Paper Menu >>

Journal Menu >>

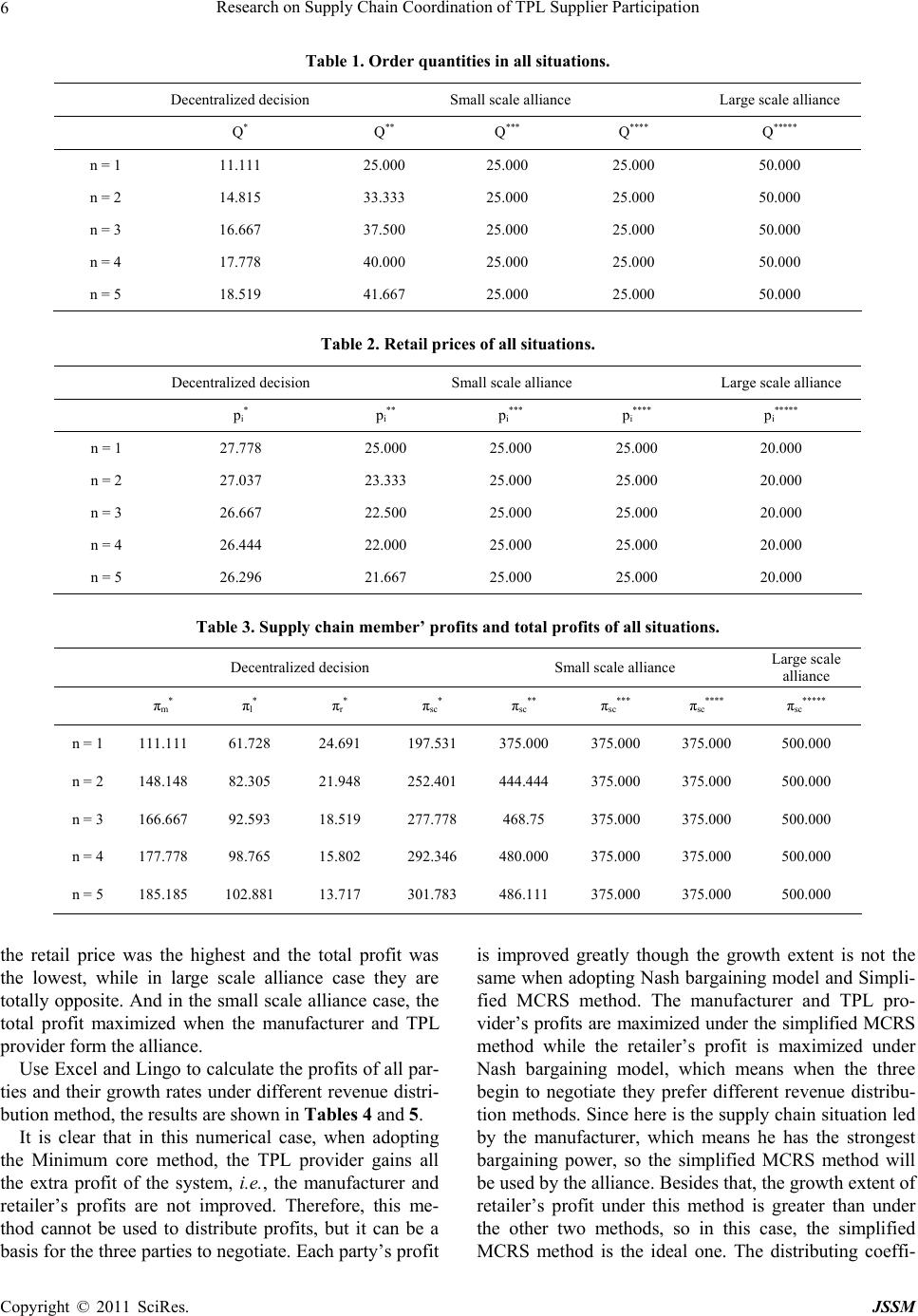

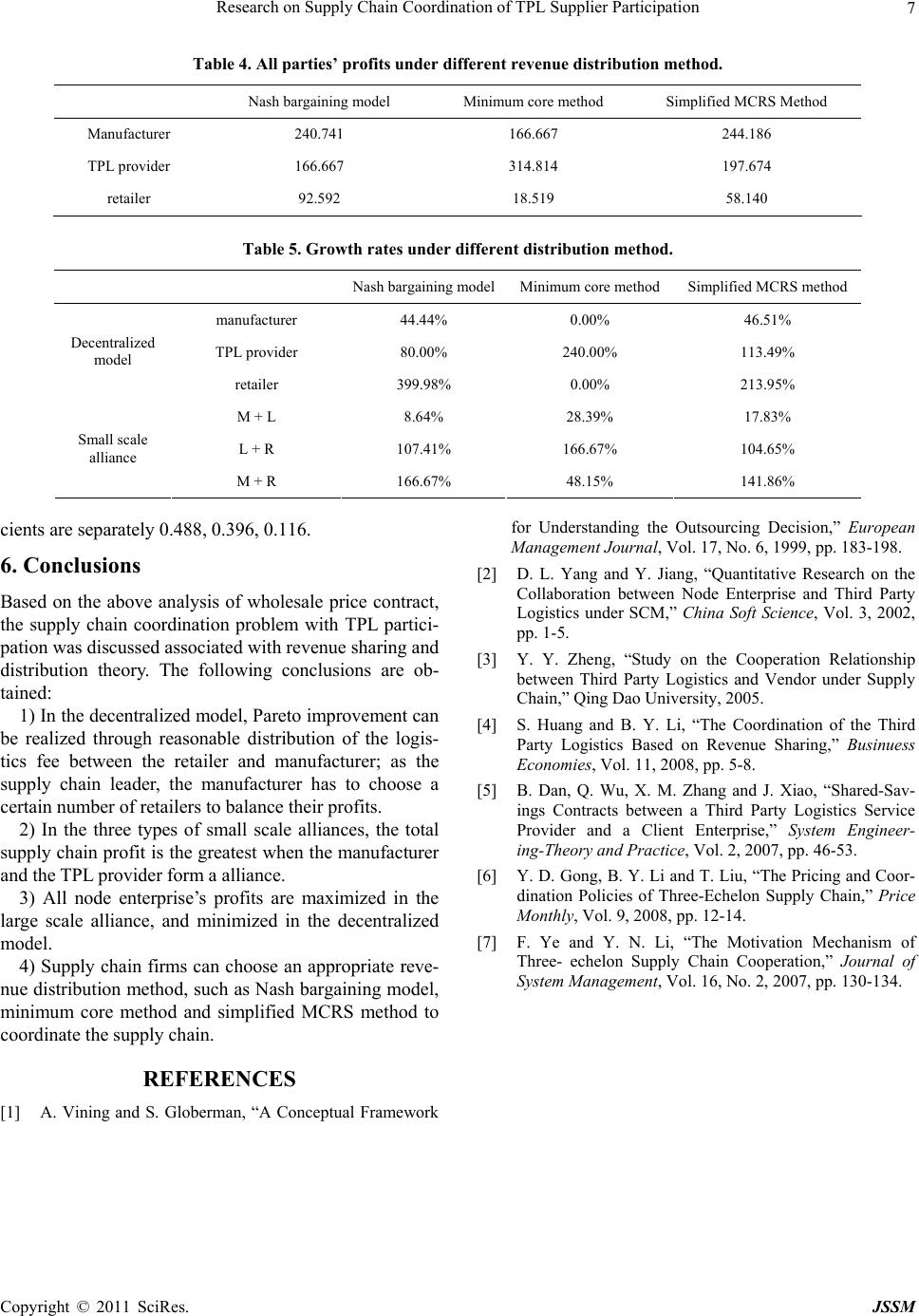

Journal of Service Science and Management, 2011, 4, 1-7 doi:10.4236/jssm.2011.41001 Published Online March 2011 (http://www.SciRP.org/journal/jssm) Copyright © 2011 SciRes. JSSM 1 Research on Supply Chain Coordination of TPL Supplier Participation* Yun Liang1, Xiaode Zuo2, Hong Lei2 1Business Administration Department, Gangdong University of Finance, Guangzhou, China; 2Management School of Jinan Univer- sity, Guangzhou, China. Email: liangy5@163.com, tzuoxd@jnu.edu.cn, leihong77@yahoo.com.cn Received October 8th, 2010; revised November 9th, 2010; accepted November 14th, 2010. ABSTRACT This paper used the Game Theory to research how to coordinate a kind of supply chain, which is made up of a domi- nant manufacturer, a TPL supplier and some retailers. It also discussed the node enterprises’ decision models in three situations: no coordination, partly coordination and all coordination based on symmetric information and proved sys- tem’s profit was optimal in the situation of all coordination. And then some ways of profit distribution were laid out. Finally, verified the validity of the models and ways of profit distribution throug h examples. Keywords: Supply Chain Coordination, Third Party Logistics, Profit Distribution 1. Introduction Enterprises tend to enhance their core competence through outsourcing logistics service under the fierce market condition. The demand for third party logistics, TPL for short, has growing gradually, so people pay more atten- tion to the relationship between TPL providers and TPL demanders. Aidan. Reference [1] established a logistics service pricing model, which optimized the profits of both parties in a simple supply chain based on the as- sumption of linear demand. Reference [2] compared the pricing and profit conditions of TPL provider and de- mander before and after cooperation. Reference [3] ana- lyzed some horizontal methods of the two parties used to coordinate the conflicts and contradictions in the out- sourcing process. Reference [4] used game theory to study the coordination problem in a supply chain com- posed of a manufacturer, a TPL provider and a retailer. Reference [5] designed a TPL revenue sharing contract, and proved that this contract can form a sound internal incentive mechanism through a dynamic game approach. It can be found that, current research mainly focus on the coordination issue between TPL provider and a single TPL demander. Little has done on the game relationship and coordination mechanism among the TPL provider, upstream and downstream enterprises. Also the condition of more than one retailer and partial cooperation has sel- dom been paid attention to. 2. Model Description Gong Deyan [6] established a supply chain model with a manufacturer, a retailer and a TPL provider. The differ- ence between this paper to his is that, more than one