Modern Economy, 2012, 3, 718-725 http://dx.doi.org/10.4236/me.2012.36092 Published Online October 2012 (http://www.SciRP.org/journal/me) Optimal Investment Problem with Multiple Risky Assets under the Constant Elasticity of Variance (CEV) Model Hui Zhao, Ximin Rong, Weiqin Ma, Bo Gao School of Science, Tianjin University, Tianjin, China Email: zhaohui_tju@hotmail.com, rongximin@tju.edu.cn, mwqmcb@126.com, mrgbnh@163.com Received August 15, 2012; revised September 16, 2012; accepted September 27, 2012 ABSTRACT This paper studies the optimal investment problem for utility maximization with multiple risky assets under the constant elasticity of variance (CEV) model. By applying stochastic optimal control approach and variable change technique, we derive explicit optimal strategy for an investor with logarithmic utility function. Finally, we analyze the properties of the optimal strategy and present a numerical example. Keywords: Constant Elasticity of Variance Model; Stochastic Optimal Control; Hamilton-Jacobi-Bellman Equation; Portfolio Selection; Multiple Risky Assets; Stochastic Volatility 1. Introduction Optimal investment problem of utility maximization is a fundamental problem in mathematical finance and has been studied in many articles. This problem is usually studied via two approaches in literatures. One is stochas- tic control approach used by Merton [1,2] for the first time. By this approach, Browne [3] found the optimal investment strategy to maximize the expected exponen- tial utility of terminal wealth for an insurance company. Yang and Zhang [4] studied a similar problem for an insurer with exponential utility via stochastic control approach. Another method is the martingale approach which was adapted to the problem of utility maximiza- tion by Pliska [5], Karatzas, Lehoczky and Shreve [6] and Cox and Huang [7]. Much of this development ap- peared in [8,9]. Applying the martingale approach, Karatzas et al. [10] investigated the utility maximization problem in an incomplete market and Zhang [11] con- sidered a similar problem. In [12], closed-form strategies were obtained for different utilities maximization of an insurer through martingale approach. Zhou [13] applied the martingale approach to study the exponential utility maximization for an insurer in the Lévy market. The above mentioned researches using the martingale method have provided results for general risky assets’ prices, but most found specific solutions for geometric Brownian motion (GBM) model or a similar one merely. Meanwhile the works applying stochastic control theory generally supposed the risky assets’ prices satisfy geo- metric Brownian motions. However, numerous studies (see e.g., [14] and the references therein) have shown that empirical evidence does not support the assumptions of GBM model and a model with stochastic volatility will be more practical. The constant elasticity