Paper Menu >>

Journal Menu >>

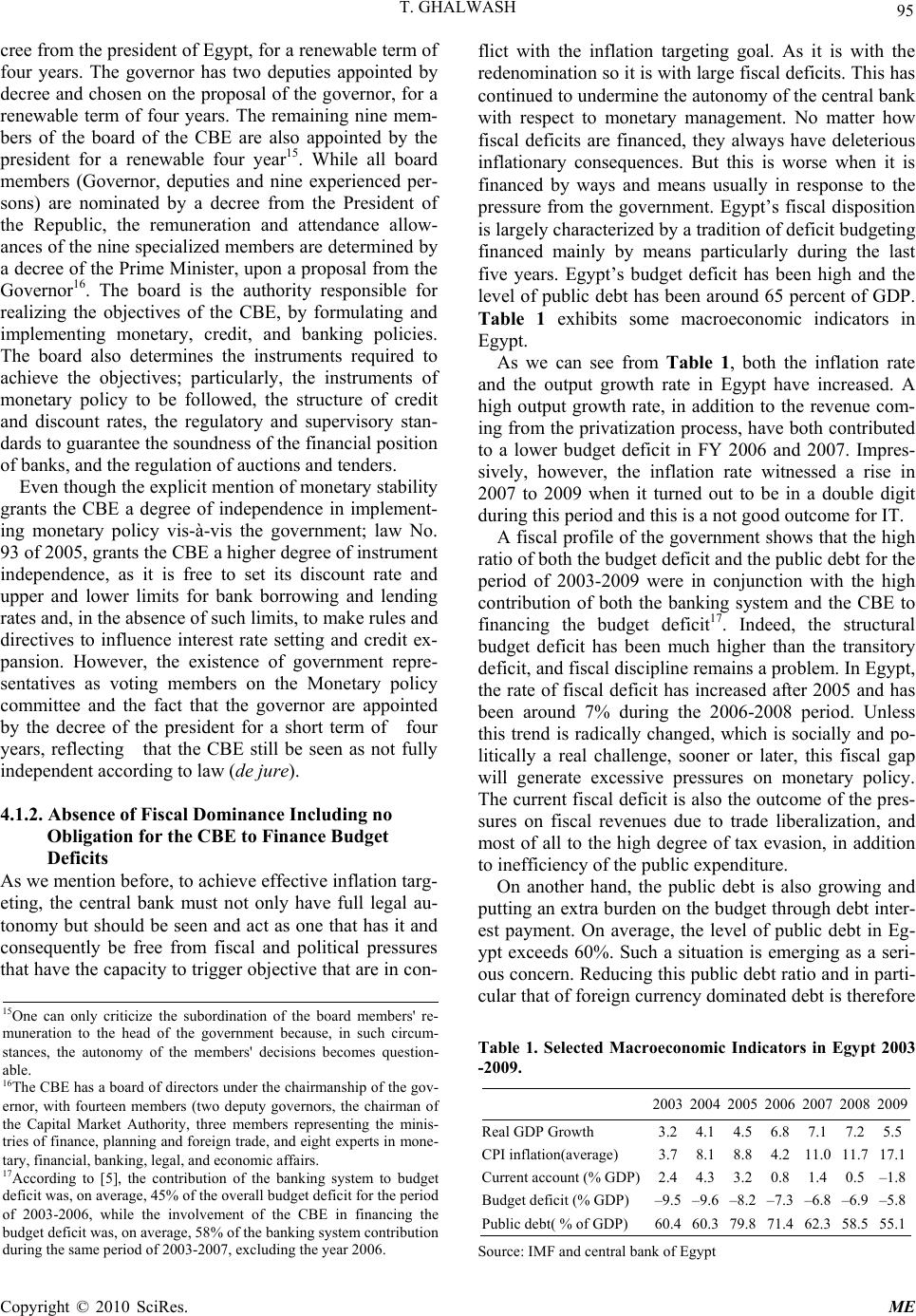

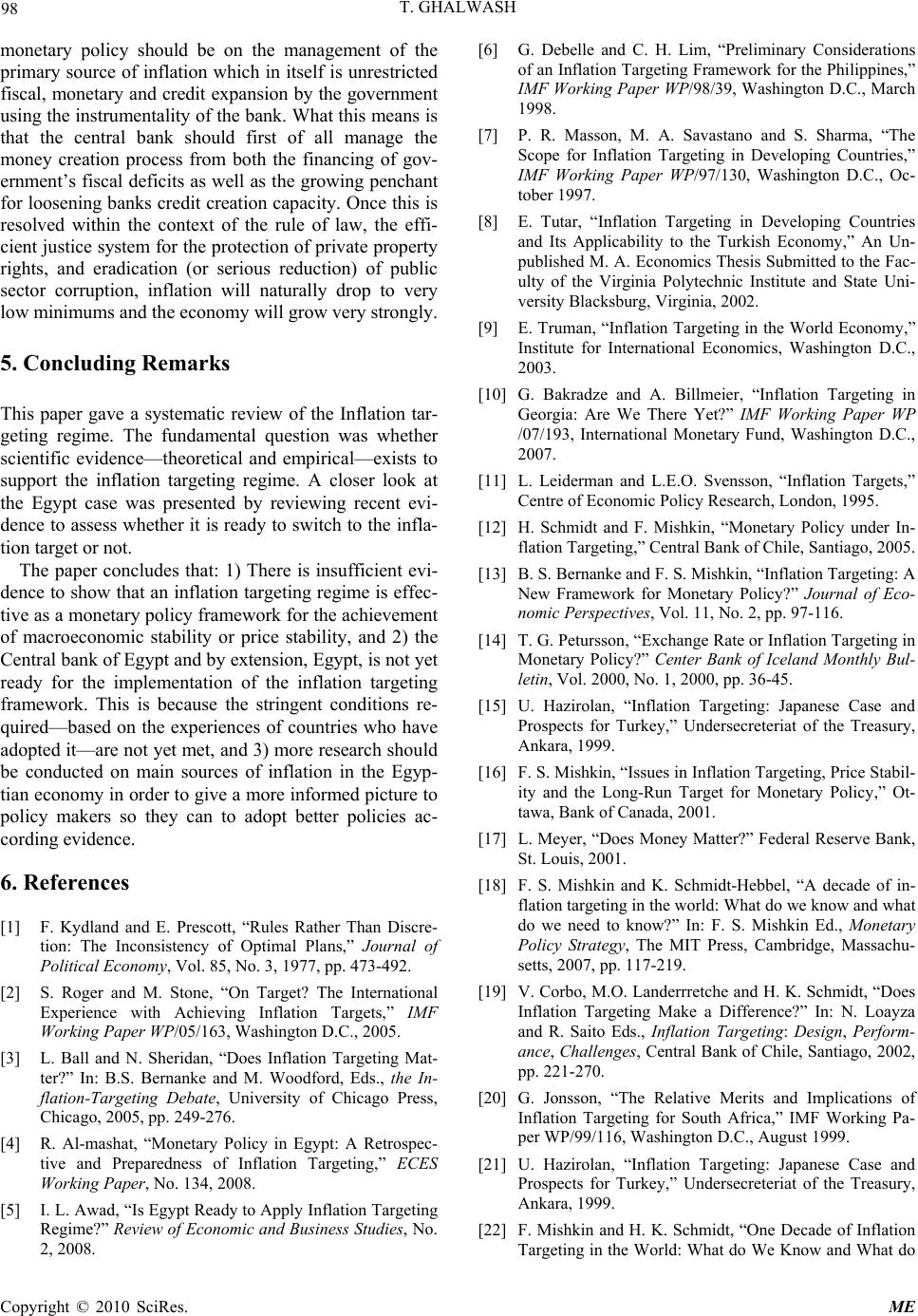

Modern Economy, 2010, 1, 89-99 doi:10.4236/me.2010.12009 Published Online August 2010 (http://www. SciRP.org/journal/me) Copyright © 2010 SciRes. ME An Inflation Targeting Regime in Egypt: A Feasible Option? Tarek Ghalwash Department of Economics, Mansoura University, Mansoura, Egypt E-mail: tarek.ghalwash@econ.umu.se Received June 6, 2010; revised July 10, 2010; accepted July 15, 2010 Abstract This paper addresses first whether scientific evidence—theoretical and empirical—exists to support the in- flation targeting regime and, secondly whether inflation target is worthwhile for Egypt. The method in this paper builds on a literature review of the theoretical and empirical research in the field of economics. Our conclusion shows that there is incomplete evidence from a number of countries supporting the inflation tar- geting regime as an effective monetary policy framework for the achievement of macroeconomic stability. The paper concludes that the Central Bank of Egypt and the Egyptian economy is not yet ready for the im- plementation of an inflation targeting regime. Keywords: Inflation Targeting, Monetary Regimes, Granger Causality Test 1. Introduction The fact that the inflation problem has received increas- ing attention in recent years has led to an increased in- terest in the effects of different monetary policy regimes. By “effects” we partly mean what governments want to achieve (i.e., a price stability, output growth), but also the effects on the economy performance so that it can succeed in an increasingly competitive world market. In other words, the interest in price stability policy issues is not only related to the “benefit side” but also the “cost side.” It is well known that the main focus of monetary policy should be attaining low, stable inflation, since any deviating from this objective may have serious conse- quences in terms of growth stability and economic wel- fare [1]. There seems to be a wide consensus among econo- mists that high and volatile inflationary rates distort rela- tive prices, discourage savings and investment, hinder economic growth and development, and can induce so- cial and political instability. In the quest to avoid this ma- laise, there are traditionally three aggregates that serve as an anchor for monetary policy management: a monetary aggregate, exchange rate, and inflation itself, which is called inflation targeting. Recently, Inflation target has become the dominant monetary policy prescription for a number of developing and industrialized countries and has been widely talked about as an economic policy1. Many countries have ado- pted inflation targeting as a monetary policy with the hopes of effectively reducing inflation and increasing economic and price stability. Even though it is often claimed that inflation targeting has helped these coun- tries achieve lower and more stable inflation along with more stable output, there is no conclusive evidence that inflation targeting directly caused the improved eco- nomic performance [3]. The adoption of an inflation targeting monetary fram- ework that started in New Zealand in 1990, is currently popular among a number of emerging market countries such as Brazil, Chile, Colombia, The Czech Republic, Hungary, Israel, Korea, Mexico, Poland, South Africa, Thailand and Turkey. In the West African sub-region, Ghana has also adopted inflation-targeting monetary fra- mework and other African countries are at various pre- paratory stages of adopting it. The debate over the effectiveness of inflation targeting to reduce price levels has been overshadowed in recent year by the financial crisis originating in the sub prime mortgage market and the run up in energy and food prices. It has focused on the view that inflation targeting places too much emphasis on inflation, potentially at the expense of other monetary policy goals. Some critics of inflation targeting see recent macroeconomic develop- 1Inflation targeting is a monetary regime that was first introduced in N ew Zealand in 1990 and as of 2006 had been adopted by more than twenty advanced and emerging economies (See Roger and Stone [2]).  T. GHALWASH Copyright © 2010 SciRes. ME 90 ments as being the downfall of inflation targeting2. Economists have started debating the pros and cons for developed and developing countries to shift from the current regime to inflation targeting. In light of these debates, one can view the debate in, for example, Egypt with regard to the country’s desire to be at the forefront of switching to an inflation targeting regime especially in the Middle East area3. On that front, the Central Bank of Egypt (CBE) announced in June 2005, its intention to “put in place a formal inflation targeting framework to anchor monetary policy once the fundamental prerequi- sites are met”. To our knowledge, there are few earlier studies deal- ing with whether Egypt is ready for inflation targeting,4 as there are a number of requirements to be met for such regime to be a sensible option as a monetary regime. Investigation is also needed as to whether the Egyptian Centre Bank (ECB) has considered the full implications of shifting to inflation targeting, in particular as to how this monetary regime will contribute to other objectives of the country, such as growth, employment creation and poverty reduction. Therefore, the main contribution of the present paper is to fill this gap in the debate. This paper will not assess the pros and cones of infla- tion targeting as this has been extensively discussed in previous studies: See, for example, [6-9]. It has, however, been observed by [10] that the growing number of coun- tries that target inflation and the perceived success of this monetary policy strategy serve as a stimulus for coun- tries that engage in alternative regimes—such as mone- tary or exchange rate targeting. This consideration raises the question of how to evaluate whether a country is ready to join the group of inflation targeters now, later or even never. This paper aims to give a systematic review of the in- flation targeting regime. The fundamental question is whether scientific evidence—theoretical and empirical— exists to support the inflation targeting regime. If infla- tion targeting can be supported, does it only apply within specific preconditions? Furthermore, a closer look at the case of Egypt is presented by reviewing recent evidence to asses whether it is ready to switch to inflation target- ing. Thus, the main objective in this paper entails not only a full understanding of the theoretical basis under- lying inflation targeting but also attempts to answer the question, is inflation targeting worthwhile in general, and especially for Egypt? The method along of this paper builds on a literature review of the theoretical and empirical research in the field of economics. The rest of the paper is structured as follows: Section 2 provides a systematic assessment of what is meant by the inflation targeting policy and what are the important preconditions for applying it. One of the objectives of this section is to provide an overview of the current understanding in the literature with respect to the applicability and relevance of the inflation target re- gime. Section 3 discusses the empirical evidence on the effects of inflation targeting in developed and developing countries and some of the lessons for monetary policy that can be drawn from the experiences of inflation tar- geting of Central Banks. Section 4 discusses whether Egypt satisfies the preconditions for adopting inflation targeting. Section 5 concludes with a summary of current knowledge and to what extent this information can pro- vide guidance to Egyptian policy-makers. 