M. E. MAZUR, M. D. RAMIREZ

610

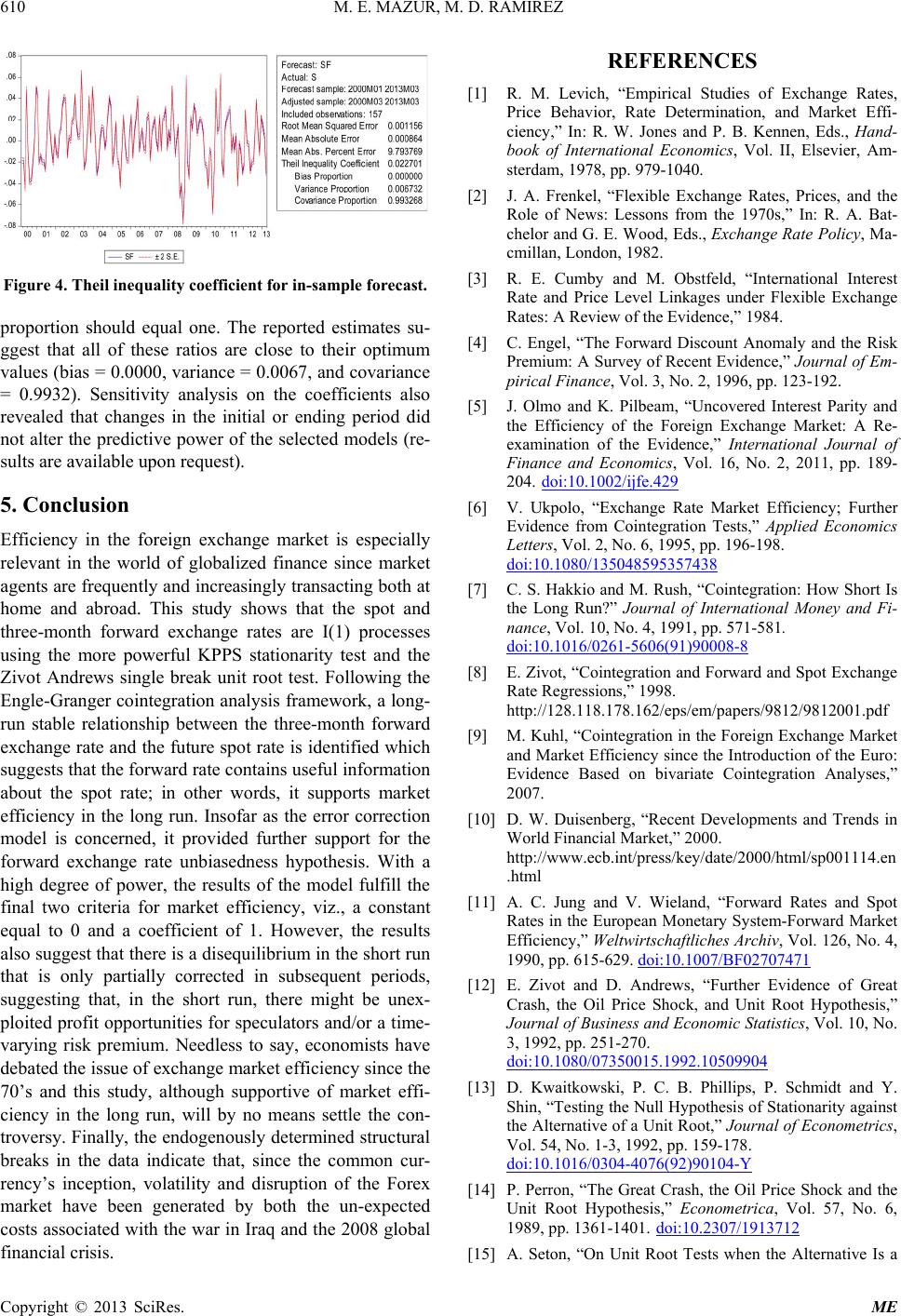

Figure 4. Theil inequality coefficient for in-sample forecast.

proportion should equal one. The reported estimates su-

ggest that all of these ratios are close to their optimum

values (bias = 0.0000, variance = 0.0067, and covariance

= 0.9932). Sensitivity analysis on the coefficients also

revealed that changes in the initial or ending period did

not alter the predictive power of the selected models (re-

sults are available upon request).