of variance (CEV) model with stochastic volatility is a natural extension of geometric Brownian motion and can explain the empirical bias ex- hibited by the GBM model, such as volatility smile. The CEV model allows the volatility to change with the un- derlying price and was first proposed by Cox and Ross [15]. In comparison with other stochastic volatility mod- els, the CEV model is easier to deal with analytically and the GBM model can be seen as its special case. The CEV model was usually applied for option pricing and sensi- tivity analysis of options in most literatures, see [16-19] for example. Recently, the CEV model has been applied in the research of optimal investment, as was done by Xiao, Zhai and Qin [20]. Gao [21,22] investigated the utility maximization problem for a participant in a de- fined-contribution pension plan under the CEV model. Gu, Yang, Li and Zhang [23] used the CEV model for studying the optimal investment and reinsurance pro- blems. However, the above researches of optimization prob- lem under the CEV model concerned only one risky asset and a risk-free asset. But actually, an investor needs to invest in multiple risky assets to disperse risk and in- crease his/her profit. Thus, to make the optimization problem even more realistic, we deal with the investment problem with a risk-free asset and multiple risky assets under the CEV model. Although Zhao and Rong [24] have studied portfolio selection problem with multiple C opyright © 2012 SciRes. ME  H. ZHAO ET AL. 719 ,0,, ,0Stt Sttn =1 d=dd , =1,2,, , d iii ijij j St SttStWt in T :=, ,WW W 1n of the stocks are described by the CEV model risky assets under the CEV model, they obtained closed- form solutions only for special model parameters. Where- as in this paper, considering to maximize the expected logarithmic utility of an investor’s terminal wealth, we derive optimal strategy explicitly for all values of the elasticity coefficient. By applying the methods of sto- chastic optimal control, we derive a complicated nonlin- ear partial differential equation (PDE). However, there are terms that contain variables concerning different as- sets’ prices, which makes it difficult to characterize the solution structure. Therefore, we conjecture a correspond- ing solution to this PDE via separating variables partially and simplify it into several PDEs. The coefficient vari- ables of these simplified PDEs are closely correlated and therefore we use a power transformation and a variable change technique to solve them. It is noteworthy that the introduction of multiple risky assets does give rise to difficulties and this research is not a routine extension of the case of one risky asset. For portfolio selection problems concerning risky assets with the CEV price processes, the characterization of solution under dimensional case is quite different from one dimensional case. Owing to the