Paper Menu >>

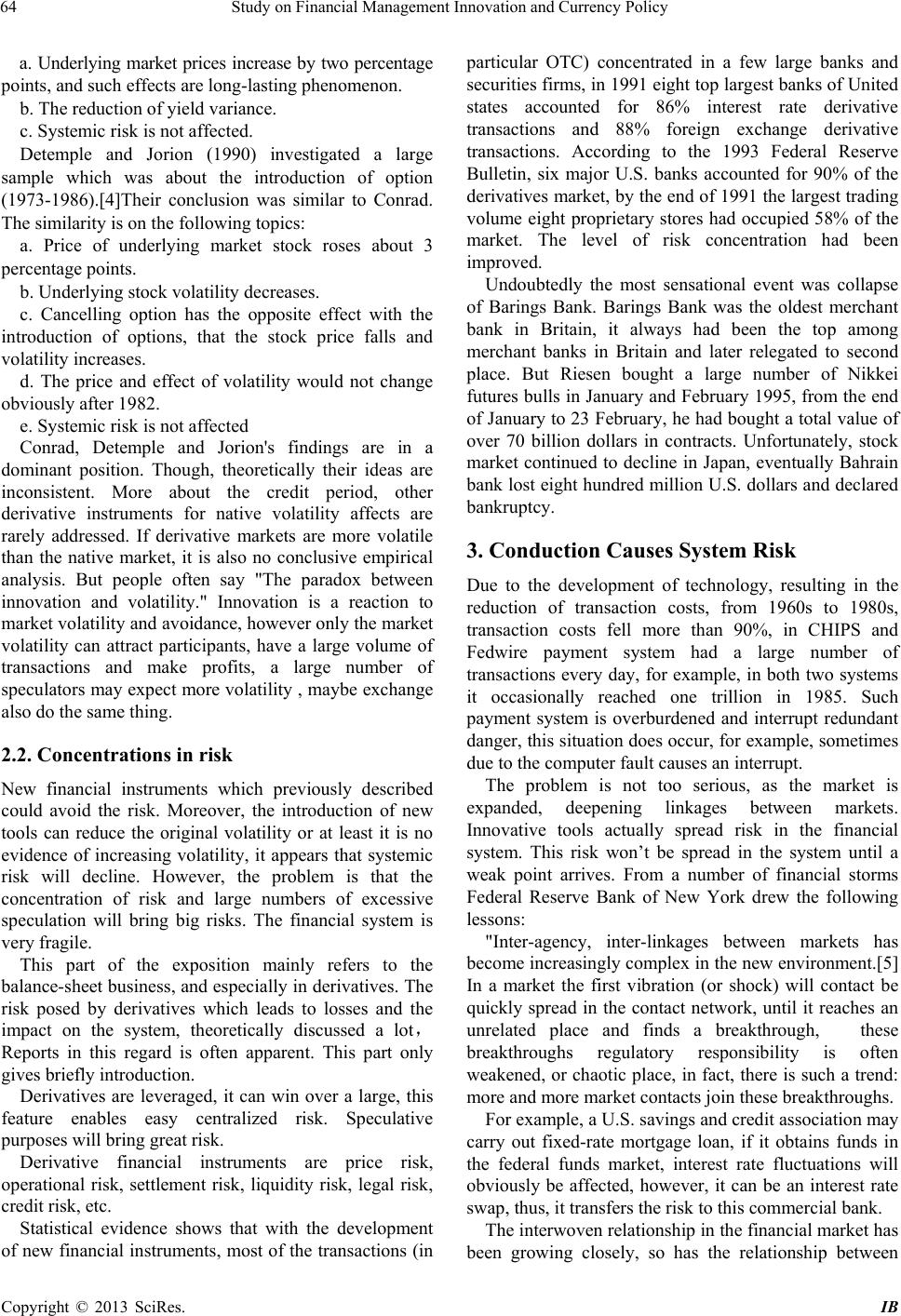

Journal Menu >>

iBusiness, 2013, 5, 63-68 http: //dx.doi.org/10.4236/ib.201 3.53B014 Published Online September 2013 (http://www.scirp.org/journal/ib) 63 Study on Financial Management Innovation and Currency Policy Xingang Wang, Shangzhi Yue Graduate School of Northeast Forestry University. Email: 920028102@qq.com, yueshangzhi@126.com Received June, 2013 ABSTRACT The thesis analyzes the role of transform risks caused by innovation tools, the extent to which financial innovation tools have an influence on risks of financial system, the extent to which financial innovation has an influence on financial statement and macro monetary policy, the extent to which financial innovation exerts influences on classification of monetary, government’s requirement for monetary, the degree to which financial innovation exerts an influence on con- trol of money supply. This thesis studies the alternative and significance of monetary aggregates, a new perspective of financial innovation and general money supply. Financial innovation can enhance the efficiency of the whole financial market and proactively promote economic development. Financial innovation is charactered by anteriority and financ- ing, also can erase inflation. Keywords: Financial Innovation; Monetary Policy; Exchange Rate 1. The Influence and Significance of Financial Innovation The appearance of financial innovation follows the de- velopment of commodity economy, including emergency of monetary, growing up of commercial banks and the wide use of bill of exchange, which are defined as main achievement of financial innovation in the history of fi- nance. In the middle of 1980s, the wave of financial innova- tion has dispersed in international financial area. The increasing emergency of new financial tools and financial institutions and financial services overwhelms us. As Professor James C. Van horme of Stanford University said, “the foundation of our financial system is financial invention, which is assimilated as a gust of fresh blood in our effective and acute financial system.Although we pay careless attention to the recent changes caused by financial service, we will be taken aback by these changes. [1] “With the growing development of financial invention, the tide, so far, remains unfolding. Historically, financial invention has greatly given im- petus to social progress and promoted several leaps, so it receives welcome from not only micro -units but also managers.[2]As we all know, technology has greatly enhanced welfare of humans, in the same way, financial invention also plays an critical role in human’s living standards and economic development.financial invention reflects decrease which can stimulate financial invention in trade cost caused by technology advance.financial invention makes financial tools shift risks to stabilize monetary markets. This thesis analyses the influence financial invention and deregulation exert on monetary policy and domestic macro-economy, [3] in addition, monetary policy greatly promotes domestic macro-economy 2. Influence of Financial Invention on Financial Market Stability 2.1. Roles of invention tools in shifting risks For most people, the use of new financial tools aims to evade risks, because they hate risks.For individual cli- ents, the ability endowed by innovation tools of shifting isks is showed in Table 1. r Table 1. Balance Sheet Risk exposure of interest rateRisk exposure of exchange rate Risk exposure of credit Liquidity risks Note issuance facilities strong 0 strong strong Currency swap of capital marketweak strong weak weak Interest rate swapstrong 0 weak weak Currency option 0 strong Weak/0weak Interest rate optionstrong 0 Weak/0weak Forward rate agreement strong 0 weak weak Securitization asset strong 0 strong strong Copyright © 2013 SciRes. IB  Study on Financial Management Innovation and Currency Policy 64 a. Underlying market prices increase by two percentage points, and such effects are long-lasting phenomenon. b. The reduction of yield variance. c. Systemic risk is not affected. Detemple and Jorion (1990) investigated a large sample which was about the introduction of option (1973-1986).