Journal of Mathematical Finance

Vol.05 No.01(2015), Article ID:53969,8 pages

10.4236/jmf.2015.51004

Entrepreneurship Dynamics under Time Inconsistent Preferences

Yang Liu, Jinqiang Yang

School of Finance, Shanghai University of Finance and Economics, Shanghai, China

Email: breadyoung@outlook.com, yang.jinqiang@mail.sufe.edu.cn

Copyright © 2015 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 21 January 2015; accepted 9 February 2015; published 11 February 2015

ABSTRACT

We investigate the implications of time inconsistent preferences on the entrepreneurial decision making. We use a time varying preference model to capture the optimal liquidation choice and investment allocation for the averse risk agent in the incomplete market. Compared to standard entrepreneurial dynamic framework, our model shows that inconsistent preferences may lead to under investment when the entrepreneur faces liquidity constraint and over investment when his liquid wealth is far away from the liquidation boundary. Moreover, the possibility of changing to the future stage has ambiguous influences on the exit decision and optimal investment.

Keywords:

Time Inconsistency, Liquidity Constraints, Precautionary Saving, Optimal Liquidation, Investment Strategy

1. Introduction

Entrepreneurs face high uncertainty and liquidity constraints, both of which have significant influences on the business decision making process. These uncertainty and constraints are important determinants for capital ac- cumulation, exit decision and asset allocation. Since [1] , the real option approach has become an essential part of optimization problem for the entrepreneurs. [2] develop an incomplete-market q-theoretic model to study entrepreneurship dynamics and find that the illiquidity, idiosyncratic risks and borrowing constrains result in business decisions, consumption and asset allocation decisions different with the standard complete markets profit-maximizing analysis for entrepreneurial firms.

In the standard optimization model framework, it is assumed that agents have a constant rate of time pre- ference. However, virtually every experimental research on time preference indicates that this assumption is unrealistic. The most relevant effect of time inconsistent is the preference change with time. Usually, an agent has different preferences at different stages. In this article, we focus on the entrepreneurs’ decision making under non-constant preference.

In our paper, we try to focus on the following interesting questions: What is the impact of time inconsistent preference on the entrepreneurial valuation? How could the time varying discount rate affects the liquidation choices? How would the entrepreneur allocate the wealth between investment, consumption and public equity? We extend the entrepreneurial optimization model in [2] by incorporating the time inconsistence preferences.

Our model gives three main contributions. First, the time inconsistent agent will under invest when his liquid wealth is close to liquidation boundary and over invest when the agent is far away from the exit threshold. Second, time inconsistent preferences weaken the effects of risk aversion on the liquidation decisions. Third, increasing the possibility of the birth of the future stage with utility discount has ambiguous influences on the exit decision and investment strategy and finally the decisions approach the steady result in the future stage.

Our research relates to the literature about time inconsistency model and its application. [3] models time varying impatience with quasi hyperbolic discount functions and explains why consumers have asset-specific marginal propensities. [4] describe the equilibrium of a discrete-time exchange economy in which consumers with arbitrary subjective discount factors and homothetic period utility functions follow linear Markov consumption and portfolio strategies. [5] consider two types of goods: goods with immediate costs and delayed benefits, and goods with immediate benefits and delayed costs. With time inconsistency model, they explain how to design optimal contract respond to consumer biases. [6] extend the real option framwork to model the investment timing decisions of entrepreneurs with time inconsistent preferences.

The remainder of the paper proceeds as follows: Section 2 presents the model; Section 3 derives the solutions; Section 4 provides the quantitative results and Section 5 concludes.

2. Model

In this section, we set out the framework for the basic model of entrepreneurial optimization problem. The liqui- dation option is described and followed by a discussion of the nature of time inconsistent preferences.