2. Monetary Policy Instruments, what does Inflation Targeting Mean? 2.1. Definition of Inflation Targeting Economists and monetary policy makers have long belie- ved that successful monetary policy should have a “nom- inal anchor”, a variable that the central bank could use to discipline their policy decisions and convince agents in the economy that the central bank was disciplined [11]. Various nominal anchors have been used in countries: examples are monetary aggregates and the exchange rate. In recent times, many countries in the world have moved towards a system/framework for conducting monetary policy known in academic and policy circles as “Infla- tion Targeting”. As the name indicates, the nominal an- chor is the inflation rate: the central bank is supposed to follow a monetary policy that is designed to achieve a stated objective with regard to the inflation rate. A review of the literature reveals several interpreta- tions of the definition of the inflation target. Inflation targeting is often defined as a framework for monetary policy, characterized by the public announcement of of- ficial quantitative targets (or target ranges) for the infla- tion rate, over one or more time horizons, and by explicit acknowledgment that low, stable inflation is the mone- tary policy’s primary long run goal ( see [12,13] and [14]). According to [15], inflation targeting is not a method to reduce the current inflation but an anchor to monitor and control price stability in an economy after a thorough disinflation period. With regards to literature discussions, [16] argues that the inflation targeting regime encompasses five main elements:1) the announcement to the public of an explicit quantitative target or range for a period of time; 2) an institutional commitment to price stability as the primary goal of monetary policy, to which other goals are subor- dinated, meaning that a country is more likely to adopt 2Joe Stiglitz, for example, has written that “Today, inflation targeting is being put to the test —and it will almost certainly fail”. 3Israel and Turkey are already adopting inflation targeting as a mone- tary policy framework. 4[4] and [5] examined whether Egypt is ready to adopt inflation targe t or not without examining whether this policy would be good for Egyp- tian economy as a whole.  T. GHALWASH Copyright © 2010 SciRes. ME 91 inflation target in the absence of fiscal and financial do- minance; 3) the central bank should have powerful mod- els to make inflation forecasts, which use some indica- tors and variables containing information on future infla- tion; 4) increased transparency of the monetary policy strategy through communication with the public and the markets about plans, objectives, and decisions of the monetary authorities; and 5) increased accountability of the central bank for attaining its inflation objectives. These defining features of inflation targeting require that the country's monetary authorities have the technical and institutional capacity for modeling and forecasting do- mestic inflation and have some idea or prediction of the time it takes for the determinants of inflation to have their full effect on the inflation rate. The inflation target provides full transparency in the implementation of monetary policy that enables financial institutions in the market to foresee the future with less uncertainty and behave accordingly. The conclusion that can perhaps be drawn from the previous discussion about the inflation targeting is that: the inflation targeting entails much more than a public announcement of numerical targets for inflation for the year ahead. This is important in the context of emerging and developing markets because many of them routinely reported numerical inflation targets or objectives as part of the government’s economic plan for the coming year, and yet their monetary-policy strategy should not be characterized as inflation targeting, as it requires all the elements mentioned above for it to be sustainable over the medium term. The main issue raised right now is how an inflation target model as a monetary policy regime works? 2.2. Inflation Target Model The simple version of this model can be written as fol- lows (see [17]): *** 2113 ()() ittt ttttt HH (1) )()( 1 * 1ttttttttErrHEH (2) )()( * 2 * 1 * tttttt HHrr (3) where is inflation rate, * is the central bank’s inflation target, t is Expectation on time t, )( * tt HH is output gap and r is interest rate and the symbol * refers to target or long-run variables (or ‘natural’ in the case of interest rate; * is the full-employment NAIRU level of output)5. The last term, t is an error term refl- ecting unobserved shock (random shock).The model con- tains three equations and three unknowns, namely, output, inflation and the interest rate. Firms are assumed to index their prices to their assessment of the central bank’s in- flation target, and * t is the public’s current estimate of the central bank’s target. Equation (1) is a price equation or a simple forward- looking Phillips curve6. The output gap explains the in- flation gap. In this model, inflation is caused by the out- put gap and the latter is caused by interest rate policies (see Equation (2)). Equation (2) is the expectation IS curve. Interest rate deviations from the target explain the output gap. If the central bank sets the interest rate below the natural rate, firms will find it profitable to borrow from the banking system to finance their Investment plans. Thus output will grow and the output gap will de- crease. Equation (3) is Taylor’s rule. It does not contain a random error because it is assumed that monetary policy operates without random errors. It is also assumed that 0 1 for stability of the equilibrium. If actual output gets close to the potential or if inflation rises above target, the central bank will increase nominal interest rates (and indirectly real interest rates). To see how the model works, consider the central bank announcement to the public regarding the formal target inflation rate. This can align the public’s expecta- tions of current and future target rates with the actual goals of the central bank. For example, reducing the pub- lic’s assessment of the current and future target inflation rates would allow average inflation to fall without any associated cost in terms of real economic activity. This implies that the monetary authorities can set any inflation target they desire without having any effect on the real equilibrium of the economy, i.e., the equilibrium level of real output is unaffected by a shock; only the equilibrium level of inflation changes7. This also implies that, given the independence of the real economy from the inflation target, inflation targeting becomes an autonomous policy objective. Therefore, the stability of the system is guar- anteed by the countercyclical role of the central bank in setting interest rates. In the same manner, the inflation target regime can also allow the central bank to reduce both inflation and output volatility by anchoring the public’s beliefs about future inflation. If a positive inflation shock causes the public to, (incorrectly), adjust upwards their estimate of the central bank’s target, a larger decline in the output gap is necessary in order to limit the rise in actual infla- tion through rising of interest rates. Greater stability of inflation expectations should reduce the volatility of in- flation and improve the short-run inflation—real activity 5The literature interprets r* as the rate that is consistent with ‘neutral’ monetary policy. This means that if the real funds rate is equal to the natural rate, then monetary policy will be consistent with b oth the inflation and output and output targets. 