Modern Economy, 2013, 4, 673-680 Published Online November 2013 (htt p://www.scirp.org/journal/me) http://dx.doi.org/10.4236/me.2013.411073 Open Access ME Optimal Operating Policies for a Multinational Company under Varying Market Economics Shu-Chen Chang Department of Business Administration Nati onal Formosa University, Taiwan Email: shu-chen@nfu.edu.tw Received March 14, 2013; revised April 29, 2013; accepted May 7, 2013 Copyright © 2013 Shu-Chen Chang. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. ABSTRACT This paper proposes a mathematical programmin g model for Multi-National Corporations (MNCs) by considering both the flexibility of ex ch ange rate an d market price un certainties. Th e results sho w that the facto ry in a host coun try should supply the produ cts demanded by the home coun try for the next period when exchange rate decreases. The quantity of products being produced and shipped should be adjusted according to the variation of market-price. Conversely, a MNC in the host country should produce products ahead of time when exchange rate increases and must adjust quantity of production and inventories according to the variation of market-price. Keywords: Exchange Rate Uncertainties; Multi-National Corporation s ; Market Price Uncertainties 1. Introduction Previous reports have showed a significant increase in the number of Multi-National Corporations (MNCs) and a tremendous growth in foreign direct investment in re- cent two decades. A MNC is defined as the corporation that owns or controls production or service facilities o ut- side the host country and operates in two or more coun- tries. However, a fundamentally different form of inter- national commercial activity has developed since World War II. The form has greatly increased worldwide eco- nomic and political interdependence. The MNCs now make direct investments in fully integrated production process including production planning and distribution under varying environments. Due to the current trend of market and economic globalization, multinational corpo- rations must face more ambiguities such as different cul- tures, values, ru les, varying degrees of business, po litical and economical uncertainties. Investments of a MNC under uncertainty have been studied in several literatures which show that sunk costs and the revenue of a MNC can be affected by the exchange-rate uncertainty [1-4] and the government policy uncertainty [5,6]. With market and economic globalization, MNCs now gradually tend to design and manage their supply chains more efficiently on a worldwide basis. The network ac- tivities of a corporation’s supply chain such as sourcing, manufacturing, and distribution are based on handling all flows of materials, information, and funds effectively and efficiently within and across the chain. When a firm faces a more complicated market environment, the mul- tinational Supply Chain Management (SCM) becomes more and more important. The managerial issues cover problems with strategic and operational dimension such as design and location of facilities, specification of sup- ply contracts, choice of product variety, management of inventories, and selection of transportation forms. Many researchers have focused on how the flexibility of exchange rate may affect a MNC’s operation; however, they seldom consider the variability of market prices at the same time. In this paper, we extend Huchzermeier and Cohen’s [2] and Mohamed’s [4] model to develop a new multi-period production-distribution model with varying exchange rate and market price. Then, we use quantitative approach to investigate for a MNC’s supply chain design process for finding its optimal operating decision by emphasizing the effects of uncertainties in exchange rate and product price. The uncertainties of exchange rate and product price are defined as stochastic dynamic processes. Using stochastic dynamic program- ming, we simulate the changes, the volatility, and the variation speed of exchange rate and market price. The goal of this research is to understand that the pro- duction and distribution decisions for a MNC are over a finite planning horizon. In other words, we would like to determine a firm’s decision when facing to the variations  S.