Paper Menu >>

Journal Menu >>

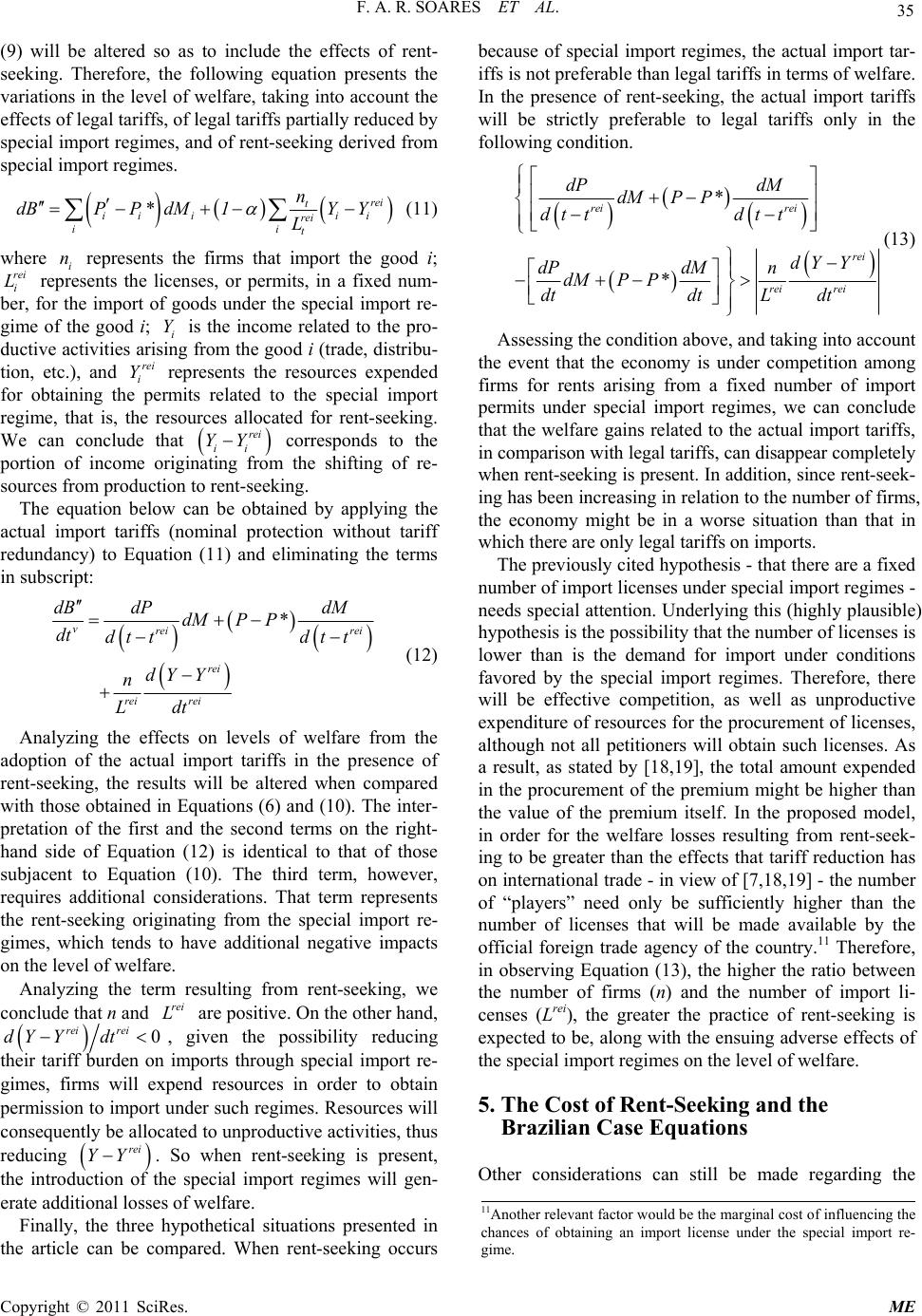

Modern Economy, 2011, 2, 31-38 doi:10.4236/me.2011.21005 Published Online February 2011 (http://www.SciRP.org/journal/me) Copyright © 2011 SciRes. ME Rent-Seek i n g , Trade Policy an d E conomic Welfare Fernando Antônio Ribeiro Soares1, Tito Belchior Silva Moreira2 1Brazilian Ministry of Defense, Brasília, DF, Brazil 2Department of Economics, Catholic University of Bra s ília, Brasília, DF, Brazil E-mail: fernando.a.r.soares@gmail.com, tito@pos.ucb.br Received December 6, 2010; revised December 25, 2010; accepted December 30, 2010. Abstract The objective of this paper is to assess the impacts that rent-seeking arising from government intervention in international trade has on welfare. More specifically, the focus is on how the granting of special import re- gimes promotes rent-seeking practices, which have negative effects on welfare. We present two concepts of nominal protection: legal tariffs and the actual import tariffs. In addition, we construct three measures of welfare: from the legal tariff; from the actual import tariffs; and from the actual import tariffs when rent-seeking is present. Finally, we compare the various measures of protection in terms of their impact on welfare. The results show that trade policies based on exceptions - such as those establishing the special im- port regimes - tends to decrease welfare. Keywords: Legal Tariffs, Actual Import Tariffs, Welfare, Rent-Seeking 1. Introduction The effects that imposing an import tariff have on trade and, consequently, on the level of welfare, have been broadly discussed in the literature [1-6]. Statically speak- ing, the results obtained indicate that a reduction in the levels of welfare arises from protection costs, which stem from various factors, including resource allocation, fail- ure to obtain significant economies of scale, and the loss of consumption opportunities. However, such welfare losses might be reduced by using trade policy instru- ments that reduce the effects of import tariffs. In this paper, we will highlight special import regimes aimed at reducing the level of nominal protection as examples of such instruments. It can be said that these special re- gimes, when acting as tariff rate reducers, tend to reduce the import burden, thereby encouraging importation. Given the capacity of special regimes to reduce the tariff burden on foreign trade, it would be feasible to evaluate whether this hypothetical economy would ob- tain welfare gains in relation to an economy in which the import tariffs are charged in full. However, the results of this evaluation are significantly modified when we draw correlations between the special regimes and rent-seek- ing activity. Specifically, the demand for special import regimes would shift resources from production to rent- seeking activities, which would negatively offset the wel- fare gains obtained through the implementation of such special regimes. As observed by [7], there would be re- source expenditure aimed at the transfer of wealth, rather than at the creation of wealth. The use of resources in order to obtain this transfer would lead to welfare losses. Since special import regimes represent state interven- tion in trade policies, they create a favorable environ- ment for the development of rent-seeking activities. In other words, given the possibility of obtaining income from import regimes, resources will be spent in an un- productive manner. Consequently, the development of policies through partial import tariff reduction, rather than having positive effects, can lead to welfare losses, which are the central focus of our analysis. The remainder of this paper is organized as follows: Section 2 describes and analyzes the nominal protection. Our analysis focuses specifically on the nominal protec- tion provided by legal tariffs and the actual import tariffs. Section 2 also introduces the concept of special import regimes, which, in turn, will be considered in the con- struction of the actual import tariffs. Section 3 assesses the impact that the imposition of nominal import protec- tion has on the level of welfare. The analysis will be based on two alternative constructs of nominal protection: legal tariffs and the actual import tariffs. Section 4 in- troduces the concept of rent-seeking and relates it to the special import regimes. Section 5 discusses how the analysis of welfare is altered by incorporation of the rent- seeking arising from special import regimes. Section 6  F. A. R. SOARES ET AL. Copyright © 2011 SciRes. ME 32 presents our conclusions. 