6The forward-looking specification is an attempt to overcome the pa- rameter instability commonly found after structural breaks. It is also motivated by the natural assumption that, as the inflation targeting regime gains credibility, expectations tend to converge to the targeted value. 7Because the changes on the interest rates policy will bring π closer to π*.  T. GHALWASH Copyright © 2010 SciRes. ME 92 trade off faced by the central bank. This, in turn, means that the volatility of both inflation and real activity would be lower under inflation targeting. In addition, when monetary policy is based on an inflation target regime, the central bank inflation forecast plays a key role in this regime. Therefore, the corresponding interest rate path is necessary for the private sector to determine the central bank’s forecast of potential output because providing interest rate projection is very important for reducing uncertainty. According to the theoretical model, a feasi- ble, and optimal, policy would set both inflation and the output gap equal to zero for all t. In this case, an interest policy consistent with such equilibrium would ensure that rt = * t r for all t. Given zero inflation, it is clear that the output gap only depends on the current and expected future interest rate gaps. This means that the inflation target can reduce the public’s uncertainty about either the current target or future targets. This can be easily seen by rewriting the Phillips curve as t HH tt T ttt T tit )( )( * 3 1121 (4) Where: Ttt T ttt/ (5) The new random error term in the Equation (4), is now composed of the original random shock and errors in the public’s forecast of the central bank’s inflation target. Thus, reductions in forecast errors associated with the public’s assessment of the inflation target, like a reduc- tion in the variance of the cost shock, allow both infla- tion (around target) and the output gap to become more stable. In this case, the interest rate projection would only provide the public with the central bank’s assess- ment of future demand shocks to which the policy rate will presumably be adjusted to offset. Following the pervious analysis, it seems that the main argument in favor of inflation targeting is that an official announcement of an inflation target makes a central bank’s policy more credible, which helps to alleviate the dynamic inconsistency problem, and thus should lead to lower (expectations of) inflation and inflation variability8. Further, one can draw the conclusion that the transpar- ency on how monetary policy operates under inflation targeting makes the formation of inflation expectations easier, thereby strengthening the ability of central banks to achieve inflation targets, and therefore, prompting other central banks to mimic this practice. 2.3. Preconditions for Inflation Targeting Regime The literature and experience of long-time inflation tar- geters have identified preconditions which have to be fulfilled in order to implement successful inflation tar- geting [18]. The first and probably the most important precondition for implementing the inflation targeting is that the central bank must be given complete independ- ence to adjust freely its instruments of monetary policy toward the attainment of the objective of low inflation. Central bank needs to have the freedom to set its instru- ments of monetary policy in a way it believes that the objective will be achieved most adequately. Instrument independence mainly implies that the central bank is not constrained by the need to finance the government budget9. In addition, there should not be any political pressure on the central bank to raise the rate of economic growth in such a way that is inconsistent with the achievement of the inflation target [19]. The second precondition for implementation of infla- tion targeting is the existence of efficient monetary pol- icy instruments. According to this condition, monetary authorities have to be able to model inflation dynamics in the country and to forecast the inflation to a reasonable degree [20]. So, the monetary authorities should have access to policy instruments that are effective in influ- encing the macroeconomic variables. And also, there must be sufficiently developed money and capital mar- kets to react quickly to the use of those instruments be- cause the monetary policy’s tools to achieve an inflation target may weaken the positions of the banks and may lead to the undershooting of the inflation target. The third, but not less important precondition for in- flation targeting is closely connected to the credibility. Under the inflation target regime, the country should incorporate transparency and accountability into the cen- tral bank’s function. Both, accountability and transpar- ency are dominantly determined by the quality of central banks communication to the public. It is very important for the central bank to inform the public about every cir- cumstance connected to its policy, in order to make its goals and instruments clear and controllable. The public can use this information to form better expectations about future policy actions and keep track of the central bank’s performance. In addition, the increased account- ability of inflation targeting enables the monetary au- thority to monitor and enhance the understanding of ex- pectations. It also decreases the possibility of a time in- consistency trap, which leads to deviations from mone- tary authority’s long-term objective. Moreover, it pro- vides a good benchmark that can easily be observed by the agents in the economy [21]10. A transparent monetary policy makes it more difficult for a central bank to devi- ate from set targets, since such behaviour would have serious and long-lasting impact effects on its credibility. 8If credible, inflationary expectations are more accurate allowing busi- nesses and consumers to better plan their production and spending. 9This means that the central bank should not be required to attain low interest rates on public debt or to maintain a particular nominal ex- change rate. 10Usually, accountability is not established by explicit legislation, but through the transparency of monetary policy that inflation targeting creates.  T. GHALWASH Copyright © 2010 SciRes. ME 93 Central bank transparency should involve making infla- tion target explicit and public. This means that the cen- tral bank should have some form of published commu- nication which not only announces the target but also describes the policy actions needed to reach and maintain the inflation target. To conclude, the previous discussion has highlighted the importance of preconditions for successful inflation targeting. 