-C. CHANG 674 in market price and exchange rate. Therefore, the objec- tive function is to maximize the profit of a MNC by re- ducing production, distribution, and inventory costs un- der the variations in exchange rate and market price. By exercising this model, we can provide useful guidance for a MNC to make operating decisions which involve un- certainties in exchang e rate and market price. This paper is organized as follows. Section 1 provides a brief literature review for SCM related to MNCs. In Section 2, we develop an integrated production planning and distribution model for a MNC suitable for varying exchange rate and market price. In Section 3, we estab- lish a stochastic dynamic programming model by incor- porating seven parameters including exchange rate and market price. We verify the correctness of this model and its optimal operation through a numerical example in Section 4. Finally, conclusions are given in Section 5. 2. Literature Review The previous studies on SCM for multinational opera- tions within a network have largely involved the up- stream and downstream flows of products, services, in- formation, and finance. The term SCM was originally introduced by consultants in the early 1980s and has subsequently received much attention in manufacturing operations. SCM was described by the logistic literature as a new integrated logistic management approach across different business processes such as purchasing, manu- facturing, distribution, and sales. Later on, many manu- facturing companies are willing to locate their facilities in any part of the world in order to obtain cheap labor, more reliable materials, parts, and subassemblies [7]. This integrated approach is extended outside the firm’s boundaries to customers and suppliers. Such a trend has incurred the problem of managing global operations for a firm in different cultures, values, rules, and politics. Also, since the Bretton Woods System was broken up, the sta- bility of the competitive environment in the early 1970s has been replaced by increasing uncertainty. Thus, a MNC must face more ambiguities in the internal and external environment such as shorter product life cycle, quick change of customer’s preference, and many com- peting rivals. Many literatures have dealt with designing and man- aging a network of facilities lo cated in different countries in response to growing environmental uncertainty [8-12]. Hodder and Jucker [8] incorporated market price and exchange-rate uncertainty and adopted cost minimization via using a mean-variance objection function to analyze the effect of uncertainty in one-period. De Meza and Van Der Ploeg [9] also tried to capture th e value of flexibility under uncertainty stochastic model of shifting production in one-period. Koqut and Kulatilaka [10] analyzed ex- plicitly the net present value of shifting production be- tween two plants which located in two different countries with exchange-rate movement using multi-period sto- chastic model. Although these approaches have made con- siderable progress in analyzing cost-minimization or pro- fit-maximiz ation for multin ational operatio ns within a net- work under market price or exchange-rate uncertainty, they did not cons ider the flexibility of exchange-rate and market price uncertainties over multiple periods. On the other hand, the importance of global issues in supply chain management and analysis has gradually received more attention in recent literatures [6,13,14]. Cohen and Lee [13] developed a comprehensive mathe- matical programming model for option valuation of global manufacturing and distributing strategy and con- structed a maximizing objective