[4]Their conclusion was similar to Conrad. The similarity is on the following topics: a. Price of underlying market stock roses about 3 percentage points. b. Underlying stock volatility decreases. c. Cancelling option has the opposite effect with the introduction of options, that the stock price falls and volatility increases. d. The price and effect of volatility would not change obviously after 1982. e. Systemic risk is not affected Conrad, Detemple and Jorion's findings are in a dominant position. Though, theoretically their ideas are inconsistent. More about the credit period, other derivative instruments for native volatility affects are rarely addressed. If derivative markets are more volatile than the native market, it is also no conclusive empirical analysis. But people often say "The paradox between innovation and volatility." Innovation is a reaction to market volatility and av oidance, however only the market volatility can attract participants, have a large volume of transactions and make profits, a large number of speculators may expect more volatility , mayb e exchange also do the same thing. 2.2. Concentrations in risk New financial instruments which previously described could avoid the risk. Moreover, the introduction of new tools can reduce the original volatility or at least it is no evidence of increasing volatility, it appears that systemic risk will decline. However, the problem is that the concentration of risk and large numbers of excessive speculation will bring big risks. The financial system is very fragile. This part of the exposition mainly refers to the balance-sheet business, and especially in derivatives. The risk posed by derivatives which leads to losses and the impact on the system, theoretically discussed a lot, Reports in this regard is often apparent. This part only gives briefly introduction. Derivatives are leveraged, it can win over a large, this feature enables easy centralized risk. Speculative purposes will bring great risk. Derivative financial instruments are price risk, operational risk, settlement risk, liquidity risk, legal risk, credit risk, etc. Statistical evidence shows that with the development of new financial instruments, most of the transactions (in particular OTC) concentrated in a few large banks and securities firms, in 1991 eight to p largest banks of Un ited states accounted for 86% interest rate derivative transactions and 88% foreign exchange derivative transactions. According to the 1993 Federal Reserve Bulletin, six major U.S. banks accounted for 90% of the derivatives market, by the end of 1991 the largest trading volume eight proprietary stores had occupied 58% of the market. The level of risk concentration had been improved. Undoubtedly the most sensational event was collapse of Barings Bank. Barings Bank was the oldest merchant bank in Britain, it always had been the top among merchant banks in Britain and later relegated to second place. But Riesen bought a large number of Nikkei futures bulls in Janu ary and February 1995, from the end of January to 23 February, he had bought a total value of over 70 billion dollars in contracts. Unfortunately, stock market continued to decline in Japan, eventually Bahrain bank lost eight hundred million U.S. dollars and declared bankruptcy. 3. Conduction Causes System Risk Due to the development of technology, resulting in the reduction of transaction costs, from 1960s to 1980s, transaction costs fell more than 90%, in CHIPS and Fedwire payment system had a large number of transactions every day, for example, in both two systems it occasionally reached one trillion in 1985. Such payment system is overburdened and interrupt redundant danger, this situation does occur, for example, sometimes due to the computer fault causes an interrupt. The problem is not too serious, as the market is expanded, deepening linkages between markets. Innovative tools actually spread risk in the financial system. This risk won’t be spread in the system until a weak point arrives. From a number of financial storms Federal Reserve Bank of New York drew the following lessons: "Inter-agency, inter-linkages between markets has become increasingly complex in the new environment.