re- tailer was considered, and the situation of partial coop- eration was discussed, which makes the analysis more practical and can obtain more new conclusions. Node enterprises operated themselves as follows: first, the manufacturer selected a profit-optimizing wholesale price, ; retailer selected a service price , which can maximize his own profit based on the given whole- sale price; finally, retailer i decided his optimal i and order quantity i. l was shared by the manufac- turer and TPL together, and the sharing ratios are 1 m pl p p q p , 2 respectively. The costs of manufacturer, TPL and retailer are , , . m l r The following assumptions were made: cc c Assumption 1: Information was perfectly symmetrical through the whole supply chain. Assumption 2: All supply chain members were risk-neutral, and they were to maximize their own prof- its. Assumption 3: The market demand is a linear function of the retailer price, that is, , and a, were constants, a > 0, b > 0. pabQ b *This paper is funded by the 211 Engineering Program of Jinan Uni- versity, Pre-Funded-Research of Management School.  Research on Supply Chain Coordination of TPL Supplier Participation 2 Assumption 4: The unit cost and wholesale price for each retailer are the same. Assumption 5: The manufacturer’s capacity and TPL’s ability were large enough to satisfy all demands.. 3. Set up and Solve the Model 3.1. Decentralized Model The manufacturer, TPL provider and retailers made their own decisions separately, that is, no alignment has been formed. So the Stackelberg model is: 1 max mmm ml ppcp Q ..max lll l s tppc Q 2 ..max riiirml i s tppcpp q j q Adopt the reverse inductive method, all the members’ price decision can be solved as followed: Phase 1, retailer will optimize his profit on a given , which is i l p 2 2 max riiirml i rlml i ppcp pq abQc ppq Suppose , we can get, i QqQ 2 max riii jrlmli pabqQcpp , 2 2 ri ij rlm i bqbQa cpp q l Because , Qnq j ii QQqnqq i Therefore, 2 21 ri irlm i bnqa cpp ql Let it equals 0, it can be solved that, 2 1 rl ml i ac pp qbn So, 2 1 rl ml i na cpp Qnq bn Phase 2, TPL provider will optimize his profit at a given , m p max lll l ppc Q Substitute the value of Q, we can get, 2 2 2 lri m l accp p Phase 3, the manufacturer optimizes his profit, 1 max mmm ml ppcp Q Substitute the value of Q and , the optimal , is arrived. l pm p * m p 2 *22 21 ml m ac cc p ri Then we can get the optimal and : * l p* i p 2 * 2 21 21 lrm l accc p , *2 2 21 1 inR pa n The total order quantity of all retailers is: *2 2 21 nR Qbn 1 So the profit of each supplier is: 2 *2 2 41 mnR bn 1 , 2 *2 2 2 41 1 lnR bn , 22 *2 22 2 41 1 ri R bn The profit of the whole supply chain is: 222 22 **** 22 2 122 41 1 scm lr nnnn R bn 2 Here, 0 rml Rac cc 3.2. Centralized Model Ye Fei and Li Yina [7] discussed the cooperation problem of a type of three-echelon supply chain with a manufac- turer, a wholesaler and a retailer. Consider the partial cooperation in their paper, the following forms of alli- ances can be induced. 