Paper Menu >>

Journal Menu >>

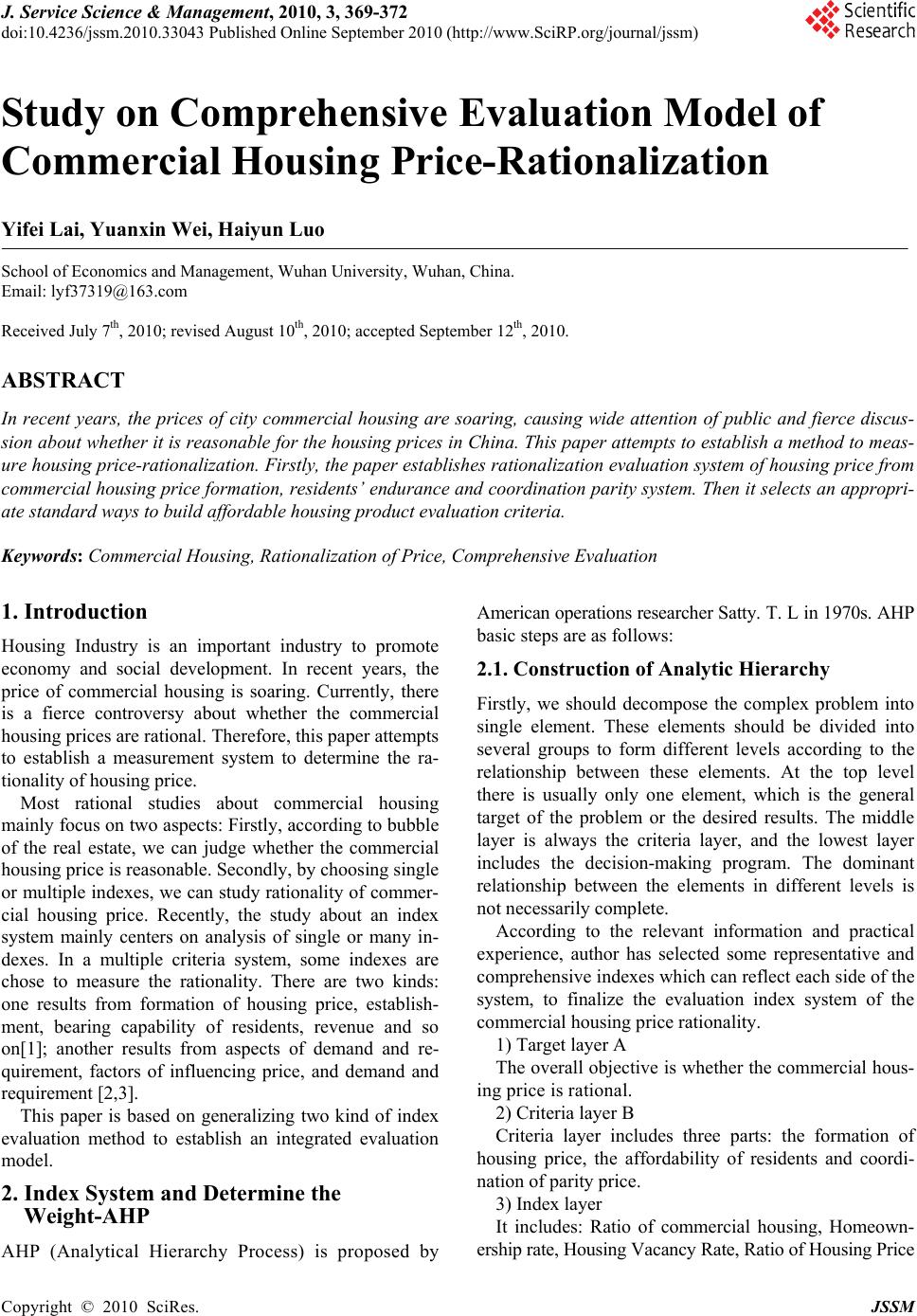

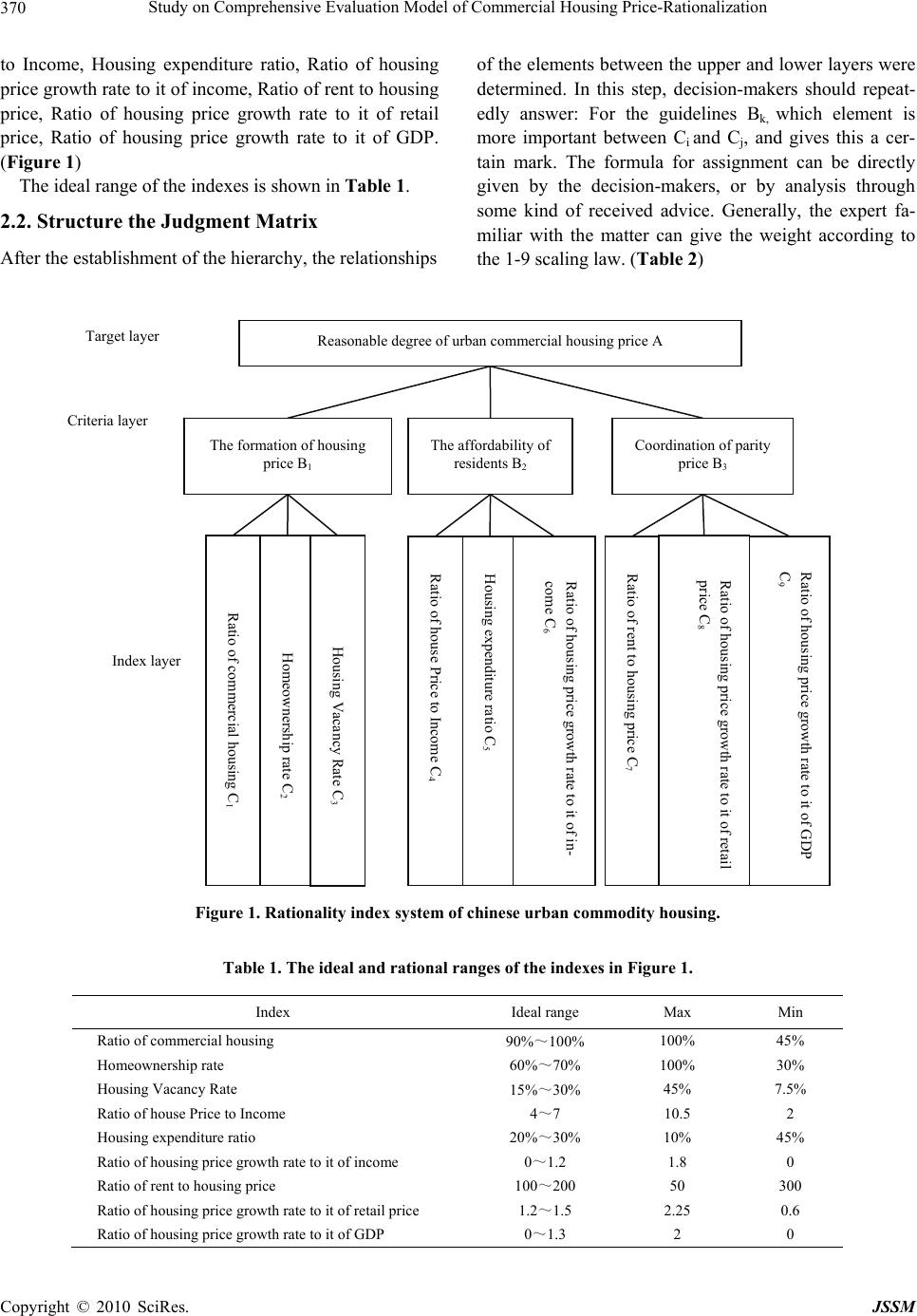

J. Service Science & Management, 2010, 3, 369-372 doi:10.4236/jssm.2010.33043 Published Online September 2010 (http://www.SciRP.org/journal/jssm) Copyright © 2010 SciRes. JSSM 369 Study on Comprehensive Evaluation Model of Commercial Housing Price-Rationalization Yifei Lai, Yuanxin Wei, Haiyun Luo School of Economics and Management, Wuhan University, Wuhan, China. Email: lyf37319@163.com Received July 7th, 2010; revised August 10th, 2010; accepted September 12th, 2010. ABSTRACT In recent years, the prices of city commercial housing are soaring, causing wide attention of public and fierce discus- sion about whether it is reasonable for the housing prices in China. This paper attempts to establish a method to meas- ure housing price-rationalization. Firstly, the paper establishes rationalization evaluation system of housing price from commercial housing price formation, residents’ endurance and coordination parity system. Then it selects an appropri- ate standard ways to build affordable housing product evaluation criteria. Keywords: Commercial Housing, Rationalization of Price, Comprehensive Evaluation 1. Introduction Housing Industry is an important industry to promote economy and social development. In recent years, the price of commercial housing is soaring. Currently, there is a fierce controversy about whether the commercial housing prices are rational. Therefore, this paper attempts to establish a measurement system to determine the ra- tionality of housing price. Most rational studies about commercial housing mainly focus on two aspects: Firstly, according to bubble of the real estate, we can judge whether the commercial housing price is reasonable. Secondly, by choosing single or multiple indexes, we can study rationality of commer- cial housing price. Recently, the study about an index system mainly centers on analysis of single or many in- dexes. In a multiple criteria system, some indexes are chose to measure the rationality. There are two kinds: one results from formation of housing price, establish- ment, bearing capability of residents, revenue and so on[1]; another results from aspects of demand and re- quirement, factors of influencing price, and demand and requirement [2,3]. This paper is based on generalizing two kind of index evaluation method to establish an integrated evaluation model. 