consideration of multiple risky assets, we conjecture the solution through separat- ing variables represented different assets’ prices and combining each price variable with time variable respec- tively. n n 0,0Stt 0 d,0=1,t S r Furthermore, we compare our result with that under the GBM model and that of one dimensional case. Firstly, the optimal policy for an investor with logarithmic utility under the CEV model is similar to that under the GBM model in form except for a stochastic volatility. Secondly, our solution is just the result of [20] when there is only one risky asset. Moreover, we present a numerical simu- lation to analyze the properties of the optimal strategy under the CEV model. This paper proceeds as follows. Section 2 proposes the utility maximization problem with multiple risky assets whose prices are driven by the CEV models and provides the general framework to solve the optimization problem. In Section 3, we derive the optimal investment strategy for logarithmic utility function and compare our result with the previous works. Section 4 provides a numerical analysis to illustrate our results. Section 5 concludes the paper. 2. Problem Formulation We consider a financial market consisting of a risk-free asset (hereinafter called “bond”) and risky assets (hereinafter called “stocks”). The price process of the bond follows 00 d=St rS t (1) where is the interest rate. The price processes (2) where 1d is a d-dimensional standard Brownian motion defined on a complete probability space ,, ,P dn = i t and . t is an aug- mented filtration generated by the Brownian motion with T, where T is a fixed and finite time horizon. is the appreciation rate of the ith stock and . Define and T 1 :=,, n =ij nd 1 2 00 00 =, 00 n St St St St St then is the instantaneous volatility matrix. The elasticity parameter satisfies 0=0 . If , the volatility matrix is constant with respect to the stock prices and Equation (2) reduces to the standard Black- Scholes model. In addition, we assume that T n πtt=1,2, , T π:= πt, ,πtt is positive definite throughout this paper. The investor is allowed to invest in those stocks as well as in the bond. Let i be the money amount invested in the ith stock at time for in. Denote by 1n and each πit is an =1,2, ,in π,0tt t-predictable process for . Corresponding to a trading strategy and an initial capital V, the investor’s wealth process ,0Xt tfollows the dynamics T T d= πd πd 0= , n trXttr t tS tWt XV 1 T =1, ,111n (3) where is an vector. n Suppose that the investor has a utility function U which is strictly concave and continuously differentiable on , . Then the investor aims to π E. max tUXT (4) By applying the classical tools of stochastic optimal control, we define the value function as 12 11 π 22 ,,,, , =E = sup =,,=,= ,0<< n t nn Htsss x UXT Sts St sSt sXtxtT (5) Copyright © 2012 SciRes. ME  H. ZHAO ET AL. 720 , ,= with 12 n ,,, Ts