1) The manufacturer and TPL provider form a small scale alliance, and the retailers are not included. So the Stackelberg model should be: 2 max , mlmlmml l ppp c cpQ 2 ..max riiirml i s tppcpp q Solve the model with reverse inductive method, ** 21 nR Qbn , ** 21 inR pan 2 ** 41 ml nR bn , 2 ** 2 41 ri R bn , 2 ** 2 2 2 41 sc nn R bn 2) TPL and retailers form a small scale alliance, and the manufacturer is not included. Now the Stackelberg model is: 1 max mmm ml ppcp Q Copyright © 2011 SciRes. JSSM  Research on Supply Chain Coordination of TPL Supplier Participation 3 1 ..max , lrliirlm l s tpppccp pQ Solve the model, we can get: *** 4 R Qb , *** 4 iR pa , 2 *** 8 mR b , 2 *** 16 lr R b , 2 *** 3 16 sc R b 3) The manufacturer and retailers form a small scale alliance, and TPL provider is not included. The Stackel- berg model is: max mr irml pcc pQ ..max lll l s tppc Q Solve the model, **** 4 R Qb , **** 4 R pa , 2 **** 8 lR b , 2 **** 16 mr R b , 2 **** 3 16 sc R b 4) The manufacturer, TPL provider and retailers form a large scale alliance and make decisions together, so the profit function of the alliance is: mlrii imlr ppccc Q Solve the function, ***** 2 R Qb , ***** 2 mlr i acc c p , 2 ***** 4 sc R b 3.3. Model Analysis Conclusion 1: In the decentralized model, with the in- crease of 2 , the retailer price decreases, the sales vol- ume increases, and the profits of the manufacturer, re- tailer, TPL provider and the whole supply chain increases. Their profits reach the peak when 21 . Prove: from *2 2 2 21 11 211 inR nR pa a nn , it is found that is an decreasing function of * i p2 . From *2 2 2 21 11 211 nR nR Qbn bn , we know is an increasing function of * Q2 . And 2 * 2 1 411 mnR bn , 2 * 2 2 1 41 1 lnR bn 2 * 2 2 2 1 411 ri nR bn Because 21 , m , l , ri are increasing func- tions of 2 , and from s cmlr , so s c is an increasing function of 2 too. And when 21 , m , l , ri , s c reach their peak value. Conclusion 1 explains that, when outsourcing logistics service to TPL, the manufacturer burdens a low fee rate 1 , that lowers his wholesale price, which in turn to re- duce the retail price and increase the sales volume (de- creasing rate of retail price is smaller than the increasing rate of sales volume), and finally all parts’ profit are im- proved. Therefore, the supply chain can get a Pareto im- provement through rational sharing of logistics fee be- tween the retailers and manufacturer. Conclusion 2: In decentralized model, along with the increase of , retailers’ retail price and order quantity will increase, the profits of the manufacturer and TPL provider will increase, but retailer’s profit will decrease. n Proof: from *2 2 2 1 21 121 1 inR R pa a n n 2 , it is easy to find out that is a decreasing function of . * i pn From *22 2 2 1 21 1 21 1 nR R Qbn bn , we know is a increasing function of . * Qn From 2 *2 2 1 41 1 mR bn , 2 *2 2 2 1 