Paper Menu >>

Journal Menu >>

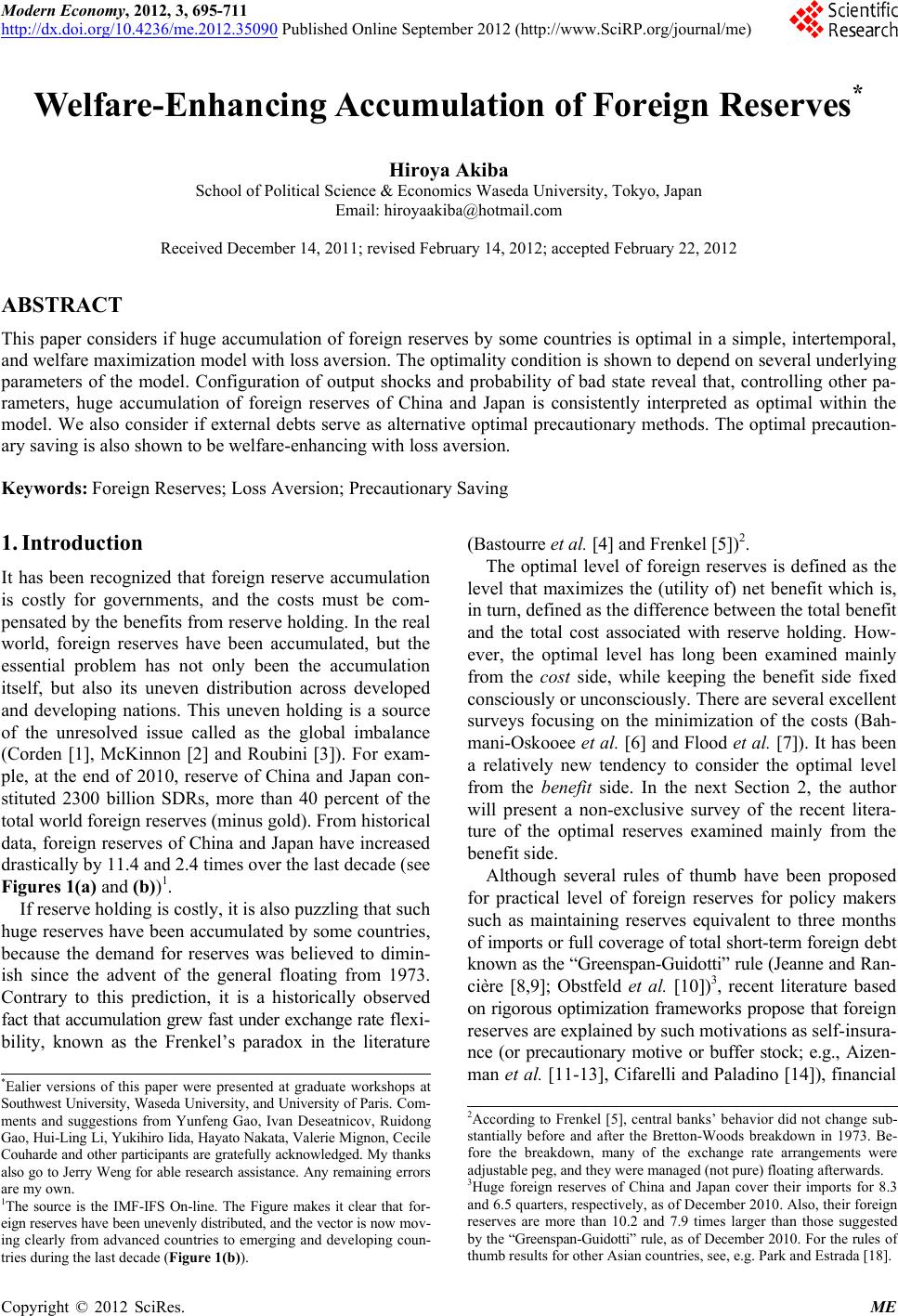

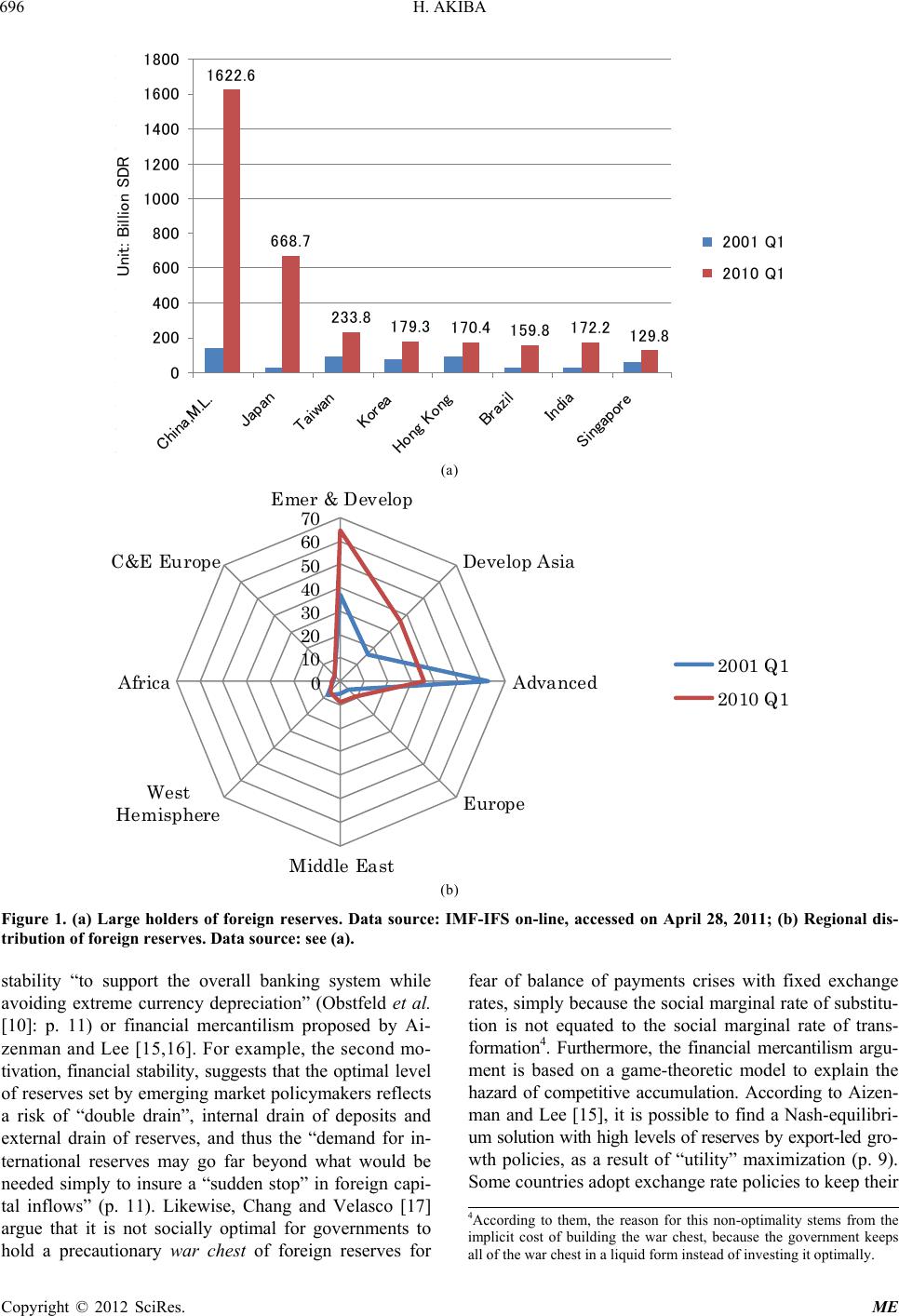

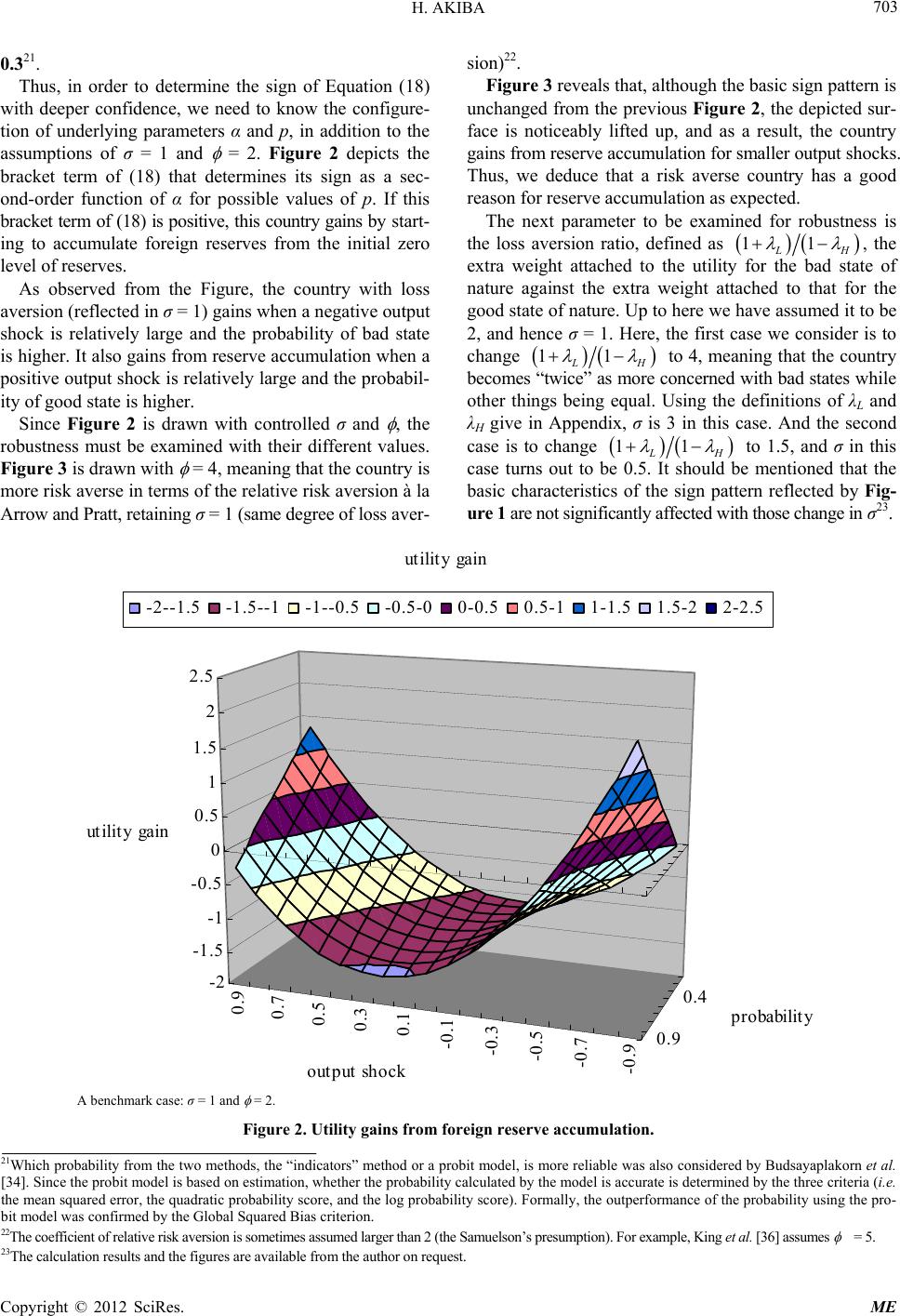

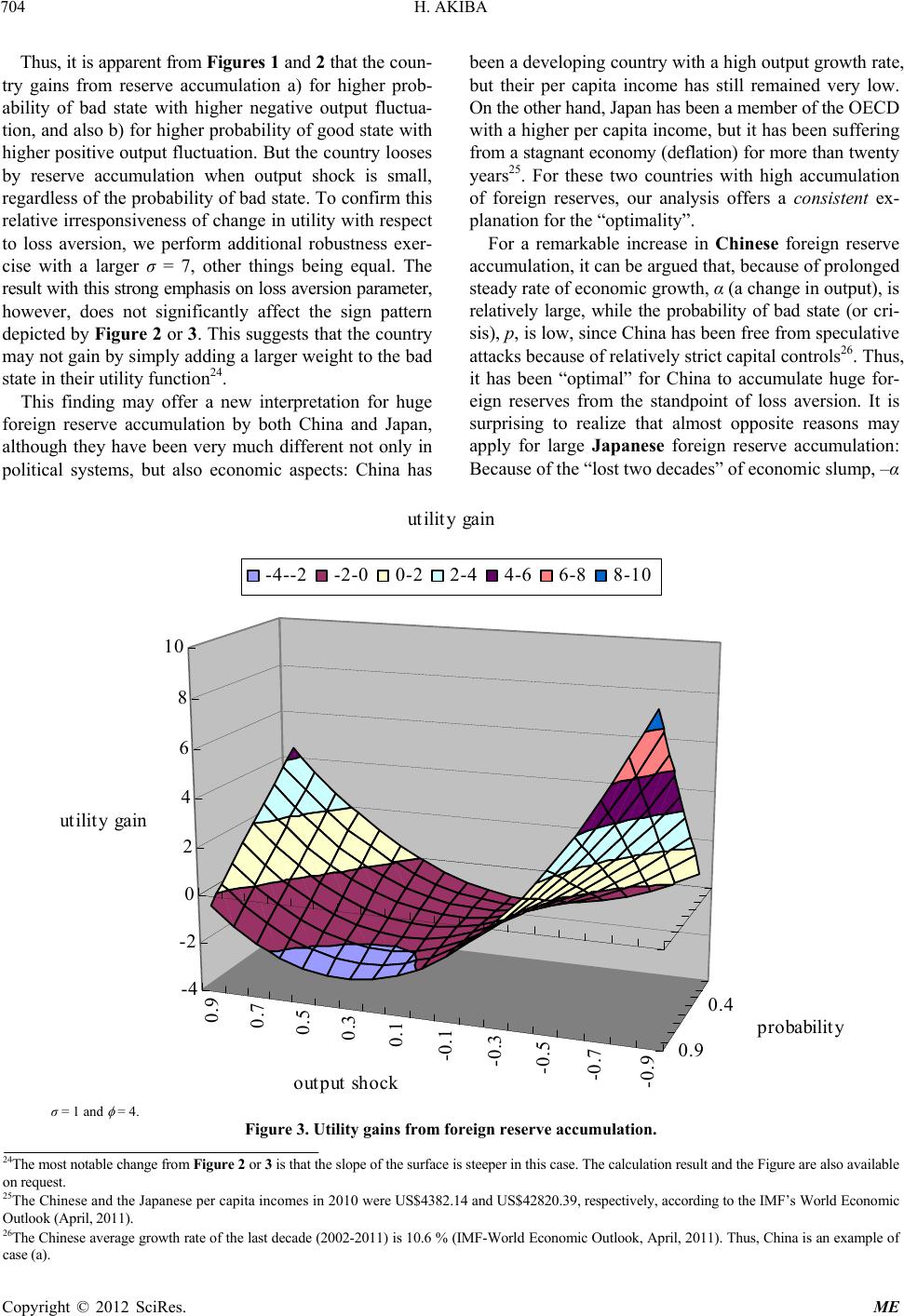

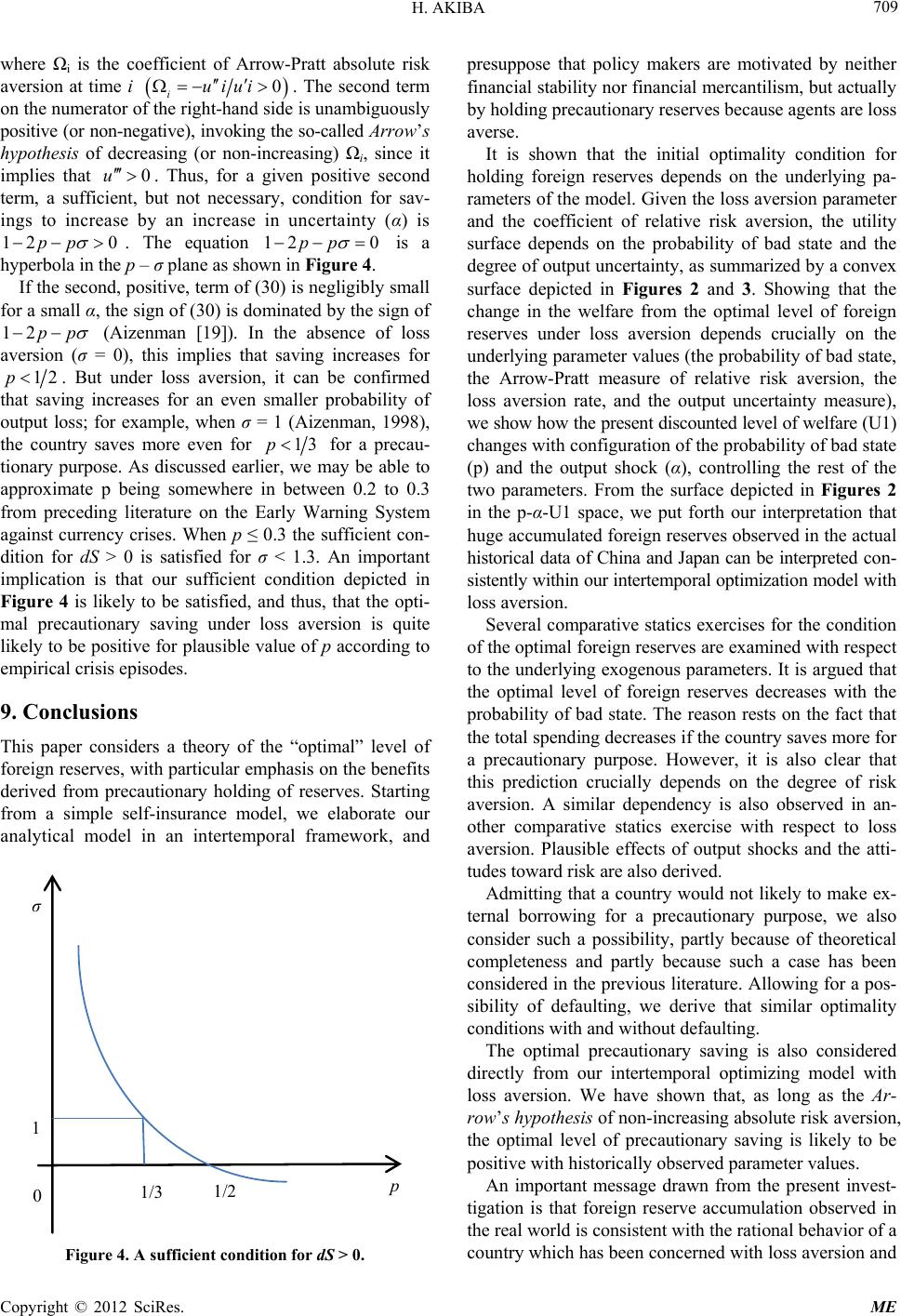

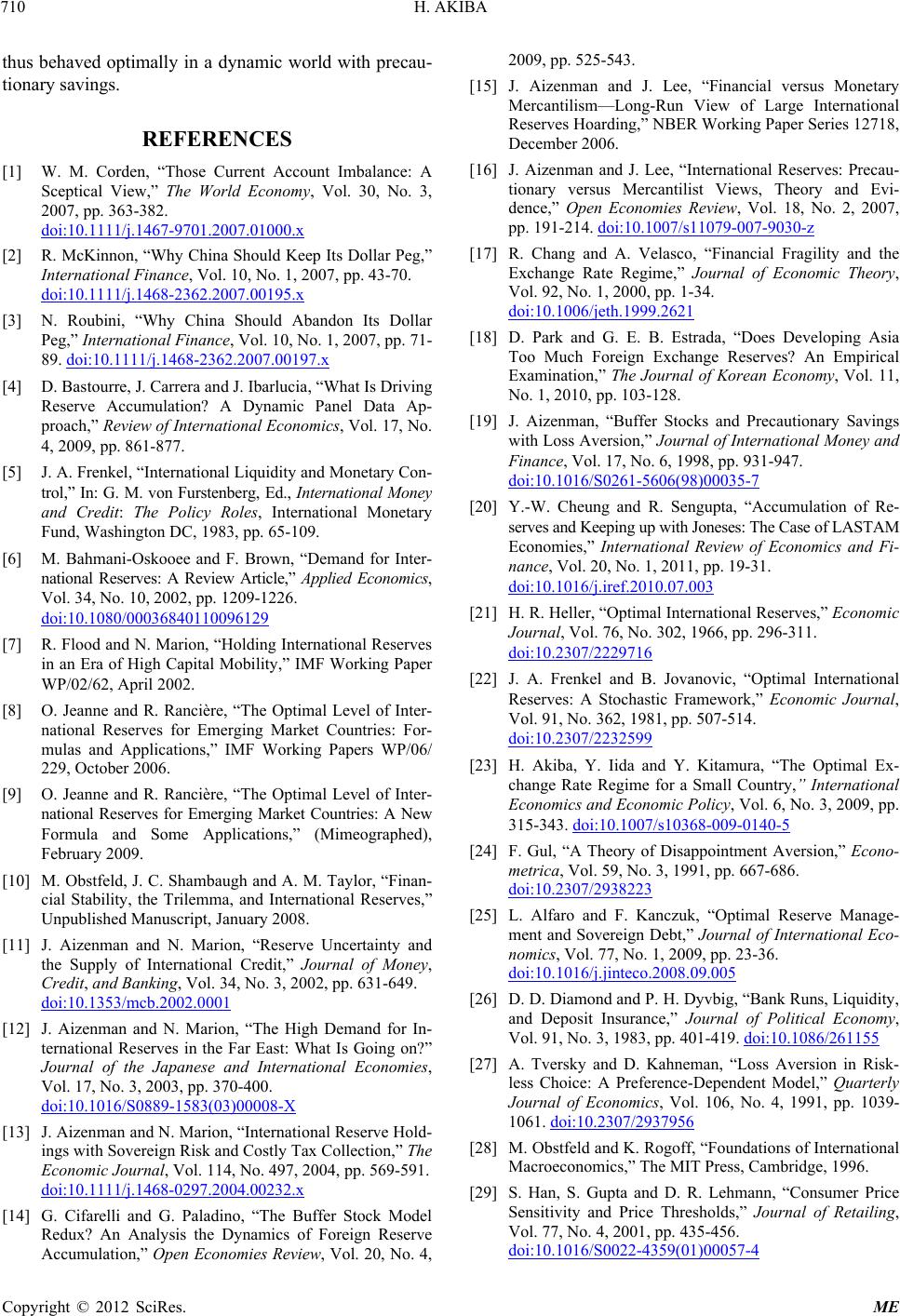

Modern Economy, 2012, 3, 695-711 http://dx.doi.org/10.4236/me.2012.35090 Published Online September 2012 (http://www.SciRP.org/journal/me) Welfare-Enhancing Accumulation of Foreign Reserves* Hiroya Akiba School of Political Science & Economics Waseda University, Tokyo, Japan Email: hiroyaakiba@hotmail.com Received December 14, 2011; revised February 14, 2012; accepted February 22, 2012 ABSTRACT This paper considers if huge accumulation of foreign reserves by some countries is optimal in a simple, intertemporal, and welfare maximization model with loss aversion. The optimality condition is shown to depend on several underlying parameters of the model. Configuration of output shocks and probability of bad state reveal that, controlling other pa- rameters, huge accumulation of foreign reserves of China and Japan is consistently interpreted as optimal within the model. We also consider if external debts serve as alternative optimal precautionary methods. The optimal precaution- ary saving is also shown to be welfare-enhancing with loss aversion. Keywords: Foreign Reserves; Loss Aversion; Precautionary Saving 1. Introduction It has been recognized that foreign reserve accumulation is costly for governments, and the costs must be com- pensated by the benefits from reserve holding. In the real world, foreign reserves have been accumulated, but the essential problem has not only been the accumulation itself, but also its uneven distribution across developed and developing nations. This uneven holding is a source of the unresolved issue called as the global imbalance (Corden [1], McKinnon [2] and Roubini [3]). For exam- ple, at the end of 2010, reserve of China and Japan con- stituted 2300 billion SDRs, more than 40 percent of the total world foreign reserves (minus gold). From historical data, foreign reserves of China and Japan have increased drastically by 11.4 and 2.4 times over the last decade (see Figures 1(a) and (b))1. If reserve holding is costly, it is also puzzling that such huge reserves have been accumulated by some countries, because the demand for reserves was believed to dimin- ish since the advent of the general floating from 1973. Contrary to this prediction, it is a historically observed fact that accumulation grew fast under exchange rate flexi- bility, known as the Frenkel’s paradox in the literature (Bastourre et al. [4] and Frenkel [5])2. The optimal level of foreign reserves is defined as the level that maximizes the (utility of) net benefit which is, in turn, defined as the difference between the total benefit and the total cost associated with reserve holding. How- ever, the optimal level has long been examined mainly from the cost side, while keeping the benefit side fixed consciously or unconsciously. There are several excellent surveys focusing on the minimization of the costs (Bah- mani-Oskooee et al. [6] and Flood et al. [7]). It has been a relatively new tendency to consider the optimal level from the benefit side. In the next Section 2, the author will present a non-exclusive survey of the recent litera- ture of the optimal reserves examined mainly from the benefit side. Although several rules of thumb have been proposed for practical level of foreign reserves for policy makers such as maintaining reserves equivalent to three months of imports or full coverage of total short-term foreign debt known as the “Greenspan-Guidotti” rule (Jeanne and Ran- cière [8,9]; Obstfeld et al. [10])3, recent literature based on rigorous optimization frameworks propose that foreign reserves are explained by such motivations as self-insura- nce (or precautionary motive or buffer stock; e.g., Aizen- man et al. [11-13], Cifarelli and Paladino [14]), financial *Ealier versions of this paper were presented at graduate workshops at Southwest University, Waseda University, and University of Paris. Com- ments and suggestions from Yunfeng Gao, Ivan Deseatnicov, Ruidong Gao, Hui-Ling Li, Yukihiro Iida, Hayato Nakata, Valerie Mignon, Cecile Couharde and other participants are gratefully acknowledged. My thanks also go to Jerry Weng for able research assistance. Any remainingerrors are my own. 1The source is the IMF-IFS On-line. The Figure makes it clear that for- eign reserves have been unevenly distributed, and the vector is now mov- ing clearly from advanced countries to emerging and developing coun- tries during the last decade (Figure 1(b)). 2According to Frenkel [5], central banks’ behavior did not change sub- stantially before and after the Bretton-Woods breakdown in 1973. Be- fore the breakdown, many of the exchange rate arrangements were adjustable peg, and they were managed (not pure) floating afterwards. 3Huge foreign reserves of China and Japan cover their imports for 8.3 and 6.5 quarters, respectively, as of December 2010. Also, their foreign reserves are more than 10.2 and 7.9 times larger than those suggested by the “Greenspan-Guidotti” rule, as of December 2010. For the rules o f thumb results for other Asian countries, see, e.g. Park and Estrada [18]. C opyright © 2012 SciRes. ME  H. AKIBA 696 Foreign Reserve minus Gold (bil.SDR) 2001 Q1 2010 Q1 China,M.L.141.9 1622.6 Japan28.17 668.7 Taiwan87.8 233.8 Korea74.9 179.3 Hong Kon g 90.9 170.4 Brazil27.1 159.8 India31.9 172.2 Singapore61.5 129.8 1622.6 668.7 233.8 179.3 170.4 159.8 172.2 129.8 0 200 400 600 800 1000 1200 1400 1600 China,M.L. Japan Taiwan Korea Hong Kong Brazil Indi a Singapore 1800 2001 Q1 2010 Q1 Unit: Billion SD R (a) 0 10 20 30 40 50 60 70 Develop Asia Advanced Europe Middle East West He misphere Africa C&E Europe Emer & Develop 2001 Q1 2010 Q1 (b) Figure 1. (a) Large holders of foreign reserves. Data source: IMF-IFS on-line, accessed on April 28, 2011; (b) Regional dis- tribution of foreign reserves. Data source: see (a). stability “to support the overall banking system while avoiding extreme currency depreciation” (Obstfeld et al. [10]: p. 11) or financial mercantilism proposed by Ai- zenman and Lee [15,16]. For example, the second mo- tivation, financial stability, suggests that the optimal level of reserves set by emerging market policymakers reflects a risk of “double drain”, internal drain of deposits and external drain of reserves, and thus the “demand for in- ternational reserves may go far beyond what would be needed simply to insure a “sudden stop” in foreign capi- tal inflows” (p. 11). Likewise, Chang and Velasco [17] argue that it is not socially optimal for governments to hold a precautionary war chest of foreign reserves for fear of balance of payments crises with fixed exchange rates, simply because the social marginal rate of substitu- tion is not equated to the social marginal rate of trans- formation4. Furthermore, the financial mercantilism argu- ment is based on a game-theoretic model to explain the hazard of competitive accumulation. According to Aizen- man and Lee [15], it is possible to find a Nash-equilibri- um solution with high levels of reserves by export-led gro- wth policies, as a result of “utility” maximization (p. 9). Some countries adopt exchange rate policies to keep their 4According to them, the reason for this non-optimality stems from the implicit cost of building the war chest, because the government keeps all of the war chest in a liquid form instead of investing it optimally. Copyright © 2012 SciRes. ME  H. AKIBA 697 exchange rate undervalued for a comptitiveness purpose. Thus, governments of those countries may prefer to accu- mulate reserves and maintain some type of capital controls. Several interesting characteristics of the optimal level of foreign reserves have been clarified by those recent researches, but there still remain unresolved or unclear issues related to reserves. There are several purposes of this paper. 1) First is to present a “pure” insurance model of foreign reserve, in the sense it neither incorporate fi- nancial stability reflecting double drain nor financial mer- cantilism; and then 2) Second is to construct a simple intertempoal model of foreign reserves with loss aver- sion5. A special emphasis is given to the probability of bad state, e.g. crisis, and we consider how the national welfare level changes depending on the probability and loss aversion; 3) Third, we offer our new, consistent, interpretation of Chinese and Japanese huge accumula- tion within an intertemporal welfare-maximizing model with loss aversion. We also examine the welfare when a country borrows for fear of a bad state from abroad, and consider the substitutability for reserves; 4) Fourth, com- pleting the present investigation, we then consider whether precautionary saving within our simple model with loss aversion is warranted. The paper is organized as follows. Section 2 presents a brief survey of the literature which emphasizes the bene- fit side of welfare. Section 3 formulates a “pure” precau- tionary and insurance model followed by a simple dy- namic model with loss aversion in Section 4. Section 5 examines whether national welfare is improved by pre- cautionary holding of foreign reserves. The effects of changes in exogenous parameters are examined in Sec- tion 6. Section 7 is devoted to examine the possibility of international debts as an alternative precautionary device. The optimal saving in a simple intertemporal utility maximization model with loss aversion is examined in Section 8. Section 9 concludes the paper. 