The Empirical Study about Introduction of Stock Index Futures on the Volatility of Spot Market

114

CSI 300 index futures launch date just over three years,

the research scholars are mostly simulation-based trans-

action data, and conclusions vary. Therefore, this paper

by choosing real transaction data were established befo re

and after the introduction of index futures GARCH

model, and the introduction of dummy variables, a series

of empirical tests to explore CSI 300 stock index futures

on the impact of volatility in the spot market, with certain

practical significance.

2. Research Methods

2.1. Sample Description

This data is selected April 16, 2007 to April 16, 2013 in

CSI 300 stock index futures contracts and the CSI 300

stock index daily closing price, that is listed on the CSI

300 stock index futures before and after the three years

of the corresponding stock the daily closing price of the

stock index of 1460 data. Among them, the futures data

for the selection of the main contract data, namely the

nearest month futures contracts of the daily closing price

data. In the most recent month before the contract set-

tlement date two or three days, month contract will be

converted into the main contract, and then turned to the

next nearest month futures contract closing data, and so

on, can be a continuous set of stock index futures price

time series. Data mainly comes from China Financial

Futures Exchange, and the News Finance website. In

accordance with the stock index futures launch time the

data is divided into two stages, the first stage before the

introduction of stock index futures, is from April 16,

2007 to April 16, 2010; second stage after the introduc-

tion of stock index futures, from April 16, 2010 to April

16, 2013.

2.2. Data Processing

Firstly, in order to eliminate heteroscedasticity, respec-

tively futures price and spot price series sequence loga-

rithm.

Assuming that the trading day closing price of a fu-

tures contract and the spot index closing price are de-

noted as t and t, then the natural logarithm of fu-

tures contract price series expressed as t

P Qln

t

P

ln

ttt

, its

logarithmic rate of return is 1

ln

PP

, the

natural logarithm of stock price series expressed as

, its logarithm yields expressed as

ln

t

St

Q

1

ln ln

tt

SQQ

t

.

The study object of this paper is the log return of stock

index future s and spot price rate.

2.3. Model Selection

Existence of financial time series data aggregation and

volatility heterosced asticity, OLS regression model is the

assumption that “homoscedasticity”, therefore, in the

study when the price volatility of financial products,

widely used heteroscedasticity model is the most widely

used in the 1982 Engle proposed autoregressive condi-

tional heteroskedasticity model (ARCH model), Boller-

slev deepened the ARCH model, the generalized autore-

gressive conditional heteroskedasticity model (GARCH

model), GARCH model can well reflect the aggregation

of price volatility, in the previous literature, the wide-

spread use of GARCH (1, 1) model reflects the aggrega-

tion of financial products.

This paper uses the GARCH (1, 1) model stock index

futures on the volatility of the spot market, and the in-

troduction of dummy variables in the conditional vari-

ance to reflect the CSI 300 stock index futures on the

impact of the stock market volatility, Before the intro-

duction of stock index futures, D = 0, after the introduc-

tion of stock index futures D = 1. The GARCH (1, 1)

model with the following :

The mean equation: ttt

yx

The conditional variance equation:

22

11tt

2

t

The GARCH (1, 1) model was respectively established

for the different stages, the model does not add dummy

variables.

