Health

Vol.6 No.1(2014), Article ID:42473,9 pages DOI:10.4236/health.2014.61020

A theoretical analysis of how user fee on healthcare can waste economic resources

![]()

Kwame Nkrumah University of Science and Technology, Kumasi, Ghana; eamporfu@gmail.com

Copyright © 2014 Eugenia Amporfu. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. In accordance of the Creative Commons Attribution License all Copyrights © 2014 are reserved for SCIRP and the owner of the intellectual property Eugenia Amporfu. All Copyright © 2014 are guarded by law and by SCIRP as a guardian.

Received 15 November 2013; revised 23 December 2013; accepted 12 January 2014

ABSTRACT

The difficulty of assessing funds to directly fund healthcare for the poor makes governments adopt user fee in the health system. Many studies have shown how user fee can cause the poor to under utilize healthcare but not on how it can lead to the waste of resources. The current study is theoretical and it examines the efficiency of regulated user fee and the factors affecting the efficiency. Efficiency focused mainly on the extent to which resources are wasted as a result of regulated user fee. The results show that the asymmetric information between the provider of healthcare and the patient combined with the costliness of investigation by the government as well as the costliness of revenue collection caused three sources of waste: excessive treatment of the rich or the non-poor, investigation and revenue collection. Comparative statics were done to examine the effect of various factors on the level of waste. The study then examined the conditions under with regulated user fee is more efficient than direct financing of healthcare by the government. Some recommendations were made to reduce wastes.

KEYWORDS

Regulated User Fee; Waste; Asymmetric Information; Cheating; Investigation

1. INTRODUCTION

Healthcare financing for the poor is a big challenge to governments in all economies. The challenge is even greater in developing economies where the large informal sector makes it difficult to identify the potential tax payers and hence reduces the revenue that can be raised by the government. The low revenue impedes government’s ability to directly fund healthcare provided in public facilities [1]. Governments of many developing countries then adopt user fee as a healthcare financing reform to transfer part of the burden of healthcare financing unto the beneficiaries. Under the user fee financing scheme, the patient is expected to pay a fee at the point of purchase of healthcare. Since the poor are unlikely to afford such services and society is not willing to see people die from treatable diseases, government intervention or regulation of user fee in the form of exemption policies to protect the poor is often adopted. The purpose of this study is to examine the efficiency of government regulated user fee in healthcare provision and factors affecting the efficiency. Efficiency here focused mainly on the waste of economic resources in the implementation of regulated user fee.

The efficiency of user fee in healthcare is well documented. The most common argument used for efficiency is the welfare loss view which states that user fee (this could be in the form of coinsurance) deters frivolous use of healthcare. According to this view, when healthcare is free at the point of purchase, as under full health insurance, the consumer consumes until the marginal benefit is zero [2]. Given that marginal cost of provision is positive, user fee is expected to reduce consumption to a level that is close to the point where marginal benefit equates marginal cost. The implication is that increase in healthcare utilization that might occur from a reduction in user fee or introduction of full health insurance represents excess utilization and hence inefficient. User fee then acts as a price to distribute resources to those who value it most. Those who are unable or unwilling to pay the price then leave the market. If there are no close substitutes that are affordable to the poor, then they leave the market and endure health deterioration. J. Nyman [3] has criticised this explanation of efficiency by arguing that the increase in utilization is only inefficient when it is due to substitution effect from the fall in price. The increase in utilization is efficient when it is due to income effect, i.e., the reduction in price at the point of purchase increases the purchasing power of the poor and given that healthcare is a normal good the increase in utilization is welfare improving and hence efficient and not wasteful.

One could argue that government fee exemption policy that accompanies user fee financing scheme could increase the purchasing power of the poor or the exemption group and hence increase utilization to improve the welfare of the poor. However, the asymmetric information that exists in the provision of healthcare can cause government intervention to stimulate strategic behaviour from providers in a way that could affect healthcare utilization of the non poor [4]. This necessitates the monitoring of healthcare providers under regulated user fee.

Implementing regulated user fee then requires resources. To ensure adherence to fee exemption or fee reduction policy for the poor, government monitoring and good information flow between the government and healthcare providers is needed. Government needs to communicate clearly to providers on who qualifies for fee exemption. Both monitoring and information flow require resources from government. In addition, government operations occur in highly bureaucratic institutions that are often associated with administrative bottlenecks, as well as different types of corruption such as diverging of funds at the ministerial level [5-7]. These requirements can increase the cost of healthcare financing, reduce the funds available for healthcare provision and hence reduce the quality of care provided. Studies (e.g. [1]) have shown that governments are often unable to do proper monitoring and have documented how this impacts the poor. To the author’s knowledge no study has examined the efficiency (in terms of wastefulness of resources) of government intervention to protect the poor in the presence of user fee.

Studies (e.g., [5]) that recommended government intervention to protect the poor faced with user fee did not examine the resulting impact on the behaviour of healthcare providers and its effect on welfare of the poor and the non-poor patients. E. Amporfu [4] examined, in a theoretical model, the incentive effect of a user fee on the behaviour of healthcare providers but did not examine the impact on efficiency. The current study extends E. Amporfu [4] by examining the efficiency (in terms of resources wasted) of government regulated user fee and using the parameters in the model to examine the factors that affect the efficiency. Information from such a study will inform policy about the conditions under which government regulated user fee can improve the welfare of society.

2. PREVIOUS STUDIES

G. Mwabu [8] reviewed the theoretical basis for the application of user fee and showed that given the special characteristics of healthcare, specifically asymmetric information and consumption externalities, user fee cannot be an efficient method of redistributing health care among users. Government intervention is required to ensure efficiency and equity in healthcare utilization. The study concluded that the best method of financing healthcare in developing countries is general tax system supplemented by moderate user fee. The moderate user fee is needed to curb moral hazard and discourage over utilization of care. Government intervention here focused on tax financing of healthcare and not on regulation of user fee.

A. Singh [9] reviewed various empirical studies on the effect of user fee on healthcare utilization and showed that the effect is mixed. While the introduction of user fee reduced health care utilization in some economies, the opposite occurred even among the poor in other economies. The increase in utilization was due to improvement in quality resulting from funds raised from user fee. The study concluded that government intervention through exemption policies is required to protect the poor. The study did not examine any strategic behaviour of healthcare providers that could be induced by exemption policies.

A similar study contributed to the user fee debate by examining the impact of user fee on access and quality and concluded that even though user fee may improve quality of care it can prevent the poor from having access to healthcare [10]. Any attempt to remove user fee should be done with proper monitoring to ensure a smooth transfer to a more appropriate method of healthcare financing. Government involvement is thus crucial in the functioning and removal of user fee. Efficiency in the study then focused on utilization of healthcare by the poor and not on the non-poor.

D. G. Duff [11] evaluated the efficiency of the imposition of user fee on publicly provided healthcare in relation to privately provided healthcare. According to this view, user fee in the public sector is justifiable only if the marginal value of healthcare provided in the public sector exceeds that in the private sector. This view is supported by B. Jacobs and N. Price [12] which showed that increase in user fee in the public sector is often accompanied by increase in fees in the public sector hence making public sector user fee inefficient. Applying this definition of efficiency to economies where healthcare is provided mainly in the public sector would always justify increasing user fee.

I. O. Yisa, A. A. Fatiregun, and E. Awolade, [13] examined the efficiency of a health system with user fee and that with free healthcare. As in the previous studies, the study found that user fees generated the required revenue needed by the facility to provide inputs, other than salaries, for service provision, but also deterred the poor from seeking care. There was evidence that the effect on healthcare seeking must have contributed in the deterioration of health status of the poor. It was recommended that critical examination of user fee as an option of healthcare financing is needed for any embarking on reforms that could have long term effect on the health of the population. The study examined efficiency effect of user fee without focusing on government regulated user fee payment scheme.

