Modern Economy, 2012, 3, 837-845 http://dx.doi.org/10.4236/me.2012.37107 Published Online November 2012 (http://www.SciRP.org/journal/me) The Determinants of Interest Rate Spreads in Nigeria: An Empirical Investigation Anthony E. Akinlo*, Babatunde Olanrewaju Owoyemi Department of Economis, Obafemi Awolowo University, Ile-Ife, Nigeria Email: *aakinlo@oauife.edu.ng Received September 17, 2012; revised October 20, 2012; accepted November 5, 2012 ABSTRACT The paper examines the determinants of interest rate spreads in Nigeria using a panel of 12 commercial banks for the period 1986-2007. The results suggest that cash reserve requirements, average loans to average total deposits, remu- neration to total assets and gross domestic product have positive effect on interest rate spreads. However, non-interest income to average total assets, treasury certificate and development stocks have negative relationship with interest rate spreads. In general, the findings that suggest a reduction in cash reserve ratio, high bank overhead costs amongst others will help to moderate the high interest rate spreads in Nigeria. Keywords: Interest Rate Spread; Determinants; Nigeria 1. Introduction The interest rate spreads (measured as the difference be- tween deposit and lending rates) not only indicate the level of inefficiency of the banking sector but show the level of development of the financial system. Bank inter- est rate spreads have several important implications for growth and development of any economy. Specifically high interest rate spreads tend to discourage potential savers and thus limiting the quantum of funds available to potentials investors. A reduction in lending arising from low savings often leads to low investment and thus the economic growth rate [1-3]. Incidentally, interest rate spreads in Nigeria increased by a large amount over the study period1. However, not many studies have been un- dertaken to analyze the main factors underlying the high interest rate spreads in the country. There is the need to fill this gap. Hence, the main objective of this paper is to investigate the issue of the determinants of interest rate spreads in Nigeria. The paper is organized as follows. In Section 2, we provide an overview of the development in the banking sector and interest rate spreads in Nigeria. Section 3 pro- vides a survey of empirical literature on determinants of interest rate spreads. Section 4 provides the methodology, data sources and variable measurements. Section 5 re- ports the empirical findings of the study. The last section concludes the article. 2. An Overview of the Banking Sector and Interest Rate Spreads in Nigeria Banking activity started in Nigeria with the establishment of the First Bank by the African Banking Corporation in 1892. Subsequently, several other banks were established but failed except National bank of Nigeria, African Con- tinental Bank, the Bank of British West Africa, Barclays Bank and the British and French Bank. The development led to enactment of the 1952 Banking Ordinance to regulate the activities of banks in country. After independence in 1960, further legislation in the form of the Banking Act of 1969 was passed to regulate the activities of banks in Nigeria. During this period, most banks in Nigeria maintained their pre-independence era focus on financing trade transactions. Following the indigenization decree promulgated in the 1970s, most of the foreign owned banks in the country were nationalized, and the federal government assumed a significant own- ership of stake in these banks. Commercial and merchant banks were empowered by law to accept deposits from individuals and companies and to conduct general bank- ing business. However, with the adoption of the Structural Adjust- ment Programme (SAP) in 1986, many far reaching re- forms were introduced to enhance the efficiency of the banking industry. These included gradual changes from the regime of strict direct controls to indirect monetary controls and elimination of the policy of selective alloca- tion of credit by the early 1990s. The commercialization and privatization programmes of this period led to a di- *Corresponding author. 1Evidence of high interest rate spreads in Nigeria over the years has been documented in the works of [4,5] amongst others. C opyright © 2012 SciRes. ME  A. E. AKINLO, B. O. OWOYEMI 838 IRS vestment of the Federal Government’s holdings in sev- eral banks. Moreover, several new commercial banks were granted licenses. The number of banks in operation in Nigeria increased from 58 1990 to 90 in 2001. The first community bank commenced operations in Decem- ber 1990. However, many of the banks became distressed, principally because regulatory capacity building could not keep up with the expansion in banks. To address the distress situation in the banking sub-sector, several pol- icy reforms were introduced. One of the reforms was the 2004 directive by the Central Bank of Nigeria (CBN) mandating all (deposit money) banks operating in Nige- ria to increase their capital base to a minimum of N25 billion by December 2005. Of the 89 banks that operated prior to this directive, only 25 banks emerged. Fourteen banks licenses were revoked, as they were unable to meet the minimum capital requirement. Four of these banks (Assurance Bank Plc, Leadbank Plc, Allstates Trust Bank Plc and Trade Bank Plc) were subsequently acquired by three capitalized banks under the ‘Purchase and Assump- tion’ strategy. 