41 1 lR bn , 22 2 *2 2 2 41 1 ri R bn , It can be found that m , l are increasing functions of but nri is decreasing function of . n Conclusion 2 tells that, the manufacturer will choose more retailers to lower the retailer price, thus to increase the sales volume and enhance his own profit; however, the retailer expects fewer competitors, thus he can in- crease his profit by raising retail price. , Conclusion 3: In the centralized model, when the three form a big alliance, the whole supply chain’s profit reaches the highest point and vise versa. In types of co- operation relationship, supply chain’s profit is maximized in the manufacturer- TPL case. That is, **** **** ******* sc scscscsc Proof: Copyright © 2011 SciRes. JSSM  Research on Supply Chain Coordination of TPL Supplier Participation Copyright © 2011 SciRes. JSSM 4 2 2 **** 222 22 22 2 232233 1 16 11 sc scR nnnnn bn a) when , 1nSuppose that the revenue distributing coefficients of manufacturer, TPL provider and retailer are respectively m, l, r, and kkk1 mlr kkk . Only when each party’s profit of a large scale alliance is bigger than that of the small scale alliance and even no alliance, supply chain members have the motive to participate in a large scale alliance. 2 **** 222 2 42 30 16 11 sc scR bn , then **** s csc ; b) when, 1n 2 222 22 2 2322331fnnnn n is a concave parabolic curve with the vertex Y-coordinate 4.1. Revenue Distribution Based on Nash Bargaining Model 2 2 2246 3143 1 nn nnn 0 0 . Take each party’s revenue (no alliance situation) as the bargaining points, i.e., * m , * l , * r are bargaining points, establish a bargaining model to solve each’s re- venue after cooperation based on Nash bargaining model. Since , , it can be induced that , 2 031fn 20f 0 1812fn 01 2 0 And from , so 2 031fn 18fn 120 0f , , 2 01 ***** ****** ****** * max mscmlsclrscr Zkk k 2 And , which means **** 0 scsc .. s t ****** msc m k , ***** * lscl k , ***** * rscr k **** **** scsc (1) ** ***** mlscm l kk Since 2 ****** 13 16 sc scR nn b 0, so *** ***** lrscl r kk **** ** s csc (2) **** ***** mrscm r kk That is, , so ** *****10 sc sc 1 mlr kkk ** ***** sc sc (3) 4.2. Revenue Distribution Based on Minimum Core Method Combine Function (1), (2) and (3), it can be concluded that, According to minimum core method, a linear planning model is set up as follows: **** **** ******* sc scscscsc Conclusion 3 shows that, in the large scale alliance case, all parties enhance supply chain’s profit through reducing retail price and increasing sales. Therefore, in this case, not only all supply chain members maximize their profits but also customers are well off. However, partial cooperation can be a compromise if evitable ob- stacles exist in the process of all-round cooperation. Moreover, among the types of partial cooperation, supply chain’s profit is maximized in the manufacturer-TPL case, which tell us that the retailer’s competition can make customers, TPL and the manufacturer well