J. Coleman [1] examined prices charged by various health facilities in Ghana under the Cash and Carry system and found that fee charged varied across various types of health facilities and did not often adhere to the fee structure proposed by the government. This was due to the obsolescence of the government’s official fee which lacked clear review process. There was also lack of adherence to the fee exemption for the poor due to lack of information to both providers and communities on the exemption policy or how it was to be implemented. The study examined the inadequacy of the government regulation and hence its ineffectiveness in protecting the poor.

Thus the existing literature has not done thorough examination of the efficiency issues of government regulated user fee healthcare financing system. The relevant efficiency issues are government ability to identify the poor, monitor the behaviour of healthcare providers, and collect revenue to fund the operations. Ability to identify the poor prevents the rich from pretending to be poor to benefit from low prices; it also prevents providers from refusing the benefits to the poor. The literature (e.g., [14]) has shown the various methods used by governments in developing countries to provide healthcare to the poor. The common examples are demographic targeting (e.g., children in Niger) and geographic targeting. The Ghanaian Livelihood Empowerment against Poverty program (LEAP) uses information from communities to identify the poor. None of these methods is without flaw, and the literature has examined their effectiveness in serving the poor. However, the literature has not examined the monitoring of physician behaviour and revenue collection involved in government regulated user fee payment mechanism. Even if government is able to clearly identify the poor, regulated user fee may not be efficient as a result of these two efficiency issues. E. Amporfu [4] assumed that the poor can be identified and that the government used cost shifting to fund healthcare for the poor.

Cost shifting is similar to regulated user fee in that under cost shifting consumers are categorized according to the fee to be paid for a given service in a way that is not necessarily consistent with profit maximization. Cost shifting refers to the practice by health care providers of raising prices paid by one group of patients in order to provide health care to another group at a lower price [15]. This is different from the textbook price discrimination where the profit-maximizing producer allocates the services between the categories of patients until the marginal revenues are equalized. Under profit maximization, as the fee paid by one category of patients decreases, providers reduce the cost of treating these patients by reducing the services they receive [16] rather than increasing the price of the other category. Thus it is price discrimination that is consistent with profit maximization but not cost shifting1.

Under cost shifting, when the price paid by one group of patients falls, the physician increases the price of the other group of patients to cover the cost of providing services to the group whose fee has fallen. This is similar to the government regulated user fee payment mechanism. Typically, under the fee exemption program government is supposed to pay for the services of the poor. Government payment is often below the market price and is also often delayed [17] and so providers would have to use revenue generated from the non-poor patients. This can cause an increase the in the market price paid by the non poor.

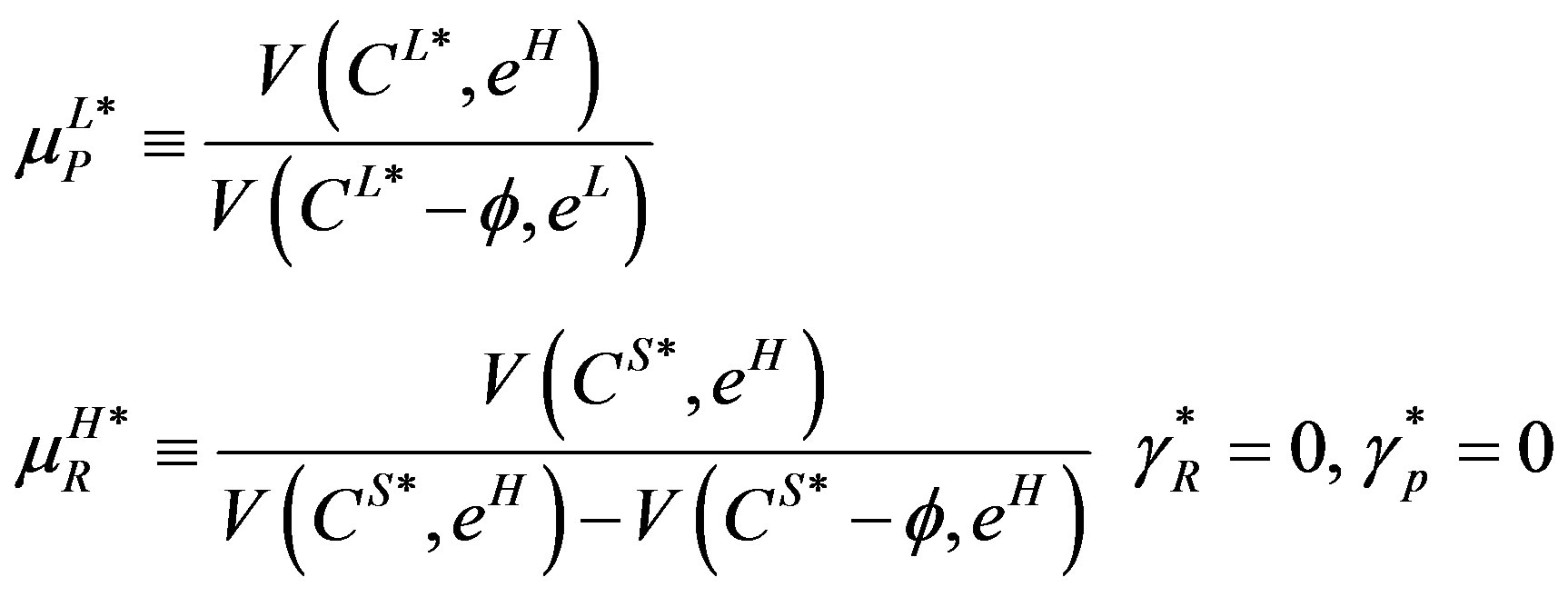

3. SUMMARY OF AMPORFU 2010

The model has two active agents: government and physician, and a passive agent, patient. The patient can be rich (R) with probability ror poor (P) and can draw a high severity of illness (θH) or low severity of illness (θL). The type of illness is only observable to the physician. High severity is treated by high treatment and low severity is treated by low treatment. The physician has to use high effort (eH) for high treatment and low effort (eL) for low treatment and eH > eL. The user fee determined by the market for high treatment is CH and that for low treatment is CL such that V(CH*, eH) = V(CL*, eL) = 0 (where V(.) is the utility of the physician) as a result of the assumption of free entry and exit. For the two utilities to be equal, CH* > CL*. Thus the physician has no incentive to use the wrong effort input for treatment. However, there is an additional assumption that the poor cannot afford CH*, implying that the poor with high severity of illness cannot access the proper treatment. The utility function of a patient is U(y − γj − Ci, h(θi, ei)) with U1 > 0, U11 < 0, U2 > 0, j = R, P, i = H, L, y is income, γi is lump sum tax collected to fund investigation and any excess revenue is given to the poor, and h is health status. A patient is better off when the proper treatment is applied than when the wrong treatment is used.

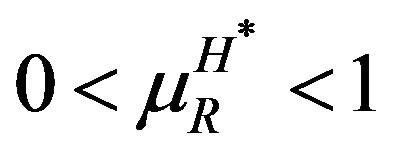

To ensure that the poor get access to proper treatment, the government mandates the physician to use the proper treatment for all patients regardless of their income status. Under this mandate, the poor always pays CL* regardless of treatment received and the rich pays CL* for low treatment and CS* for high treatment, with CS* > CH* > CL*. This implies that V(CS*, eH) > V(CL*, eL) = 0 and V(CL*, eH) < 0. The government enforces the mandate through investigation of the physician. After observing the patient type, the physician chooses the type of treatment for the patient. The government simultaneously decides to investigate (at cost k) or not after observing the treatment provided to the patients. The model allows the government to collect revenue from the rich to fund investigation but revenue collection is assumed to be costly. For every dollar collected, ω is lost due to corruption and other bottlenecks. The physician pays a fine,  , if found guilty of using the wrong treatment. Investigation always reveals the truth. Two cases are examined: when investigation is costly (k > 0) and when investigation is not costly (k = 0). Under the costless case the physician always uses the proper treatment for patients because the government always investigates whenever a patient was treated. In the costly case, however, the physician always treats a poor patient with low severity and a rich patient with high severity with the proper treatment but uses mixed strategy of sometimes using the right treatment when a poor patient has high severity of illness or a rich patient has low severity of illness. In response, the government never investigates when a poor patient receives high treatment or when a rich patient receives low treatment. The government, however, investigates with probability less than one when a poor patient receives low treatment or when a rich patient receives high treatment.