function for after-tax profits. Although their approach included stochastic variables in the su b-mode ls, the facility location, capacity of plant and technology are assumed to be fixed. Thus, they did not consider the random fluctuations of cur- rency’s exchange rate on the network operation. Kulati- laka and Koqut [14] explored how a MNC provides in- centives to managers to modify production plans appro- priately. They developed a stochastic dynamic program- ming model to evaluate the cost based on varying ex- change rate in multi-periods. They also determined the quantity of shifting production between two manufactur- ing locations in two different countries. However, the decisions about material flow, product distribution, de- mand and processing time uncertainties were not consid- ered in their model. Several literatures have proposed models for uncer- tainty management in global supply chain. Such models emphasize centralized decision-making and optimization [2,15]. Huchzermeier and Cohen [2] extended Cohen and Lee’s work [13] by taking exchange-rate uncertainty into account to develop a stochastic dynamic programming formulation for the evaluation of global manufacturing strategy options with switching costs. Their model con- sists of three sub-models: the stochastic exchange rate sub-model, the valuation sub-model, and the supply chain network sub-model. Moreover, they also considered plant capacity and customer demand in their model. Among these sub-models, the supp ly chain network sub-model is to maximize the expected discounted after-tax profit of a multinational firm. However, the formulation did not include stochastic market prices and processing time. Dasu and Li [12] analyzed the structure of the optimal policies for a firm with operating plants located in two countries based on a randomly changing exchange rate and switching costs. Their approach can determine when and how much to alter the quantities produced in differ- ent countries. However, they failed to consider the in- ventories carried from one period to the next in their model. Open Access ME  S.-C. CHANG 675 3. The Proposed Model The MNC decisions discussed in this paper include pro- duction strategies, international lo cations, and operation s. Production strategies will determine the levels of prod- ucts to be made and sold. The operation decisions in- clude the distribution of products to various markets, and different inventory levels of products. In this paper, we would like to develop a stochastic dynamic programming model which includes a stochastic exchange rate sub- model, a pricing sub-model with varying sub-demand, and a supply chain network sub-model to analyze global manufacturing strategies. Many research works proposed the measures for sup- ply chain performance using objective functions directly based on minimizing cost, maximizing sales, maximizing profit, or maximizing returns from investments. Among these objective functions, cost-minimization and profit- maximization are widely used. In our model, the objec- tive function is to maximize a MNC’s profit by consid- ering plant capacity and demand satisfaction. Profit is total revenue subtracted by total cost. Total cost includes manufacturing cost, inventory cost, and dis- tribution cost. Total revenue and total cost should incor- porate exchange rates. We define the related variables shown in Table 1. 3.1. The Exchange Rate Function and Total Revenue Sub-Model According to Harvey and Quinn’s model [16] and Mo- hamed’s model [4], we assume that predicted exchange rate in the t-th period for a target market in the m-th period is a probability distribution function. Then, the exchange rate can be expressed as , ˆmt e ,, ˆmt mmt epee. According to Kaihara’s [17] argument, we assume that dynamic price of a product is associated with the demand for that product. So, the price of a product , mt P depends on its market demand , mt D t TR . Hence, in any given period, the total revenue from all markets can be described by the foll o wi n g expression: ,, , 11 ,, 11 ˆ MJ tmtjmtjmt mj MJ mmt jmtjmt mj TRe PD pee PDD , (1) Based on the total revenue as described above, the price is non-constant and can be expressed as being de- pendent on the demand. That is, ,,jm tjm t PPD , mt abD, , . 