Applied Mathematics, 2013, 4, 1347-1360 http://dx.doi.org/10.4236/am.2013.49182 Published Online September 2013 (http://www.scirp.org/journal/am) A Closed-Form Approximation for Pricing Temperature-Based Weather Derivatives A. E. Clements, A. S. Hurn, K. A. Lindsay School of Economics and Finance, Queensland University of Technology, Brisbane, Australia Email: a.clements@qut.edu.au, s.hurn@qut.edu.au, kenneth.lindsay@qut.edu.au Received May 22, 2013; revised June 22, 2013; accepted June 30, 2013 Copyright © 2013 A. E. Clements et al. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. ABSTRACT This paper develops analytical distributions of temperature indices on which temperature derivatives are written. If the deviations of daily temperatures from their expected values are modelled as an Ornstein-Uhlenbeck process with time- varying variance, then the distributions of the temperature index on which the derivative is written is the sum of trun- cated, correlated Gaussian deviates. The key result of this paper is to provide an analytical approximation to the distri- bution of this sum, thus allowing the accurate computation of payoffs without the need for any simulation. A data set comprising average daily temperature spanning over a hundred years for four Australian cities is used to demonstrate the efficacy of this approach for estimating the payoffs to temperature derivatives. It is demonstrated that expected pay- offs computed directly from historical records are a particularly poor approach to the problem when there are trends in underlying average daily temperature. It is shown that the proposed analytical approach is superior to historical pricing. Keywords: Weather Derivatives; Temperature Models; Cooling-Degree Days; Distributions for Correlated Variables 1. Introduction A weather derivative takes its value from an underlying measure of weather, such as temperature, rainfall or snowfall over a particular period of time, and permits the financial risk associated with climatic conditions to be managed. Major participants in this market include utili- ties and insurance companies along with other firms with costs or revenues that are dependent upon the weather. For example, an electricity supplier normally provides its customers with electricity at a fixed price irrespective of the wholesale price. On the other hand the wholesale price of electricity can fluctuate wildly with extreme temperatures, and so temperature-based derivatives can provide a hedging tool for fluctuations in wholesale elec- tricity prices. The first weather derivative was transacted in the US in 1996 and the size of the market now exceeds US$ 8 billion. Almost all weather derivatives are based on temperature indices such as heating degree days and cooling degree days and consequently the focus of this paper will be exclusively on developing closed-form ap- proximations to the distribution of the temperature indi- ces on which temperature-based derivatives are written which in turn affects their valuation1. Traditionally, the valuation of options discounts the expected payoff at the risk-free force of interest based on a zero-arbitrage argument involving the formation of a portfolio consisting of a risk-free combination of an op- tion and the underlying asset [3]. Because temperature cannot be traded, there is no arbitrage-free pricing framework available to price this kind of option. The generally accepted way to value temperature derivatives is the actuarial method in which the fair price is taken to be the expected value of the payoff ignoring discounting and any volatility premium. The crucial element of this valuation strategy is the accurate calculation of the dis- tribution of the relevant temperature index on which the weather derivative is written. The most direct way to compute the distribution of temperature indices is from historical records [4,5]. A more elaborate method is to fit a model to the time-series 1The first recorded activity was an over-the-counter heating degree day swap option between Entergy-Koch and Enron for the winter of 1997 in Milwaukee, Wisconsin [1]. Garmen et al. [2] posit that 98% - 99% o all weather derivatives currently traded are based on temperature. Cur- rently temperature- ased derivatives are traded in several US, European and Japanese cities. C opyright © 2013 SciRes. AM  A. E. CLEMENTS ET AL. 1348 of average daily temperature so as to capture seasonal variations in both temperature and its volatility [5,6]. The model is then used to simulate temperature outcomes over the period of the contract in order to construct the distribution of the temperature-based index on which the derivative is written. Note that widely-available mete- orological forecasts are not suitable for this purpose be- cause these forecasts are made over relatively short ho- rizons, such as 7 days, whereas temperature derivatives are often traded well before the contracts generate any payoffs [6-8]. This paper makes two contributions to the existing lit- erature on pricing temperature derivatives. First, it builds on the early work of Benth and Šaltynė-Benth [9] by developing closed-form approximations to the distribu- tion of the indices on which temperature-based deriva- tives are written with particular emphasis on obtaining good estimates of the variance of relevant index. Second, two methods are provided for estimating the parameters of the model underpinning the behaviour of temperature that are required to implement the pricing strategy. There are respectively a two-step least-squares based approach and a more comprehensive maximum-likelihood proce- dure. The ideas developed in this paper are applied to data comprising average daily temperatures for over a century in four Australian cities, namely, Brisbane (BNE), Mel- bourne (MEL), Perth (PER) and Sydney (SYD), where accurate temperature records of long-duration are avail- able at single weather stations. This is a quality data set which represents a substantial improvement on what ap- pears to be the current standard used in the literature. The empirical results based on this data set, demonstrate that the closed-form pricing strategy performs substantially better that using historical pricing. 