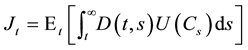

Time is continuous and horizon is infinite. There is a single perishable consumption good. The agent derives utility from a consumption process  according to

according to

(1)

(1)

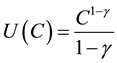

where  is a concave function. For tractability, we choose

is a concave function. For tractability, we choose , where

, where  is the coefficient

is the coefficient

of relative risk aversion.  denotes the agent’s intertemporal discount function: the agent’s value at time

denotes the agent’s intertemporal discount function: the agent’s value at time  of $1 received at the future time s. We thus have

of $1 received at the future time s. We thus have

(2)

(2)

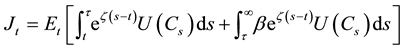

for . As in [7] , the present stage could last for a random duration of time. For simplicity, we assume that the lifespan of present agent

. As in [7] , the present stage could last for a random duration of time. For simplicity, we assume that the lifespan of present agent  is exponentially distributed with parameter

is exponentially distributed with parameter . Stated in another way, the birth of future agent is modeled as a Poisson process with intensity

. Stated in another way, the birth of future agent is modeled as a Poisson process with intensity . We define

. We define  where

where  measures the degree of the agent’s utility discount in future stage. We assume the agent is in the present stage, and thus the value function is:

measures the degree of the agent’s utility discount in future stage. We assume the agent is in the present stage, and thus the value function is:

(3)

(3)

Consider the setting for a standard entrepreneurial problem as in [2] . The agent possesses a firm and our pro- duction specification features the widely used “AK” technology augmented with capital adjustment costs. Let I denote the gross investment. The change of capital stock  is given by:

is given by:

where

measures the degree of the adjustment cost.

The entrepreneur has an option to liquidate capital at any moment. Liquidation is irreversible and gives a terminal value

The agent can invest in risk free asset and public equity. These two financial asset represent the standard investment opportunities in the classical [8] model. The risk free asset accumulates with a constant interest rate

ratio for the public equity is:

and the entrepreneurial business. The non diversifiable risks

Let

After exiting from the business, the agent retires and

The agent is allowed to borrow against capital at all times in our model. To make sure the debt is risk free, we set the liquidation value of the capital

The optimization problem of the agent involves the maximization of the utility defined as (3). First, before liquidation

3. Solution

3.1. Benchmark: Time Consistent Preference

As a benchmark, we consider the case in which the entrepreneurial preference is time consistent. The constant preference case reduces to [2] , and the solution to this problem is summarized in Proposition 1.

Proposition 1. The entrepreneur operates the business if and only if

the following ordinary differential equation (ODE):

where

approaches the complete-markets solution given by

The ODE (8) satisfies the following boundary conditions at endogenous liquidation choice

capital ratio

3.2. Time Inconsistent Case

Consider the case of an entrepreneur who makes decisions under the belief that future selves act in the interest of the current self. This assumption has been analyzed in [9] . In addition, this assumption is also consistent with empirical evidence on 401 (K) investment (see [10] ), and health club attendance (see [11] ).

Assume the entrepreneur is in the present stage where the value function takes the form as (3). The standard dynamic programming argument implies that the agent’s optimal consumption, investment and public equity allocation solve the following Hamilton-Jaobi-Bellman (HJB) equation of value function

where

Let

Proposition 2. The scaled CE wealth

When

the valuation in complete-market.

optimal liquidation choice

The consumption, investment and public equity allocation are given by

4. Quantitative Results

Parameter choices. Where possible, we borrow the parameters from [2] . We set

4.1. Optimal Liquidation Boundary

Figure 1 plots the effects of risk aversion and correlation on liquidation boundaries. Panel A presents

Figure 1. Effects of risk aversion and correlation on liquidation choices.

significant in time inconsistent case. Therefore,

The magnitude of utility discounting parameter

4.2. CE Wealth and Investment Decision

The time inconsistency affects not only the liquidation choice but also the wealth and operation strategies. Figure 3 plots the effects of inconsistency on CE wealth, Tobin’s q, entrepreneurial investment and con- sumption. We define private enterprise value

time inconsistent case. Panel C plots the investment decision and indicates that there exist both over- and under- investment in time inconsistent case compared to the constant preference. The entrepreneur will invest less when his liquid wealth approaches the liquidation threshold. In a higher level of liquid wealth, on the other hand, the inconsistent preference agent will invest more than standard model. Panel D presents the consumption in two preference settings. The inconsistent agent will consume less and this reflects their precautionary saving con- sidering the utility discount in the future stage.