2. Nominal Protection wit hin Special Import Regimes Nominal protection is related to government intervention in trade policies, through which protection against com- petition from imported goods is granted to domestic productive sectors. As we will see further in this article, the use of this mechanism generates distortions in the functioning of the economy, which in turn have a nega- tive impact on welfare. This article will address nominal protection from two viewpoints: that related to legal tariffs and that related to the actual import tariffs.1 There are differences between these two protection mechanisms in terms of their func- tion and different effects on the level of welfare. According to the legal tariff criterion, nominal protec- tion can be defined as the percentage excess of domestic prices in relation to the prevailing prices worldwide, as the result of the application of a measure of protection, such as an ad valorem import tariff or a specific import tariff. Since the ad valorem import tariff is the most commonly used mechanism, we have adopted it as the measure in the present analysis. Therefore, supposing that the ad valorem tariff is the only protection mecha- nism and that this tariff is not prohibitive, one can define the price of an imported good as equal to the sum of the import value (at international prices) plus the value of the tariff, and nominal protection will be expressed as a per- centage of the imported value, as outlined by [8]: 1 ii i PP* t (1) where i P denotes the domestic price of the good i, * i P denotes the international price of the good i, and i t de- notes the level of nominal protection of the good pro- vided by the legal tariff. Therefore, the following expression is obtained for the nominal protection defined by the legal tariff * * ii ii PP tP (2) Legal tariffs, as measures of protection, have various problems, although the discussion of such problems is beyond the scope of this paper. For example, special im- port regimes are not considered in the construction of legal tariffs. They distort and overestimate this measure of protection. Special import regimes are government concessions made to firms or industries, so that those firms and industries can import products at partially re- duced import tariff rates.2 In other words, the special import regimes represent a tariff exemption on imports. Given the previous discussion, it is necessary to obtain a measure of nominal protection that considers the effect of the special import regimes. To that end, the actual import tariffs will be constructed.3 This measure of pro- tection considers not only the effects of legal tariffs, but also the portion reduced by the special import regimes. Therefore, as observed by [9], “(···) the actual import tariffs subtracts the effects of the special import regimes from the legal tariffs, providing a more robust measure of protection. In other words, the actual import tariffs subtracts the effects of the reduction and exemption from the import tariff, thereby allowing a more accurate measure of protection to be estimated.” The domestic price of the imported good, under the actual import tariffs, can be determined through the lin- ear combination of the imports levied by legal tariffs and those also levied by legal tariffs obtaining reductions due to special regimes: ´*111,0 1 rei ii iiii PPtP* tt (3) where i P denotes the domestic price of good i im- ported under the special import tariff regime, and rei i t denotes the tariff reducer formed from the special import tariff regime concerning the imported good. Thus, rei ii tt represents the legal tariff reduced by the spe- cial import tariff regime. The nominal protection provided by the actual import tariffs can be determined through the linear combination of the legal tariff and the legal tariff reduced by the spe- cial import tariff regime: 1, 01 vrei ii ii tt tt (4) where v i t denotes the actual import tariffs on the good i. 3. Effects of Tariff Protection on Welfare with Special Import Regimes As previously stated, the effects that import tariffs have on welfare are discussed extensively in the literature on international trade. These analyses are based, primarily, on static arguments. One of the most important studies in this area is that conducted by [1]. That study demon- strated that interference with international trade tends to 1A third criterion to assess nominal protection would be the implicit tariff or the comparison of international prices. Under this criterion, the p rotection granted to the domestic productive sectors is obtained through the difference between internal and external prices. 2For this article, we will assume that special import tariff regimes are obtained by firms or industries through demand from government agencies. In practice, special import tariff regimes can be obtained by firms or industries (productive sectors) and can even favor a certain geographical area of the country or contain other specific considera- tions. 3The actual import tariff is defined as a ratio between the amount o f im p ort tariff collected and the value of the im p orts.  