Technology and Investment

Vol.4 No.2(2013), Article ID:31863,9 pages DOI:10.4236/ti.2013.42009

Case Study on the Lean Six Sigma Management for Information Technology Service Management Project of G Commercial Bank*

1Department of Business Administration, School of Management, Jinan University, Guangzhou, China

2School of Business Administration, South China University of Technology, Guangzhou, China

3The Party School of the CPC Guangdong Provincial Committee, Guangzhou, China

4School of Management, Jinan University, Guangzhou, China

Email: txuym@126.com, shermon@163.com

Copyright © 2013 Yongmei Xu et al. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Received December 10, 2012; revised March 29, 2013; accepted April 6, 2013

Keywords: Information Systems; Information Technology Infrastructure Library; Information Technology Service Management; Six Sigma; Critical Success Factors; Commercial Bank

ABSTRACT

Based on the literature review which concludes the Lean Six Sigma management theory, Information Technology Infrastructure Library (ITIL) and the key success factors of Information Technology service management (ITSM), this paper analyzes the present situation of information system in G bank and also the challenge it is facing. Furthermore, this paper puts forward a process optimization scheme for the production changes of G bank’s ITSM with the Lean Six Sigma management theory. What’s more, the paper dissects the production changes of G bank’s ITSM by means of DMAIC method in order to achieve these four goals: Firstly, optimizing the process and improving the internal work efficiency also. Secondly, reducing the variation and the error rate and also improving the system availability. Thirdly, strengthen the business interaction in order that the IT value could be reflected preferably. The last but not least, cutting the overtime is to improve employee satisfaction. But improving the ITSM of the banking industry is our ultimate aim.

1. Introduction

Information Technology service management (ITSM) based on Information Technology Infrastructure Library (ITIL), which integrates the best practices of global IT management and forms the normative truth standard to reduce effectively cost and improve the quality of service, is applied widely in the world [1]. The whole framework of ITIL is illustrated in Figure 1. ITIL, which was developed by the Central Computer and Telecommunications Agency (CCTA, merged with the OGC) of the UK government in the middle of 1980s, is a set of service management standard library which focuses on IT industry. In the past 20 years, the content of ITIL has been updated and renewed. Today the OGC has enacted the ITIL 3.0.

This paper is organized in the following: Section 2 is a literature review, including Six Sigma Process Improvement, ITSM and their critical success factors (CSF). Section 3 is the introduction information systems of G Commercial Bank. Section 4 is ITSM project preparation of G Commercial Bank. Section 5 is ITSM project implementation of G Commercial Bank ITSM project. Finally, Section 6 is conclusion.

2. Literature Review

2.1. The Improvement of Six Sigma Process

The Six Sigma process improvement initiative originated in 1986 from Motorola’s drive toward reducing defects by minimizing variation in processes, which in turn required explicit measurement of solid metrics [2]. Applications of the Six Sigma project execution methodology have since expanded to include more explorative objectives, such as increasing customer satisfaction, or devel-

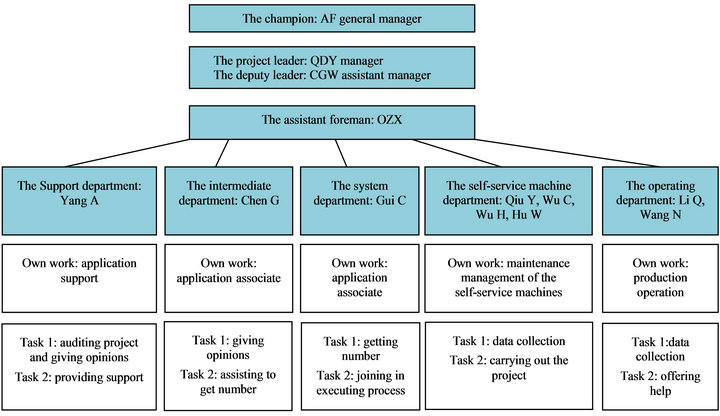

Figure 1. G bank’s organization chart of Lean Six Sigma.

oping closer supplier relationships, and the use of softer practices, such as brainstorming and “five-why” analyses to capture tacit knowledge of project team members [3]. The question that remains unanswered is whether the use of tacit-knowledge-capturing practices provides a higher degree of project success.