off. min , .. s t ****** msc m k , ***** * lscl k , ***** * rscr k ** ***** mlscm l kk , *** ***** lrscl r kk , **** ***** mrscmr kk 1 mlr kkk 4.3. Revenue Distribution Based on Simplified MCRS Method 4. Revenue Distribution under Joint Decision Making According to simplified MCRS Method, the linear func- tion group is set up as follows: From the above analysis, it is clear that large scale alli- ance can bring about greatest profit. However, revenue conflict will lead to inefficient cooperation, the supply chain can only be coordinated through reasonable fair distribution of revenue. minmax min ***** 1 , ,, jjj j n jsc j jmlr  Research on Supply Chain Coordination of TPL Supplier Participation 5 And, maxj , minj are defined as: *** ***** max **** ***** max ** ***** max ** minmin min , , , , , msclr lscmr rscml mmllr * r 5. Numerical Analysis Utilizing some data from reference 4 and 6, the parame- ters’ value are set as follows: , , 30a0.2b5 m c , , , 2 l c3 r c20.8 . 1) 2 ’s influence on order quantity, all parties’ pricing decisions and profits. When : 3n From Figure 1, it’s clear that along with the increase of 2 , the wholesale price, logistics service price and retail price decrease while the order quantity increases, and the increase rate of is bigger than the decrease rate of . Q i And from Figure 2, when 2 p increases, all parties’ profits as well as the whole supply chain’s profit increase. They reach the peak when 21 . 2) ’s influence on order quantity, all parties’ pricing decisions and profits. n From Table 1, in the decentralized model and small scale alliance situation, the order quantities increase with the increase of , and when retailer is included into the alliance, i.e., the large scale alliance situation, the value of has no effect on order quantities. n n From Table 2, in the decentralized model and small scale alliance situation, the retail prices increase with the increase of , and when retailer is included into the alliance, i.e., the large scale alliance situation, the value of has no effect on retail prices. n n From Table 3, in the decentralized model and small scale alliance situation, the total profits of the supply chain increase with the increase of , and when retailer is included into the alliance, i.e., the large scale alliance situation, the value of has no effect on total supply chain profits. And in the decentralized model, the profits of manufacture and TPL provider increase with the in- crease of , and the retailer’s profit is just opposite. Therefore, the manufacturer can increase the whole sup- ply chain’s profit and his own profit by increasing the number of retailers, but he should consider some bad effects such as retailers’ joint boycotts. n n n 3) the comparison of order quantity, retail price and sales volume and profit under three circumstances. From the three above tables, it can be concluded that in decentralized model, the order quantity was minimized, Figure 1. 