5 The trend of interest rate spreads is as shown in Fig- ure 1. It shows that the interest rate spreads was low at 2.5 in 1986. It increased to 5.2 in 1987 following gov- ernments’ liberalization of the entering requirements into the banking business and the total removal of interest rate control. The spreads experienced a fall in 1988 which could be linked to the establishment of the Nigerian De- posit Insurance Corporation and relaxation of bank port- folio restrictions. It rose to 8.2 and 8.9 in 1989 and 1990. This was the period when banks were permitted to pay interest on demand deposits. Auction markets for gov- ernment securities were introduced; capital adequacy standards were reviewed upward and the extension of credit based on foreign exchange deposits was banned. All these might have in one way or the other influenced the interest rate spreads. It dropped to 6.51 in 1991 when embargo was placed on bank licensing. The Central Bank was to regulate and supervise all financial institutions and interest rate re-administered. Interest rate spreads became double-digit from in 1992 and 1993 standing at 15.1 and 19.43 respectively. This was the period when government once again removed interest rate control, commenced the privatization of government-owned banks, deregulated the capital market and removed the credit controls. Moreover, in 1993, the monetary author- ity introduced the indirect monetary instruments and took over five banks for restructuring. The interest rate spreads decelerated to a single-digit value between 1994 and 1996 following government re-imposed control of interest and exchange rate. However, spreads maintained double digit value through the period 1997 and 2007 at- taining a peak of 24.62 in 2002. On the average over the 0 5 10 15 0 86 88 90 92 94 96 9800020406 Figure 1. Plot of interest rate spreads 1986-2007. study period, interest rate spreads maintained upward trends. 3. Empirical Evidence on the Determi na n t s of Interest Rate Spreads Some empirical studies have been conducted on the de- terminants of interest rate spread in the developed coun- tries. However, in developing countries, Nigeria inclu- sive, not very many studies have been conducted on the subject matter. In this subsection, we provide a summary of the findings of the few existing empirical studies on the determinants of interest rate spreads. The study by [6]) examined the determinants of bank net interest margins for a sample of US banks using annual data for 1989- 1993 in a country specific basis. The results for the pooled sample suggested that the proxies for default risk (ratio of net loan charge—offs to total loans), the oppor- tunity cost of non-interest bearing reserves, leverage (ra- tio of core capital to total assets), and management effi- ciency (ratio of earning assets to total assets) are all sta- tistically significant and positively related to bank inter- est margins. The ratio of liquid assets to total liabilities, a proxy for low liquidity risk, was inversely related to the bank interest margins. [7] in a cross country study found that between 1988-1995 interest margins in six European countries and the US were affected by the degree of bank capitalization, bank market structure, and the volatility of interest rates. The study by [8] observed that for the Eastern Carib- bean countries, unlike the evidence gathered above, the impact of loan loss provisioning has been to reduce bank interest margin rather than increase it once the tendency of banks to under provision in the case of government loans was accounted for. Like in other countries, operat- ing expenses seem to have a large impact on bank spreads in the Eastern Caribbean region. Over the sample period, the ratio of operating expenses to total asset ex- plains 23 percent of the estimated spreads. Using monthly data for Argentinean banks from June 1993 to Copyright © 2012 SciRes. ME  A. E. AKINLO, B. O. OWOYEMI 839 July 1997 period, [9] studied the determinants of the in- termediation spreads for loan and deposits dominated in both domestic as well as foreign currencies. Both in- termediation margins are related to the average tax ratio, the cost of reserve requirements, operating costs, prob- lem loans, exchange rate risk, and market structure measured using Herfindahl index. The only marked dif- ference between domestic and foreign currency markets is a positive and significant impact of the market struc- ture on spreads for the former markets and a non-sig- nificant impact for the latter. For both markets, the in- termediation spreads are mostly affected by operating costs and problems loans. The quantitative effects of both factors