Theoretical Economics Letters

Vol. 2 No. 5 (2012) , Article ID: 25922 , 5 pages DOI:10.4236/tel.2012.25099

The Process and Achievement of the Application of XBRL in Aviation Industry—Based on Eastern Airlines Application Example

Research Center of Accounting Informationization and Financial Decision-Making, East China University of Science and Technology, Shanghai, China

Email: hurenyu@126.com

Received August 1, 2012; revised September 3, 2012; accepted October 5, 2012

Keywords: XBRL Establishment; Eastern Airlines; XBRL Taxonomy

ABSTRACT

In the field of accounting informationization, the establishment and development of XBRL has aroused wide concerns. Abandoning the constrain of the conventional theoretical study, this paper is based on the case of applying XBRL in Eastern Airlines (abbr. CEAIR) to integrate theory with practice. The authors researched the extension of the general taxonomy in specific industry, described the obstacles during the operation and the achievement it would obtain, as well as the valuable experience.

1. Introduction

As a milestone and a new start of Chinese accounting informationization, the XBRL General Taxonomy was released by the National Standardization Management Committee and the Ministry of Finance on Oct 19, 2010, which laid the foundation for establishing a scientific, sound and globally accepted accounting standards system in China [1]. After that, to promote the construction of corporate accounting informationization and drive the implementation of general XBRL taxonomies on Chinese accounting standard, since Jan 1, 2011, Ministry of Finance has carried out the pilot implementation plan of XBRL general taxonomy in corporate and accounting firms [2]. The fist pilot units included 13 corporations such as China National Petroleum Corporation (601857), CEAIR (600115) and 12 large-scale accounting firms involving BDO China Shu Lun Pan CPA LLP., PWC, KPMG, DTT, and EY. Our team participated in the project “Platform Construction and Application Demonstration of Standard Financial Report Based on XBRL” (2009BAH45B04), which is the sub project of “National Technology Support Program (2009 BAH45B00)”. Based on the application of XBRL in CEAIR, the authors discussed how to combine the theory and practice when applying XBRL, the extension of general XBRL taxonomy to specific industry taxonomy, as well as the obstacles encountered and the results achieved during the implementation of project, which brought in a deeper understanding of applying XBRL in enterprise.

2. The Implementation of the XBRL Project in China Eastern Airlines

2.1. The Status and Difficulties in the CEAIR XBRL Implementation

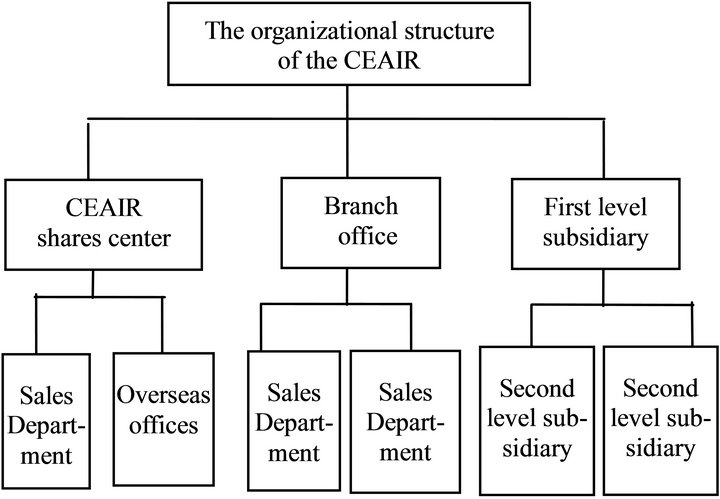

The organizational structure of CEAIR is very special (as shown in Figure 1). The headquarters contain a lot of branch offices and subsidiaries, which are also divided into a lot of the business departments. Meanwhile, the company also set up a number of departments, centers, as well as overseas offices. Because CEAIR has a large complex structure, it is hard to make the data format unified for facilitating the submission and delivery of data. The reason for this problem is that different objects have different sizes and informationization levels. For example, some objects have a complete data processing and aggregation, while others are still in the initial stage of manual processing. But the overall company must realize the whole data collection and presentation in order to achieve the data unification. Therefore, it can be imagined that it is so difficult to realize XBRL in such a large and complex system. Once the enterprise information system is unable to load the XBRL data, the entire system will break down or collapse.