F. A. R. SOARES ET AL. Copyright © 2011 SciRes. ME 33 distort the national and international allocation of re- sources. As a consequence, the availability of goods is lower than it could be with better resource allocation. In this context, international trade restrictions will generate losses related to consumption opportunities, which pri- marily reduces the consumer surplus and the surplus in productive export sectors. We can also cite the losses arising from the failure to obtain significant economies of scale, as detailed by [10-12]. This article will focus on the analysis of welfare losses deriving from tariff-induced distortions in decisions re- lated to consumption and production. However, in our analysis, we will assess not only the effects of legal tar- iffs on the level of welfare, but also the effects of the actual import tariffs. We will show that these two factors have different effects on the level of welfare. The model proposed by [13] will be used in order to measure the levels of welfare derived from nominal pro- tection. Feenstra decomposes the effects that trade poli- cies have on welfare into four possible channels: 1) dead- weight losses arising from distortions in consumption and production; 2) possible trade gains obtained from terms of trade; 3) gains or losses arising from changes in the production scale of firms; and 4) gains or losses aris- ing from changes in the profits among countries. This study will examine the variations in the level of welfare arising from the distortions of consumption and production caused by the levying of an import tariff.4 First, the following equation for determining the varia- tion in the level of welfare will be applied: * ii i i dBPP dM (5) The term on the left-hand side denotes the variation in the welfare, while that on the right-hand side denotes the loss of economic efficiency resulting from a change in the volume of imports i dM . First, as presented by [13], the legal tariff to be applied to a single good will be considered, and it will be as- sumed that the prices of other goods remain constant. Eliminating the terms in subscript, Equation (5) can be rewritten as follows: * dB dPdM dMP P dt dtdt (6) Analyzing the first term on the right-hand side of Equation (6), we have 0dPdt , given that an import tariff tends to increase the domestic price of the imported good, and 0dM . The second term on the right-hand side presents 0PP* , resulting from positive legal protection of the economy. On the other hand, an import tariff (legal tariff) makes imported good more expensive, reducing the imports, which implies that 0dM dt . Consequently, the application of a legal tariff on imports results in a reduction in the level of welfare (i.e., 0dB dt ). Using Equation (3) in Equation (5), taking into account not only legal tariffs but also the effects of the special import regimes, we obtain the following equation for variation in levels of welfare: ´* ii i i dBPP dM (7) In contrast with the [13] model, the actual import tar- iffs to be applied to a single good and the prices of other goods will remain constant. Eliminating the terms in subscript and making use of Equation (4), Equation (7) can be rewritten as follows: vv v dB dPdM dMP P* dt dtdt (8) Rewriting Equation (8) in order to decompose the ef- fects that legal tariffs, as well as legal tariffs partially reduced by special import regimes, have on the level of welfare, we obtain the following equation: 1 ,01 v rei rei dB dPdM dMP P* dt dt dt dP dM dMP P* dt tdt t (9) Analyzing the effects of a legal tariff on imports under special regimes has on the level of welfare, the results obtained differ from those obtained using Equation (6), which measures only the impacts of legal tariffs. The interpretation of the first and second terms on the right-hand side of the Equation (9) is identical to that of Equation (6). However, whereas the analysis in Equation (6) is for all imports, the analysis in Equation (9) is for only part of the imports. On the other hand, due to the special import regimes, the third and fourth terms on the right-hand side of the equation will imply a relatively smaller negative variation in the level of welfare than that represented by the variation deriving from the appli- cation of legal tariffs. This issue deserves further discus- sion. Although the application of a legal tariff on imports is partially reduced by the special regimes, it has fewer negative effects on welfare than does the full application of legal tariffs. The necessary, sufficient condition for this is that v tt. In other words, supposing a situation in which all goods are imported under the special import regimes (assuming that 0 ), we therefore have, 4In our analysis, we will consider a small economy open to trade and therefore not capable of influencing international prices. In addition, the analysis of welfare will focus on the distortions in consumption and p roduction, keeping constant, by simplicity, the terms of trade.  