0PPD 0DPP 3.2. The Total Cost Sub-Model The total cost can be expressed as t TC Table 1. Notations. Notation Remark Set of target markets 1,2, ,, ,mM Set of facilities 1,2, ,, ,kK Set of products 1, 2,,,,jJ T Set of time periods 1,2, ,, ,tT ,jm t P Unit price of sales for product j in period t for target market m ,jm t Demand quantity for product j in period t for target market m ,mt e The initial exchange rate in period t for target market m m e Probability value of exchange rate for target market m ,kt e The initial exchange rate in period t for target facility k k e Probability value of exchange rate for target facility k ,kj t CN Manufacturing cost per unit of pro d uct j at facility k in period t ,kj t Q Quantity of produc t j at facility k in period t ,jk t P Inventory ho l ding cost per unit of product j at facility k in period t ,jk t I nventory quantity of product j at facility k in period t ,jm t P shipping cost of product j in period t for target market m ,jmk t DQ Quan t i t y of product j produced from facility k to market m in period t a Constant coefficient (i.e. intercept of product-price equation) b Constant coe f ficient (i.e. partial adjustment coefficient of product-price) ,, 1 DICOST MCOST INCOST K tktkt k TC , kt (2) where , is the distribution cost, , is the manufacturing cost, and , is the inven- tory cost. Each of these costs is described as follows: DICOSTkt MCOSTkt INCO S Tkt The distribution cost In any given period, the distribution cost , DICOSTkt is expressed in dollars as follows: ,,, 11 ˆ DICOST MJ ktkt jmtjmkt mj eDP DQ , (3) The manufacturing cost The manufacturing cost is incurred by production cost including labor cost, machine maintenance cost, and other costs directly related to the capacity and raw material purchasing cost. In any given period, manufacturing cost MCOSTt is given by the formula: Open Access ME  S.-C. CHANG 676 ,,, 1 ˆ MCOST J ktktkjtkjt j eCNQ , , jmt t , , , (4) The inventory cost If a MNC has excess in supply (i.e. the quantity of good supply exceeds the quantity of good demand), they will incur inventory expense. The inventory cost (, IN ) can be expressed in dollars by incorpo- rating the exchange rate in any given period as follows: C O S Tkt ,,, 1 ˆ INCOST J ktktjkt jkt j eIPI (5) Total profit can be maximized by total revenue sub- tracted by total cost. Therefore, the complete integrated production and distribution model can be described as follows: 11 Max subject to TT tt tt TR TC ,, , 11 ˆ MJ tmtjmt mj TRe PD ,,, 1 MCOST INCOST DICOST K t ktktk k TC ,,, 1 ˆ MCOST J ktktkjtkjt j eCNQ ,,, 1 ˆ INCOST J ktktjkt jkt j eIPI ,,, 11 ˆ DICOST MJ ktkt jmtjmkt mj eDP DQ ,, 1 K mt jmkt k DDQ ,,1 , 1 M kjt jktjmktjkt m QIDQI , , ,, ˆmt mmt epee ,, ˆkt kkt epee ,, mt jmtjmt PpD abD ,,,,, ,, ,, ,,1 ,,,,, , ,, ,,,0 kt mtjmtjmtkjtkjtjkt jk tjmtjmk tjk t ee PDCN QIP IDPDQIab , 4. An Example We demonstrate the usefulness of our proposed model through a numerical example. The following scenario is considered in this example. Assume that manufacturing facilities exist (or to be built) in both home and host countries and there is no capacity requirement. Any ma- nufacturing facility only produces one kind of products and supplies both home and host countries without any arbitrage. There are two planning periods and two types of demand function for products in our example. In addi- tion, the unit manufacturing cost, unit distribution cost, and unit inventory cost are kept constant in each same period. However, product unit price is uncertain in each individual market since this price must depend on market demand. Before simulating the effects of exchange rate and market price function, we list all giv en parameters in Ta- ble 2. The model is simulated using LINGO simulation language. 