2. Literature Reviewed6 Since the preceding literature on the problems related to the optimal foreign reserves have been reviewed and discussed in excellent survey articles by Bahmani-Osk- ooee and Brown [6] and Flood and Marion [7], our re- view here is confined as concise as possible. The former survey even mentioned that there were at least seven ear- lier review articles prior to it. Thus, our task of this re- view should focus primarily on new points of view ad- dressed since late 1990s. It seems to the author that several biases have been observed in the articles reviewed in those preceding sur- veys. The first bias is that, although the theories of the demand for the foreign reserves have been extensively emphasized and examined, discussions on the supply side have been relatively scarce (Bahmani-Oskooee et al. [6]). Secondly, although empirical investigation has grown rap- idly after the generalized floating exchange rate regime since 1973, it has been totally unclear that why hypo- thetical statistical models can be used to estimate an “ap- propriate” level or the “optimal” demand for the foreign reserves. It seems that this unfounded bias is blamed for an explicit or implicit assumption of regarding the actual level as the “optimal” or “appropriate” level of the for- eign reserves. The third bias is related to the second one, disregarding close scrutiny of the “optimality”. The eco- nomic significance of “optimality” absolutely dictates that the models either maximize some welfare benefits (i.e. utility or profits) or minimize some costs, or both. The fourth bias is found in empirical investigation because of theoretical examination on the optimality of welfare bene- fits has been premature. As a result, the most of statistical investigation has been dominated exclusively by models of cost minimization put forth by e.g. Heller [21] or Fren- kel and Jovanovic [22]. However, it is surprising that no single literature has been found that examines and ap- proaches to welfare implications by utility or profit maxi- mization, except those to be reviewed below. Many countries that observed or experienced financial crises during 1980s and 1990s have since been accumu- lating foreign reserves under the uncertainty of exchange rates, with their perception of non-robustness of the so- called “soft-peg” regimes7. Several motives for holding foreign reserves are pointed out. Bahmani-Oskooee and Brown [6] (p. 1210) summarize five distinct reasons: to smooth out temporary payments imbalances, to defuse a speculative run on currencies, to build prestige, to impawn for collateral, and to intervene foreign exchange market. However, as the previous literature has been biased as explained above, here we focus on the third bias of blur treatment of optimality. In view of an unreasonable em- phasize on the cost minimization in the preceding literature as pointed out as the fourth bias, a novel feature of our review below is that here we intentionally review some important recent theoretical contributions on the “optimal” level of foreign reserves that explicitly consider the wel- fare gains from the maximization of benefits8. Thus, we 5“Loss aversion” is defined as the tendency of agents to be more sensi- tive to reductions in their consumption plan than to increases relative to a reference point (Aizenman[19]; Aizenman et al. [12,13]). 6In addition to several rules of thumb for practical level of foreign re- serves mentioned earlier, there has been another strand of literature to discuss the dynamics of reserve accumulation, known as the “Mrs. Machlup’s Wardrobe” hypothesis. However, we disregard the hypothe- sis here, since it has not been well-based on the optimality. For a recent empirical study on the hypothesis, see Cheung and Sengupta [20]. 7Although foreign reserves were expected to diminish after the onset o f a generalized floating regime since 1973, it is puzzling that the accu- mulation began to grow fast. See Bastourre, Carrera and Ibarlucia [4]. One of the possible reasons is the “Fear of Floating” (Akiba et al. [23]). 8In this respect, our review is necessarily biased since the cost side o f foreign reserves is either disregarded or implicitly kept constant. Copyright © 2012 SciRes. ME  H. AKIBA 698 totally disregard empirical articles in our discussion below simply because they have been exclusively examined through the cost side of foreign reserves. One additional new point of view is examination of effects of interna- tional debts on the level of foreign reserves, as the mone- tary authority (or government agencies) might determine both of them jointly through the budget constraint. Moreover, Aizenman [19,12] first formulates a model for the optimal level of foreign reserves by applying a microeconomic utility maximization problem. Using the concept of “disappointment aversion” by Gull [24], he derives the government’s optimal level of foreign re- serves by applying an individual’s expected utility func- tion that exhibits “disappointment” from a smaller con- sumption than the certainty equivalent level under in- come uncertainty. The “disappointment aversion” meas- ure has been called “loss aversion” after expanding its domain over total wealth. Applying the concept of “loss aversion” within a framework of buffer stock and foreign reserves, Aizenman [19,12] shows that the foreign re- serves as buffer stock in fact depend on disappointment aversion (or loss aversion) in a tractable way. Specifically, it rigorously shows that the optimal foreign reserves are increasing with loss aversion, and the optimal level is likely to be positive under income uncertainty. In order to show the importance of loss aversion, Ai- zenman and Marion [11], recognizing that the Korean financial crisis since 1997 was caused by a fall in will- ingness of international loans due to a decrease in the Korean reserve level, show that a change in reserves has an asymmetric effect, especially when an expected large fall in reserves causes a large reduction in the supply of international credit when the private sector downgrades its prior belief towards repayment possibilities or becomes more pessimistic about the future level of reserve posi- tion. This asymmetric effect is the essence of the notion of disappointment (or loss) aversion. Both Aizenman and Marion [12,13] and Alfaro and Kanczuk [25] consider an intertemporal, 2-period, and dynamic stochastic model under income uncertainty. They examine whether a country, maximizing the present dis- counted value of the expected utility, holds foreign re- serves for a precautionary purpose. The novel feature of the model lies in their assumption that the government maximizes the country’s welfare by jointly choosing the optimal levels of foreign reserves and international debts. In the former article, the government finances its foreign reserves’ costs by collecting taxes. Moreover, while the former article shows that the optimal foreign reserve level is unambiguously positive when the country’s historical reserve position is zero, the latter article also calibrates the optimal dynamic course of foreign reserves, showing that the optimal level is zero. The differences reveal two interesting facts toward the model. First the positive re- serve level in the former article is shown only at the point of time where the initial holding is zero, while the latter article examines the future reserve level is zero. Second, while the former article has not considered the possibility of default, the latter article assumes it as a possible choice. The common feature of both studies is that the optimal reserves decrease as the discount factor decreases. This is a plausible result, as it implies more consumption in an earlier period and tilts the tax rates toward a later period. Thus, international reserve holding must fall, while ex- ternal borrowing must rise to satisfy the budget constraint.9 But, the latter article shows that both are not perfect sub- stitutes because of possibility of default. Since the most of the latter article’s results are based only on calibration with specific assumptions of an isoelastic utility function and GDP being fitted by an AR(1) process, and even though their several robustness exercises, their conclu- sion of the optimal level of foreign reserves being zero remains to be explained in view of the large actual ac- cumulation of foreign reserves in many developed, de- veloping, and emerging economies. Aizenman and Lee [15,16] consider whether foreign reserves for a precautionary purpose is consistent with a mercantilist interpretation. They distinguished two differ- ent mercantilisms: financial and monetary. The former one is characterized by direct subsidies, financial repressions, or moral suasion, while the latter one hinges on hoarding foreign reserves. As long as both mercantilisms have a negative beggar-thy-neighbor externality associated with costs, large reserve holding is inefficient. While their article [15] deduces that monetary mercantilism is ob- servationally near-equivalent to precautionary holding, they come up from their regression in their article [16] with a conclusion that the precautionary motive plays a more visible role than the mercantilist motive represented by the growth rate of real exports and national price lev- els. Then, they construct a two-period dynamic model of a private bank embodying a precautionary motive by self-insurance. The model is similar in spirit to Aizenman and Marion [12,13] that the bank borrows (accepts de- posits) and either invests in real capital or hoards as re- serves. Thus, the model is a straightforward application of the familiar bank run model by Diamond and Dybvig [26]. By maximizing the expected profits, they derive that the optimal reserves are held up to the point where the expected opportunity cost of hoarding reserves equals the expected precautionary benefit. Then, they calculate the optimal demand for deposit and the profit, and they simulate it under a liquidity shock defined by fluctuations in the ratio of reserves to deposit. They show a plausible result that the reserve ratio increases with the volatility. 