Figure 4 plots the effects of

Figure 2. Effects of

Figure 3. Effects of time inconsistence preferences on CE wealth and entrepreneurial investment and consumption decisions.

Figure 4. Effects of poison intension

agent’s liquid wealth equals the capital

5. Conclutions

This paper extends the entrepreneurial dynamics model to account for time inconsistent preferences. Entrepreneurs need to formulate the investment decisions taking into account the possibility of future stage with utility discount. This sets up a conflict between two opposing forces. First, the agent desires to take advantage of the option to exit, and also has an incentive to invest more and longer to offset the utility discount in future stage. Second, the time inconsistent preference lead to motivation of precautionary saving and thus reducing the investment. We extend the model of [2] to consider the decision making process for an industry made up of time inconsistent entrepreneurs.

We find that time inconsistency leads to under investment when the entrepreneurial liquid wealth is close to the liquidation boundary and over investment when the liquid wealth is far away from the exit threshold. For further analysis, we study the effects of some key factors in our model. Inconsistency weakens the effects of risk aversion which accelerates the liquidation. The effects of the correlation between the firm and the public equity are ambiguous and non monotonic in both cases, but the inconsistent setting delays the exit decision compared to consistent model. The magnitude of Poisson process intensity

Acknowledgements

Jinqiang Yang acknowledges support by Natural Science Foundation of China (#71202007 #71472117), New Century Excellent Talents in University (#NCET-13-0895) and Chen Guang Project of Shanghai Municipal Education Commission and Shanghai Education Development Foundation (#12CG44).

References

- Mcdonald, R. and Daniel, S. (1986) The Value of Waiting to Invest. Quarterly Journal of Economics, 101, 707-727.

- Chong, W., Wang, N. and Yang, J.Q. (2012) A Unified Model of Entrepreneurship Dynamics. Journal of Financial Eco- nomics, 106, 1-23. http://dx.doi.org/10.1016/j.jfineco.2012.05.002

- Laibson, D. (1997) Golden Eggs and Hyperbolic Discounting. The Quarterly Journal of Economics, 112, 443-477.

- Luttmer, E.G.J. and Thomas, M. (2003) Subjective Discounting in an Exchange Economy. Journal of Political Economy, 111, 959-989. http://dx.doi.org/10.1086/376954

- DellaVigna, S. and Ulrike, M. (2004) Contract Design and Self-Control: Theory and Evidence. The Quarterly Journal of Economics, 119, 353-402. http://dx.doi.org/10.1162/0033553041382111

- Grenadier, S.R. and Wang, N. (2007) Investment under Uncertainty and Time-Inconsistent Preferences. Journal of Fi- nancial Economics, 84, 2-39. http://dx.doi.org/10.1016/j.jfineco.2006.01.002

- Harris, C. and David, L. (2004) Instantaneous Gratification. Mimeo.

- Merton, R.C. (1971) Optimum Consumption and Portfolio Rules in a Continuous-Time Model. Journal of Economic Theory, 3, 373-413. http://dx.doi.org/10.1016/0022-0531(71)90038-X

- O’Donoghue, T. and Matthew, R. (1999) Doing It Now or Later. American Economic Review, 89, 103-124. http://dx.doi.org/10.1016/0022-0531(71)90038-X

- Madrian, B.C. and Shea, D.F. (2001) The Power of Suggestion: Inertia in 401 (k) Participation and Savings Behavior. The Quarterly Journal of Economics, 116, 1149-1187. http://dx.doi.org/10.1162/003355301753265543

- DellaVigna, S. and Malmendier, U. (2004) Overestimating Self Control: Evidence from the Health Club Industry. No. w10819, National Bureau of Economic Research. http://dx.doi.org/10.3386/w10819