, if found guilty of using the wrong treatment. Investigation always reveals the truth. Two cases are examined: when investigation is costly (k > 0) and when investigation is not costly (k = 0). Under the costless case the physician always uses the proper treatment for patients because the government always investigates whenever a patient was treated. In the costly case, however, the physician always treats a poor patient with low severity and a rich patient with high severity with the proper treatment but uses mixed strategy of sometimes using the right treatment when a poor patient has high severity of illness or a rich patient has low severity of illness. In response, the government never investigates when a poor patient receives high treatment or when a rich patient receives low treatment. The government, however, investigates with probability less than one when a poor patient receives low treatment or when a rich patient receives high treatment.

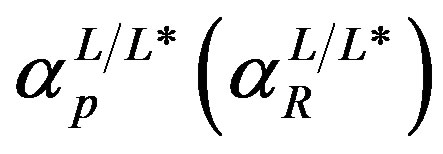

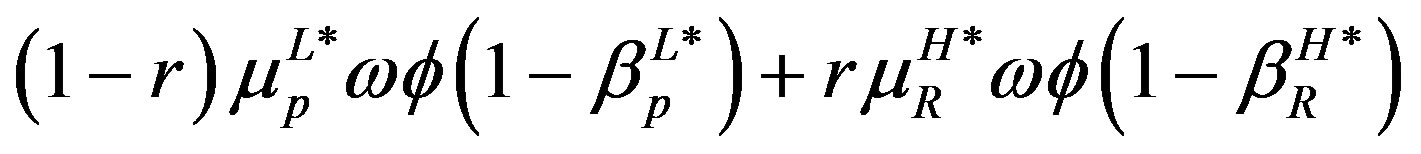

The physician’s strategies under the costly case are:

(1a)

(1a)

where  represents the probability of treating a poor (rich) patient with low treatment given that the patient had low severity of illness;

represents the probability of treating a poor (rich) patient with low treatment given that the patient had low severity of illness;  represents the probability of treating a rich (poor) patient with high treatment given that the patient had low severity of illness. The explanations of the parameters are as follows: πp(πR) is the probability that a patient was poor (rich), k is the cost of investigation,

represents the probability of treating a rich (poor) patient with high treatment given that the patient had low severity of illness. The explanations of the parameters are as follows: πp(πR) is the probability that a patient was poor (rich), k is the cost of investigation,  is the fine the physician had to pay if found guilty after investigation; and finally, ω is the costliness of government. The CS* is set by the market such that as a result of free entry and exit the physician’s expected utility is zero:

is the fine the physician had to pay if found guilty after investigation; and finally, ω is the costliness of government. The CS* is set by the market such that as a result of free entry and exit the physician’s expected utility is zero:

(1b)

(1b)

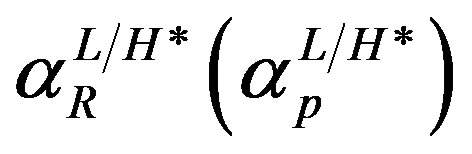

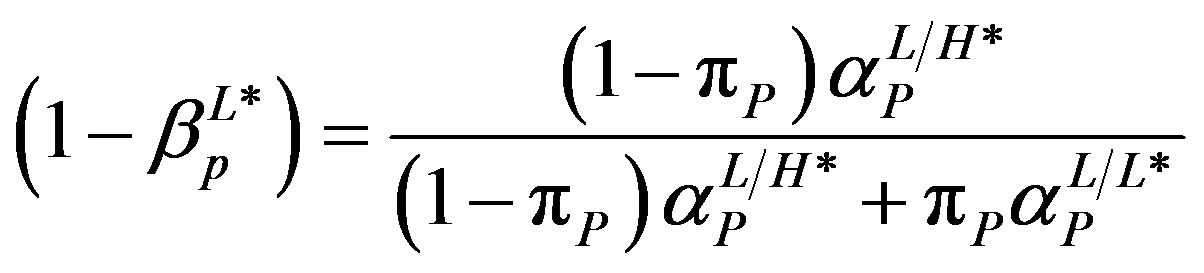

The government’s strategies are:

(2)

(2)

where  represents the probability that the government would investigate given that it has observed a poor patient had received low treatment while

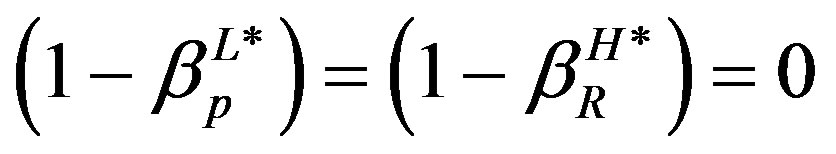

represents the probability that the government would investigate given that it has observed a poor patient had received low treatment while  represents the probability of investigating given that a rich patient had received high treatment. In equilibrium it is too costly for the government to redistribute revenues from the rich to the poor so

represents the probability of investigating given that a rich patient had received high treatment. In equilibrium it is too costly for the government to redistribute revenues from the rich to the poor so

. The only revenue collected then is the fine2.

. The only revenue collected then is the fine2.

4. REGULATED USERFEE AND WASTE

As explained, in the absence of cost shifting, (or regulated user fee) there is no cheating but the rich receive the right treatment while all the poor receive low treatment since that is all they can afford. Regulated fee then allows the poor to receive high treatment but that comes at a cost of waste or inefficiency. The waste can be found by calculating the resources lost in the system.

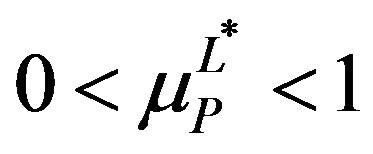

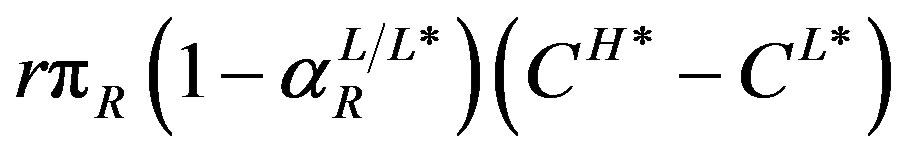

To compute the waste, it is assumed that V(Ci*, ei) is linear, i.e., V(Ci*, ei) = Ci* − ei. Recall that V(CH*, eH) = V(CL*, eL) = 0 which implies under linearity that CH* = eH and CL* = eL. Waste is categorized according to source: treatment waste, investigation waste and revenue waste. Treatment waste results from the unnecessary provision of high treatment to the rich patients who have low severity of illness. In the absence of regulated user fee, the rich patients receive the right treatment so no resources are wasted during treatment. Even though the poor patients receive only low treatment regardless of the type of illness, with eH > eL the poor with high severity of illness receive less effort (not more) than they need and so there is no waste of resources. Too little resources are used for the poor, rather than too much. Thus, treatment waste occurs from the cheating that results from regulated user fee. Such unnecessary treatment makes the rich patients worse off and it is wasteful because the equilibrium is such that the physician is indifferent between cheating and not cheating implying a zero expected utility in equilibrium. The extra resource, eH − eL, (with linearity this becomes CH* − CL*) could have been used for something else, such as treating the poor with high severity of illness who received low treatment, to improve social welfare. The treatment waste then is:

(3)

(3)

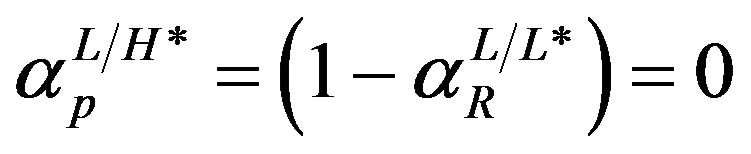

Note that treatment waste is zero under the costless investigation case (because ) even though there is regulated user fee. Thus, user fee per se does not cause the waste. The rich pay CS* > CH* for the high treatment and so CH* pays the physician for the high treatment and CS* − CH* represents a transfer from the rich to the physician, which eventually is transferred to the poor (zero expected profit for the physician) and so is not waste. The waste results when user fee is combined with costly investigation (to ensure compliance) so that cheating occurs. Since the government cannot enforce the regulated user fee without investigation, treatment waste is difficult to avoid when investigation is costly. Thus unlike previous the literature that argue user fee reduces excess utilization of healthcare from the rich, the current study has shown that the asymmetric information between the physician and the patient leads to excess utilization of care by the rich through inducement.

