Paper Menu >>

Journal Menu >>

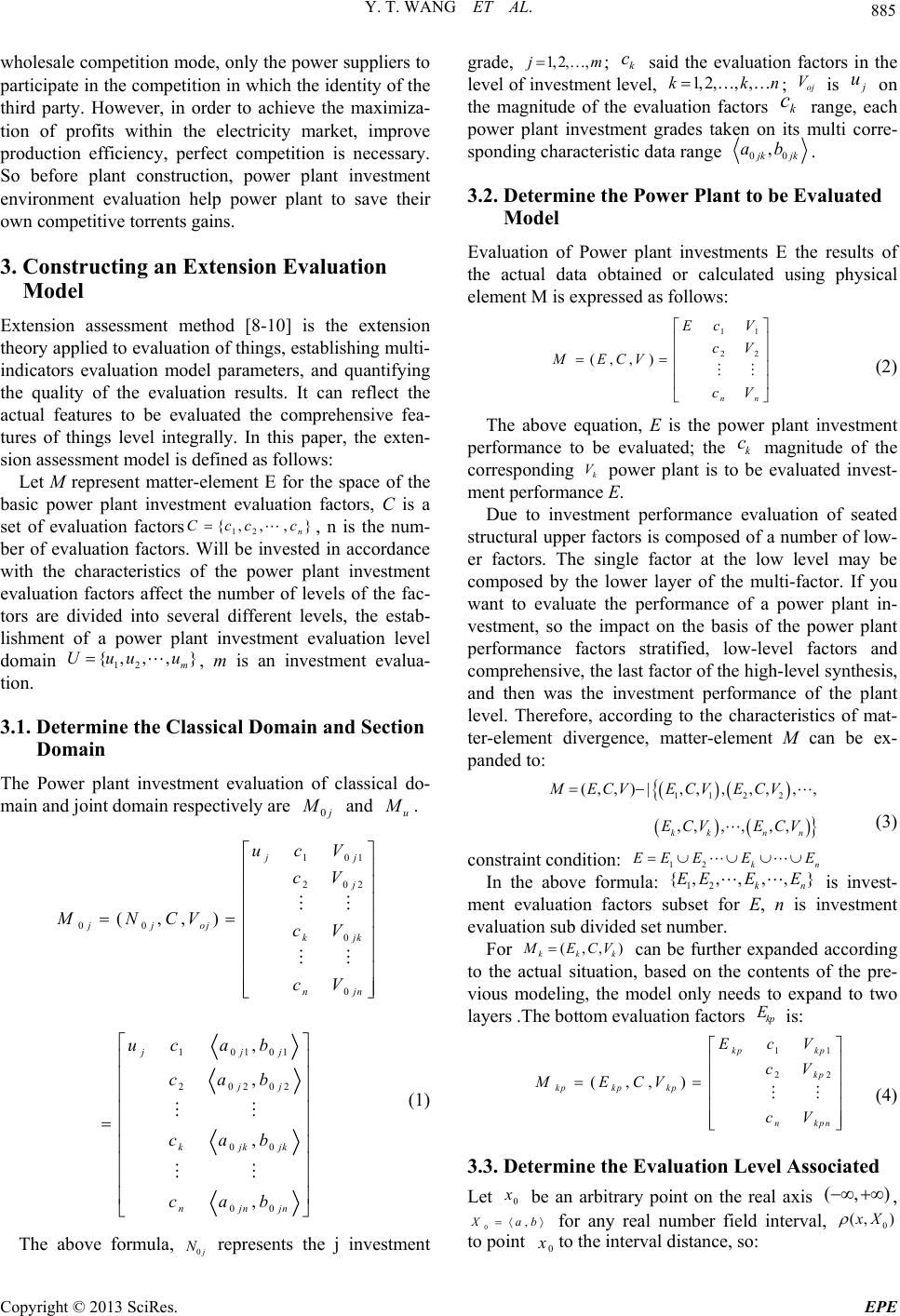

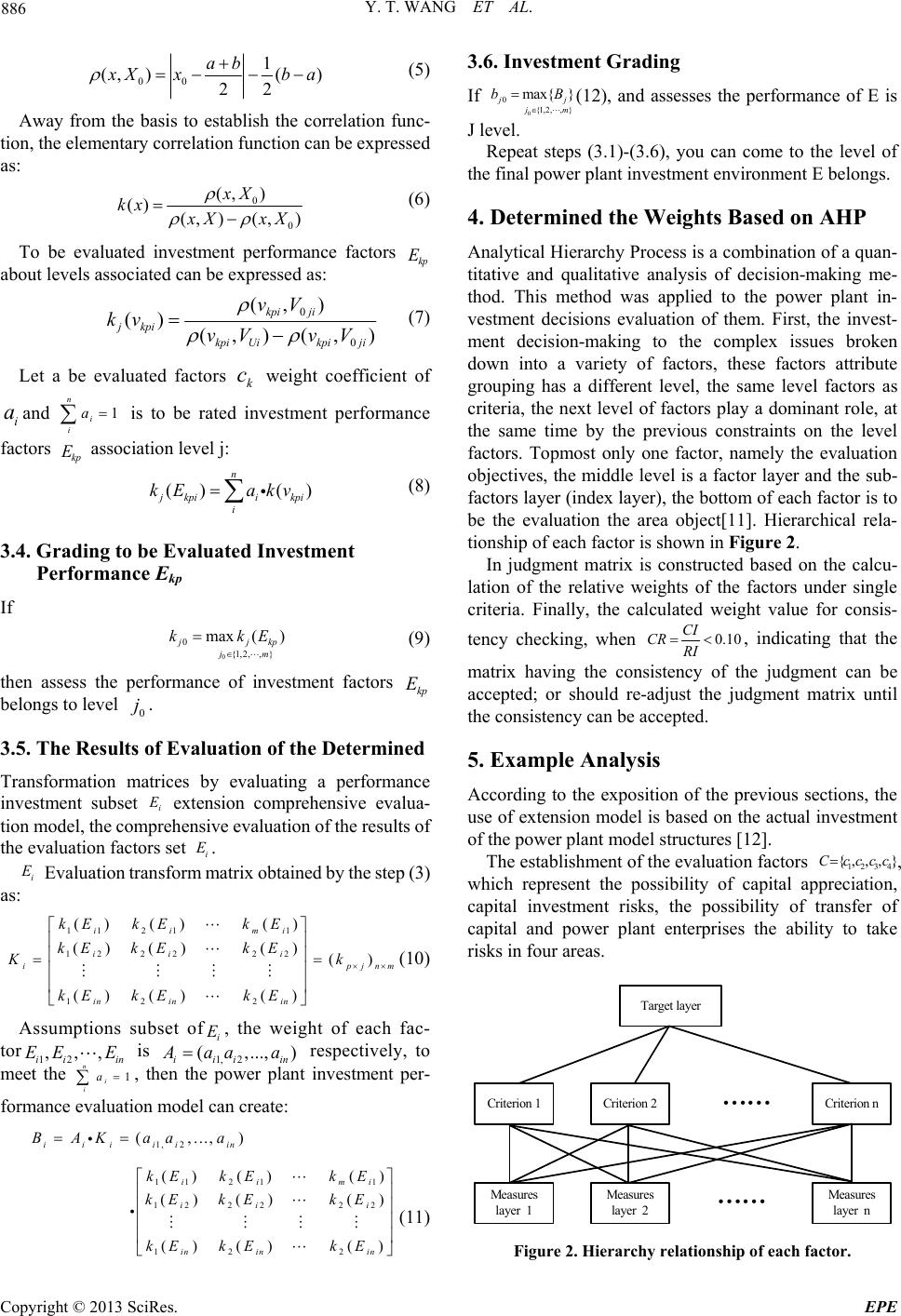

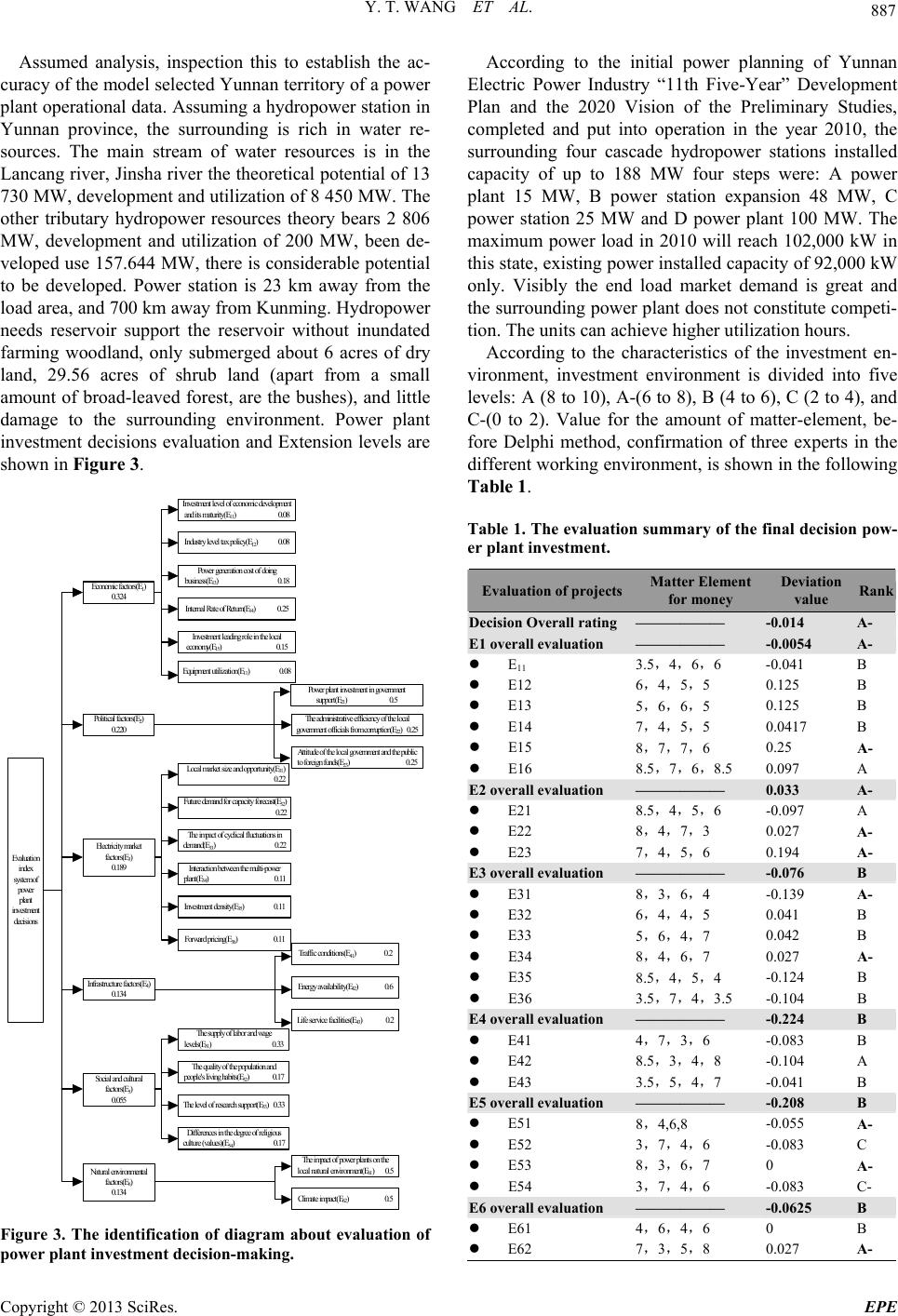

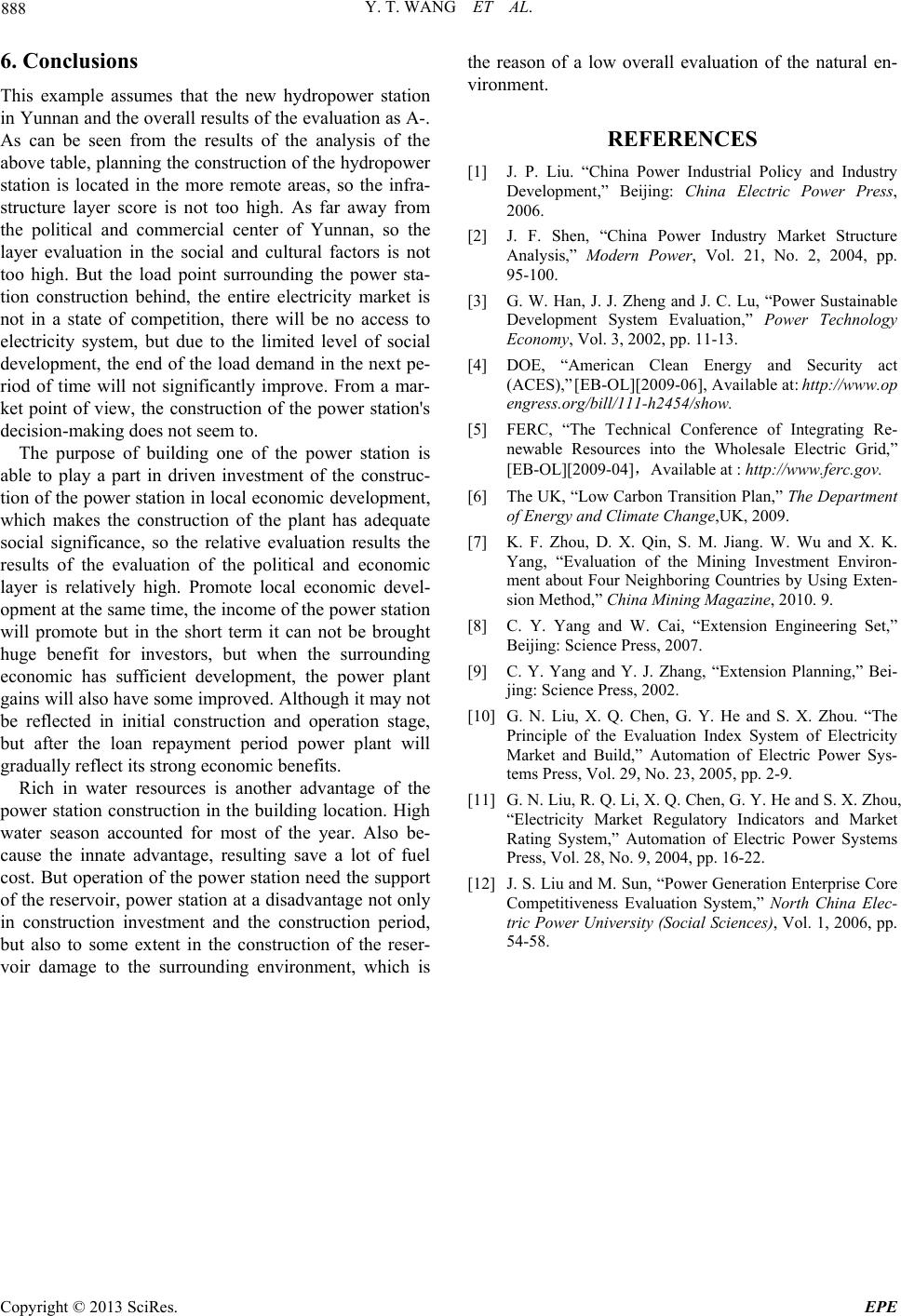

Energy and Power Engineering, 2013, 5, 884-888 doi:10.4236/epe.2013.54B170 Published Online July 2013 (http://www.scirp.org/journal/epe) Extension Study on Electricity Market of Power Plant Investment Environment Yuting Wang1, Kezhen Liu1, Chenkai Mo2 1Faculty of Power Engineering, Kunming University of Science and Technology, Kunming, Yunnan Province, China 2Jiaxin Power Plant, Jiaxin, Zhejiang Province, China Email: wangyuting1030@foxmail.com, liukzh@sina.com.cn Received February, 2013 ABSTRACT When the global electricity indu stry has reorganized th e structure and introduced co mpetitive market mechanism world widely, China is no exception. Since 2002, “Electricity System Reform Program” was enacted. The mode of the State Power Corporation was divided. It means China's electricity market steps into the mode of Wholesale Competition. The meaning of the evaluation of power plant investment decision is to provide references for the market members when they made the decisions throug h the comprehensive evaluation of inter nal performance of Power Plant and th e external investment environment, therefore further optimizing the allocation of funds, avoiding the risks, pursuing maximize of the profits. Keywords: Power Plant Investment Environment; Evaluation Index System; Extension Evaluation 1. Introduction Since China’s first construction of power lines in 1882, China has gradually become one of the largest power systems in the world [1]. Closely related to the develop- ment of China's electric power industry and the reform of the electricity system, the government’s over interference in enterprises and highly unified planning economic sys- tem from the beginning of the liberation to reform and open up the separation of government administration from enterprise management and self-exploration of the market-oriented operating system and then gradually try to plant network separate competitive bidding market. China’s electric power system reform has gone through a tortuous and long road. From the separation of plant and grid, power plant investment project always has been the focus of the electric power investment research because as its large investment and long construction cycle since 2002. Therefore, investment environment evaluation can make investment decision more scientific, standardized and programming before the power project investment, thus reducing the maximum degree of the risk from the policy [2,3]. 