ssxUx. The Hamilton-Jacobi-Bellman (HJB) equation asso- ciated with the portfolio selection problem under the CEV model is T 11 TT =1 TT TT 1 2 ππ sup 1ππ=0, 2 tsx n is i nx xx HSHrxH ISS H rH S SSH 11 T si xs I S H 2 00 00 , 00 00 , n n s (6) where 1 2 1 := 00 := 00 s s S s s S T 1, , ss s n H:=HH, T 1, , xs xsn H 1 . s s n s s nnn HH HH T 0,=1,, := xs HH and 11 1 := ss ss ss H Besides, we define :=0,,1,, i in i π , whose th component is 1. Differentiating with respect to in Equation (6) gives the optimal policy 1 *T πx n 1 =. x s xxx SH H SS r H 1 (7) Putting Equation (7) into HJB Equation (6), after sim- plification, we have T 11 TT =1 T 1 TT 11 TT 1 2 1 2 11 2 tsx n is i x nxs xx 2 =0 . si nn x I xs xs xx HSHrxH ISS H H rSH H rSS r HSSH H 1 1 1 (8) The problem now is to solve the nonlinear partial dif- ferential equation (PDE) (8) for and recover from derivatives of * π . 3. Optimal Strategy for the Logarithmic Utility In this paper, we consider the investment problem for logarithmic utility function =ln .Ux x (9) A solution to Equation (8) is conjectured in the fol- lowing form: 1 =1 =1 ,,,, =ln ,, n nn ii ii ii Htss x gts dts () () =1 =1 ,=0,,=1 nn ii ii ii dTs gTs (10) with the boundary conditions given by . Then () =1 =1 =1 2 =1 =ln,= ln, =ln, =0, 1 =, 1 =,=, nn i ii i tttss s ii i ii ii ss ss ss ss iii j ii ii ni xi i ns ii xx xsi i xgdHgxd HgxdH Hg x g HgH x x ij where and . Plugging these deriva- tives into Equation (8) gives ,=1,2, ,ij n d222 =1=1=1 =1 d222 =1=1=1 =1 =1 =1 T =1 =1=1 d =1=1 =1 1ln 2 1 2 1 2| | 1 2 nn n ii i tiiiji sss iii ii ij nnn ii i tii iji sss iii ii ij nn i iii si ii nnn k ijijij ij k nn ijk gsg sgx dsd sd rg rsg rrssg (11) 11 =1 =0, ij ss ij ikjkijni i gg ss g T denotes the adjoint matrix of here , ij is the element of in the ith row and th column and j T T represents the determinant of the matrix , namely, 1 T T 1 = In order to eliminate the dependence on . , we can Copyright © 2012 SciRes. ME  H. ZHAO ET AL. 721 split Equation (11) into two equations: =1 =1=1 =1 =0 , 2 i ti i iji sss iii ii ij gsg sg (12) 22 2 1 nn nd i i 22 2 =1 =1 =0 . nd ii iji =1 =1=1 =1 =1 T =1 =1 =1 11 =1=1 =1 1 2 1 2| | 1 2 nn i tii ss iii ij ij ss ij ni i sd gg g (13) For Equation (12), we use a power transform and a va 2 and = ii ii nn i iii si ii nn i ij nk ji jij k nnd ikjkij ijk dsd rg rsg r rssg ss riable change technique proposed by Cox [16] to solve it. Let ,= , ii ii tsm tyys (14) with the bounda () ,=1 ii mTy. 242 , . i y ii ry condition =1 n i Hence, i 21 () 22 =,=2 =2 214 ii tts i ii i si ii i mg sm gs yiyy ii msm Bringing these derivatives into Equation (12), we ob 2 0. d ii jiiy i j mym (15) We conjecture a solution to Equation (15) in the fol- lo =1 ii ii i t Lty (16) with the boundary conditions given by utting Equation Eget: 2 =1 2=0 di ti j ij ii i g tain 2 =1 =1=1 22 =1 =1 21 2= nn ti ii nd i ijiy y ii ij ym wing form: nn =1 ,= i