5. Results and Discussion The simulation results can be classified into three cate- gories. The first category is the effect of production be- havior when exchange rate has no significant change while the market price is changing. The second category is the effect of production behavior when exchange rate decreases while the market price is changing. The third category is the effect of production behavior when ex- change rate increases while the market price is changing. The simulation results for the above three categories are given in Tables 3-5, respectively. 5.1. Exchange Rate Insignificant Change but Market Price Changes As we can see from Type A in Table 3, the optimal products for home country and host country are 1470 and 1476 units, respectively, in both periods. The optimal Table 2. Input parameters. Home country Host country Unit manufacturing cost$59.73 $23.28 Unit distributing cost $22 $20 Unit inventory holding cost of product $4.57 $3.88 3000 tt PD 15000.5 tt PD Price function for product 3000 tt PD 2000 tt PD Value of exchange rate in initial period $2 The type of flexibility exchange rate in next period no significantly change Increasing Decreasing The composite type of flexibility exchange rate in next period ($1 $2 $3) ($2 $3 $4) ($0.5 $1 $2) Probability value of exchange rate occurring in second period (0.2 0.6 0.2) (0.2 0.6 0.2) (0.1 0.8 0.1) Note: the value of exchange rate is exchange rate of currency of home coun- ry. t Open Access ME  S.-C. CHANG Open Access ME 677 Table 3. Results for no significantly changing exchange rates. Type A Type B Market Period 1 Period 2 Period 1 Period 2 Home country 1470 1476 1470 1470 The produced quantity Host country 1470 1476 988 988 (From home country to host country)0 0 0 0 The shipped quantity (From host country to home country)0 0 0 0 Home country 0 0 0 0 The inventoried quanti ty Host country 0 0 0 0 Home country 1470 1476 1470 1470 The quantity of demand for product Host country 1470 1476 988 988 Home country $1530 $1530 $1530 $1530 The price of product (expressed by currency of ho me country) Host country $1544 $ 15 44 $2024 $2024 Total profits (expressed by currency of home country) $8,683,997 $8,230,016 Notes: Type A: demand function for product is in home country, and t 3000 t P t DD1500 0.5 t P in host country. Type B: demand function for product is in home country, and t in host country. 3000 t P t DD2000 t P demands for products in home country and host country in both periods are also 1470 and 1476 units, respectively. Type B of Table 3 shows that the optimal products for home country and host country are 1470 and 988 units, respectively, in both periods. The optimal demands for products in home country and host country are also 1470 and 988 units, respectively, in both p eriods. Based on the results of Type A and Type B as described above, we find that no matter how the market price changes, the optimal demand is always equal to the production quan- tity in both demand functions when exchange rate has insignificant changes. However, the production quantity will decrease when th e price-function becomes more fle- xible. The products of each country are produced internally to supply the demands in both periods when exchange rate has insignificant changes. Th e production quantity is different as market-price varies. In other words, the best operating decision of a MNC is to make products inter- nally in each country and supply that country’s demand without shipping and inventory if there is no significant change in exchange rate. Moreover, a MNC should pay attention to the change in production quantity if mar- ket-price varies. 