2. China’s Power Market Characteristics Analysis Since the enactment of promulgated The Power System Reform Plan from 2002, our country’s electric power market gradually began to change to Wholesale Compe- tition mode [4-7]. In this mode, all power generation companies and transmission network is no longer a ver- tically integrated operation monopoly power company must be in the vertical split its affiliated power genera- tion companies to pull away from the grid in removing all independent into a self-financing independent power producers. At the same time, establish a relatively sound basis the separation of plant and grid the electricity mar- ket, power generation companies in this electricity mar- ket bidding. Wholesale competition model is shown in Figure 1. At present, China’s power market is moving towards Independent pow er producersIndependent pow er producersIndependent pow er producersIndependent pow er producers D is trib utio n companies Distribution companies L arge u sersLarge users Small end-userSma ll end-user Tra n smiss io n Netwo rk The Wholesale Market Figure 1. Wholesale competition model. Copyright © 2013 SciRes. EPE  Y. T. WANG ET AL. 885 wholesale competition mode, only the power suppliers to participate in the competition in which the identity of th e third party. However, in order to achieve the maximiza- tion of profits within the electricity market, improve production efficiency, perfect competition is necessary. So before plant construction, power plant investment environment evaluation help power plant to save their own competitive torrents gains. 3. Constructing an Extension Evaluation Model Extension assessment method [8-10] is the extension theory applied to evalua tion of things, establishing multi- indicators evaluation model parameters, and quantifying the quality of the evaluation results. It can reflect the actual features to be evaluated the comprehensive fea- tures of things level integrally. In this paper, the exten- sion assessment model is defined as follows: Let M represent matter-element E for the space of the basic power plant investment evaluation factors, C is a set of evaluation factors, n is the num- ber of evaluation factors. Will be invested in accordance with the characteristics of the power plant investment evaluation