2. A Model of Daily Temperature The first step in pricing any temperature-based option must be a model of the underlying index from which the option derives its value, which in the case of temperature derivatives is average daily temperature. Let average daily temperature be expressed as the sum of the seasonal mean temperature () Tt at time t and the deviation of the average daily temperature from its seasonal mean. Suppose that is modelled by the Ornstein- Uhlenbeck process2 () t θ () t θ () ddd, ttW θαθ σα =− +>0, ,Ws , (1.1) where dW is the increment in the Wiener process. The parameter and the volatility are to be deter- mined from observations of average daily temperature. Equation (1.1) has solution α () t σ () () () () ed tts ts α θσ −− −∞ = (1.2) with autocorrelation function at lag u given by () ()() () () () 22 e, ed u tts Ettu St Sts s α α θθ σ − −− −∞ += = (1.3) where is the variance of daily average tempera- ture. It is straightforward to show that and satisfy () St () 2t σ () St () () () 2d2. d St tS t σα =+ t The joint distribution of the average daily temperatures Tt and ts at the respective calender times t and is given by the product T+ ) () ts+ ( 0s> ()() () ,,, ttsttst , TTfTt fTtsTt ++ =+ (1.4) where ( , t ) Tt is the marginal distribution of Tt, namely () () 2 1 ,exp 2 2π tt tt t TT fTt S S − =− and () () () () () 2 2 2 1 ,, 2πe e exp 2e ts ts ts t s ts tst t s ts t fTt sTtSS TT TT SS α α α +− + − ++ − + += − −−− ×− − is the transitional probability density function from t to t. Consequently the joint probability density func- tion, , in Equation (1.4) becomes T s T+ ( , tts fTT + ) () 2 e 2πtts t SS S φ β − +− where () ()()() () 22 2 2 2 ts ttt tttstst tsts tts t STTSTTTTST T SS S β φβ +++ + −−−− +− =− ++ and e α β − = ( , tts TT + . Thus the joint probability density function of is multivariate Gaussian with mean value ) ( , ) tts+ μTT= and covariance matrix e. e s tt stts SS SS α α − − + Σ= This model of average daily temperature is now used to develop a closed-form approximation to the distribu- tions of the underlying temperature indices on which 2This specification is consistent with previous work [9-11]. Copyright © 2013 SciRes. AM  A. E. CLEMENTS ET AL. Copyright © 2013 SciRes. AM 1349 ) TT ) x vanilla European options3 are written, namely cumulative heating degree days (HDDs) and cumulative cooling de- gree days (CDDs). Let D be the strike of a call option defined as a particular value of the CDD index. The buyer of this option pays an up-front premium and receives a payout if the value of the CDD index exceeds D at the maturity of the option. The tick value of a cumulative CDD call option with strike D and duration N days is therefore 3. Distribution of Temperature Indices Let ave denote the average temperatures in degrees Cel- sius measured on a particular day at a specific weather station. The HDD and CDD indices at that station on that day are defined respectively by T ( max,0 . NN CD=− (1.7) The per-unit monetary payoff from the contract is its expected tick value () () ave ave max,0, max,0 , HDDT T CDDTT =− =− (1.5) [] ()() d, NN D ExDfx ∞ =− (1.8) where () N x is the probability density function of CN and therefore the efficacy of this pricing strategy relies upon the accurate estimation of () N x. The idea pur- sued here is that although the daily contributions to CN are truncated correlated random variables in which the degree of truncation is nontrivial, nevertheless CN will behave as a Gaussian random variable provided N is suitably large. The central theoretical result of the paper is summarized in Proposition 1. where T˚C is a threshold temperature. The choice of threshold, in this instance 18˚C, is set by market conven- tion and is the standard used in the US. In the southern (northern) hemisphere the HDD (CDD) season would be from May to September, while the CDD (HDD) season would be from November to March. Without loss of generality, the analysis of this paper will be limited to considering European call options written on cumulative CDDs. Proposition 1 The CDD index over a period of N consecutive days is defined by The tick value CN of a European option defined on cumulative cooling degree days is approximately Gaus- sian distributed with mean value ( 1 , max,0 N Nkkk k C = ==− (1.6) [] () () 1 , N Nkkkk k CSzzz φ = =Φ+ where k is the average daily temperature on the day of the derivative. Tth kand variance Var C with expression () ()() () () () () ()( ) () () () [] [] () () () () () () () () 1 1 ,, 11 2 ,,, 2 , , 2 1 exp 21 11 N kk kkkkkk k NN j kkjjkjkjkkj kjk kjj kjk kkkjjk kkjk kj jkjkkk k jk Sz zzzzzz SS zzzz zzSSSzS SSz zz SSSpz pz q qq φφ φχφη ββφφη βη = − ==+ Φ−+Φ ×−−Φ− +Φ+Φ− ++Φ+− + + + −Φ−×Φ + ++ 2, k z − where () kk k () ,ezTTS=− , k jk α β −− = and the constants , k , , k , p and q are defined respectively by () () () () ,, ,, ,2 ,, 222 ,, ,,, ,, ,1 jjjk kkkjjkjkjkjkjk jk k jk jk jk jk j jkkj jkkj jkk zS zSzS zSS pqp SSSS SS ββ φηη β ηχ ηφη βββ −− ===− =− Φ− −−− , . η Φ− (1.9) Proposition 1 establishes that accurate closed-form expressions for the mean and the variance of CN are available in terms of the density function and distribution function of the standard normal distribution alone. Given these results, the per-unit monetary payoff of a CDD call option is stated in Proposition 2. Proposition 2 The per-unit monetary payoff of a European call op- tion with strike D written on CN, where the distribution of CN is Gaussian with mean and variance established in Proposition 1, is given by 3The choice of European option is not limiting in the sense that many more complex derivative strategies are in fact combinations of simple European options.  A. E. CLEMENTS ET AL. 1350 [] () () [] Var, . Var N N N CD CC φξξ ξξ − +Φ = The focus of subsequent subsections is to develop and prove the results stated in Proposition 1. 