3. Inflation Targeting in Emerging Countries: Empirical Evidence The objective in this section is to review the empirical literature for developed and developing countries that is relevant to the objectives of this paper. An attempt will be made to present a systematic review, considering dif- ferent aspects of inflation targeting regime, such as regulatory effects on 1) inflation rate, 2) real economy, and 3) expected inflation. 3.1. Evidence in Developed Countries As mentioned above the academic debate around the in- flation target regime started soon after New Zealand first instituted this monetary policy framework in early 1990. Since that time, 22 countries have formally adopted in- flation targeting, and no country that has adopted it has abandoned it, although inflation targeting contribution to overall economic performance is still being debated. There is an extensive empirical literature related to the connection between inflation targeting regime as a mo- netary policy and economic performance. The finding of empirical studies shows that inflation targeting countries have succeeded to reduce inflation and the volatility of inflation and to obtain inflation outcomes closer to target levels [22]. Reference [6] compares average inflation levels for seven inflation targeting countries with 7 countries ex- cluding nontargeters countries. This contribution finds a much steeper decline in inflation in the case of the for- mer group, concluding that inflation targeting is useful for countries facing lack of anti-inflation credibility. [23] interpret similar results as a process of ‘convergence’, in that on average inflation targeting countries converge to the inflation rates of the non- inflation targeting countries in the targeting period. [24] are able to conclude that inflation targeting countries have been able to meet their inflation targets and reduce inflation volatility11. Closely related to the previous results, [25] employ cross-section difference-in-difference regressions to ex- amine the treatment effects of inflation targeting in 20 OECD countries, seven of which adopt inflation target- ing. They discover that after adopting inflation targeting, the economic performance of these countries improves. But, non-targeting countries also experience improve- ments around the same time. Thus, they argue that better economic performance reflects factors other than the monetary regime and conclude that inflation targeting does not produce a major effect. In other words, inflation targeting is irrelevant. However, there are other studies that show a some- what different result. [26] Provide a comparative analysis. They match three inflation-targeting countries (New Zea- land, Canada, and the United Kingdom) with three near- by non-inflation-targeting countries (Australia, the Uni- ted States, and Germany), finding little empirical evide- nce that an inflation-targeting regime performs better than a non-inflation-targeting regime. In addition, [27] states that “there is no evidence that inflation targeting has been detrimental to growth productivity, employment, or other measures of economic performance”, a view supported by [28] in his comparison of 5 industrial coun- tries that have been targeting inflation for at least 10 years and 6 non-inflation targeting industrial countries. Finally, [29] use matching methods to evaluate the tre- atment effects of adopting inflation targeting on seven industrial countries with fifteen non-inflation targeting in- dustrial countries as the non-treatment group. They show no significant effects on inflation and its variability, ar- guing the window-dressing view of inflation targeting. [30] uses the same method and sample data as [29], find- ing that inflation targeting does not significantly affect output growth or its variability. [31], however, show that inflation targeting OECD countries suffer smaller output losses in terms of sacrifice ratio during the disinflation- ary period than non-targeting counterparts. [32], employ- ing intervention analysis, find lower inflation rates, well- anchored and accurate inflation expectations for both targeting and non-targeting countries. In summary, we can say that the empirical studies re- viewed fail to produce convincing evidence that IT im- proves inflation rate and economic stability. In addition, as [23] argue, the environment of the 1990s was in gen- eral terms a stable economic environment, “a period fri- endly to price stability” and inflation was on a downward trend in many countries, especially developed countries. 3.2. Evidence in Developing Countries Recently, more than a dozen developing countries have officially adopted inflation targeting. Thus, a complete evaluation of the effectiveness of inflation targeting req- uires further evidence from developing countries. But, in 11Comparing the pre-targeting period with the post-targeting period may not capture the impact of inflation targeting per se, but rather a re-orientation of monetary policy towards lowering inflation (which could be achieved with or without inflation targeting). Comparisons between inflation-targeting countries and non-targeting countries are weaker and , a g ain , de p end on the control g rou p used.  T. GHALWASH Copyright © 2010 SciRes. ME 94 general, most developing countries—whether they tar- geted inflation or not—performed much better in terms of growth and inflation since 2000 than during the 1990s. The evidence also shows that those that adopted inflation targeting tended to see bigger improvements than others, both in terms of inflation and growth performance12. Reference [29] evaluates the effect of inflation targeting on inflation and inflation variability in thirteen developing countries that have adopted this policy by the end of 2004, using a variety of propensity score matching methods. They found that inflation targeting has quantitatively large and statistically significant effects on lowering both in- flation and inflation variability in these countries. On average, the adoption of inflation targeting has led to a reduction in the level of inflation by nearly 3 percent13. Following the methodology, [35] focus specifically on developing economies, excluding industrial economies from among their inflation targets and their non-inflation targets. They found that the effects of inflation targeting were statistically and economically significant. On the another hand, [36] used panel data to assess the effect of inflation target in developing countries, and found no evidence that the inflation targeting regime improves performance of inflation and output growth in developing countries. That is, inflation targeting regimes do not lower the costs of disinflation. Finally, a group of scholars from Cambridge University conducted a pains- taking research in the effect of inflation target, they con- cluded in these words: “We have attempted in this study to gauge empirical evidence for both developed and emerging countries that adopted the new monetary policy strategy that has come to be known as inflation targeting (IT). It may very well be the case that IT countries, de- veloped and emerging, have been successful in taming and controlling inflation. But then there is also evidence that clearly suggests that non-IT central banks have also been successful in achieving and maintaining