are nearly the same for the domestic currency market. The study by [10] found that interest margin was posi- tively related to bank’s market power, operating costs, credit risk and degree of interest rate risk. However, in- crease in bank’s equity was found to have an adverse effect on margin when the bank faced little interest rate risk. The paper by [11] examined the impact of financial liberalization of the Colombian economy on interest rate margin in the banking system. The results obtained were mixed. They found that liberalization increased banking sector competition significantly, lowered market power and reduced financial taxation from its highest level of the late 1970s. Moreover, they found that banks were responsive to changes in loan quality, possibly reflecting an improvement in the banking supervision and/or re- porting. In his work, [12] applied the two-step procedure for a sample of five Latin American countries during the mid 1990’s (Argentina, Bolivia, Colombia, Chile and Peru). Their results showed positive coefficients for capital ratio (statistically significant for Bolivia and Colombia), cost ratio (statistically significant for Argentina and Bolivia), and the liquidity ratio (statistically significant for Bolivia, Colombia, and Peru). As for the effect of nonperforming loans, the evidence was mixed. Apart from Colombia, where the coefficient for nonperforming loans was posi- tive and statistically significant, for the other countries the coefficient was negative (statistically significant for Argentina and Peru). In the second stage, [12] ran a re- gression for the measure of “pure” bank spreads on mac- roeconomic variables reflecting interest rate volatility, inflation rate and GDP growth rate. Their results showed that interest rate volatility increased bank spreads in Bo- livia and Chile; the same happened with inflation in Co- lombia, Chile and Peru. For the other cases, the coeffi- cients were not statistically significant. The study by [13] examined the determinants of banks spreads in Uganda from 1999-2005. They found that spreads and margins have been mainly driven by time invariant bank characteristics as well as overhead costs and sectoral compositions of loans. Likewise, [5] provided empirical evidence on the de- terminants of interest rate spreads in a liberalized finan- cial system for the period 1989-2000, using selected banks in Nigeria. Ex-ante interest rate spreads equations were estimated using bank balance sheet and income statement as well as macroeconomic data. The results showed that macroeconomic and monetary policy/finan- cial regulation factors were more important determinants of commercial banks’ interest spreads than bank level factors. Inflation rate, GDP, financial deepening, cash reserve requirement, risk premium, Treasure bill rate, loan asset quality, liquidity risk and non interest expenses were the most important factors that affected commercial banks’ interest rate spreads during the period. The study by [14] used unique bank-by-bank balance sheet and income statement information to investigate the intermediation efficiency in the Nigerian pre-consoli- dated banking sector during 2000-2005. He analyzed whether the Central Bank of Nigeria’s policy of recent banking consolidation can be justified and rationalized by looking at the determinants of spreads. Indeed, spreads decomposition and panel estimations showed that the reform of the banking sector could be the first step to raise the intermediation efficiency of the Nigerian bank- ing sector. He found that larger banks enjoyed lower overhead costs and that increased concentration in the banking sector was not detrimental to spreads. The re- sults equally showed that increased holdings of liquidity and capital positively impacted spreads in 2005, while stable macroeconomic environment enhanced more effi- cient channeling of savings to productive investments. The work by [15] explored the factors behind consis- tently high interest rate spreads and margins in Uganda. The results showed that small size of Ugandan banks, high treasury bill rates and institutional deficiencies were major determinants of bank spreads and margins. More- over, the results showed that macroeconomic factors such high inflation rate and exchange rate appreciation had significant impact on interest rate spreads in Uganda. 4. Methodology In examining the determinants of interest rate spreads in Nigeria, the study employs panel data procedures since the sample contains data across banks and over time. In the estimation, three estimation models were adopted, namely, pooled OLS, fixed-effects and random effects. The adoption of pooled OLS is based on the assumption that there is no group or individual effects among the banks. However, as panel contains observation on the same cross-sectional units over several time periods, the possibility of cross-sectional effects on each firm or on a set of group of banks is very high. In order to take care of Copyright © 2012 SciRes. ME  A. E. AKINLO, B. O. OWOYEMI 840 this problem, the study adopts other estimation tech- niques namely, fixed effects and random effects. Random effects assume that the individual or group effects are uncorrelated with other explanatory variables and can be estimated. The fixed effects, on the other hand, takes into consideration the individuality of each bank or cross- sectional unit included in the sample by allowing the intercept vary for each bank while assuming that the slope coefficients are constant across banks. 