9According to Aizenman and Marion ([12]: p. 394), the effect of the decrease in the discount factor is “very similar to the effect of political uncertaint y or corru p tion.” Copyright © 2012 SciRes. ME  H. AKIBA 699 01UpUYpUY In addition, they also show that the deposit is increasing with reserves, because an increase in reserves means a decrease in investment, and hence output. Thus, the costs associated with this loss in output must be mitigated by an increase in deposit. Jeanne and Rancière [8,9] construct an intertemporal aggregate model with uncertainty in a sudden stop where the government maximizes the present discounted expected utility of a representative individual. The period utility or felicity function is assumed to be isoelastic to derive closed- form solutions. Uncertainty in sudden-stop is shown to justify holding foreign reserves as self-insurance for a precautionary purpose. When the capital account runs a deficit by a sudden stop, the deficit implies a surplus in the current account because of the balance of payments identity, causing a fall in absorption. Upon optimization, the optimal level of foreign reserves in normal time (i.e. no sudden-stop) is shown as a fixed fraction of the output level. This fraction is approximately equal to the sum of the short-term debts to GDP and the output cost of a sudden stop. A general conclusion emerging from our brief litera- ture review so far of the theoretical elaboration is that, although the optimal level of foreign reserves is positive when considered independently from external debts, this conclusion may be somehow modified once they are considered jointly for optimization. Since our preceding literature review focuses on the “optimality” of foreign reserves from a different standpoint of (expected) utility or profit maximization, the purpose of this study contin- ues to examine the welfare (i.e. the social utility) impli- cations by emphasizing precautionary holding of reserves within a framework of loss aversion theory, and synthe- sizes the latter framework with a simple dynamic two- period model under income uncertainty with joint deter- mination of foreign reserves and international debts. We also consider a defaulting case for external debts as a possible alternative choice when the state of nature turns from “good” to “bad”. 3. Precautionary Foreign Reserve as Simple Insurance This section considers a “pure” insurance model of for- eign reserve, in the sense it neither incorporate financial stability reflecting double drain nor financial mercantile- ism. This model may be interpreted as reflecting the es- sential characteristics of the optimal, precautionary, for- eign reserves in a static model. Suppose a country faces a possible output loss of x (>0) with probability p at a given period. For simplicity, we assume only two states of nature with loss and no loss. Utility and output are denoted by U and Y, respectively. Thus, the expected U, U0, is given by: Y (1) Since utility is decreased by , the country may decide to hold precautionary saving, denoted by h. This idea is consistent with Bastourre, Carrera, and Ibar- lucia [4] who consider that precautionary holding of sav- ing for foreign reserves works as insurance. We simply assume that h covers full amount in case of loss of α h . The expected utility in this case, U1, is: 11UpUYhpUY h (2) For the precautionary saving h to be meaningful, U1 > U0 must hold. Since '0dU dhU Yh 1, the maxi- mum amount that this country saves, h*, must satisfies: *1UY hpUYpUY (3) It immediately follows from (3) that: * UYUY hUY U (4) Thus, because of the monotonicity of U, > 0, it follows that: * h (5) Thus, the optimal foreign reserves must be smaller than the possible output loss. Assuming the concavity of utility function, differentia- tion of Equation (3) for a given Y yields: ** 0dh dpUYUYU Yh (6) Thus, the optimal level of foreign reserves as buffer stock is increased with an increase in the probability of loss. Because of concavity of U, Jensen’s inequality, UEY EUY, holds where E is the expectations operator. Thus, 11UpYpY pUYpUY (7) It then follows from (3) and (7) that: * UYpUY h (8) The monotonicity assumption of U implies that: * hpE (9) Thus, inequalities (5) and (9) imply that the optimal level of foreign reserves as buffer stock is larger than the expected loss E , but smaller than the possible out- put loss E . Since pα h increases with an increase in p, h* also increases, implying that the mini- mum level of buffer stock increases with p. It can easily be shown that this conclusion is not altered when h is assumed to cover only a part of loss neman [27]). . In the following sections, we will take a closer look at the ex- pected utility and the effects of loss probability, p, as policymakers may not conceive a good and a bad state symmetrically even when p is a half (Tversky and Kah- Copyright © 2012 SciRes. ME  H. AKIBA 700 4. Precautionary Reserve Holding in a Thucts a buffer stock model to derive the dis- co 11 2s UuC EuC (10) subject to the discounted present value of Simple Dynamic Model with Loss Aversion is section constr demand for international reserves under loss aversion. We presuppose that policymakers are not only interested in financial stability or financial mercantilism, but also their primary concern is to avert additional “disutility” arising from a bad state which differs from utility of a good state under uncertainty (Aizenman [19]). The model is formulated in a simple but standard intertemporal model (e.g. Obstfeld and Rogoff (OR, hereafter), [28], Chapter 1). It is assumed that the policy authority of a country maximizes the social welfare summarized in a well-be- haved period utility (or felicity) function, and the author- ity may hold foreign reserves as precautionary savings in the presence of loss aversion10. It should be emphasized that the government’s maximization is determined after recognizing the private sector’s maximization. The private sector is assumed to maximize the unted present value of their utility function for two periods, their budget constraint of the form of 11221 2 11r YYr (11) where u is the utility function, C1 is consumption in CICI the first period, C2s is that in the second period when state s is realized, E is the expectation operator, It (t = 1, 2) is the investment, Yt (t = 1, 2) is the output in the t-th pe- riod, β is the discount factor, and r is the real rate of in- terest determined in the world capital market and thus exogenously taken by this small country. The production function for new output in each period is given by 1 tt YFK (12) where K stands for capital. As usual, it is assum al choices by the private sector, it is assumed that the policy authority foresees some risk of exogenous shocks that is reflected in fluctuations of the future (i.e. second period) output, Y2. Specifically, it is assumed in (12) that, while γ = 0 in t = 1 (i.e. no un- certainty), γ is either +α or –α with probability 1-p and p, respectively, in period 2 (α > 0). Thus, p is the probabil- ity of bad state, while 1 − p is that of good state. Facing with the production uncertainty, it is assumed that the policy authority undertakes two changes in policy (Ai- zenman [19]; Aizenman and Marion [12]; Jeanne and Rancière [8,9]): 1) In order to compensate for possible output losses in future, the policy authority holds buffer stock as precau- tionary savings. Thus, they withholds R (< Y1) of re- sources from the private sector in period 1 that will be repaid in period 2 with interest payments, (1 + rf)R. rf is the safe interest rate which is possibly zero. This real resources R is called “Foreign Reserves”. For simplicity, it is assumed that the management cost of holding R is zero. In addition to R, the policy authority may decide external borrowing from abroad, B, in period 1, which is repaid with the interest in period 2, rB. They may decide to default without any penalty in period 2, but this option would be costly in the longer-run, as this country will be excluded from the international capital market. It is also assumed that the management cost of holding B is zero, and rB ≥ r ≥ rf ≥ 011. 