consis- tently low inflation rates”. The previous empirical findings produce mixed evi- dence in economic performance for developing and de- veloped countries, but it seems developing countries gain more from inflation targeting policy than do developed countries. The main conclusion that we can draw from these discussions is that it may very well be the case that infla- tion targeting countries, developed and emerging, have been successful in taming and controlling inflation. But then there is also evidence that clearly suggests that non- inflation targeting central banks have also been success- ful in achieving and maintaining consistently low infla- tion rates. Our overall conclusion, then, is that the avail- able evidence we have managed to gauge clearly sug- gests that a central bank does not need to pursue an infla- tion targeting strategy to achieve and maintain low infla- tion, particularly during the mature phase of stationary targeting. The main question that arises is, is inflation target worthwhile for Egypt’s Economy? To answer this question, we will try to assess, theoretically and empiri- cally, if Egypt meets the preconditions for adopting an inflation target with some general comments on inflation targeting itself as a monetary policy. 4. Is Egypt Ready for Adopting Inflation Targeting In this section, we try to analyze the prerequisites and ap- plicability of inflation targeting in Egypt to evaluate its feasibility. The main focus will be on the assessment of whether the preconditions of inflation targeting are satis- fied in Egypt. In order to do that, we explore three basic elements that are the precondition for adopting the infla- tion target: 1) Independence status of the Central bank of Egypt (CBE); and 2) inflation forecasting capability in Egypt; and 3) existence of relationship between the mo- netary policy instruments and inflation. 4.1. Independence Status of the Central Bank of Egypt (CBE) Related to the institutional conditions discussed in the precondition requirements for adopting inflation target- ing, the independence of the central bank seems to be the first feature that should be implemented. This am- biguity arises from the fact that there are several kinds of independence: political and economic, de jure and de- facto,14 constitutional and statutory, independence within and independence from the government, strategic (to formulate policy) and tactical (day-to-day operations), instrument independence but not goal independence [37], and independence of the executive, judiciary, and legis- lative [38]. In this manner, we try to asses whether Egypt has satisfied the first preconditions for an IT regime in such a way that it makes the adoption of an IT regime in Egypt feasible to anchor individuals’ expectations around the potential inflation targets. In order to do that, we explore two basic elements that are related to the in- stitution conditions: 1) Independence status of the CBE from the government; and 2) absence of fiscal domi- nance including no obligation for the CB to finance budget deficits. 4.1.1. Independence Status of the CBE from the Government In Egypt, the central bank governor is appointed by de- 12[33], and [34] are among those who find more significant and positive effects of inflation targeting. 13These findings are consistent with the earlier conclusions of [24], and [23]. 14De jure CBI would be equivalent to CBI as measured on the basis o f legal documents whereas de facto CBI would be equivalent to CBI as factually implemented.  T. GHALWASH Copyright © 2010 SciRes. ME 95 cree from the president of Egypt, for a renewable term of four years. The governor has two deputies appointed by decree and chosen on the proposal of the governor, for a renewable term of four years. The remaining nine mem- bers of the board of the CBE are also appointed by the president for a renewable four year15. While all board members (Governor, deputies and nine experienced per- sons) are nominated by a decree from the President of the Republic, the remuneration and attendance allow- ances of the nine specialized members are determined by a decree of the Prime Minister, upon a proposal from the Governor16. The board is the authority responsible for realizing the objectives of the CBE, by formulating and implementing monetary, credit, and banking policies. The board also determines the instruments required to achieve the objectives; particularly, the instruments of monetary policy to be followed, the structure of credit and discount rates, the regulatory and supervisory stan- dards to guarantee the soundness of the financial position of banks, and the regulation of auctions and tenders. Even though the explicit mention of monetary stability grants the CBE a degree of independence in implement- ing monetary policy vis-à-vis the government; law No. 93 of 2005, grants the CBE a higher degree of instrument independence, as it is free to set its discount rate and upper and lower limits for bank borrowing and lending rates and, in the absence of such limits, to make rules and directives to influence interest rate setting and credit ex- pansion. However, the existence of government repre- sentatives as voting members on the Monetary policy committee and the fact that the governor are appointed by the decree of the president for a short term of four years, reflecting that the CBE still be seen as not fully independent according to law (de jure). 4.1.2. Absence of Fiscal Dominance Including no Obligation for the CBE to Finance Budget Deficits As we mention before, to achieve effective inflation targ- eting, the central bank must not only have full legal au- tonomy but should be seen and act as one that has it and consequently be free from fiscal and political pressures that have the capacity to trigger objective that are in con- flict with the inflation targeting goal. As it is with the redenomination so it is with large fiscal deficits. This has continued to undermine the autonomy of the central bank with respect to monetary management. No matter how fiscal deficits are financed, they always have deleterious inflationary consequences. But this is worse when it is financed by ways and means usually in response to the pressure from the government. Egypt’s fiscal disposition is largely characterized by a tradition of deficit budgeting financed mainly by means particularly during the last five years. Egypt’s budget deficit has been high and the level of public debt has been around 65 percent of GDP. Table 1 exhibits some macroeconomic indicators in Egypt. As we can see from Table 1, both the inflation rate and the output growth rate in Egypt have increased. A high output growth rate, in addition to the revenue com- ing from the privatization process, have both contributed to a lower budget deficit in FY 2006 and 2007. Impres- sively, however, the inflation rate witnessed a rise in 2007 to 2009 when it turned out to be in a double digit during this period and this is a not good outcome for IT. A fiscal profile of the government shows that the high ratio of both the budget deficit and the public debt for the period of 2003-2009 were in conjunction with the high contribution of both the banking system and the CBE to financing the budget deficit17. Indeed, the structural budget deficit has been much higher than the transitory deficit, and fiscal discipline remains a problem. In Egypt, the rate of fiscal deficit has increased after 2005 and has been around 7% during the 2006-2008 period. Unless this trend is radically changed, which is socially and po- litically a real challenge, sooner or later, this fiscal gap will generate excessive pressures on monetary policy. The current fiscal deficit is also the outcome of the pres- sures on fiscal revenues due to trade liberalization, and most of all to the high degree of tax evasion, in addition to inefficiency of the public expenditure. On another hand, the public debt is also growing and putting an extra burden on the budget through debt inter- est payment. On average, the level of public debt in Eg- ypt exceeds 60%. Such a situation is emerging as a seri- ous concern. Reducing this public debt ratio and in parti- cular that of foreign currency dominated debt is therefore Table 1. Selected Macroeconomic Indicators in Egypt 2003 -2009. 