factors affect the number of levels of the fac- tors are divided into several different levels, the estab- lishment of a power plant investment evaluation level domain , m is an investment evalua- tion. 12 {,,, } n Ccc c } m u 12 {, ,,Uuu 3.1. Determine the Classical Domain and Section Domain The Power plant investment evaluation of classical do- main and joint domain respectively are 0 j M and u M . 101 202 00 0 0 (,,) jj j jjoj kj nj ucV cV MNCV cV cV k n 10101 20202 00 00 , , , , jj jj kjkjk njnjn uc ab cab cab cab j (1) The above formula, 0 j N represents the j investment grade, 1, 2,, j m ; said the evaluation factors in the level of investment level, is on the magnitude of the evaluation factors range, each power plant investment grades taken on its multi corre- sponding characteristic d ata range k c 1, 2,,,kk ; c n oj V k j u 0 , jk 11 22 nn 0jk ab . 3.2. Determine the Power Plant to be Evaluated Model Evaluation of Power plant investments E the results of the actual data obtained or calculated using physical element M is expressed as follows: (,,) E cV cV cV MECV k c (2) The above equation, E is the power plant investment performance to be evaluated; the magnitude of the corresponding k power plant is to be evaluated invest- ment performance E. V Due to investment performance evaluation of seated structural upper factors is composed of a number of low- er factors. The single factor at the low level may be composed by the lower layer of the multi-factor. If you want to evaluate the performance of a power plant in- vestment, so the impact on the basis of the power plant performance factors stratified, low-level factors and comprehensive, the last factor of the high-level synthesis, and then was the investment performance of the plant level. Therefore, according to the characteristics of mat- ter-element divergence, matter-element M can be ex- panded to : 11 | ,,2 , ,2 , ,(,,), M ECVE CVECV ,, kk ECV, ,n E kn ,, n CV (3) constraint condition: 12 E EE E E , , , k In the above formula: 12 {, ,} n E EEE is invest- ment evaluation factors subset for E, n is investment evaluation s ub divide d set n u mber. For kkk (,,) M ECV can be further expanded according to the actual situation, based on the contents of the pre- vious modeling, the model only needs to expand to two layers .The bottom evaluation factors is: kp E kp nk Ec 11 22 ,) kp kp kp p V CV (, kpkp ME n cV cV (4) 3.3. Determine the Evaluation Level Associated Let 0 x be an arbitrary