F. A. R. SOARES ET AL. Copyright © 2011 SciRes. ME 34 rei rei dPdM dPdM dMP P*dMP P* dtdt dt tdt t , in module, and, consequently, BB , that is, the nega- tive variation in the level of welfare is lower under spe- cial import regimes. Advancing and defining the above discussion, we can state that the granting of a special import regime by the government would not necessarily change the domestic prices of the imported goods, given that nominal protec- tion is defined by the marginal import tariff and not by the mean import rate. Therefore, the collection of taxes on trade would be transferred from the government to the beneficiaries of the special import regimes. From this standpoint, rather than an alteration in the level of wel- fare, there would be a mere transfer of income. Tariffs cuts, however, can lead to a decrease in the prices effectively paid by the importers and thus to al- terations in the level of welfare. The introduction of the special regimes could result in part of the nominal pro- tection becoming redundant,5 which would lead to the use of nominal protection that is effectively lower than that declared (legal tariff), as argued by [14]. Prices would fall, imports would increase, and goods would be imported within the parameters of the special import regimes. Therefore, Equation (9) would be converted into the equation below, where α is equal to zero: vrei rei dB dPdM dMP P* dt dt tdt t (10) where tv, in this case, is the nominal protection without tariff redundancy. In summary, the special import regimes would reduce nominal protection, which would then reduce the distor- tions in consumption and production. As a result, the level of welfare might be higher than when such regimes are not in place. 4. Effects of Tariff Protection on Welfare with Special Import Regimes and Rent-Seeking Rent-seeking activity is not aimed at obtaining income through the development and creation of productive ac- tivities. On the contrary, the objective of rent-seeking is to receive income, and, to that end, expend resources in a nonproductive manner, through relationships with public agents in general and by using the discretionary power on the part of such public agents6 to take advantage of and legal loopholes, regulatory exceptions etc.7 Discus- sions of rent-seeking that focus on international trade analysis, the object of this article, can be found in [20-25]. As stated by [20], rent-seeking stems from govern- ment restrictions on economic activity, such restrictions or interventions generating income that is, in turn, de- manded by the economic agents. Competition for such income among the economic agents induces the shifts resources from productive activity to rent-seeking activ- ity, thereby making it more costly for society as a whole. Again according to [20], such competition can be either legal or illegal. When rent-seeking involves illegal ac- tivities, it takes the form of bribery, corruption smug- gling and so on. Rent-seeking related to international trade (imports) was defined by [9] as “(···) unproductive activities that commence when the economy presents high levels of protection for its productive sectors. Such activities in- clude smuggling, under-invoicing by importers, lobbying, procurement of import licenses through the solicitation of government employees connected to foreign trade, competition for special import regimes etc.”8 One of the forms of rent-seeking behavior, as seen in [21], is the allocation of time and resources by firms or their repre- sentatives in attempts to obtain concessions such as im- port licenses. This form of rent-seeking will be discussed and adopted as a measure in this article. The analysis made in the previous section showed that the goods imported with the tariff reduction provided by special import regimes have fewer negative effects on welfare. These results, however, do not consider special import regime incentives to rent-seeking activities. Exploring the condition presented in the previous paragraph, we should consider that the firms, or their representatives, will expend resources in attempts to in- fluence the government bureaucracy in order to obtain import permits under special import regimes. In addition, a fixed number of permits will be considered. In order to import under the special import regimes, firms will com- pete for a limited number of permits, which gives rise to competitive rent-seeking.9 Furthermore, rent-seeking will supposedly occur only in relation to the goods imported under the special import regimes.10 Based on the considerations above, Equations (7) and 5We would then have effective a pp lication of the actual im p ort tariffs. 6Rent-seeking does not necessarily involve public agents. However, in the case of trade policies, there is a high probability that representatives of the public sector are involved. One good example of this was the p rocurement of import licenses, through import substitutions, during the industrialization in Brazil, especially in the 1950s. 7Detailed definitions and analyses of rent-seeking can be found in [15- 19]. 8Emphasis added. 9This premise is highly relevant to the operation of the model. 10This supposition might constitute a significant limitation of the model However, facts related to international trade show that it coincides with events occurring today. Given that most legal tariffs are subject to regional and multilateral agreements, such as those mediated by the World Trade Organization, the nation-states find strong resistance to the alteration of such tariffs.  