2) The motivation of the policy authority for holding buffer stock R or external debts B is assumed to be a “loss aversion”, implying that “losses loom larger than corresponding gains”(Tversky and Kahneman [27]: p. 1047). Thus, at the point of autarky (i.e. before interna- tional trade), they have an expected utility of the following form in period 2 (see Gul [24]; Aizenman [19]: p. 936; Aizenman and Marion, [12]: p. 395): ed that F(0) = 0 and F’(0) = , and that the marginal product of capital (MPK) is strictly positive, but diminishing with capital input, F' > 0 and F'' < 0. The production process is assumed reversible, implying that in the planning ho- rizon of two, capital is assumed consumable, with K0 = K3 = 0. K1 is assumed given exogenously by historical data. It should be emphasized that the private sector maximizes their lifetime utility (10) in advance without knowing government’s loss aversion policy by reserves or debts accumulation. Recognizing the optim 22,2, 11 1 H HLL EuCpuY puY As clarified in the Appendix section, λH is defined as 1pp , whereas λL is defined as 11pp . σ is a parameter which measures loss aversion of the policy authority of this country. 1 + λL in the expected utility is the extra weight at- tached to the bad state of the nature where the govern- ment would be disappointed (relative to the probability weight, p, used in the conventional utility). Similarly, 1 – λH attached to the good state of the nature means that the government attaches to a lighter weight. By construction, it is clear that λs and p are interrelated to each other (see the Appendix section), as in Aizenman [19] and 10Loss aversion has been widely known in such fields as Marketing or Behavioral Economics as an explanation of asymmetric responses o f consumers to a price change. For example, see Han et al. [29] for a p ractical application. 11For simplicity, it is assumed that the price of debts is unchanged even after default. For a case of changing price, see Alfaro and Kanczuk [25]. Copyright © 2012 SciRes. ME  H. AKIBA 701 Aizenman and Marion [12]12. Thus, replacing 2s EuC by 2 ;s WC , the maximization problem for the policy authority under loss aversion is formally presented as: 11 2 12, 2, max ; 11 1 s HH LL UuCWC uCp uY puY (10’) σ is called the “loss aversion rate”, and Y2,H is the level of higher output when γ = +α (good state), but Y2,L is the lower output level when γ = –α (bad co state)13. The budget nstraint is: 112 2 12 1 111 Bf CICIr YBRYrBrRr (11’) with production function with capital stock constraints: levels of consumption and invest- m r than r (the mar- ginal product of capital). Thus, for B = 0, the presen discounted lifetime budget constraint (11’) with buffe med easilye fare level is er decreased o stigation. Our purpose of this paper, therefore, can be focusing on examining a possibility that precautionary holding of foreign reserves as buffer stocks is welfare improving in the presence of loss aversion, even if the PPF is shrunk inwards. Put differently, we would like to know if it is optimal for the policy authority to hold for- eign reserves as buffer stocks under production risk in the presence of disappointment aversion15. We also ad- dress if external debts B affect the optimal level of R. 5. The Optimal Reserve Holding in a Dynamic Model with Loss Aversion Using the model specified in the last section, this section considers whether there exists the marginal benefit of holding reserves as buffer stocks that reflect loss aver- sion for the monetary authority. We assume, for simplic- ity, the rate of interest on the safe assets, rf, is set to zero. Assume also that the authority neither has foreign re- serves nor external debts at the beginning of the first pe- riod, or alternatively the historical levels of foreign re- serve accumulation and external debts are zero. The private sector of this economy is assumed to choose their optimal levels of consumption and invest- ment, without realizing that the monetary authority chooses R optimally as buffer stocks. This implies that, for the op- timal investment decision, I1, the following condition is satisfied: 103 1, , 0 tt ttt YFKKKIKK (12’) From the model summarized above, there are three facts worth further emphasizing. First, it is straightforward to confirm that, upon maximization of (10) or (10’) at the first stage with respect to consumption and investment, the standard (expected) intertemporal Euler equation and the equality of the MPK and the real rate of interest are established (see, e.g. OR [28], Chapter 1, Section 1.2.2). Recall that we have assumed that the private sector chooses the optimal ent before the monetary authority implements precau- tionary policy against possible loss in the second period. Secondly, external debts B and buffer stock R are possi- ble substitutes, as they must satisfy the intertemporal budget constraint (11’). Thirdly, we explicitly assume in (11’) that the government (or monetary authority) saves R as buffer stocks in the first period, and invests it in safe assets whose interest rate rf is smalle 14 t r stock R lies strictly inside of the constraint (11’) without it, provided that r > rf, as also confir by d- picting an intertemporal production possibilities frontier (PPF) (see OR [28], Chapter 1, Section 1.2.3). Similarly, for R = 0, the budget constraint with external debts B lies strictly outside of the constraint (11’) without it if rB is strictly larger than r, rB > r. Thus, considering from the supply side of the economy, the national wel eithr increased. The last observation is directly relevant to our present inve 1 22 22 11 1 110 HH LL uY pFKruY pFKruY (13) Since K0 = 0 is given historically by assumption, and thus K0 + I1 = K1, u'(Y1) measures the MPK in utility unit at the first period under our assumption of autarky. Re- call that we have assumed the equality between MPK and the real rate of interest before the loss aversion policy implemented by the monetary authority. After observing (13), the authority considers the mar- ginal benefit accruing from reserve holding16: 1 1 22 11 1 HH LL UuY R rpuYp uY (14) where Equation (14) is also evaluated at the autarky point (i.e. no international trade). Solving the private sector’s 12For more details of loss aversion, see, e.g. Aizenman [19], Benartzi and Thaler [30], Kahneman, Knetsch, and Thaler [31], where it is pos- tulated that λs is also a non-linear function of p, although the functional form is slightly different. 13It is assumed here that E[u(C2)] can be expressed in this way even i f the probabilities of two states of the world are different for simplicity. N ote that Aizenman [19] consider a special case where λH and λLare constant, and fixed at λH = λL = 1/2 (see the Appendix section for more detail). We relax these restrictions in what follows. 14In what follows, r f is assumed to be zero for simplicity. 15Note that PPF shrinks inward only when rf < r (=MPK). 16More generally it is assumed that the country has neither positive nor negative trade balances carried over from the previous periods at the beginning of the planning horizon. Copyright © 2012 SciRes. ME  H. AKIBA 702 optimality condition (13) for u'(Y1) and substituting it in the government’s optimality condition (14) yields: 1 22 11 1 HH UpFKuY R (15) the (Arrow-Pratt) measure of relative risk on 22 11 LL pF KuY Computing the first-order-approximation of u'(C2) around the neighborhood of α = 0, making use of the definition of aversi Yu u , and denoting the latter by , we with end up 22 1 H uC uC and 22 1C u L uC . Upon substitution of these approximated expressions into (15) yields: 11 11 111 H L p p 1 22 UuYF K R (16) As explained earlier, loss aversion implies that λH and λL are respectively given by non-linear functions of p (see Appendix): 1 and 11 HL p p pp (17) Substituting (17) into (16) yields: 22 111 1 1 111 uYF K Up Rp p (18) which is the desired expression. From (18) it is apparent that, when α = 0 (i.e., no uncertainty in the future output), the right-hand side of (18) reduces to 22 0uY F K , implying that a country has no incentive to hold foreign reserves. However, as also ap- parent from (18), the sign is likely to be positive, depend- ing on the configuration of the underlying parameters, α, , σ, and p, implying that the optimal level of demand for foreign reserves is positive at the zero level of foreign reserves at the beginning of the planning period. Thus, a country is optimal to hold a positive level of foreign re- serves as buffer stocks (i.e., by a precautionary motive due to loss aversion) in order to smooth consumption. A simple numerical example may help understanding the possibility of positive demand for foreign reserves due to a precautionary motive. Empirical estimates of the loss aversion ratio, 11 LH , are typically around the neighborhood of 2, implying that 12 (Aizenman [19]; Aizenman and Marion 12]). Thus, we assume that σ = 1. The coefficient of relative risk aversion is consid- ered to be in the neighborhood of 2 (the “Samuelson’s presumption”). We thus assume that is 2. Then, at the e right- ha pproxi- a more so obability for 10 Asian countries is 0.28 . The reason for this low probability, also commonly found in the literature, is that “frequently indicators are signaling and no currency follows” (Edison [33]: p. 36). Thus, son [33] implies that the probability found in Kraay [32] is somewhat overestimated, as some indicators exceed th m . A similar assessment was also obtained from an EW model by Ito and Orri [35] who first