2.2. The Critical Success Factors of ITSM

The critical success factors (CSF) approach was first established in the 1960s and popularized by various researchers, including Rockart and Bullen [4] who provided an operational definition of CSF: “key areas where things must go right in order to successfully achieve objectives and goals”. It has been pointed out by Williams and Ramaprasad [5] that although the CSF approach is widely used by researchers to produce a plethora of factors, it is important to discriminate between different levels of criticality.

They distinguish four types of criticality: 1) Factors linked to success by a known causal mechanism, 2) Factors necessary and sufficient for success, 3) Factors necessary for success, and 4) factors associated with success. This research offers guidelines to practitioners by focusing on the fourth level. We identify a set of CSFs associated with successful ITSM implementation.

The study of Wui-Gee Tan, Aileen Cater-Steel and Mark Toleman indicates that the commitment of senior management is crucial to the project’s success as is a project champion and the recognition of the need for an appropriate alteration management strategy to transform the organizational culture to a service-oriented focus. Maintaining close and forthright relationships with multiple vendors facilitates technology transfer to in-house staff while a benefits realization plan is a valuable tool for tracking and communicating tangible and intangible project benefits to the project stakeholders. An effective project governance and execution process further contributes to the implementation success [6-9].

3. The Development and Present Situation of G Bank’s Information System

G bank now has 215 IT staffs and more than 500 sets equipment in the center machine room. From year 2006 to 2010, the year volume of G bank has risen from 2.2 million to 50 million, besides, its IT system which is supporting to business development grew rapidly and the relation between the application systems is complex. And these can be reflected by the following, the capacity of the storage system from 10 TB increase to 150 TB, the application and platform related to the integrated frontbanking system which is bearing the bank’s core business like ATM has dozens of equipment or system, such as gateway, gold card, encryption server, Network control device, self-service terminal platform, Comprehensive monitoring platform, network, storage, Universal file transfer, Batch automation, Backup, user management, etc.

G bank has build up an information system platform which is about all the customers in the bank, and also a marketing management system for personal and the customers of the public. A number of applications have been launched like the unified management for financial production of home and foreign currency, the personal financial service level has also been improved effectively. Furthermore, in G bank, the FOVA system development has completed successfully, which was put into production in Macau branch, Seng Heng bank, Seoul branch and Singapore branch one after another, that made a solid first step for the overseas business system promotion, and it was networked with the global institutions in 2009. There was a breakthrough on the construction of risk management information system in G bank, the function of the corporate client credit management system (CM 2002) has been perfected further, while the personal customer credit management system (PCM2003) has been promoted all over the bank, and many application systems will be launched such as the interest rate management,internal ratings based approaches, business operation risk management and market risk management.

4. The Preparation of ITSM Project in G Bank

4.1. The Organization Chart of Lean Six Sigma

G bank has chosen some key staffs from 5 departments including support, intermediate, system, self-help and operation section as a kaizen team, and it was strict with the control of project team members (Figure 1), that avoided the following situations successfully: the wrong person is assigned to Lean Six Sigma project; The black belt and green belt almost have no time to do the project; It’s short of the support from finance, IT, HR, equipment maintenance and other business departments; The project team is so big, whose involving departments is too much, that its team meeting and communication are not enough.

4.2. The Educational Training about Lean Six Sigma

The propulsion of G bank ITSM project has the following two characteristics: first, it has alterationd the tradition that the survey and scheme were made by the intermediary organ. There is a project team that is formed by the key staffs from the province branch or secondary branch professional department and the workers at the production line,while the consulting company is mainly responsible for providing technical support method; Second, in order to get the supporting data ,the staffs work at a selected spot for a while. The staffs have been arranged in the pilots including the province branch, Qingyuan branch and Foshan branch to record roundthe-clock working content and duration (accurate to seconds) of the main post personnel, so that it can obtain statistical about the effective input time. Besides, G bank has held some field trainings, project meetings, interviews and questionnaires (the quantity was more than 300), that can ensure the reliability of the data. Finally, they have screened the main influence factors and targeted to improvement by means of the analysis of the data and summary of the present situation about the scientific and technological work.