5.2. Exchange Rate Decreases and Market Price Changes When the currency of a host country is strong (decreas- ing exchange rate) in the second period, we find that the unit manufacturing cost in host country will decline. At that time, a MNC must face two operating decisions. One is to produce products in host country for both periods and the other is to produce products for home country in the factories at host country in the second period. Based on the above decisions, we find that the first decision de- rives $62.72 unit cost from the manufacturing cost in home country and the second on e derives $45.44 un it cost fro m the manufacturing and distributing costs. For a MNC, the second decision is more economically efficient than the first. The simulation results are shown in Table 4. As we can see from Type A (Type B) in Table 4, the optimal products for home country and host country are 0 and 2954 units (0 and 2465 units), respectively, in second period. In addition, the optimal demands for products in home country and host country are 1478 and 1476 units (1477 and 988 units), respectively, in the second period. The behavior of shipping products from host country to home country occurs in the second period, and the quan- tity of shipping is 1478 and 1477 units in Type A and Type B, respectively. Hence, the market demand of home country is supplied by the products produced in host country if exchange rate decreases in the second period. In other words, we choose an optimal operating decision that will decrease the quantity of products being pro- duced and shipped according to the variation in mar- ket-price in host country for the second period, and sup- ply the market’s demand in home country with the prod- ucts manufactured in host country for the second period. Hence, the quantity of producing and shipping is signifi- cantly affected by the price-function forms. Thus, the variation of market-price will affect the operating deci- sions of a MNC. 5.3. Exchange Rate Increases and Market Price Changes When the currency of host country is weak (increasing  S.-C. CHANG 678 exchange rate) in the second period, we find that the unit manufacturing cost in host country will increase. At that time, a MNC must face two operating decisions. One is that the products d emand ed by ho st co un tr y in the seco nd period will be produced ahead of time. The other is that the products demanded by host country in the second period will be produced in home country. Based on the above decisions, we find from Type A and Type B in Table 5 that the first decision derives $54.32 unit cost from the manufacturing and inventory cost in host coun- try, while the second one d erives $64.3 unit cost from the manufacturing and distributing costs. Thus, for a MNC, the first decision is more economically efficient than the second. As we can see from Type A (Type B) in Table 5, the optimal amount of products produced in host country are 2958 and 0 units (1479 and 0 units) in the first and sec- ond period, respectively. In addition, the optimal de- mands for products in host country are 1470 and 1482 units (988 and 991 units) in the first and second period, respectively. Hence, the products to supply host country in the second period will be produced ahead of time when exchange rate increases. The behavior of invento- rying products occurs in the first period and this quantity is 1482 and 991 units in Type A and Type B, respec- tively. In other words, a MNC in host country should choose the optimal operating decision: decreasing the quantity of products being produced and inventoried ac- cording to the market-price change in host county in the first period, and producing products ahead of time for the Table 4. Results for decreasing exchange rates. Type A Type B Market Period 1 Period 2 Period 1 Period 2 Home country 1470 0 1470 0 The produced quantity Host country 1476 2954 988 2465 (From home country to host country)0 0 0 0 The shipped quantity (From host country to home country)0 1478 0 1477 Home country 0 0 0 0 The inventoried quanti ty Host country 0 0 0 0 Home country 1470 1478 1470 1477 The quantity of demand for product Host country 1476 1476 988 988 Home country $1530 $1522 $1530 $1523 The price of product (expressed by currency of home country) Host country $1544 $762 $2024 $1012 Total profits = (expressed by currency of home country) $7,669,216 $7,323,056 Notes: Type A: demand function for product is in home country, and t 3000 t P t D1500 0.5 t PD t DD in host country. Type B: demand function for product is in home country, and t in host country. 