estimated the crisis mode five Asian countries hit by the 1997 crisis and then dicted out-of-sample forecasts of the crisis probablities. initial autarky position, if both good and bad state are equally likely, (i.e. p = 0.5), the bracket term on th nd side of (18) is unambiguously positive for a mately 0.795 < α < 1, meaning that a country’s welfare improves by holding foreign reserves as buffer stocks17. The probability of bad state, p, is difficult to assess. According to historical data, the probability of crisis is not high. For example, according to Kraay [32], the pro- portion of currency crises caused by successful specula- tive attacks against the total attacks in a sample of 54 industrial and developing countries over the period Janu- ary 1975 to April 1999 is 0.3918. According to phisticated method of out-of-sample predictions using 21 “indicators”, using a “signaling” approach of an “Early Warning (EW, hereafter)” system Edison [33] also re- ports crisis probabilities for a sample of 21 developing countries as of December 1996. For example, the simple average pr19 Edi - e threshold values of crisis without inducing specula- tive attacks. In a recent article, Budsayaplakorn et al. [34] also replicate the “indicators” method employed by Edi- son [33] and find that the average probability of crisis for five Asian crisis-hit countries is 0.32 (their Table 5, p. 17). But, according to the estimated probability by a probit odel, they report that the average probability is even lower for those countries, 0.19 (their Table 5) l for pre- The average predicted probablity for the five countries is 0.27820. Thus, we can consider p being very low as alleged in the literature, somewhere in-between 0.2 to 19Those ten Asian countries include Indonesia, Korea, Malaysia, Philip- p ines, Thailand, Turkey, India, Pakistan, Sri Lanka, and Singapore. Fo r the rest of eleven non-Asian countries, the average probability of crisis is even lower, 0.22. verage out-of- 17A more than 79.5 percent change in output may be unlikely. Historical data indicate that the Philippines’ nominal output decreased by the maximum of 11.8%, while the Thailand’s and the Korea’s real output decreased by 17.35% and 20.95%, respectively, after the Asian cur- rency crisis since 1997 (The data source is the IMF-IFS online). 18This depends on how to define a crisis. His definition is the monthly p ercentage change in the exchange rate is larger than some threshold level but the average absolute percentage change in the 12 months before the p eriod is smaller than some threshold level. 75 attacks were successful out of the total of 192 episodes, and thus the probability o 20See Ito and Orii ([35]: p. 20), Figure 5, Panel A. The a sample predicted probability for 1997 is calculated by their benchmark model. The five crisis-hit countries are Indonesia, Malaysia, Korea, Phil- lipines, and Thailand. f successful crisis is approximated to 0.39. Copyright © 2012 SciRes. ME  H. AKIBA ME 703 0.321. Thus, in order to determine the sign of Equatio with deeper confidence, we need to know the confi tion of underlying parameters α and p, in addition to the as m of (18) ulate foreign reserves froinitial zero level of reserves. try with loss aversion (reflected in σ = 1) gains when a negative output shock is relatively large and the probability of bad state is higher. It also gains from reserve accumulation w positive output shock is relatively large and the p ity of good state is higher. Since Figure 2 is drawn with controlled σ and , the ro erse in terms of the relative risk aversion à la Arrow and Pratt, retaining σ = 1 (same degree of loss aver- e basic s sion)22. Figure 3 reveals that, although thign pattern is unchanged from the previous Figure 2, the depicted sur- face is noticeably lifted up, and as a result, the country gains from reserve accumulation for smaller output shocks. Thus, we deduce that a risk averse country has a good reason for reserve accumulation as expected. The next parameter to be examined for robustness is the loss aversion ratio, defined as 11 L H , the extra weight attached to the utility for the bad state of nature against the extra weight attached to that for the n (18) gure- sumptions of σ = 1 and = 2. Figure 2 depicts the bracket term of (18) that determines its sign as a sec- ond-order function of α for possible values of p. If this bracket teris positive, this country gains by start- ing to accumm the As observed from the Figure, the coun good state of nature. Up to here we have assumed it to be 2, and hence σ = 1. Here, the first case we consider is to change 11 L H to 4, meaning that the country becomes “twice” as more concerned with bad states while other things being equal. Using the definitions of λL and λH give in Appendix, σ is 3 in this case. And the second case is to change 11 L H to 1.5, and σ in this case turns out to be 0.5. It should be mentioned that the basic characteristics of the sign pattern reflected by Fi g- ure 1 are not significantly affected with those change in σ23. hen a robabil- bustness must be examined with their different values. Figure 3 is drawn with = 4, meaning that the country is more risk av Copyright © 2012 SciRes. 0. 0. 0.5 0.3 0.1 -0.1 9 7 -0.3 -0.5 -0.7 .9-0 0.9 0.4 -2 -1.5 -1 -0.5 0 0.5 1 1.5 2 utility gain 2.5 pr obability ainutility g -2--1.5 -1.5--1 -1--0.5 -0.5-0 0-0.5 0.5-1 1-1.5 1.5-22-2.5 output shock A benchmark case: σ = 1 and = 2. Figure 2. Utility gains from foreign reserve accumulation. 21Which probability from the two methods, the “indicators” method or a p [34]. Since the probit model is based on estimation, whether the probabili the mean squared error, the quadratic probability score, and the log proba bit model was confirmed by the Global Squared Bias criterion. 22The coefficient of relative risk aversion is sometimes assumed larger than 2 ( 23The calculation result rob ty c bili the S s and the fi it model, is more reliable was also considered by Budsayaplakorn et al. alculated by the model is accurate is determined by the three criteria (i.e. ty score). Formally, the outperformance of the probability using the pro- amuelson’s presumption). For example, King et al. [36] assumes = 5. g ures are available from the author on re q uest.  H. AKIBA 704 Thus, it is apparent from Figures 1 and 2 that the coun- try gains from reserve accumulation a) for higher prob- ability of bad state with higher negative output fluctua- tion, and also b) for higher probability of good state with higher positive output fluctuation. But the country looses by reserve accumulation when output shock is small, regardless of the probability of bad state. To confirm this relative irresponsiveness of change in utility with respect to ing a larger weight to the bad st be cumulation of low, since Chin e that almost o loss aversion, we perform additional robustness exer- cise with a larger σ = 7, other things being equal. The result with this strong emphasis on loss aversion parameter, however, does not significantly affect the sign pattern depicted by Figure 2 or 3. This suggests that the country may not gain by simply add ate in their utility function24. This finding may offer a new interpretation for huge foreign reserve accumulation by both China and Japan, although they have been very much different not only in political systems, but also economic aspects: China has en a developing country with a high output growth rate, but their per capita income has still remained very low. On the other hand, Japan has been a member of the OECD with a higher per capita income, but it has been suffering from a stagnant economy (deflation) for more than twenty years25. For these two countries with high ac foreign reserves, our analysis offers a consistent ex- planation for the “optimality”. For a remarkable increase in Chinese foreign reserve accumulation, it can be argued that, because of prolonged steady rate of economic growth, α (a change in output), is relatively large, while the probability of bad state (or cri- sis), p, isa has been free from speculative attacks because of relatively strict capital controls26. Thus, it has been “optimal” for China to accumulate huge for- eign reserves from the standpoint of loss aversion. It is surprising to realizpposite reasons may apply for large Japanese foreign reserve accumulation: Because of the “lost two decades” of economic slump, –α 0.9 0.7 0.5 0.3 0.1 -0.1 -0.3 -0.5 -0.7 -0.9 0.9 0.4 -4 -2 0 2 4 6 8 10 utility gain output shock probability utilitainy g -4--2 -2-0 0-2 2-44-66-88-10 for σ = 1 and = 4. Figure 3. Utility gains from eign reserve accumulation. 24The most notable change from Figure 2 or 3 is that the slope of the surface is steeper in this case. The calculation result and the Figure are also available on request. 25The Chinese and the Japanese per capita incomes in 2010 were US$4382.14 and US$42820.39, respectively, according to the IMF’s World Economic Outlook (April, 2011). 