CEAIR is a corporation listed in the three markets. Its governance structure is very complex. It is difficult to translate the data in the ERP system to the format of XBRL due to the complex structure of CEAIR. Although the ERP data can be automatically transformed to XBRL data through data interface, it does not work in some of the business department and subsidiaries since they are not applied to ERP software. Thus it requires a large amount of manual input because of the poor readability of these unstructured financial data.

2.2. The Concrete Implementation Plan and Steps of the Application of XBRL in CEAIR

In general, there are three modes to achieve XBRL financial reporting.The first is using corporate information system such as ERP systems in which the direct output is printed document or PDF file which cannot be directly converted and used. Instead, manual input is required to form XBRL files in accordance with the formation of the XBRL documents when converting. Manual inputting in this mode also increases the risk of data errors. The risk of errors and high cost caused by manual entry will deteriorated the actual application value in this mode [3].

The second mode is to form a variety of financial statements by the enterprise information system itself such as ERP system. And these financial statements can be stored in the form of electronic documents such as Excel or Word. When the XBRL statements are required by the relevant securities institutions or banks, they can be converted by XBRL format converter in accordance with the corresponding taxonomies and the instance document requirements. Although this mode is currently the main application one in the practical application, it is only a transitional stage for the future development of data. XBRL will be the future data form in enterprise, thus all valuable data (including general ledger data) will be transformed into XBRL form [4].

In the third mode, the enterprise’s own ERP system is integrated with XBRL adapter. Therefore, the financial report processing can be completed during information processing in accordance with XBRL standard.

Figure 1. The organizational structure of the CEAIR.

Meantime, the XBRL documents can be output in real time.

The application of such mode requires a new version of ERP software with an embedded XBRL adapter developed by the original ERP system vendors. In the new ERP system, extraction and conversion to XBRL metadata are completed in all aspects of the business processing, and the standard XBRL documents will be generated timely according to the XBRL taxonomy, for instance, the financial statements requirements. Among all modes, the third one is the best mode for the application of XBRL financial reporting, but also the most difficult one to be achieved [5]. Compared with others, this third mode can exert the advantage of XBRL to the most extent, can quickly and efficiently provide various kinds of real-time financial information which is convenient to be exchanged.

This project adopted the third mode, in which XBRL is completely embedded in the new ERP system to realize the standardization and intelligentization of all data.

First of all, CEAIR identified specific objectives on the implementation of XBRL:

1) Extend the CEAIR’s CAS taxonomy;

2) Dock the interface between the Oracle ERP system data and the audit report, and extract the part of data automatically;

3) Expand the taxonomy of branch companies and subsidiaries on the basis of CAS, and make the audit report classified by using the technology of XBRL;

4) Conbine the data of branch companies and subsidiary companies, and produce the financial statement data for disclosure to public;

5) Achieve intelligent analysis of financial data for management and help their effective decision-making.