) even though there is regulated user fee. Thus, user fee per se does not cause the waste. The rich pay CS* > CH* for the high treatment and so CH* pays the physician for the high treatment and CS* − CH* represents a transfer from the rich to the physician, which eventually is transferred to the poor (zero expected profit for the physician) and so is not waste. The waste results when user fee is combined with costly investigation (to ensure compliance) so that cheating occurs. Since the government cannot enforce the regulated user fee without investigation, treatment waste is difficult to avoid when investigation is costly. Thus unlike previous the literature that argue user fee reduces excess utilization of healthcare from the rich, the current study has shown that the asymmetric information between the physician and the patient leads to excess utilization of care by the rich through inducement.

As the name implies, investigation waste comes from the costliness of investigation. Even though investigation occurs under the costless investigation case, no waste results because of the zero cost of investigation. Thus, resources are used for investigating the physician only in the costly investigation case. The cost of investigation then increases the total cost of treatment to society. The resulting waste from investigation is:

(4)

(4)

The first square bracket represents the probability of providing low treatment to a poor patient. The first term in the square bracket is the probability that the physician provides low treatment to a poor patient with high severity of illness and the second term represents the probability that the physician provides low treatment to a poor patient who has low severity of illness. The first term of (4) then is the expected cost of investigating the physician for treating a poor patient with low severity of illness. The second square bracket is probability of providing high treatment to the rich. The first term in the square bracket represents the probability of providing high treatment to the rich with low severity of illness and the second term is the probability of treating a rich patient with high severity of illness. The second term of (4) then is the expected cost of investigating the physician for treating the rich with high treatment.

Revenue waste comes from the costliness of government and occurs whenever the government collects revenue. Since , the only revenue collected is the fine from the physician. The revenue waste is:

, the only revenue collected is the fine from the physician. The revenue waste is:

(5)

(5)

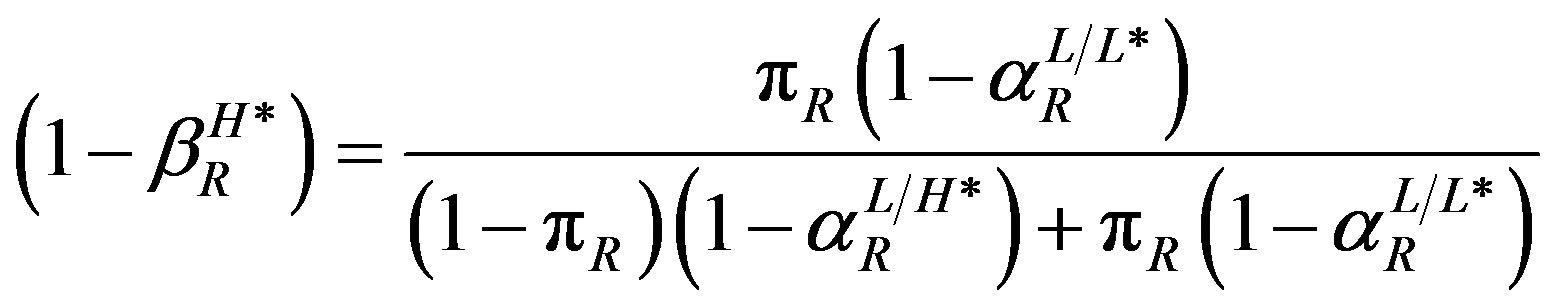

The first term represents the revenue waste from the fine collected when the physician is found guilty of cheating when treating the poor. The second term represents the revenue waste that results when the physician is found guilty of cheating when treating the rich. The symbol  is the probability that a poor patient has high severity of illness given that he or she has received low treatment. And

is the probability that a poor patient has high severity of illness given that he or she has received low treatment. And

is the probability that a rich patient has low severity of illness given that he or she has received high treatment. In the costless investigation equilibrium,

is the probability that a rich patient has low severity of illness given that he or she has received high treatment. In the costless investigation equilibrium,  implying

implying  and so (5) is zero under costless investigation but positive under costly investigation where

and so (5) is zero under costless investigation but positive under costly investigation where . With zero cheating under costless investigation, no fine is collected and so this waste is also zero. In an extreme case in which w = 1, the government does not investigate because it cannot collect the revenue to pay for the investigation. In such a case then investigation waste is zero.

. With zero cheating under costless investigation, no fine is collected and so this waste is also zero. In an extreme case in which w = 1, the government does not investigate because it cannot collect the revenue to pay for the investigation. In such a case then investigation waste is zero.

