa axa Which is denoted by ;; L CR aaaa .The -level set of a is then: 1,1 LC RC aaaaa 1, 1 LU L CRC aaaaaa 3. Fuzzy Currency Options Pricing Model 3.1. Estimate Fuzzy Volatility from Fuzzy Estimators of 2 —Fuzzy Estimators Based on Confidence Intervals Following the proposition proved by Papadopoulos and Sfiris in [3], we consider the fuzzy volatility as: 22 2 1 2 22 2 1 22 1 1if 11 22 11 21 22 1 1if 11 22 11 21 ns s x s x n xns s sx x n its -cut is the following: 22 2, 22 11 11 ss uu nn (1) where 11 122 2 u (2) 3.2. The G-K Model and Its Fuzzy Pattern The G-K model for a European call currency option with expiry date T and strike price K. t s denotes the spot exchange rate at time 0,tT, and t c denotes the price of a currency option at time t. The G-K model is as: 12 12 , rr tt cseNd KeNdTt (3) 2 121 21 ln2 , t dsKrr dd (4) where 1 r denotes the foreign interest rate, 2 r denotes the domestic interest rate, denotes the volatility, and N stands for the cumulative distribution function of a standard normal random variable 0, 1N. Under the considerations of fuzzy exchange rate t s , fuzzy interest rate 1 r , 2 r , fuzzy volatility , the fuzzy price is denoted as t c . The fuzzy patterns of G-K model are described as the interval: 12 12 () UL LU Lrr L tt cseNdKeNd (5) 12 12 () LU UL Urr U tt cseNdKeNd (6) where 2 121 ln 2 LLLU LU t dsKrr (7) 2 121 ln 2 UUUL UL t dsKrr (8)  X. YU ET AL. Copyright © 2011 SciRes. AM 463 Table 1. The price intervals for a given belief degree. c c c 0.8 [0.5475, 0.5502] 0.87 [0.5479, 0.5497] 0.94 [0.5484, 0.5492] 0.81 [0.5475, 0.5501] 0.88 [0.5480, 0.5496] 0.95 [0.5484, 0.5491] 0.82 [0.5476, 0.5500] 0.89 [0.5480, 0.5495] 0.96 [0.5486, 0.5491] 0.83 [0.5476, 0.5499] 0.9 [0.5482, 0.5495] 0.97 [0.5486, 0.5490] 0.84 [0.5477, 0.5499] 0.91 [0.5482, 0.5494] 0.98 [0.5487, 0.5490] 0.85 [0.5478, 0.5498] 0.92 [0.5483, 0.5494] 0.99 [0.5487, 0.5488] 0.86 [0.5479, 0.5498] 0.93 [0.5483, 0.5493] 1.00 [0.5488, 0.5488] 21 LL U dd (9) 21 UU L dd (10) 3.3. To Calculation the Fuzzy Currency Option Steps Calculating the fuzzy currency option as the following steps: Step 1. We compute the Estimate fuzzy volatility from fuzzy estimators of 2 based the history data following (1)-(2). Step 2. On the hypothesis of the fuzzy interest and fuzzy exchange rate are triangular fuzzy numbers, and we obtain the -cuts of fuzzy currency option which are closed intervals following (1) -(2), (5)-(10). 4. Empirical Example In this section, our model is tested with the daily market price data of EUR/CNY. These market data come from [5] and cover the period 9-27-2010 to 11-15-2010. We calculate 20.013287,s the spot exchange rate is around 9.2418, and assume the strike price is K = 9.12 with one year to expiry. Let 0.01 . The triangular fuzzy numbers are 11.09%,1.1%,1.11% ;r 22.4%,2.5%,2.6% ;r 9.2398,9.2418,9.2438 t s . Because the closed form of volatility interval based on samples are very hard to get, so we adopt numerical al- gorithm to solve optimization model. For example, we average the interval [0.8, 1] into 20 equal parts, that is 0.8,0.81,0.82, ,1 . Based on every , we calcu- late the intervals of option price as Table 1, from which, we find that with increasing ,the left interval in- creasing while the right interval decreasing, and both intersects when 1 where is the situation matches the actual price by Equations (3,4). For 0.95 , it means that the call currency option price will lie in the closed interval [0.5484, 0.5491] with belief degree 0.95. From another point of view, if a financial analyst is comfortable with this belief degree 0.95, then he (she) can pick any value from the closed interval [0.5484, 0.5491] as the optio n p ri ce fo r his(her)later use. 5. Conclusions Owing to the fluctuation of financial market from time to time, the data sometimes cannot be expected in a precise sense. Therefore, the fuzzy sets theory provides a useful tool for conquering this kind of impreciseness. The fuzzy pattern of G-K model is proposed in this paper. Under the considerations of fuzzy estimators for the volatility of exchange rate which based on statistical data, the Euro- pean call currency option price turns into a fuzzy number. This makes the financial analyst who can pick any Eu- ropean call currency option with an acceptable belief degree for he (her) later use and get the interval for the price with the give n bel i e f degree. 6. Acknowledgments Supported by Youth Fund of Hunan Institute of Humani- ties Science and technology (2 008QN013). 7. References [1] G. Sarwar and T. Krehbiel, “Empirical Performance of Alternative Piecing Models of Currency Options,” The Journal of Futures Markets, Vol. 20, No. 2, March 2000, pp. 265-291. doi:10.1002/(SICI)1096-9934(200003)20:3<265::AID-F UT4>3.0.CO;2-4 [2] P. B. N. Bollen and E. Rasiel, “The Performance of Al- ternative Valuation Models in the OTC Currency Options Market,” Journal of International Money and Finance, Vol. 22, No. 1, February 2003, pp. 33-64.  X. YU ET AL. Copyright © 2011 SciRes. AM 464 doi:10.1016/S0261-5606(02)00073-6 [3] A. Thavaneswaran, J. Singh and S. S. Appadoo, “Option Pricing for Some Stochastic Volatility Models,” The Journal of Risk Finance, Vol. 7, No. 4, 2006, pp. 425-445. doi:10.1108/15265940610688982 [4] G. J. Klir and B. Yuan, “Fuzzy Sets and Fuzzy Logic: Theory and Applications,” Prentice Hall, Englewood Cliffs, 1995. [5] http://www.123cha.com/hl/?q=100&from=EUR&to=CN Y&s=EURCNY#symbol=EURCNY=X;range=3m |