point on the real axis (,) , 0, X ab for any real number field interval, 0)(, x X to point 0 x to the interval distance, so: Copyright © 2013 SciRes. EPE  Y. T. WANG ET AL. 886 00 1 (, )() 22 ab x Xx b a (5) Away from the basis to establish the correlation func- tion, the elementary correlatio n function can be expressed as: 0 0 (, ) () (, )(,) xX kx x XxX (6) To be evaluated investment performance factors kp E about levels associated can be expressed as: 0 0 (, ) () (,)(, ) kpi ji jkpi kpi Uikpiji vV kv vV vV (7) Let a be evaluated factors weight coefficient of and is to be rated investment performance k c i a1 n i i a factors kp E association level j: () ( n) j kpii kpi i kE akv (8) 3.4. Grading to be Evaluated Investment Performance Ekp If 0 0{1,2, , } max () jj jm kk kp E (9) then assess the performance of investment factors belongs to level . kp E 0 j 3.5. The Results of Evaluation of the Determined Transformation matrices by evaluating a performance investment subset i E extension comprehensive evalua- tion m odel, the com preh ensi v e eval uati on of the resul ts of the evaluation factors set i E . i E Evaluation transform matrix obtained by the step (3 ) as: 11 211 122222 12 2 () ()() ()()() () () ()() ii mi ii i ipj nm in inin kEkEk E kEkEkE Kk kE kEkE (10) Assumptions subset of, the weight of each fac- tor is i E ( ii 12 1, 2i in ,,, iii EE En,..., ) A aa a meet the , then the power plant investment per- formance evaluation model can create: respectively, to 1 i i a n 1, 2 (,..., ) iii iiin B AK aaa 11 211 12 2222 122 () ()() () ()() () ()() ii m ii in inin kEkEk E kE kEkE kEkEkE 3.6. Investment Grading If 0 0{1,2,, } max{ } j j j m b B (12), and assesses the performance of E is J level. Repeat steps (3.1)-(3.6), you can come to the level of the final power plant investment environment E belongs. 4. Determined the Weights Based on AHP Analytical Hierarchy Process is a combination of a quan- titative and qualitative analysis of decision-making me- thod. This method was applied to the power plant in- vestment decisions evaluation of them. First, the invest- ment decision-making to the complex issues broken down into a variety of factors, these factors attribute grouping has a different level, the same level factors as criteria, the next level of factors play a dominant role, at the same time by the previous constraints on the level factors. Topmost only one factor, namely the evaluation objectives, the middle level is a factor layer and