4.3. The Project Selection of ITSM about Lean Six Sigma Management

According to the situation of IT management in G bank, the most urgent problem to solve is that the production here is frequent occurrence, besides, based on the statistical data, it can be found that about 70% production events are owing to the manufacturing alteration. Therefore, following project objectives should be determined: the first one is optimizing the process and improving the internal work efficiency also. The second is reducing the variation and the error rate and also improving the system availability. The third is to strengthen the business interaction and have the IT value been reflected preferably. The last but not least, cutting the overtime time can enhance employee satisfaction.

5. The Project Implementation of ITSM in G Bank

5.1. The Definition Phase (D)

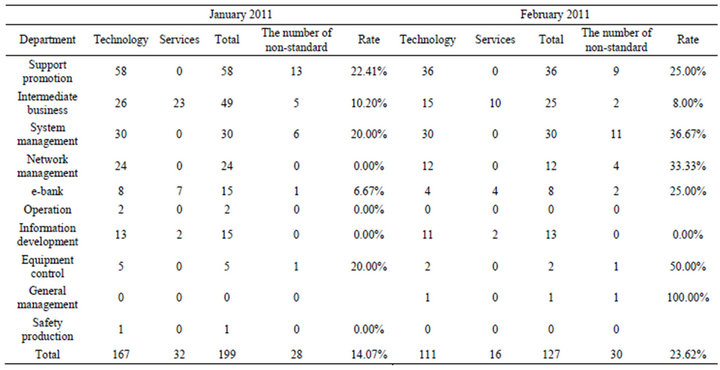

In January 2011, there were 199 alterations in total in G bank, and 28 alterations of those were in a lack of standardization.In the next month the amount of alterations was 127, while 30 alterations lacked of standardization. The rates of non-standard were 14.07% and 23.62%, which were in high level (Table 1).

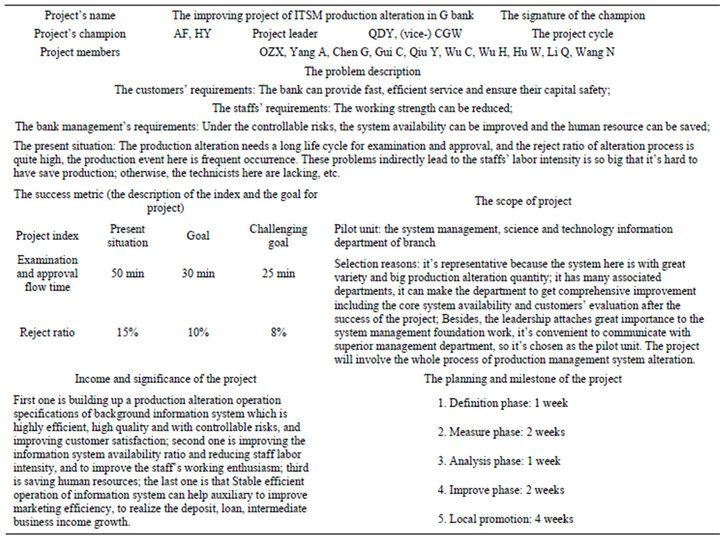

After the evaluation, G bank has set a goal that the rates of non-standard should be dropped to 8% or blew, and this goal has obtained the approval of the department general manager club (Table 2).

5.2. The Measure Phase (M)

The project team has measured the alterations of G bank, including three key stages: before the implementation, in the implementation and after the implementation. The stage before the implementation: it included early warning of alteration plan, implementation project establishment, risk control evaluation, SD (Service Desk, G bank IT internal helpdesk system), submitting alteration list. The stage in the implementation: It referred to implementation requirements, risk response, emergency treat-

Table 1. The alterations’ content distribution in January and February 2011.

Table 2. The definition table of project.