4.1. Model Specification The general model specification is represented by the following equation2: ,,itit Wt,t it Z IRS X (1) where IRS is defined as interest rate spreads for bank i indexes bank i and t indexes time t; Xit is a vector of bank-specific variables for bank i and time t; Wt contains time varying, banking industry-specific variables; Zt is a vector of time-variant macroeconomic variables, and εit is error term for bank i and time t. In this equation, it is assumed that the error term is distributed independently and identically in a manner that the variance is equal to zero. 4.2. Sources and Measurement of Data The study utilized data obtained from 12 banks selected from the 25 banks that survived the consolidation exer- cise of 2004. The banks were selected based on the availability of the relevant data on the various variables used in the study. Only banks with complete data set for all the variables used in the estimation were selected for the study. Bank-specific and industry-specific data were sourced from annual reports and statement of accounts of the selected banks. However, data on macroeconomic variable were sourced from Statistical Bulletin (2007) published by the Central Bank of Nigeria (CBN). 4.3. Definition and Measurement of Variables Interest Rate Spreads (IRS): This refers to the differ- ence between bank’s lending and deposit rate. It was calculated as average bank lending rate minus average bank deposit rate3. Cash Reserve Requirements (CRR): This is the pre- scribed percentage of Commercial banks’ total deposits that must be kept with the monetary authority as a cau- tion. The cash deposit is expressed as a ratio of each bank’s total demand deposit liabilities. Average Capital Employed to Average Total Assets (KPTEMP): This refers to a bank’s net worth, capital asset ratio or capital adequacy. Loan to Deposit Ratio (LDEPRAT): This is the ratio of commercial bank loans to total deposit. It is referred to a bank’s liquidity risk. Average Loans to Average Total Assets (LNASS): This refers to the size of a bank’s loan asset. Non Interest Expenses to Average Total Assets (NXPVTA): This refers to bank’s expenses management efficiency. Remuneration to Total Assets (REMUTA): This re- fers to bank’s personnel cost. Minimum Rediscount Rate (MRR): This is the most favorable rate of interest at which the Central bank lends to financially sound deposit money banks. Gross Domestic Product (GDP): This is the produc- tive capacity of an economy. The real domestic product is the nominal value of the GDP deflated by the con- sumer price index. Development Stocks (DS): This is one of the tradi- tional money market/government-issued financial instru- ments that provide the government with short term funds as well as provide financial institutions with opportuni- ties for local investment of idle funds. It has about thirty-six month’s maturity. Treasury Certificates (TC): This is also a traditional money market/government-issued financial instrument. It was introduced to have a longer maturity period (one to two years), but not long enough to be used as a govern- ment long term security. Treasury Bonds (TB): It is also a government-issued financial instrument. Changes in Inflation (CINFL AT): This refers to vari- ability in the level of inflation over selected number of years. 5. Empirical Results 5.1. Descriptive Statistics Table 1 provides the descriptive statistics of the data series employed in the study. For almost all the variables, the mean and median values lie within their maximum and minimum values showing a good level of consis- tency. The kurtosis of the eight of the twelve variables included in the analysis exceeds 3 meaning that the series are leptokurtic (peaked) relative to the normal4. Also, the probability that the Jarque-Bera statistic exceeds (in ab- solute value) the observed value is generally low for all the series. This suggests the rejection of the hypothesis of ormal distribution at 5%. 2This model has been adopted by few existing studies including [15- 17]. 