[5] In a market the first vibration (or shock) will contact be quickly spread in the contact network, until it reaches an unrelated place and finds a breakthrough, these breakthroughs regulatory responsibility is often weakened, or chaotic place, in fact, there is such a trend: more and more market contacts join these breakthroughs. For example, a U.S. savings and credit association may carry out fixed-rate mortgage loan, if it obtains funds in the federal funds market, interest rate fluctuations will obviously be affected, however, it can be an interest rate swap, thus, it transfers the risk to this commercial bank. The interwoven relationship in the financial market has been growing closely, so has the relationship between Copyright © 2013 SciRes. IB  Study on Financial Management Innovation and Currency Policy 65 different markets. Because of the diversification of the management, some countries allow the financial institu- tion participate many trades include banking, security, futures and share option at the same time. Therefore no mater which part has crisis, it will affect the others and cause a larger chain reaction. It is the same in the international financial market. Some international financial institutions and corporation s encounter the damage or bankrupt by trading derivative instruments will make the financial market rise and fall fiercely. The traders are connected with each other by financial trade in the financial market. The deficit will bring chain reaction and spread rapidly. Especially in global financial times, it may endanger th e stability of the whole financi a l mark et . For example, the above-mentioned Bahrain bank bankrupt event has made the world’s financial market a mess. England bank announced that the Bahrain bank bankrupt on 26th February, 1995, then the Asian stock market down in different degree on 27th, Nikki index dropped 664.24 point; the range of price drop is 3.8 per- cent, the stock market of Taipei dropped 3.1 percen t. The British stock market has also been affected, 100 kinds of stock index of London Financial Times dropped 0.19 percent. [6] On the same day in foreign exchange market, the Pound and Lira are devalued while the Mark and Franc are increased in value. That day, the exchange rate of Pound to Mark dropped to 2.3000, the important sup- porting point, becoming the low point for more than two years. The exchange rate of Lira to Mark dropped to 116.7, the record low. The world’s crisis of stock market in 1987 was caused by derivative instrument market and spread to the spot market. Due to the centered risk, the big financial institutions have more possibility to be bankrupt. Meanwhile, be- cause the market connection has been closer and the conduction effect has been stronger, the crisis of the whole financial institutio n has been increased. Th e author point out that the financial crisis like the one in 1929 is not occurred due to the enhancement of safeguard and insurance system by each management authority. The public’s confidence has been strengthened. On the other hand, it is easier to raise huge capital than before as long as you have a good reputation, so it is easier to loan and merger and acquisitions, and avoid the further chain im- pacts. 3) The influence of financial innovation on financial reports There are many financial approaches, the adoption of approaches of balance sheet and the complicated of the measures present a new problem of transparency. Some hedge technology is complex on math and some trades promise has no precedent. ①The problem of accounting management How to express the specific instrument business in fi- nancial statement, different accountant in different bank and institution has different ideas. Different institutions continue to use the differen t conv en tio ns and it can not be compared among institutions. Some people think we should adopt historical cost method, while some think current market method is better. Some accountants think the process should be reflected in the sheet, some think it should be made a footnote out of the sheet. In a word, there in no unified accounting convention to handle these businesses. So the institution s and banks can not be compared, the result may widely divergent. These problems cause two