2. Index System and Determine the Weight-AHP AHP (Analytical Hierarchy Process) is proposed by American operations researcher Satty. T. L in 1970s. AHP basic steps are as follows: 2.1. Construction of Analytic Hierarchy Firstly, we should decompose the complex problem into single element. These elements should be divided into several groups to form different levels according to the relationship between these elements. At the top level there is usually only one element, which is the general target of the problem or the desired results. The middle layer is always the criteria layer, and the lowest layer includes the decision-making program. The dominant relationship between the elements in different levels is not necessarily complete. According to the relevant information and practical experience, author has selected some representative and comprehensive indexes which can reflect each side of the system, to finalize the evaluation index system of the commercial housing price rationality. 1) Target layer A The overall objective is whether the commercial hous- ing price is rational. 2) Criteria layer B Criteria layer includes three parts: the formation of housing price, the affordability of residents and coordi- nation of parity price. 3) Index layer It includes: Ratio of commercial housing, Homeown- ership rate, Housing Vacancy Rate, Ratio of Housing Price  Study on Comprehensive Evaluation Model of Commercial Housing Price-Rationalization 370 to Income, Housing expenditure ratio, Ratio of housing price growth rate to it of income, Ratio of rent to housing price, Ratio of housing price growth rate to it of retail price, Ratio of housing price growth rate to it of GDP. (Figure 1) The ideal range of the indexes is shown in Table 1. 2.2. Structure the Judgment Matrix After the establishment of the hierarchy, the relationships of the elements between the upper and lower layers were determined. In this step, decision-makers should repeat- edly answer: For the guidelines Bk, which element is more important between Ci and Cj, and gives this a cer- tain mark. The formula for assignment can be directly given by the decision-makers, or by analysis through some kind of received advice. Generally, the expert fa- miliar with the matter can give the weight according to the 1-9 scaling law. (Table 2) Figure 1. Rationality index system of chinese urban commodity housing. Table 1. The ideal and rational ranges of the indexes in Figure 1. Index Ideal range Max Min Ratio of commercial housing 90%~100% 100% 45% Homeownership rate 60%~70% 100% 30% Housing Vacancy Rate 15%~30% 45% 7.5% Ratio of house Price to Income 4~7 10.5 2 Housing expenditure ratio 20%~30% 10% 45% Ratio of housing price growth rate to it of income 0~1.2 1.8 0 Ratio of rent to housing price 100~200 50 300 Ratio of housing price growth rate to it of retail price 1.2~1.5 2.25 0.6 Ratio of housing price growth rate to it of GDP 0~1.3 2 0 Target layer Reasonable degree of urban commercial housing price A Coordination