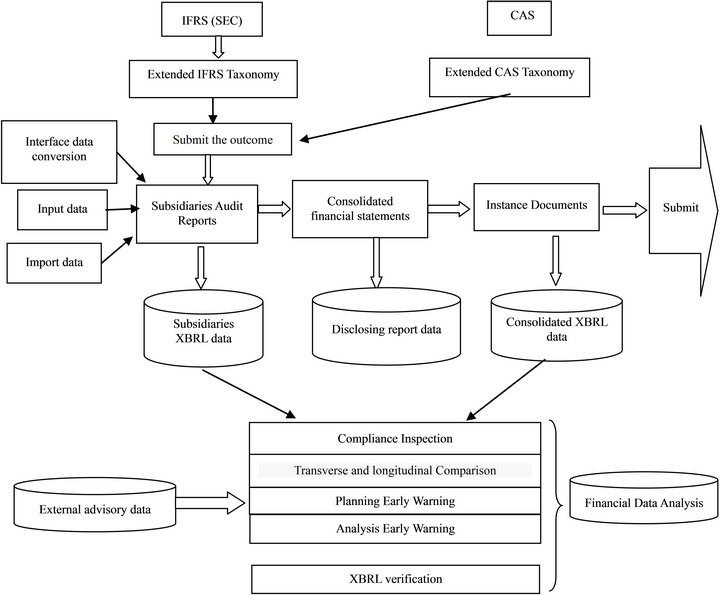

Secondly, the group of CEAIR XBRL project proposed the effective solution on difficulties and obstacles on XBRL research. Following is the specific steps of CEAIR XBRL implementation (as shown in Figure 2).

Figure 2 is the implementation scheme of XBRL in CEAIR. Because of the complex structure of the corporation, there are three different ways in storing data, including ERP system Excel and manual entry. The data in the ERP can be automatically converted into the module of the audit report filling, while some business departments and the subsidiaries who have no ERP system rely on Excel data or manual entry data. After the completion of filling module, it is the step of parsing data and generating XBRL data, and then next step is the module of consolidated financial statements, in which procedure can automatically identify mutual data and summarize them based on XBRL Taxonomy and XBRL extended Taxonomy. For example, procedure can automatically identify the data with the label “Profit for the year” and summarize that data from holding corporation and

Figure 2. The implementation scheme of XBRL in CEAIR.

subsidiaries, and then form the consolidated financial statement through the internal offset and adjustment of financial data between holding company and subsidiary company. At last it will generate financial XBRL instance documents based on the consolidated financial statements.

The non-financial information, which need to be disclosed, also be generated based on XBRL extended Taxonomy. For example, the extended Taxonomy is the top five suppliers who own the most accounts payable, and then procedure can automatically identify the top five to generate the instance document module. Then the financial and non-financial XBRL instance documents are merged to generate the final XBRL instance document for reporting.

In this whole process, the enterprise can use XBRL data, combined XBRL data and external consulting data of branch companies and subsidiaries at any time for compliance inspection, transverse and longitudinal comparison, planing early warning, analytic early warning, and XBRL verification.

The scheme above resolves so many problems about the XBRL application:

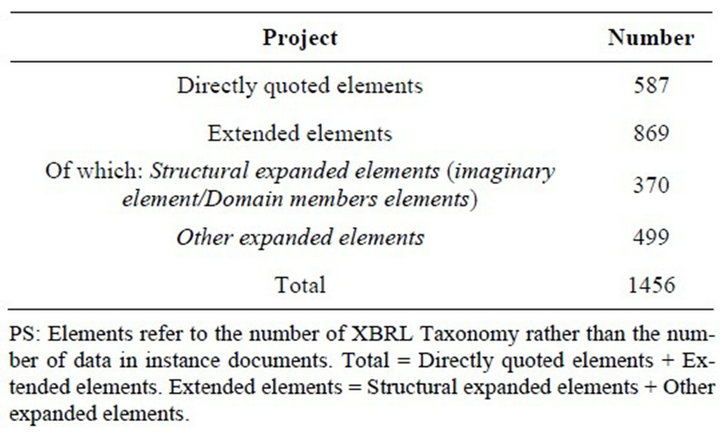

1) Extend XBRL Taxonomy based on IFRS and CAS (as shown in Table 1 & Figure 3). CEAIR has completed the expansion of XBRL Taxonomy based on the company’s specific requirements for using Taxonomy. The holding corporation has completed the expansion of XBRL Taxonomy, as well as the branch offices and subsidiaries;

2) Implement the unification of data interface. Considering the complex structure of the CEAIR and the different degree on informationization of the subsidiary companies, departments, centers, and the operators, it is necessary to standardize data input of each object according to the XBRL data interface. In accordance with the requirement of the data input in XBRL, CEAIR designed the special template in which each object only needed to input required data including ERP system data input, Excel data input, manual data input (according to the degree on informationization of different object). This greatly simplified the workload of post-extracting and merging of data [6];