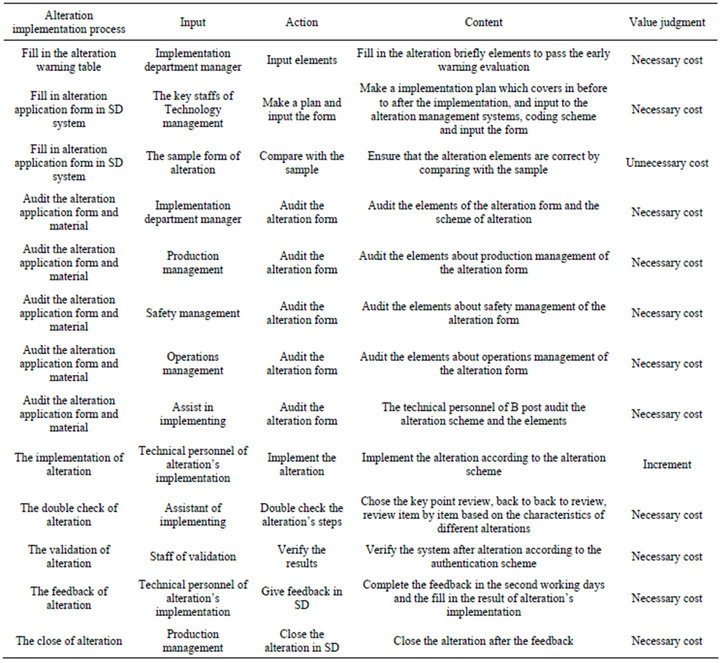

ment. The stage after the implementation: It contained results Verification, feedback of alteration list, required data update and filing (Table 3).

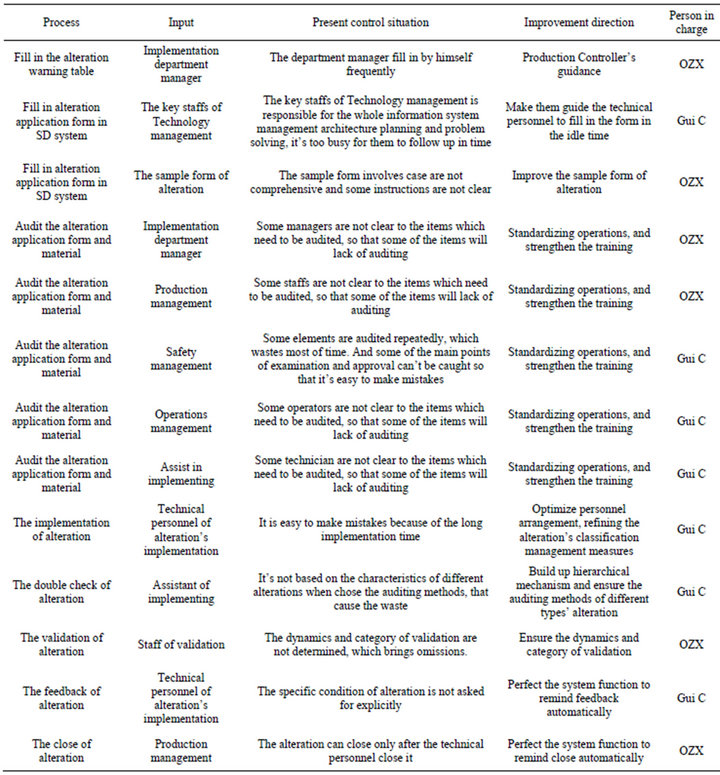

5.3. The Analysis Phase (A)

According to the alteration process evaluation above, and after the comprehensive analysis of the project team’s “brain storm”, each process improvement direction of alteration should be determined (Table 4).

5.4. The Improve Phase (A)

G bank has taken the optimization measures for the management before alteration, during the alteration and after it.

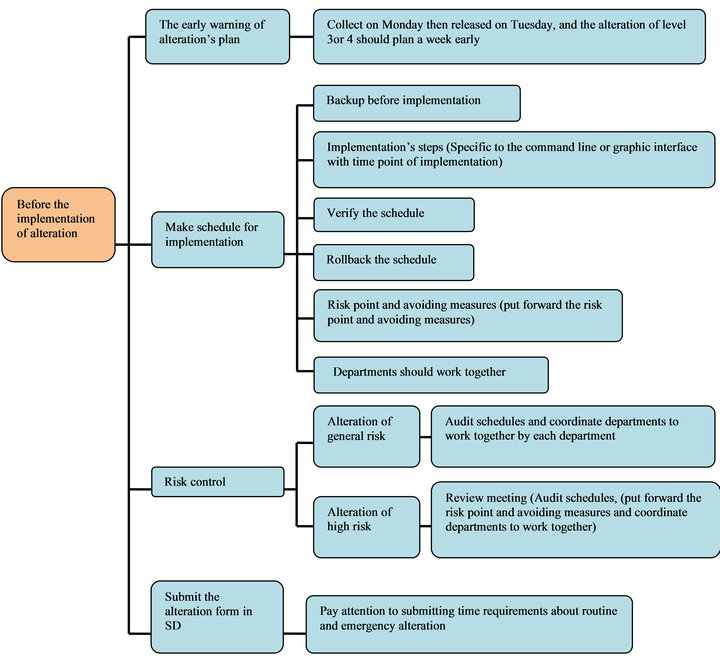

5.4.1. The Optimization about the Management before Alteration

The detail measures is that making the alteration’s collection schedule (including elements interpretation and case template), the templates and cases for the plan, the detailed explanation of SD system elements, and organizing trainings which cover the whole science and technology department (Figure 2).