the sub- factors layer (index layer), the bottom of each factor is to be the evaluation the area object[11]. Hierarchical rela- tionship of each factor is shown in Figure 2. In judgment matrix is constructed based on the calcu- lation of the relative weights of the factors under single criteria. Finally, the calculated weight value for consis- tency checking, when 0.10 CI CR RI , indicating that the matrix having the consistency of the judgment can be accepted; or should re-adjust the judgment matrix until the consistency can be accepted. 5. Example Analysis According to the exposition of the previous sections, the use of extension model is based on the actual investment of the power plant model structures [12]. The establishment of the evaluation factors 1234 {,, , }Ccccc , which represent the possibility of capital appreciation, capital investment risks, the possibility of transfer of capital and power plant enterprises the ability to take risks in four areas. i i (11) Target layer Criterion 1C riterion 2…… Criterion n M easures layer 1 Measures layer 2…… Measu res laye r n Figure 2. Hierarchy relationship of each factor. Copyright © 2013 SciRes. EPE  Y. T. WANG ET AL. 887 Assumed analysis, inspection this to establish the ac- curacy of the model selected Yunnan territory of a power plant operational data. Assuming a hydropow er station in Yunnan province, the surrounding is rich in water re- sources. The main stream of water resources is in the Lancang river, Jinsha river the theoretical potential of 13 730 MW, development and utilizatio n of 8 450 MW. The other tributary hydropower resources theory bears 2 806 MW, development and utilization of 200 MW, been de- veloped use 157.644 MW, there is considerable potential to be developed. Power station is 23 km away from the load area, and 700 km away from Kunming. Hydropower needs reservoir support the reservoir without inundated farming woodland, only submerged about 6 acres of dry land, 29.56 acres of shrub land (apart from a small amount of broad-leaved forest, are the bushes), and little damage to the surrounding environment. Power plant investment decisions evaluation and Extension levels are shown in Figure 3. Evaluation index system of power plant investment decisions Econom ic factors(E1) 0.324 Investment level of econom ic developm ent an d its ma tu rity (E 11) 0 .0 8 Industry level tax policy(E12) 0.0 8 Pow er generation cost of doing business(E13) 0.1 8 Inte rn al R a te o f R e