3) According to the data from branch companies and subsidiary companies, XBRL can generate corresponding instance documents, provides a good platform for transverse contrast in the branch companies or the subsidiary companies. At the same time, XBRL can also summary the data submitted by the branch companies or the subsidiary companies to form consolidated statements, in which every data change will be recorded automatically;

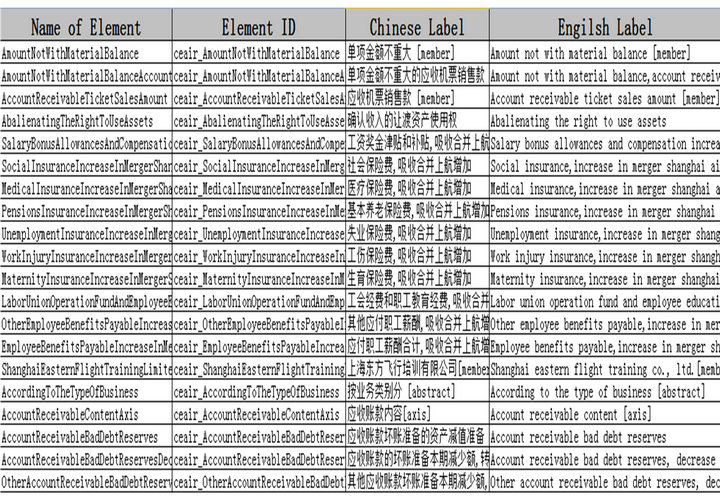

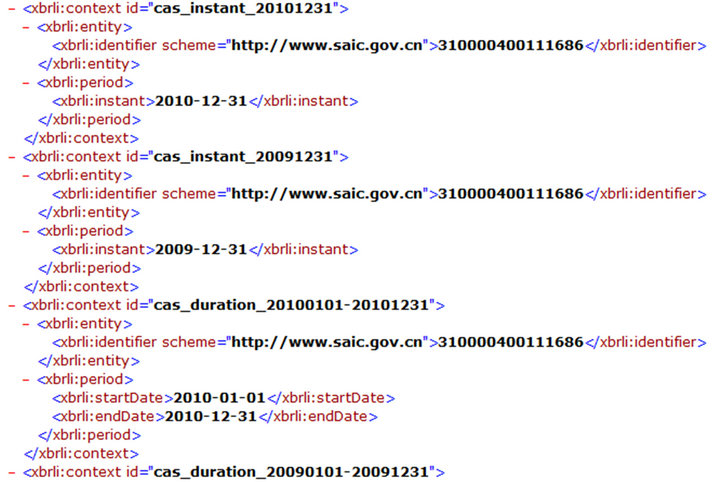

4) By converting the consolidate financial statements formed above to the formation of XBRL, the user will get the instance document in XBRL (as shown in Figure 4), which is also the financial reports disclosed in XBRL. Information users can undertake the data analysis of diversification by using this report in XBRL. At the same time, it is helpful for the company’s management decision-maker to not only compare the data between different departments, but also comduct the longitudinal comparison between their own business and other enterprises, which will greatly improve the efficiency of management decision-making.

Table 1. The statistics of the national universal classification standard elements.

Figure 3. Extension elements of XBRL Taxonomy in statistics, Excel documents, 870 lines.

Figure 4. CEAIR XBRL instance documents.

3. The Promoting Significance of XBRL in the Aviation Industry

CEAIR has witnessed great achievements in XBRL application, including the data docking between XBRL system and the Oracle system, the unification of data interface, data extraction, analysis and integration, as well as the generation of XBRL reports. Besides, the extension of Taxonomy for aviation industry is also a critical step and an important achievement of realize the data extraction in aviation industry. These are essentially significant for the application and popularization of XBRL in aviation industry.

It’s believed that the promotion of XBRL in aviation industry has three aspects of meaning and improvement space.