2003 2004 2005 2006 2007 2008 2009 Real GDP Growth 3.24.1 4.5 6.8 7.17.25.5 CPI inflation(average) 3.78.1 8.8 4.2 11.011.717.1 Current account (% GDP)2.44.3 3.2 0.8 1.40.5–1.8 Budget deficit (% GDP) –9.5–9.6 –8.2 –7.3 –6.8–6.9–5.8 Public debt( % of GDP) 60.460.3 79.8 71.4 62.358.555.1 Source: IMF and central bank of Egypt 15One can only criticize the subordination of the board members' re- muneration to the head of the government because, in such circum- stances, the autonomy of the members' decisions becomes question- able. 16The CBE has a board of directors under the chairmanship of the gov- ernor, with fourteen members (two deputy governors, the chairman o f the Capital Market Authority, three members representing the minis- tries of finance, planning and foreign trade, and eight experts in mone- tary, financial, banking, legal, and economic affairs. 17According to [5], the contribution of the banking system to budge t deficit was, on average, 45% of the overall budget deficit for the period of 2003-2006, while the involvement of the CBE in financing the budget deficit was, on average, 58% of the banking system contri b ution during the same period of 2003-2007, excluding the year 2006.  T. GHALWASH Copyright © 2010 SciRes. ME 96 necessary to reduce the vulnerabilities in a context of a more exchange rate flexibility. For the time being, in Egypt, despite the progress achieved in the ratio of pub- lic debt in 2007-2009 compared to the previous periods, the government still relies on seigniorage revenues in order to close the transitory gap between its revenue and its expenditure flows. It is true that the reliance on seigniorage revenues is often higher in developing coun- tries due to low and unstable incomes and poor tax col- lection procedures but this is not consistent with inflation targeting, and is likely to hamper the central bank’s in- dependence. The conclusion one can draw from the previous facts is that the legal instrument independence granted to the CBE is sketchy and does not go beyond the de jure in- dependence18. Consequently, the existence of govern- ment representatives as voting members on the MPC and the coercion of the CBE to extend finance to the gov- ernment are two elements sufficient to undermine any meaning of the de facto independence of the CBE. 4.2. Inflation Forecasting Capability in Egypt As mentioned above, the inflation forecast is central to any inflation-targeting regime and requires a well-de- veloped technical infrastructure, including quality data, construction of an appropriate price index, and forecast- ing and modeling capabilities. A forward-looking infla- tion targeting framework is, in fact, “inflation forecast targeting” [40]. Indeed, inflation targeting is not applied mechanically and does not focus only on current infla- tion but on containing inflation as a medium-term goal. Central banks pay attention to indicators that can predict future inflation [41]. To what extent is this technical infrastructure currently available in Egypt? Regarding the quality of data, unre- liability of data is one of the major problems facing econometric modeling and estimation in Egypt which incidentally is central to price-inflation forecasting for inflation targeting. Even with so many reforms and im- provement of the data collection in Egypt19, timely and reliable data availability remains an issue20. The absence of this desideratum means that we cannot meet the de- mands for full, timely, and accurate information on key variables such as GDP, financial and trade data etc. over required time periods. Since forecasting is at the heart of inflation targeting, such forecasts may not be as robust as should be expected by its advocates since data is neces- sary to implement them. Although the CBE generates its own data, in some cases, particularly in the past, there are significant divergences among the data series being published on the same subject by other organizations with data-generating responsibility. These could have a consequence of fundamental disparities in data generat- ing and reporting procedures. Moreover, the use of the consumer price index (CPI) in Egypt for evaluating the inflation behaviour may serve a useful tool, but it will be risky if the CBE is planning to use it for the purpose of inflation targeting. As in all de- veloping countries, choosing such an index is problem- atic. The first reason is that foodstuffs, which make up a large part of the basket, have highly variable prices be- cause of their sensitivity to weather conditions. This high variability translates into more volatile CPI inflation. Second, goods and services with subsidized prices have a substantial share of the basket. Large movements in regulated prices, which have a direct impact on the over- all price level, may lead to poor control of inflation and damage the central bank’s credibility. In the Egyptian case, food & non alcoholic beverages accounted for more than 50% of the old CPI basket, and still account for al- most 40% of the current one. Within this category, bread, cooking oil and sugar benefit from consumption subsi- dies. Also subsidized are petroleum products (rent, po- wer and fuel represent around 10% of the basket) phar- maceuticals (medical care represents 4%), water, elec- tricity & gas (around 12%), (CAPMAS, 2005). Given this information, one can conclude that having a target limited to the CPI in Egypt is a serious problem, because it will underpin any meaning of expectations about future inflation: a key determinant of actual inflation. The ef- fectiveness of monetary policy as a nominal anchor de- pends on what is targeted and how. One of the funda- mental problems arising from this framework is therefore the absence of a valid price index. 4.3. Existence of Relationship between the Monetary Policy Instruments and Inflation In this section, we examine one of the main preconditi- ons for a successful adoption of inflation targeting fram- ework as expounded in many empirical studies and gives a solid understanding of the relationship between mone- tary policy instruments and macroeconomic outcomes via the monetary transmission mechanism. In order to quantify the importance of monetary policy variables in determining changes in the consumer price index (CPI) in Egypt, this paper adopts the Granger causality tests in both bivariate and multivariate using the baseline VAR model form which is employed by [43] and, more re- cently, by [44]. The baseline VAR model representation 18One of the tough critiques of the CCMP came from the Morgan Stanley report about the government, specifically the prime minister, overriding both the CCMP and the MPC of the CBE [39]. 