2 ’s influence on order quantity, all parties’ pricing decisions. Figure 2. 2 ’s influence on all parties’ profits and total supply chain profit. Copyright © 2011 SciRes. JSSM  Research on Supply Chain Coordination of TPL Supplier Participation 6 Table 1. Order quantities in all situations. Decentralized decision Small scale alliance Large scale alliance Q * Q ** Q *** Q **** Q ***** n = 1 11.111 25.000 25.000 25.000 50.000 n = 2 14.815 33.333 25.000 25.000 50.000 n = 3 16.667 37.500 25.000 25.000 50.000 n = 4 17.778 40.000 25.000 25.000 50.000 n = 5 18.519 41.667 25.000 25.000 50.000 Table 2. Retail prices of all situations. Decentralized decision Small scale alliance Large scale alliance p i* p i** p i*** p i**** p i***** n = 1 27.778 25.000 25.000 25.000 20.000 n = 2 27.037 23.333 25.000 25.000 20.000 n = 3 26.667 22.500 25.000 25.000 20.000 n = 4 26.444 22.000 25.000 25.000 20.000 n = 5 26.296 21.667 25.000 25.000 20.000 Table 3. Supply chain member’ profits and total profits of all situations. Decentralized decision Small scale alliance Large scale alliance πm* πl* πr* πsc* πsc** πsc*** πsc**** πsc***** n = 1 111.111 61.728 24.691 197.531 375.000 375.000 375.000 500.000 n = 2 148.148 82.305 21.948 252.401 444.444 375.000 375.000 500.000 n = 3 166.667 92.593 18.519 277.778 468.75 375.000 375.000 500.000 n = 4 177.778 98.765 15.802 292.346 480.000 375.000 375.000 500.000 n = 5 185.185 102.881 13.717 301.783 486.111 375.000 375.000 500.000 the retail price was the highest and the total profit was the lowest, while in large scale alliance case they are totally opposite. And in the small scale alliance case, the total profit maximized when the manufacturer and TPL provider form the alliance. Use Excel and Lingo to calculate the profits of all par- ties and their growth rates under different revenue distri- bution method, the results are shown in Tables 4 and 5. It is clear that in this numerical case, when adopting the Minimum core method, the TPL provider gains all the extra profit of the system, i.e., the manufacturer and retailer’s profits are not improved. Therefore, this me- thod cannot be used to distribute profits, but it can be a basis for the three parties to negotiate. Each party’s profit is improved greatly though the growth extent is not the same when adopting Nash bargaining model and Simpli- fied MCRS method. The manufacturer and TPL pro- vider’s profits are maximized under the simplified MCRS method while the retailer’s profit is maximized under Nash bargaining model, which means when the three begin to negotiate they prefer different revenue distribu- tion methods. Since here is the supply chain situation led by the manufacturer, which means he has the strongest bargaining power, so the simplified MCRS method will be used by the alliance. Besides that, the growth extent of retailer’s profit under this method is greater than under the other two methods, so in this case, the simplified MCRS method