3The ex-ante ante approach in calculating the interest rate spreads was used. This approach uses the rates quoted on loans and on deposits and draws inferences from the difference between them. n 4The few exception are Gross domestic Product (GDP), development stocks (DS), treasury bonds (TB) and treasury certificates (TC). Copyright © 2012 SciRes. ME  A. E. AKINLO, B. O. OWOYEMI Copyright © 2012 SciRes. ME 841 Table 1. Descriptive statistics. IRS KPTEMP LDEPRAT LNASS REMUTANXPVTAGDP MRR DS TB TC CINFLAT Mean 61555.757 0.15871 0.502605 0.542839 0.0805730.13809390702.715.67626 3009.171 210967.1 11579.37 0.807634 Median 1826 0.070665 0.467513 0.286839 0.020186 0.069746 377830.814.31 2960 134387.6 0 1.5 Maximum 43537 2.131332 2.034027 5.9 6.6020411.211406562043.726 4909 430608.2 37342.731.5 Minimum 0 0.20076 0.121213 0.090174 1.89E−050.01721925599712.75 980 0 0 −43.5 Std. Dev. 9421.071 0.333611 0.239431 0.969675 0.580736 0.231762 81991.11 3.240154 1232.408 179291.9 15278.39 17.67513 Skewness 1.960768 4.483397 2.851987 3.544564 10.96457 3.433519 0.4023671.70739−0.01967 0.208101 0.812722 −0.77919 Kurtosis 6.087207 23.37996 17.92046 14.95635 123.3166 13.57072 2.420211 5.889912 1.751833 1.326232 1.8244413.84996 Jarque−Bera 135.9632 2705.948 1392.724 1054.605 81640.14 867.3095 5.369655 109.2339 8.512096 16.23704 21.96437 17.19916 Probability 0 0 0 0 0 0 0.058233 0 0.014178 0.000298 0.0000170.000184 Sum 806404.2 20.79101 65.84131 71.1119 10.555118.08977511820482053.59394201.4 27636691 1516897105.8 Sum Sq. Dev. 1.15E+10 14.46855 7.452511 122.2352 43.84313 6.9827578.74E+111364.8181.97E+08 4.18E+12 3.03E+1040613.31 Observations 131 131 131 131 131 131 131 131 131 131 131 131 5.2. Correlation Matrix Table 2 shows the degree of association among the vari- ables. In general, the results show that while some are positively related to interest rate spreads, few others are negatively related. Specifically, cash reserve require- ments, ratio of non-interest expenses to average total assets, non-interest income to average to average total assets, gross domestic product and treasury bills have positive relationship with interest rate spreads. However, ratio of loan to total deposit, remuneration to total assets, minimum rediscount rate, development stocks, treasury certificates and changes in inflation have negative rela- tionship with interest rate spreads5. 5.3. Panel Unit Root Tests To ascertain the unit root characteristics of the panel data, we estimate unit root test for each variable in the model. Specifically, the study used Levin, Lin and Chu; Im, Pesaran and Shin W-stat, ADF-Fisher Chi-square and PP-Fisher Chi-square tests. The results as contained in Table 3 show stationarity for all the variables at different levels of difference. Specifically, IRS, CRR and TC were stationary at second difference. However, KPTEMP, LDEPRAT, LNASS, NXPVTA, REMUTA, NIYAV- TASS, GDP, TB were stationary at first difference while MRR, DS and CINFLAT were stationary at level. 5.4. Regression Results The results for the determinants of interest rate spreads using pooled and fixed effects panel methods respec- tively are presented in Table 4. Column 1 refers to the estimation with pooled OLS and column 2 shows estima- tion results with fixed effects approach6. The results ob- tained from pooled OLS are quite consistent with that obtained using the fixed effects in both signs and magni- tude. The results from the two estimation approaches show that cash reserve ratio is positively related to interest rate spreads. The coefficient is significant in both results. The results show that a 1 percent increase in cash reserve ratio will increase interest rate spreads by 0.43 percent in the fixed effects model. This results support the findings of [18-21]. The finding is very much in support of the assertion that statutory minimum reserve requirements are implicit taxes that increase interest rate spreads be- cause banks tend to shift them to customers by either increasing the lending rate or reducing the deposit rate. The ratio of average capital employed to average total assets has negative effect but only significant at 10 per- cent in the pooled OLS. A 1 percent increase in the ratio of average capital employed to average total assets will lead to 0.82 percent reduction in the interest spreads. Loan to deposit ratio (LDEPRAT) has a positive sign but significant only in the fixed effect model. The result shows that a 1 percent rise in LDEPRAT would increase IRS by 0.53 percent. The average loan to average total assets (LNASS) coefficient is positive but not signifi- cant7. The coefficient of the ratio of non interest expenses to average total assets (NXPVTA) is positive but not significant in the two estimation approaches. The ratio of remuneration to total assets (REMUTA) has a significant 6The [22] test conducted showed that fixed-effects model provide a better results. Therefore, we only report the fixed effects model here. 7The ratio of average loans to average total assets is only significant at 20 percent in the fixed effect model. 5In general examining simple bivariate correlation in a conventional matrix does not take account of each variable’s correlation with all other explanatory variables; hence caution should be exercised in in- terpreting the result of the correlation matrix.  