of parity price B3 Ratio of rent to housing price C7 Ratio of housing price growth rate to it of retail price C8 Ratio of housing price growth rate to it of GDP C9 The affordability of residents B2 Ratio of house Price to Income C4 Housing expenditure ratio C5 Criteria layer Index layer The formation of housing price B1 Ratio of housing price growth rate to it of in- come C6 Ratio of commercial housing C1 Homeownership rate C2 Housing Vacancy Rate C3 Copyright © 2010 SciRes. JSSM  Study on Comprehensive Evaluation Model of Commercial Housing Price-Rationalization 371 Table 2. 1-9 scaling law. Significance level Cij Concern the previous layer, Ci and Cj are equally important 1 Concern the previous layer, Ci is slightly important than Cj 3 Concern the previous layer, Ci is obviously important than Cj 5 Concern the previous layer, Ci is strongly important than Cj 7 Concern the previous layer, Ci is extremely important than Cj 9 Concern the previous layer, Ci is slightly less important than Cj 1/3 Concern the previous layer, Ci is obviously less important than Cj 1/5 Concern the previous layer, Ci is strongly less important than Cj 1/7 Concern the previous layer, Ci is extremely less important than Cj 1/9 The important scale between the two adjacent judgments 2,4,6,8,1/2,1/4,1/6,1/8 Structure the comparison matrix Cn × n: 11 121 21 222 12 n n nn nn nn CC C CC C C CC C 2.3. Single-Level Sorting and Consistency Check In theory, single-level sorting can come down to the cal- culation of the characteristic roots and eigenvector of the judgment matrix C. CW = maxW, here, max is the maxi- mum characteristic root, and W is the corresponding normalized vector to max. Wi is the component of W, it is the weight. We choose square-root method to calculate max and W. Steps are as follows: 1) Calculate Mi, the product of each row elements of matrix; n j iji cM 1 , ni ,,2,1 2) Calculate i W, the n-th root of Mi; ni iMW 3) Normalization of the vector T n WWWW ,,, 21 ; n j j i i W W W 1 Then T n WWWW ,,, 21 4) Calculate the maximum characteristic root max; n ii i nW AW 1 max )( , here, (AW)i is the i-th component of AW. Then we calculate the consistency index: 1 max n n CI . Obviously, when the matrix is of full consistency, CI = 0. And we also need to determine the average and random index of the matrix, RI. For 1 × 1 to 10 × 10 matrix, RI is shown in Table 3. When n > 2, the rate of CI to RI is called random con- sistency rate of judgment matrix (CR), CR = CI/RI. When CR < 0.1, the matrix is acceptable and has full consistency. Or, proper modification is essential. 