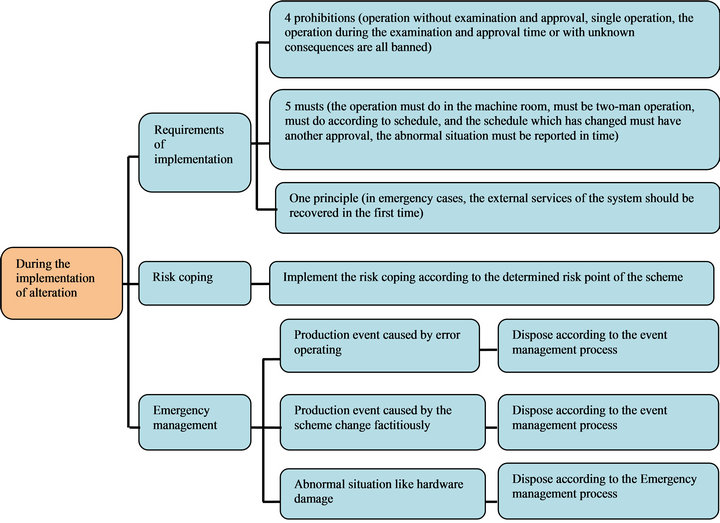

5.4.2. The Optimization about the Management during Alteration

The control of the alteration implementation must be strengthened, and the following requirements should be carried out strictly: one principle (in emergency cases, the external services of the system should be recovered in

Table 3. The value judgment evaluation about production process’ treatment scheme in G bank IT department.

Table 4. The improvement direction of alteration process.

the first time), 4 prohibitions (operation without examination and approval, single operation, the operation during the examination and approval time or with unknown consequences are all banned), 5 musts (the operation must do in the machine room, must be two-man operation, must do according to schedule, and the schedule which has changed must have another approval, the abnormal situation must be reported in time), thus it can put an end to the production fault event caused by the inappropriate implementations (Figure 3).

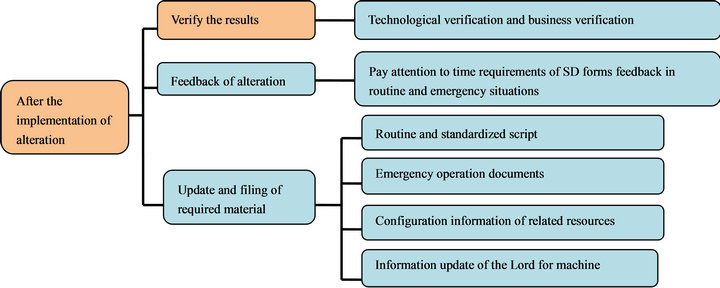

5.4.3. The Optimization about the Management after Alteration

Only pass the verification in test environment that the implementation schedule and execution script of production alteration can implement in the production environment in order to reduce the uncertainty of the operation risk (Figure 4).

Figure 2. The optimization about the management before alteration.

G bank needs to improve the management process of implementation: 1) The control of the alteration implementation must be strengthened, and the following requirements should be carried out strictly: one principle, 4 prohibitions and 5 musts in order to put an end to the production fault event caused by the inappropriate implementations; 2) Only pass the verification in test environment that the implementation schedule and execution script of production alteration can implement in the production environment in order to reduce the uncertainty of the operation risk; 3) The risk control before the implementation should be strengthened and for the implementation schedule with high risk, something must be done, such as auditing schedules strictly, ensuring the risk point and avoiding measures and coordinating departments to work together; 4) The implementation steps should be extended to the command line or graphic interface, the time point of implementation should be marked out, and also the key procedures should be noted that which is the target server, so that it can achieve implementing clearly and operating with understood; 5) For the implementation with undetermined risk or high risk, the predetermined precept should be prepared, so that it can cope with implementation plan is anomalous; 6) Each department should fully consider the reasonable arrangement of alteration personnel to avoid the risk caused by working in fatigue like that the single one implements in a long time or into the late night; 7) After the improving the process, in G bank, the average examination and approval time of alteration is from 50 minutes down to 28

Figure 3. The optimization about the management during alteration.

