Valuation Channel and Losses of Chinese External Wealth 23

ture losses on the stock of its foreign assets and liabilities,

or a combination of the two. The latter are valuation ef-

fects. If valuation of some economy’s NFA is positive,

implying a wealth transfer from other countries through

international financial channel, which makes net foreign

asset increased or net foreign liability decreased. On the

contrary, if valuation of some economy’s NFA is negative,

implying a wealth outflow to other countries through

international financial markets, which makes net foreign

asset decreased or net foreign liability increased. Con-

sider the case of the China with both a large trade surplus

and positive net foreign assets, negative valuation of net

foreign assets implying vast losses of external wealth.

3. International Assets Position

In this section, I describe briery the construction of my

dataset. All data are available from IMF’s International

Financial Statistics. Export and import is flowing asset,

net foreign asset and “risk assets” are cumulative assets.

These assets are measured in US$million. Use nominal

effective exchange rate (2005=100) as RMB exchange

rate. Select annual data for the period 1991-2010, quar-

terly data for the period 1981Q1-2010Q4 as sample, take

1981 (or 1981 Q1) as initial period of cumulative assets.

Following official classifications, I split China’s net

foreign asset into four categories: Foreign Direct Invest-

ment (FDI), Portfolio Investment Assets (Equity Securi-

ties and Debt Securities), Other Investment Assets and

Reserve Assets (including gold reserves). “Risk assets”

calculated as cumulative Other Investment Assets and

Reserve Assets.

Denote by t

the end of period t position for some

asset X. Use the following updating equation:

1tttt

XFXDX

(4)

where t

X denotes the flows corresponding to asset X

that enter the balance of payments, and t denotes a

discrepancy reflecting a market valuation adjustment or

(less often) a change of coverage in the series between

periods t−1and t.