3000 t P 2000 t P Table 5. Results for increasing exchange rates. Type A Type B Market Period 1 Period 2 Period 1 Period 2 Home country 1470 1476 1470 1470 The produced quantity Host country 2958 0 1479 0 (From home country to host country)0 0 0 0 The shipped quantity (From host country to home country)0 0 0 0 Home country 0 0 0 0 The inventoried quanti ty Host country 1482 0 991 0 Home country 1470 1476 1470 1470 The quantity of demand for product Host country 1470 1482 988 991 Home country $1530 $1530 $1530 $1530 The price of product (expressed by currency of home country) Host country $1544 $2277 $2024 $3027 Total profits (expressed by currency of home country) $9,797,307 $9,222,230 Notes: Type A: demand function for product is in home country, and t 3000 t P t D1500 0.5 t PD product isin home country , and in host country . in host country. Type B: demand function for 3000 tt PD 2000 tt PD Open Access ME  S.-C. CHANG 679 eriod. Henduction 6. Conclusions tend and modify the previous gl ch sions under the environment with exchange-rate and mar- ERENCES [1] J. M. Camparms in the United States under Ey,” Review Eco- second pce, quantities of pro and in- ventories are significantly affected by price-functions. This implies that the variation of market-price will affect the operating policies o f a MNC. In this paper, we exobal nomic Statistic, Vol. 74, No. 5, 1993, pp. 614-622. supply chain network models to develop an integrated production and distribution model for a MNC operating under the environment with varying exchange rate and market price. Our model incorporates two new charac- teristics. First, exchange rate and processing time uncer- tainties are considered in the model. Second, we allow the market price of products to be dependent on the de- mand levels and stock of existing products. The results derived from the model show that planning a MNC’s cost is the main factor for deciding which operating decision should be chosen. This is similar to Mohamed’s [4] re- sults, where the profit will decrease when the exchange rate is decreased under the assumption of constant mar- ket price for products. We demonstrate that a MNC can utilize machines in the inventory or distribution to avoid possible fluctuation in exchange rate. Through the com- putational experiment, a MNC may choose to maintain current operating decisions when exchange rate has no significant change. However, if exchange rate decreases and a flexible p rice-function form is used, the host coun- try should overproduce and distribute the excess part of products to the home country in order to minimize the total cost. In addition, the host country should pay atten- tion to the ch ange in quantity of produ cts being pro duced and shipped according to the variation of market- p ri ce. If exchange rate increases and price-function forms ange, the firms of a MNC in the host country should produce products ahead of time in order to minimize the total cost and adjust the quantity of products being pro- duced and inventoried according to the change in price- function forms. That is, the firms of a MNC in the host country should choose the optimal operating decision to produce products ahead of time for the second period and the host country should be able to adjust the quantity of products being produced and inventoried, according to the market-price’s variety. The potential benefit of this operating strategy increases the firm’s profit and reduces its downside risk. An interesting and somewhat