F. A. R. SOARES ET AL. Copyright © 2011 SciRes. ME 35 (9) will be altered so as to include the effects of rent- seeking. Therefore, the following equation presents the variations in the level of welfare, taking into account the effects of legal tariffs, of legal tariffs partially reduced by special import regimes, and of rent-seeking derived from special import regimes. *rei t ii iii rei ii t n dBPPdM1Y Y L (11) where i n represents the firms that import the good i; rei i L represents the licenses, or permits, in a fixed num- ber, for the import of goods under the special import re- gime of the good i; i Y is the income related to the pro- ductive activities arising from the good i (trade, distribu- tion, etc.), and rei i Y represents the resources expended for obtaining the permits related to the special import regime, that is, the resources allocated for rent-seeking. We can conclude that rei ii YY corresponds to the portion of income originating from the shifting of re- sources from production to rent-seeking. The equation below can be obtained by applying the actual import tariffs (nominal protection without tariff redundancy) to Equation (11) and eliminating the terms in subscript: vrei rei rei rei rei dB dPdM dMP P* dt dt tdt t dYY n Ldt (12) Analyzing the effects on levels of welfare from the adoption of the actual import tariffs in the presence of rent-seeking, the results will be altered when compared with those obtained in Equations (6) and (10). The inter- pretation of the first and the second terms on the right- hand side of Equation (12) is identical to that of those subjacent to Equation (10). The third term, however, requires additional considerations. That term represents the rent-seeking originating from the special import re- gimes, which tends to have additional negative impacts on the level of welfare. Analyzing the term resulting from rent-seeking, we conclude that n and rei L are positive. On the other hand, 0 reirei dY Ydt , given the possibility reducing their tariff burden on imports through special import re- gimes, firms will expend resources in order to obtain permission to import under such regimes. Resources will consequently be allocated to unproductive activities, thus reducing rei YY. So when rent-seeking is present, the introduction of the special import regimes will gen- erate additional losses of welfare. Finally, the three hypothetical situations presented in the article can be compared. When rent-seeking occurs because of special import regimes, the actual import tar- iffs is not preferable than legal tariffs in terms of welfare. In the presence of rent-seeking, the actual import tariffs will be strictly preferable to legal tariffs only in the following condition. * rei rei rei rei rei dP dM dMP P dt tdtt dYY dPdM n dMP P* dtdt Ldt (13) Assessing the condition above, and taking into account the event that the economy is under competition among firms for rents arising from a fixed number of import permits under special import regimes, we can conclude that the welfare gains related to the actual import tariffs, in comparison with legal tariffs, can disappear completely when rent-seeking is present. In addition, since rent-seek- ing has been increasing in relation to the number of firms, the economy might be in a worse situation than that in which there are only legal tariffs on imports. The previously cited hypothesis - that there are a fixed number of import licenses under special import regimes - needs special attention. Underlying this (highly plausible) hypothesis is the possibility that the number of licenses is lower than is the demand for import under conditions favored by the special import regimes. Therefore, there will be effective competition, as well as unproductive expenditure of resources for the procurement of licenses, although not all petitioners will obtain such licenses. As a result, as stated by [18,19], the total amount expended in the procurement of the premium might be higher than the value of the premium itself. In the proposed model, in order for the welfare losses resulting from rent-seek- ing to be greater than the effects that tariff reduction has on international trade - in view of [7,18,19] - the number of “players” need only be sufficiently higher than the number of licenses that will be made available by the official foreign trade agency of the country.11 Therefore, in observing Equation (13), the higher the ratio between the number of firms (n) and the number of import li- censes (Lrei), the greater the practice of rent-seeking is expected to be, along with the ensuing adverse effects of the special import regimes on the level of welfare. 5. The Cost of Rent-Seeking and the Brazilian Case Equations Other considerations can still be made regarding the 11Another relevant factor would b e the marginal cost of influencing the chances of obtaining an import license under the special import re- gime.  