3.1. Mean of CN It follows directly from Equation (1.6) that 1 N C=++ where () () 2 1 []exp d 2 2π k kTk k T TS S θ θ ∞ − =−− . θ (1.10) Let () kk zTTS=− k , then the change of variable kk TS θ =− z gives immediately [] () () () 22 ed 2π , k z kz kk kk kk Szz z Sz zz φ − −∞ =− =Φ+ (1.11) where and are respectively the probability density function and cumulative distribution function of the standard normal. The quoted expression for () z φ () zΦ C immediately from result (1.11). Moreover, it should b follow e noted in passing that the proof of Proposition 2 is analogous to the derivation of Equation (1.11). ppendic s 3.2. Variance of CN The computation of the variance of CN is less straight- forward. The key steps in this calculation are outlined here with the detail being relegated to Aes 1 and 2. The analysis begins by noting that Var C can be expressed as the sum of variances in the usual form j (1.12) Straightforward calculation indicates that and covariances [] [] 1 VarVar2Cov ,. NNN Nk k C− =+ 11 1 kk jk == =+ [] () () () () 2 2 2 Varexp d 2 2π , k kTk k kk kk which u T T S S Sz zz θ θθ φ ∞ − − =− −Φ+ (1.13) nder the change of variable kk TS θ =− z be- comes [] () () () () 2 2 Var d . k z kk k Szzzz Sz zz φ φ −∞ =− kk k k −Φ+ (1.14) It is demonstrated in Appendix 1 that (1.15) thereby completing the computation of the first item on the right hand side of Equation (1.12 The second item on the right hand side of Equation (1.12) is a sum of covariances of generi () () ( Var[ ] kk kk Sz z φ =Φ −+ () ) () () () kkkk k zz zzz φ Φ ×−−Φ− ). c form ()()( ) Cov,,d d ttsttsts tttstts TTTTTfTT TT ++++ + (1.16) in which t and s (> 0) are to be given appropriate values. First, the integral on the right hand sid simplified using the change of variables =− −− e of Equation (1.16) is tt t TT Sz=− and ts tsts+++ [] TT Sw=− to get ()()( ) [] [] Cov,d d zz tts tt SSzzz w + = −− , , tt s tstststtts zwfzz + ++ ++ −∞ −∞ × − (1.17) where () tt zTT S=− t and () ts tsts zTTS ++ =− + and () ts ,t zz +probab w, namely is the joint ility density of z and () , 2 1e, 2π w S ψ − ts ts t SS β + +− (1.18) where e α β − = () () 22 2 2 ,. 2 tst tsts ts t SzzwSSSw zw SS β ψβ ++ + −+ =− and + The integral in Equation (1.17) is expressed as a re- peated integral in which integration is first performed w ith respect to w and then again with respect to z. The detailed calculations can be found in Appendix 2, but the outcome of these operations is that ()( )()() () () () () ()() 2 2 Cov d, tt tsttstststt tst zttsts tttst tts ts t SSz zzzSS zSzS zz SSSz SS φχφ β βφβφφη β ++++ ++ ++ −∞ + Φ+Φ + − ×Φ+− − (1.19) ,ts++ =ts tts tts zz S η + + + −+ Copyright © 2013 SciRes. AM  A. E. CLEMENTS ET AL. 1351 where ts + and ts + are defined respectively by 2 2 , . ts tst t ts ts t tts tst ts ts t zS zS SS zSz S β ++ − ( SS β η β χ β ++ + + + + − = − = − 1.20) In particular each component of Cov , e eva and cumu andard norma he usefulness tts+ , with luated from the the exception of the integral, may b probability density function lative dis- tribution function l with appropriately of ex- pr () z φ of the st guments. T () zΦ chosen ar ession (1.19) for Cov , tts+ can be i if the value of the integral appearing in this formula can be expressed, albeit approximate terms of () φ and () Φ with appropr chosen arguments. For positive values of the parameter q, this objective can be achieved by mproximation mproved ly, in iately aking the ap () ()() () 22 1e , tt ts t pz zqzz ts η + −− +− + ≈−Φ− (1.21) 2 ts tst zS zS SS β β ++ − Φ − noting, in particular, that the approximation agrees with the interpolated function at and as dependently of the values ofeters quality of the approximationoved by the values of p and q to ensurefirst and de- t zz= the param is impr that the z=. z→−∞ in- p and q. The choosing second ome of rivatives of the interpolating function match those of the interpolated function when t z The outcthis matching procedure is that () () () () 2 2 , tst ts ts t ts S pSS φη β η β η + + + + =− Φ− − (1.22) 1. ts ts qp η φη + + Φ− =− In particular, it is easy to show that The use of the interpolating formula (1.2 the integral in expression (1.19) leads to the conclusion that 0, as required. 1) to evaluate q> () () () () 2 2 d 11 exp . ztts t t tt zz pz pz zz ξφ + −∞ Φ + + ≈Φ −Φ− ()( )()() () [] [] () () () ()( ) () () 2 2 2 Cov , 11 1 exp tts t tsttstststts tts ttstt tts ttst tts tts ttstt tt SSz zzz zz SSSz SSSz zz SSSpz qq pz z φχφη β βφφη β + ++++ + ++ + ++ ++ =Φ+Φ −++Φ −− + + −Φ ++ + ×− (1.24) aced by k and replaced by j) when substituted into expression (1.12) provide a closed-form approximation for the vari- ance of the cumulative temperature index which is then treated as a Gaussian random variable with the computed variance and mean value given by expression (1.11). 4. Approximating the Variance A closed-form expression for the variance of the cumula- tive temperature index was derived in the previous sub- section. Curiously a heuristic argument based on inter- polation can be used to generate a simpler expression for this variance, one that exhibits good accuracy despite the em by 21q + Expressions (1.15) and (1.24) (with t repl ts+ pirical nature of the derivation. The argument begins noting that the k-th day in the lifetime of a CDD op- tion will contribute to the cumulative temperature index driving the value of the option with probability () , , k kkk k TT pzz S − =Φ= (1.25) where () zΦ is the cumulative distribu the standard normal and T is the tem tion function of perature above irst sum- mation on the right hand side of Equation proximate values which CDDs are accumulated. If the k-th day always contributes to the cumulative temperature index then the variance of that contribution would be Sk. On the other hand if the k-th day never contributes to the cumulative temperature index then the variance of that contribution would be zero. Since in reality the k-th day contributes fraction pk of the time then linear interpolation suggests that the variance of this contribution may be reasonably approximated by Skpk. Based on this idea, the f (1.12) has ap- 21 11 q qq + ++ (1.23) Expression (1.23) is now incorporated into expression (1.19) to give the final approximate form [] 11 Var . kk k kk pS == ≈ (1.26) The second summation on