Firstly, the promotion of XBRL in aviation industry can facilitate the informationization process of the Industry. Since XBRL is a technology based on the combination of computer technology and enterprise resource management system, the widespread application of it can simplify the input process and directly insert data into the original information system to realize data intellectualization through the utilization of formulas and programs.

Secondly, the promotion of XBRL in aviation industry ensures that the format of data is unified within the aviation industry. Thus other aviation companies can also store and retrieve data in XBRL format, make the efficient comparison and analysis of the industry data, such as the financial state, operation efficiency, transportation conditions and production capacity of different companies in the same industry [7]. Meanwhile, the comparison could be extended from financial data to non-financial data. Take the storage of customers’ information as an example. If such information can be stored in XBRL to create a customer information share within allied companies and apply integral accumulation service, which would provide more benefits for customers choosing the allied airliners and enhance their competitiveness. That is to say, it’s hard to measure the benefits XBRL data will bring in improving the industry service level and enterprise management decision-making. The application of XBRL data system will help aviation industry better recognize its situation for now and in the future.

Finally, the promotion of XBRL in aviation industry ensures that stakeholders like shareholders, creditors and state regulation institutions can better supervise the listed companies, and also meets the need for internal control, which guarantees the parent companies or superiors can better supervise their subsidiaries or subordinates. The contemporary cases of corporate governance tell us all kinds of corruption due to management overriding internal control lead to great loss for an enterprise. However, the intellectual XBRL system can automatically record any alteration of data and can prevent unauthorized data revision effectively. Besides, XBRL can verify itself and efficiently prevent data omissions and errors resulted from bulky data amount of subsidiaries. It makes the supervision and recognition of financial information by companies’ stakeholders more convenient and efficient.

4. Conclusion

In a word, through the applications and experiment of XBRL projects in the CEAIR, the promotion of XBRL in China has gained a considerable progress and it is an important step in the long development of the theory towards practices. In this project, we have obtained a series of breakthrough in XBRL development including constructing the XBRL framework from the complex organizational structure of the CEAIR, the hierarchical collection of information, the generation of the XBRL report, the research of General XBRL Taxonomy and the extention of XBRL Taxonomy in aviation industry. The endeavor of the CEAIR on the XBRL shows us that XBRL theory can be very useful in the enterprise and the practices. In addition, we can foresee the huge influences and changes on the national data made by XBRL. Based on the success in the CEAIR project, let us look forward to the future.

REFERENCES

- R. Y. Hu, Y. S. Zhu and W. C. Wei, “The Design of GL Metadata Standard,” New Accounting, No. 7, 2009, pp. 2-4.

- R. Y. Hu and Y. S. Zhu, “Research on Accounting Information Metadata,” China Management Informationization, Vol. 11, No. 12, 2008, pp. 5-7.

- J. K. Ji, R. Y. Hu, Y. S. Zhu, et al., “Discussion about the Application of Metadata Standard on Enterprise Resource Planning,” China Management Informationization, Vol. 11, No. 20, 2008, pp. 5-7.

- M. Yi, “Comparison about Financial Reporting Format and Sharing the Socialized Accounting Information— Thinking about the Application of XBRL,” East China University of Science and Technology, Shanghai, 2007.

- A. O. Melashchenko, “Implementation of XBRL as International Standard of Organizing Fiscal Reporting in Ukraine,” Journal of Automation and Information Sciences, Vol. 43, No. 10, 2011, pp. 72-82. doi:10.1615/JAutomatInfScien.v43.i10.80

- XPDRL Project, “Improving the Project Documentation Quality in the Spanish Architectural, Engineering and Construction Sector,” Automation in Construction, Vol. 19, No. 2, 2010, pp. 270-282. doi:10.1016/j.autcon.2009.10.001

- A. Mena, F. Lopez, J. M. Framinan, et al. “XPDRL Project: Improving the Project Documentation Quality in the Spanish Architectural, Engineering and Construction Sector,” Automation in Construction, Vol. 19, No. 2, 2010, pp. 270-282. doi:10.1016/j.autcon.2009.10.001.