26The Chinese average growth rate of the last decade (2002-2011) is 10.6 % (IMF-World Economic Outlook, April, 2011). Thus, China is an example o f case (a). Copyright © 2012 SciRes. ME  H. AKIBA 705 (<0) is relatively large in absolute value, while p has been alleged to be large because of huge unsettled national debts, almost 600 trillion yen (more than 120 percent of nominal GDP) at the end of 200927. Thus, it may be rea- sonable to understand why Japan has such a large “opti- mal” accumulation of foreign reserves for a reason of loss aversion, even though this interpretation may be reason- able in hindsight once we recall that Japan has been blamed for attaining the unprecedented high rate of economic growth by increasing its exports like “concentrated heavy rain”, or by “mercantilism”. The next question to ask is how much foreign reserves to accumulate as the “optimal” level. The answer has al 6. Effects of Exogenous Changes on the Optimal Reserves This section examines the effects of exogenous shifts in the four underlying parameters, and explores if a policy of holding of foreign reserves at autarky is much more legitimate and convincing. The results are summarized in Panel A of Table 1. 6.1. An Increase in p The first exercise is the effect of an exogenous increase in the probability of bad state, p. Partial differentiation of (18) with respect to p yields: ready been given in our discussion in Section 3, where we have found that the optimal precautionary savings as buffer stock should be larger than the expected loss (see Equation (9)) but smaller than the possible output loss (see Equation (5))28. 1 22 1 221 1 uY F K U pR p (19) which is negative for = 2 and σ = 1. In other words, when the probability of a bad state is more likely to in- crease, the desirability of holding foreign reserves for a precautionary purpose is diminished. This is plausible, ation would be possible w to the probability of state of the nature. 6.2. An Increase in σ The second exercise is an effect of increase in a parame- ter which measures loss aversion of the policy authority of this country, i.e. σ. Partial differentiation of (18) with respect to σ yields: because if the country holds foreign reserves, the total spending would be reduced in a worse situation under the risk of a higher probability of a bad state. This character- istic is visualized clearly in Figure 2, where the utility surface has a slope downward with the probability of bad state, p. However, another interpret hen the (Arrow-Pratt) measure of relative risk aversion is smaller than unity. This in fact is equivalent to a qualification made by Aizenman [19] (p. 943) that “the concavity of the marginal utility is playing only a secon- dary role”. Needless to say, (19) is also positive for = 0, meaning that the desirability of holding foreign reserves is increased when the instantaneous (period) utility func- tion is a linear function of consumption. If (19) is evalu- ated at the initial point where α = 0 (i.e. no output uncer- tainty), the whole expression reduces to 0, implying that the desirability of holding foreign reserves is insensitive 22 1 221 1 1 uY F K Upp Rp (20) which is negative for = 2. Thus, the desirability of holding foreign reserves diminishes for a higher measure of loss aversion. This is also plausible, as the partial de- rivatives of λH and λL in (17) with respect to σ are shown to be positive for the former, but zero for the latter for p = 0.5. Thus, for a higher measure of loss aversion σ, the country attaches a higher weight for a good state, but an unchanged weight for a bad state, implying that the coun- try’s precautionary motive for holding foreign reserves is weaker than otherwise. However, (20) is positive when < 1. This implies that, if the preceding remark on the case (1) by Aizenman [19] is plausible, the desirability of holding foreign re- serves increases for a higher measure of loss aversion. A similar interpretation to the preceding case (1) applies to this case when the instantaneous (period) utility function f consumption. Since a mar- wise. Also, if (20) is evaluated at the initial point where α sitive to loss aversion. 27The Japanese average annual growth rate of the “lost two decades” (1992-2011) is only 0.87%. The lowest growth rate is –6.29% in 2009 (IMF-World Economic Outlook, April, 2011). According to Figure 2, utility is increased by reserve accumulation at a point where p= 0.6 and α = –0.6. This “indifference curve” shows the same utility for a lower p with a higher α. A similar indifference relation is observed in Figure 3 where, for example, p = 0.8 with α = –0.3. Thus, Japan is an example o f case (bthe Bloomsberg’s report dated April 21, 2011 (http://www.bloomm/news), the 28 J arch 11, 2011 is estimated as 16.9 trillion yen, about 3.5% o is closer to a linear function o ginal increase in loss aversion for a linear utility function implies a decrease in the expected utility level, the desir- ). Accroding to sberg.co “sovereign vulnerability index ranks Japan as the second most vulnerable”, next to Greece. The USA was ranked 5th. According to the press release by the Japanese Cnet Office dated une 24, 2011, the total loss incurred by the “Great East Japan Earth- quake” on M abi ability of holding foreign reserves increases than other- = 0, the whole expression reduces to 0, i.e. the desirabil- ity of holding foreign reserves as a buffer stock is insen- f t the end of 2010, while that of Chine was 49%. 11)). the 2010 nominal GDP (479.2 trillion yen). The Japanese foreign reserve ratio to GDP was 19% a (Author’s calculation based on the IMF’s World Economic Outlook (April, 20 Copyright © 2012 SciRes. ME  H. AKIBA Copyright © 2012 SciRes. ME 706 ts o nel Fores) Table 1. Comparative statics results for benefi Pa Parameter R ( f foreign reserves (R) and external debts (B). A eign Reserv p 12 222 1 Uu FK pR p 1 1 σ 12 222 1FK Rp 1 1p Uu p α 12 2 1 Uu FK p Rp 1 1121p p φ 12 Uu FK 221 1Rp 1 1p p δ - β 2 1 21 1 uY UFK Bp 1 [11 21p Note: Evaluated at R = B = 0. Panel B nal Debts): No Defaulting B (International Debts): Defaulting* Parameter B (Internatio p 12 221 1 1 Uu FK pB p 2 21 2 pB 2 91 211 1 uFK p U σ 21 1p 12 22 Uu FK p B 2 1p 1 2 B 2 121 1 1 u pp FK p U α 2 2 1 11121 FK p pp p 1 U B u U B F 211 1211K pppp 1p 1 2 u φ 12 2 1 211 (1) Uu FK Rp pp 2 2211 11 1 u FKpp p p 1 R U δ - 2 2 1112 1 u pFK p 1 B U β 2 2 1 1111 21 B uFK p p 1 U 1 2 (121 11 U B 2 1 u p ) 1 11 F Kp p Note: Evaluated * at R = B = 0. means evaluated at rB = 0 and δ = 0.  H. AKIBA 707 6.3. An Increase in α The third com crease in future output shock, which implies that outp is more uncertain as it fluctuates more widely. The increase in the fluctuation is reflan increase in α. Diffe entiating (18) partially with respect to α, and evaluating at the initial point where the historical level of foreign reserve accumulation is assumed zero and no output un- certainty (α = 0) yields: parative statics exercise is an effect of in- ut ected in r- 1 22 1 111 U R uY F K p pp 21p (21) which is ambiguous in sign, but positive for α > 0.083 under our assumption of = 2, σ = 1 and 12p at the autarky position. Thus, we arriplausible prediction that the desirability of holding foreign reserves is likely to increase when future outes more uncertain than otherwise. 6.4. An Increase in The fourth and the final exercise is an effect of increase itudes milar pro- cedure as in the previous cases, partial differentiation of (18) with respect to yields: ve at a put becom in the att towards risk, . Following a si 1 22 211 1 1 U R uYF Kpp p (22) Thus, if α is set to zero at autarky point, (22) is also zero. It is also positive for 13 if evaluated under our assumptions nd of σ = 1, = 2 a12p. The posi- tive value see it implies that the desir- ability of holdirves is stronger for a higher relative riskalso clear that (22) is posi- tive when σ = ms plausible, ng foreign rese aversion, 1, = 2 as . It is and 13p , regardless of α(>0), iming that reser becomes more desirable with relative risk aversion. In addition to those effects, it should be mentioned that an increase in β, the subjective discount factor, will ce- teris paribus increase the desirability of holding the op- timal level of foreign reserves for a precautionary pur- pose at the zero reserve level, on condition that (18) is unambiguously positive. This plausible implication is simi- lar to the one in Aizenman and Marion [12,13]. Our new finding is that all effects summarized in Equations (20)- (22) are further strengthened by an increase in β. 7. The Optimal International Debts nd compares ith the optimal R. When the state of nature is good, the government has no reason for defaulting, but it is t the government chooses to default when the state is bad. Thus, consumption in period 2 is changed to: plyve holding This section considers the optimal level of B, a it w assumed tha 22 11 111 111 1 HfB CFKrRrB I KrYCIBR (23-1) 2211 111 11 1 1 Lf CKrRIK rY CIBR (23-2) where (1 > δ > 0) is “the additional loss of output in au- tarky, a common feature in sovereign debts models” (Al- faro and Kanczuk [: p. 25). 