mtyI () =1, =0 i ITLT for =1, ,in. P ), we n (16) intoquation (15 =1 =1 21 n ti i . Lt ty (17) Again to eliminate the ,=1,, i yi n, wtions: LL dependence on e can split Equation (17) into 1n condi 2 =1 =1 i ti j ij (18) 2=0,=1,,. ii ti LLtin (19) Taking into account the boundary conditi tio 21 =0. nd ILt ons, the solu- ns to Equations (18) and (19) are () =1,=0, =1 i,, . tLti n (20) Subsequently, we have the following therithmic ut orem. Theorem 1. The optimal strategy for the loga ility maximization with multiple stocks under the CEV model is given by 1 T n St rXt 1 (21) and the value function is given by () 1 =1 , , ni ni i * π=,tSt ,,, ,=ln tss xxdts where () ,,=1,, ii dtsi n satisfy 2 =1=1=1 =1 T =1 =1 1 2 1=0 2| | ii i ti i iji sss iii ii ij nn ijijij ij dsd dr rrss Proof. Equations (7) and (10) leads to 22 nn nd s . 1 *T π=SS rx 1 () =1 , ns ni i xSg g where T (1)( ) 1 :=,, n ss s n gg g. Due to Equations (14), (16) ), we have for each 21 0, i y ii m and then and (201in, =2 = i si gs 1 T =. n tSt rXt 1 According to Equations (14), (16) and (20), we ob =1 n i mediately 21), we find that the * πtS tain =1 i g. This together with Equations (10) and (13) im- completes the proof. Remark 2. From Equation ( optimal investment proportion * πtXt is inde- pendent of the wealth. This caned by the relative risk tolerance be explain Ux xUx , which is a constant for logarithmic wealth has no influence on the optimal proportion invested in stocks. Remark 3. For a logarithmic utility function, the op utility. Thus, the under a geom timal policy under the CEV model is similar to that etric Brownian motion (GBM) model. How- Copyright © 2012 SciRes. ME  H. ZHAO ET AL. Copyright © 2012 SciRes. ME 722 ever, the volatility matrix of the stocks St is not constant but related to the prices of stocresult implies that the CEV model fully consrole of ks. This iders the unidimensional an the stochastic price of the stock market. Remark 4. In the case where there is only one stock and a bond, i.e . =1n, ,,St are d we are back to the settings of [20]. Equation (21) reduces to * π=, r tXt 2 2St which is the same as the optimal policy Zhai and Qin [20]. From Equation (22), we find that (22) derived by Xiao, * πt decreases with . A bigger means a larger volatility, which increases risks for investors. Thus, in- s would reduce thamount invested in the stock to avoid risks. 4. Numeri vestore cal Analysis me numerical simulations to optimal strategy and illus- ), i.e., n ks at In this section, we provide so analyze the properties of the trate the dynamic behavior of the optimal strategy. We assume that there are two stocks and one bond in the market during the time horizon =10T (years =2. Throughout the numerical analysis, we use the optimal proportion invested in stoctime t, i.e., *Xt to denote the optimal strategy. Let πt 12 18.16 12.15 = 0.03,=0.12,0.1,=, 12.03 13.10 =1,0= 13.5,0= 12.5. r