is the ideal one. The distributing coeffi- Copyright © 2011 SciRes. JSSM  Research on Supply Chain Coordination of TPL Supplier Participation 7 Table 4. All parties’ profits under diffe re nt re venue distribution method. Nash bargaining model Minimum core method Simplified MCRS Method Manufacturer 240.741 166.667 244.186 TPL provider 166.667 314.814 197.674 retailer 92.592 18.519 58.140 Table 5. Growth rates under different distribution method. Nash bargaining modelMinimum core methodSimplified MCRS method manufacturer 44.44% 0.00% 46.51% TPL provider 80.00% 240.00% 113.49% Decentralized model retailer 399.98% 0.00% 213.95% M + L 8.64% 28.39% 17.83% L + R 107.41% 166.67% 104.65% Small scale alliance M + R 166.67% 48.15% 141.86% cients are separately 0.488, 0.396, 0.116. 6. Conclusions Based on the above analysis of wholesale price contract, the supply chain coordination problem with TPL partici- pation was discussed associated with revenue sharing and distribution theory. The following conclusions are ob- tained: 1) In the decentralized model, Pareto improvement can be realized through reasonable distribution of the logis- tics fee between the retailer and manufacturer; as the supply chain leader, the manufacturer has to choose a certain number of retailers to balance their profits. 2) In the three types of small scale alliances, the total supply chain profit is the greatest when the manufacturer and the TPL provider form a alliance. 3) All node enterprise’s profits are maximized in the large scale alliance, and minimized in the decentralized model. 4) Supply chain firms can choose an appropriate reve- nue distribution method, such as Nash bargaining model, minimum core method and simplified MCRS method to coordinate the supply chain. REFERENCES [1] A. Vining and S. Globerman, “A Conceptual Framework for Understanding the Outsourcing Decision,” European Management Journal, Vol. 17, No. 6, 1999, pp. 183-198. [2] D. L. Yang and Y. Jiang, “Quantitative Research on the Collaboration between Node Enterprise and Third Party Logistics under SCM,” China Soft Science, Vol. 3, 2002, pp. 1-5. [3] Y. Y. Zheng, “Study on the Cooperation Relationship between Third Party Logistics and Vendor under Supply Chain,” Qing Dao University, 2005. [4] S. Huang and B. Y. Li, “The Coordination of the Third Party Logistics Based on Revenue Sharing,” Businuess Economies, Vol. 11, 2008, pp. 5-8. [5] B. Dan, Q. Wu, X. M. Zhang and J. Xiao, “Shared-Sav- ings Contracts between a Third Party Logistics Service Provider and a Client Enterprise,” System Engineer- ing-Theory and Practice, Vol. 2, 2007, pp. 46-53. [6] Y. D. Gong, B. Y. Li and T. Liu, “The Pricing and Coor- dination Policies of Three-Echelon Supply Chain,” Price Monthly, Vol. 9, 2008, pp. 12-14. [7] F. Ye and Y. N. Li, “The Motivation Mechanism of Three- echelon Supply Chain Cooperation,” Journal of System Management, Vol. 16, No. 2, 2007, pp. 130-134. Copyright © 2011 SciRes. JSSM |