F. A. R. SOARES ET AL. Copyright © 2011 SciRes. ME 36 proposed model. Ideally, the validity of a mathematical representation should be tested empirically, and this is also important for the case in question. Taking into con- sideration Equation (13), the terms on the left-hand side of inequality could be obtained, for instance, by using the triangles devised by [1].12 The terms on the right-hand side of the equation, however, are more difficult to ob- tain empirically. A measure of the incentives of the eco- nomic agents for the expenditure of resources in rent- seeking, arising from the introduction of a special import regime, would be necessary. It would be necessary to determine at least the number of firms engaged in seek- ing the rents; the expected value of the rents, and the chances involved, as well as the costs deriving from the attempt to capture income.13 However, the valuation suggested in the previous paragraph is not easily collectable, so as to provide em- pirical data. Discussing the effects of rent-seeking on welfare, [20] also affirmed that the various forms of competition for rents are, by nature, difficult to observe and quantify. In addition, [20] stated that the empirical results obtained can be questioned.14 The empirical difficulty related to the valuation of rent-seeking is mitigated by the qualitative results that can be obtained. A fixed number of import licenses un- der special import regimes will give rise to competitive rent-seeking behavior, as has been seen. The motivation for such behavior is the premium; in this case, the im- porting of goods at partially reduced duties via the spe- cial import regime. Therefore, the resources will be di- rected toward obtaining the premium rather than toward expanding the availability of goods and services. Ineffi- cient allocation of resources, having negative impacts on welfare, will result. In the model constructed, if the ex- penditure for the capture of rents is greater than the wel- fare gains attributable to the goods imported under the special regimes, there will be welfare losses.15 However, if the introduction of the special import regime does not alter the domestic price of the imported goods or the volume of imports16 - there being a mere redistribution of resources from the government to the importers - greater rent-seeking activity can be expected. This would derive from the fact that the rents had been fully appropriated by the importers.17 Otherwise, the premium deriving from the special import regime would be higher, as would the investment in the capture of income, the result of which would be greater deterioration in the level of welfare. Returning to the discussion of the Brazilian case, we can assume that the special import regimes had greater importance prior to the 1990s, before trade liberalization. During that period, imports were limited due to problems relative to external restrictions - imbalances in transac- tion accounts - as well as to industrial policy objectives, specifically import substitution.18 In the scenario prior to the lifting of trade barriers, special import regimes effec- tively made imports feasible. Currently, with the trade liberalization in terms of quantum of imports, special import regimes have lost the importance.19 The liberalization of quantity of imported goods, despite increasing the degrees of freedom, does not rule out the discussion of prices. Therefore, if the agents, in attempts to maximize their results, are able to reduce the price paid for the imported goods, they will do so, provided the cost incurred in obtaining the tariff re- duction (rent-seeking through foreign trade) is lower that the effective tariff reduction.20 6. Conclusions Government decisions regarding the trade policy to be adopted take on added importance due to their impact on the level of welfare. Each of the possible policies, as well as each combination of such policies, has different ef- fects on the economy. The optimal choice should obvi- ously favor the maximization of the level of welfare. If 12The equation below could be applied as a proxy for the variations in the level of welfare resulting from a tariff variation deriving from the imposition of a special import regime: 11 1, 1,2, 2 nn ttt tt dWdM dtt,n where dW represents the variations of the level of welfare; dM repre- sents the variations in the value of imports, and dt represents the varia- tions in the import tariff rate, including those occurring under the effect of special import regimes. 13References [26-28] established that the total rent-seeking expenditure, on competitive balance, will be equal to the expected amount of the rents. However, this outcome is not assured if the number of petitioners outweighs the income available. That is to say, some agents would have a positive return on their investment (rent-seeking) and would capture income, whereas others would have a zero return, meaning that they would not capture income despite the investment. 