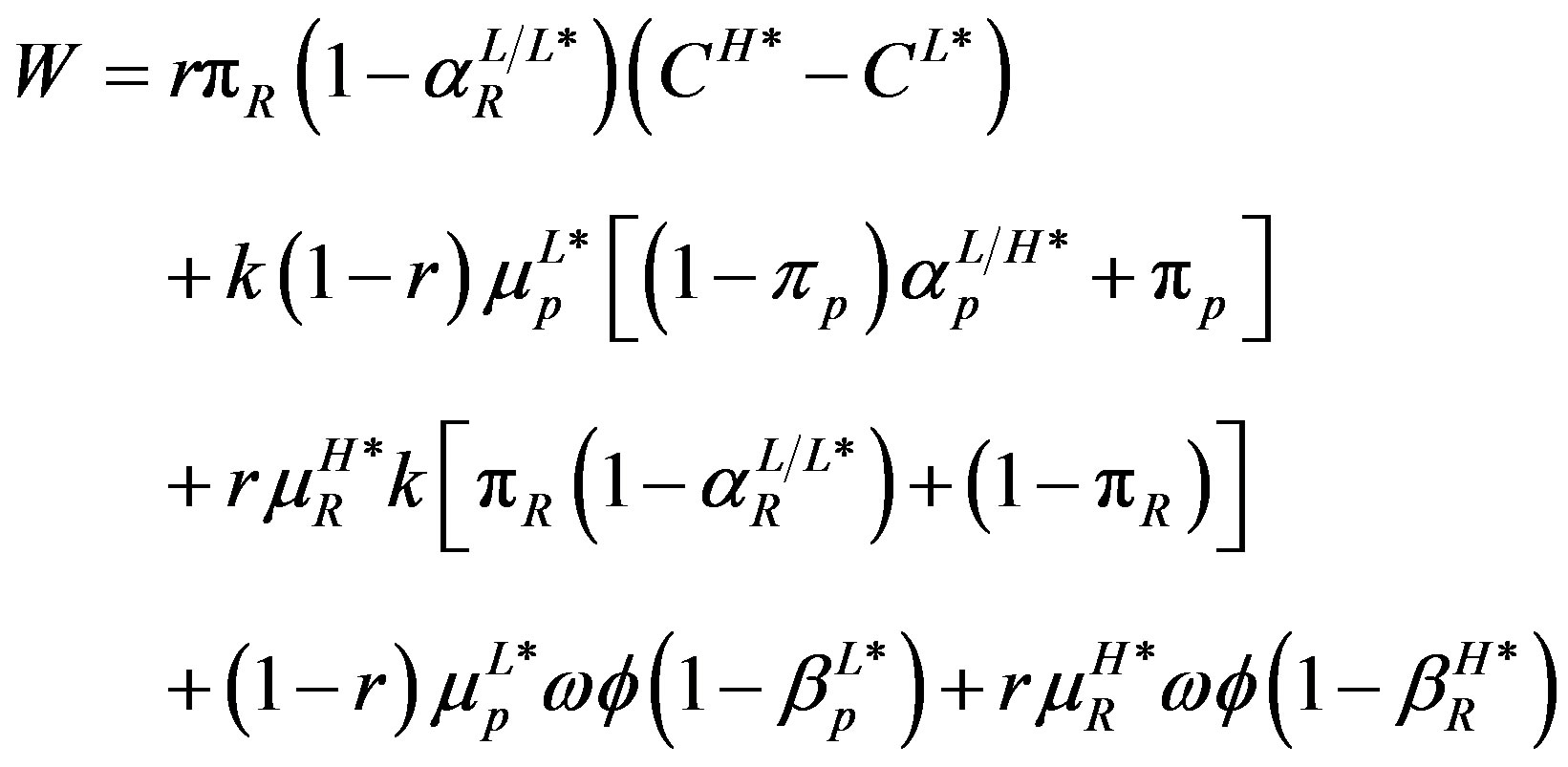

The total waste, W, is the sum of (3), (4) and (5):

(6)

(6)

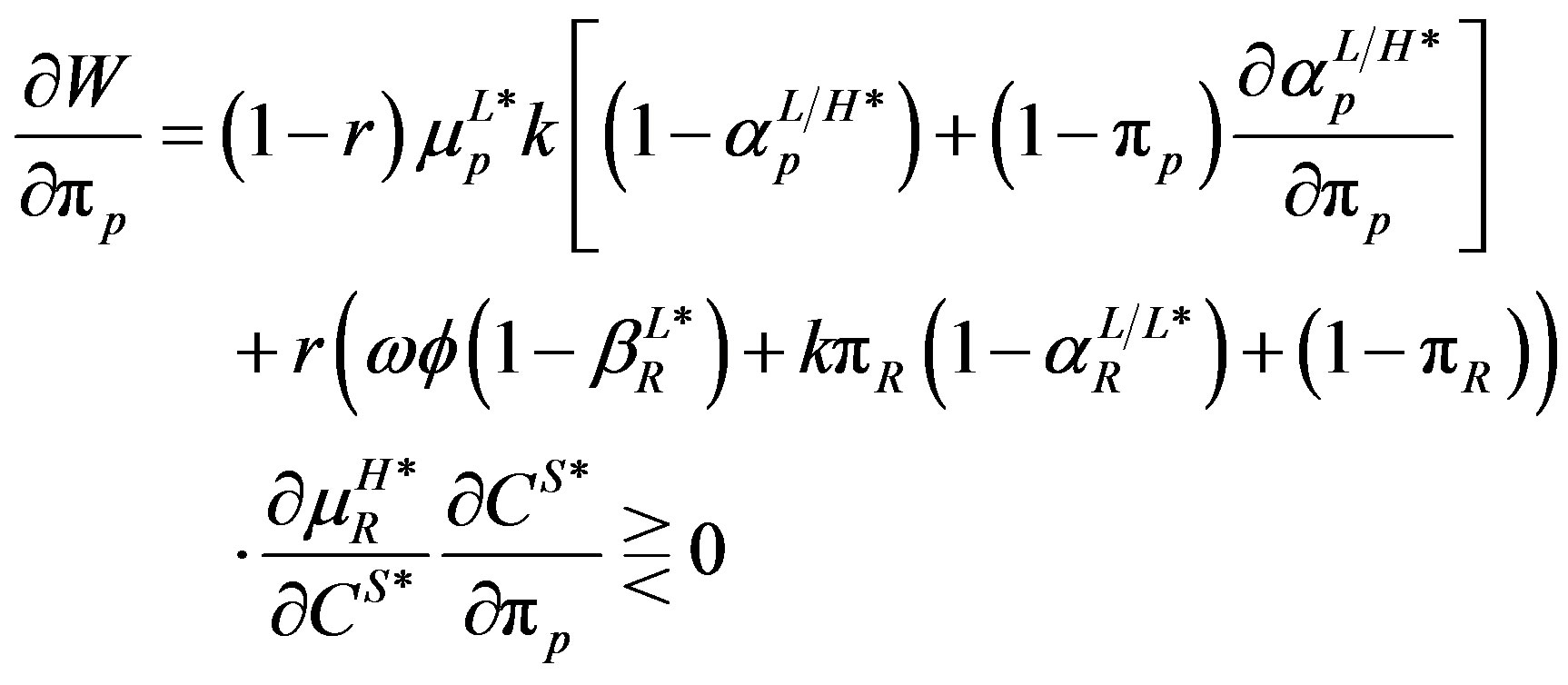

Notice that W = 0 when k = 0. To find out the factors that affect the extent of the waste, comparative statics is done on the total waste with respect to the parameters. The computations used the assumption of the linearity of the physician’s utility3.

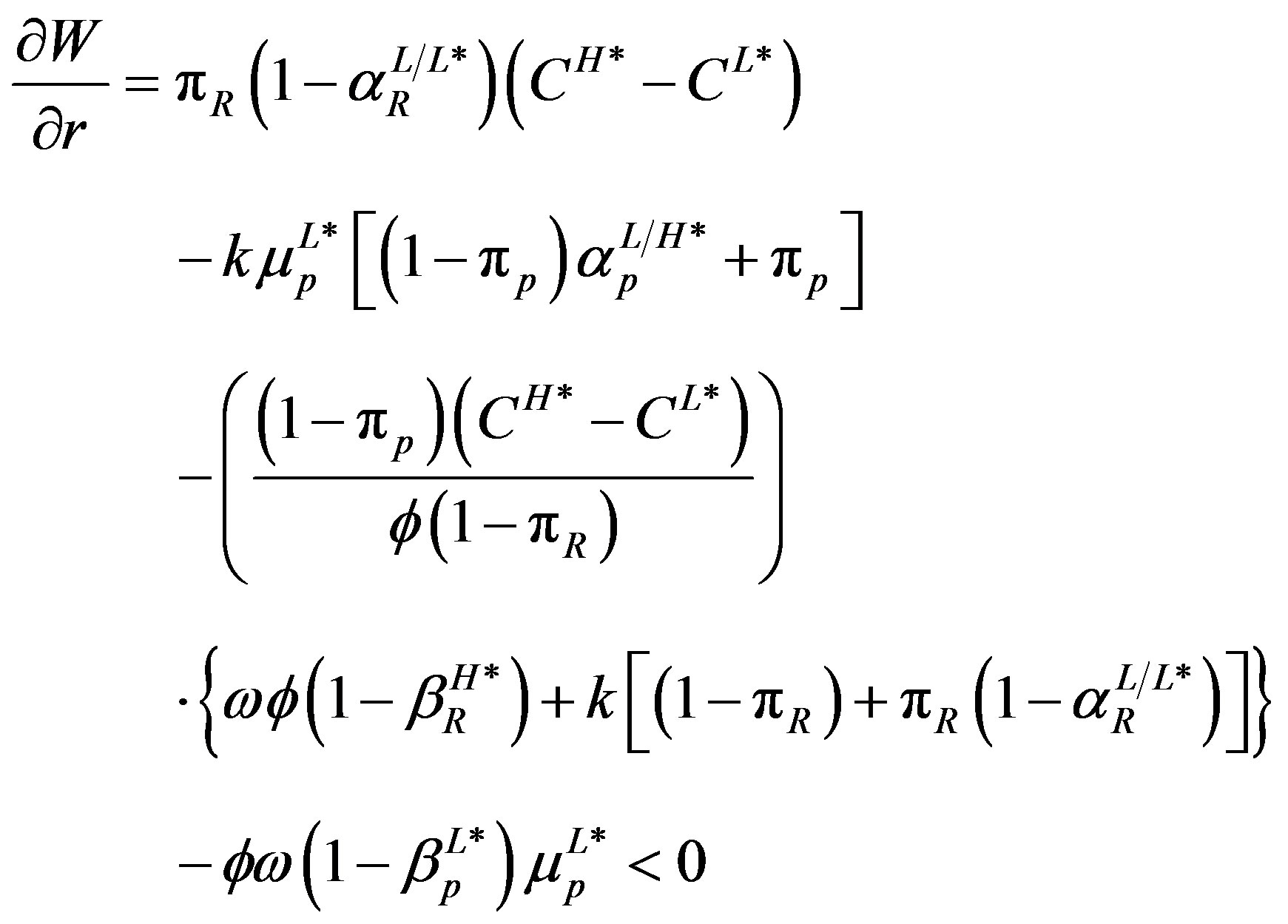

(7)