SS Figure 1 shows the effects of the appreciation rate 1 on the optimal strategies. As expected, the optimal pro- portion invested in stock 1 increases with respect to its appreciation rate 1 . Since multiple stocks are consid- ered, we can analyze the impact of one stock on the other stock. From Figure 1, we find that there is an inverse relationship between 1 and the optimal strategy of stock 2. This is consistent with intuition. When the ap- preciation rate of one stock increases constantly, it is optimal to increase the proportion of wealth in this stock and reduce investment in the other stock. Furthermore, Figure 1 also shows that the total proportion invested in two stocks changes moderately with 1 . This implies that the influence of one stock’s appreciation rate on the total investment is not obvious. In Figure 2, the parameters are given by: 12 12 = 0.03,=0.12,0.1,=, 1.5 1.2 =0.4, 0=8,0=6. r SS Figures 2(a) and (b) plot the evolution of the stocks’ prices and the optimal strategy over time under the CEV model, respectively. Unlike the GBM model, the optimal proportion invested in each stock under the CEV model 0.02 0.04 0.8 0.06 0.080.10.12 0.140.160.180.2 −0.6 −0.4 −0.2 0 0.2 0.4 Proportion invested in stock 1 Proportion invested in stock 2 Proportion invested in two stocks 0.6 Optimal propotion μ1 Figure 1. The effect of μ1 on the optimal strategy.  H. ZHAO ET AL. 723 0 1 23 4 5 67 8 91 0 5 10 15 20 t Stock price Stock 1 Stock 2 (a) 0 1 2 3 4 5 6 7 8 910 −0.3 −0.2 −0.1 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 t Optimal propotion Proportion invested in stock 1 Proportion invested in stock 2 Proportion invested in two stocks (b) Figure 2. (a) Evolution of stocks’ prices over time; (b) Evolution of optimal strategy over tim. fluctuates with the overall tendency of optimal proportion invested in ure 2(b) also indicates that sometimes it is optimal to sell short stock 1. e stocks’ prices. As shown in Figure 2(b), over time (see Figure 2(a)). Moreover, Fig stock 1 decreases with respect to time. This is because that the actual price of stock 1 has a decreasing trend On the contrary, the optimal strategy of stock 2 increases in general due to the rising tendency of its price. Conse- Copyright © 2012 SciRes. ME  H. ZHAO ET AL. 724 quently, the total proportion invested in stocks is rela- tively steady over time. 5. Conclusion By considering multiple risky assets and a risk-free asset in a financial market, this paper extends the port der the constant elasticity of vari- l. We propose the framework of port- si d by n of Tianjin under grant ts’ innovation training foun- tainty: The Continuous-Time Case,” The Review of Eco- nomics and Sta, pp. 247-257. doi:10.2307/19 folio selection problem un ance (CEV) mode folio selection problem with multiple risky assets under the CEV model. Explicit solution for the logarithmic utility maximization has been