turn(E14) 0.2 5 Investment le ading role in the local economy(E15) 0 .1 5 Equipment utilization(E11) 0 .0 8 P o litic a l fa cto r s( E 2) 0.220 Pow er plant investm ent in governm ent support(E21) 0 .5 Th e adm inistrative efficiency of the local government officials from corruption(E22) 0.25 A ttitude of the local government and the public to foreign funds(E23) 0 .2 5 Electricity m arket factors(E3) 0.189 Local m arket size and opportunity(E31) 0.22 Future dem and for capacity forecast(E32) 0.22 Th e imp act of cyclical fluctuations in demand(E33) 0.2 2 Inte raction between the m ulti-power plant(E34) 0 .1 1 Investment density(E35) 0 .1 1 Forward pricing(E36) 0 .1 1 Infra stru ctu re fa cto rs (E 4) 0.134 Traffic conditions(E41) 0 .2 E n erg y av aila b ility(E 42) 0 .6 L ife s erv ice fac ilities(E 43) 0 .2 Social and cultural factors(E5) 0.055 The supply of labor and w age levels(E51) 0 .3 3 The quality of the population and people's living habits(E52) 0 .1 7 Th e level of research support(E53) 0.33 D ifferences in the degree of religious culture (values)(E54) 0.1 7 N a tu ral en v iro nmen tal factors(E6) 0.134 The im pact of power plants on the local natural environment(E61) 0 .5 C lim ate im p act(E62) 0.5 Figure 3. The identification of diagram about evaluation of power plant investment deci sion-making. According to the initial power planning of Yunnan Electric Power Industry “11th Five-Year” Development Plan and the 2020 Vision of the Preliminary Studies, completed and put into operation in the year 2010, the surrounding four cascade hydropower stations installed capacity of up to 188 MW four steps were: A power plant 15 MW, B power station expansion 48 MW, C power station 25 MW and D power plant 100 MW. The maximum power load in 2010 will reach 102,000 kW in this state, existing power installed capacity of 92,000 kW only. Visibly the end load market demand is great and the surround ing power plant does no t constitute competi- tion. The units can achiev e higher utilization hours. According to the characteristics of the investment en- vironment, investment environment is divided into five levels: A (8 to 10), A-(6 to 8), B (4 to 6), C (2 to 4), and C-(0 to 2). Value for the amount of matter-element, be- fore Delphi method, confirmation of three experts in the different working environment, is shown in the following Table 1. Table 1. The evaluation summary of the final decision pow- er plant investment. Evaluation of projectsMatter