P. X. ZHAO 47

respectively. The response Y is generated according the

model with . In the following simulation

procedure, we choose the following two missing data

mechanism:

~0,0.5N

Case1:

,

exp 10.50.450.5exp 10.50.45

yu

uy

u

,

Case 2:

,

exp1 0.50.451exp1 0.50.45

yu

yu yu

The average missing rates of these two cases are 0.15

and 0.25 respectively. For each case, we take 1000 simu-

lation runs. In addition, the sample size is taken as n =

200.

For comparison, we consider two methods for construct-

ing the confiden ce intervals: the imputed estimation method

(IEL) proposed by this paper, and the naïve empirical

likelihood method (NEL). The latter is neglecting the

incomplete data information, and constructing the confi-

dence intervals for the regression coefficients only based

on the complete data. The averages of the confid ence in t er -

vals with the nominal level

1 95%,

computed with

1000 simulation runs, are summarized in Figures 1 and 2.

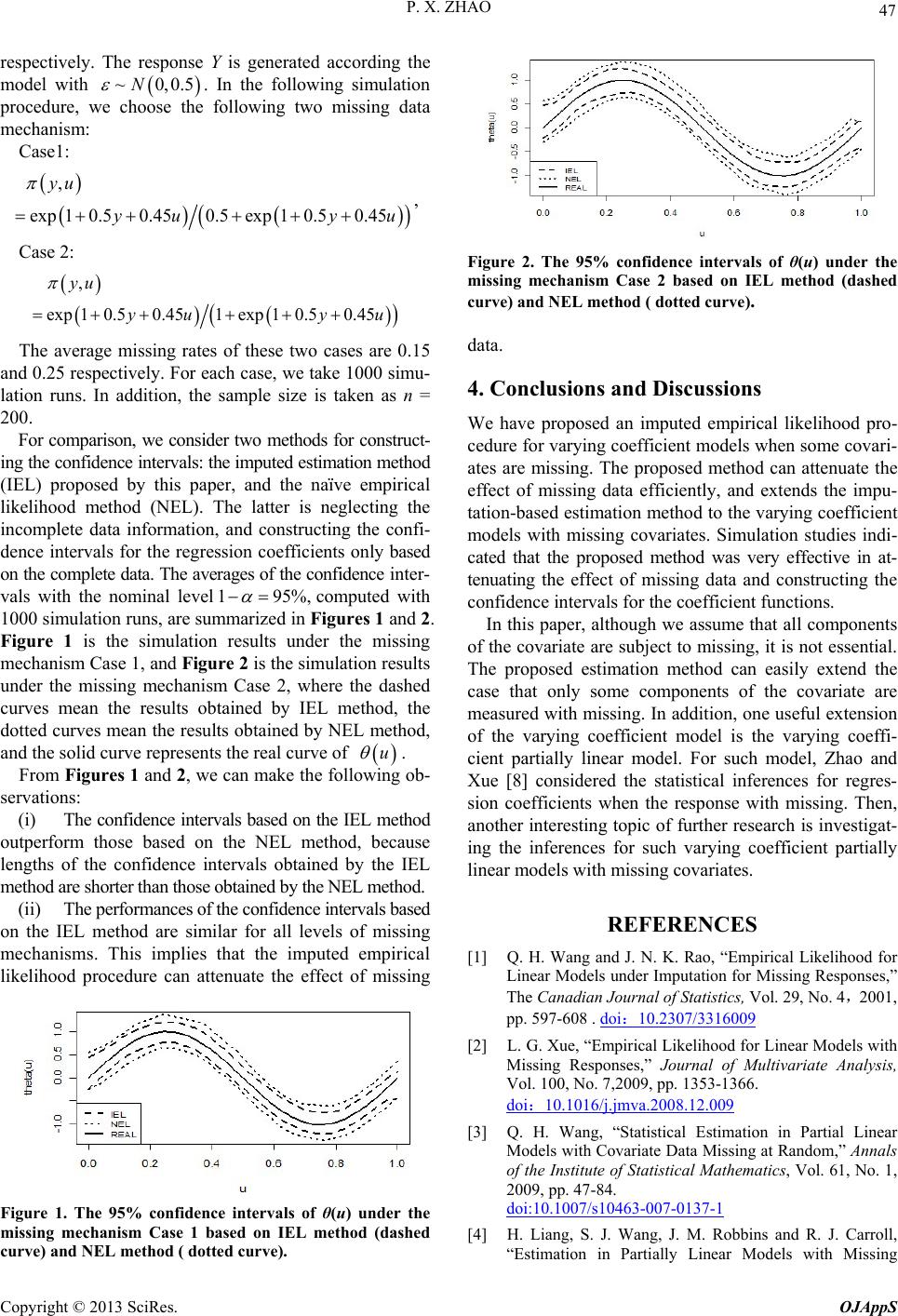

Figure 1 is the simulation results under the missing

mechanism Case 1, and Figure 2 is the simulation results

under the missing mechanism Case 2, where the dashed

curves mean the results obtained by IEL method, the

dotted curves mean the results obtained by NEL method,

and the solid curve represents the real curve of

u

.

From Figures 1 and 2, we can make the following ob-

servations:

(i) The confidence intervals based on the I EL method

outperform those based on the NEL method, because

lengths of the confidence intervals obtained by the IEL

method are shorter than those obtained by the NEL method.

(ii) The performances of the confidence intervals based

on the IEL method are similar for all levels of missing

mechanisms. This implies that the imputed empirical

likelihood procedure can attenuate the effect of missing

Figure 1. The 95% confidence intervals of θ(u) under the

missing mechanism Case 1 based on IEL method (dashed

curve) and NEL method ( dotted curve).

Figure 2. The 95% confidence intervals of θ(u) under the