(7)

Equation (7) shows that a change in the proportion of the rich has a negative effect on total waste when treatment waste is sufficiently small. The intuition here is that when investigation decreases significantly with an increase in the proportion of the rich, then total waste decreases when the resulting decrease in investigation waste and revenue waste exceeds the increase in treatment waste. The investigation waste decreases, even though cheating does not change, because of the fall in investigation. Investigation falls because the high treatment fee falls with the proportion of the rich and hence reduces the incentive for the physician to cheat when treating a rich patient. Consistent with mixed strategy equilibrium, the fall in investigation is to make the physician indifferent between cheating and not cheating.

Given that the proportion of the rich is smaller in a poor economy than a rich economy, an economy with a high proportion of rich residents can be considered richer than the economy with a lower proportion of rich residents. Thus, even though cheating is not affected by the richness of the economy, the results here show that regulated user fee is more efficient in a rich economy than a poor economy because the relatively low high treatment fee in a rich economy reduces investigation and, consequently, the resulting waste.

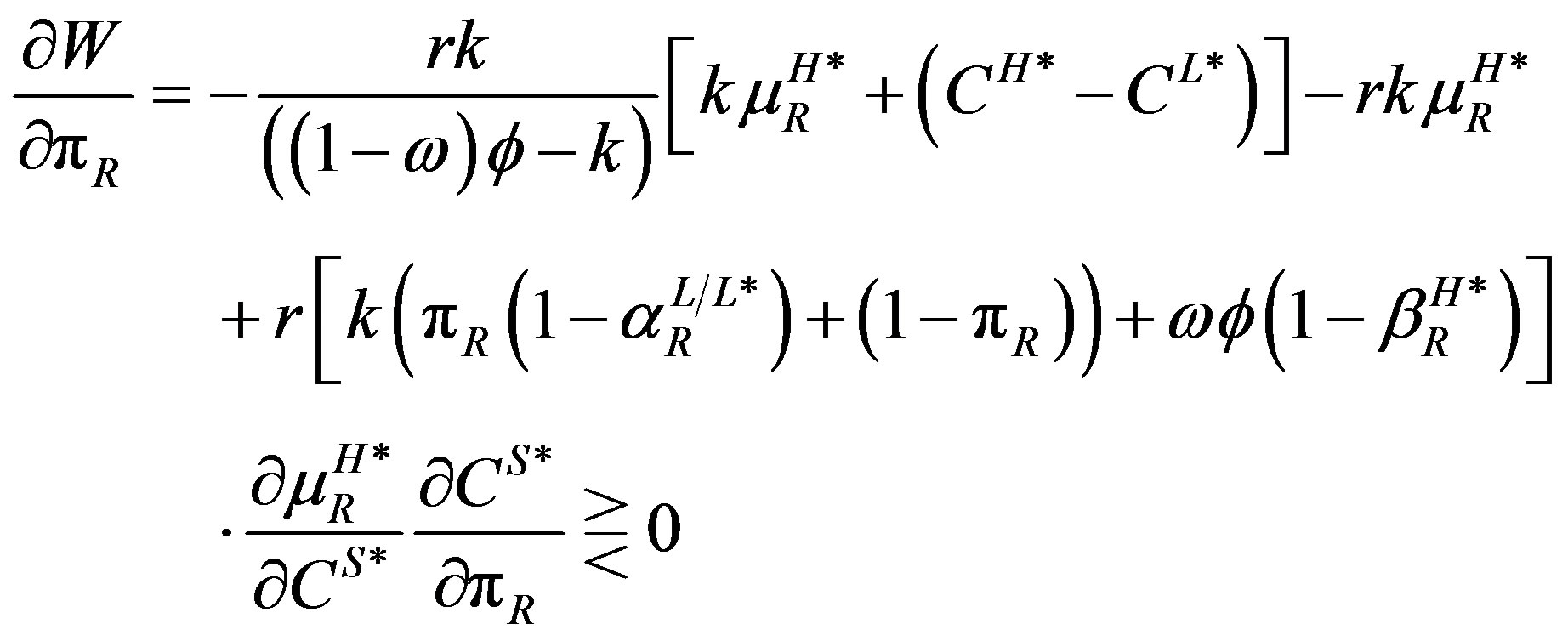

(8)

(8)

The computation of Equation (8) shows that an increase in the cost of investigation increases waste from all the three sources of waste. The treatment waste increases because cheating when treating the rich increases with the cost of investigation. The physician expects the government to reduce investigation, as the cost of investigation increases, hence the increase in cheating. The revenue waste also increases because the conditional probabilities of cheating both increase in the cost of investigation. Increase in the cost of investigation directly increases the investigation waste but also indirectly increases investigation waste through the resulting increase in cheating when treating both the rich and the poor. In general an increase in the cost of investigation increases cheating and so waste increases as well. The high cost of investigation could explain why many healthcare providers’ cheating behaviour could go unpunished especially in developing countries (Coleman, 1997). When it is too expensive to investigate, governments may choose not to investigate, the results in the study shows that the reduction in investigation could induce cheating and hence make both the rich and the poor worse off. Thus, whether the economy is rich or poor, regulated user fee becomes less wasteful as the cost of investigation gets cheaper through the adoption of innovative technology for investigation.

(9)

(9)

As shown in (9), an increase in the costliness of government increases total waste as well. The increase in waste comes from the effect of costliness of government on cheating. The increase in costliness of government indirectly increases treatment waste and investigation waste through the resulting increase in cheating. Intuitively, when the government is costly it is difficult for it to raise enough revenue to fund investigation so the probabilities of investigation are expected to fall resulting in an increase in cheating. The revenue waste increases due to direct effect of the increased costliness of government and indirectly through the resulting increase in cheating. Even though regulated user fee is more suitable for an economy where the costliness of government is high, the more costly the government is the less efficient is regulated user fee.