A. E. AKINLO, B. O. OWOYEMI 842 Table 2. Correlation matrix. IRS CRR KPTEMP LDEPRAT LNASSNXPVTAREMUTANIYAVTASSMRRGDP DS TB TCCINFLAT IRS 1.000 CRR 0.754 1.000 KPTEMP 0.601 0.346 1.000 LDEPRAT −0.065 −0.046 −0.057 1.000 LNASS 0.501 0.258 0.812 0.009 1.000 NXPVTA 0.537 0.323 0.785 −0.073 0.719 1.000 REMUTA −0.036 −0.034 −0.030 −0.099 −0.031 −0.0251.000 NIYAVTASS 0.303 0.133 0.608 −0.010 0.897 0.615 −0.0151.000 MRR −0.065 −0.083 −0.007 −0.097 −0.027 −0.031 −0.0600.002 1.000 GDP 0.453 0.539 0.209 0.204 0.0770.143 −0.110 −0.022 0.0191.000 DS −0.499 −0.565 −0.197 −0.301 −0.106 −0.1680.103 0.0004 0.123−0.836 1.000 TB 0.479 0.539 0.189 0.243 0.1290.169 −0.0790.022 −0.0540.753 −0.941 1.000 TC −0.329 −0.363 −0.130 −0.154 −0.169 −0.126 −0.022 −0.089 0.366−0.326 0.560 −0.633 1.000 CINFLAT −0.039 −0.007 0.003 −0.131 0.027 0.029 0.016 0.022 0.0330.033 0.130 −0.138 0.1981.000 Table 3. Panel unit root tests individual effects 1986-2007. Variables Level LLC ρ-V IPS ρ-V ADF ρ-V PP ρ-V IRS 2 2.37 0.99 −2.7 0.00** 63.04 0.00** 124.27 0.00** CRR 2 −2.70 0.00** −12.58 0.00** 125.33 0.00** 234.22 0.00** KPTEMP 1 −11.47 0.00** −9.2 0.00** 111.38 0.00** 135.47 0.00** LDEPRAT 1 −23.37 0.00** −10.36 0.00** 67.52 0.00** 134.7 0.00** LNASS 1 −6.48 0.00** −5.29 0.00** 73.82 0.00** 145.59 0.00** NXPVTA 1 −4.06 0.00** −7.17 0.00** 92.49 0.00** 176.04 0.00** REMUTA 1 3,784,800 1.00 −5.43 0.00** 72.88 0.00** 175.24 0.00** NIYAVTASS 1 −6.45 0.00** −5.81 0.00** 78.28 0.00** 136.91 0.00** MRR 0 −9.46 0.00** −6.58 0.00** 83.82 0.00** 144.78 0.00** GDP 1 −8.31 0.00** −5.04 0.00** 65.1 0.00** 221.07 0.00** DS 0 −2.66 0.00** −5.43 0.00** 70.4 0.00** 33.98 0.09*** TB 1 −8.71 0.00** −7.06 0.00** 89.5 0.00** 175.06 0.00** TC 2 −16.95 0.00** −13.39 0.00** 164.51 0.00** 282.25 0.00** CINFLAT 0 −9.19 0.00** −5.95 0.00** 76.44 0.00** 70.57 0.00** Notes: The null hypothesis (Ho) is that there is no unit root, (H1) some do not have a unit root process. Significance levels are denoted *: 1%, **: 5%, ***: 10%: and indicate rejection of the null hypothesis. 0, 1, and 2 represent level, first and second difference respectively. Probabilities for Fisher tests are computed using an asymptotic Chi-square distribution. All other tests assume asymptotic normality. LLC denotes Levin, Lin and Chin, IPS denotes Im Pesaran Shin W-Stat, ADF indicates Augmented Dickey Fuller test, PP denotes Phillip Peron is also reported, and ρ-V indicates Probability value. Copyright © 2012 SciRes. ME  A. E. AKINLO, B. O. OWOYEMI 843 Table 4. Pooled OLS and fixed effects 1986-2007. Variable Pooled OLS 1 t-statistic Fixed Effects 2 t-statistic Constant - - −0.989741 −0.079724 LOG (CRR) 0.606898*** 19.07599 0.428597*** 12.92405 KPTEMP −0.820387* −1.731124 −0.371179 −0.979037 LDEPRAT 0.274806 1.157877 0.531888** 2.594412 LNASS 0.941695*** 4.015137 0.294473* 1.465834 NXPVTA 0.210381 0.384788 0.141088 0.327951 D (REMUTA) 2.43E−05** 2.365429 2.06E−05** 2.588548 NIYAVTASS −2.867447** −2.975764 −1.078530 −1.347358 MRR 0.018147 0.888362 0.017399 1.129850 LOG (GDP) 0.273711** 2.685783 0.832121 1.069112 LOG (DS) −0.091433 −0.610702 −0.756797** −2.224561 D (TB) −5.42E−07 −0.607967 −1.11E−07 −0.164564 D (TC) −1.96E−05*** −2.976032 −2.48E−05*** −3.260388 CINFLAT −0.004690* −1.569960 −0.003215 −1.050968 R−2 squared 0.872880 0.924384 F-statistic 108.4750 Durbin-Watson 0.610638 0.856808 Schwarz criterion 2.531685 2.194683 Note: ***, ** and * denote significance at 1%, 5% and 10% respectively. positive effect on interest rate spreads. The results show that a 1% rise in ratio of remuneration to total assets will cause interest rate spreads to increase by 0.0000243%. This means that as profitability of the bank decreases due to increase in remuneration or other expenses, the banks recoup the losses by increasing the spreads, that is, either charging more on loans or paying less to deposits or some combination of the two. Non interest income to average total assets (NIYAVTASS) has a negative coef- ficient. However, the coefficient is significant only in the pooled OLS estimation. The coefficient of minimum rediscount rate (MRR) is positive but not significant. Gross domestic product (GDP) has a positive relationship interest rate spreads but significant only in the pooled OLS estimation. The results show that a 1 percent in- crease in gross domestic product will lead to 0.27 per- cent increase in interest rate spreads. The positive rela- tionship between GDP and interest rate spreads contra- dicts the business cycles effect discussed by [23]8. De- velopment stocks (DS), treasury bills, treasury certifi- cates and changes in inflation have negative effects on interest rate spreads. However, the coefficients of treas- ury bills and changes in inflation are not significant at 5 percent level in either of the estimation techniques9. In the fixed effects results, a 1 percent increase in develop- ment stock will reduce interest rate spreads by 0.76 per- cent, while a 1 percent increase in treasury certificate will reduce interest rate spreads by 0.000025 percent. 