missing mechanism Case 2 based on IEL method (dashed

curve) and NEL method ( dotted curve).

data.

4. Conclusions and Discussions

We have proposed an imputed empirical likelihood pro-

cedure for varying coefficient models when some covari-

ates are missing. The proposed method can attenuate the

effect of missing data efficiently, and extends the impu-

tation-based estimation method to the varying coefficient

models with missing covariates. Simulation studies indi-

cated that the proposed method was very effective in at-

tenuating the effect of missing data and constructing the

confidence intervals for the coefficient functions.

In this paper, although we assume that all components

of the covariate are subject to missing, it is not essential.

The proposed estimation method can easily extend the

case that only some components of the covariate are

measured with missing. In addition, one useful extension

of the varying coefficient model is the varying coeffi-

cient partially linear model. For such model, Zhao and

Xue [8] considered the statistical inferences for regres-

sion coefficients when the response with missing. Then,

another interesting topic of further research is investigat-

ing the inferences for such varying coefficient partially

linear models with missing covariates.

REFERENCES

[1] Q. H. Wang and J. N. K. Rao, “Empirical Likelihood for

Linear Models under Imputation for Missing Responses,”

The Canadian Journal of Statistics, Vol. 29, No. 4,2001,

pp. 597-608 . doi:10.2307/3316009

[2] L. G. Xue, “Empirical Likelihood for Linear Models with

Missing Responses,” Journal of Multivariate Analysis,

Vol. 100, No. 7,2009, pp. 1353-1366.

doi:10.1016/j.jmva.2008.12.009

[3] Q. H. Wang, “Statistical Estimation in Partial Linear

Models with Covariate Data Missing at Random,” Annals

of the Institute of Statistical Mathematics, Vol. 61, No. 1,

2009, pp. 47-84.

doi:10.1007/s10463-007-0137-1

[4] H. Liang, S. J. Wang, J. M. Robbins and R. J. Carroll,

“Estimation in Partially Linear Models with Missing

Copyright © 2013 SciRes. OJAppS