the right hand side of Equa- tion (1.12) is a correction to expression (1.26) to take account of the fact that contributions to the value of the temperature index from different days are not independ- mm Copyright © 2013 SciRes. AM  A. E. CLEMENTS ET AL. 1352 ent. The contribution made by the quantity Cov , tts+ to the variance of the temperature index is argued in a similar way. In the absence of clipping, the variance of this product is equal to Cov , kj θθ with value () e k k S α −− assuming that jk>. However, the product kj is nonzero with probability kj pp and therefore the same linear interpolation argument suggests that Cov, kj () is reasonably approximated by e k−− . Based on kj k S α e righ pp mmation on ththis idea, the seco Equation (1.12) has approximate value nd sut hand side of () 11 111 1 2Cov,2 e. NNN N k kjkk j kjkk jk pSp α −− −− formula == +==+ ≈ (1.27) In conclusion, linear interpolation suggests that the variance of is well approximated by the [] () 1 111 Var2e . NNN k Nkk kkj kkk CpSpSp α −−− ===+ =+ (1.28) In fact Equatio.28) is the first-order approxion to the closed-from expressif the variance in Proposi- tion 1. Consequently, it is expected that this approx tion will perform particularly e level of truncation is low and also when the persistence in tem- perature is low which means that deviatio j n (1imat on o ima- well when th ns in tempera- ture, , are restored to their mean value relativ quic To test the accuracy of the approximate closed-form ex () t θ kly. ely pression for Var C stated in Proposition 1, tranches of one milliorealizations of Equation (1.1), each of dnu- ration 90 daysonstructed for fixed values of and . Specificrealization obt d by dfrom the m , were c ally, each rawing 0 θ α f σ aine () 0 ,, θθ arginal density o 90 was θ expressed in the form () 2 0,NS, and subsequent values of θ were determined exactly using the iteration () 2 1 ee2sinh, 1,,, kk k SkN αα θθ αξ −− − =+ = (1.29) where () 0,1 kN ξ . Realizations of () t θ generated in this way had mean value zero and stationary standard deviat which was set at 4C˚ for all simulation ex- periments. A t i old value of en, say, an liza ( and a gi he generated one million inndently and identical tributed realizations of CTable 1 shows th n experime ” and “Std Dev” give the andard de illion simulations. Estimates of this standard devia- tion based on Proposition 1 (Exact) and ment of Section 1.4 (Approx) are shown. on S hresh rea θ was chos Θ d a cumulative CDD for the 90 day period was con- structed from a tion () 090 ,, θθ using the for- mula () 90 1 max,0 . k k C θ = =−Θ 1.30) For a given value of α ven value of Θ, each tranc of one million realization of Equation (1.1) depe DDs. ly dis- e result of sevents for the case α and thresh- olds () 3,2,,0, ,2,3SSSSSSΘ∈ −−−. Table 2 shows the equivalent result when 0.5 α = and the thresholds are unchanged. Table 1. For α = 0.2 the column headed “Θ” gives threshold temperature relative to zero for contributions to cumulative CDD. Columns headed “Mean mean cumulative CDD and its stviation based on one m 0.2= the heuristic argu- Θ Mean Std Dev Exact Approx −12 1080.1 116.63 116.67 116.69 −8 722.98 114.25 114.23 114.32 −4 99.545 99.272 0 143.57 63.269 61.422 4 389.92 99.608 63.325 29.975 24.680 24.465 23.148 8 3.0560 5.7022 5.3141 6.2514 12 0.1379 0.8556 0.5688 1.4022 Table 2. For α = 0.5 the column headed “Θ” gives threshold temperature relative to zero for contributions to cumulative CDD. Columns headed “Mean” and “Std Dev” give the meanmulati andarationn one on sims. Es ofandaia- tion based on Pgu- ment of Sectionpprohow cuve CDDd its stand devi based o milli ulation roposition 1 (Exact) and the heuristic a stimate this strd dev r 1.4 (Ax) are sn. Θ Mean Std Dev Exact Approx − 121080.1 75.730 75.751 75.766 −8 723.01 74.189 74.181 74.346 −4 389.95 64.740 64.703 65.310 0 143.60 41.281 41.246 42.409 4 29.982 16.243 16.154 18.359 8 3.0537 3.8667 3.7333 5.9155 12 0.1379 0.6207 0.5527 1.3970 It is clear from these results that the variance of cumu- lative CDDs predicted by the closed-form approximation of Prositionhi praMin- ences between the n Proposition 1 and achiy sin bidly whene threempliesandaia- tions or more above the mean temperature largely due to the fact that thesestances realizations of CDDs will be valwev is not a scenario te pr The most inobon is 1 es in thecurahe c esof varia. In th ofnter is he reshd tempe lies on below teragily m ap op 1 is ac approxim eved in ate varia ctice. ce in or differ thateved bmulatioecome event on thshold terature two strd dev under circum dominated by zeroues. Hoer this hat will b teresting occur in servati actice. n Table and 2 li unexpected accy of theuristitimate nce ol e region eratur most i or est, that he av when t e dath teperature taken to be zero in this analysis, the heuristic proach delivers parsimonious estimates of variance Copyright © 2013 SciRes. AM  A. E. CLEMENTS ET AL. 1353 that, although marginally inferior to the estimates of true variance provided by Proposition 1, are negligibly dif- ferent from it for all practical purposes. 5. Parameter Estimation To use this model for predicting the payoffs from tem- perature-based derivatives an estimate of the parameter α in Equation (1.1) is required. This parameter meas- ures the rate at which deviations of temperature from the seasonal are restored to this mean. In order to do so, it is first necessary to obtain estimates of () Tt and () t σ . Following Campbell and Diebold [6], () Tt and () t σ are approximated by the Fourier series () () () () () ( 00 1 2 0 cossin , cos sin n kkkk k n kkk Tsabsas bs sc csd ωω σω = =+ ++ =+ + (1.31) ) 1 , k k s ω = where 2π365 kk ω = and 0s= is assumed to be the calender date of the first observation of average daily temperature. The contribution 0 bs in the expression for () Ts is present to take account of any annual trend in daily average temperature. Otherwise expressions (1.31) assume that seasonal variations in daily average tem- perature follow an annual cycle which is independent of calendar year. Consequently, the expr corresponding to the expression (1.31) fo () 2 ession for r () St σ is () ()() 0 1 cossin , n kkkk k Ssppsqs ωω = =+ + (1.32) where the Fourier coefficients related to the Fourier coefficienn by the formulae Suppose that the data consists of observations average temperatures 01 1 ,, ,,, , nn cc cd ts 01 1 ,,,,, n pp pq d are ,q 00 2, 2, 2, kkkk kkk cpq cp dpq αω αωα =+ = =− + (1.33) where k takes all integer values from 1k= to kn= inclusive. Two strategies to estimate the value of α and the coefficients in the Fourier series (1.31) are now de- scribed. 