14According to [20], a tariff has both production and consumption costs and it has been shown that rent-seeking entails costs in addition to those of a tariff: “Many forms of competition for rents, however, are by their nature difficult to observe and quantify and one might therefore question the empirical content of the result so far obtained.” (Emphasis added.) 15In the event of tariff redundancy. 16In this case, the tariff redundancy would not be provoked. 17Lower prices are not passed on to consumers. 18In fact, external restrictions and the import substitution model are closely related. Among other factors, a lack of balance-of-payment equilibrium justified the adoption of the import substitution model in the 1930s. 19According to [29], the principal special import regimes currently in existence are those that benefit export activities. Among such regimes are the drawback regime, the Regime Aduaneiro Especial de Entre- p osto Industrial sob Controle Informativo (Recof, Special Customs Regime of Industrial Warehousing under Information Control), the industrial production in the Free Trade Zone of Manaus, and the auto- mobile industry. 20On the basis of [26-28] devised an axiom showing that, in the long-term competitive balance, the total value of rent-seeking expenses will be equal to that of the rents expected.  F. A. R. SOARES ET AL. Copyright © 2011 SciRes. ME 37 the intervention is suboptimal, trade interventions should be aimed at minimizing welfare losses. This study has presented two measures of government intervention in foreign trade and has specifically dis- cussed the nominal protection afforded by legal tariffs. Another measure of nominal protection has also been shown. That measure was constructed on the basis of the actual import tariffs, which differs from measures based on legal tariffs in that it considers the effects of the spe- cial import regimes Two measures of welfare have been created, one based on legal tariffs and the other based on the actual import tariffs. The actual import tariffs, due to the tariff reduc- tion provided by the special import regimes, initially proved to be a more efficient trade policy measure, ac- cording to the criterion of welfare. Within this context, one could say, in principle, that the resources not with- held by the government (i.e., those transferred to the pri- vate sector) - from the standpoint of their effect on wel- fare - simply constitute income redistribution.21 However, the resources allocated in order to redistribute income redirected to importers could be deemed to have been expended in an unproductive manner, thus negatively affecting social welfare. Therefore, special import regimes stimulate firms to engage in rent-seeking activities, motivating them to transfer resources to such activities. Due to the competi- tion for the right to import goods under the special re- gimes, there is unproductive expenditure of resources. Consequently, as the result of rent-seeking, the protec- tion provided by the actual import tariffs, in terms of welfare, can be worse than that provided by the legal tariff. Special import regimes can cause other economic im- balances. Such imbalances would originate from the im- port tariff (legal tariff) exemptions themselves. These (non-linear) exemptions would create distortions in the price structure, thereby resulting in inefficient allocation of resources. The loss of economic efficiency would re- sult in additional welfare losses, which should be added to those resulting from rent-seeking activities.22 There- fore, we can conclude that the trade policies of a country should not be founded on the concession of special re- gimes, exemptions, and exceptions. The elimination of such mechanisms would allow greater transparency, simplification of the procedures, and clarification of the incentives, all of which would lead to the greater eco- nomic efficiency and hence to a higher level of welfare. In conclusion, we have discussed the effects that the norms imposed by government agents, as well as the ensuing rent-seeking, have on welfare. The discussion of trade policies is currently of less importance than it has been in previous periods, especially between the 1930s and the 1980s - prevailed when, for example, import substitution in Latin America countries. Nevertheless, there is scope for analysis. In addition, in assessing its importance as a line of research to be pursued in future studies, one must consider that the mechanism addressed in this article and its framework can be adapted to other aspects of economy and society. The instrument can be applied to various elements in discussions of the government agenda. As examples, we can cite the environmental, industrial, and regulatory policies for which the delegation of infrastructure to the private sector (concessions and privatization) is currently the focus of vigorous debate. Finally, we can conclude that the regulatory and normative activities of the govern- ment remain in place, allowing the continued existence of potential loopholes for rent-seeking practices and their potential effects on welfare - all that changes is the forum for discussion. 