common anxieties: firstly, the transparency of position statement. Secondly, the actions are taken to assume the risk of banks and enter- prises. ②Transparency One result of Off-Balance Sheet Activities is the spe- cific risk can not be explained clearly. The banking manager must ensure the degree of the relationship be- tween the whole and specific risks that Off-Balance Sheet Activities are taken and the Balance Sh eet Activities, and also ensure the proper standard of risk comparison to determine the capital rate, at last to determine the capital level of bank management. The bank situation is more salient compared with corporation, the materials should be provided to stockholders and borrowers. But with the development of Off-Balance Sheet Activities, the tradi- tional financial statement is always imperfect or clear, and it makes clients of banks and institutions different to know the whole business. But credit should be estimated on the basis of financial statement which published regu- larly at intervals. However, with the influence of Off-Balance Sheet Activities, it is more difficult to un- derstand the communiqué which has been published, and so is the estimate of risk and credit. ③Risk taking Due to the lack of unified accounting conventions, es- pecially the Off-Balance Sheet, the financial statement that published lack credit, it also cau ses a problem that is the corporation bank may take more risks. 3 The choice and significance of monetary aggregates index ⑴The influence of financial innovation on M1 M1 is a very important monetary definition. It was re- garded to be the most important monetary policy index by western economist and currency authorities. That is because the M1 held the following three characteristics for a long time: firstly, M1 include the main exchange medium, secondly, the relationship between M1 and sta- bility and forecast of national economy, thirdly, M1 is easier to control by the monetary authority. ⑵The significance of broad money Copyright © 2013 SciRes. IB  Study on Financial Management Innovation and Currency Policy 66 Because the disappearance of stability between M1 and national economy index. The US Federal Reserve has no longer paid much attention to M1 since 1993, while the M2 and M3 attract more attention. M2 and M3 are popular instead of M1. Many econo- mists think that the relationship between broad money and the final economic index is more stable, and it has less influence from financial innovation; because of the large capacity of broad index. The broad index will not be affect when the public change account in RPs and MMDAs which has the similar functions in M1 and M2. However, the problems of M1 gradually appear in gen- eral indices. ① Redefining and dividing money In 1996, the repor t of Bank of Eng land stated: [7 ] “The problems of defining money become more acute for the fact of developing innovation and modernization. At pre- sent, there is a series of financial products of little differ- ence. As a matter of fact, monetary and non-moenytary cannot be divided wit h speci fic and accurate standards.” With the increasing of financial products and new components in the definition of broad money, the defini- tion of money has to be changed constantly to keep up with innovation. Meanwhile, it is a hard work to divide money because of the addition of new tools and changing of old tools. Monetary must be analyzed carefully, di- vided and classified accurately and rationally, so it is very diffic ul t to define broad money. ② The Adjustment of Broad Money Indices Broad Money M2 may be replaced by M3, M4……with stronger and broader explanatory ability over time. For instance, in 1997, the report of Bank of England stated, gradually there is no difference between the Housing Association savings and bank savings, therefore the central bank should attach much more importance to M4. The research of Weale (1996) also showed that the savings of the Housing Association and banks have higher substitutab ility, which means it is improper for the central bank to pay attention to M3 only for the control of money. As a matter of fact, it cannot be solved by only focus- ing on changing M3 to M4, for it is not for good and all, and the