7.1. Without Defaulting Following a similar procedure as we derived Equation (14) by assuming that the authority neither have external debts nor foreign reserves at the beginning of the first period, or alternatively the historical levels of external debts and foreign reserves are zero, the marginal benefit accru- ing from external debt holding is, for a non defaulting case: 25] 1 2 11 1 12 H HB LLB UuYpuYrr B puYrr (24) The private sector of this economy is assumed to choose their optimal levels of consumption and investment be- fore the monetary authority chooses B optimally. This implies that, for the optimal investment decision, I1, the same condition as Equation (13) is satisfied. Upon sub- stitution of (13), λH, and λL, into (24) yields: 2 1 2 2 1 111 111 B B uY U Bp pFKr pFKr (25) Evaluation of (25) with our assumption rB = 0 (Ai- zenman and Marion [3,4]) reduces (25) to: 1 22 1 11 1111 U B uY F K p pp (26) Thus, at the autarky point where p = 0.5, σ = 1 and = 2 as before, the optimal level of external debts is unam- biguously positive for α in between 0 and 0.795. Thus, it Copyright © 2012 SciRes. ME  H. AKIBA 708 is optimal for the country to hold some external debts for this region of α. However, recalling that the optimal level of foreign reserves is zero for this region of α, we can see that this result is consistent with Alfaro and Kanczuk [25], arguing that the optimal level of foreign reserves is zero, while that of international debts is positive, bsed model output uncertainty being in be- llowing a similar procedure as before and using (23-2): a on their simulation. What we have found is that our uggests that their conclusion based on loss aversion also s is true for the extent of tween 0 < α < 0.795. For larger uncertainty α ≥ 0.795, the opposite conclusion is deduced; the optimal level of B is zero, while that of R is positive. 7.2. With Defaulting When the government chooses to default for a low output level due to a bad state, we can derive the marginal change at the autarky point, fo 2 1 2 1 111 111 B uY U Bp pFKr p (27) < α < 0.795, but also greater than (26), in from external debts is larger on-defaulting case. How- gaining credibility. 7.3. Effects of Exogenous Changes on the Optimal Debts with or without Default A similar procedure of comparative statics exercises for the optimal B yields the results summarized in Panel B of Ta metric result between R and B for non-defaulting case (the first column of Panel B). However, this symmetric nature is a natural consequence of the budget constraint (11’), in which R and B enter the constraint at the first period with opposite signs. Thus, since the marginal bene- fits of holding R (Equation (18)) or B (Equation (26)) are evaluated at the beginning of the first period at R = B = 0, that the defaulting 8. Precautionary Saving with Loss Aversion This section considers the optimal precautionary sav with loss or disappointment aversion in a simple two-period dynamic model under uncertainty. We simplify t vious model in section IV with an assumption of 0, and by disregarding production, and hence investment. Y2 – α. Thus, the problem faced by the government is to maximize (10’) with re- to the lifetime budget con- 2 11 1FK Evaluating at the initial autarky position with our as- sumption rB = 0 and, in addition δ = 0 reduces (27) to (see the Equation (28) below): This is not only positive as (26) with the same parame- ter values for 0 implying that a utility ga for defaulting case than for n ever, this larger utility gain with defaulting should not be emphasized, as the country in the longer-run will have a larger cost of inability to borrow from the world capital market for sometime before re ble 1. Several characteristics are outstanding from it. The first and the most noticeable characteristic is the sym- the comparative statics results of R and B must have the opposite signs for each other. In other words, they are “substitutes” each other in the sense of Alfaro and Kanc- zuk [25]. Secondly, as a comparison between defaulting (the first column of Panel B) and non-defaulting (the second col- umn) cases reveals, the comparative statics values are lar- ger in absolute value for the case of non-defaulting than defaulting (except the case of δ). This implies optimality of holding B is strengthened for a case for this one-shot game. Moreover, this observation is also consistent with that of Alfaro and Kanczuk [25] who observe that they are not “complete substitutes”. We confirm this characteristic in our model incorporating loss aversion. ing he pre- R = B = Outputs are assumed given exogenously, but the sec- ond-period endowment of output is stochastic by α as before, Y2H = Y2 + α and Y2L = spect to S (saving), subject straint 12 12 11CCr YYr , where S is de- fined by S = Y1 – C1. The first-order condition is: 12 2 11 1 11 H L uY SpuYrS puYrS (29) where 11 r is assumed equal to the discount rate, β. Expanding the marginal utilities around the neighbor- hood of S = 0 and α = 0 by Taylor series and approxi- mating them at the first and the second degree, it c shown that ( see the Equation (30) below): an be 2 1 21111 1 uY UFK p Bp 1[11 11p p (28) 2 11 1 111 12 HL dS uY rS pp ruY 2 211 121 uY rS pp 2 1 1 12 112 1 rpuY r 12 1r (30) Copyright © 2012 SciRes. ME  H. AKIBA 709 where Ωi is the coefficient of Arrow-Pratt absolute risk aversion at time i 0uiui . The second term on thght-hand side is unambiguously voking the so-called Arr hypo g (or non-increasing) Ωi, since it . Thus, for a given positive second rtainty (α) is i e numerator of the ri positive (or non-negative), in thesis of decreasin lies that 0u 0pp ow’s imp ter 12 m, a sufficient, but not necessary, condition for sav- ings to increase by an increase in unce . The equation 12 0pp is a Figure 4. If the second, positive, term of (30) is negligibly small for a small α, the sign of (30) is dominated by the sig 12pp hyperbola in the p – σ plane as shown in n of (Aizenman [19]). In the absence of aversion (σ = 0), this implies that saving increases for loss 12p. But under loss aversion, it can be confirmed that saving increases for an even smaller probability of output loss; for example, when σ = 1 (Aizenman, 1998), the country saves more even for 13p for a precau- tionary purpose. As discussed earlier, we may be able to approximate p being somewhere in between 0.2 to 0.3 from preceding literature on the Early Warning System against currency crises. When p ≤ 0.3 the sufficient con- dition for dS > 0 is satisfied for σ < 1.3. An important implication is that our sufficient condition depicted in Figure 4 is likely to be satisfied, and thus, that the opti- mal precautionary saving under loss aversion is quite likely to be positive for plausible value of p according to empirical crisis episodes. 9. Conclusions This paper considers a t foreign reserves, with pa heory of the “optimal” level of rticular emphasis on the benefits derived from precautionary holding of reserves. Starting from a simple self-insurance model, we elaborate our analytical model in an intertemporal framework, and σ p 0 1/2 1/3 1 Figure 4. A sufficient condition for dS > 0. presuppose that policy makers are motivated by neither financial stability nor financial mercantilism, but actually by holding precautionary reserves because agents are loss Itn for surface depicted in Figures 2 and 3. Showing that the change in the welfare from the optimal level of foreign reserves under loss aversion depends crucially on the underlying parameter values (the probability of bad state, the Arrow-Pratt measure of relative risk aversion, the loss aversion rate, and the output uncertainty measure), we show how the present discounted level of welfare (U1) changes with configuration of the probability of bad state (p) and the output shock (α), controlling the rest of the two parameters. From the surface depicted in Figures 2 in the p-α-U1 space, we put forth our interpretation that huge accumulated foreign reserves observed in the actual historical data of China and Japan can be interpreted con- sistently within our intertemporal optimization model with loss aversion. Several comparative statics exercises for the condition of the optimal foreign reserves are examined with respect to the underlying exogenous parameters. It is argued that the optimal level of foreign reserves decreases with the probability of bad state. The reason rests on the fact that the total spending decreases if the country saves more for a precautionary purpose. However, it is also clear that this prediction crucially depends on the degree of risk aversion. A similar dependency is also observed in an- other comparative statics exercise with respect to loss aversion. Plausible effects of output shocks and the atti- tudes toward risk are also derived. Admitting that a country would not likely to make ex- ternal borrowing for a precautionary purpose, we also consider such a possibility, partly because of theoretical completeness and partly because such a case has been considered in the previous literature. Allowing for a pos- sibility of defaulting, we derive that similar optimality conditions with and without defaulting. The optimal precautionary saving is also considered directly from our intertemporal optimizing model with loss aversion. We have shown that, as long as the Ar- row’s hypothesis of non-increasing absolute risk aversion, the optimal level of precautionary saving is likely to be positive with historically observed parameter values. An important message drawn from the present invest- tigation is that foreign reserve accumulation observed in the real world is consistent with the rational behavior of a country which has been concerned with loss aversion and averse. is shown that the initial optimality conditio holding foreign reserves depends on the underlying pa- rameters of the model. Given the loss aversion parameter and the coefficient of relative risk aversion, the utility surface depends on the probability of bad state and the degree of output uncertainty, as summarized by a