Element for money Deviation value Rank Decision Overall rating —————— -0.014 A- E1 overall evaluation —————— -0.0054 A- E11 3.5,4,6,6 -0.041 B E12 6,4,5,5 0.125 B E13 5,6,6,5 0.125 B E14 7,4,5,5 0.0417 B E15 8,7,7,6 0.25 A- E16 8.5,7,6,8.5 0.097 A E2 overall evaluation —————— 0.033 A- E21 8.5,4,5,6 -0.097 A E22 8,4,7,3 0.027 A- E23 7,4,5,6 0.194 A- E3 overall evaluation —————— -0.076 B E31 8,3,6,4 -0.139 A- E32 6,4,4,5 0.041 B E33 5,6,4,7 0.042 B E34 8,4,6,7 0.027 A- E35 8.5,4,5,4 -0.124 B E36 3.5,7,4,3.5 -0.104 B E4 overall evaluation —————— -0.224 B E41 4,7,3,6 -0.083 B E42 8.5,3,4,8 -0.104 A E43 3.5,5,4,7 -0.041 B E5 overall evaluation —————— -0.208 B E51 8,4,6,8 -0.055 A- E52 3,7,4,6 -0.083 C E53 8,3,6,7 0 A- E54 3,7,4,6 -0.083 C- E6 overall evaluation —————— -0.0625 B E61 4,6,4,6 0 B E62 7,3,5,8 0.027 A- Copyright © 2013 SciRes. EPE  Y. T. WANG ET AL. Copyright © 2013 SciRes. EPE 888 6. Conclusions This example assumes that the new hydropower station in Yunnan and the overall results of th e evaluation as A-. As can be seen from the results of the analysis of the above table, planning the construction of the hydropower station is located in the more remote areas, so the infra- structure layer score is not too high. As far away from the political and commercial center of Yunnan, so the layer evaluation in the social and cultural factors is not too high. But the load point surrounding the power sta- tion construction behind, the entire electricity market is not in a state of competition, there will be no access to electricity system, but due to the limited level of social development, the end of the load demand in the next pe- riod of time will not significantly improve. From a mar- ket point of view, the construction of the power station's decision-making does no t seem to . The purpose of building one of the power station is able to play a part in driven investment of the construc- tion of the power station in local economic development, which makes the construction of the plant has adequate social significance, so the relative evaluation results the results of the evaluation of the political and economic layer is relatively high. Promote local economic devel- opment at the same time, the income of the power station will promote but in the short term it can not be brought huge benefit for investors, but when the surrounding economic has sufficient development, the power plant gains will also have some imp roved. Although it may not be