Figure 4. The optimization about the management after alteration.

minutes, at the same time the rates of non-standard drops to 9.6%, it means the aim of project implementation has been achieved.

5.5. The Control Phase (C)

Based on implementing the alteration management system, each department should strengthen the internal control in every link of alteration (Especially the risk assessment, project review, department coordination before implementation and the risk control in the process of implementation, etc.), the safety production’s alteration can be managed regularly in essence to achieve zero accidents, moreover try the best to have good production alteration management, event management, emergency management in order to ensure that the system can operate stably and efficiently.

6. Conclusion

This paper has analyzed the present situation of information system in G bank and also the challenge it is facing. Furthermore, a scheme has been determined in this paper, that is the Lean Six Sigma management theory will be used to optimize the management of alteration and production in the G bank’s ITSM. We try to achieve the four goals with DMAIC: the first one is optimizing the process and also improving the internal work efficiency. The second one is reducing the variation and the error rate and also improving the system availability. The third one is to strengthen the business interaction and have the IT value been reflected preferably. The last but not least, the overtime time can be reduced and employee satisfaction can be enhanced at the same time. Certainly, the Lean Six Sigma pursues perfection, so we need to make sure that the effect of program is “evergreen”. Specific measures are as follows: 1) Long-term process ability has been set up; 2) The operation control plan has been updated and implemented; 3) Process has returned to process owner for maintenance; 4) The team final report, including the future improvement opportunities confirmation, etc.

7. Acknowledgements

Thanks for the helpful discussion with Mr. H. Y. Xu and the vigorously help that XX bank has given in this paper.

REFERENCES

- J. van Bon, M. Picper and A. der Veen, “Foundations of IT Service Management Based on ITIL,” Van Haren Publishing, Zaltbommel, 2005.

- G. Anand, P. T. Ward and M. V. Tatikonda, “Role of Explicit and Tacit Knowledge in Six Sigma Projects: An Empirical Examination of Differential Project Success,” Journal of Operations Management, Vol. 28, No. 4, 2010, pp. 303-315.

- S. Kumar and Y. P. Gupta, “Statistical Process Control at Motorola’s Austin Assembly Plant,” Interfaces, Vol. 23, No. 2, 1993, pp. 84-92. doi:10.1287/inte.23.2.84

- J. Rockhart and C. A. Bullen, “Primer on Critical Success Factors, Center for Information Systems Research,” Massachusetts Institute of Technology, Cambridge, 1981.

- R. W. Hoerl, “Six Sigma Black Belts: What Do They Need to Know?” Journal of Quality Technology, Vol. 33, No. 4, 2001, pp. 391-406.

- W.-G. Tan, A. Cater-Steel, M. Toleman, “Implementing IT Service Management: A Case Study Focussing on Critical Success Factors,” Journal of Computer Information Systems, Vol. 50, No. 2, 2009, pp. 1-12.

- J. J. Williams and A. Ramaprasad, “A Taxonomy of Critical Success Factors,” European Journal of Information Systems, Vol. 5, No. 5, 1996, pp. 250-260. doi:10.1057/ejis.1996.30

- J. P. Wan, H. Zhang and D. Wan, “Evaluation on Information Technology Service Management Process with AHP,” Technology and Investment, Vol. 2, No. 1, 2011, pp. 38-46. doi:10.4236/ti.2011.21005

- J. P. Wan and D. Wan, “Analysis on Information Technology Service Management Project Implementation,” Technology and Investment, Vol. 2, No. 3, 2011, pp. 184-192. doi:10.4236/ti.2011.23019

NOTES

*This paper is supported by key items of the soft science project in Guangdong provincial department of science and technology (Item Number: 2011A070102001) and the high-tech office in Guangdong provincial department of science and technology (Item Number: 2011B010100031), and also the significant science and technology special project in Guangdong provincial department of science and technology (Item Number: 2012A010800032).