7. References [1] H. G. Johnson, “The Cost of Protection and Scientific tariff,” The Journal of Political Economy, Vol. 68, No. 4, 1960, pp. 327-345. doi:10.1086/258340 [2] M. C. Kemp, “The Gain From International Trade,” The Economic Journal, Vol. 72, 1962, pp. 802-819. doi:10.2307/2228352 [3] H. Leibenstein, “Allocative Efficiency VS. ‘X-Effi- ciency’,” American Economic Review, Vol. 56, No.3, 1966, pp. 392-415. [4] J. N. Bhagwati, “The Generalized Theory of Distortions and Welfare,” In: J. N. Bagwati, R. W. Jones, R. A. Mun- dell and J. Vanel, Eds., Trade, Balance of Payments and Growth: Papers in International Economics in Honor of Charles P. Kindleberger, North Holland, Amsterdam, 1971. [5] W. M. Corden, Trade Policy and Economic Welfare, Clarendon Press, Oxford, 1974. [6] W. M. Corden, “Normative Theory of International The- ory,” In: R. W. Jones and P. B. Kenen, Eds., Handbook of International Economics I, North Holland, Amsterdam, 1984. [7] W. J. Corcoran, “Long-Run Equilibrium and Total Ex- penditures in Rent-Seeking”, Public Choic, Vol. 43, 1984, pp. 89-94. doi:10.1007/BF00137909 [8] B. Balassa, “Concepts and Measurement of Protection”, In: B. Balassa and Associates, The Structure of Protec- tion in Developing Countries, The John Hopkins Press, 1971. [9] F. A. R. Soares, “A Liberalização Comercial e seus Im- pactos Alocativos na Economia Brasileira”, Dissertação de Mestrado, Universidade de Brasília, Brasília, 2000. 21Supposing there is a central planner to maximize welfare, one should assess whether the redistribution of resources could be considered de- sired. 22See [30].  F. A. R. SOARES ET AL. Copyright © 2011 SciRes. ME 38 [10] P. R. Krugman, “Increasing Returns, Monopolistic Com- petition, and International Trade,” Journal of Interna- tional Economic, Vol. 9, No. 4, 1979, pp. 469-479. doi:10.1016/0022-1996(79)90017-5 [11] P. R. Krugman, “Scale Economies, Product Differentia- tion, and the Pattern of Trade,” American Economic Re- view, Vol. 70, No. 5, 1980, pp. 950-959. [12] P. R. Krugman, Increasing Returns and the Theory of International Trade, NBER Working Paper, No. 1752, NBER, Cambridge, MA, 1985. [13] R. C. Feenstra, “Estimating the Effects of Trade Policy,” In: G. M. Grossman, K. Rogoff, Handbook of Interna- tional Economics III, North Holland, Amsterdam, 1995. [14] W. M. Corden, The Theory of Protection, Clarendon Press, Oxford, 1971. [15] J. M. Buchanan, “Rent Seeking and Profit Seeking,” In: J. M. Buchanan, R. D. Tollison and G. Tullock, Eds., To- ward a The ory of the R ent-S eeki ng Socie ty, Texas A & M University Press, College Station, 1980. [16] R. D. Tollison, “Rent Seeking: a Survey,” Kyklos, Vol. 35, No. 4, 1982, pp. 575-602. doi:10.1111/j.1467-6435.1982.tb00174.x [17] G. Tullock, “The Welfare Costs of Tariffs, Monopolies and Theft,” Western Economic Journal, Vol. 5, No. 3, 1967, pp. 224-232. [18] G. Tullock, “Rent Seeking as a Negative-Sum Game,” In: J. M. Buchanan, R. D. Tollison and G. Tullock, Eds., Toward a Theory of the Rent-Seeking Societ, Texas A & M University Press, College Station, 1980. [19] G. Tullock, “Efficient Rent Seeking,” In: J. M. Buchanan, R. D. Tollison and G. Tullock, Eds., Toward a Theory of the Rent-Seeking Society, Texas A & M University Press, College Station, 1980. [20] A. O. Krueger, “The Political Economy of the Rent-Seek- ing Society,” American Economic Review, Vol. 64, No. 3, 1974, pp. 291-303. [21] A. O. Krueger, “Trade Policies in Developing Countries,” In: R. W. Jones and P. B. Kenen, Handbook of Interna- tional Economics I, North Holland, Amsterdam. [22] J. N. Bhagwati and T. N. Srinivasan, “Revenue Seeking: a Generalization of the Theory of Tariffs,” Journa l of Po - litical Economy, Vol. 88, No. 6, 1980, pp. 1069-1087. doi:10.1086/260929 [23] R. E. Baldwin, “Rent-Seeking and Trade Policy: An In- dustry approach,” Review of world Economics, Vol. 120, No. 4, pp. 1984, 662-677. [24] R. E. Baldwin, “The Political Economy of Trade Policy,” Journal of Economic Perspectives, Vol. 3, No. 4, 1989, pp. 119- 135. [25] R. C. Feenstra, “How Costly is Protectionism?” The Journal of Economic Perspectives, Vol. 6, No. 3, 1992, pp. 159-178. [26] G. S. Becker, “Crime and Punishment: An Economic Ap- proach,” Journal of Political Economy, Vol. 76, No. 2, 1968, pp. 169-217. doi:10.1086/259394 [27] R. A. Posner, “The Social Cost of Monopoly and Regula- tion,” Journal of Political Economy, Vol. 83, No. 4, 1975, pp. 807-827. doi:10.1086/260357 [28] E. Foster, “The Treatment of Rents in Cost-Benefit Analysis,” American Economic Review, Vol. 71, 1981, pp. 171-178. [29] G. Piani and P. Miranda, Regimes Especiais de Importação e “Ex-Tarifários”: Caso do Brasil, Texto para Discussão, No. 1249, IPEA, Rio de Janeiro. [30] F. A. R. Soares, “A Liberalização Comercial e seus Impactos Alocativos na Economia Brasileira,” Economia Aplicad, Vol. 6, No. 3, 2002, pp. 485-510. |