convex Copyright © 2012 SciRes. ME  H. AKIBA 710 thus behaved optimally in a dynamic world with precau- tionary savings. REFERENCES [1] W. M. Corden, “Those Current Account Imbalance: A Sceptical View,” The World Economy, Vol. 30, No. 3, 2007, pp. 363-382. doi:10.1111/j.1467-9701.2007.01000.x [2] R. McKinnon, “Why China Should Keep Its Dollar Peg,” International Finance, Vol. 10, No. 1, 2007, pp. 43-70. doi:10.1111/j.1468-2362.2007.00195.x [3] N. Roubini, “Why China Should Abandon Its Dollar Peg,” International Finance, Vol. 10, No. 1, 2007, pp. 71- 89. doi:10.1111/j.1468-2362.2007.00197.x [4] D. Bastourre, J. Carrera and J. Ibarlucia, “What Is Driving Reserve Accumulation? A Dynamic Panel Data Ap- proach,” Review of International Economics, Vol. 17, No. 4, 2009, pp. 861-877. [5] J. A. Frenkel, “International Liquidity and Monetary Con- trol,” In: G. M. von Furstenberg, Ed., International Money and Credit: The Policy Roles, International Monetary Fund, Washington DC, 1983, pp. 65-109. [6] M. Bahmani-Oskooee and F. Brown, “Demand for Inter- national Reserves: A Review Article,” Applied Economics, Vol. 34, No. 10, 2002, pp. 1209-1226. doi:10.1080/00036840110096129 [7] R. Flood and N. Marion, “Holding International Reserves in an Era of High Capital Mobility,” IMF Working Paper WP/02/62, April 2002. [8] O. Jeanne and R. Rancière, “The Optimal Level of Inter- national Reserves for Emerging Market Countries: For- mulas and Applications,” IMF Working Papers WP/06/ R. Rancière, “The Op ld J C [11] J. Aizenmaeserve Uncertain 229, October 2006. [9] O. Jeanne and timal Level of Inter- national Reserves for Emerging Market Countries: A New Formula and Some Applications,” (Mimeographed), February 2009. [10] M. Obstfe,.. Shambaugh and A. M. Taylor, “Finan- cial Stability, the Trilemma, and International Reserves,” Unpublished Manuscript, January 2008. n and N. Marion, “Rty and the Supply of International Credit,” Journal of Money, Credit, and Banking, Vol. 34, No. 3, 2002, pp. 631-649. doi:10.1353/mcb.2002.0001 [12] J. Aizenman and N. Marion, “The High Demand for In- ional Reserves in the Far East: What Is Going on?” Journal of the Japanese and International Economies, l. 17, No. 3, 2003, pp. 370-400. 2009, pp. 525-543. [15] J. Aizenman and J. Lee, “Financial versus Monetary Mercantilism—Long-Run View of Large International Reserves Hoarding,” NBER Working Paper Series 12718, December 2006. [16] J. Aizenman and J. Lee, “International Reserves: Precau- tionary versus Mercantilist Views, Theory and Evi- dence,” Open Economies Review, Vol. 18, No. 2, 2007, pp. 191-214. doi:10.1007/s11079-007-9030-z [17] R. Chang and A. Velasco, “Financial Fragility and the Exchange Rate Regime,” Journal of Economic Theory, Vol. 92, No. 1, 2000, pp. 1-34. doi:10.1006/jeth.1999.2621 ng Asia Too Much Foreign Exchange Reserves? An Empirical Examination,” The Journal of Korean Economy, Vol. 11, No. 1, 2010, pp. 103-128. [19] J. Aizenman, “Buffer Stocks and Precautionary Savings th Loss A [18] D. Park and G. E. B. Estrada, “Does Developi wiversion,” Journal of International Money and Finance, Vol. 17, No. 6, 1998, pp. 931-947. doi:10.1016/S0261-5606(98)00035-7 [20] Y.-W. Cheung and R. Sengupta, “Accumulation of Re- serves and Keeping up with Joneses: The Case of LASTAM Economies,” International Review of Economics and Fi- nance, Vol. 20, No. 1, 2011, pp. 19-31. doi:10.1016/j.iref.2010.07.003 [21] H. R. Heller, “Optimal International Reserves,” Economic Journal, Vol. 76, No. 302, 1966, pp. 296-311. doi:10.2307/2229716 [22] J. A. Frenkel and B. Jovanovic, “Optimal Interna Reserves: A Stochastic Framework,” Economic Journal Vol. 91, No. 362, 1981, pp. 507-514. doi:10.2307/2232599 tional , [23] H. Akiba, Y. Iida and Y. Kitamura, “The Optimal Ex- change Rate Regime for a Small Country,” International Economics and Economic Policy, Vol. 6, No. 3, 2009, pp. 315-343. doi:10.1007/s10368-009-0140-5 [24] F. Gul, “A Theory of Disappointment Aversion,” Econo- metrica, Vol. 59, No. 3, 1991, pp. 667-686. doi:10.2307/2938223 [25] L. Alfaro and F. Kanczuk ment and Sover , “Optimal Reserve Manage- eign Debt,” Journal of International Eco- nomics, Vol. 77, No. 1, 2009, pp. 23-36. doi:10.1016/j.jinteco.2008.09.005 [26] D. D. Diamond and P. H. Dyvbig, “Bank Runs, Liquidity, and Deposit Insurance,” Journal of Political Economy, Vol. 91, No. 3, 1983, pp. 401-419. doi:10.1086/261155 [27] A. Tversky and D. Kahneman, “Loss Aversion in Risk- ternat Vo doi:10.1016/S0889-1583(03)00008-X [13] J. Aizenman and N. Marion, “International Reserve Hold- ings with Sovereign Risk and Costly Collection,” The Economic Journal, Vol. 114, No. 497, 2004, pp. 569-591. less Choice: A Preference-Dependent Model,” Quarterly Journal of Economics, Vol. 106, No. 4, 1991, pp. 1039- 1061. doi:10.2307/2937956 [28] M. Obstfeld and K. Rogoff, “Foundations of International Macroeconomics,” The MIT Press, Cambridge, 1996. [29] S. Han, S. Gupta and D. R. Lehmann, “Consumer Price Sensitivity and Price Thresholds,” Journal of Retailing, Vol. 77, No. 4, 2001, pp. 435-456. doi:10.1016/S0022-4359(01)00057-4 Tax doi:10.1111/j.1468-0297.2004.00232.x [14] G. Cifarelli and G. Paladino, “The Buffer Stock Model Redux? An Analysis the Dynamics of Foreign Reserve Accumulation,” Open Economies Review, Vol. 20, No. 4, Copyright © 2012 SciRes. ME  H. AKIBA ME 711 [30] S. Benartzi and R. H. Thaler, “Myopic Loss Aversion and the Equity Premium Puzzle,” NBER Working Paper No. 4369, May 1993. [31] D. Kahneman, J. L. Knetsch and R. H. Thaler, “Experi- mental Tests of the Endowment Effect and the Coase Theorem,” Journal of Political Economy, Vol. 98, No. 6, 1990, pp. 1325-1348. doi:10.1086/261737 Copyright © 2012 SciRes. [32] A. Kraay, “Do High Interest Rates Defend Currencies during Speculative Attacks?” Journal of International Economics, Vol. 59, No. 2, 2003, pp. 271-321. doi:10.1016/S0022-1996(02)00021-1 [33] H. J. Edison, “Do Indicators of Financial Crises Work? An Evaluation of an Early Warning System,” Interna- tional Journal of Finance and Economics, Vol. 8, No. 1, 1972003, pp. 11-53. doi:10.1002/ijfe. [34] S. Budsayaplakorn, S. Dibooglu and I. Mathur, “Can Macroeconomic Indicators Predict a Currency Crisis? Evidence from Selected Southeast Asian Countries,” Emerging Markets Finance & Trade, Vol. 46, No. 6, 2010, pp. 5-21. [35] T. Ito and K. Orii, “Early Warning Systems of Currency Crises,” Public Policy Review, Vol. 5, No. 1, 2009, pp. 1- 24. [36] M. S. Kingl, L. Sarno and E. Sojli, “Timing Exchange Rates Using Order Flow: The Case of the Loonie,” Jour- nal of Banking & Finance, Vol. 34, No. 12, 2010, pp. 2917-2928. doi:10.1016/j.jbankfin.2010.02.016 Appendix tainty equivalent consumption, μ, i.e. the “expected dis- appointment”. This average loss below the certainty equi- valent consumpt This section recapitulates the definition of loss aversion as put forth in Aizenman [19] and Azenman and Marion [12], and clarifies the demand side of the economy (i.e. ex ion reflects the authority’s sentiment of “disappointment” (Aizenman [19]: p. 935). Equation (A-1) postulates that theutility equals the difference betweeected utility and are only two orresponds to a ts loss averse expected n the conventional exp pected utility) in the second period in more detail. The relationships between the degree of loss aversion (σ), the probabilities of bad and good states, (p, 1 – p), and the extra weights attached to utility in good and bad states (λH, λL) are presented. As it will be explained below, the definition of loss aversion is an application of the con- cept of risk aversion by subtracting the expected disap- pointment from the conventional expected utility. Assume that the policy authority possesses the ex- pected utility of uncertain consumption 2 s C in n states of nature, s 1,,n, denoted by 2 ;s WC in the second period. σ is called the loss aversion rate. Assume also that there is the “certainty equivalent” level of consumption μ, defined by 2 ;s WC u , where u is a conventional utility index with 0u and 0u . Then, loss aversion is defined by the existence of a positive parameter σ that satisfies: 2 22 2 ;s ss s C WC uCf CdsuuC a measure of loss aversion (σ) times the “expected dis- appointment”. Assume further that, for simplicity, there states of nature, C2H and C2L, where C2H c higher and C2L to a lower level of consumption with probability of 1 – p and p, respectively. Thus, p represen probability of bad state. Then, sincethe u(μ) does not depend on states of nature but a constant, it is straightfor- ward to derive W . Upon integration of (A-1) yields: 22 2 1 H L L WpuCpuC pW uC (A-2) and thus solving (A-2) for W yields: 22 11 1 H HLL W puCpuC (A-3) 2 22 2 2 | Pr s ss s s fC ds EuCEuuCC C 2s (A-1) where f is the probability density function of C2s, E is the expectation operator, and Pr(s) is the probability of state s. The term 2 |s Eu C where 1 Hpp and 11 Lpp . Note that λH and λL are non-linear with p, as in Tversky and Kahneman [27] and Benartzi and Thaler [30]. Note that they are both positive, λH = λL for p = 1/2, and 0 Hp and 0 Lp . Thus, the policy author- ity attaches a lower weight to 2 H uC , but a higher weight to 2 L uC for a higher probability of bad state. Finally, it should be mentioned that W reduces to the conventional expected utility when the loss aversion rate, σ, is zero. is the expected value of 2 s uuC , conditional on C2s below the cer- |