3. Weighted Comprehensive Evaluation The linear weighted comprehensive evaluation can be more comprehensive to evaluate the rationality of urban hous- ing price, and can identify the priorities and weaknesses. In addition, it gives a composite index which can reflect the general information. This can make up the deficiency of statistical indicator system. Weighted comprehensive evaluation uses the individual index standardized to multiply the corresponding weight and then add to the overall evaluation. %100 1 i n i iAWA Here, , A: the rationality index of housing price, Wi: the weight of i-index, Ai: the rationality index of i-index. 1 1 n i i W Accordingly, A∈[0,1]. If A = 100%, the commercial housing prices are entirely reasonable; If A = 0, the hous- ing prices are completely unreasonable. In this article, we provides A = 60% as the critical point, that means urban commercial housing prices is basically rational in China. Table 3. Average random consistency index RI. n123 45 6 7 8 9 10 R I 00 0.580.91.121.26 1.36 1.411.461.49 Copyright © 2010 SciRes. JSSM  Study on Comprehensive Evaluation Model of Commercial Housing Price-Rationalization 372 4. Conclusions This paper establishes the integrated evaluation model of urban commercial housing. The sorting of indexes are as follows: Ratio of commercial housing, Homeownership rate, Housing Vacancy Rate, Ratio of house Price to In- come, Housing expenditure ratio, Ratio of housing price growth rate to it of income, Ratio of rent to housing price, Ratio of housing price growth rate to it of retail price, Ratio of housing price growth rate to it of GDP. On one hand, the results reflected the relative importance of the factors which affect China’s commercial housing. On the other hand, it reflects we should cut down housing prices, increase income, and improve the affordability of resi- dents of purchase currently. REFERENCES [1] G. F. Wen, “Observation about Housing Price,” Price Theory and Practice, Vol. 4, 1998. [2] Y. L. Zhao and H. Li, “Construction of City Housing Price System,” Research about Engineering and Higher Education, Vol. 23, No. 4, 2004, pp. 11-12. [3] R. Y. Zhu and X. M. Li, “Positive Analysis about Rea- sonableness of City Housing Price in the East of Our Country,” China Consumption Price, Vol. 23, No. 4, 2008, pp. 11-12. [4] D. Du and Q. H. Pang, “Comprehensive Evaluation Me- thod and Selective Case,” Tsinghua University Press, Bei- jing, 2005. [5] I. Greef and R. Haas, “Housing Prices, Bank Lending, and Monetary Policy,” Financial Structure, Bank Behav- ior and Monetary Policy in the EMU Conference, Gron- ingen, 2000. [6] J. R. A. Pozdena, “Testing for Bubbles in the U. S. Hous- ing Market,” University of Oregon, 2006. [7] J. M. Quigley, “Real Estate and the Asian Crisis,” Jour- nal of Housing Economics, Vol. 10, No. 2, 2001, pp. 129- 161. Copyright © 2010 SciRes. JSSM |