reflected in initial construction and operation stage, but after the loan repayment period power plant will gradually reflect its strong economic benefits. Rich in water resources is another advantage of the power station construction in the building location. High water season accounted for most of the year. Also be- cause the innate advantage, resulting save a lot of fuel cost. But operation of the power station need the support of the reservoir, power station at a disadvantage not only in construction investment and the construction period, but also to some extent in the construction of the reser- voir damage to the surrounding environment, which is the reason of a low overall evaluation of the natural en- vironment. REFERENCES [1] J. P. Liu. “China Power Industrial Policy and Industry Development,” Beijing: China Electric Power Press, 2006. [2] J. F. Shen, “China Power Industry Market Structure Analysis,” Modern Power, Vol. 21, No. 2, 2004, pp. 95-100. [3] G. W. Han, J. J. Zheng and J. C. Lu, “Power Sustainable Development System Evaluation,” Power Technology Economy, Vol. 3, 2002, pp. 11-13. [4] DOE, “American Clean Energy and Security act (ACES),”[EB-OL][2009-06], Available at:http://www.op engress.org/bill/111-h2454/show. [5] FERC, “The Technical Conference of Integrating Re- newable Resources into the Wholesale Electric Grid,” [EB-OL][2009-04],Available at : http://www.ferc.gov. [6] The UK, “Low Carbon Transition Plan,” The Department of Energy and Climate Change,UK, 2009. [7] K. F. Zhou, D. X. Qin, S. M. Jiang. W. Wu and X. K. Yang, “Evaluation of the Mining Investment Environ- ment about Four Neighboring Countries by Using Exten- sion Method,” China Mining Magazine, 2010. 9. [8] C. Y. Yang and W. Cai, “Extension Engineering Set,” Beijing: Science Press, 2007. [9] C. Y. Yang and Y. J. Zhang, “Extension Planning,” Bei- jing: Science Press, 2002. [10] G. N. Liu, X. Q. Chen, G. Y. He and S. X. Zhou. “The Principle of the Evaluation Index System of Electricity Market and Build,” Automation of Electric Power Sys- tems Press, Vol. 29, No. 23, 2005, pp. 2-9. [11] G. N. Liu, R. Q. Li, X. Q. Chen, G. Y. He and S. X. Zhou, “Electricity Market Regulatory Indicators and Market Rating System,” Automation of Electric Power Systems Press, Vol. 28, No. 9, 2004, pp. 16-22. [12] J. S. Liu and M. Sun, “Power Generation Enterprise Core Competitiveness Evaluation System,” North China Elec- tric Power University (Social Sciences), Vol. 1, 2006, pp. 54-58. |