5.5. Further Consideration The adoption of pooled OLS is premised on the assump- tion of the exogeneity of the explanatory variables. However, this approach breaks down when the assump- tion of exogeneity is relaxed. Hence, relaxing the as- sumption requires that we adopt another estimation ap- proach capable of correcting biases introduced by in- cluding the lagged dependent variable in the right hand side of the equation. Consequently, a Generalized 9The coefficient of changes in inflation is only significant at 20 percent in the pooled OLS estimation results. The negative effect of inflation on interest rate spreads could be attributed to conduct of monetary policy in Nigeria and some other developing countries. Generally, lending rates tend to vary more than deposit rate, such that a loose monetary olicy that leads to higher inflation would be associated with lower lending rates, and, as a result, lower the interest rate spreads. See [20] for details. 8The authors argue that during recession the creditworthiness of the orrower declines and therefore he can borrow only at a higher interest rate, and this raises the spread. Copyright © 2012 SciRes. ME  A. E. AKINLO, B. O. OWOYEMI 844 Method of Moments (GMM) estimator in [24] approach was adopted to generate consistent estimates. Basically, such panel estimation techniques allow one to control for endogeneity or simultaneity of some of the explanatory variable in particular GMM estimators, as well as for potential biases due to correlation between the explana- tory variables and the regression residual. Moreover, the use of GMM estimation technique provides the robust- ness check for the results obtained through the pooled OLS and fixed-effects approaches. The results of the Generalized Method of Moments (GMM) for the sample period are as shown in Table 5. In general, the results from the GMM seem to diverge from the results from pooled OLS and fixed effects. Many areas of differences are discernible. In particular, some of the variables that are significant in pooled OLS and fixed effects are either not significant or barely significant. Moreover, the signs of the coefficients of some variables are different. The lagged value of the dependent variable, interest rate spreads (IRS (−1)) has a positive effect and is significant. This confirms the positive inertia effect of interest rate spreads. The coefficient of cash reserve requirement (CRR) is negative as compared with the positive sign obtained in the pooled OLS and fixed effects estimation tech- niques. However, the coefficient is not significant. Therefore, firm inference cannot be drawn from it. The ratios of average capital employed to average total assets, non interest expenses to average total assets, and remu- neration to total assets have negative effects on interest rate spreads as against positive effects obtained under pooled OLS and fixed effects models. However, their Table 5. Panel generalized method of moments 1986-2007. Variable Pooled OLS t-statistic IRS (−1) 1.330263 6.096511*** CRR −0.071689 −0.388612 KPTEMP −1483.884 −1.556921* LDEPRAT −115.6666 −0.368751 LNASS −162.0543 −0.221647 NXPVTA −2790.196 −1.239996 REMUTA −75.38301 −0.441414 NIYAVTASS 3849.895 1.166095 MRR −13.75431 −0.592386 GDP −0.002142 −1.100810 DS 0−266873 1.554071* TB 0.001709 1713846* J-statistic 1.48E−16 Instrument rank 12.000000 Note: *** and * denote significance at 1% and 10% respectively. coefficients are not significant. In like manner, the coef- ficient of minimum rediscount rate is negative as op- posed to the positive sign obtained under pooled OLS and fixed effects models. Non-interest income to average total assets (NIYAVTASS) has a non significant positive effect on interest rate spreads. Gross domestic product (GDP) has negative relation- ship with interest rate spreads while treasury bills and development stocks have positive relationship with in- terest rate spreads. The signs of the coefficients of these three variables are contrary to those obtained under pooled OLS and fixed effects models. In general, as the coefficients of many of these variable are not signifi- cance, firm can conclusion cannot be based on them. This simply suggests that pooled OLS and fixed effects tend to perform better in the estimation of the model adopted in our work. Thus attention should be focused on the results generated through these estimation techniques. 6. Concluding Remarks The purpose of this study is to examine the determinants of interest rate spreads in Nigeria over the period 1986- 2007. Based on data availability, some of the potential determinants of interest rate spreads analyzed include cash reserve ratio, ratio of average capital to average total assets, ratio of loans to total deposit, ratio of aver- age loans to average total assets, and ratio of non interest expenses to average total assets. Others include ratio of remuneration to total assets minimum rediscount rate, gross domestic product development stocks, treasury certificates, treasury bills and changes in inflation. The specified model was estimated using both pooled OLS and fixed-effects methods. However, for robustness check the model was estimated using the GMM approach. The results show among other things that cash reserve ratio and loans to total deposits ratio are positively related to interest rate spreads. In the same way, ratios of average loans to average total assets and remuneration