Applied Mathematics

Vol.07 No.09(2016), Article ID:66771,12 pages

10.4236/am.2016.79075

A New Approach for Solving Boundary Value Problem in Partial Differential Equation Arising in Financial Market

Fadugba Sunday Emmanuel1*, Emeka Helen Oluyemisi2

1Department of Mathematical Sciences, Ekiti State University, Ado Ekiti, Nigeria

2Department of Mathematical and Physical Sciences, Afe Babalola University, Ado Ekiti, Nigeria

Copyright © 2016 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 1 April 2016; accepted 23 May 2016; published 26 May 2016

ABSTRACT

In this paper, we present a new approach for solving boundary value problem in partial differential equation arising in financial market by means of the Laplace transform. The result shows that the Laplace transform for the price of the European call option which pays dividend yield reduces to the Black-Scholes-Merton model.

Keywords:

Black-Scholes-Merton Model, Boundary Value Problem, European Call Option, Financial Market, Laplace Transform

1. Introduction

An option is a contract that gives the right (not an obligation) to its holder to buy or sell some amount of the underlying asset at a future date for a prescribed price. The underlying assets include stocks, stock indices, debt instruments, commodities and foreign currency. A call option gives its holder the right to buy the underlying asset, whereas a put option gives its holder the right to sell. Vanilla options are actively traded on organized exchanges. They are also subject to certain regularity and standardization conditions. Vanilla options can be classified as American options and European options. An American option gives a financial agent the right, but not obligation to buy or to sell the underlying assets on or prior to the expiry date at the specified price called the exercise price. European option is an option that can be exercised only at the expiry date with linear payoff. European option comes in two forms namely European call and put options.

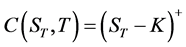

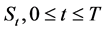

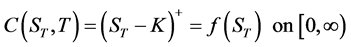

A European call option is an option that can be exercised only at expiry and has a linear payoff given by the difference between underlying asset price at maturity and the exercise price. The payoff for the European call option is given by

. (1)

. (1)

A European put option is an option that can be exercised only at expiry and has a linear payoff given by the difference between the exercise price and underlying asset price at maturity. The payoff for the European put option is given by

. (2)

. (2)

The revolution on derivative securities both in exchange markets and in academic communities began in the early 1970’s. How to rationally price an option was not clear until 1973, when Black and Scholes published their seminal work on option pricing in which they described a mathematical frame work for finding the fair price of a European option (see [1] ).

Moreover, in the same year, [2] extended the Black-Scholes model in several important ways. Since its invention, the Black-Scholes formula has been widely used by traders to determine the price of an option. However this famous formula has been questioned after the 1987 crash.

One of the main concerns about financial options is what the exact values of options are. For the simplest model in the case of constant coefficients, an exact pricing formula was derived by Black and Scholes, known as the Black-Scholes formula. However, in the general case of time and space dependent coefficients the exact pricing formula is not yet established, and thus numerical solutions have been used (see [3] ).

There are many exhaustive texts and literatures in this subject area such as [4] - [10] , just to mention a few.

In this paper, we present a new approach for solving boundary value problem in partial differential equation arising in financial market via the Laplace transform. The rest of the paper is organized as follows: Section 2 presents the Black-Scholes-Merton partial differential equation for the price of European call option which pays a dividend yield. In Section 3, we consider the Laplace transform and some of its fundamental properties. Section 4 presents the Laplace transform for solving boundary value problem in partial differential equation arising in financial market. We also show that our result reduces to Black-Scholes-Merton like formula. Section 5 concludes the paper.

2. The Black-Scholes-Merton Partial Differential Equation

We consider a market where the underlying asset price  is governed by the stochastic differential equation of the form

is governed by the stochastic differential equation of the form

(3)

(3)

where  is the volatility, r is the riskless interest rate, d is the dividend yield and

is the volatility, r is the riskless interest rate, d is the dividend yield and  is a one-dimensional Wiener process. Standard arbitrage arguments show that any derivative

is a one-dimensional Wiener process. Standard arbitrage arguments show that any derivative  written on

written on  must satisfy the partial differential equation of the form

must satisfy the partial differential equation of the form

. (4)

. (4)

Setting  in (4), then we have the Black-Scholes-Merton partial differential equation for the price of European call option given by

in (4), then we have the Black-Scholes-Merton partial differential equation for the price of European call option given by

(5)

(5)

with boundary conditions

(6)

(6)

(7)

(7)

and final time condition given by

. (8)

. (8)

Equation (7) states that the option is worthless when the stock price is zero.

3. The Laplace Transform and Its Fundamental Properties

Let  be a piece-wise continuous function on every closed interval

be a piece-wise continuous function on every closed interval

whenever the integral exists. Conversely, the inverse Laplace transform of

Let

1) Linearity of the Laplace Transform

Equation (11) is intermediate from the definition and the linearity of the definite integral.

2) Scaling Property

3) Shifting Property

4) Commutativity Property

The Laplace transform is commutative. i.e.

5) The Laplace Transforms on Differentiation

Let

there exist constant M and X such that

Note that the condition

6) Convolution Property

Theorem 1: Convolution Theorem

Let

product given by

is denoted by

We present some of the results on the existence and uniqueness of the Laplace transform below.