DX

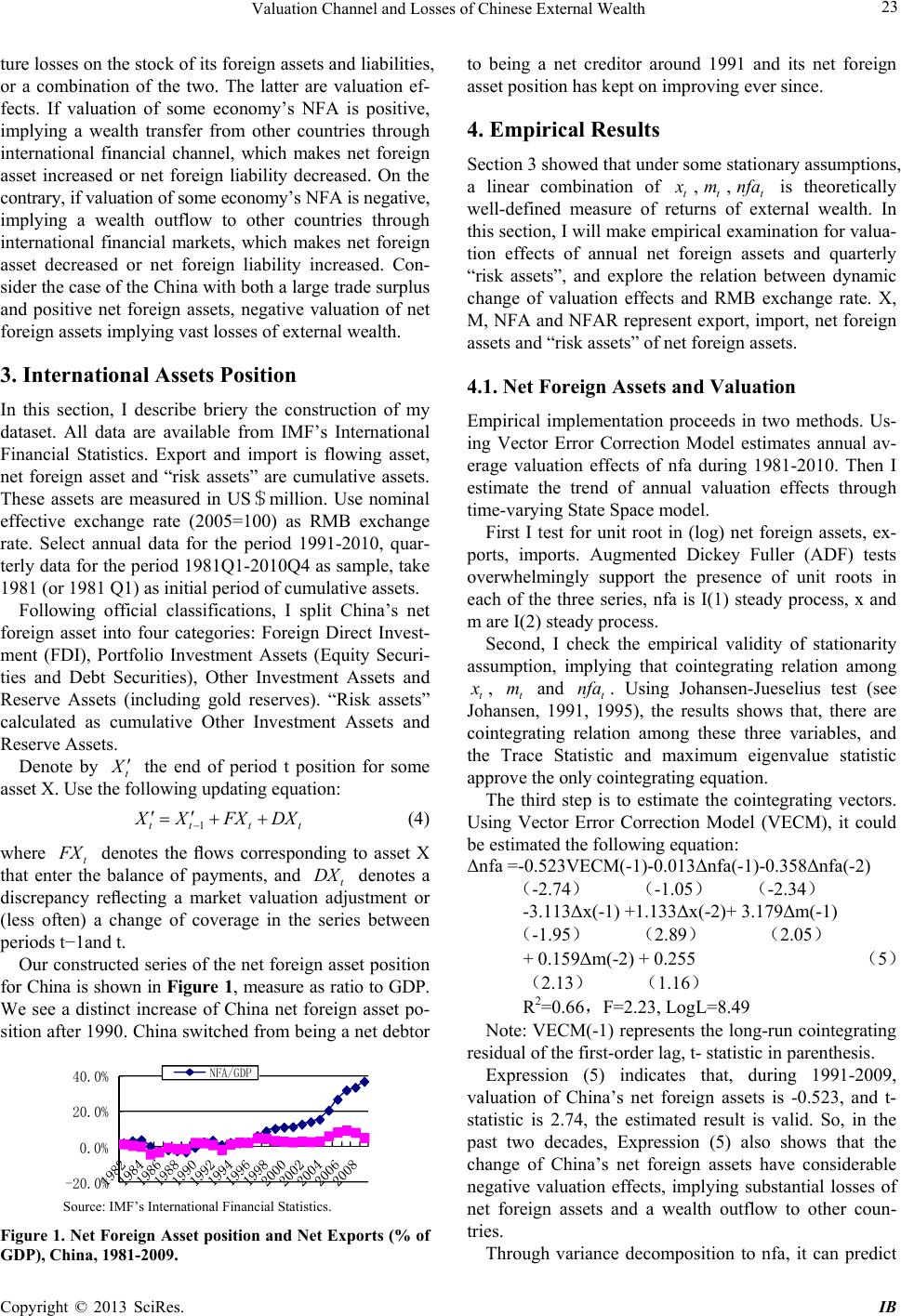

Our constructed series of the net foreign asset position

for China is shown in Figure 1, measure as ratio to GDP.

We see a distinct increase of China net foreign asset po-

sition after 1990. China switched from being a net debtor

-20.0%

0.0%

20.0%

40.0%

NFA

GDP

Source: IMF’s International Financial Statistics.

Figure 1. Net Foreign Asset position and Net Exports (% of

GDP), China, 1981-2009.

to being a net creditor around 1991 and its net foreign

asset position has kept on improving ever since.

4. Empirical Results

Section 3 showed that under some stationary assumptions,

a linear combination of t

,t,t is theoretically

well-defined measure of returns of external wealth. In

this section, I will make empirical examination for valua-

tion effects of annual net foreign assets and quarterly

“risk assets”, and explore the relation between dynamic

change of valuation effects and RMB exchange rate. X,

M, NFA and NFAR represent export, import, net foreign

assets and “risk assets” of net foreign assets.

mnfa

4.1. Net Foreign Assets and Valuation

Empirical implementation proceeds in two methods. Us-

ing Vector Error Correction Model estimates annual av-

erage valuation effects of nfa during 1981-2010. Then I

estimate the trend of annual valuation effects through

time-varying State Space model.

First I test for unit root in (log) net foreign assets, ex-

ports, imports. Augmented Dickey Fuller (ADF) tests

overwhelmingly support the presence of unit roots in

each of the three series, nfa is I(1) steady process, x and

m are I(2) steady process.

Second, I check the empirical validity of stationarity

assumption, implying that cointegrating relation among

t

, t and t. Using Johansen-Jueselius test (see

Johansen, 1991, 1995), the results shows that, there are

cointegrating relation among these three variables, and

the Trace Statistic and maximum eigenvalue statistic

approve the only cointegrating equation.

mnfa

The third step is to estimate the cointegrating vectors.

Using Vector Error Correction Model (VECM), it could

be estimated the following equation:

Δnfa =-0.523VECM(-1)-0.013Δnfa(-1)-0 .358Δnfa(-2)

(-2.74) (-1.05) (-2.34)

-3.113Δx(-1) +1.133Δx(-2)+ 3.179Δm(-1)

(-1.95) (2.89) (2.05)

+ 0.159Δm(-2) + 0.255 (5)

(2.13) (1.16)

R2=0.66,F=2.23, LogL=8.49

Note: VECM(-1) represents the long-run cointegrating

residual of the first-order lag, t- statistic in parenthesis.

Expression (5) indicates that, during 1991-2009,

valuation of China’s net foreign assets is -0.523, and t-

statistic is 2.74, the estimated result is valid. So, in the

past two decades, Expression (5) also shows that the

change of China’s net foreign assets have considerable

negative valuation effects, implying substantial losses of

net foreign assets and a wealth outflow to other coun-

tries.

Through variance decomposition to nfa, it can predict

Copyright © 2013 SciRes. IB