surpris- ing outcome of this an alysis is that the operating strateg y is affected by the fluctuation in exchange-rate and mar- ket-price’s variety because the quantity of products to be produced, sh ipped, and inventoried will change based on the variation in market-price when exchange rate is con- sidered. In conclusion, we claim that the contribution of this paper is to provide a manufacturing planning strat- egy for a MNC to make more accurate operating deci- ket-price uncertainties. REF , “Entry by Foreign Fi xchange Rate Uncertaint http://dx.doi.org/10.2307/2110014 [2] A. Huchzermeier and M. A. Cohen, “Valuing Operat Flexibility under Exchange Rate Rional isk,” Operational Re- on the Level search, Vol. 44, No. 1, 1996, pp. 100-113. [3] J. Darby, A. Hughes-Hallett, J. reland and L. Piscitelli, “The Impact of Exchange Rate Uncertainty of Investment,” Economic Journal, Vol. 109, No. 454, 1999, pp. 55-67. http://dx.doi.org/10.1111/1468-0297.00416 [4] Z. M. Mohamed, “ Model for a Multi-National Company Ope An Integrated Production-Distribution rating under Varying Exchange Rate,” International Journal of Pro- duction Economics, Vol. 58, No. 1, 1999, pp. 81-92. http://dx.doi.org/10.1016/S0925-5273(98)00080-2 [5] D. Rodrik, “Policy Uncertainty and Private Investmen Developing Countries,” Journal Development Ecot in nomic, Vol. 36, No. 2, 1991, pp. 229-242. http://dx.doi.org/10.1016/0304-3878(91)90034-S [6] C. J. Vidal and M. Goetschalckx, “M Uncertainties on Global Logistics System,” Journal of odeling the Effect of 986, Price and Exchange Rate Uncertainty,” Engi- Business Logistics, Vol. 21, No. 1, 2000, pp.95-120. [7] A. L. McDonald, “Of Floating Factories and Mating Di- nosaurs,” Harvard Business Review, Vol. 64, No. 6, 1 pp. 82-86. [8] J. E. Hodder and J. V. Jucker, “International Plant Loca- tion under neering Costs and Production Economics, Vol. 9, No. 1-3, 1985, pp. 225-229. http://dx.doi.org/10.1016/0167-188X(85)90032-1 [9] D. De Meza and F. V ity as a Motive for Multinationality,” Journatl Ind an Der Ploeg, “Production Flexibil- ustrial Economics, Vol. 35, No. 3, 1987, pp. 343-352. http://dx.doi.org/10.2307/2098639 [10] B. Koqut and N. Kulatilaka, “Multinational F and the Theory of Foreign Direct lexibility Investment,” Working iability,” Management Sci- Paper, University of Pennsylvania, Philadelphia, 1988. [11] L. Li, E. Porteus and H. Zhang, “Optimal Operating Poli- cies for Multi-Plant Stochastic Manufacturing Systems in a Changing Environment,” Management Science, Vo. 47, No. 11, 2001, pp.1539-1551. [12] S. Dasu and L. Li, “Optimal Operating Polices in the Pre- sence of Exchange Rate Var ence, Vol. 43, No. 5, 1997, pp. 705-722. http://dx.doi.org/10.1287/mnsc.43.5.705 [13] M. A. Cohen and H. L. Lee, “Strategic A grated Production-Distribution Systems: nalysis of Inte- Models and Me- thods,” Operations Research, Vol. 36, No. 2, 1988, pp. 216-228. http://dx.doi.org/10.1287/opre.36.2.216 [14] N. Kulatilaka and B. Koqut, “Operating Flexibility, Glo- Open Access ME  S.-C. CHANG 680 bal Manufacturing, and the Option Value of a Multina- tional Network,” Management Science, Vol. 40, No. 1, 1994, pp. 123-139. http://dx.doi.org/10.1287/mnsc.40.1.123 [15] M. A. Cohen and S. search and Applications,” Production Mallik, “Global Supply Chains: R and Operations e- Management, Vol. 6, No. 3, 1997, pp. 193-210. http://dx.doi.org/10.1111/j.1937-5956.1997.tb00426.x [16] J. T. Harvey and S. F. Quinn, “Expectations and Rational o- Expectations in the Foreign Exchange Market,” Journal of Economic Issues, Vol. 31, No. 2, 1997, pp. 615-622. [17] T. Kaihara, “Supply Chain Management wit h Market Ec nomics,” International Journal of Production Economics, Vol. 73, No. 1, 2001, pp. 5-14. http://dx.doi.org/10.1016/S0925-5273(01)00092-5 Open Access ME

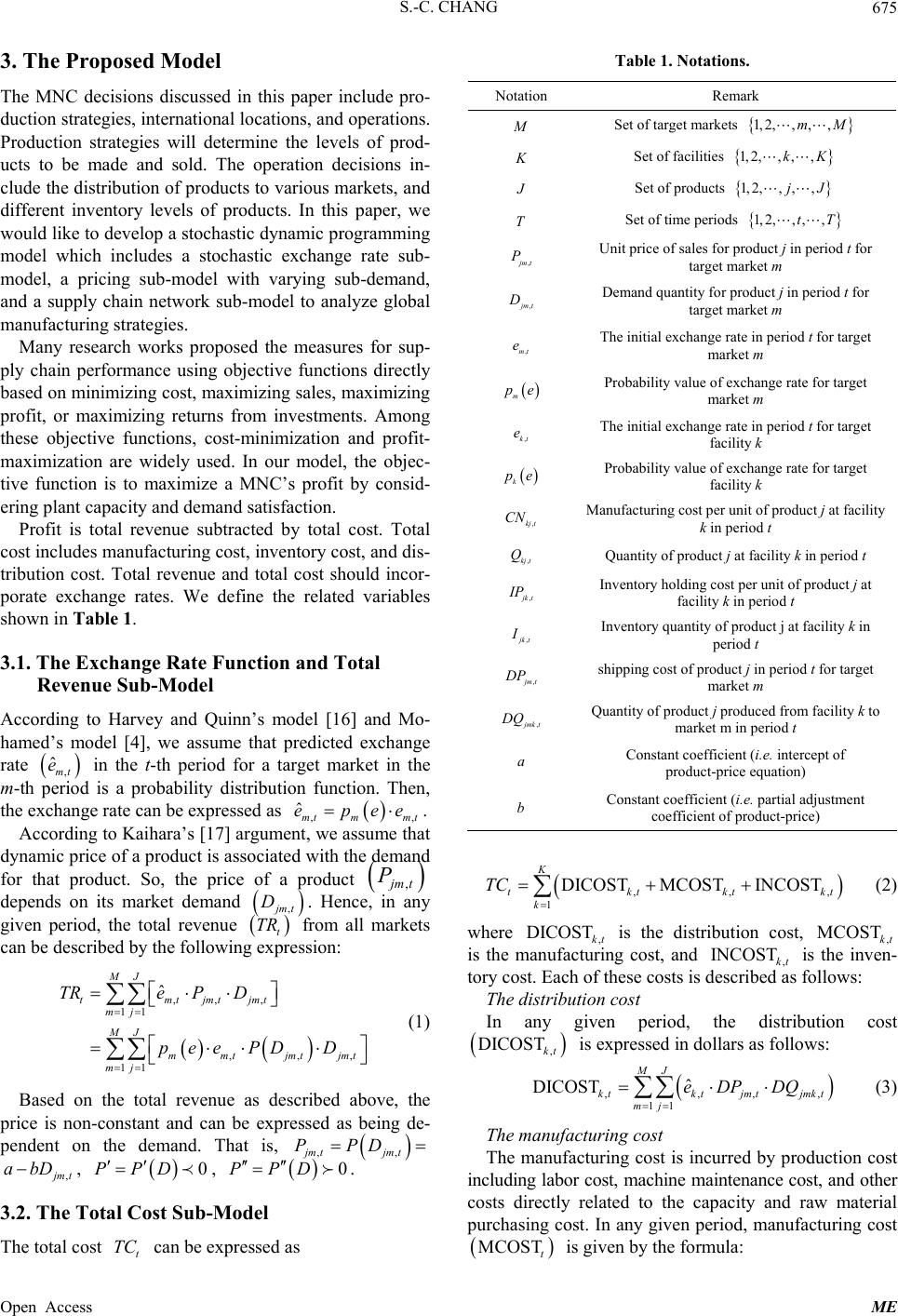

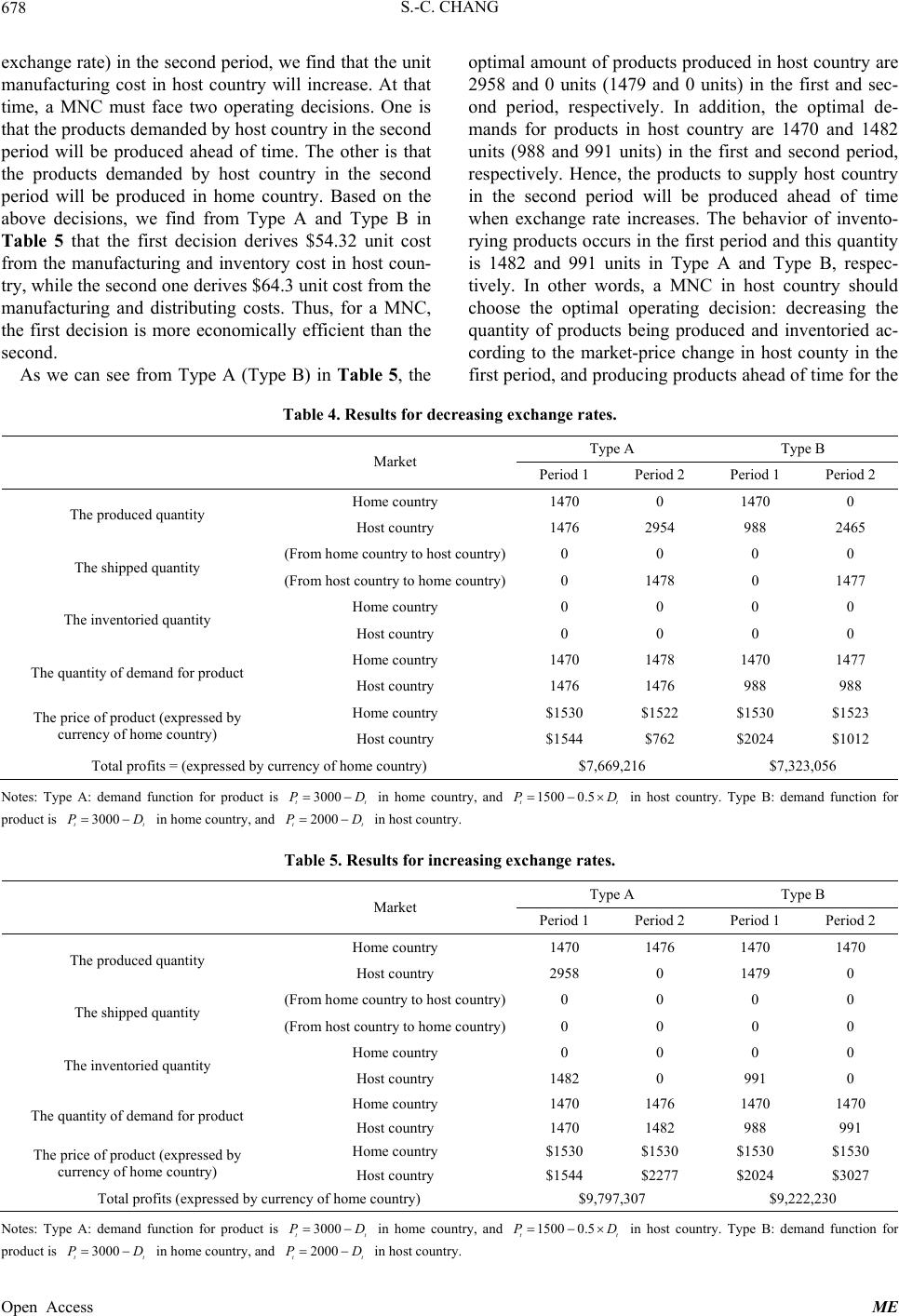

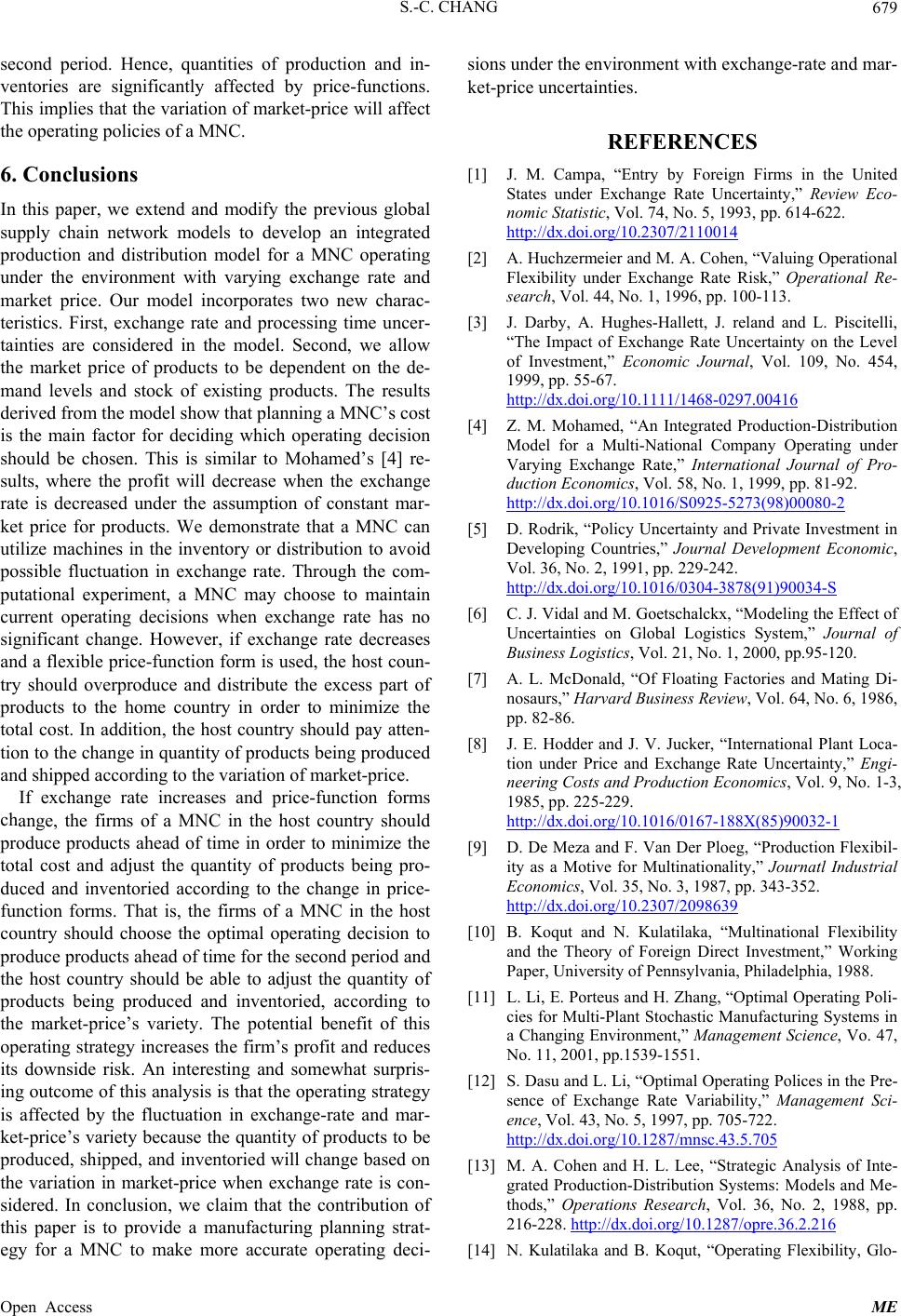

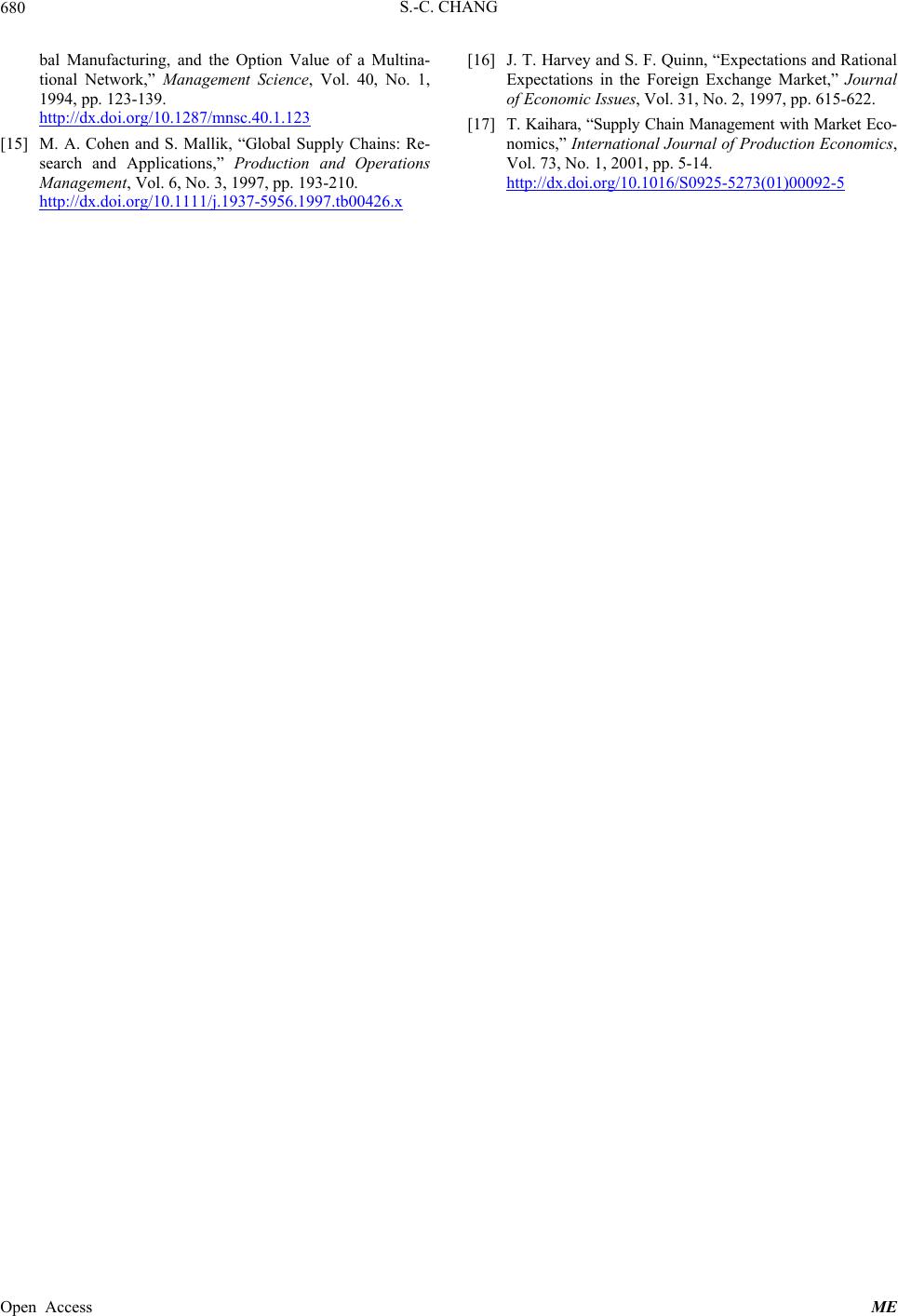

|