indices need to be modified with the development of financial innovation, which all hinder the control of money. ③ The Significance of Broad Money Indices Even though the instruction of the controlling indices of the monetary aggregates has broadened, the problems still exist. If one index of monetary aggregates control in imple- ment of money supply strategy, it’s better to keep a stable connection between money aggregates and ultimate tar- get. The motive of owning money should be synchro- nized. In this way, the growth rate of money aggregates can exactly reflect the growth level of expenditure. The sig- nificance of monetary control is the reduction in money means the reduction in money available for spending, so there will be a stable and close relationship between money aggregates and nominal incomes. But according to the communiqué of Bank of England, it seems that the financial innovation has changed the quantity of money --- the connection among incomes. Since 1990, the rela- tionships between M3 and nominal incomes and between M4 and nominal incomes have changed greatly: ⑴from 1984 to 1989, in contr ast to rate flow of incomes, M3 and M4 have descended in 1990s; ⑵the experience of 1980w shows that there was two years’ time-lag during the period of the increasing of M3 and ensuing inflation --- there was a high monetary growth in 1983, and there was a high inflation in 1985 afterwards; The high mone- tary growth in 1988 also r esulted in the inflation in 1990. However, there was no such connection since 1990. From 1993, M3 increased constantly, but the rate of inflation decreased, which shows no clear connection between money aggregates and inflation. 4. The Effects of Financial Innovation on Monetary Supply R. W. Haver and Scott E. Haine[8] have studied the fluc- tuation of American monetary supply, and they point that the fluctuation of monetary supply is mainly caused by money multiplier, not by the instability of provisions. Garcia considers that money multiplier will change greatly in following conditio ns: in different levels of con - trolled money aggregates, in unequal condition of legal reserve ratio and in the same level of different reserve ratios. The regulations of different reserve ratio can promote financial innovation, such as MMMF, for reserve is like tax. It will cause the instability of money multiplier. As assets of different reserve ratio can be converted and these assets have similar functions, all of which cause the final change of money multiplier. Take ATS Account as example. ATS is typical, for it is functioned as checking account, but only deposit reserve requirement is paid. C: Currency in circulation held by the public CD: Checkable Deposits K: the ratio of C and CD (that is, C=kCD) T: Savings Deposit and Term Deposit rt: term deposit reserve requirement ratio DD: demand d e po si t rd: demand deposit reserve requirement ratio Suppose①depository institutions don’t have excess Copyright © 2013 SciRes. IB  Study on Financial Management Innovation and Currency Policy 67 reserves, ②only demand deposit and ATS are checkable deposits and d is used to represent the ratio of ATS bal- ances in checkable deposits, the ratio of demand deposits is (1—d), that is ATS=dCD DD=(1—d)CD If t is used to represent the ratio of term deposit and checkable deposit, that is T=tCD, Total reserve of the deposit system R can be expressed as: R=rdDD+rtT+rtATS also can be expressed as: R=rd(1—d)CD+rtCD+rtdCD so R=[rd+rtt—d (rd—rt)]CD=RCD R is the average ratio of reserve requirement. Monetary amount is the product multipling the mone- tary base by the currency multiplier. Monetary base is sum of currency held by the public and reserves existed by depository institutions. KCD+(1-d)CD+dcD= Result Similarly, the multiplier m2 can be launched M2 (M1+T) Noting = Clearly, m1 and m2 are an increasing function of d. It means opening check deposit will result in increasing of the multiplier m1 and m2 when it is in the proportion of larger, so that M1 and M2 increases, and vice versa counter to it. The reason is very simple, as ATS prepara- tion is low, so it increases the proportion of the total re- serve ratio decreased, causing the multiplier increases. 