to total assets are positively related to interest rate spreads. The same pattern holds for gross domestic product. However, development stocks and treasury certificates are nega- tively related to interest rate spreads in Nigeria. Generally, the results show that policy measures that would lead to a reduction in remuneration and other ex- penses and a reduction in the ratio of loan to total assets have potentials of reducing the interest rate spreads in Nigeria. Also, reduction in the statutory reserve require- ments prescribed by the Central banks would help to re- duce the interest rate spreads. REFERENCES [1] G. Quaden, “Efficiency and Stability in an Evolving Fi- nancial System,” 2004. Copyright © 2012 SciRes. ME  A. E. AKINLO, B. O. OWOYEMI Copyright © 2012 SciRes. ME 845 www.bub.be/Sg/En/Contact/pdf/2004/spo40517an.pdf [2] S. C. Valverde, R. L. del Pasto and F. R. Fernandez, “Banks, Financial Innovations and RegionalGrowth,” 2004. www.ugr.es/~franrod/ingrowth04.pdf [3] N. S. Ndung’u and R. W. Ngugi, “Banking Sector Interest Rate Spreads in Kenya,” Kenya Institute for Public Policy Research and Analysis (KIPPRA), Discussion Paper No. 5, 2000. [4] E. A. Onwioduokit and P. Adamu, “Financial Liberaliza- tion in Nigeria: An Assessment of Relative Impact,” In: Nigerian Economic Society, Benefits and Costs of Eco- nomic Reforms in Nigeria. Selected Papers for the 2005 Annual Conference of Nigerian Economic Society, 2005. [5] C. I. Enendu, “Determinants of Commercial Bank Interest Rate Spreads in a Liberalized Financial System: Empiri- cal Evidence form Nigeria 1989-2000,” Economic and Financial Review, Vol. 41, No. 1, 2003. [6] L. Angbazo, “Commercial bank Net Interest Margins, Default Risk, Interest-Rate Risk, and Off-Balance Sheet Banking,” Journal of banking and Finance, Vol. 21, No. 1, 1997, pp. 55- 87. doi:10.1016/S0378-4266(96)00025-8 [7] A. Saunders and L. Schumacher, “The Determinants of Bank Interest Rate Margins: An International Study,” Jour- nal of International Money and Finance, Vol. 19, No. 6, pp. 813-832. doi:10.1016/S0261-5606(00)00033-4 [8] R. Randall, “Interest Rate Spreads in the Eastern Carib- bean,” IMF Working Paper, WP/98/59. [9] L. Catao, “Intermediation Spreads in a Dual currency Economy: Argentina in 1990s,” IMF Working Paper, WP/ 98/90. [10] K. P. Wong, “On the Determinants of Bank Interest Mar- gins under Credit and Interest Rate Risks,” Journal of Banking and Finance, Vol. 21, No. 2, 1997, pp. 251-271. doi:10.1016/S0378-4266(96)00037-4 [11] A. Barajas, R. Steiner and N. Salazar, “Interest Spreads in Banking in Colombia, 1975-96,” Journal of Development Economics, Vol. 88, pp. 192-204. [12] P. L. Brock and L. Rojas-Suarez, “Understanding the Behaviour of Bank Spreads in Latin America,” Journal of Development Economics, Vol. 63, 2000, pp. 113-135. doi:10.1016/S0304-3878(00)00102-4 [13] T. A. Beck and H. Hesse, “Bank Efficiency, Ownership and Market Structure: Why Are Interest Spreads So High in Uganda?” World Bank Policy Research Working Paper 4027, 2006. [14] H. Hesse, “Financial Intermediation in the Pre-Consoli- dated Banking Sector in Nigeria,” World Bank Policy Research Working Paper 4267, 2007. [15] T. Beck and H. Hesse, “Why Are Interest Spreads So High in Uganda?” Journal of Development Economics, Vol. 88, No. 2, 2009, pp. 192-204. doi:10.1016/j.jdeveco.2008.07.004 [16] T. Ho and A. Saunders, “The Determinants of Bank In- terest Margins: Theory and Empirical Evidence,” Journal of Financial and Quantitative Analysis, Vol. 16, No. 4, 1981, pp. 581-600. doi:10.2307/2330377 [17] P. Martinez and M. S. Mody, “How Foreign Participation and Market Concentration Impact Bank Spreads: Evi- dence from Latin America,” Journal of Money, Credit and Banking, Vol. 36, No. 3, pp. 511-537. doi:10.1353/mcb.2004.0048 [18] E. W. Chirwa and M. Mlachila, “Financial Reforms and Interest Rate Spreads in the Commercial Banking System in Malawi,” IMF Staff Papers, Vol. 51, No. 1, 2004, pp. 96-122. [19] W. Samuel and L. Valderrama, “The Monetary Policy Regime and Banking Spreads in Barbados,” IMF Work- ing Paper, WP/06/211, 2006. [20] J. Crowley, “Interest Rate Spreads in English-Speaking African Countries,” IMF Working Paper, WP/07/101, 2007. [21] D. Tennant and A. Folawewo, “Macroeconomic and Market Determinants of Banking Sector Interest Rate Spread: Empirical Evidence from Low and Middle In- come Countries,” Department of Economics, University of West Indies, Mona, Mimeo. [22] J. A. Hausman, “Specification Tests in Econometrics,” Econometrica, Vol. 46, No. 6, 1978, pp. 1251-1271. doi:10.2307/1913827 [23] B. Bernanke and M. Gertler, “Agency Costs, Net Worth, and Business Fluctuations,” American Economic Review, Vol. 79, No. 1, 1989, pp. 14-31 [24] M. Arellano and S. R. Bond, “Some Tests of Specifica- tion for Panel Data: Monte Carlo Evidence and an Appli- cation to Employment Equations,” Review of Economic Studies, Vol. 58, No. 2, 1991, pp. 277-297. doi:10.2307/2297968

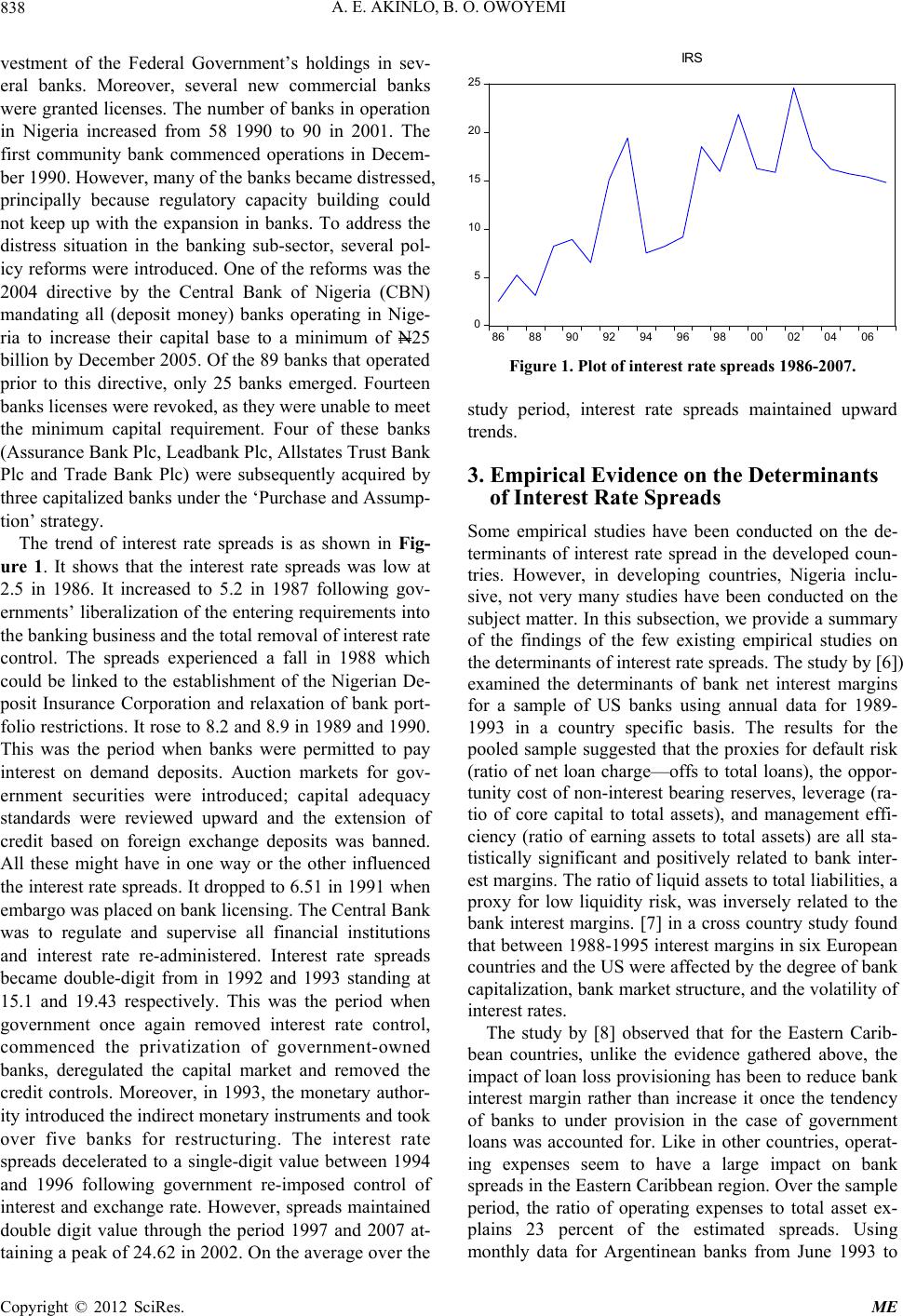

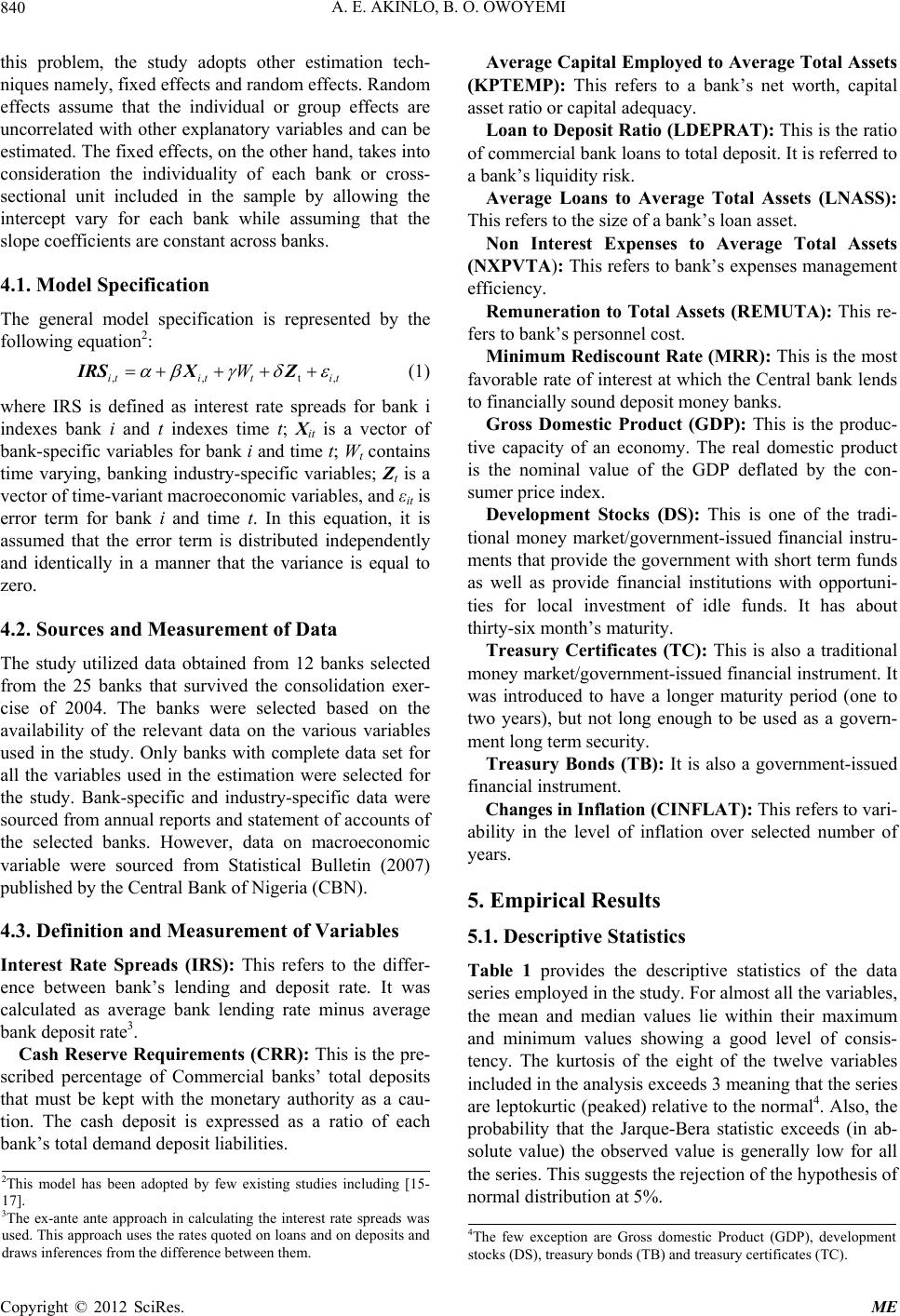

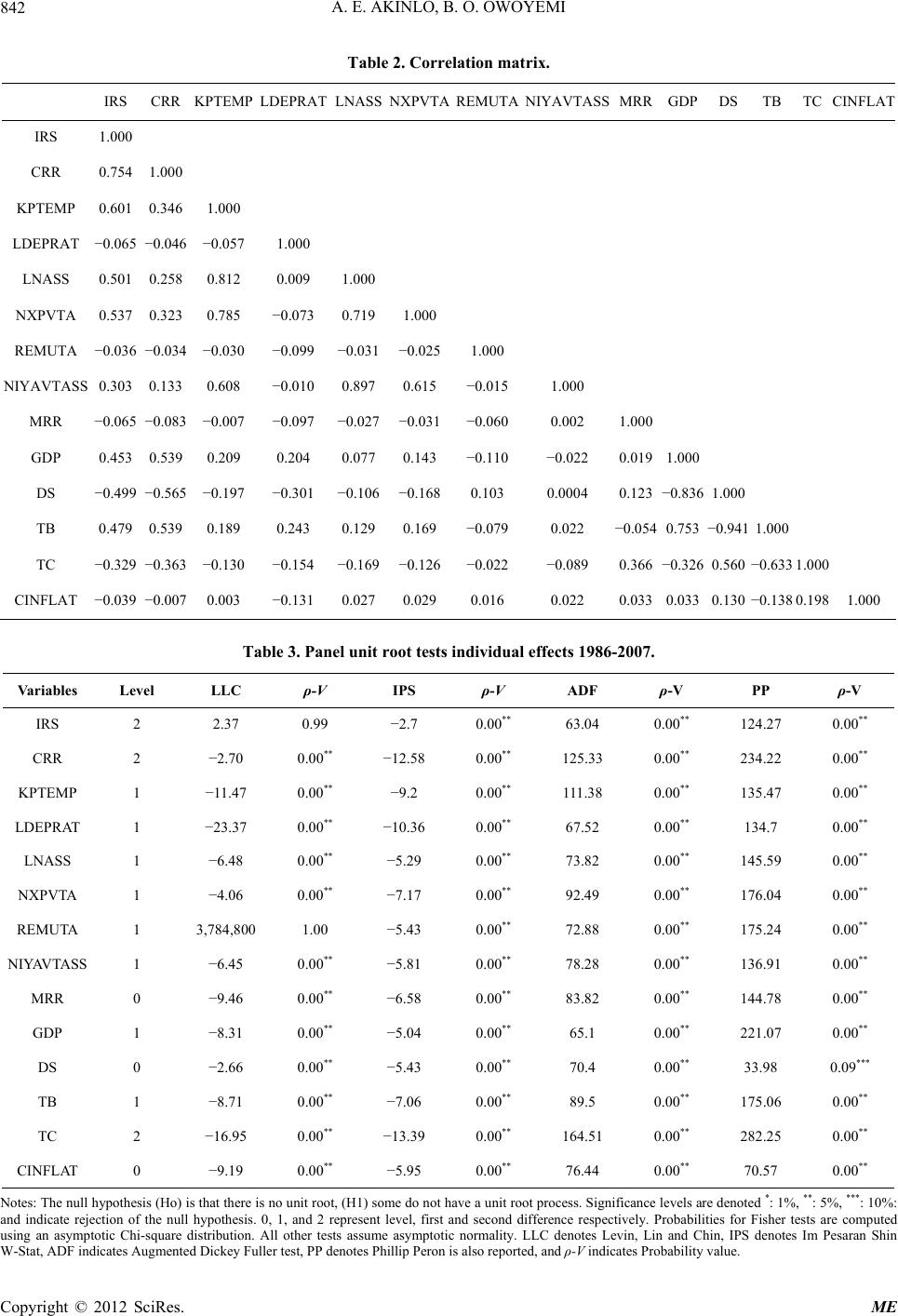

|