5. Conclusion

Efficiency in the foreign exchange market is especially

relevant in the world of globalized finance since market

agents are frequently and increasingly transacting both at

home and abroad. This study shows that the spot and

three-month forward exchange rates are I(1) processes

using the more powerful KPPS stationarity test and the

Zivot Andrews single break unit root test. Following the

Engle-Granger cointegration analysis framework, a long-

run stable relationship between the three-month forward

exchange rate and the future spot rate is identified which

suggests that the forward rate contains useful information

about the spot rate; in other words, it supports market

efficiency in the long run. Insofar as the error correction

model is concerned, it provided further support for the

forward exchange rate unbiasedness hypothesis. With a

high degree of power, the results of the model fulfill the

final two criteria for market efficiency, viz., a constant

equal to 0 and a coefficient of 1. However, the results

also suggest that there is a disequilibrium in the short run

that is only partially corrected in subsequent periods,

suggesting that, in the short run, there might be unex-

ploited profit opportunities for speculators and/or a time-

varying risk premium. Needless to say, economists have

debated the issue of exchange market efficiency since the

70’s and this study, although supportive of market effi-

ciency in the long run, will by no means settle the con-

troversy. Finally, the endogenously determined structural

breaks in the data indicate that, since the common cur-

rency’s inception, volatility and disruption of the Forex

market have been generated by both the un-expected

costs associated with the war in Iraq and the 2008 global

financial crisis.

REFERENCES

[1] R. M. Levich, “Empirical Studies of Exchange Rates,

Price Behavior, Rate Determination, and Market Effi-

ciency,” In: R. W. Jones and P. B. Kennen, Eds., Hand-

book of International Economics, Vol. II, Elsevier, Am-

sterdam, 1978, pp. 979-1040.

[2] J. A. Frenkel, “Flexible Exchange Rates, Prices, and the

Role of News: Lessons from the 1970s,” In: R. A. Bat-

chelor and G. E. Wood, Eds., Exchange Rate Policy, Ma-

cmillan, London, 1982.

[3] R. E. Cumby and M. Obstfeld, “International Interest

Rate and Price Level Linkages under Flexible Exchange

Rates: A Review of the Evidence,” 1984.

[4] C. Engel, “The Forward Discount Anomaly and the Risk

Premium: A Survey of Recent Evidence,” Journal of Em-

pirical Finance, Vol. 3, No. 2, 1996, pp. 123-192.

[5] J. Olmo and K. Pilbeam, “Uncovered Interest Parity and

the Efficiency of the Foreign Exchange Market: A Re-

examination of the Evidence,” International Journal of

Finance and Economics, Vol. 16, No. 2, 2011, pp. 189-

204. doi:10.1002/ijfe.429

[6] V. Ukpolo, “Exchange Rate Market Efficiency; Further

Evidence from Cointegration Tests,” Applied Economics

Letters, Vol. 2, No. 6, 1995, pp. 196-198.

doi:10.1080/135048595357438

[7] C. S. Hakkio and M. Rush, “Cointegration: How Short Is

the Long Run?” Journal of International Money and Fi-

nance, Vol. 10, No. 4, 1991, pp. 571-581.

doi:10.1016/0261-5606(91)90008-8

[8] E. Zivot, “Cointegration and Forward and Spot Exchange

Rate Regressions,” 1998.

http://128.118.178.162/eps/em/papers/9812/9812001.pdf

[9] M. Kuhl, “Cointegration in the Foreign Exchange Market

and Market Efficiency since the Introduction of the Euro:

Evidence Based on bivariate Cointegration Analyses,”

2007.

[10] D. W. Duisenberg, “Recent Developments and Trends in

World Financial Market,” 2000.

http://www.ecb.int/press/key/date/2000/html/sp001114.en

.html

[11] A. C. Jung and V. Wieland, “Forward Rates and Spot

Rates in the European Monetary System-Forward Market

Efficiency,” Weltwirtschaftliches Archiv, Vol. 126, No. 4,

1990, pp. 615-629. doi:10.1007/BF02707471

[12] E. Zivot and D. Andrews, “Further Evidence of Great

Crash, the Oil Price Shock, and Unit Root Hypothesis,”

Journal of Business and Economic Statistics, Vol. 10, No.

3, 1992, pp. 251-270.

doi:10.1080/07350015.1992.10509904

[13] D. Kwaitkowski, P. C. B. Phillips, P. Schmidt and Y.

Shin, “Testing the Null Hypothesis of Stationarity against

the Alternative of a Unit Root,” Journal of Econometrics,

Vol. 54, No. 1-3, 1992, pp. 159-178.

doi:10.1016/0304-4076(92)90104-Y

[14] P. Perron, “The Great Crash, the Oil Price Shock and the

Unit Root Hypothesis,” Econometrica, Vol. 57, No. 6,

1989, pp. 1361-1401. doi:10.2307/1913712

[15] A. Seton, “On Unit Root Tests when the Alternative Is a

Copyright © 2013 SciRes. ME