3. Empirical Tests

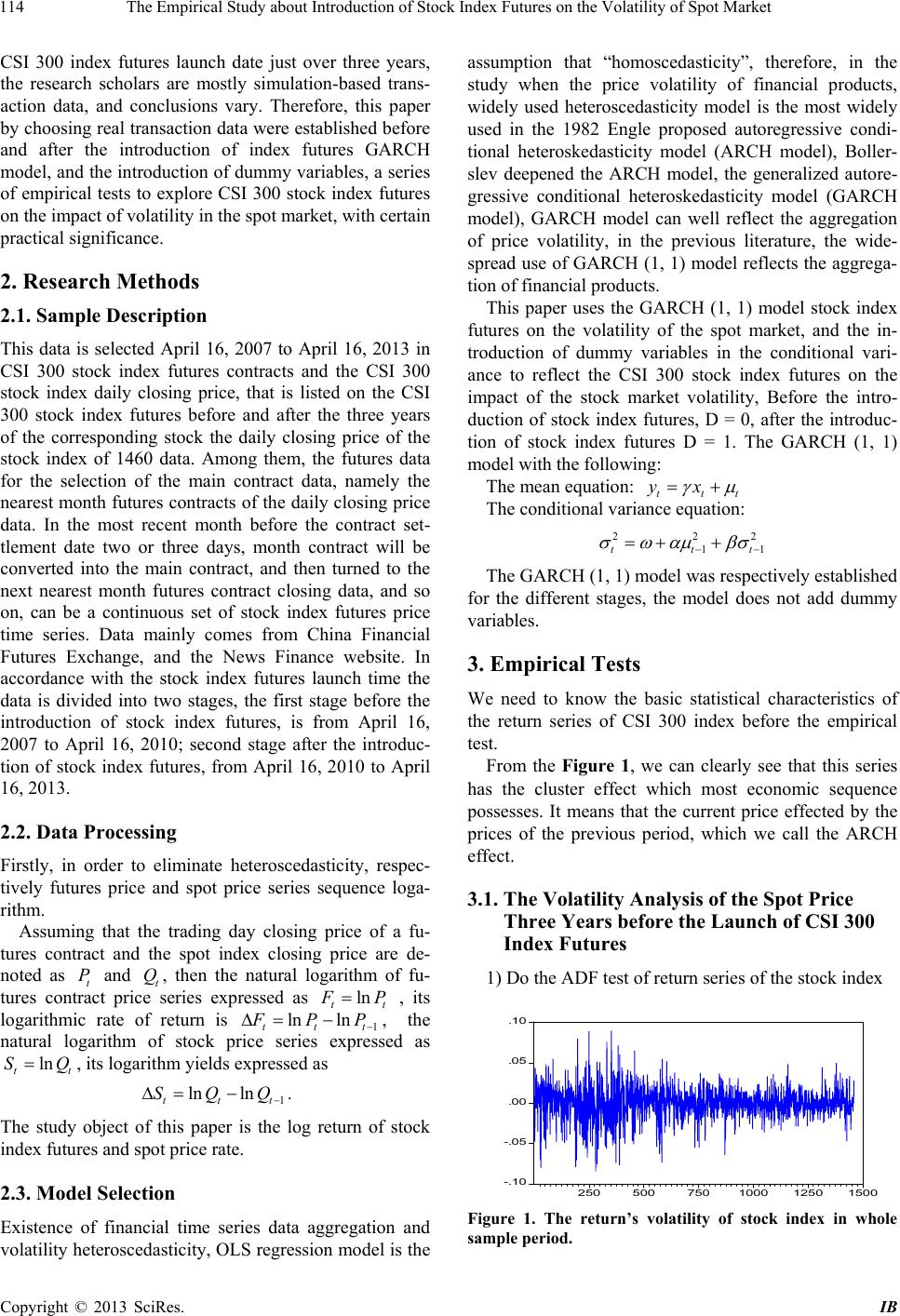

We need to know the basic statistical characteristics of

the return series of CSI 300 index before the empirical

test.

From the Figure 1, we can clearly see that this series

has the cluster effect which most economic sequence

possesses. It means that the current price effected by the

prices of the previous period, which we call the ARCH

effect.

3.1. The Volatility Analysis of the Spot Price

Three Years before the Launch of CSI 300

Index Futures

1) Do the ADF test of return series of the stock index

-.10

-.05

.00

.05

.10

250 500 7501000 1250 150

Figure 1. The return’s volatility of stock index in whole

sample period.

Copyright © 2013 SciRes. IB