19In 2005, Egypt subscribed to the IMF’s Special Data Dissemination System (SDDS), which requires prompt posting of various macroeco- nomic datasets, compiled in line with best International practice and comparable across countries. 20[42] using the Data Quality Assessment Framework (DQAF) to as- sess the quality of data in Egypt. the most defects in the Egyptian data were found in the accuracy and reliability.  T. GHALWASH Copyright © 2010 SciRes. ME 97 is given by: 1 () () tt t YALYLZ (6) where t Y is a k vector of endogenous variables, t Z is a d vector of exogenous variables, and A and are matrices of coefficients, and t is a vector of structural shocks with the variance covariance matrix () . In the baseline model, the vector of endogenous vari- ables consists of the gross domestic product (GDP), consumer price index (CPI), Broad money supply (M2), Government fiscal spending (FS), interest rate (R) and exchange rate (EX)21: ),,,,2,,(EXRFSMCPIGDPZt (7) In order to apply the Granger casualty test in a VAR framework, the general mathematical representation of the test can be written as: 111 11 mm ttjtj jtjt jj yyz (8) 222 2 11 mm tjtjjtjt jj zzz (9) where i are the constant terms, m is the lag order, and it are error terms and assumed to be serially un- correlated with zero mean and finite covariance matrix. In order to test causality from z to y, the null hypo- thesis )(01 H is expressed as 10 (1,2,...,) jjm and the alternative is at least one of ),,...,2,1( 1mj j is significantly different from zero. Similarly, )(02 H of testing the causality from y to z is 20 ( jj ),...,2,1 m against at least one of 02 is not zero. The paper used annual data from 1998Q1 to 2009Q4 gathered from the International Monetary Fund’s Inter- national Financial Statistics, and Central Bank of Egypt. Table 2 presents the results of the bivariate and multi- variate block Granger causality tests for CPI and GDP in Egypt. As we can see in Table 2, the results suggest the ca- usal link between the policy variables on consumer price index and gross domestic product. The joint probabilities for the multivariate tests suggest the rejection of the null hypothesis. The bivariate tests for Cosumer price index (CPI) suggest that all the variables except interest rate and money supply cause significant variations in CPI. This means that the level of output, exchange rate and fiscal spending cause variations in the level of prices or the CPI22. The findings support that the fact that fiscal policy is also important for achieving price stability and economic growth. In addition, the bivariate tests show that money supply has a significant Granger-effect on output but not on prices. The empirical results suggest that Egypt’s exchange rate is quite significant with re- spect to GDP as with CPI. This is not surprising given the recent float of the Egyptian currency, and the subse- quent positive effects on exports and the rate of growth of GDP. The results also show consumer price index, money supply, and government fiscal spending signifi- cantly drive GDP. The previous results show that the interest rate and money supply as a monetary target regime are not suffi- cient in the Egyptian economy to send the right message to individuals to adjust their expectation about inflation. Meaning that, the mechanism of the inflation targeting model, as presented in Section 2, undermines the infla- tion target. Another important point of concern is about the indi- rect effect between the money supply and inflation. It seems that the impact of money supply adjustments on inflation is not a one-time strike on inflation. Therefore when the monetary policy rate is adjusted in order to influence other rates, which invariably affects the spend- ing decisions of economic actors, it neither affects the economy nor inflation in a manner that is readily pre- dictable. The transmission mechanism of monetary policy has long and variable lags because the economy takes time to adjust to changes in monetary conditions. Inflation tar- geting however does not seem to operate within this frame of reasoning which suggests that the actual infla- tion can be adjusted to hit the target inflation within a short period if a deviation is observed. This belief is just deceptive. What happens is merely the suppression of the truth about the prevailing conditions of inflation. Ac- cording to the previous points, if we recognize the causes and uproot the inflation in Egyptian economy, then that problem is almost solved. It is expected that the focus of Table 2. Granger Causality Tests: Baseline VAR, 1998– 2009 1/. Effect on CPI Chi-square probability Effect on GDP Chi-square probability GDP 15.14 0.001* CPI 10.57 0.004* M2 3.10 0.681 M2 6.61 0.092** FS 8.45 0.057** FS 8.59 0.064** R 5.66 0.249 R 4.89 0.138 EX 12.84 0.003* EX 11.59 0.005* Jointly33.67 0.000* Jointly 41.27 0.000* Source: Authors’ calculations. 1/ The block Granger causality test for exclusion of a variable is based on a Wald test and follows a χ² distribution; * and ** denote rejection of the exclusion at the 1 and 5 percent level. 21All variables are in logs for all variables except interest rate where we have used the level. 22This is expected since in a small open economy like Egypt, prices o f traded goods return rapidly to world levels following an exchange rate appreciation.  T. GHALWASH Copyright © 2010 SciRes. ME 98 monetary policy should be on the management of the primary source of inflation which in itself is unrestricted fiscal, monetary and credit expansion by the government using the instrumentality of the bank. What this means is that the central bank should first of all manage the money creation process from both the financing of gov- ernment’s fiscal deficits as well as the growing penchant for loosening banks credit creation capacity. Once this is resolved within the context of the rule of law, the effi- cient justice system for the protection of private property rights, and eradication (or serious reduction) of public sector corruption, inflation will naturally drop to very low minimums and the economy will grow very strongly. 5. Concluding Remarks This paper gave a systematic review of the Inflation tar- geting regime. The fundamental question was whether scientific evidence—theoretical and empirical—exists to support the inflation targeting regime. A closer look at the Egypt case was presented by reviewing recent evi- dence to assess whether it is ready to switch to the infla- tion target or not. The paper concludes that: 1) There is insufficient evi- dence to show that an inflation targeting regime is effec- tive as a monetary policy framework for the achievement of macroeconomic stability or price stability, and 2) the Central bank of Egypt and by extension, Egypt, is not yet ready for the implementation of the inflation targeting framework. This is because the stringent conditions re- quired—based on the experiences of countries who have adopted it—are not yet met, and 3) more research should be conducted on main sources of inflation in the Egyp- tian economy in order to give a more informed picture to policy makers so they can to adopt better policies ac- cording evidence. 