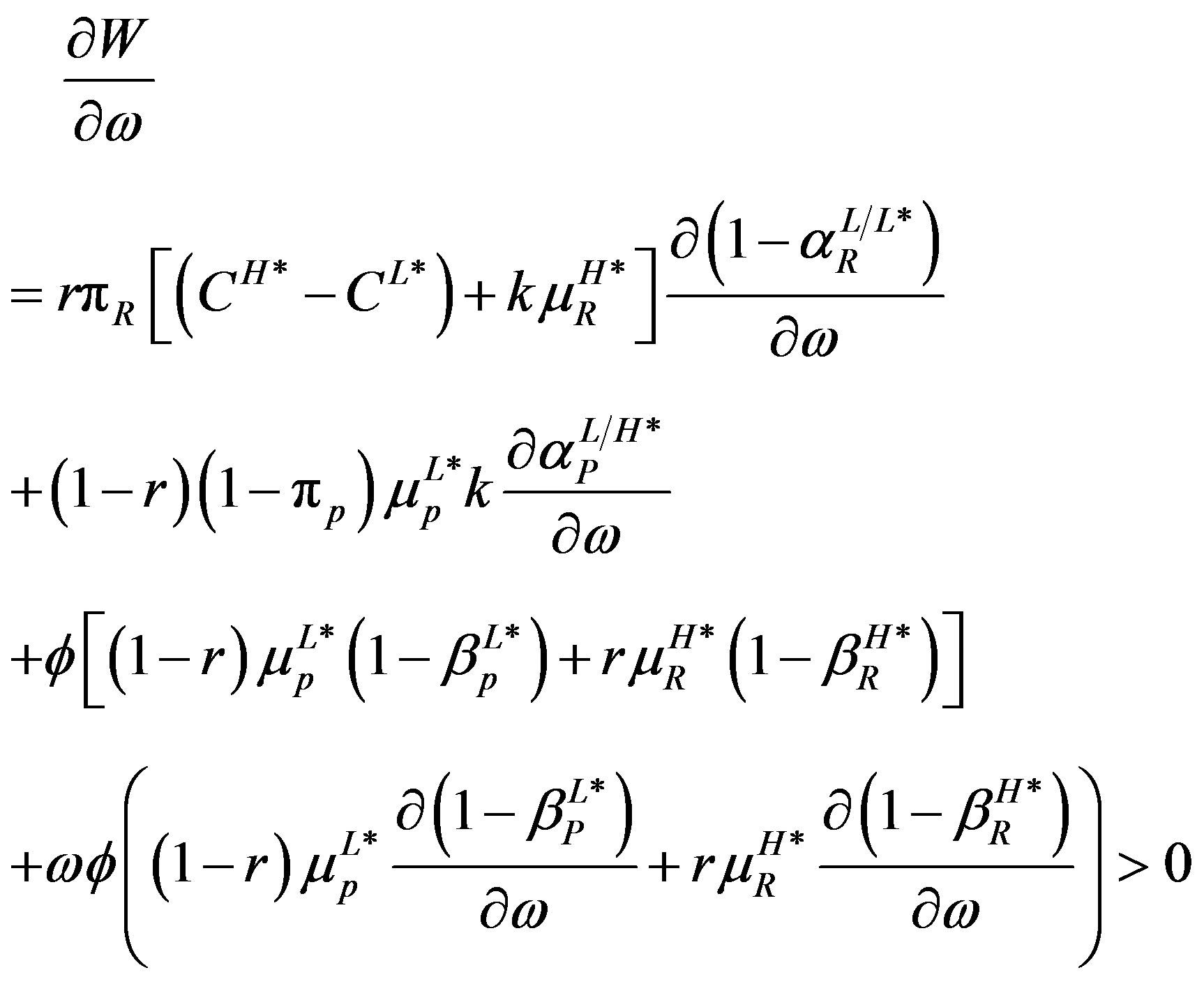

(10)

(10)

Equation (10) shows that an increase in the fine leads to a decrease in the level of waste. The treatment waste and revenue waste decrease indirectly through the resulting decrease in cheating. Cheating falls with the fine because a higher fine increases the payoff from investigation. Investigation waste decrease, partly, because of a fall in investigation and partly because of the fall in cheating. Thus, if the fine is sufficiently high regulated user fee redistributes income with little waste.

(11)

(11)

Equation (11) shows that an increase in the probability that a poor patient has low severity of illness has indeterminate effect on waste. Only investigation waste and revenue wastes are affected. Treatment waste is not affected because treatment waste pertains to the unnecessary treatment of the rich. Investigation waste increases indirectly through the resulting increase in cheating when treating the poor. When poor patients are likely to have low severity of illness the physician is not likely to expect investigation when a poor patient with high severity of illness receives low treatment. The investigation waste also decreases indirectly through the resulting fall in the probability of investigating the physician when a rich patient receives high treatment. The partial fall in investigation waste is reinforced by the fall in revenue waste which also decreases because of the fall in the probability of investigating the physician when a rich patient receives high treatment. Investigation falls because the reduction in the high treatment fee which in turn falls because less high treatment cost from treating the poor is passed on to the high treatment fee paid by the rich. The overall waste falls if the fall in investigation exceeds the effect of the increase in cheating. Thus even though regulated user fee benefits poor patients if the poor are high risk the results here show that the benefit comes at the cost of high level of waste.

(12)

(12)

An increase in the probability that a rich patient has low severity of illness decreases treatment waste, increases revenue waste but may increase or decrease investigation waste. Investigation waste increases if the resulting increase in investigation is stronger than the resulting fall in cheating. Treatment waste decreases because of the resulting fall in cheating when treating rich patients. The increase in revenue waste also comes from the resulting increase in investigation of high treatment. Thus an increase in the probability that a rich patient has low severity of illness causes total waste to increase if any increase in investigation waste and revenue waste exceeds the fall in treatment waste. Even though the rich are better off under regulated user fee when they are low risk patients, because of the fall in cheating, the improvement in welfare may come at a cost of inefficiency due to costliness of investigation and fine collection.

These results are summarized below:

PROPOSITION: Regulated user fee leads to waste. The waste comes from treatment, investigation and revenue collection. An increase in the fine, the proportion of the rich, reduces the level of waste. However, the waste increases with an increase in the cost of investigation and the costliness of government and is ambiguously affected by an increase in the probability that a rich or poor patient has low severity of illness.

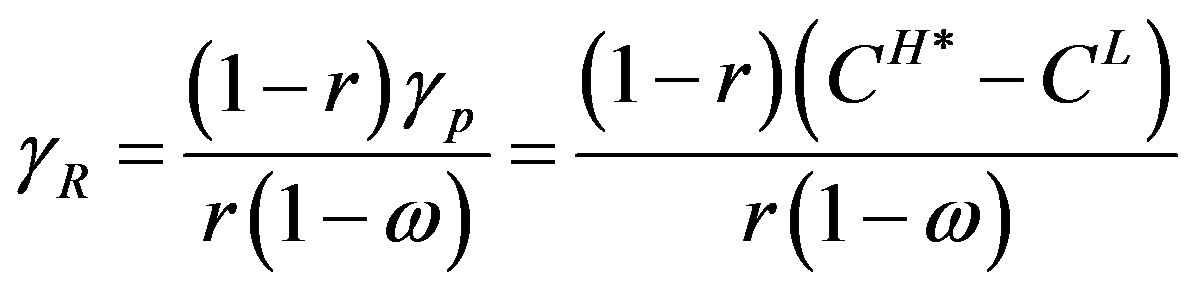

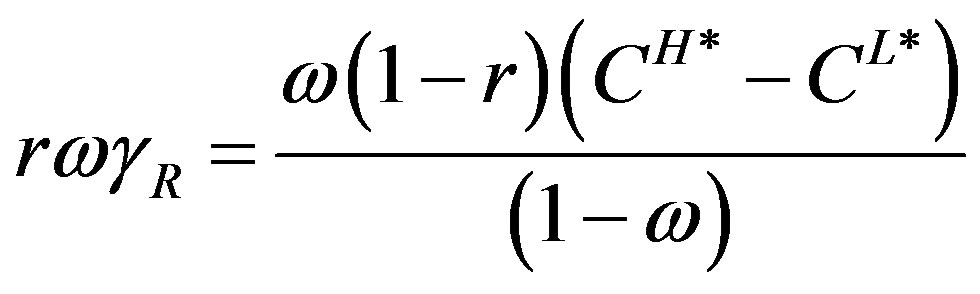

The important question here is, is the regulated user fee a better policy than direct redistribution of income through taxes. Under the redistribution system, the government collects enough taxes (CH* − CL) to pay for the high treatment of the poor. This ensures that patients are able to afford both types of treatment and so the free entry and exit would ensure that V(CH*, eH) = V(CL*, eL) = 0, hence eliminating the incentive to cheat. However, the assumption of the costliness of government implies that part of the taxes collected is lost due to inefficiencies in the system. If the government uses the tax system then the government’s budget is balanced if what is collected after waste is equal to what the poor receive, i.e., r(1 − w)gR = (1 − r)gp which implies that