5.1. Two-Step Estimator k of daily 12 ,,, TT T at times 12 ,, , tt t. The Fourier coefficients of ( Tin a straightforward way by minimizing t tion ) s can be estim he ob ated jective func- () () . j Tt () 2 001 1 1 ,,,,,,, N nn j j abaabbT = Ψ=− the tions n beputed Once these coefficients are known, thendevia from the seasonal means ca com directly from the formula 12 ,,, n θθθ () jj TTt θ =− . The prblem is now to find the values of α and the coefficients 01 ,, ,cc o which fit the residuals ybby and Sorensen [12], 1 ,, , nn cd d ,,, θθθ . best Bi 12 n Using a result established b an unbiased estimate ˆ α of α is given by the expres- sion 11 2222 1 nn nn j kkk θ θθθ σσσ σ −− 11 1 1 2 2 111 1 . 1 kj j kjk j nnn kkj j θθ σσ σ == = − === − 1 11 2 11 22 11 k kk kk = −− −− −− log − − − (1.34) no Th f pute the Fourier coefficients The difficulty, however, in using this expression is that 2 k σ is unknown whereas what wn is the seasonal variance of the residuals. or finding the values of α and the coefficients 01 1 ,,,,,, nn cc cdd ng. om is k e strategy is therefore the followi Step 1: C an 01 n d 1,, n qq of () St directly from the deviations 12 ,,, ,,pp p θθθ . Step 2: C compute the from expr rier co hoose an arbitrary vlue for Fourier coeffi ession (1.33) with efficients of a cients αα = α 01 ,,cc Knowing , say α , and 0 1 ,,,d the Fo nn c d . u- 0 () 2 σ ation (1 pdate the esti by reco 22 en .3 ma m ab 1) te of puting i les ,, σσ . Exprn 0 α n t , n cc c, 22 to . This procedure 01 ,, 0 essio urn nbe (1.34) is computed f now used to may then be d unt rom Equ u iterated 1,n d and 0,, n σσ . This procedure is repeated il consecutive estimates of α are not deemed to be significantly different. The estimate of and the Fourier coefficients ,ab, 11 ,,,,, nn aabb and 01 , ,,cc c be 00 either 1 , nn d d can th h m the re from its isfies the showo the formal solu- used as they stand or can be used as an initial guess for the parameters ofe maximum likelihood estimation procetlined in te next subsection. dure ou mean va tio 5.2. Maximum-Likelihood Estimation The feasibility of parameteration by maximum likelihood (ML) in this instance relies on the fact that the transitional probability density function of average daily temperature can be computed under assumption that the deviations of average daily temperatu lue satstochastic differential Equation (1.1). Ito’s lemma applied to t stochastic differential Equation (1.1) may be esti he n to lead t n () () () () eed, . j j tt ts t sj t tsWtt αα θθ σ −− −− =+ > (1.35) with () j t θθ =. The important observation from this solution is that () t θ is a Gaussian random variable with mean value () () e tt j θθ = Et α −− and variance Copyright © 2013 SciRes. AM  A. E. CLEMENTS ET AL. 1354 () () () 22 ,e d tts ttss α χσ −− = () () () 2 e, j j jt tt j St St α −− =− (1.36) where the latter expression for () , tt χ t is derived di- rectly from the definition of () St given in Equation (1.3). Because () () TTt t θ =+ , then the average daily temperature T is itself Gaussian distributed with mean value () () () ej tt jj TtT T α −− +− and variance ( ,e ) () () () 2j tt j t StSt α −− =−t χ in which () () () 00 1k= Thus the averageaily temperature () Tt has transi- tional probability cossin . n kkkk Tta btatbt ωω =+ ++ d density function (1.37) () () () , e ,, 2π, Tt jj j fTtTt tt ψ χ − =, (1.38) where () () () () () () 2 e ,. 2, j tt j j TTt T Tt tt α ψχ −− −− The the sequence j T− = likelihood of observing12 ,,, TT T es of average daily temperatures at calendar tim 12 ,, , tt t is therefore () () 11 1 ,, . jj jj j fT t Tt ++ = =∏ 011 011 1 ;,,,,, ;,,,,,, nnn n N aaab bcccdd α − (1.39) In practice, the parameters are estimated by minimiz- ing the negative log-likelihood function () () () () ( () ) 1 1 1 12 1 1 2 111 2 11 11 loglog 2πlog e 22 e 1, 2e jj jj jj Ntt j j tt Njj jj tt jjj NS TT TT SS α α α + + + −−− + = −− −++ −− =+ − −= +− −−− + − S (1.40) where the notation () j SSt= has been used. The op- timal values for the param of this model are taken to be those which mession (1.39). Although model (1.1) is s of the intrinsic function , from a purelyoint of view it is e treat the Fourier coefficients as the parameters The task is now to provide a means of gauging the effi- cacy of the analytical expressions for the mean and vari- ance of CN given derived previously in terms of the the expected payoffs to options contracts. Payoffs based on the analytical results of the paper are compared to h torical pricing as outlined in [4,5]. The metric for co parison is taken to be the mean “profit” of a 90-day call option contract. Profit is defined from the point of view of the buyer of the call option as the difference be of the contract and the maximum and minimum s for cumulative CDDs are re- ble 3. There are two observations of note Table 3. First, the distribution of cumulative eters inimize expr specified in term technical p of () t σ to be asier to () St determined by the ML procedure. 6. Empirical Illustration is- m- tween the actual tick value expected tick value or “price” of the option. Of course, this is not meant to represent a true price for the option, as this no- tional pricing strategy takes no account of discounting or overhead expenses. But of course, any pricing scheme will stand or fall by its ability to estimate the expected tick value accurately. 