derived via stochastic con- trol approach. It is shown that for portfolio selection problems concerning risky assets with the CEV price processes, there are differences in solution characteriza- tion and calculations between one dimensional case and n dimensional case. The optimal policy under the CEV model is the same as that under the GBM model in form except for a stochastic volatility matrix. Finally, numeri- cal results demonstrate the properties of the multidimen- onal optimal strategy under the CEV model. 6. Acknowledgements The authors would be very grateful to referees for their suggestions and this research was supporte the Natural Science Foundatio 09JCYBJC01800 and studen dation of Tianjin University under grant 201210056341. REFERENCES [1] R. C. Merton, “Lifetime Portfolio Selection under Uncer- tistics, Vol. 51, No. 3, 1969 26560 [2] R. C. Merton, “Optimum Consumption and Portfolio Rules in a Continuous-Time Model,” Journal of Eco- nomic Theory, Vol. 3, No. 4, 1971, pp. 373-413. doi:10.1016/0022-0531(71)90038-X [3] S. Browne, “Optimal Investment Policies for a Firm with a Random Risk Process: Exponential Utility and Mini- mizing the Probability of Ruin,” Mathematics of Opera- tions Research, Vol. 20, No. 4, 1995, pp. 937-958. doi:10.1287/moor.20.4.937 [4] H. Yang and L. Zhang, “Optimal Investment for Insurer with Jump-Diffusion Risk Process,” Insurance: Mathe- matics and Economics, Vol. 37, No. 3, 2005, pp. 615-634. doi:10.1016/j.insmatheco.2005.06.009 [5] S. Pliska, “A Stochastic Calculus Model of Continuous Trading: Optimal Portfolios,” Mathematics of Operations Research, Vol. 11, No. 2, 1986, pp. 371-382. doi:10.1287/moor.11.2.371 [6] I. Karatzas, J. P. Lehoczky and S. E. Shreve, “Optimal Portfolio and Consumption Decisions for a ‘Small Inves- tor’ on a Finite Horizon,” SIAM Journal on Control and Optimization, Vol. 25, No. 6, 1987, pp. 1557-1586. doi:10.1137/0325086 [7] J. C. Cox and C. F. Huang, “Optimal Consumption and Portfolio Policies When Asset Prices Follow a Diffusion Process,” Journal of Economic Theory, Vol. 49, No. 1, 1989, pp. 33-83. doi:10.1016/0022-0531(89)90067-7 [8] I. Karatzas, “Optimization Problems in the Theory of Continuous Trading,” SIAM Journal on Control and Op- timization, Vol. 27, No. 6, 1989, pp. 1221-1259. doi:10.1137/0327063 [9] I. Karatzas and S. E. Shreve, “Brownian Motion and Sto- chastic Calculus,” Springer Verlag, New York, 1991. doi:10.1007/978-1-4612-0949-2 [10] I. Karatzas, J. P. Lehoczky, S. E. Shreve and G. L “Martingale and Duali . Xu, ty Methods for Utility Maximiza- tion in an Incomplete Market,” SIAM Journal on Control and Optimization, Vol. 29, No. 3, 1991, pp. 702-730. doi:10.1137/0329039 [11] A. Zhang, “A Secret to Create a Complete Market from an Incomplete Market,” Applied Mathematics and Com- putation, Vol. 191, No. 1, 2007, pp. 253-262. doi:10.1016/j.amc.2007.02.086 [12] Z. Wang, J. Xia and