.Thus the waste when income is redistributed directly through taxes is:

.Thus the waste when income is redistributed directly through taxes is:

which approaches infinity when the w approaches one. Regulated user fee is more efficient than taxation if the waste under the tax system exceeds that under the regulated user fee. Similarly, taxation is more efficient than regulated user fee when the waste under regulated user fee exceeds that under taxation. Thus, there is a critical level of w at which regulated user fee and taxation produce the same waste. This paper then has examined the case in which the costliness of government exceeds the critical level. Even though costliness of investigation makes the equilibrium of regulated user fee a second-best, direct redistribution through taxes results in a third-best equilibrium if government is critically costly. Moreover, the results in this study have shown that the waste under regulated user fee is low in a rich economy, when the fine is sufficiently high, or when innovative technologies are adopted.

which approaches infinity when the w approaches one. Regulated user fee is more efficient than taxation if the waste under the tax system exceeds that under the regulated user fee. Similarly, taxation is more efficient than regulated user fee when the waste under regulated user fee exceeds that under taxation. Thus, there is a critical level of w at which regulated user fee and taxation produce the same waste. This paper then has examined the case in which the costliness of government exceeds the critical level. Even though costliness of investigation makes the equilibrium of regulated user fee a second-best, direct redistribution through taxes results in a third-best equilibrium if government is critically costly. Moreover, the results in this study have shown that the waste under regulated user fee is low in a rich economy, when the fine is sufficiently high, or when innovative technologies are adopted.

5. CONCLUSIONS

The study has shown that the asymmetric information that exists between the healthcare provider and the patient coupled with the costliness of investigation can make regulated user fee for healthcare wasteful and hence inefficient. The waste results from treatment, investigation, and revenue collection. Treatment waste comes from the incentive created by the regulated user fee for the physician to provide excessive treatment to non-poor patients. The incentive is enforced by the costliness of investigation. The investigation waste occurs because resources have to be used to investigate the healthcare provider to ensure that there is conformity to the regulation. Revenue waste results from the costliness of government, making revenue collection expensive. The level of waste or inefficiency falls when the proportion of the poor in the economy is low or when the punishment is severe enough to deter providers from using the wrong treatment for patients regardless of their ability to pay. The study also showed that the inefficiencies caused by regulated user fee worsen with the cost of investigation and the costliness of government.

Even though regulated user fee benefits the poor if they are likely to be high-risk patients, because of the resulting low cheating, such benefit comes at a cost of increased waste from increased investigation and fine collection. It also benefits the rich if they are likely to be high risk patients because of the resulting low probability of cheating. Such benefit can also be wasteful because of the accompanying increase in investigation and fine collection. Despite the inefficiencies, regulated user fee is a better healthcare financing method than direct tax financing when government is critically costly.

Given that it is impossible to implement regulated user fee effectively without monitoring the behaviour of healthcare providers and that investigation increases the cost of care, the study recommends that regulated user fee be implemented only when it is possible to adopt innovative technology that makes effective investigation affordable. In addition, regulated user fee requires a good technology to minimize the cost of revenue collection.

Another recommendation from the study is that regulated user fee could be implemented efficiently in economies with a small proportion of poor residents. This implies that regulated user fee may not be the right policy for developing countries where there are large percentages of poor residents. Since regulated user fee creates a wedge between the fee paid by the rich and the poor, it creates incentives for healthcare providers to use wrong treatment for patients regardless of their income; the policy should only be implemented when the health of patients is not highly valued. Even though the incentives for choosing wrong treatment is minimized by investigation, as long as investigation is costly it may not be efficient to investigate all cases handled by healthcare providers, it is always likely for some patients, regardless of income, to receive wrong treatment. Developing economies with high investigation cost then may be better off adopting innovative methods for revenue collection in order to fund healthcare directly using tax revenue.

REFERENCES

- Coleman, N.A. (1997) Uneven implementation of user fee policy in Ghana. Takemi Program in International Health, Harvard School of Public Health.

- Feldstein, M. (1973) The welfare loss of excess health insurance. Journal of Political Economy, 81, 251-280. http://dx.doi.org/10.1086/260027

- Nyman, J. (1999) The economics of moral hazard revisited. Journal of Health Economics, 18, 811-824. http://dx.doi.org/10.1016/S0167-6296(99)00015-6

- Amporfu, E. (2010) Incentive effects of government mandated user fee. Journal of University of Science and Technology, 30, 36-49.

- Vian, T. (2008) Review of corruption in the health sector: Theory, methods, and interventions. Health Policy and Planning, 23, 83-94. http://dx.doi.org/10.1093/heapol/czm048

- Edwards, R.D. (2007) The cost of public income redistribution and private charity. Journal of Libertarian Studies, 21, 3-20.

- Burbridge, J.B. and Myers, G.M. (2004) Tariff wars and trade deals with costly government. Review of International Economics, 12, 453-459.

- Mwabu, G. (1997) User charges for healthcare: A review of underlying theory and assumptions. Working Papers No. 127, World Institute for Development Economics Research. http://www.wider.unu.edu/publications/working-papers/previous/en_GB/wp-127/_files/82530852647738745/default/WP127.pdf

- Singh, A. (2003) Building the user fee experience: The African case. Discussion Paper Number 3, World Health Organization. https://extranet.who.int/iris/restricted/bitstream/10665/69026/1/EIP_FER_DP_03.3.pdf

- James, C., Hanson, K., McPake, B., Balabanova, D., Gwatkin, D., Hopwood, I., Kirunga, C., Knippenberg, R., Meessen, B., Morris, S.S., Preker, A., Soucat, A., Souteyrand, Y., Tibouti, A., Villeneuve, P. and Xu, K. (2006) To retain or remove user fee? Reflections on the current debate. Applied Health Economics Health Policy, 5, 137- 153. http://dx.doi.org/10.2165/00148365-200605030-00001

- Duff, D.G. (2004) Benefit taxes and user fees in theory and practice. The University of Toronto Law Journal, 54, 391-447. http://dx.doi.org/10.1353/tlj.2004.0013

- Jacobs, B. and Price, N. (2004) The impact of the introduction of user fees at a district hospital in Cambodia. Health Policy and Planning, 19, 310-321. http://dx.doi.org/10.1093/heapol/czh036

- Yisa, I.O., Fatiregun, A.A. and Awolade, E. (2004) User charges in health care: A review of the concept, goals and implications to national health system. Annals of Ibadan Postgraduate Medicine, 1, 49-54.

- Domelen, J.V. (2007) Reaching the poor and vulnerable: Targeting strategies for social funds and other community driven programs. SP Discussion Paper No. 0711. http://siteresources.worldbank.org/SOCIALPROTECTION/Resources/SP-Discussion-papers/Social-Funds-DP/0711.pdf

- Morrisey, M.A. and Sloan, F.A. (1989) Hospital cost shifting and the medicare prospective payment system. Working Paper, University of Alabama at Birmingham.

- Showalter, M.H. (1985) Physician’s cost shifting behaviour: Medicaid versus other patients. Contemporary Economic Policy, 15, 74-84. http://dx.doi.org/10.1111/j.1465-7287.1997.tb00467.x

- Ridde, V., Diarra, A. and Moha, M. (2011) Userfees abolition policy in Niger: Comparing the under five years exemption implementation in two districts. Health Policy, 99, 219-225. http://dx.doi.org/10.1016/j.healthpol.2010.09.017

- Morrisey, M.A. (1995) Movies and myths: Hospital cost shifting. Business Economics, 30, 22-25.

NOTES

1M. A. Morriesey [18] calls the textbook price discrimination static cost shifting and calls cost shifting, as defined in this paper, as dynamic cost shifting.

2Derivations of the strategies as in Amporfu (2010) and are available upon request.

3The derivatives of the equations are available upon request.