Theorem 2: Existence of Laplace Transform

Let

at infinity with

Theorem 3: Uniqueness of Laplace Transform Let

tions with an exponential order at infinity. Assume that

for every

Relation to the Mellin and the Fourier Transformations

Laplace transformation is closely related to an extended form of other popular transforms, particularly Mellin and Fourier. Both can be obtained through a change of variables. By setting

The Laplace transform (9) yields

where

4. Laplace Transform for Solving Boundary Value Problems in Partial Differential Equation Arising in Financial Market

By change of variables

with boundary conditions

and final time condition given by

Let the Laplace transform for the price of the European call option be defined as

and the inverse Laplace transform for the price of the European call option be given by

where

Taking the Laplace transform of (5) using (24) we have that

where

Substituting (27), (28), (29) and (30) into (26) yields

Simplifying further and rearranging terms in (31) we have that

We consider the following two cases as follows.

CASE I

For

The general solution to (33) can be obtained as

where

and the particular solution respectively.

We assume that the solution to (33) is of the form

The first and the second derivatives of (36) are obtained as

and

Substituting (36), (37) and (38) into (35), and simplifying further, we have that

Solving (39), we obtain the following roots

Hence the complementary solution to the homogeneous part of (33) is obtained as

where

For the particular solution of (33), we assume that

Using (42) and (33), and equating the coefficients of terms, we obtain

Substituting (43) and (44) into the particular solution, we have that

Substituting (41) and (45) into (34)

Equation (46) is the general solution to (33) for

CASE II

For

Following the above procedures, the general solution to the last equation is obtained as

with

Equation (47) coincides with the complementary solution of (33) given by (41).

In the case of

We want the option pricing function to be continuous and differentiable at the transition point

Setting (50) = (52) and (51) = (53) and solving further, we obtain

and

Substituting (54) and (55) into (49) and (48), we have

and

respectively. Equations (56) and (57) can also be written as

Equation (58) is the Laplace transform of the price of European call option which pays a dividend yield.

Theorem 4

If

reduces to the Black-Scholes-Merton valuation formula

with

by means of the Laplace transform of the form

where

Proof: From (57) and (58a) we can write that

Setting

Therefore, (59) becomes

Let us first consider the term

Using the values of

and

Therefore (63) yields

Thus,

Substituting the value of

Comparing (65) with (58c), we have that

Taking the inverse Laplace transform of (65), we obtain

where

We also consider the term

Substituting the values of

Simplifying (70) further, we obtain

Once again we compare (71) with (58c), we deduce that

Taking the Laplace transform of (72), we have that

where

The inverse Laplace transform of (62) is obtained as

Substituting (67), (68), (73) and (74) into (75) yields

This completes the proof.

Theorem 5

If

reduces to the Black-Scholes-Merton valuation formula given by

with

by means of the Laplace transform given by

where

Remark 1

1) The proof of Theorem 5 follows from Theorem 4, since (56) and (57) have the same inverse Laplace transforms.

2 The above results show that the prices of European call option with dividend yield given by (56) and (57) coincide with the Black-Scholes-Merton model given by (58b) by means of (58c).

5. Conclusion

Finance is one of the fastest developing areas in the modern corporate and banking world. In this paper, we have considered the boundary value problem in partial differential equation arising in financial market. We used a new approach for solving the Black-Scholes-Merton partial differential equation for the price of European call option which pays a dividend yield by means of the Laplace transform. The same approach can be used for European put option with dividend paying stock. The results show that the Laplace transform for the price of the European call option with dividend paying stock coincides with the Black-Scholes-Merton model; it is very effective and is a good tool for solving partial differential equations arising in financial market and other areas such as engineering and applied sciences.

Cite this paper

Fadugba Sunday Emmanuel,Emeka Helen Oluyemisi, (2016) A New Approach for Solving Boundary Value Problem in Partial Differential Equation Arising in Financial Market. Applied Mathematics,07,840-851. doi: 10.4236/am.2016.79075

References

- 1. Black, F. and Scholes, M. (1973) The Pricing of Options and Corporate Liabilities. Journal of Political Economy, 81, 637-654.

http://dx.doi.org/10.1086/260062 - 2. Merton, R.C. (1973) Theory of Rational Option Pricing. Bell Journal of Economics and Management Science, 4, 141-183.

http://dx.doi.org/10.2307/3003143 - 3. Lee, H. and Sheen, D. (2009) Laplace Transformation Method for the Black-Scholes Equation. International Journal of Numerical Analysis and Modelling, 6, 642-658.

- 4. Cohen, A.M. (2007) Numerical Methods for Laplace Transform Inversion. Springer, New York.

- 5. Nwozo, C.R. and Fadugba, S.E. (2014) Performance Measure of Laplace Transforms for Pricing Path Dependent Options. International Journal of Pure and Applied Mathematics, 94, 175-197.

http://dx.doi.org/10.12732/ijpam.v94i2.5 - 6. Fadugba, S.E. and Ogunrinde, R.B. (2014) Black-Scholes Partial Differential Equation in the Mellin Transform Domain. International Journal of Scientific and Technology Research, 3, 200-206.

- 7. Lee, R. (2003) Option Pricing by Transform Methods: Extension, Unification and Error Control. Stanford University, Working Paper.

- 8. Petrella, G. and Kuo, S.G. (2004) Numerical Pricing of Discrete Barrier and Lookback Options via Laplace Transforms. Journal of Computational Finance, 8, 1-37.

- 9. Zieneb, E. and Rokiah, R.A. (2013) Solving an Asian Options PDE via Laplace Transform. Science Asia, 39S, 67-69.

http://dx.doi.org/10.2306/scienceasia1513-1874.2013.39S.067 - 10. Shimko, D.C. (1992) Finance in Continuous Time. A Primer, Kolb Publishing.

NOTES

*Corresponding author.