6. References [1] F. Kydland and E. Prescott, “Rules Rather Than Discre- tion: The Inconsistency of Optimal Plans,” Journal of Political Economy, Vol. 85, No. 3, 1977, pp. 473-492. [2] S. Roger and M. Stone, “On Target? The International Experience with Achieving Inflation Targets,” IMF Working Paper WP/05/163, Washington D.C., 2005. [3] L. Ball and N. Sheridan, “Does Inflation Targeting Mat- ter?” In: B.S. Bernanke and M. Woodford, Eds., the In- flation-Targeting Debate, University of Chicago Press, Chicago, 2005, pp. 249-276. [4] R. Al-mashat, “Monetary Policy in Egypt: A Retrospec- tive and Preparedness of Inflation Targeting,” ECES Working Paper, No. 134, 2008. [5] I. L. Awad, “Is Egypt Ready to Apply Inflation Targeting Regime?” Review of Economic and Business Studies, No. 2, 2008. [6] G. Debelle and C. H. Lim, “Preliminary Considerations of an Inflation Targeting Framework for the Philippines,” IMF Working Paper WP/98/39, Washington D.C., March 1998. [7] P. R. Masson, M. A. Savastano and S. Sharma, “The Scope for Inflation Targeting in Developing Countries,” IMF Working Paper WP/97/130, Washington D.C., Oc- tober 1997. [8] E. Tutar, “Inflation Targeting in Developing Countries and Its Applicability to the Turkish Economy,” An Un- published M. A. Economics Thesis Submitted to the Fac- ulty of the Virginia Polytechnic Institute and State Uni- versity Blacksburg, Virginia, 2002. [9] E. Truman, “Inflation Targeting in the World Economy,” Institute for International Economics, Washington D.C., 2003. [10] G. Bakradze and A. Billmeier, “Inflation Targeting in Georgia: Are We There Yet?” IMF Working Paper WP /07/193, International Monetary Fund, Washington D.C., 2007. [11] L. Leiderman and L.E.O. Svensson, “Inflation Targets,” Centre of Economic Policy Research, London, 1995. [12] H. Schmidt and F. Mishkin, “Monetary Policy under In- flation Targeting,” Central Bank of Chile, Santiago, 2005. [13] B. S. Bernanke and F. S. Mishkin, “Inflation Targeting: A New Framework for Monetary Policy?” Journal of Eco- nomic Perspectives, Vol. 11, No. 2, pp. 97-116. [14] T. G. Petursson, “Exchange Rate or Inflation Targeting in Monetary Policy?” Center Bank of Iceland Monthly Bul- letin, Vol. 2000, No. 1, 2000, pp. 36-45. [15] U. Hazirolan, “Inflation Targeting: Japanese Case and Prospects for Turkey,” Undersecreteriat of the Treasury, Ankara, 1999. [16] F. S. Mishkin, “Issues in Inflation Targeting, Price Stabil- ity and the Long-Run Target for Monetary Policy,” Ot- tawa, Bank of Canada, 2001. [17] L. Meyer, “Does Money Matter?” Federal Reserve Bank, St. Louis, 2001. [18] F. S. Mishkin and K. Schmidt-Hebbel, “A decade of in- flation targeting in the world: What do we know and what do we need to know?” In: F. S. Mishkin Ed., Monetary Policy Strategy, The MIT Press, Cambridge, Massachu- setts, 2007, pp. 117-219. [19] V. Corbo, M.O. Landerrretche and H. K. Schmidt, “Does Inflation Targeting Make a Difference?” In: N. Loayza and R. Saito Eds., Inflation Targeting: Design, Perform- ance, Challenges, Central Bank of Chile, Santiago, 2002, pp. 221-270. [20] G. Jonsson, “The Relative Merits and Implications of Inflation Targeting for South Africa,” IMF Working Pa- per WP/99/116, Washington D.C., August 1999. [21] U. Hazirolan, “Inflation Targeting: Japanese Case and Prospects for Turkey,” Undersecreteriat of the Treasury, Ankara, 1999. [22] F. Mishkin and H. K. Schmidt, “One Decade of Inflation Targeting in the World: What do We Know and What do  T. GHALWASH Copyright © 2010 SciRes. ME 99 We Need to Know?” In: N. Loayza and R. Soto Eds., In- flation Targeting: Design, Performance, Challenges, Central Bank of Chile, Santiago, 2002, pp. 171-219. [23] J. M. Neumann and J. von Hagen, “Does Inflation Tar- geting Matter?” Federal Reserve Bank of St. Louis Re- view, Vol. 84, No. 4, 2002, pp. 127-148. [24] V. Corbo, M.O. Landerrretche and K. Schmidt-Hebbel, “Does Inflation Targeting Make A Difference?” In: N. Loayza and R. Saito, Eds., Inflation Targeting: Design, Performance, Challenges, Central Bank of Chile, Santi- ago, . [25] L. Ball and N. Sheridan, “Does Inflation Targeting Mat- ter?” In: B. S. Bernanke and M. Woodford Eds., The In- flation-Targeting Debate, University of Chicago Press, 2005, pp. 249-276. [26] M. J. Dueker and A. M. Fischer, “Do Inflation Targeters Outperform Non-Targeters?” Federal Reserve Bank of St. Louis Review, Vol. 88, No. 5, 2006, pp. 431-450. [27] L. Svensson, “Inflation Targeting,” In: L. Blum and S. Durlauf, Eds., The New Palgrave Dictionary of Econom- ics, 2nd Edition, 2007. [28] M. Dotsey, “A Review of Inflation Targeting in Devel- oped Countries,” Federal Reserve Bank of Philadelphia Business Review, No. Q3, 2006, pp. 10-20. [29] S. Lin and H. Ye, “Does Inflation Targeting Really Make a Difference? Evaluating the Treatment Effect of Infla- tion Targeting in Seven Industrial Countries,” Journal of Monetary Economics, Vol. 54, No. 8, 2007, pp. 2521- 2533. [30] C. E. Walsh, “Inflation Targeting: What Have We Learn- ed?” International Finance, Vol. 12, No. 2, 2009, pp. 195-233. [31] C. Gonçalves and A. Carvalho, “Inflation Targeting Mat- ters: Evidence from OECD Economics’ Sacrifice Ratios,” Journal of Money, Credit and Banking, Vol. 41, No. 1, 2009, pp. 233-243. [32] A. Angeriz and P. Arestis, “Assessing Inflation Targeting through Intervention Analysis,” Oxford Economic Papers, Vol. 60, No. 2, 2008, pp. 293-317. [33] Batini, Nicoletta, and D. Laxton, “Under What Condi- tions Can Inflation Targeting Be Adopted? The Experi- ence of Emerging Markets,” Working Papers Central Bank of Chile, No. 406, Central Bank of Chile, 2005. [34] Vega, Marco, and Diego Winkelried, “Inflation Targeting and Inflation Behavior: A Successful Story? International Journal of Central Banking, Vol. 1, No. 3, 2005, pp. 153- 175. [35] C. Goncalves and J. M. Salles, “Inflation Targeting in Emerging Economies: What do the Data Say?” Journal of Development Economics, Vol. 85, No. 1-2, 2008, pp. 312-318. [36] R. D. Brito and B. Bystedt, “Inflation Targeting in Emerging Economies: Panel Evidence,” Journal of De- velopment Economics, Vol. 91, No. 2, 2009, pp. 198-210. [37] G. Debelle and S. Fischer, “How Independent Should a Central Bank be?” In: J. C. Fuhrer Ed., Goals, Guidelines and Constraints Facing Monetary Policymakers, Federal Reserve Bank, Boston, Conference Series No. 38, 1994, pp. 195-221. [38] A. Chandavarkar, “Central Banking in Developing Coun- tries,” Macmillan Press LTD, New York, 1996. [39] S. Cevik, “When a Prime Minister Makes Monetary Pol- icy,” Morgan Stanley Report about Egypt, 2007. www. morganstanley.com/views/gef/archive/2007/20070328-W ed.html [40] L. Svensson, “Inflation Forecast Targeting: Implementing and Monitoring Inflation Targets,” European Economic Review, Vol. 41, No. 6, 1997, pp. 1111-1146. [41] B. S. Bernanke and F. S. Mishkin, “Inflation Targeting: A New Framework for Monetary Policy?” Journal of Eco- nomic Perspectives, Vol. 11, No. 2, 1997, pp. 97-116. [42] IMF, “Arab Republic of Egypt: Report on the Obse- rvance of Standards and Codes-Data Module,” IMF Country Report, No. 05/238, Washington DC, 2005. [43] J. Gottschalk and D. Moore, “Implementing Inflation Targeting Regimes: The Case of Poland,” Journal of Comparative Economics, Vol. 29, No. 1, March 2001, pp. 24-39. [44] G. Bakradze and A. Billmeier, “Inflation Targeting in Georgia: Are We There Yet?” IMF Working Paper WP /07/193, International Monetary Fund, Washington D.C., 2007. |