L. Zhang, “Optimal Investment for an Insurer: The Martingale Approach,” Insurance: Mathe- matics and Economics, Vol. 40, No. 2, 2007, pp. 322-334. doi:10.1016/j.insmatheco.2006.05.003 [13] Q. Zhou, “Optimal Investment for an Insurer in the Lévy Market: The Martingale Approach,” Statistics & Prob- ability Letters, Vol. 79, No. 14, 2009, pp. 1602-1607. doi:10.1016/j.spl.2009.03.027 [14] D. G. Hobson and L. C. G. Rogers, “Complete Models with Stochastic Volatility,” Mathematical Finance, Vol. 8, No. 1, 1998, pp. 27-48. doi:10.1111/1467-9965.00043 [15] J. C. Cox and S. A. Ross, “The Valuation of Options f Alternative Stochastic Process or es,” Journal of Financial Economics, Vol. 3, No. 1-2, 1976, pp. 145-166. doi:10.1016/0304-405X(76)90023-4 [16] J. C. Cox, “The Constant Elasticity of Variance Option lasticity ith Time-Dependent 000814 Pricing Model,” The Journal of Portfolio Management, Vol. 22, 1996, pp. 15-17. [17] C. F. Lo, P. H. Yuen and C. H. Hui, “Constant E of Variance Option Pricing Model w Parameters,” International Journal of Theoretical and Applied Finance, Vol. 3, No. 4, 2000, pp. 661-674. doi:10.1142/S0219024900 [18] D. Davydov and V. Linetsky, “Pricing and Hedging Path- Dependent Options under the CEV Process,” Manage- ment Science, Vol. 47, No. 7, 2001, pp. 949-965. doi:10.1287/mnsc.47.7.949.9804 [19] Y. L. Hsu, T. I. Lin and C. F. Lee, “Constant Elasticity of Variance (CEV) Option Pricing Model: Integration and Detailed Derivation,” Mathematics and Computers in Simulation, Vol. 79, No. 1, 2008, pp. 60-71. doi:10.1016/j.matcom.2007.09.012 310. 7 [20] J. Xiao, H. Zhai and C. Qin, “The Constant Elasticity of Variance (CEV) Model and the Legendre Transform-Dual Solution for Annuity Contracts,” Insurance: Mathematics and Economics, Vol. 40, No. 2, 2007, pp. 302- doi:10.1016/j.insmatheco.2006.04.00 Copyright © 2012 SciRes. ME  H. ZHAO ET AL. Copyright © 2012 SciRes. ME 725 [21] J. Gao, “Optimal Portfolios for DC Pension Plans under a CEV Model,” Insurance: Mathematics and Economics, Vol. 44, No. 3, 2009, pp. 479-490. doi:10.1016/j.insmatheco.2009.01.005 [22] J. Gao, “Optimal Investment Strategy for Annuity Con- tracts under the Constant Elasticity of Variance (CEV) Model,” Insurance: Mathematics and Economics, Vol. 45, No. 1, 2009, pp. 9-18. doi:10.1016/j.insmatheco.2009.02.006 [23] M. Gu, Y. Yang, S. Li and J. Zhang, “Constant Elasticity of Variance Model for P vestment Strategies,” Insurance: Math roportional Reinsurance and In- ematics and Eco- nomics, Vol. 46, No. 3, 2010, pp. 580-587. doi:10.1016/j.insmatheco.2010.03.001 [24] H. Zhao and X. Rong, “Portfolio Selection Problem with Multiple Risky Assets under the Constant El Variance Model,” Insurance: Mathema asticity of tics and Econom- ics, Vol. 50, No. 1, 2012, pp. 179-190. doi:10.1016/j.insmatheco.2011.10.013

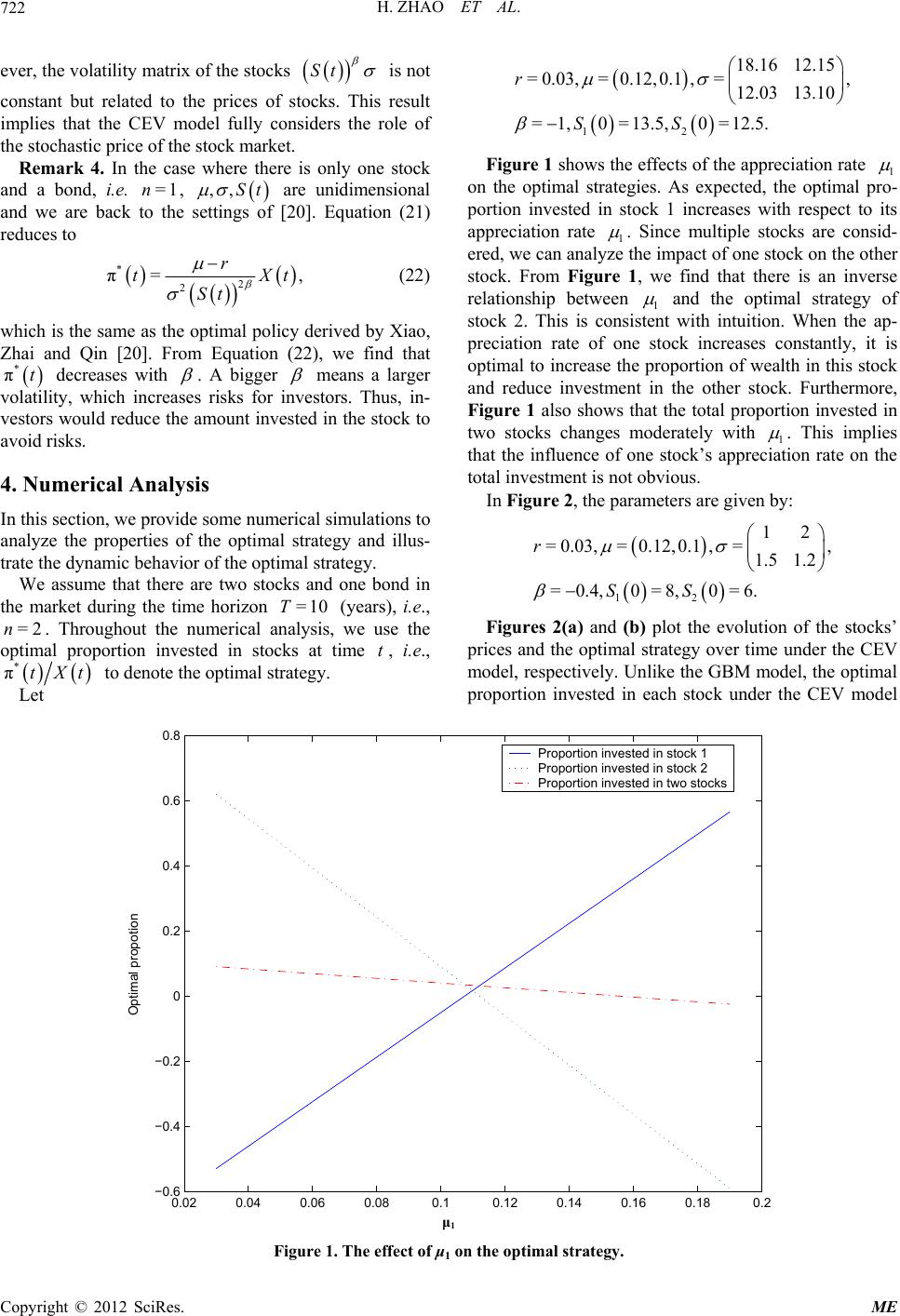

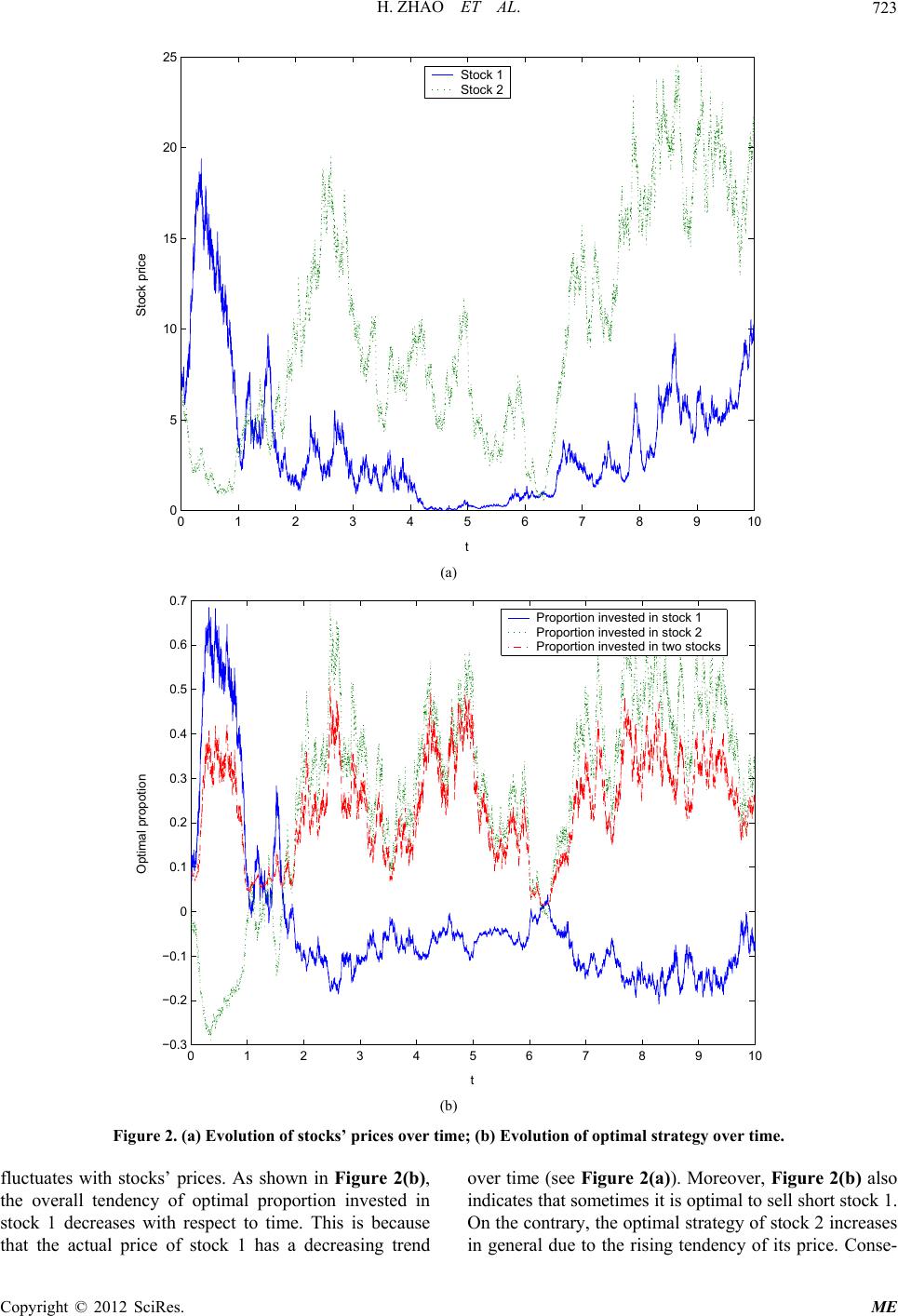

|