6.1. Data The data set comprises daily temperature records in degrees Celsius for Brisbane (1/1/ 1887-31/8/2007), Melbourne (1/1/1856-31/8/2007), Perth (1/1/1897-31/8/2007) and Sydney (1/1/1859-31/8/2007). These locations were chosen primarily because they had accurate temperature records of over 100 years duration measured at comparable weather stations4. Figure 1 shows the long-term expected values (upper panel) and standard deviations (lower panel) of daily temperatures for each day of the year. The figure shows that the behaviour of the mean and standard deviation is amenable to modelling by a low-order Fourier series ap- proximation. In this exercise the order of the series is taken to be 3. The Fourier approximation is applied only over the period over which the option is to be written, namely, 1 January to 31 March, inclusive. Descriptive statistic ported in Ta arising from CDDs for Melbourne is skewed to the right as evidenced by a mean which is significantly larger than the median. Second, Perth is notable for the diffuse nature of the dis- tribution of cumulative CDDs, recording a standard de- viation significantly larger than those of the other cities. The distributions of cumulative CDDs for each city is illustrated in Figure 2 which plots both the distribution of historical cumulative CDDs (shaded region) and the predicted distributions for 1950 (dashed line) and 2007 (solid line) generated by closed-form approximations to the distributions of CDDs derived in the paper. To the uniformed eye, the distribution of historical cumulative CDDs may appear well behaved and taken as reasonable evidence in favour of using historical records to price temperature-based derivatives. When compared to the 4All the raw data were supplied by Climate Information Services, Na- tional Climate Centre, Australian Bureau of Meteorology. The con- struction of the temperature record for each city is discussed in Appen- dix 3. Copyright © 2013 SciRes. AM  A. E. CLEMENTS ET AL. 1355 Figure 1. The expected value of the average daily tempera- tures (upper panel) and the expected value of the volatility of average daily temperatures (lower panel) are shown for Brisbane, Melbourne, Perth and Sydney. Table 3. Mean, median, standard deviation, minimum and maximum cumulative CDDs in four Australian cities. Summary Statistics N Mean (SD) Med. Min. Max. BNE 121 584.2 (54.5) 584.6 463.3 705.9 MEL 152 207.9 (64.1) 195.6 93.5 391.4 PER 111 489.6 (83.3) 492.2 298.3 688.3 SYD 149 350.0 (60.1) 350.2 225.5 533.3 distributions for 1950 and 2007 generated by the ana- lytical approach, however, the potential for error inheren with different strike prices, written on the period 1 January to t in the historical approach becomes evident. Not only does the mean of the predicted distribution change no- ticeably over time, but the distribution also has lower volatility. 6.2. Payoffs The profits generated by two call-option contracts Figure 2. Density of historical cumulative CDDs based on data up to and including 1949 (shaded area), predicted den- sity of cumulative CDD for 1950 (dashed line) and predicted density of cumulative CDD for 2007 (solid line). Copyright © 2013 SciRes. AM  A. E. CLEMENTS ET AL. 1356 31 March are now reported in Tables 4 and 5 respec- tively. The call options used in the experiment have re- spective strike prices set to be approximately D =+ 0.5 σ and 0.75D σ =+ where e tion of CDDs up to the current year under consideration. The experiments begin by pricing these options for the year 1950 using data up to and including 1949. The ac- tual payoff for 1950 is recorded, the profit or loss stored Table 4. Means and standard deviations of profits to a 90- day call option defined on CDDs with strike price D ap proximately equal to μ + 0.5σ, where μ and σ are the un conditional mean and standard deviation of available his- torical CDDs. The option is priced for each year from 1950 to 2007 inclusive. BNE MEL PER SYD is the uncondi- devia-tional man and σ is the unconditional standard andt updato include the latest observation on cumese st reed up to and incl givitotal8 see proor ehe means and standard deations he prorded easu thorma of each ethodsd to ine expected valu The historical pricing reported in Tables 4 and 5 is using data for the entire year and the best estimates of thee us cong the cl-from apprations of thestributio of ce CDDs. Bntrastquar versfo- cthe period f 1 Janary to t 31 Mah in eacits thn asoniancv- erage perature for this-day od alonIn other words, the fitting procedure is impnted on the period over which the contract is written. The main reason for adopting this approach is that the behaviour of temparts e yeaelatedthe pe of the not ballowo inflpater estimhe mean and variance processes. Another benefit of this approach is thabetter resolution of the measseshe num of par Theking c be d from icing of call options priced on of- m - - Strike D 600 240 530 380 Historical Mean Payoff −8.1 −14.3 −23.8 7.8 SDev Payoff 33.1 45.8 43.2 48.9 Quarterly Model Mean Payoff 7.2 13.2 2.2 11.7 SDev Payoff 29.6 41.5 41.8 35.5 Annual Model Mean Payoff 5.8 15.4 18.3 4.0 SDev Payoff 29.1 41.4 40.0 34.6 Table 5. Means and standard deviations of profits to a 90- day call option defined on CDDs with strike price D ap- proximately equal to μ + 0.75σ, where μ and σ are the un- conditional mean and standard deviation of available his- torical CDDs. The option is priced for each year from 1950 to 2007 inclusive. BNE MEL PER SYD Strike D 620 260 550 400 Historical Mean Payoff −17.7 −24.7 −35.1 −4.2 SDev Payoff Model off 6.11.9 1.9. Annual 5.3 13.4 4. SDev Payoff 22.4 34.2 36.6 29.2 25.3 38.3 36.1 42.7 Quarterly Mean Pay2 3 8 SDev Payoff 22.7 34.2 34.2 30.1 Model Mean Payoff 5 13.6 the data seted ulative CDDs uding 2007 . Th ng a eps are of 5 peat paratfits f ach option. Tviof t fits are rega of the m as m use res of determ e perfnce tick es. self-explanatory, but the implementation of the closed- form approximations needs further elucidation. Two variations of this method are implemented, namely an annual version and a quarterly version. The annual ap- proach fits the mean and seasonal variance of average daily temperature e param ters ared inmputi osed umulativ oxim y co , the di terly n ion usses on romuherc h year and f daily tem e meand sea 90 al var peri e of a e. lemeonly perature in of thr unr to riod