5. “New Ideas” of Financial Innovation and Broad Currency Supply Considering the broad currency supply, financial innova- tion in the currency supply and asset supply performance in this area are these non-bank assets of monetary greatly improved while the non-bank deposit-taking financial assets greatly improved among the financial assets held by the public of the whole society, and it has been able to easily convert to bank deposits. Advanced science and technology greatly reduces the lower cost of conversion between the two, improving the liquidity of non-banking assets. That is, in broad currency Conceptu ally, monetary expansion existed not only in commercial banks create credit but also other financial institutions such as trusts, savings loan associations, housing associations, insurance company, etc. They are also carried out of the expansion of financial assets, in essence, they also involving in monetary creation. Therefore, from the perspective of the broader currency, monetary authorities should consider how to put them into the control of the total currency supply. This is called the “new ideas” of currency su pply theory. As early as 1959, The Radcliffe Report pointed out that it is not just in the traditional sense, but of the whole social mobility to really impact on the economy’s currency supply. The decision of the currency supply is not only for commercial banks, but also for the entire financial system including commercial banks and non-commercial bank financial institutions. Subsequently, Gurleyheshaw also pointed out: [9] “There are many similarities between currency system and non-monetary system agencies, and these similarities more important than those differences. These two types of financial in- termediaries have created financial claims, and they have created specific liabilities based on certain assets which held by them...... Moreover, they can create loadable funds, can cause excess amount of currency.” They em- phasized the identities among financial institutions, cre- ated some form of evidence of financial claims, played the role of credit creation. Tobin further elaborated the “new ideas”, and stressed the identity of intermediaries as financial institutions and the identity of currency and other financial assets. At that time, “new idea” was criti- cized by mainstream economics, but there is a very real sense in financial innovation-driven financial services cross tendency for homogeneity today. It can be seen as the test of the “new ideas”. For example, in 1987 the Bank of England proposed a new currency aggregates M4 and M5, which take full account of the economic role of debt in the non-bank financial institutions. In summary, the currency supply has also been im- pacted by financial innovation. Base currency less af- fected, while currency multiplier larger varied. Thus, while the central bank reduced the base currency, the public may pass among different asset reserve ratio ad- justment, the conversion to aug ment the multiplier so that the currency supply can not to achieve the desired ef- fect.[10] REFERENCES [1] T. F. Kargil and J. L. G. Garcia: Financial Reform Eight- ies, 1990. [2] C. James, “Van Horne of Financial Innovations and Ex- cesses,” The Journal of Finance, July 1985. [3] W. A. Silber, “The Process of Financial Innovation,” American Economic Review, May 1983. [4] Thomas Mayer Financial Innovation—the Conflict be- tween Micro and Macro Optimality, American Economic Review, 1982. [5] Donald, Monetary Policy in an Era of Change Federal Reserve Bulletin Feb, 1989. [6] Donald, Policy Targets and Operating Procedures in the 1990s Federal Reserve Bulletin Jan, 1990. [7] L. Zhang, “Conduction from the Financial Analysis of the Monetary Policy Transmission Mechan ism,” Reforms and Strategies, Vol. 1, 2009, pp. 70-73. Copyright © 2013 SciRes. IB  Study on Financial Management Innovation and Currency Policy Copyright © 2013 SciRes. IB 68 [8] M. K. Lewis, Monetary Economics, Beijing: Science Press, 2008, pp. 98-99. [9] Y. H. Su and Z. Ding, “Basket of Currencies Exchange Rate Regime Research,” Shandong Finance College, Vol. 6, 2008, pp. 20-26. [10] Donald “Policy Targets and Operating Procedures in the 1990s,” Federal Reserve Bulletin Jan, 1990. |