option are eing ed tuence rame ates for t t n and variance proce with tsameber ameters. first strionclusion torawn these results is just how bad historical pricing performs for the Australian temperature data. Interestingly enough, it ap- pears that historical pricing in three of the cities has sub- stantially over-priced the call options. This result is counter-intuitive as the conventional view is that there is an upward trend in temperature which would result in the under-pr the history cu ulative CDDs. The resolution of this conundrum is to be found in the behaviour of temperature between the years 1890 and 1920. During this period, Brisbane, Melbourne and Perth recorded substantial outliers in cumulative CDDs, the likes of which were not seen again until late in the sam- ple period. These outliers will have had a disproportion- ate affect on the pricing of temperature derivatives in the 1960s, 1970s and 1980s. Their existence also explains the deterioration of profits based on historical pricing when moving from lower to higher exercise prices. The weather station in Sydney where the temperature data were recorded did not show these extreme temperature events and consequently historical pricing for Sydney performs significantly better. Taken as a whole, the closed-approximations used to price the call options generate mean profits closer to zero Copyright © 2013 SciRes. AM  A. E. CLEMENTS ET AL. Copyright © 2013 SciRes. AM 1357 icing is again a manifestation of the outliers in ence in performance when moving from th and with lower standard deviations than historical pricing. Nevertheless, this method appears to underprice some- what, even though these pricing errors are smaller in magnitude than those generated by the historical method. This underpr cumulative CDDs but in this case, not enough weight is given to them. There is little difference in terms of performance of quarterly and annual models, with the exception of Perth where the quarterly model performs better. It is conjectured that this is due to the ability of the quarterly model to better resolve the extreme tem- perature variations that are prone to take place in Perth. Unlike the case documented for historical pricing, there seems little differ e lower to the higher exercise price for the the closed- form approach. 7. Conclusions This paper has derived closed-form expressions for ap- proximating the distribution of temperature indices. The major practical use for these approximations is in esti- mating the payoffs to temperature-based weather deriva- tives. Although the cumulative cooling degree day index is the focus of this research, the methods used are equally applicable to derivatives based on cumulative heating degree days. Common practice when modelling average daily temperature is to regard the deviations of tempera- ture from its expected value as an Ornstein-Uhlenbeck process. The key result derived in this paper, is that if this model of temperature is adopted, then the distribu- tion of cumulative cooling degree days may be con- structed as the sum of truncated, correlated Gaussian deviates. The mean and variance of the resultant Gaus- sian distribution depend on the parameters of the under- lying temperature process and its autocorrelation struc- ture. The efficacy of these approximate distributions is tested by estimating the payoffs to temperature-based derivatives. Time series data spanning over a hundred years of average daily temperatures in four major Austra- lian cities are used to estimate the payoffs to European call options written on cooling degree days. The robust conclusion to emerge from this line of research is that the closed-form distributions perform more reliably than the historical pricing method that is commonly advocated in the literature. REFERENCES [1] J. Tindall, “Weather Derivatives: Pricing and Risk Man- agement Applications,” Institute of Actuaries of Australia, Unpublished Manuscript, 2006. [2] M. Garman, C. Blanco and R. Erickson, “Weather De- rivatives: Instruments and Pricing Issues,” Environmental Finance, 2000. [3] F. Black and M. Scholes, “The Pricing of Options and Corporate Liabilities,” Journal of Political Economy, Vol. 81, 1973, pp. 637-659. doi:10.1086/260062 [4] L. Zeng, “Pricing Weather Derivatives,” Journal of Risk Finance, Vol. 81, No. 3, 2000, pp. 72-78. doi:10.1108/eb043449 [5] E. Platen and J. West, “Fair Pricing of Weather Deriva- tives,” Quantitative Finance Research Centre, University of Technology Sydney, Research Paper Series, 106, 2003. [6] S. D. Campbell and F. X. Diebold, “Weather Forecasting for Weather Derivatives,” Journal of the American Statis- tical Society, Vol. 100, 2005, pp. 6-16. [7] D. S. Wilks, “Statistical Methods in the Atmospheric Sciences,” Academic Press, New York, 1995. [8] S. Jewson and of Weather Fore- casts in the Pritives,” Meterologi- R. Caballero, “The Use cing of Weather Deriva cal Applications, Vol. 10, No. 4, 2003, pp. 377-389. doi:10.1017/S1350482703001099 [9] F. E. Benth and J. Šaltynė-Benth, “Stochastic Modelling of Temperature Variations with a View Toward Weather Derivatives,” Applied Mathematical Finance, Vol. 12, No. 1, 2005, pp. 53-85. doi:10.1080/1350486042000271638 [10] M. H. A. Davis, “Pricing Weather Derivatives by Mar- ginal Value,” Quantitative Finance, Vol. 1, 2001, pp. 1-4. doi:10.1080/713665730 [11] P. Alaton, B. Djehiche and D. Stillberger, “ and Pricing Weather De On Modelling rivatives,” Applied Mathematical Finance, Vol. 9, No. 1, 2002, pp. 1-20. doi:10.1080/13504860210132897 [12] B. M. Bibby and M. Sorensen, “Martingale Estimation Functions for Discretely Observed Diffusion Processes,” Bernoulli, Vol. 1, No. 1/2, 1995, pp. 17-39. doi:10.2307/3318679  A. E. CLEMENTS ET AL. 1358 Appendix 1 Proof of Result (1.15) It has been shown in Equation (1.13) that [] () 2 k z () The manipulation of this integral uses the fact that the Gaussian probability density function enjoys the property . Thus It is now straightforward algebra to verify the asser- tion in Equation (1.14), namely that () () 2 Var d . kk k kk kk Szzzz Sz zz φ φ −∞ =− −Φ+ () () zzz φφ ′ =− () () () () ()( ) () () () () () () () () 2 22 2 2 2 d 2d 2d 2d 1. k k k k k z kk z kk k z kk kkk z z kk kkkk kkkkk k Szzzz Szzzzzz SzzSzzz z SzzSzzzSz z SzzSz z φ φ φ φφ φ −∞ −∞ −∞ −∞ −∞ − =−+ ′ =Φ+ − =Φ+−+ =+Φ+ Var k has value where the calculation has noted that is an even- valued function of z and that . Appendix 2 Proof of Result (1.19) The calculation of () ()() () () () () , kk kkkkkk Sz zzzzzz φφ Φ− +Φ−−Φ− () z φ ( =Φ − () ) 1zz−Φ Cov , tts+ requires I, the value of the integral ()()( ) ,dd tts zz t tsttstst SSzzzwfzzz w + +++ −∞ −∞−− (1.41) in which () , ts t zz + is the probability density function 2 1e, 2π ts ts t S SS β − + +− with () 22 2 2 2 tst tsts ts t Szzw SSSw SS β ψβ ++ + −+ =− + and e α β − =. By re-expressing in the form () 22 2, 2 2 ts t ts ts t SS z wz S SS β β + + + −− − () ()() 2d t ts t ts t t z S Szzzgzz SS φ β +−∞ + =− − (1.42) where () z φ is the standard normal probabil nction and () ity density expression (1.41) is re-expressed as the repeated integral fu z is the integral () () 2 2 1 2π expd . 2 ts z ts t ts ts ts t zw S Swz Sw SS β β + + −∞ + + + −− − ⋅− − (1.43) Phase I The evaluation of this integral is achieved by changing the variable of integration from w to using the sub- stitution 2. ts t tstst SS wz SSS ξβ β + ++ =− − () z The outcome of this operation is that takes the simplified form () () () () () 2 d tsz ts tts ts SS gz z S ξ β + + + −∞ + − =− (1.44) where () 2. ts t tsts tsts t SS zzz SSS ξβ β + ++ ++ =− − It now follows immediately from the definition of , the cumulative function of the standard normal tion, and the basic properties of that () zΦ distribu () z φ () ()() () 2 tsttsts ts ts SS gz S βφξξ ξ + +++ + − =+ Φ (1.45) in which the dependence of ts + nven on z has been sup- pressed for representational coience. Consequently () () () () () 2 d. t z tts tt tsts ts SSSzzz z βφ φξξ ξ +−∞ +++ =− − ×+Φ (1.46) This completes the first phase in the computation of the value of I using repeated integration. Phase II The second phase of calculation continues by dividing the right hand side of Equation (1.46) into the two inte- grals Copyright © 2013 SciRes. AM  A. E. CLEMENTS ET AL. Copyright © 2013 SciRes. AM 1359 () () ()() () () () ()() () 2 2 d d. t t z ttstttsts ts z t tstts SSSzzz SSSz zz βφφξξξ βφφξξξ ++++ −∞ + + −∞ −+Φ −− +Φ The function is now replaced by its definition in te inteome rearrangement, I is expressed as tfour integrals, name ts ts+ + he first of thesgrals, and after s () ts z ξ + he sum of ly () () () () () () () )( () ()() 2 2 dd d. tt t zz tttsttsttst tsts z tsttsts ts IzSSSzzzzSSzz S zzz βφξφ ξφ βφϕξξξ +++++ −∞ −∞ + +++ −∞ =−+ Φ d t z tt tst z Szzz SS βξ φ + −∞ −+Φ−Φ − (1.47) The third and fntegrals on the right hand side of this equation are now manipulated using integration by parts. Manipulation of the third integral gives ourth i () () () () () () ()( ) () () 2d, t z tts ts Sz z SS φφξ β + −∞ +− (1.48) 2 dd tt z z zt t ts tsts t tts t S zzz zzz S z ξφφ ξφφξ β φηβ ++ + −∞ −∞ −∞ + Φ=−Φ− =− Φ− where ts S β +− 2. ts tst t ts t S η ++ + + = s zS zS β β − − (1.49) Manipulation of the fourth integral gives t S () () () () ) () ) () ( ( () () () ()() () () () 2 2 d d d. t tt t z tssts zz z φφξξ φ +++ −∞ =− t zz tsts tsts ts t z t ttstststs ts t zz z SS S zzz SS ξ ϕξξ ξβφξ β φφηηη βφξ β ++++ −∞ −∞ + +++ + −∞ + +Φ + Φ−Φ − + Φ−Φ − (1.50) 1.50) are notion (1.47 t S =− Results (1.48) and (w incorporated into Equa) to get () () ()( ) () () () () ()() 2 2 d. t z t ttsts ttstts ts t t tsttts S IzS zz SS zzS SSz φξ β φ βφφη +++++ −∞ + + + −∞ =+ − +− The final stage of this calculation is note that d ts z φ SS z φ η Φ (1.51) t z ttst tstts zz SSS βξ ++ + ++ Φ to () () () () () 2 2 2 2. tt s tst ts t zS z S SS β β ++ + dexpd 2π2 tt zz ts ts t tsts ts ts t tstts zSS zzz zz S SS SS z S φ φξ φβ β βφ ++ + + −∞ −∞+ + + + =×− − − ts+ − =Φ To summarize, the repeated integral (1.41) has final value − − ()( )()() )( () () () () ()() 2 d, ts zzS SSz η βφφη + Φ +− (1.52) t ttst tstt zz SSS βξ ++ + −∞ ++ Φ t tsttststst z st tsttts ISSzzz z φχφ φ ++++ + + =Φ+  A. E. CLEMENTS ET AL. 1360 where the constants st+ and ts + by and the function are defined ively () ts z ξ + respect () 2 ts t tts tst SS zS z S β β + ++ − − 86071) weather station. The location of the office 2 2 , , . ts tst t ts ts ts t tstst ts ts t zS zS SS zS zS zSS β η χ β β ξ β ++ + + + ++ + + − = = − − = − (1.53) The construction of the temperature data for the four Australian cities used in the empirical illustration is now outlined in detail. Brisbane: The temperature record contains 44043 ob- servations starting on the 1/1/1887 and ending on 31/8/ 2007. The time series is constructed from data collected ree weather stations: Brisbane Regional Office (Station Number 40214) 1/1/1887-31/3/1986; Brisbane Airport (Station Number 40223) 1/4/1986-14/2/2000); and again from Brisbane Airport (Station Number 40842) 15/2/2000-31/8/2007. Melbourne: The temperature record contains 55358 observations starting on 1/1/1856 and ending on 31/8/ 2007. The time series is a continuous set of observations made at the Melbourne Regional Office (Station Number changed in the early 1980s although the name of station did not. Perth: The temperature record contains 40393 obser- vations starting on 1/1/1897 and ending The time series is constructed from data collected at two weather stations: Perth Regional Office (Station Number Sydney: The temperature record contains 54263 ob- servations starting on 1/1/1859 and ending on 31/8/2007. The time series is a continuous set of observations made at the Sydney Observatory Hill ( weather station. Instances of single missing values were treated by av- eraging adjacent records. In a few rare cases where sev- eral days were missing, the long term average for those days was inserted. Finally, following Campbell and Diebold removed. Appendix 3 9034) 1/1/1897-2/6/1944; and Perth Airport (Station Number 9021) 3/6/1944-31/8/2007. from th on 31/8/2007. Station Number 66062) [6], all occurrences of the 29 February were Copyright © 2013 SciRes. AM

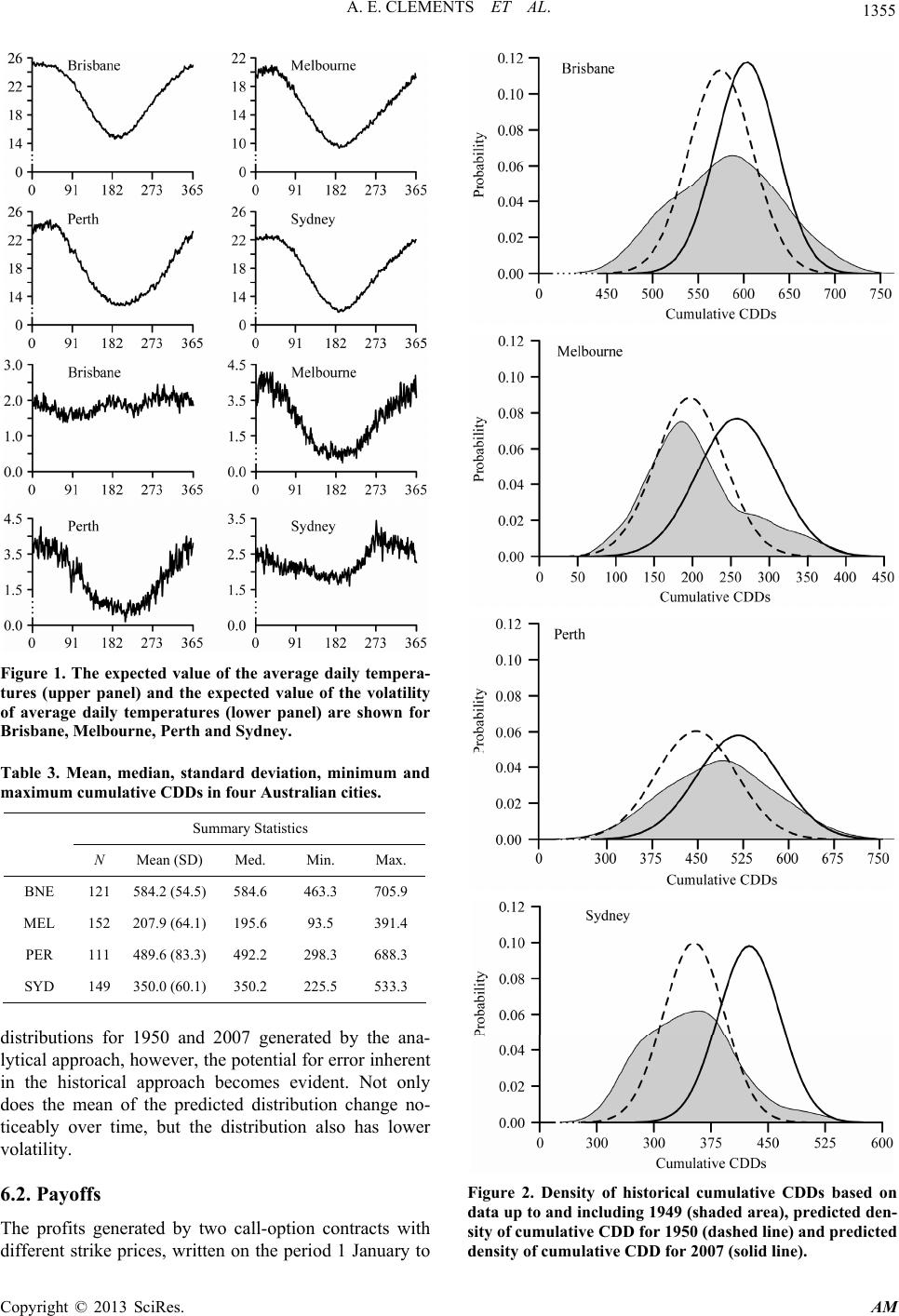

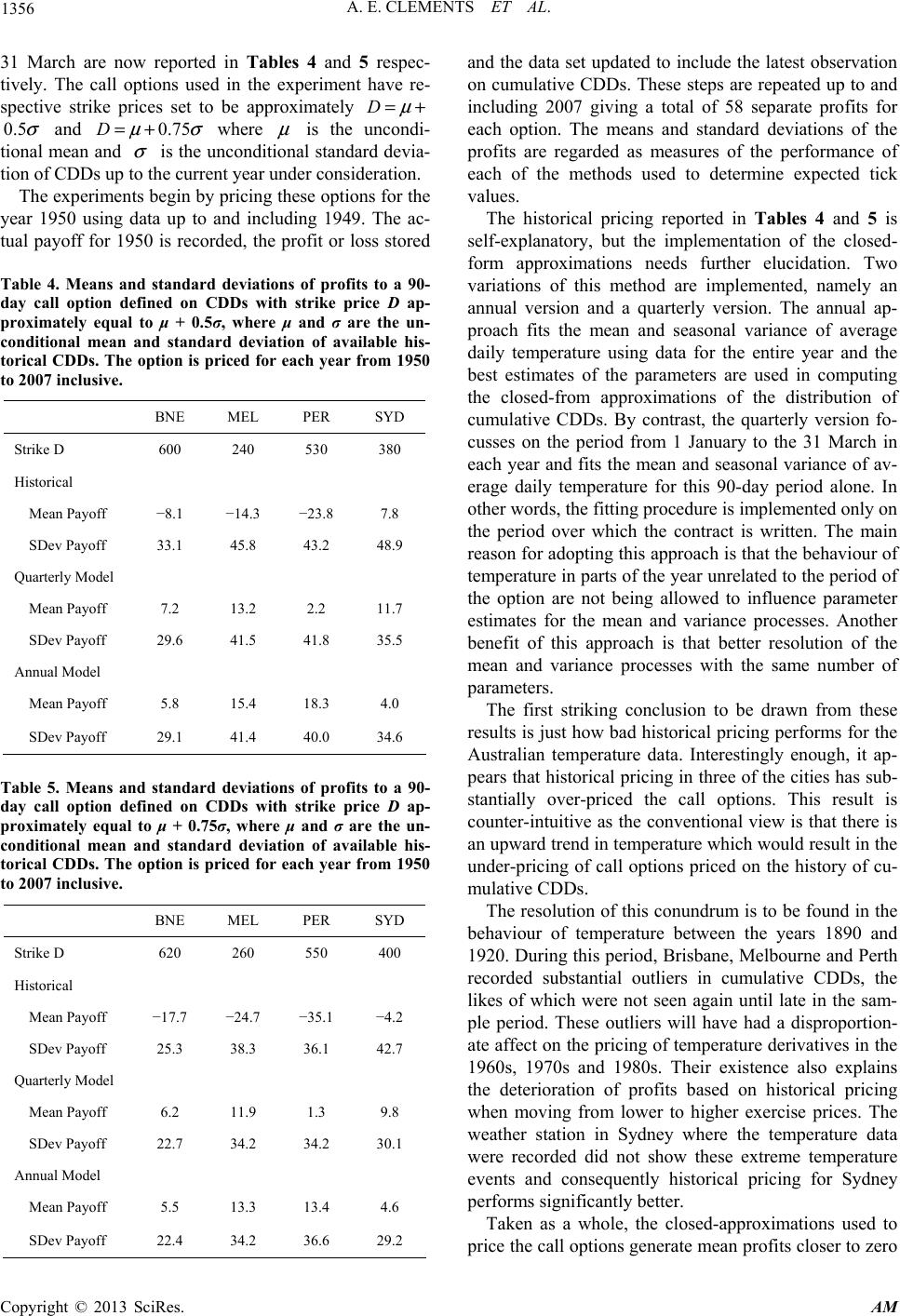

|